|

市场调查报告书

商品编码

1693607

欧洲化妆品塑胶包装:市场占有率分析、行业趋势和统计数据、成长预测(2025-2030 年)Europe Cosmetic Plastic Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

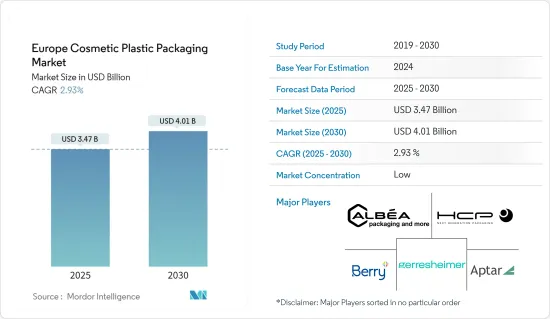

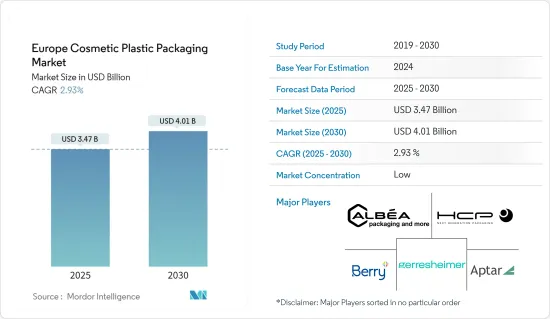

预计 2025 年欧洲化妆品塑胶包装市场规模将达到 34.7 亿美元,预计到 2030 年将达到 40.1 亿美元,预测期内(2025-2030 年)的复合年增长率为 2.93%。

就产量而言,预计市场将从 2025 年的 273.4 亿件成长到 2030 年的 318.7 亿件,预测期内(2025-2030 年)的复合年增长率为 3.11%。

受动态细分市场、不断变化的消费者偏好和全球美容趋势的影响,欧洲化妆品市场蓬勃发展。市场包括护肤、护髮品、化妆品和香水等多种产品,满足不同消费者的需求和偏好。由于对有机和天然产品的需求不断增长、电子商务平台的兴起以及人们对整装仪容和卫生意识的不断提高,市场正在经历显着增长。

关键亮点

- 随着对永续性的关注度不断提高,化妆品製造商越来越关注天然、环保的成分和乳化剂。向「绿色」美容的转变不仅仅是一种短暂的趋势。越来越多的研究强调传统化妆品的毒性,这有助于推动天然化妆品市场的快速和永续成长。

- 欧洲对化妆品的需求不断增长,加上消费者意识的提高、整装仪容的改变、对美容的关注度增加以及对美容产品的兴趣日益浓厚,促使企业投资于创新包装解决方案。包装技术和永续性措施的进步进一步支持了这一趋势,它们正在成为市场的关键因素。

- 智慧包装正在彻底改变美容和化妆品领域,提高生产力并重塑生产模式。在全球范围内,物联网和智慧包装的应用正在蓬勃发展,其中美容行业,尤其是化妆品和彩妆行业处于领先地位。化妆品瓶和护肤品的创新包装仍然是小众市场,但却为创造力和创新提供了无与伦比的机会。

- 欧洲目前正在解决一个迫切的环境问题:塑胶废弃物。根据欧盟委员会的报告,欧洲大部分塑胶未被回收利用,而是被掩埋垃圾掩埋场。儘管回收极为重要,但它也伴随着挑战。它耗费大量资源,成本高昂。其能否获利取决于最终产品的强劲需求和废弃塑胶的充足供应,而这需要大规模的加工设施。

- 2024 年 4 月,雅诗兰黛公司 (ELC) 与微软巩固了战略伙伴关係,并宣布了成立人工智慧创新实验室的计画。此次合作旨在利用微软 Azure OpenAI 服务中的先进生成式 AI 工具,为 ELC 的 20 多个领先美容品牌提供支援。这些公司的目标是与消费者建立更深层的联繫,加快推出在当地引起共鸣的产品,并最终透过产生人工智慧引领美容产业的转型。

欧洲化妆品塑胶包装市场趋势

彩妆产品成长

- 欧洲化妆品塑胶包装市场主要受到化妆品和美容产品销售强劲成长的推动。据欧洲化妆品协会称,该市场主要由五个欧洲国家主导。德国、法国、英国、义大利和西班牙。

- 在不断增长的需求的推动下,该地区的品牌对消费者产生了重大影响。这些品牌利用大型促销宣传活动和代言直接影响化妆品市场。透过电子商务管道购买化妆品进一步推动了需求的稳定成长,这主要是因为它的便利性。

- 欧莱雅公司和雅诗兰黛公司等主要美容品牌凭藉其化妆品系列,在提供高端产品方面处于领先地位。这种对价值的关注推动了对多功能美容产品日益增长的需求,尤其是在高端美容领域。公司正在不断创新以满足不断变化的客户偏好,并认识到当今快节奏的世界对便利性的需求。随着化妆品需求的不断增长,管状、棒状和瓶状等包装形式的需求在销售额方面也在增长。

- 例如,全球美容产品製造公司欧莱雅 (L'Oreal) 表示,该地区的销售结构正在不断增长,从 2020 年的 99.55 亿美元增长到 2023 年的 139.1 亿美元。欧莱雅占据市场占有率,其销售数据凸显了该地区对化妆品日益增长的需求。

西班牙经济强劲成长

- 视觉品质、永续性和便利性操作是品牌所有者在生产化妆品塑胶产品时考虑的关键因素。这些轻质化妆品适用于高端个人护理应用。此外,几家在该市场运营的公司也表现出了兴趣,并正在创新新的解决方案。

- 2023 年 5 月,Edmond de Rothschild Private 股权 伙伴关係旗下公司 Amethis Europe 收购了 HB Aesthetics 的少数股权。此次收购旨在帮助中小企业实现国际化。 HB Aesthetics 为专业人士设计和销售高端药妆品。此类收购正在推动国内化妆品塑胶包装市场的发展。

- 由于消费者偏好和需求的不断变化,化妆品行业的产品种类正在大幅增加。例如,2023 年 6 月,专注于永续化妆品并在西班牙各地经营的品牌 Freshly Cosmetics 宣布将开设两家新的 Freshly 商店:一家在马德里,另一家在首都,还有一家在加利西亚。预计这种扩张将在预测期内改善对化妆品塑胶包装的需求。

- 越来越多的公司做出符合联合国 17 个永续发展目标 (SDG) 的承诺。与联合国 17 个永续发展目标 (SDG) 一致的行动可能使西班牙化妆品塑胶包装市场受益,并最终促进其成长。致力于永续发展目标显示了公司对永续性和社会责任的奉献精神。因此,将活动与永续发展目标结合的西班牙化妆品公司可能会获得消费者更高的信任和忠诚度,从而增加市场占有率。

- 投资者和商业伙伴在评估公司时越来越多地考虑环境、社会和管治(ESG) 因素。与永续发展目标保持一致可以使西班牙化妆品公司对寻求永续投资机会的投资者更具吸引力。它还可能与其他重视永续性的公司建立伙伴关係,从而推动化妆品塑胶包装市场的创新和成长。

欧洲化妆品塑胶包装产业概况

欧洲化妆品塑胶包装市场主要由 Albea Group、Hcp Packaging、Gerresheimer AG、Berry Global Inc. 和 AptarGroup Inc. 等主要企业组成。市场参与企业正在采取收购和伙伴关係等策略来加强其产品供应并获得可持续的竞争优势。

- 2024 年 6 月 - Berry Global Inc. 在其产品线中引入了新的可自订矩形 Domino 瓶。瓶子由 100% 再生 (PCR) 塑胶製成,适用于美容、居家医疗和个人护理领域。

- 2024 年 3 月 - Aptar Beauty 推出新版微型真空包装,其 rPET 容器完全由再生 PET 製成。法国实验室 SVR 以其对永续性和循环经济的坚定承诺而闻名,最近,该实验室选择了 Aptar Beauty 的 Micro 30 毫升 rPET 真空包装作为其 PALPEBRAL 系列的首次亮相。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- 产业相关人员分析

- 评估近期地缘政治发展对化妆品包装市场的影响

第五章市场动态

- 市场驱动因素

- 欧洲化妆品需求稳定成长

- 更重视创新和有吸引力的包装

- 市场限制

- 欧洲国家化妆品塑胶包装回收率低对永续性构成威胁

- 对该地区永续性关注变化的分析

- 欧洲化妆品塑胶包装市场目前使用的聚合物分析

第六章市场区隔

- 依树脂类型

- PE(高密度聚乙烯和低密度聚乙烯)

- PP

- PET 和 PVC

- 聚苯乙烯(PS)

- 生物基塑胶(生质塑胶)

- 依产品类型

- 瓶子

- 管棒

- 泵浦和分配器

- 小袋

- 其他的

- 按应用

- 护肤

- 护髮

- 口腔护理

- 彩妆产品

- 除臭剂和香水

- 其他的

- 按国家

- 英国

- 德国

- 法国

- 义大利

- 西班牙

第七章竞争格局

- 公司简介

- Albea Group

- Hcp Packaging Co. Ltd

- Gerresheimer AG

- Berry Global Inc.

- AptarGroup Inc.

- Amcor Group GmbH

- Cosmopak USA LLC

- Quadpack Industries SA

- Libo Cosmetics Company Ltd

- Mpack Poland Sp. ZOO

- Politech Sp. ZOO

- Huhtamaki Oyj

- Rieke Corp(Trimas Corporation)

- Berlin Packaging LLC

- Mktg Industry SRL

第八章投资分析

第九章 市场机会与未来趋势

The Europe Cosmetic Plastic Packaging Market size is estimated at USD 3.47 billion in 2025, and is expected to reach USD 4.01 billion by 2030, at a CAGR of 2.93% during the forecast period (2025-2030). In terms of production volume, the market is expected to grow from 27.34 billion units in 2025 to 31.87 billion units by 2030, at a CAGR of 3.11% during the forecast period (2025-2030).

The European cosmetic market is thriving, driven by dynamic market segments, evolving consumer preferences, and the influence of global beauty trends. The market encompasses many products, including skincare, haircare, cosmetics, and fragrances, catering to diverse consumer needs and preferences. The market is witnessing significant growth due to the increasing demand for organic and natural products, the rise of e-commerce platforms, and the growing awareness of personal grooming and hygiene.

Key Highlights

- Amid a rising emphasis on sustainability, cosmetics manufacturers increasingly seek natural and eco-friendly ingredients and emulsifiers. The shift toward 'green' beauty is not just a passing trend. Mounting research highlights the toxicity of conventional cosmetics, propelling the rapid and sustainable growth of the natural cosmetics market.

- Increasing demand for cosmetic products in Europe, coupled with heightened consumer awareness, evolving lifestyles, a growing emphasis on personal grooming, and a surging interest in beauty products, collectively propels companies to invest in innovative packaging solutions. This trend is further supported by advancements in packaging technology and sustainability initiatives, which are becoming crucial factors in the market.

- Smart packaging is revolutionizing the beauty and cosmetics sectors, enhancing productivity and reshaping production paradigms. Globally, the adoption of IoT and smart packaging is surging, with the beauty industry, mainly cosmetics and makeup, at the forefront. While innovative packaging in makeup bottles and skincare products remains a niche, it offers unparalleled opportunities for creativity and innovation.

- Europe is currently grappling with a pressing environmental issue: plastic waste. The European Commission reports that most European plastic is incinerated in landfills rather than recycled. Recycling, while crucial, poses challenges. It is resource-intensive and often costly. Profitability hinges on robust demand for the end product and the availability of ample waste plastic, necessitating large-scale processing facilities.

- In April 2024, Estee Lauder Companies (ELC) and Microsoft Corp. unveiled plans for an AI Innovation Lab, solidifying their strategic partnership. By harnessing the advanced generative AI tools within Microsoft's Azure OpenAI Service, the collaboration aims to enhance ELC's 20+ prestigious beauty brands. Their goal is to forge deeper consumer bonds, expedite product launches with local resonance, and, ultimately, spearhead the beauty industry's transformation through generative AI.

Europe Cosmetic Plastic Packaging Market Trends

Make-up Products to Witness Growth

- The European cosmetic plastic packaging market is primarily attributed to the significant growth in make-up and beauty product sales. According to Cosmetics Europe, the market is dominated by five leading European countries: Germany, France, the United Kingdom, Italy, and Spain.

- Brands in the region wield significant influence over consumers, driven by escalating demand. These brands leverage extensive promotional campaigns and endorsements, directly impacting the market for cosmetics. The increasing availability of cosmetics through e-commerce channels further fuels the steady rise in demand, mainly due to its convenience.

- Leading beauty brands like L'Oreal SA and Estee Lauder Companies Inc. are at the forefront of offering premium value in their make-up lines. This emphasis on value has fueled a rising demand for multifunctional beauty products, especially in the luxury beauty segment. Companies are innovating to meet these evolving customer preferences and recognize the need for convenience in today's fast-paced world. In response to the rising demand for make-up products, the demand for packaging formats such as tubes, sticks, bottles, and others is also growing in value sales.

- For instance, L'Oreal, the global beauty manufacturing company, showed a growing sales structure in the region, increasing from USD 9.955 billion in 2020 to USD 13.91 billion in 2023. This growing sales of Loreal, which covered 20% of Europe's market share, highlights the rise of demand for cosmetic products in the region.

Spain to Register Major Growth

- Visual quality, sustainability, and convenient handling are significant factors brand owners focus on while manufacturing cosmetic plastic products. These lightweight cosmetic products are suitable for high-end personal care applications. Also, several companies operating in the market are showing interest and innovating new solutions.

- In May 2023, Amethis Europe, part of the Edmond de Rothschild Private Equity partnership, acquired a minority stake in HB Aesthetics. This acquisition supported SMEs in their internationalization efforts. HB Aesthetics designs and distributes high-end dermo-cosmetic products for professionals. Such acquisitions drive the country's cosmetic plastic packaging market.

- The cosmetic industry is witnessing a significant expansion in product offerings due to evolving consumer preferences and demands. For instance, in June 2023, Freshly Cosmetics, a brand specializing in sustainable cosmetics and operating across Spain, announced two new Freshly Stores: one in Madrid, the second store in the capital, and the first in Galicia. Such expansions would improve the need for cosmetic plastic packaging during the forecast period.

- More and more companies are making commitments aligned with the United Nations' 17 Sustainable Development Goals (SDGs). Aligning activities with the United Nations' 17 Sustainable Development Goals (SDGs) may benefit Spain's cosmetic plastic packaging market, ultimately contributing to its growth. Committing to the SDGs demonstrates a company's dedication to sustainability and social responsibility. As a result, cosmetic companies in Spain that align their activities with the SDGs may experience increased consumer trust and loyalty, leading to a growth in market share.

- When evaluating companies, investors and business partners increasingly consider environmental, social, and governance (ESG) factors. Aligning with the SDGs can make cosmetic companies in Spain more attractive to investors seeking sustainable investment opportunities. It may facilitate partnerships with other businesses that prioritize sustainability, potentially leading to collaborations that drive innovation and growth in the cosmetic plastic packaging market.

Europe Cosmetic Plastic Packaging Industry Overview

The European cosmetic plastic packaging market is fragmented, with the presence of significant players like Albea Group, Hcp Packaging Co. Ltd, Gerresheimer AG, Berry Global Inc., and AptarGroup Inc. Players in the market are adopting strategies such as acquisitions and partnerships to enhance their product offerings and gain sustainable competitive advantage.

- June 2024 - Berry Global Inc. introduced a new offering to its product line: a customizable, rectangular Domino bottle. This bottle is crafted using up to 100% post-consumer recycled (PCR) plastic, catering to the beauty, home, and personal care sectors.

- March 2024 - Aptar Beauty introduced a new iteration of its Micro airless packaging, featuring a container crafted entirely from recycled PET in its rPET variant. French Laboratory SVR, known for its robust commitment to sustainability and circularity, opted for Aptar Beauty's Micro 30 ml rPET airless packaging for its recent PALPEBRAL collection debut.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Stakeholder Analysis

- 4.4 Assessment of the Impact of the Recent Geopolitical Developments on the Cosmetic Packaging Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Steady Rise in Demand for Cosmetic Products in Europe

- 5.1.2 Increasing Focus on Innovation and Attractive Packaging

- 5.2 Market Restraints

- 5.2.1 Low Rates of Re-usability of Plastic Packaging of Cosmetic Products Across European Countries have Posed a Threat to Sustainability

- 5.3 Analysis of Change in Focus to Sustainability in the Region

- 5.4 Analysis of Polymers Currently Used in the European Cosmetic Plastic Packaging Market

6 MARKET SEGMENTATION

- 6.1 By Resin Type

- 6.1.1 PE (HDPE and LDPE)

- 6.1.2 PP

- 6.1.3 PET and PVC

- 6.1.4 Polystyrene (PS)

- 6.1.5 Bio-based Plastics (Bioplastic)

- 6.2 By Product Type

- 6.2.1 Bottles

- 6.2.2 Tubes and Sticks

- 6.2.3 Pumps and Dispensers

- 6.2.4 Pouches

- 6.2.5 Other Product Types

- 6.3 By Application

- 6.3.1 Skin Care

- 6.3.2 Hair Care

- 6.3.3 Oral Care

- 6.3.4 Make-up Products

- 6.3.5 Deodorants and Fragrances

- 6.3.6 Other Applications

- 6.4 By Country

- 6.4.1 United Kingdom

- 6.4.2 Germany

- 6.4.3 France

- 6.4.4 Italy

- 6.4.5 Spain

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Albea Group

- 7.1.2 Hcp Packaging Co. Ltd

- 7.1.3 Gerresheimer AG

- 7.1.4 Berry Global Inc.

- 7.1.5 AptarGroup Inc.

- 7.1.6 Amcor Group GmbH

- 7.1.7 Cosmopak USA LLC

- 7.1.8 Quadpack Industries SA

- 7.1.9 Libo Cosmetics Company Ltd

- 7.1.10 Mpack Poland Sp. Z.O.O.

- 7.1.11 Politech Sp. Z.O.O.

- 7.1.12 Huhtamaki Oyj

- 7.1.13 Rieke Corp (Trimas Corporation)

- 7.1.14 Berlin Packaging LLC

- 7.1.15 Mktg Industry SRL