|

市场调查报告书

商品编码

1693595

可膨胀石墨:市场占有率分析、行业趋势和统计数据、成长预测(2025-2030 年)Expandable Graphite - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

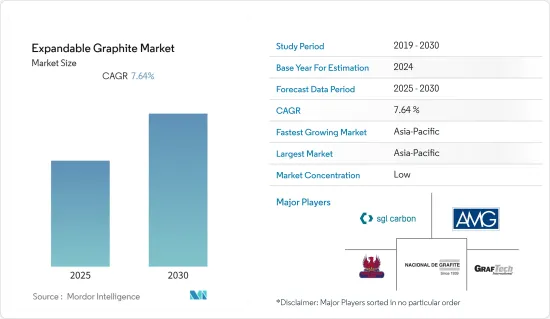

预计预测期内可膨胀石墨市场复合年增长率为 7.64%。

主要亮点

- 从中期来看,由于建筑业越来越多地采用可膨胀石墨作为阻燃剂、对非卤阻燃剂的需求不断增长以及家电市场的增长等因素,全球可膨胀石墨消费量预计将增加。

- 但由于石墨供应有限,估计可膨胀石墨的需求可能很快就会下降。此外,供应有限和价格上涨预计也会阻碍市场发展。

- 然而,随着建筑和垫片中耐火材料和石棉基耐火材料等危险耐火材料的使用禁令日益严格,预计将为扩大的石墨市场带来新的机会。

- 在收益和预测方面,预计亚太地区将在预测期内主导全球市场。

可膨胀石墨市场趋势

阻燃剂领域预计将占据很大份额

- 可膨胀石墨是层状石墨,每层之间都含有酸。加热时,酸会产生气体,导致层状石墨膨胀并透过切断空气供应来灭火。

- 阻燃剂的目的是减少火势的发生或减缓或防止火势的蔓延。阻燃剂用于软垫家具、汽车座椅、地毯和其他可能成为火源的区域。可膨胀石墨特别适合作为阻燃添加剂。

- 可膨胀石墨具有受热膨胀的特性,因此被广泛应用于各行各业作为阻燃剂。例如建筑、电子、汽车、纺织品等。

- 在北美,美国在建设产业中占有重要份额。除美国外,加拿大和墨西哥是建筑业投资的主要贡献者。根据美国人口普查局的数据,2022年新的私人仓储建设将达到615.3亿美元,比2021年的12,795亿美元成长24.6%。

- 德国联邦统计局的数据显示,2022 年德国服饰收益约 68 亿欧元,而 2021 年为 57 亿欧元。此外,2022年德国纺织业的收益将达到约127.9亿欧元,而2021年为118亿欧元。

- 预计所有上述因素将在预测期内推动全球可膨胀石墨市场的发展。

亚太地区占市场主导地位

- 在亚太地区,中国是GDP最大的经济体。国际货币基金组织数据显示,2021年该国实际GDP折合成率成长8.4%,主要得益于工业活动和进出口贸易的逐步恢復。然而,到2022年,这一比例下降至3.0%。预计2023年GDP成长率为5.2%。

- 中国是该地区的主要国家之一,也是各种用途可膨胀石墨的主要消费国。

- 2022年,诺德曼与ADT合作在北京西南部建立了新的生产工厂。新的生产设施拥有未来30至40年的营运许可,并配备了现代化的集中水处理系统。原料石墨配送中心也位于同一化工园区内,确保快速供应这种生产可膨胀石墨的最重要原料。

- 可膨胀石墨对于各种行业使用的电池来说是一种特别有价值且众所周知的元素。 2022 年,科莱恩宣布将在该国未来的 Dayabey 工厂生产第二条受专利保护的无卤素 Exolit OP 阻燃剂生产线。该公司已投资约 4,000 万瑞士法郎(约 4,560 万美元)用于扩大创新和永续防火解决方案及相关技术专长的取得管道,并支持电动车和电气电子领域工程塑胶应用的显着成长。

- 印度是全球多个产业最大的新兴市场之一。该国认为可膨胀石墨有多种用途,包括电动车电池、阻燃剂、柔性线圈和石墨烯。

- 2022年,澳洲石墨矿开发商Evion Group(前身为Blackearth)和印度石墨生产商Metachem在普纳收购了一块占地5英亩的土地,以建立合资下游石墨加工厂。

- 该合资企业名为 Panthera Graphite Technologies,初始阶段(前三年)每年将可生产 2,000-2,500 吨可膨胀石墨。此后,从第四年开始,产能将扩大至每年4000-5000吨。该工厂计划于2023年11月开始运作。

- 预计所有上述因素将在预测期内刺激该国所研究市场的需求。

可膨胀石墨产业概况

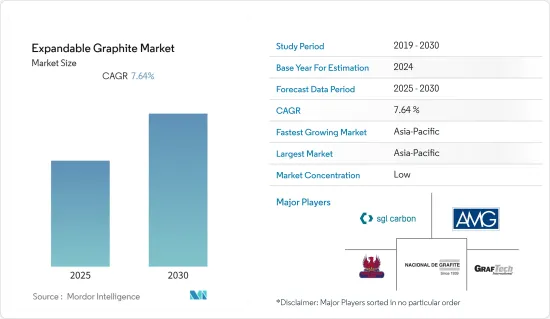

可膨胀石墨市场较为分散。市场上的主要石墨製造商包括(不分先后顺序)SGL Carbon、AMG Mining AG、Durrans Group、Nacional de Grafite 和 GrafTech International Ltd。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 可膨胀石墨作为阻燃剂的应用日益广泛

- 无卤阻燃剂需求不断成长

- 限制因素

- 扩大石墨供应限制

- 其他阻碍因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔

- 应用

- 阻燃剂

- 柔性箔

- 导电添加剂

- 冶金

- 石墨烯

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 其他中东和非洲地区

- 亚太地区

第六章竞争格局

- 併购、合资、合作与协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- GrafTech International Ltd.

- Nacional de Grafite

- NeoGraf Solution

- Northern Graphite

- Qingdao Black Dragon Graphite Group

- Qingdao Jinhui Graphite Co. Ltd

- Qingdao YanXin Graphite Products Co., LTD.

- Sanyo Corporation

- SGL Carbon

- Shijiazhuang ADT Carbonic Material Factory

- Yichang Xincheng Graphite Co., Ltd.

第七章 市场机会与未来趋势

- 加强对危险防火材料的禁令

简介目录

Product Code: 92746

The Expandable Graphite Market is expected to register a CAGR of 7.64% during the forecast period.

Key Highlights

- Over the medium term, factors such as the increasing adoption of expandable graphite as a flame retardant in the construction industry, increasing demand for non-halogenated flame retardants, and growth in the consumer electronics market are expected to increase the global consumption of expandable graphite.

- However, it is estimated that the demand for expandable graphite may decrease shortly due to the limited supply of graphite. Furthermore, limited supply and rising prices are also expected to hamper the market.

- Nevertheless, increasing bans on hazardous refractories such as brominated or asbestos refractories in buildings and gaskets are expected to provide new opportunities for the expanded graphite market.

- In terms of revenue, Asia-Pacific is expected to dominate the global market during the forecast period.

Expandable Graphite Market Trends

The Flame Retardant Segment is Anticipated to Hold a Significant Share

- Expandable graphite is a stratiform graphite and contains acids between each stratum. When heated, an acid generates gas, and these stratiforms are expanded, which enables to put off a fire by cutting off the supply of air.

- Flame retardants are intended to limit, slow, or prevent the spread of fires. Whether in upholstered furniture, car seats, or carpets, flame retardants are used wherever there are potential sources of fire. Expandable graphite is particularly suitable as a flame-retardant additive.

- Expandable graphite is widely used as a flame retardant in different industries due to its ability to expand during heating. A few industries include building and construction, electronics, automotive, and textiles.

- In North America, the United States has a major share in the construction industry. Besides the United States, Canada and Mexico contribute significantly to the construction sector investments. According to the US Census Bureau, the value of new private warehouse construction in 2022 stood at USD 61.53 billion, 24.6% higher than the USD 1,279.5 billion in 2021.

- According to the German Federal Statistics Office, the German clothing industry recorded a revenue of around EUR 6.8 billion in 2022, compared to EUR 5.7 billion in 2021. Moreover, the revenue recorded from the German textile industry in 2022 was approximately EUR 12.79 billion, which was EUR 11.8 billion in 2021.

- All the above factors are expected to drive the global expandable graphite market during the forecast period.

Asia-Pacific Region to Dominate the Market

- In the Asia-Pacific region, China accounts for the largest economy in terms of GDP. According to the IMF, the country's real GDP grew 8.4% annually in 2021, primarily driven by the gradual resumption of industrial activities and import-export trade. However, it declined to 3.0% in 2022. The country's GDP is expected to grow 5.2% in 2023.

- China is one of the major countries in the region and has a major consumption of expandable graphite for various applications.

- In 2022, Nordmann, in partnership with ADT, set up a new production plant southwest of Beijing. The new production facility has an operating permit for the next 30-40 years and is installed with a modern and centralized water treatment system. The distribution center for raw graphite is located in the same chemical park, ensuring a faster supply of the most important raw material for producing the expandable graphite.

- The use of expandable graphite is an exceptionally valuable and especially well-known element for the batteries used in various industries. In 2022, Clariant announced the manufacturing of a second line of patent-protected halogen-free Exolit OP flame retardants at the future Daya Bay plant in the country. The company invested around CHF 40 million (~USD 45.6 million) to expand access to innovative and sustainable fire protection solutions and related technical expertise to support the significant growth of engineering plastics applications in e-mobility and electrical and electronic segments.

- India is one of the largest emerging markets in the world in various industries. The country has seen various applications of expandable graphite such as electric vehicle batteries, flame retardants, flexible coils, and graphene.

- In 2022, an Australian graphite mine developer Evion Group (Formerly known as Blackearth) and an Indian graphite producer Metachem acquired a 5-acre site in Pune to set up a downstream graphite processing plant under their joint venture.

- The JV, known as Panthera Graphite Technologies, can produce 2,000 - 2,500 tons per annum of expandable graphite in the initial stages (first three years). It will then expand production capacity to 4,000 - 5,000 tons per annum from the fourth year. The plant is expected to be commissioned in November 2023.

- All the abovementioned factors are expected to boost the demand for the market studied in the country during the forecast period.

Expandable Graphite Industry Overview

The expandable graphite market is fragmented in nature. Some major graphite manufacturers in the market include (in no particular order) SGL Carbon, AMG Mining AG, Durrans Group, Nacional de Grafite, and GrafTech International Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Adoption of Expandable Graphite as a Flame Retardant

- 4.1.2 Increasing Demand for Non-Halogenated Flame Retardants

- 4.2 Restraints

- 4.2.1 Limited Supply of Expanded Graphite

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size by Value)

- 5.1 Applications

- 5.1.1 Flame Retardant

- 5.1.2 Flexible Foils

- 5.1.3 Conductive Additives

- 5.1.4 Metallurgy

- 5.1.5 Graphene

- 5.2 Geography

- 5.2.1 Asia-Pacific

- 5.2.1.1 China

- 5.2.1.2 India

- 5.2.1.3 Japan

- 5.2.1.4 South Korea

- 5.2.1.5 Rest of Asia-Pacific

- 5.2.2 North America

- 5.2.2.1 United States

- 5.2.2.2 Canada

- 5.2.2.3 Mexico

- 5.2.3 Europe

- 5.2.3.1 Germany

- 5.2.3.2 United Kingdom

- 5.2.3.3 France

- 5.2.3.4 Italy

- 5.2.3.5 Rest of Europe

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Rest of South America

- 5.2.5 Middle-East and Africa

- 5.2.5.1 South Africa

- 5.2.5.2 Saudi Arabia

- 5.2.5.3 Rest of Middle-East and Africa

- 5.2.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 GrafTech International Ltd.

- 6.4.2 Nacional de Grafite

- 6.4.3 NeoGraf Solution

- 6.4.4 Northern Graphite

- 6.4.5 Qingdao Black Dragon Graphite Group

- 6.4.6 Qingdao Jinhui Graphite Co. Ltd

- 6.4.7 Qingdao YanXin Graphite Products Co., LTD.

- 6.4.8 Sanyo Corporation

- 6.4.9 SGL Carbon

- 6.4.10 Shijiazhuang ADT Carbonic Material Factory

- 6.4.11 Yichang Xincheng Graphite Co., Ltd.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Bans on Hazardous Fire-Resistance Materials

02-2729-4219

+886-2-2729-4219