|

市场调查报告书

商品编码

1693402

泰国密封剂:市场占有率分析、行业趋势和成长预测(2025-2030 年)Thailand Sealants - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

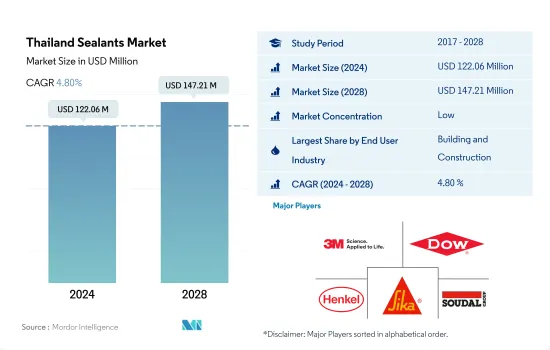

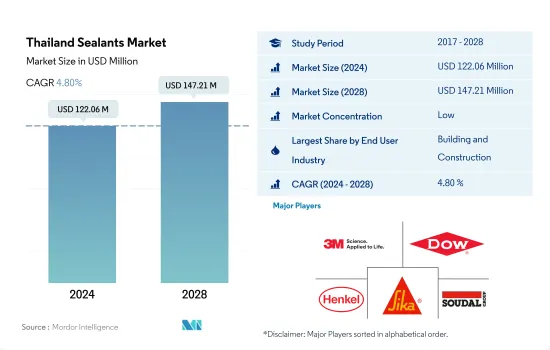

泰国密封剂市场规模预计在 2024 年为 1.2206 亿美元,预计到 2028 年将达到 1.4721 亿美元,预测期内(2024-2028 年)的复合年增长率为 4.80%。

汽车工业的兴起和先进医疗设备需求的不断增长预计将推动泰国密封胶的消费

- 建筑业占据泰国密封剂市场的大部分份额,其次是其他终端用户行业,因为密封剂在建筑和施工中的应用范围很广。此外,建筑密封剂的使用寿命很长,且易于应用于各种基材。 2021 年,建筑业可能为泰国 GDP 贡献 4,391.3 亿泰铢,并因住宅投资增加而实现显着增长,预计这将在未来几年推动对密封胶的需求。

- 预计其他终端用户工业部门将在泰国密封剂市场的价值和数量上占据第二大份额,其中电子和电气设备预计将占很大一部分。电气设备製造中使用各种密封剂来达到灌封和保护的目的。用于密封感测器、电缆等。由于泰国拥有大型製造商,未来几年泰国的电子产业可能会成长。这将推动其他终端用户产业对密封剂的产能和需求。

- 密封材料在汽车工业中有多种用途,主要用于引擎和汽车垫圈。近年来,泰国已成为汽车製造商的主要枢纽,拥有完善的生产设施和主要企业,这可能会在未来几年产生对密封剂的需求。密封剂也用于医疗用途,例如组装和密封医疗设备零件,因此在泰国最终用户行业密封材料市场中占有一定份额。

泰国密封材料市场趋势

公共基础设施计划支出增加可能促进建筑业的成长

- 预计 2022 年至 2028 年预测期内泰国建筑业的复合年增长率约为 2.59%。泰国是东南亚最受建筑商青睐的中心之一,拥有庞大的建筑业可供投资。由于交通线路和地铁基础设施建设等公共工程项目的增加,住宅的需求持续增长。 2014 年至 2019 年,住宅建筑是泰国建筑业最大的组成部分,占 2019 年建筑业总价值的 40% 以上。预计建筑业将在 2023 年復苏,预计 2021 年总建筑支出将成长 4.5-5%,2022-2023 年将成长 5-5.5%。

- 特别是在东部经济走廊,政府支持计画的投资可能会鼓励私人投资的涌入(例如工业)。随着各国政府为因应持续的经济成长和都市化而发展国家基础设施,邻国也将出现新的机会。

- 2021年,多个住宅计划推出,进一步推动了该细分市场的成长。计划包括价值 5.07 亿美元的 Skyrise Avenue Sukhumvit 64 混合用途开发项目和价值 1.17 亿美元的 Arom Wongamat 公寓大楼。这些计划预计于2024-2025年左右完工。预计该国不断发展的基础设施将在预测期内推动对黏合剂的需求。

泰国占东南亚国协汽车总产量的近50.1%,预计将引领该产业。

- 过去50年来,泰国汽车工业经历了巨大的成长。该国正不断向符合S曲线、生产附加价值更高的下一代汽车产业迈进,并努力使其汽车产业政策与环境保护政策保持一致。泰国是东协地区最大的汽车生产国。 2020年产量为1,427,074辆,占东协总产量的50.1%。其次是印尼(691,150辆,约24.2%)和马来西亚(485,186辆,约17.0%)。

- 2019年汽车产量约2,013,710辆,但2020年受新冠疫情影响,产量骤降至1,427,074辆,下降约29%。因此,2019年至2021年汽车产量波动幅度约为-16%,2020年至2021年汽车产量波动幅度约为-1%。

- 泰国是世界第11大汽车生产国,也是东协第一大汽车生产国,凭藉着成熟的价值链,有望成为东协的电动车中心。为满足当地需求,泰国的电动车库存正稳定成长。更重要的是,几家泰国知名公司正在积极投资该国的电动车充电基础设施,显示对未来需求成长的信心日益增强。政府和私人机构为增加充电站等电动车基础设施所做的努力表明泰国的电动车生态系统正在快速发展。

泰国密封胶产业概况

泰国密封胶市场较为分散,前五大企业占22.73%。市场的主要企业有:3M、陶氏、汉高股份公司、西卡股份公司和Soudal Holding NV。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章执行摘要和主要发现

第二章 报告要约

第三章 引言

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 产业主要趋势

- 最终用户趋势

- 航太

- 车

- 建筑与施工

- 法律规范

- 泰国

- 价值炼和通路分析

第五章市场区隔

- 最终用户产业

- 航太

- 车

- 建筑与施工

- 医疗保健

- 其他的

- 树脂

- 丙烯酸纤维

- 环氧树脂

- 聚氨酯

- 硅胶

- 其他的

第六章竞争格局

- 关键策略趋势

- 市场占有率分析

- 商业状况

- 公司简介

- 3M

- Arkema Group

- Dow

- HB Fuller Company

- Henkel AG & Co. KGaA

- Plic Firston(泰国)有限公司

- Shin-Etsu Chemical Co., Ltd.

- Sika AG

- Soudal Holding NV

- THE YOKOHAMA RUBBER CO., LTD.

第七章 CEO 的关键策略问题

第 8 章 附录

- 全球黏合剂和密封剂产业概况

- 概述

- 五力分析框架(产业吸引力分析)

- 全球价值链分析

- 驱动因素、限制因素和机会

- 资讯来源及延伸阅读

- 图片列表

- 关键见解

- 数据包

- 词彙表

简介目录

Product Code: 92458

The Thailand Sealants Market size is estimated at 122.06 million USD in 2024, and is expected to reach 147.21 million USD by 2028, growing at a CAGR of 4.80% during the forecast period (2024-2028).

The emerging automotive industry and rising demand for advanced medical equipment are expected to boost the consumption of sealants in Thailand

- The construction industry holds a major share of the Thai sealants market, followed by other end-user industries due to the diverse applications of sealants in building and construction. Moreover, construction sealants are designed for longevity and ease of application on different substrates. The construction sector contributed THB 439.13 billion to the nation's GDP in 2021 and is likely to register significant growth owing to increasing investment in residential construction, which is expected to boost the demand for sealants in the upcoming years.

- The other end-user industries segment is anticipated to hold the second-highest share in value and volume in the Thai sealants market, of which electronics and electrical equipment will account for the major portion. Various sealants are used in electrical equipment manufacturing for potting and protecting applications. They are used for sealing sensors and cables, etc. The Thai electronics industry is likely to grow over the coming years, owing to the presence of major manufacturers in the country. This will foster the production capacity and demand for sealants in the other end-user industries segment.

- Sealants are used in diverse applications in the automotive industry, mostly for engines and car gaskets, and exhibit extensive bonding to various substrates. Thailand has been a major hub for automakers over the last few years due to well-organized production facilities and the presence of leading companies, which is likely to create demand for sealants over the coming years. Sealants are also used for healthcare applications, such as assembling and sealing medical device parts, thus, accounting for a decent share of the Thai sealants market among end-user industries.

Thailand Sealants Market Trends

Increasing spending on public infrastructure projects is likely to facilitate the growth of construction sector

- The Thai construction industry is projected to record a CAGR of about 2.59% during the forecast period 2022-2028. Thailand is one of Southeast Asia's most exciting hubs for contractors, with a huge construction sector to invest in. With increasing public works, such as the construction of transit lines and subway infrastructure, the demand for residential construction has been consistently growing. Residential construction was the largest segment in the Thai construction industry between 2014 and 2019, accounting for more than 40% of its total value in 2019. The construction industry is expected to recover by 2023, with total construction spending having been forecast to rise by 4.5-5% in 2021 and then by 5-5.5% in 2022-2023.

- The major driver in the country for increasing construction will be public-sector spending on infrastructure megaprojects, especially in the Eastern Economic Corridor, where investment in government-backed projects will encourage crowding-in of private-sector investment (e.g., industrial estates). There will also be new opportunities in neighbouring countries as their governments improve national infrastructure in response to continued economic growth and urbanization.

- The segment's growth was further propelled in 2021 as a few residential projects started construction. The projects include the Skyrise Avenue Sukhumvit 64 Mixed-Use Development of USD 507 million and the Arom Wongamat Condominium Tower of USD 117 million, among others. The timelines for completing these projects range from around 2024 to 2025. The growing infrastructure development in the country is expected to generate demand for adhesives over the forecast period.

Nearly 50.1% share of the overall automotive production among the ASEAN countries is likely to drive the industry in Thailand

- The Thai automobile sector has grown tremendously over the last 50 years. The country is constantly advancing its next-generation automotive industry to follow the S-Curve promotion with better value-added production, and it also aims for the automotive industrial policy to be aligned with the environmental protection policy. Thailand is the largest auto producer in the ASEAN region. In 2020, production totaled 1,427,074 units, accounting for 50.1% of total ASEAN production. This was followed by Indonesia (690,150 units, or approximately 24.2%) and Malaysia (485,186 units, or approximately 17.0%).

- In 2019, the country recorded about 20.13,710 units of vehicles produced, which drastically reduced to 14,27,074 units in 2020, accounting for a decline of about 29% owing to the COVID-19 pandemic. As a result, the variation in automotive production between 2019 and 2021 amounted to about -16%, whereas between 2020 and 2021, the variation was recorded at about -1%.

- Thailand, ranked as the 11th largest automotive producer in the world and the first in ASEAN, is poised to become ASEAN's EV center, owing to its well-established value chain, which provides the industry with top-notch quality products at a competitive price. Thailand's EV stock has been steadily increasing in response to local demand. More importantly, several well-known Thai corporations have been actively investing in EV charging infrastructure around the country, indicating rising confidence in future demand increases. Efforts by governmental and private sector institutions to increase EV infrastructure, such as charging stations, suggest that Thailand's EV ecosystem is developing rapidly.

Thailand Sealants Industry Overview

The Thailand Sealants Market is fragmented, with the top five companies occupying 22.73%. The major players in this market are 3M, Dow, Henkel AG & Co. KGaA, Sika AG and Soudal Holding N.V. (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 End User Trends

- 4.1.1 Aerospace

- 4.1.2 Automotive

- 4.1.3 Building and Construction

- 4.2 Regulatory Framework

- 4.2.1 Thailand

- 4.3 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2028 and analysis of growth prospects)

- 5.1 End User Industry

- 5.1.1 Aerospace

- 5.1.2 Automotive

- 5.1.3 Building and Construction

- 5.1.4 Healthcare

- 5.1.5 Other End-user Industries

- 5.2 Resin

- 5.2.1 Acrylic

- 5.2.2 Epoxy

- 5.2.3 Polyurethane

- 5.2.4 Silicone

- 5.2.5 Other Resins

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 3M

- 6.4.2 Arkema Group

- 6.4.3 Dow

- 6.4.4 H.B. Fuller Company

- 6.4.5 Henkel AG & Co. KGaA

- 6.4.6 Plic Firston (Thailand) Co., Ltd

- 6.4.7 Shin-Etsu Chemical Co., Ltd.

- 6.4.8 Sika AG

- 6.4.9 Soudal Holding N.V.

- 6.4.10 THE YOKOHAMA RUBBER CO., LTD.

7 KEY STRATEGIC QUESTIONS FOR ADHESIVES AND SEALANTS CEOS

8 APPENDIX

- 8.1 Global Adhesives and Sealants Industry Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework (Industry Attractiveness Analysis)

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Drivers, Restraints, and Opportunities

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219