|

市场调查报告书

商品编码

1693403

马来西亚密封剂:市场占有率分析、行业趋势和统计数据、成长预测(2025-2030 年)Malaysia Sealants - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

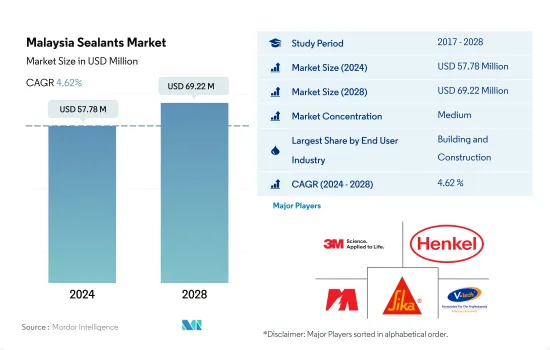

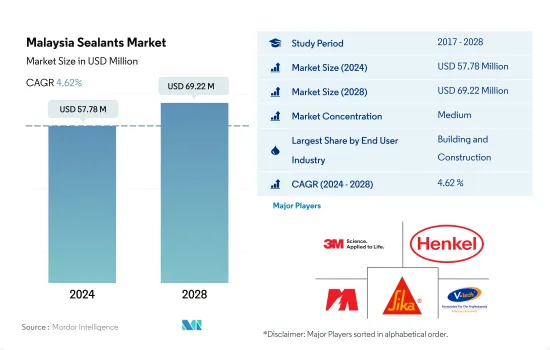

马来西亚密封剂市场规模预计在 2024 年为 5,778 万美元,预计到 2028 年将达到 6,922 万美元,在市场估计和预测期(2024-2028 年)内以 4.62% 的复合年增长率增长。

马来西亚作为外包目的地和医疗设备製造中心的崛起将大大增加对密封剂的需求

- 马来西亚密封剂市场主要由建设产业推动,其次是其他终端用户行业,因为密封剂在建筑和建设活动中有多种应用,例如防水、防风雨密封、裂缝密封和接缝密封。建筑密封剂的设计使用寿命长,易于应用于各种基材。建筑业在马来西亚经济中发挥着至关重要的作用。然而,由于疫情限制和原材料短缺,2020 年建设活动有所下降,随后在 2021 年有所復苏,提振了全国对密封剂的需求。

- 密封剂在医疗保健行业有广泛的应用,主要用于组装和密封医疗设备组件。医用级密封剂在玻璃、金属、塑胶和涂漆表面等各种基材上具有独特的适用性,耐候性、耐热性和抗老化等关键特性可能会推动对密封剂的需求。马来西亚正在成为东南亚地区製造商的外包目的地和医疗设备製造中心。预计这将在预测期内促进该国对密封剂的需求。

- 由于电子和电气设备製造业中灌封和保护材料等多种应用,其他终端用户工业部门可能会占据马来西亚密封剂市场的很大份额。密封剂用于密封感测器、电缆等。此外,电子商务活动的快速成长和消费性电子领域的强大市场定位可能会推动马来西亚密封剂市场的发展。

马来西亚密封胶市场趋势

私人和工业投资以及即将启动的大型建设计划将扩大该行业的规模

- 预计 2022 年至 2028 年预测期间马来西亚建设产业的复合年增长率约为 3.37%。 2019 年,马来西亚建筑业产出约 1,463.7 亿令吉,较 2018 年略有成长。由于多个计划因偿还债务而停滞,马来西亚建筑业在 2019 年成长放缓。由于多个大型建筑计划的停止以及未售出住宅库存的增加,建设产业在 2019 年基本上处于停滞状态。

- 2020年,由于民用、非住宅和住宅出现负成长,马来西亚建筑业萎缩了13.9%。截至2021年12月的财政年度,马来西亚建设活动年减12.9%。与2021年第三季相比,住宅下降,非住宅和土木工程建筑活动有所下降。到了2021年,该国的建筑业产出下降5%。

- 马来西亚正在大力投资和推动私人和工业建设。根据 2022 年私人和工业建筑预测,住宅领域预计在 2021 年增长 6.08% 至 226.28 亿马币,然后在 2022 年上半年因供应过剩的担忧而萎缩 1.67%。预测期内,全国的建筑业发展将会扩大。

电动车需求的增加将影响该国的汽车产业

- 马来西亚继续成为跨国汽车製造商青睐的基地。本田、丰田、日产、梅赛德斯-奔驰和宝马等全球汽车公司都在马来西亚设立工厂,以满足日益增长的客户需求。汽车工业在马来西亚工业领域占有重要地位,贡献了马来西亚GDP的4%以上,是东协第三大汽车市场。马来西亚目前拥有28家乘用车、商用车、摩托车、Scooter、汽车零件製造和组装厂。

- 毫无疑问,该行业促进了工程、辅助和支援行业的发展。它还有助于技能发展和提高技术和工程能力。马来西亚的汽车产业似乎未能免受全球数位化趋势和新经营模式出现的影响。 2019年,该国汽车产量约571,632辆,但受新冠疫情影响,2020年产量暴跌至485,186辆,下降了15%。受此影响,2019 年至 2021 年汽车产量变化约为 -16%,而 2020 年至 2021 年则为 -1%。

- 电动车(EV)已被国内汽车产业蓝图确定为未来汽车动力系统的关键技术。电动车最近才在马来西亚产生重大影响。然而,马来西亚缺乏电动车基础设施和高度依赖石化燃料是主要障碍。

马来西亚密封胶产业概况

马来西亚密封剂市场适度整合,前五大公司占45.69%。市场的主要企业有:3M、Henkel AG & Co. KGaA、Mohm Chemical Sdn。 Bhd.、Sika AG 和 VITAL TECHNICAL SDN BHD(按字母顺序)

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章执行摘要和主要发现

第二章 报告要约

第三章 引言

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 产业主要趋势

- 最终用户趋势

- 航太

- 车

- 建筑与施工

- 法律规范

- 马来西亚

- 价值炼和通路分析

第五章市场区隔

- 最终用户产业

- 航太

- 车

- 建筑与施工

- 卫生保健

- 其他最终用户产业

- 树脂

- 丙烯酸纤维

- 环氧树脂

- 聚氨酯

- 硅胶

- 其他树脂

第六章竞争格局

- 重大策略倡议

- 市场占有率分析

- 商业状况

- 公司简介.

- 3M

- Arkema Group

- Dow

- Henkel AG & Co. KGaA

- Illinois Tool Works Inc.

- Mohm Chemical Sdn. Bhd.

- Sika AG

- Soudal Holding NV

- VITAL TECHNICAL SDN BHD

- Wacker Chemie AG

第七章:CEO面临的关键策略问题

第 8 章 附录

- 全球黏合剂和密封剂产业概况

- 概述

- 五力分析框架(产业吸引力分析)

- 全球价值链分析

- 驱动因素、阻碍因素和机会

- 资讯来源及延伸阅读

- 图片列表

- 关键见解

- 资料包

- 词彙表

简介目录

Product Code: 92459

The Malaysia Sealants Market size is estimated at 57.78 million USD in 2024, and is expected to reach 69.22 million USD by 2028, growing at a CAGR of 4.62% during the forecast period (2024-2028).

Malaysia's growing emergence as an outsourcing destination and medical device manufacturing hub to substantially boost the sealants demand

- The Malaysian sealants market is primarily driven by the construction industry, followed by the other end-user industries segment due to the diverse applications of sealants in building and construction activities, such as waterproofing, weather-sealing, cracks-sealing, and joint-sealing. Construction sealants are designed for longevity and ease of application on different substrates. The construction industry plays a vital role in the Malaysian economy. However, construction activities decreased in 2020 due to the COVID-19 pandemic-induced restrictions and scarcity of raw materials, which was restored in 2021, thus, boosting the sealants demand across the country.

- Sealants have considerable applications in the healthcare industry and are primarily used for assembling and sealing medical device parts. Medical-grade sealants have unique applicability to various substrates, such as glass, metal, plastic, painted surfaces, etc., and significant features such as weather-proofing, heat resistance, and anti-aging are likely to boost the demand for sealants. Malaysia is emerging as an outsourcing destination and medical device manufacturing hub for manufacturers in the Southeast Asian region. This, in turn, is expected to boost the sealants demand in the country over the forecast period.

- The other end-user industries segment is likely to obtain a decent share in the Malaysian sealants market owing to the diverse applications in the electronics and electrical equipment manufacturing industry for potting and protecting materials. They are used for sealing sensors and cables, etc. Moreover, the rapid growth of e-commerce activities, along with the strong market positioning of the consumer electronics segment, is likely to propel the Malaysian sealants market.

Malaysia Sealants Market Trends

Private and industrial investments along with the upcoming mega-construction projects will augment the industry size

- The Malaysian construction industry is expected to record a CAGR of about 3.37% during the forecast period from 2022 to 2028. In 2019, the construction output in Malaysia stood at approximately MYR 146.37 billion, exhibiting a slight growth from 2018. Malaysia's construction sector grew slower in 2019, as a few projects were stalled to cover the debt values. Owing to a halt in several mega-construction projects and an increasing inventory of unsold housing stocks, the construction industry remained almost stagnant in 2019.

- In 2020, the Malaysian construction sector contracted by 13.9% due to negative growth in civil engineering, non-residential, and residential buildings. Malaysia's construction activity contracted 12.9% Y-o-Y in the December quarter of 2021. Decreasing numbers were seen in residential buildings compared to the third quarter of 2021, with a decrease in non-residential buildings and civil engineering. By 2021, the construction output fell by 5% in the country.

- Malaysia promotes and makes significant investments in private and industrial construction. As per the 2022 construction forecast for private and industrial construction, the residential sector was expected to record a 6.08% increase to MYR 22,628 million in 2021 and a decline by 1.67% in the first half of 2022 as concerns over the supply overhang linger. The growing construction developments across the country over the forecast period.

Growing demand for electric vehicles will influence the country's automotive industry

- Malaysia remains an appealing base for multinational automakers. Honda, Toyota, Nissan, Mercedes-Benz, and BMW are among the global automobile corporations that have established operations in the country to capitalize on growing customer demand. The industry is a crucial part of the country's industrial sector, contributing above 4% of its GDP and remaining the third-largest automotive market in ASEAN. Malaysia currently has 28 manufacturing and assembly plants for passenger vehicles, commercial vehicles, motorcycles, and scooters, as well as automotive parts and components.

- The industry has undoubtedly aided the growth of engineering, auxiliary, and supporting sectors. It also helps with skill development and the advancement of technology and engineering capabilities. The automotive industry in Malaysia will not be immune to the global trend of digitalization and the advent of new business models. In 2019, the country produced about 5,71,632 units of vehicles, which drastically reduced to 4,85,186 units in 2020, with a 15% decline due to the COVID-19 pandemic. Due to this, the variation in automotive production between 2019 and 2021 was about -16%, whereas it was recorded at -1% between 2020 and 2021.

- The electric vehicle (EV) is recognized as a critical technology for the future of automotive power systems in the country's automotive industry's roadmaps. EVs have just recently emerged as a significant influence in Malaysia. However, in Malaysia, the absence of EV infrastructure and the country's heavy reliance on fossil fuels creates a considerable obstacle.

Malaysia Sealants Industry Overview

The Malaysia Sealants Market is moderately consolidated, with the top five companies occupying 45.69%. The major players in this market are 3M, Henkel AG & Co. KGaA, Mohm Chemical Sdn. Bhd., Sika AG and VITAL TECHNICAL SDN BHD (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 End User Trends

- 4.1.1 Aerospace

- 4.1.2 Automotive

- 4.1.3 Building and Construction

- 4.2 Regulatory Framework

- 4.2.1 Malaysia

- 4.3 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2028 and analysis of growth prospects)

- 5.1 End User Industry

- 5.1.1 Aerospace

- 5.1.2 Automotive

- 5.1.3 Building and Construction

- 5.1.4 Healthcare

- 5.1.5 Other End-user Industries

- 5.2 Resin

- 5.2.1 Acrylic

- 5.2.2 Epoxy

- 5.2.3 Polyurethane

- 5.2.4 Silicone

- 5.2.5 Other Resins

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 3M

- 6.4.2 Arkema Group

- 6.4.3 Dow

- 6.4.4 Henkel AG & Co. KGaA

- 6.4.5 Illinois Tool Works Inc.

- 6.4.6 Mohm Chemical Sdn. Bhd.

- 6.4.7 Sika AG

- 6.4.8 Soudal Holding N.V.

- 6.4.9 VITAL TECHNICAL SDN BHD

- 6.4.10 Wacker Chemie AG

7 KEY STRATEGIC QUESTIONS FOR ADHESIVES AND SEALANTS CEOS

8 APPENDIX

- 8.1 Global Adhesives and Sealants Industry Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework (Industry Attractiveness Analysis)

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Drivers, Restraints, and Opportunities

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219