|

市场调查报告书

商品编码

1693606

汽车车库设备:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Automotive Garage Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

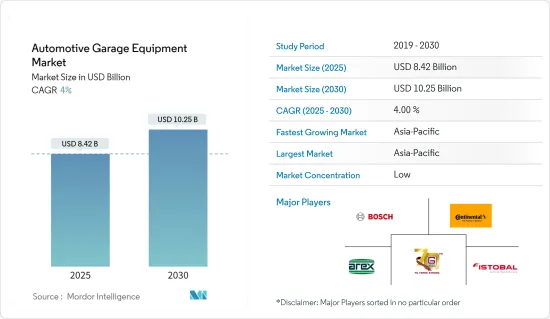

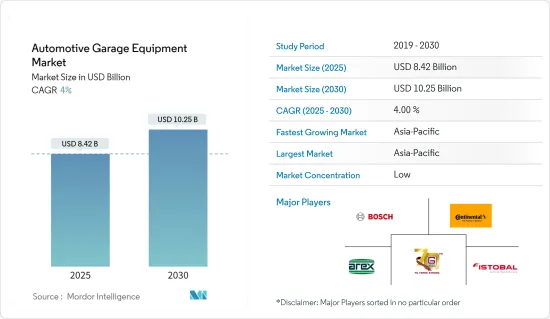

预计 2025 年汽车车库设备市场规模为 84.2 亿美元,到 2030 年将达到 102.5 亿美元,市场估计和预测期(2025-2030 年)的复合年增长率为 4%。

汽车修理设备市场的需求受到现有修理厂和独立修理厂的升级以及印度和巴西等新兴国家汽车销售成长的推动。

例如,根据国际贸易理事会的数据,继 2023 年巴西电动和混合动力汽车销量实现惊人的 91% 增长之后,预计 2024 年巴西电动和混合动力汽车销量将再增长 60%。

此外,随着OEM製造商优先收集数据以提高车辆性能,对适当的汽车维修设备的需求增加,市场预计还会扩大。

此外,随着汽车製造商专注于技术突破和製造更省油的汽车,对汽车车库设备的需求也可能会增加。由于大量商用车队对车轮定位的好处表现出浓厚的兴趣,汽车服务设备製造商对商用车辆车轮定位仪的需求正在增加。

例如,2023年10月,Hunter尖端重型车轮定位设备的领先经销商Totalkare宣布与Hunter工程公司建立合作伙伴关係,将三种产品推向商用车维修行业的前沿。

预计预测期内亚太地区、欧洲和北美将显着成长。这些地区主要国家的汽车产量激增以及汽车消费者对汽车安全的日益关注预计将推动对汽车车库设备的需求。

汽车车库设备的市场趋势

乘用车占最高市场占有率

近年来,乘用车以其时尚的设计、紧凑的尺寸和经济的价值等特点,受到广大驾驶员的欢迎。乘用车是许多已开发国家最常见的交通工具。生活方式的改善、购买力平价和可支配收入的增加、品牌知名度的提高和经济成长正在导致全球消费者偏好的变化,从而促进乘用车的销售。

- 印度汽车工业协会预测,2022-23 年乘用车销量将从 14,67,039 辆增加到 17,47,376 辆。

随着全球需求的增加,成本的下降、技术的进步和政府的支持正在帮助推动电动车销售呈指数级增长。例如,根据国际能源总署(IEA)的预测,2023年第一季电动车销量将超过230万辆,比2022年成长约25%。

运动型多功能车 (SUV) 需求的不断增长为市场参与企业创造了商机,并成为全球乘用车领域的主要驱动力。

乘用车销售量的成长意味着对车库设备的需求增加,例如煞车检查和维修、换油、轮胎保养和引擎诊断,这些都是提高燃油经济性、可靠性和安全性所必需的。

配备先进技术的更新、更有效率的车库设备的引入以及提供各种车辆维修服务的公司之间的联盟也在推动市场的发展。这些市场趋势以及新兴国家的发展预示着近期市场前景乐观。

- 例如,2024年1月,ETAS与博世开始了诊断软体和资讯服务的联合业务活动。未来,ETAS计划为整个车辆生命週期提供创作和诊断解决方案,从车辆製造到道路上的车辆健康监测、维护和故障排除。

亚太地区市占率最大

预计未来几年亚太汽车维修设备市场将大幅成长。该地区对汽车车库设备的需求主要受到中国、印度和其他国家新车、二手和商用车销售成长的推动。各汽车製造商正在投资开发自动驾驶、混合动力汽车和电动车的电气和数位技术,预计将对市场产生正面影响。

- 例如,比亚迪于2024年1月推出了一款智慧汽车系统,以在自动停车等先进技术领域与竞争对手竞争。该公司计划投资 50 亿元人民币(7.018 亿美元),在中国各城市建设全球首个专用全地形试驾设施。

近年来,及时预防性维护的需求变得越来越重要,大多数消费者都试图保持汽车处于良好状态,从而对市场产生积极影响。

考虑到每个国家汽车行业的成长以及具有先进安全和便利功能的汽车的生产,汽车修理厂正致力于升级其设施以适应新时代的汽车。许多老牌新兴企业正在推出新设备以满足需求。

- 2023年1月,全球大型公司的汽车智慧诊断、侦测及TPMS产品供应商Autel在印度推出了三大产品线,分别是汽车诊断产品、防盗器系列设备及汽车胎压监测系统TPMS系列。

这些因素和发展预计将为亚太地区的市场参与企业提供大量机会,鼓励该地区进行更多活动并推动未来的显着成长。

汽车车库设备产业概况

汽车车库设备市场由全球和地区知名参与企业整合和主导。市场的主要企业包括大陆集团、罗伯特博世有限公司、奥托立夫公司、电装公司和德尔福汽车公司。公司正在采取新产品发布、合作和合併等策略来保持其在市场中的地位。

- 例如,2023年9月,Google云端与大陆集团宣布建立策略伙伴关係。透过将大陆集团的专业知识与Google的数据和人工智慧技术相结合,两家公司将为汽车行业提供创新、灵活且面向未来的数位解决方案。

- 2023 年 1 月,德尔福科技为独立维修店技术人员推出了一个新的中心:Masters of Motion。这是进一步支持技术人员和研讨会的持续宣传活动的开始。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究范围

第二章调查方法

第三章执行摘要

第四章价值链分析

第五章市场动态

- 市场驱动因素

- 乘用车销量成长

- 市场限制

- 因车库设备故障而导致维修工作停工

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

第六章市场区隔

- 依设备类型

- 起重设备

- 废气检测设备

- 车身修理厂设备

- 车轮和轮胎设备

- 车辆诊断和检查

- 清洗设备

- 其他设备

- 按车辆类型

- 搭乘用车

- 商用车

- 按地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 其他欧洲国家

- 亚太地区

- 印度

- 中国

- 日本

- 韩国

- 其他亚太地区

- 其他的

- 南美洲

- 中东和非洲

- 北美洲

第七章竞争格局

- 供应商市场占有率

- 公司简介

- Robert Bosch GmbH

- Continental AG

- Istobal SA

- Aro Equipments Pvt. Ltd

- Guangzhou Jingjia Auto Equipment Co. Ltd

- Arex Test Systems BV

- Boston Garage Equipment Ltd

- Vehicle Service Group

- Gray Manufacturing Company Inc.

- VisiCon Automatisierungstechnik GmbH

- MAHA Mechanical Engineering Haldenwang GmbH & Co. KG

第八章 市场机会与未来趋势

The Automotive Garage Equipment Market size is estimated at USD 8.42 billion in 2025, and is expected to reach USD 10.25 billion by 2030, at a CAGR of 4% during the forecast period (2025-2030).

The demand in the automotive garage equipment market is driven by the upgradation of existing repair shops and independent garages and increasing vehicle sales in emerging economies such as India and Brazil.

For example, according to the International Trade Council, Brazil anticipates a 60% surge in electric and hybrid car sales in 2024 based on a stellar performance in 2023, where sales experienced an impressive 91% growth.

Moreover, the market is anticipated to expand as OEMs start prioritizing the accumulation of data on enhancing vehicle performance, which will elevate the need for suitable automotive garage equipment.

In addition, as automakers are gravitating toward technical breakthroughs and the creation of fuel-efficient automobiles, there is likely to be an increase in the demand for automotive garage equipment. Automotive garage equipment manufacturers are experiencing growth in demand for commercial vehicle wheel aligners as extensive fleets of commercial vehicles are now showing greater interest in the advantages of wheel alignment.

For instance, in October 2023, Totalkare, a key distributor of Hunter's cutting-edge heavy-duty wheel alignment equipment, announced a partnership with Hunter Engineering Company, bringing a trio of products to the forefront of the commercial vehicle maintenance industry.

Asia-Pacific, followed by Europe and North America, is expected to witness notable growth over the forecast period. The surge in vehicle production and vehicle production across major countries in these regions and increasing safety concerns among car consumers are expected to drive the demand for automotive garage equipment.

Automotive Garage Equipment Market Trends

Passenger Cars Hold Highest Market Share

Passenger cars have gained immense popularity among drivers over the past few years due to features such as stylish design, compact size, and economic value. Passenger cars are the most common mode of transportation in numerous advanced countries. The improving lifestyles, increasing power purchase parity and disposable income, raising brand awareness, and growing economy are leading to customer preference changes globally, resulting in high sales of passenger cars.

- According to the Society of Indian Automobile Manufacturers, sales of passenger cars increased from 14,67,039 to 17,47,376 units in 2022-23.

With the increase in global demand, electric car sales have been growing exponentially due to falling costs, improving technology, and government support. For instance, over 2.3 million electric cars were sold in the first quarter of 2023, about 25% more than in 2022, according to the International Energy Agency.

The rise in the demand for sport utility vehicles (SUVs) creates profitable opportunities for market players and acts as a major driving factor for the passenger cars segment globally.

The rise in passenger car sales leads to growth in demand for garage equipment as it is needed for various factors such as brake inspection and repair, oil change, tire maintenance, engine diagnostic, and others for better mileage, reliability, and enhanced safety.

The introduction of newer, more efficient garage equipment with advanced technologies and the collaborations of companies to offer various services for automotive repair are also driving the market. Such trends and developments in the market indicate an optimistic outlook for the market in the near future.

- For instance, in January 2024, ETAS and Bosch diagnostic software and information services started joint business activities. In the future, ETAS will offer authoring and diagnostic solutions across the entire vehicle life cycle - from vehicle manufacturing to health monitoring, maintenance, and troubleshooting of vehicles on the road.

Asia-Pacific Holds the Highest Market Share

The Asia-Pacific automotive garage equipment market is expected to grow significantly over the coming years. The demand for automotive garage equipment in the region is mainly supported by increasing sales of new and used cars and commercial vehicles across China, India, and other countries. Various automakers are investing in the development of electric and digital technologies for autonomous, hybrid, and electric vehicles, which is expected to have a positive impact on the market.

- For instance, in January 2024, BYD launched its AI-powered smart car system to better compete with rivals on advanced technologies such as automated parking. The company plans to invest CNY 5 billion (USD 701.8 million) to build the world's first all-terrain professional test drive sites in cities across China.

As the need for timely preventive maintenance has gained significant importance in recent years, most consumers are trying to keep their vehicles in proper condition, positively influencing the market.

Considering the growth of the automotive sector in various countries and vehicles produced with advanced safety and convenient features, automotive workshops are focusing on upgrading their equipment to comply with new-aged vehicles. Many existing players and new startups are launching new equipment to cater to the demand.

- In January 2023, Autel, a leading global provider of automotive intelligent diagnostics, inspection, and TPMS products, launched three major product lines for India, namely automotive diagnostic products, immobilizer series of devices, and TPMS series for automotive tire pressure monitoring systems.

Due to these factors and developments, it is expected that Asia-Pacific will provide numerous opportunities for market players and encourage them to expand their activities in the region, leading to significant growth in the future.

Automotive Garage Equipment Industry Overview

The automotive garage equipment market is consolidated and led by globally and regionally established players. Some of the major players in the market include Continental AG, Robert Bosch GmbH, Autoliv Inc., Denso Corporation, and Delphi Automotive PLC. The companies adopt strategies such as new product launches, collaborations, and mergers to sustain their market positions.

- For instance, in September 2023, Google Cloud and Continental announced a strategic partnership. Together, they will provide innovative, flexible, and future-oriented digital solutions for the automotive industry by combining Continental's expertise with Google's data and AI technologies.

- In January 2023, Delphi Technologies launched its new Masters of Motion hub aimed at independent garage technicians. This is the start of a sustained campaign to provide added support for technicians and workshops.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 VALUE CHAIN ANALYSIS

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increase in Sales of Passenger Cars

- 5.2 Market Restraints

- 5.2.1 Failure in Garage Equipment may Result in Downtime of the Repair Work

- 5.3 Industry Attractiveness - Porter's Five Forces Analysis

- 5.3.1 Threat of New Entrants

- 5.3.2 Bargaining Power of Buyers/Consumers

- 5.3.3 Bargaining Power of Suppliers

- 5.3.4 Threat of Substitute Products

- 5.3.5 Intensity of Competitive Rivalry

6 MARKET SEGMENTATION (Market Size in Value USD billion)

- 6.1 By Equipment Type

- 6.1.1 Lifting Equipment

- 6.1.2 Emission Testing Equipment

- 6.1.3 Body Shop Equipment

- 6.1.4 Wheel and Tire Equipment

- 6.1.5 Vehicle Diagnostic and Testing

- 6.1.6 Washing Equipment

- 6.1.7 Other Equipment Types

- 6.2 By Vehicle Type

- 6.2.1 Passenger Cars

- 6.2.2 Commercial Vehicles

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.1.3 Rest of North America

- 6.3.2 Europe

- 6.3.2.1 Germany

- 6.3.2.2 United Kingdom

- 6.3.2.3 France

- 6.3.2.4 Italy

- 6.3.2.5 Spain

- 6.3.2.6 Rest of Europe

- 6.3.3 Asia-Pacific

- 6.3.3.1 India

- 6.3.3.2 China

- 6.3.3.3 Japan

- 6.3.3.4 South Korea

- 6.3.3.5 Rest of Asia-Pacific

- 6.3.4 Rest of the world

- 6.3.4.1 South America

- 6.3.4.2 Middle East and Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Vendor Market Share

- 7.2 Company Profiles

- 7.2.1 Robert Bosch GmbH

- 7.2.2 Continental AG

- 7.2.3 Istobal SA

- 7.2.4 Aro Equipments Pvt. Ltd

- 7.2.5 Guangzhou Jingjia Auto Equipment Co. Ltd

- 7.2.6 Arex Test Systems BV

- 7.2.7 Boston Garage Equipment Ltd

- 7.2.8 Vehicle Service Group

- 7.2.9 Gray Manufacturing Company Inc.

- 7.2.10 VisiCon Automatisierungstechnik GmbH

- 7.2.11 MAHA Mechanical Engineering Haldenwang GmbH & Co. KG