|

市场调查报告书

商品编码

1693596

GRC覆层:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)GRC Cladding - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

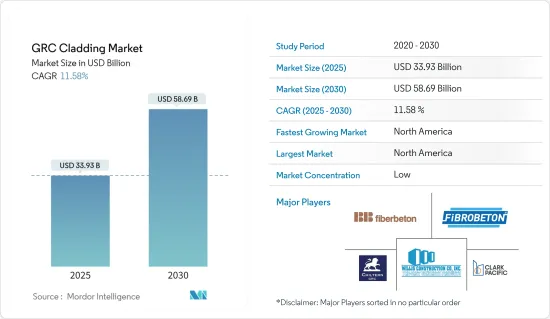

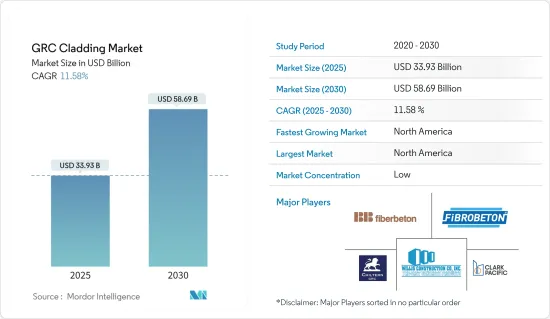

预计 2025 年 GRC覆层市场规模为 339.3 亿美元,到 2030 年将达到 586.9 亿美元,预测期间(2025-2030 年)的复合年增长率为 11.58%。

主要亮点

- 玻璃纤维增强混凝土(GRC) 是一种轻质覆层层板,主要用作建筑结构中的支撑板。纤维增强混凝土通常被认为比标准混凝土更有利于环境。

- GRC覆层市场受到对绿建筑(LEED 评级)日益重视的推动,卓越的机械性能有望推动市场成长。在美国,建筑规范要求墙板和覆层材料不得成为火势蔓延的媒介。

- 美国和英国对水泥混合物是否有火灾隐患有严格的指导方针。这导致了对更耐火的外墙材料的需求。

- GRC 具有良好的耐火性和不燃性,因为它是由特殊的聚合物和纤维混合而成,具有不透水、耐候和阻燃的特性。

- GRC 与其他材料相比具有许多优势。 GRC 是一种真正出色的水泥替代品,它更轻、更坚固、更灵活、更耐用且更耐火。

- 由于其特性,当使用岩绒时,GRC 可提供隔热、防水和隔音功能。这项特性可能会增加极端天气地区的需求。

- 较大的 GRC 产品(例如覆层层板)采用喷涂方法生产。喷射混凝土 GRC 通常比预混合料振铸 GRC 更坚固。

- 为了应对迅速出现的气候紧急情况,并提高住宅建筑的抗震能力,加拿大国家研究委员会在《国家建筑规范》(2025 年)中引入了气候适应性建筑指南,以抵御极端天气事件。

GRC覆层市场趋势

商业空间需求激增推动市场

根据最近的一项研究,到2024年底,办公空间的需求将增加12-18%。预计成长将受到本财年办公室租户逐步回归和宏观经济环境改善的推动。

最近的银行业危机为商业房地产蒙上了一层阴影。由于不受「系统重要性」同业的限制,美国地区性银行一直积极向商业房地产发放贷款。这引发了人们对「恶性循环」情景的担忧,即房地产困境和银行倒闭相互加剧。这看起来似乎有点牵强,因为大部分房地产市场的表现仍然很出色。但这是因为双方都无法崩坏对方。关于替代贷款机构和私募股权的讨论很多,但考虑到未来几年需要偿还的巨额债务,减少银行贷款(银行贷款仍占商业房地产贷款总额的 50% 至 60%)并不是一个好主意。再融资已经很困难了,而且随着信贷标准的收紧,可能会变得更加困难。

儘管美国市场面临许多週期性和结构性挑战,但仍有许多理由对其他地区的办公室运转率感到乐观。例如,在欧洲,预计到 2022 年,平均办公室运转率将从 43% 恢復至 55%,周中运转率将接近新冠疫情之前的平均值(70%)。在许多亚太市场(例如首尔、东京),办公室运转率几乎已恢復到疫情前的水平。在整个亚太地区,优质建筑的供应有限,导致空置率较低,租金上涨。

在印度,儘管 2023 年第一季供应量年减 23%,但预计商业空间供应量将回升,到 2023 年第三季达到约 4,700 万至 4,900 万平方英尺。根据净吸收量,预计 2023 年的供应量将超过疫情前 2017-2019 年的平均值。预计到 2024 年供应量将以每年 22% 的速度成长,达到 5,800 万至 6,000 万平方英尺。追求高品质将导致机构业主和现有开发人员建筑之间的需求两极化。

北美预计将主导市场

仓储和配送业是最受欢迎的商业领域之一,近年来已占美国商业投资的一半以上。

随着办公大楼市场的持续繁荣,未来的租赁活动可能会集中在最受欢迎的子市场和甲级建筑中的较小空间。大型商店正在整合空间并投资电子商务和基础设施。

受医院大规模扩建以及门诊病人和医疗办公室需求復苏的推动,医疗保健建设支出将在 2023 年之前保持高位。这个大型计划的推动因素包括近期的人口变化、容量、维护需求以及影响医疗服务的新技术(如穿戴式装置和远端医疗)。

大型新建设施预计将越来越多地使用预製和模组化来简化计划进度和预算。相较之下,专业医疗和护理设施(SCH)仍然受到严重资源限制,限制了建设活动。

教堂关闭的速度超过了开放的速度,为重建和再利用创造了新的机会。在一些竞争最激烈的市场中,基础设施和交通的投资可能会支持休閒和休閒建设的支出。

GRC覆层产业概况

该报告介绍了 GRC覆层市场的主要国际参与者。市场高度分散,大公司占据市场占有率。主要企业正在透过合作、创新、扩张、奖励和认可以及其他策略来改进其产品并保持竞争力。

GRC 覆层市场的主要企业包括 UltraTech Cement Ltd、Clark Pacific、BB Fiberbeton、Asahi Building-wall、Willis Construction Co. Inc.、Loveld、Fibrobeton、GB Architectural Cladding Products Ltd、Ibstock Telling 和 BCM GRC Limited。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 调查结果

- 调查前提

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态与洞察

- 市场概览

- 市场驱动因素

- 住宅领域需求不断成长推动市场

- 都市化加速推动市场

- 市场限制

- 租金上涨阻碍市场成长

- 市场机会

- 建设产业成长推动市场

- 深入了解供应链/价值链分析

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

- 政府法规和倡议

- 科技趋势

- COVID-19 市场影响

第五章市场区隔

- 按应用

- 商业建筑

- 住宅建筑

- 基础设施建设

- 按地区

- 亚太地区

- 北美洲

- 欧洲

- 南美洲

- 中东和非洲

第六章竞争格局

- 市场集中度概览

- 公司简介

- UltraTech Cement Ltd

- Clark Pacific

- BB Fiberbeton

- ASAHI BUILDING-WALL CO. LTD

- Willis Construction Co. Inc.

- Loveld

- Fibrobeton

- GB Architectural Cladding Products Ltd

- Ibstock Telling

- BCM GRC Limited

- 其他公司

第七章:市场的未来

第 8 章 附录

The GRC Cladding Market size is estimated at USD 33.93 billion in 2025, and is expected to reach USD 58.69 billion by 2030, at a CAGR of 11.58% during the forecast period (2025-2030).

Key Highlights

- Glass-reinforced concrete cladding (GRC) is a lightweight cladding panel primarily used as fascia panels in building structures. Concrete, reinforced with fibers, is often presented as an environmental improvement compared to typical concrete.

- The GRC cladding market is driven by the increased emphasis on green buildings (LEED ratings), and superior mechanical characteristics are expected to drive the market's growth. In the United Kingdom, building regulations state that the materials used for external wall construction or wall cladding should not be a medium for spreading fire.

- The United States and the United Kingdom have stringent guidelines on whether cement formulations can run the risk of combustion. This increased the need for a more fire-resistant material for wall cladding.

- GRC is effective at fire resistance and incombustibility because the mix's special blend of polymers and fibers makes it impermeable, weather-resistant, and fire-retardant.

- GRC has many different advantages that come with its use over other materials. It is a genuinely amazing cement alternative that is lighter, stronger, more flexible, more durable, and fire-resistant.

- Due to its nature, GRC, water, and sound insulation provide thermal insulation by applying rock wool. This property may lead to increased demand in regions with extreme weather conditions.

- Larger GRC products, like cladding panels, are manufactured using a spray. Sprayed GRC is generally stronger than premix vibration-cast GRC.

- In the wake of the rapidly emerging climate change emergency and to help improve resiliency in residential buildings, the National Research Council, Canada, has introduced guidelines in the National Building Code (2025) for climate-resilient construction to withstand extreme weather events.

GRC Cladding Market Trends

The Surge in the Demand for Commercial Spaces is Driving the Market

According to a recent study, the demand for office space will increase by 12-18% by the end of 2024. The growth is expected to be driven by the current fiscal year, the gradual return of office tenants, and the improving macroeconomic environment.

The recent banking crisis has cast a long shadow on commercial real estate. Unburdened by the regulations of their larger 'systemically important' peers, US regional banks have been aggressively lending against commercial property. This raises the specter of a 'doom-loop' scenario, where real estate woes and banking failures reinforce each other. This may seem far-fetched, as much of the real estate market continues to outperform. However, this is because neither can bring the other down. For all the talk of alternative lenders and private equity, a pullback on bank lending (which continues to account for 50% to 60% of total commercial real estate lending) is ill-advised, given the massive amounts of debt that will need to be repaid over the next several years. Refinancing has already been challenging, and it is only likely to become more so as credit standards tighten.

While there are many challenges to the US market in terms of cyclicality and structural issues, there are many reasons to be optimistic about office occupancies in other regions. For example, in Europe, average office occupancies recovered to 55% compared to 43% in 2022, and midweek rates are now close to the pre-COVID-19 average (70%). In many Asia-Pacific markets (Seoul, Tokyo, etc.), office attendance is almost back to where it was before the pandemic. In Asia-Pacific, a limited supply of high-quality buildings keeps vacancy low and pushes up rents.

In India, despite a year-over-year decline of 23% in supply in Q1 2023, the supply of commercial spaces was projected to pick up and reach around 47-49 million square feet by Q3 2023. Based on net absorption, the 2023 supply was projected to be above the average of 2017-2019 before the pandemic. In 2024, supply is projected to grow by 22% yearly to 58-60 million square feet. A flight to quality drives demand polarization toward institutional owners and established developer buildings.

North America is Expected to Dominate the Market

Warehouse and distribution, a commercial segment, is in high demand and has increased in recent years to account for more than half of US commercial investment.

As the office market continues to boom, future leasing activity will likely focus on smaller spaces in the most sought-after submarkets and class-A buildings. Big-box stores are consolidating their space and investing in e-commerce offerings and infrastructure.

Healthcare construction spending remained high through 2023, driven by large-scale hospital expansions and outpatient and medical office demand recovery. Large-scale projects were supported by recent changes in demographics, capacity, maintenance needs, and new technologies that affect health services (such as wearables and telehealth).

Large-scale new facilities are expected to increasingly use prefabrication and modularization to streamline project schedules and budgets. In contrast, specialty care and nursing home (SCH) facilities remain heavily constrained by resources, limiting construction activity.

Churches are closing at a faster rate than they are opening, which is creating new opportunities for renovation or repurposing. Investments in infrastructure and transportation will support spending on the construction of amusement and recreational facilities in some of the most competitive markets.

GRC Cladding Industry Overview

The report covers major international players operating in the GRC cladding market. The market is highly fragmented, with large companies claiming significant market share. Key players engage in collaborations, innovations, business expansion, awards and recognition, and other strategies to improve their offerings and remain competitive.

Some of the key players in the GRC cladding market are UltraTech Cement Ltd, Clark Pacific, BB Fiberbeton, Asahi Building-wall Co. Ltd, Willis Construction Co. Inc., Loveld, Fibrobeton, GB Architectural Cladding Products Ltd, Ibstock Telling, BCM GRC Limited, etc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS AND DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Demand in the Residential Segment Driving the Market

- 4.2.2 Increasing Urbanization Driving the Market

- 4.3 Market Restraints

- 4.3.1 Increasing Rents Hindering the Growth of the Market

- 4.4 Market Opportunities

- 4.4.1 Growing Construction Industry Driving the Market

- 4.5 Insights into Supply Chain/Value Chain Analysis

- 4.6 Industry Attractiveness - Porter's Five Force Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Government Regulations and Initiatives

- 4.8 Technological Trends

- 4.9 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Application

- 5.1.1 Commercial Construction

- 5.1.2 Residential Construction

- 5.1.3 Infrastructure Construction

- 5.2 By Geography

- 5.2.1 Asia-Pacific

- 5.2.2 North America

- 5.2.3 Europe

- 5.2.4 South America

- 5.2.5 Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 UltraTech Cement Ltd

- 6.2.2 Clark Pacific

- 6.2.3 BB Fiberbeton

- 6.2.4 ASAHI BUILDING-WALL CO. LTD

- 6.2.5 Willis Construction Co. Inc.

- 6.2.6 Loveld

- 6.2.7 Fibrobeton

- 6.2.8 GB Architectural Cladding Products Ltd

- 6.2.9 Ibstock Telling

- 6.2.10 BCM GRC Limited*

- 6.3 Other Companies