|

市场调查报告书

商品编码

1693421

丙烯酸黏合剂:市场占有率分析、产业趋势与统计、成长预测(2025-2030)Acrylic Adhesives - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

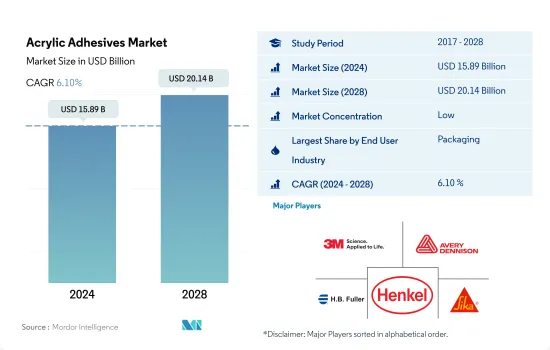

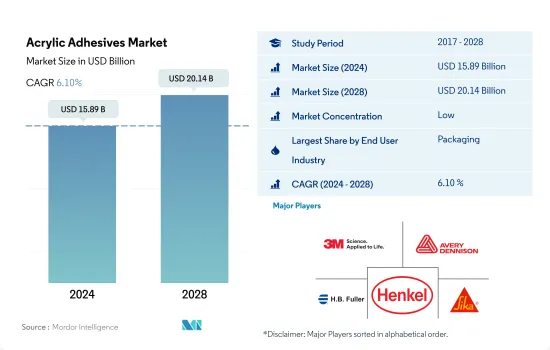

丙烯酸黏合剂市场规模预计在 2024 年为 158.9 亿美元,预计到 2028 年将达到 201.4 亿美元,预测期内(2024-2028 年)的复合年增长率为 6.10%。

材料技术的进步推动丙烯酸黏合剂的成长

- 丙烯酸黏合剂因其防水、防风雨、裂缝密封和黏合等用途而被广泛应用于建筑业。预计到 2030 年,全球建筑业每年将以 3.5% 的速度成长。预计到 2021 年,亚太地区和欧洲将占全球建筑市场成长的 67%。因此,建筑用丙烯酸胶黏剂在全球胶黏剂市场中占有最大份额。

- 黏合剂广泛应用于汽车工业,因为它们可以应用于玻璃、金属、塑胶和油漆表面等表面。其特性包括极强的耐候性、耐用性和长寿命,这些特性在汽车行业中都很有用。这些用于引擎和汽车垫圈。由于发展中国家的需求不断增长,预计在 2022 年至 2028 年预测期内,全球整体汽车产业的电动车领域将以 17.75% 的复合年增长率成长。预计这将在 2022-2028 年预测期内推动对汽车丙烯酸黏合剂的需求。

- 各种各样的黏合剂被广泛用于电子、电气设备的製造。它们用于粘合和密封感测器和电缆。预计电子业和家用电子电器产业的复合年增长率将分别达到 2.51% 和 5.77%,从而导致 2022-2028 年预测期内对丙烯酸黏合剂的需求增加。

- 在医疗产业中,黏合剂用于组装医疗设备零件等应用。预计 2022-2028 年预测期内,全球医疗保健投资的增加将导致对丙烯酸黏合剂的需求增加。

亚太地区和欧洲将推动全球丙烯酸黏合剂需求

- 在整个研究期间,亚太地区占据了丙烯酸黏合剂需求的最大份额,这得益于建筑包装活动、汽车、医疗设备和航太工业以及其他成熟的终端用户行业的高生产能力。中国是全球最大的建筑和汽车市场,到2021年将占亚太地区需求的55%。

- 2017年至2019年,丙烯酸胶黏剂的需求呈现稳定成长。欧洲和北美建筑包装行业需求的不断增长是成长的主要动力。全球汽车产业需求疲软限制了该期间丙烯酸黏合剂需求的成长。

- 2020年,由于新冠疫情,所有终端用户产业对丙烯酸黏合剂的需求均下降。在南非和巴西等其他国家,建设活动被视为必不可少的,并允许在疫情期间进行。这些因素减轻了全球影响,将跌幅限制在 6.69%。

- 由于美国、澳洲、欧盟国家等的纾困措施和支持计划,需求将在 2021 年开始復苏,预计这一成长趋势将在整个预测期内持续下去。预计欧洲、南美和亚太地区的投资和预算分配增加将成为这一成长的主要驱动力。预计 2022-2028 年预测期内全球对丙烯酸黏合剂的需求将以 4.43% 的复合年增长率成长。

全球丙烯酸胶黏剂市场趋势

开发中国家电子商务产业的快速成长将推动该产业

- 2020 年开始,包装产业出现了几个长期趋势,推动需求成长;随着经济活动转向因应 COVID-19 疫情带来的挑战,包装产业成长加速。该行业的强劲表现支持了食品饮料和医疗保健等主要终端市场的收益成长和扩张,同时也证明了该行业在更广泛的经济不确定时期的整体稳定性。

- 2021 年,由于买家和卖家在疫情导致交易几乎停滞之后急切地重返市场,包装行业的併购活动激增。疫情期间包装公司的强劲表现强化了这样一种观念:包装产业在整体市场动盪期间提供了稳定性。疫情也增强了现有的顺风因素,例如电子商务的快速扩张以及品牌所有者采用包装来在超级市场货架上区分其产品,为该行业更强劲的长期增长奠定了基础。

- 截至目前,可溶解包装、节省空间包装和智慧包装是包装产业出现的一些创新。采用可食用包装是一种有趣且创新的替代方案,它有可能减少对石化燃料的依赖并显着减少碳足迹,并且由于其永续性而在整个食品行业中变得越来越普遍。这些因素为食品和饮料领域的包装产业创造了成长机会,并有望在预测期内推动包装产业的成长。

随着住宅和基础设施建设的不断推进,建筑业蓬勃发展

- 建筑业呈现稳定成长,2017 年至 2019 年的复合年增长率为 2.6%。这一成长受到全球经济活动好转和独栋住宅需求增加的推动。 2020年,新冠疫情对全球建筑业产生了重大影响。劳动力供应限制、建筑融资和供应链中断以及经济不确定性对全球 AEC 产业产生了负面影响。

- 虽然2021年呈现正成长,但疫情对供应链的衝击导致原物料价格上涨,仍在困扰产业。不过,由于建筑业对一个国家的经济影响重大,北美和亚太国家都透过提供支持计画来重新启动经济週期。支持计划包括澳大利亚的HomeBuilder计划和欧盟国家的经济復苏计划。

- 亚太地区的建设活动,预计到 2028 年仍将是最大的建筑市场,这得益于其庞大的人口、不断加快的都市化以及中国、印度、日本、印尼和韩国等国家对基础设施建设的投资不断增加。

- 预计在预测期内,对绿色建筑的日益重视和减少全球建设活动排放的努力将带来更永续的营运程序。例如,法国在向低碳能源经济转型的过程中,已为建筑业累计75 亿欧元。

丙烯酸黏合剂产业概况

丙烯酸黏合剂市场分散,前五大公司占据19.23%的市场份额。市场的主要企业包括 3M、AVERY DENNISON CORPORATION、HB Fuller Company、Henkel AG & Co. KGaA、Sika AG 等。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章执行摘要和主要发现

第二章 报告要约

第三章 引言

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 产业主要趋势

- 最终用户趋势

- 航太

- 车

- 建筑与施工

- 鞋类皮革

- 包装

- 法律规范

- 阿根廷

- 澳洲

- 巴西

- 加拿大

- 中国

- EU

- 印度

- 印尼

- 日本

- 马来西亚

- 墨西哥

- 俄罗斯

- 沙乌地阿拉伯

- 新加坡

- 南非

- 韩国

- 泰国

- 美国

- 价值炼和通路分析

第五章市场区隔

- 最终用户产业

- 航太

- 车

- 建筑与施工

- 鞋类和皮革

- 医疗保健

- 包装

- 其他的

- 科技

- 反应性

- 溶剂型

- 紫外线固化胶合剂

- 水性

- 地区

- 亚太地区

- 澳洲

- 中国

- 印度

- 印尼

- 日本

- 马来西亚

- 新加坡

- 韩国

- 泰国

- 其他亚太地区

- 欧洲

- 法国

- 德国

- 义大利

- 俄罗斯

- 西班牙

- 英国

- 其他欧洲国家

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 北美洲

- 加拿大

- 墨西哥

- 美国

- 北美其他地区

- 南美洲

- 阿根廷

- 巴西

- 南美洲其他地区

- 亚太地区

第六章 竞争格局

- 关键策略趋势

- 市场占有率分析

- 商业状况

- 公司简介

- 3M

- Arkema Group

- AVERY DENNISON CORPORATION

- Dow

- HB Fuller Company

- Henkel AG & Co. KGaA

- Hubei Huitian New Materials Co. Ltd

- Huntsman International LLC

- Jowat SE

- Kangda New Materials(Group)Co., Ltd.

- MAPEI SpA

- NANPAO RESINS CHEMICAL GROUP

- Pidilite Industries Ltd.

- Sika AG

- Soudal Holding NV

第七章:CEO面临的关键策略问题

第 8 章 附录

- 全球黏合剂和密封剂产业概况

- 概述

- 五力分析框架(产业吸引力分析)

- 全球价值链分析

- 驱动因素、限制因素和机会

- 资讯来源及延伸阅读

- 图片列表

- 关键见解

- 数据包

- 词彙表

简介目录

Product Code: 92480

The Acrylic Adhesives Market size is estimated at 15.89 billion USD in 2024, and is expected to reach 20.14 billion USD by 2028, growing at a CAGR of 6.10% during the forecast period (2024-2028).

Advancement in material technology to augment the growth of acrylic adhesives

- Acrylic adhesives are widely used in the construction industry because of their applications, such as waterproofing, weather-sealing, cracks sealing, and bonding. The construction industry globally is expected to grow 3.5% annually up to 2030. Asia-Pacific and Europe accounted for 67% of the global construction market's growth in 2021. Thus, construction acrylic adhesives account for the largest share of the global adhesives market by volume.

- Adhesives are widely used in the automotive industry because of their application to surfaces such as glass, metal, plastic, and painted surfaces. Their features are helpful in the automotive industry, such as extreme weather resistance, durability, and long-lasting. These are used in engines and car gaskets. The electric vehicles segment of the automotive industry is expected to record a 17.75% CAGR globally in the forecast period, 2022-2028, because of the increased demand in growing economies. This is expected to increase demand for automotive acrylic adhesives in the forecast period 2022-2028.

- Different adhesives are widely used in electronics and electrical equipment manufacturing. They are used for bonding and sealing sensors and cables. The electronics and household appliances industries are expected to record CAGRs of 2.51% and 5.77%, respectively, which will lead to an increase in demand for acrylic adhesives in the forecast period 2022-2028.

- Adhesives are used in the healthcare industry for applications such as assembling medical device parts. The increase in healthcare investments worldwide is expected to lead to an increase in demand for acrylic adhesives in the forecast period 2022-2028.

Asia-Pacific and Europe to carry the global demand for acrylic adhesives

- The Asia-Pacific region accounted for the largest share of the demand for acrylic adhesives throughout the entire study period because of the large number of construction and packaging activities, automotive, medical devices, and aerospace production capacities, and other well-established end-user industries in the region. China is the largest construction and automotive market globally and accounted for up to 55% of the demand from the Asia-Pacific region in 2021.

- During 2017-19, the demand for acrylic adhesives witnessed steady growth. The rising demand from construction and packaging industries in Europe and North America were major drivers of growth. The decline of the demand from the automotive industry globally restricted the growth of the demand for acrylic adhesives during this period. declined with a CAGR of 2.89% during this period, 2017-19.

- In 2020, the demand for acrylic adhesives from all end-user industries declined because of the covid-19 pandemic. In some countries like South Africa, and Brazil among others construction activities were deemed essential and were allowed to operate during the pandemic. Factors like these have cushioned the global impact restricting the decline to 6.69%.

- In 2021, due to the relief packages and support schemes in countries like the United States, Australia, and countries in the EU among others, the demand started to recover and this growth trend is expected to continue throughout the forecast period. Increased investments and budget allotments witnessed in countries of Europe, South America, and the Asia Pacific regions are expected to be major driving factors for this growth. The global demand for acrylic adhesives is expected to grow with a CAGR of 4.43% during the forecast period, 2022-2028.

Global Acrylic Adhesives Market Trends

Fast paced growth of e-commerce industry in developing nations to augment the industry

- In 2020, the packaging industry started with multiple long-term trends driving higher demand, and growth accelerated as economic activity switched to address the challenges posed by the COVID-19 pandemic. The industry's robust performance supported rising revenues and the expansion of important end markets such as food and beverage and healthcare and also demonstrated the industry's general stability during a period of overall economic uncertainty.

- Packaging M&A activities soared in 2021, as buyers and sellers enthusiastically returned to the market after deal-making almost ceased during the pandemic in 2020. During the pandemic, the strong performance of packaging companies reinforced the idea that the industry offers stability during moments of general market turbulence. The pandemic also strengthened previously existing tailwinds, including rapid e-commerce expansion and brand owners employing packaging to differentiate their products on supermarket shelves, positioning the sector for stronger long-term growth.

- As of now, dissolvable packaging, space-saving packaging, and smart packaging are a few innovations that have come up in the packaging industry. The adoption of edible packaging, an interesting and innovative alternative that alleviates the reliance on fossil fuels and has the potential to significantly decrease the carbon footprint, is now becoming popular across the food industry owing to its sustainability. These factors have created a growth opportunity for the packaging industry in the food and beverage sector, which is expected to boost the packaging industry's growth during the forecast period.

Growing residential and infrastructural development to thrive the construction sector

- The building and construction industry witnessed steady growth, with a CAGR of 2.6% from 2017 to 2019. This growth was driven by the upswing in global economic activity and increasing demand for single-family homes. In 2020, the COVID-19 pandemic had a major impact on the global building and construction industry. Constraints in labor supply, disruptions in construction finances and the supply chain, and economic uncertainty negatively impacted the global building and construction industry.

- Though the industry showed positive growth in 2021, the pandemic's effect on supply chains, which resulted in a hike in raw material prices, is still plaguing the industry. However, as the construction industry heavily influences a nation's economy, countries in Europe, North America, and Asia-Pacific have used the construction industry to restart their economic cycles by offering support schemes. Some support schemes include the Homebuilder Programme in Australia and the economic recovery plan of EU countries.

- The Asia-Pacific region experiences the highest volume of construction activities, and it is expected to remain the largest construction market till 2028 due to its huge population, increasing urbanization, and increasing investments in infrastructural development in countries like China, India, Japan, Indonesia, and South Korea.

- Increasing emphasis on green buildings and efforts to reduce emissions from global construction activities are expected to result in more sustainable operational procedures during the forecast period. For example, France has sanctioned EUR 7.5 billion for the construction industry to transform itself into a low-carbon energy economy.

Acrylic Adhesives Industry Overview

The Acrylic Adhesives Market is fragmented, with the top five companies occupying 19.23%. The major players in this market are 3M, AVERY DENNISON CORPORATION, H.B. Fuller Company, Henkel AG & Co. KGaA and Sika AG (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 End User Trends

- 4.1.1 Aerospace

- 4.1.2 Automotive

- 4.1.3 Building and Construction

- 4.1.4 Footwear and Leather

- 4.1.5 Packaging

- 4.2 Regulatory Framework

- 4.2.1 Argentina

- 4.2.2 Australia

- 4.2.3 Brazil

- 4.2.4 Canada

- 4.2.5 China

- 4.2.6 EU

- 4.2.7 India

- 4.2.8 Indonesia

- 4.2.9 Japan

- 4.2.10 Malaysia

- 4.2.11 Mexico

- 4.2.12 Russia

- 4.2.13 Saudi Arabia

- 4.2.14 Singapore

- 4.2.15 South Africa

- 4.2.16 South Korea

- 4.2.17 Thailand

- 4.2.18 United States

- 4.3 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2028 and analysis of growth prospects)

- 5.1 End User Industry

- 5.1.1 Aerospace

- 5.1.2 Automotive

- 5.1.3 Building and Construction

- 5.1.4 Footwear and Leather

- 5.1.5 Healthcare

- 5.1.6 Packaging

- 5.1.7 Other End-user Industries

- 5.2 Technology

- 5.2.1 Reactive

- 5.2.2 Solvent-borne

- 5.2.3 UV Cured Adhesives

- 5.2.4 Water-borne

- 5.3 Region

- 5.3.1 Asia-Pacific

- 5.3.1.1 Australia

- 5.3.1.2 China

- 5.3.1.3 India

- 5.3.1.4 Indonesia

- 5.3.1.5 Japan

- 5.3.1.6 Malaysia

- 5.3.1.7 Singapore

- 5.3.1.8 South Korea

- 5.3.1.9 Thailand

- 5.3.1.10 Rest of Asia-Pacific

- 5.3.2 Europe

- 5.3.2.1 France

- 5.3.2.2 Germany

- 5.3.2.3 Italy

- 5.3.2.4 Russia

- 5.3.2.5 Spain

- 5.3.2.6 United Kingdom

- 5.3.2.7 Rest of Europe

- 5.3.3 Middle East & Africa

- 5.3.3.1 Saudi Arabia

- 5.3.3.2 South Africa

- 5.3.3.3 Rest of Middle East & Africa

- 5.3.4 North America

- 5.3.4.1 Canada

- 5.3.4.2 Mexico

- 5.3.4.3 United States

- 5.3.4.4 Rest of North America

- 5.3.5 South America

- 5.3.5.1 Argentina

- 5.3.5.2 Brazil

- 5.3.5.3 Rest of South America

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 3M

- 6.4.2 Arkema Group

- 6.4.3 AVERY DENNISON CORPORATION

- 6.4.4 Dow

- 6.4.5 H.B. Fuller Company

- 6.4.6 Henkel AG & Co. KGaA

- 6.4.7 Hubei Huitian New Materials Co. Ltd

- 6.4.8 Huntsman International LLC

- 6.4.9 Jowat SE

- 6.4.10 Kangda New Materials (Group) Co., Ltd.

- 6.4.11 MAPEI S.p.A.

- 6.4.12 NANPAO RESINS CHEMICAL GROUP

- 6.4.13 Pidilite Industries Ltd.

- 6.4.14 Sika AG

- 6.4.15 Soudal Holding N.V.

7 KEY STRATEGIC QUESTIONS FOR ADHESIVES AND SEALANTS CEOS

8 APPENDIX

- 8.1 Global Adhesives and Sealants Industry Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework (Industry Attractiveness Analysis)

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Drivers, Restraints, and Opportunities

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219