|

市场调查报告书

商品编码

1693401

印尼密封剂:市场占有率分析、行业趋势和统计数据、成长预测(2025-2030 年)Indonesia Sealants - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

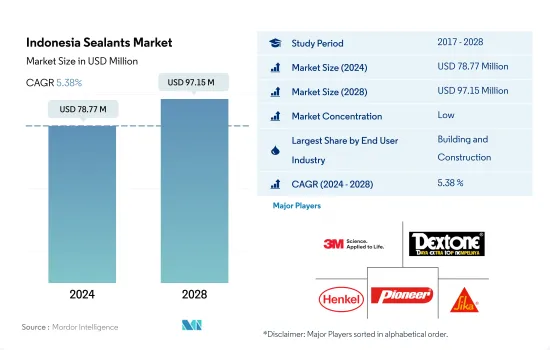

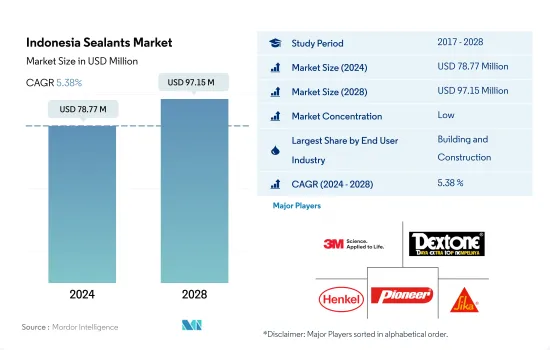

预计 2024 年印尼密封剂市场规模为 7,877 万美元,到 2028 年将达到 9,715 万美元,预测期内(2024-2028 年)的复合年增长率为 5.38%。

政府对电动车购买的激励措施,加上电动车的日益普及,预计将推动印尼密封胶的消费

- 印尼密封剂市场主要受建设产业的推动,其次是其他终端用户产业,因为密封剂在建筑和建设活动中有着广泛的应用,如防水、防风雨密封、裂缝密封和接缝密封。此外,建筑密封剂的使用寿命很长,且易于应用于各种基材。建筑业是 2021 年该国国内生产总值) 的第四大贡献产业。然而,由于新冠疫情限制和原材料短缺,2020 年建设活动有所下降。

- 其他终端用途产业预计将占据印尼密封剂市场的第二大市场占有率,因为它们在电子和电气设备製造业中作为灌封和保护材料有着广泛的应用,可用于密封感测器、电缆等。印尼电子市场预计将呈现显着的成长率,从而在预测期内创造对密封剂的需求。此外,电子商务活动的快速成长以及消费性电子领域的强大市场定位预计将推动印尼密封胶市场的行业规模。

- 密封剂在医疗保健和汽车行业有着广泛的应用,印尼最近在这些领域取得了重大进展。密封剂在医疗保健领域主要用于组装和密封医疗设备零件。由于政府的利好政策和消费者对轻型车的偏好,对电动车的需求不断增加,可能会逐渐影响对密封剂的需求。

印尼密封胶市场趋势

政府和公共对住宅和非住宅建筑计划的投资将推动该行业

- 预计印尼建设产业在 2022 年至 2028 年期间的复合年增长率约为 3.43%。过去十年,印尼建筑业的成长速度一直在下降,2019 年与 2018 年相比仅成长了 6.2% 多一点。然而,2020 年,由于新冠疫情,建筑业经历了大幅放缓。在 2022-2028 年的预测期内,印尼建筑胶合剂市场预计将以约 3.37% 的复合年增长率扩张,以金额为准也将以约 5.42% 的复合年增长率扩张。

- 目前,该行业正在投资大型计划以促进国家的发展。例如,印尼正准备斥资约 400 亿美元扩建雅加达地铁网络,以促进该国建设产业的发展。印尼政府也宣布将在婆罗洲岛建设新首都,耗资466兆印尼币(266亿英镑),耗时10年。

- 同时,三菱商事正与淡马锡控股公司计划在雅加达西南25公里处建造一座智慧城市。该智慧城市将包括住宅、购物中心和医疗设施,目标是容纳 40,000 至 60,000 名永久居民。此外,政府还计划维修印尼东部省份多达 2,200 套低品质住宅,总预算维修385 亿印度卢比。发展,尤其是住宅建筑的发展,往往会增加该国对黏合剂和密封剂的需求。

汽车零件出口额强劲成长带动产业成长

- 印尼的汽车产业仍然是一个有前景的产业,为该国的经济发展做出了重大贡献。印尼共和国产业部长阿古斯古米旺卡塔萨斯米塔表示,2021年印尼汽车产业呈现惊人成长,成长率达到17.82%的两位数。 2019年,印尼汽车产量约1,286,848辆,但受新冠疫情影响,2020年产量大幅下滑至690,176辆,降幅约46%。受此影响,2019年至2021年汽车产量变化约为-13%,而2020年至2021年汽车产量变化约为63%。

- 2019年至2021年,印尼汽车业贸易连续多年保持顺差。 2020年,全球疫情导致进出口双双下滑,限制和扰乱了经济活动,扰乱了全球供应链,打击了整体生产。然而,2021年生产强劲,导致出口和进口均大幅成长,贸易差额达19.3亿美元。儘管 2021 年的商业活动达到了近十年来的最高水平,但贸易顺差与 2019 年和 2020 年相比却是最低的,当时的顺差分别为 20 亿美元和 19.5 亿美元。

- 从全球来看,电动车的发展预示着印尼交通运输部门政策的根本转变。鑑于该国的镍蕴藏量,印尼完全有能力成为全球电动车供应链的主要企业。为了成为该地区电动车未来的一部分,印尼需要投资技术、人才、可再生能源和基础设施。

印尼密封胶产业概况

印尼密封胶市场较为分散,前五大公司占24.25%的市占率。市场的主要企业有:3M、DEXTONE INDONESIA、Henkel AG & Co. KGaA、Pioneer Adhesives, Inc. 和 Sika AG(按字母顺序排列)

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章执行摘要和主要发现

第二章 报告要约

第三章 引言

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 产业主要趋势

- 最终用户趋势

- 航太

- 车

- 建筑与施工

- 法律规范

- 印尼

- 价值炼和通路分析

第五章市场区隔

- 最终用户产业

- 航太

- 车

- 建筑与施工

- 卫生保健

- 其他最终用户产业

- 树脂

- 丙烯酸纤维

- 环氧树脂

- 聚氨酯

- 硅胶

- 其他树脂

第六章竞争格局

- 关键策略趋势

- 市场占有率分析

- 商业状况

- 公司简介.

- 3M

- Arkema Group

- DEXTONE INDONESIA

- Dow

- HB Fuller Company

- Henkel AG & Co. KGaA

- IKA GROUP

- Illinois Tool Works Inc.

- Pioneer Adhesives, Inc.

- Sika AG

第七章:CEO面临的关键策略问题

第 8 章 附录

- 全球黏合剂和密封剂产业概况

- 概述

- 五力分析框架(产业吸引力分析)

- 全球价值链分析

- 驱动因素、阻碍因素和机会

- 资讯来源及延伸阅读

- 图片列表

- 关键见解

- 资料包

- 词彙表

简介目录

Product Code: 92457

The Indonesia Sealants Market size is estimated at 78.77 million USD in 2024, and is expected to reach 97.15 million USD by 2028, growing at a CAGR of 5.38% during the forecast period (2024-2028).

Rising popularity of electric vehicles in addition to government incentives for the purchase of EVs predicted to raise the consumption of sealants in Indonesia

- The Indonesian sealants market is largely driven by the construction industry, followed by other end-user industries due to the wide range of applications of sealants in building and construction activities such as waterproofing, weather-sealing, cracks-sealing, and joint-sealing. Moreover, construction sealants are designed for longevity and ease of application on different substrates. The construction industry has registered as the fourth-largest contributor to the country's GDP in 2021. However, construction activities decreased in 2020 due to COVID-19 restrictions and the scarcity of raw materials.

- Other end-user industries are likely to obtain the second largest market share of the Indonesian sealants market owing to the diverse applications in the electronics and electrical equipment manufacturing industry for potting and protecting materials, and they are used for sealing sensors and cables, etc. The electronics market of Indonesia is expected to showcase a considerable growth rate which will create demand for sealants over the projected time period. Moreover, the rapid growth of e-commerce activities, along with the strong market positioning of the consumer electronics segment, would like to propel the industry size of the Indonesian sealants market.

- Sealants have considerable applications in the healthcare and automotive industries, and Indonesia has achieved significant development in these sectors in recent times. Sealants are used in healthcare mostly for assembling and sealing medical device parts. Increasing demand for electric vehicles due to favourable government policies, along with consumer preferences for lightweight vehicles, will gradually influence the demand for sealants.

Indonesia Sealants Market Trends

Government & public investments in residential and non-residential construction projects will boost the industry

- The Indonesian construction industry is expected to expand at a CAGR of roughly 3.43% from 2022 to 2028. Over the last decade, the construction sector in Indonesia has grown with a downward trend, reporting a gain of more than 6.2% in 2019 when compared to 2018. However, the building sector experienced a significant slowdown in 2020 as a result of the COVID-19 epidemic. During the forecast period of 2022 to 2028, the Indonesia building adhesives market is expected to expand at a CAGR of approximately 3.37% in terms of volume and 5.42% in terms of value during the forecast period.

- Currently, the industry is investing in large infrastructure projects in order to increase the development of the country. For instance, Indonesia has been preparing to spend about USD 40 billion to extend Jakarta's metro network, which is poised to boost the country's construction industry. Furthermore, the government of Indonesia revealed that the new capital city would be built on the island of Borneo with an investment of IDR 466 trillion (GBP 26.6 billion), and construction would take 10 years.

- On the other hand, Mitsubishi Corp., along with Temasek Holding, is planning to build a smart city 25 km southwest of Jakarta. The smart city includes homes, shopping centers, and medical facilities, with the goal of housing 40,000 to 60,000 permanent residents. Moreover, the government has planned to renovate as many as 2,200 low-quality houses in the eastern Indonesian province, which will be renovated and rebuilt with a total budget of IDR 38.5 billion. The development, specifically residential construction, tends to increase the demand for adhesives and sealants in the country.

Considerable growth of export values for automotive parts & components will proliferate the industry growth

- The automotive industry in Indonesia remains a promising sector that contributes significantly to the country's economic progress. According to Agus Gumiwang Kartasasmita, Minister of Sector Republic of Indonesia, the automobile industry in Indonesia witnessed tremendous growth in 2021, with a double-digit growth rate of 17.82%. In 2019, the country produced about 12,86,848 units of vehicles which drastically reduced to 6,90,176 units in 2020, accounting for a decline of about 46% owing to the COVID-19 pandemic. Due to this reason, the variation in automotive production between 2019 and 2021 resulted in about -13%, whereas between 2020 and 2021, the variation was about 63%.

- The trade in the automotive sector in Indonesia showed a surplus in all years from 2019 to 2021. Both exports and imports fell in 2020 as a result of the global pandemic, which generated limitations and disruptions in economic activities, so impeding the global supply chain and hurting total production. However, in line with the robust output in 2021, both export and import values increased significantly, with a trade balance of USD 1.93 billion. Although 2021 had the highest level of commercial activity in the prior ten years, the trade balance surplus was the lowest in comparison to 2019 and 2020, which had balance values of USD 2 billion and USD 1.95 billion, respectively.

- Globally, the development of EVs signaled a fundamental shift in the Indonesian transportation sector's policies. Given the country's nickel reserves, Indonesia is well-placed to become a major player in the global EV supply chain. To be a part of the region's EV future, Indonesia needs to invest in technology, talent resources, renewable energy, and infrastructure.

Indonesia Sealants Industry Overview

The Indonesia Sealants Market is fragmented, with the top five companies occupying 24.25%. The major players in this market are 3M, DEXTONE INDONESIA, Henkel AG & Co. KGaA, Pioneer Adhesives, Inc. and Sika AG (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 End User Trends

- 4.1.1 Aerospace

- 4.1.2 Automotive

- 4.1.3 Building and Construction

- 4.2 Regulatory Framework

- 4.2.1 Indonesia

- 4.3 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2028 and analysis of growth prospects)

- 5.1 End User Industry

- 5.1.1 Aerospace

- 5.1.2 Automotive

- 5.1.3 Building and Construction

- 5.1.4 Healthcare

- 5.1.5 Other End-user Industries

- 5.2 Resin

- 5.2.1 Acrylic

- 5.2.2 Epoxy

- 5.2.3 Polyurethane

- 5.2.4 Silicone

- 5.2.5 Other Resins

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 3M

- 6.4.2 Arkema Group

- 6.4.3 DEXTONE INDONESIA

- 6.4.4 Dow

- 6.4.5 H.B. Fuller Company

- 6.4.6 Henkel AG & Co. KGaA

- 6.4.7 IKA GROUP

- 6.4.8 Illinois Tool Works Inc.

- 6.4.9 Pioneer Adhesives, Inc.

- 6.4.10 Sika AG

7 KEY STRATEGIC QUESTIONS FOR ADHESIVES AND SEALANTS CEOS

8 APPENDIX

- 8.1 Global Adhesives and Sealants Industry Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework (Industry Attractiveness Analysis)

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Drivers, Restraints, and Opportunities

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219