|

市场调查报告书

商品编码

1693609

喷墨头:市场占有率分析、产业趋势与成长预测(2025-2030)Inkjet Printhead - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

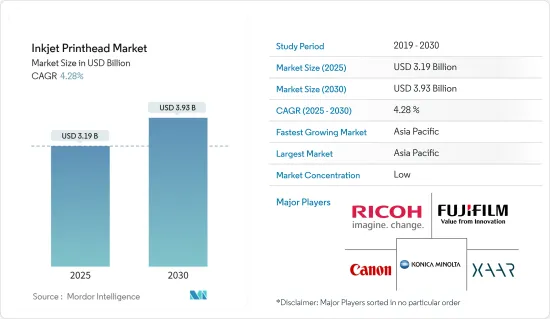

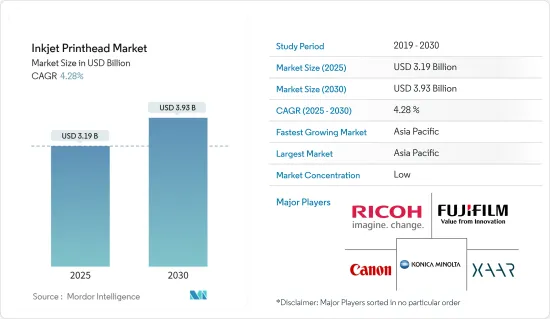

喷墨头市场规模预计在 2025 年为 31.9 亿美元,预计到 2030 年将达到 39.3 亿美元,预测期内(2025-2030 年)的复合年增长率为 4.28%。

在多个领域应用不断扩展、数位印刷解决方案需求不断增长以及技术开拓的推动下,全球喷墨头市场为製造商、供应商和相关人员提供了巨大的可能性。喷墨头市场克服障碍并抓住成长机会以应对不断变化的消费者期望和不断变化的市场动态,预计该市场将蓬勃发展并发生转变。

由于喷墨技术的广泛应用及其在办公室和个人空间中的使用日益增多,预计全球对喷墨头的需求将会成长。喷墨印表机被商业印刷企业用来製作高品质的小册子和手册,也常用于家庭和小型办公室。

电子商务的成长推动了对包装、运输标籤、个人化商品等客製印刷解决方案的需求。喷墨印表机的速度和灵活性使其成为这些应用的理想选择。

多功能印表机通常用于商务办公室和教育环境。这是一款多功能印表机,可影印、列印、管理纸张、扫描、传真等。这导致需求增加,尤其是在教育机构。

喷墨多功能印表机具有 Wi-Fi、LCD 萤幕、USB、触控和蓝牙等连接选项,使其更易于使用和操作。多功能喷墨印表机比单功能喷墨印表机更具成本效益。

然而,与其他列印技术相比,喷墨头的高成本仍然是一个主要障碍,儘管该技术具有许多革命性的优势,但限制了该行业的成长和采用率。许多消费者和组织发现很难进入印字头市场,因为购买、安装和维护列印头需要大量开支,尤其是在新兴地区和对成本敏感的行业。

由于最终用户在日常业务中优先考虑永续性,预计压电按需喷墨列印头和其他低功耗技术在后疫情时代市场环境中的需求将会增加。市场参与企业也在努力提高客户对其无热技术的认识。

喷墨头市场趋势

工业印製强劲成长

- 由于包装材料印刷应用数量的增加,预计预测期内全球工业喷墨头市场将会成长。喷墨印表机在包装过程中定期在线上列印批次资料和代码。这些印表机消除了诸如压花等接触印刷技术中经常出现的印刷褪色或丢失以及薄膜上出现孔洞等问题。标籤、铝箔、包装、传单和纸箱只是使用连续喷墨印表机的少数数位印刷应用。

- 数位纺织喷墨印表机设计为直接在各种天然和合成纤维上列印。印表机的有效列印能力提高了生产速度和产量。数位纺织印表机非常适合商用和工业纺织品印刷,因为它们可以在各种织物和服装上印刷,包括棉、丝绸、羊毛和混纺面料。

- 喷墨列印业务数位化而发生了重大变化。如今,它与数位印刷不断扩大的可能性紧密结合,包括产品个人化、创新和交流。客户希望获得有关产品的互动功能和全面的资讯。这些小工具具有虚拟实境和与社群媒体连结的二维码等技术元素。

- 工业喷墨列印系统及其列印头分为两大类,每类又包含子类型:连续喷墨 (CIJ) 和按需喷墨 (DOD)。在连续喷墨系统中,液滴不断从列印头喷出,并可返回列印表面或收集器以供重复使用。另一方面,按需滴注方法仅在需要时释放液滴。

- 喷墨列印对于印刷电子产业的应用尤其具有吸引力,因为它能够实现快速原型製作,低温固化导电、半导体和电介质油墨,製造成本低,技术环保,并且与各种基板相容以及具有多种基板选项。预计软性电子产品应用需求的不断增长将推动市场向前发展。例如,预计在预测期内使用数位健康和健身追踪器的个人数量将呈指数级增长。

亚太地区将经历大幅成长

- 预计亚太地区喷墨头市场在预测期内将大幅成长。低廉的人事费用和製造成本推动了市场的成长,使亚太地区成为寻求建立喷墨头製造设施的公司的热门地点。

- 亚太地区正成为最大的印刷油墨市场之一,其中以中国、印度和其他几个新兴经济体为主导。该地区是 DIC、SAKATA INX CORPORATION和东洋油墨等多家国际油墨製造商的所在地,这些製造商在市场上占有重要地位。

- 中国是创新化学品的主要供应国,包括油墨和溶剂成分,这些化学品是印刷过程必不可少的输入材料,也是许多欧洲印刷公司的供应来源。智慧型手机製造商正在加大对这些印表机生产的投资,这进一步推动了市场的发展。

- 2024年3月,日本京瓷公司推出了喷嘴中带有墨水再循环技术的新型喷墨头。该公司的 KJ4B-EX600-RC 列印头将有助于提高包括纺织品、建筑材料和瓦楞纸板在内的广泛印刷应用的生产率。该产品相容于多种墨水。此外,墨水可以透过喷嘴再循环,使其与干燥速度更快的墨水相容,从而实现更广泛的应用。该解决方案还可确保更高的生产率、更高的驱动频率和更高的最大滴量。此外,单片压电致动器可提供高列印质量,而简单而坚固的流道结构可确保耐用性。京瓷的印字头技术也支援连续列印,提高了工业列印的生产率。

- 喷墨印刷和其他数位印刷的需求正在迅速从传统纸质介质转向纸质介质。

- 油墨应用领域从传统纸质介质迅速扩展到纺织品、食品包装和建筑材料,以及油墨配方的多样化以满足生产率的提高和更广泛的应用范围,正在推动市场的成长。因此,随着对更好的列印解析度和更高的耐用性的需求不断增长,对能够高速处理各种墨水的列印头的需求也日益增长。

喷墨头市场概况

由于全球参与企业和中小型企业的存在,喷墨头市场高度细分。该市场的一些主要参与企业包括理光公司、富士胶片控股公司、佳能公司、柯尼卡美能达公司和XAAR PLC。市场参与企业正在采取联盟和收购等策略来加强其产品供应并获得可持续的竞争优势。

- 2023年12月,精工Epson株式会社的集团公司秋田Seiko Epson Corp.株式会社竣工建设总投资达35亿日元(2,300万美元)的新厂。新工厂旨在使秋田Epson未来的列印头生产能力提高三倍。随着商用和工业喷墨印表机需求的增加以及技术从类比向数位转变(例如在数位印染)的进步,配备 PrecisionCore MicroTFP 列印头的商用和工业喷墨印表机的需求也在不断增长,以提高灵活性。在Epson新的秋田工厂,该公司旨在加快印表机头的生产和组装速度,以适应 MicroTFP 列印晶片产量的增加。

- Seiko Epson Corp.东北Epson公司原计划于 2024 年 6 月投资约 51 亿日圆(3,160 万美元)建造一座专门生产喷墨头的新工厂。精工Epson的Seiko Epson Corp.决定投资约 51 亿日圆(3.1 亿美元)建造一座专门生产喷墨头的最先进的工厂。该工程预计于2024年6月15日动工,2025年9月完工。这项策略措施将增强东北Epson的印字头生产能力,可望使其在现有水准上翻两番。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 生态系分析

- 产业吸引力-波特五力分析

- 喷墨列印市场的关键创新

- COVID-19 及近期趋势对喷墨头市场成长的影响

- 喷墨印字头主要类别定价分析

第五章市场动态

- 市场驱动因素

- 压电列印头在工业和商业领域中得到越来越广泛的应用

- 持续的技术进步

- 市场限制

- 与其他技术相比,成本仍然是一个重大限制因素

第六章市场区隔

- 依技术类型

- 按需投放

- 热的

- 压电基座

- 常用

- 按需投放

- 按类型

- 基于MEMS

- 传统的

- 按最终用户

- 消费群

- 工业印刷

- 图形印刷

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第七章竞争格局

- 公司简介

- Ricoh Company Ltd

- FUJIFILM Holdings Corporation

- Canon Inc.

- Konica Minolta Inc.

- XAAR PLC

- Memjet Holdings Limited

- Funai Electric Co. Ltd

- Kyocera Corporation

- Toshiba Corporation

- Hewlett-Packard Development Company LP

- 精工Epson公司

8.供应商市场占有率分析

第九章投资分析

第十章:投资分析市场未来展望

The Inkjet Printhead Market size is estimated at USD 3.19 billion in 2025, and is expected to reach USD 3.93 billion by 2030, at a CAGR of 4.28% during the forecast period (2025-2030).

Driven by expanding applications across multiple sectors, growing demand for digital printing solutions, and technical developments, the global inkjet print head market presents significant possibilities for manufacturers, suppliers, and stakeholders. The inkjet printhead market is anticipated to flourish and change in response to shifting consumer expectations and market dynamics by resolving obstacles and seizing growth opportunities.

Technological proliferation and rising applications in offices and personal spaces are expected to augment the demand for inkjet printheads globally. In addition to being used in commercial printing businesses to make high-quality brochures, pamphlets, and other materials, inkjet printers are commonly used in homes and small offices.

The need for on-demand printing solutions for packaging, shipping labels, and personalized goods has grown due to the growth of e-commerce. Inkjet printers' speed and flexibility make them ideal for these kinds of uses.

Multifunctional printers are frequently used in business offices and educational settings. These versatile printers can copy, print, manage paper, scan, and fax. Thus, their demand is increasing, notably at educational institutions.

Several multifunctional inkjet printers offer Wi-Fi, LCD screens, USB, touch, and Bluetooth connectivity options, improving their usability and control. They are more cost-effective compared to single-functional inkjet printers.

However, compared to other printing technologies, the high cost of inkjet printheads continues to be a major barrier, restricting industry growth and acceptance rates despite the technology's many breakthroughs and benefits. Many consumers and organizations find it difficult to enter the printhead market due to the significant expenditure necessary for printhead acquisition, installation, and maintenance, especially in emerging regions and cost-sensitive industries.

Piezoelectric drop-on-demand printheads and other low-power consumption technologies are anticipated to witness increased demand in the post-COVID-19 market environment as end users increasingly prioritize sustainability in their daily business operations. Market participants are also working to increase customer awareness of their heat-free technologies.

Inkjet Printhead Market Trends

Industrial Printing to Witness Major Growth

- The global market for industrial inkjet printheads is expected to witness growth during the forecast period due to a boost in the application of these printers for printing on packaging materials. Inline printing of batch data and codes is constantly done during the packaging process with inkjet printers. The problems that are commonly brought on by contact printing techniques like embossing, similar to blurry or missing prints, as well as holes in films, are eliminated with these printers. Labels, foils, packaging, leaflets, and cartons are just some of the digital printing applications that use industrial inkjet printers.

- Digital textile inkjet printers are designed to print directly on various natural and synthetic fabrics. The effective printing capabilities of the printer increase the speed and volume of manufacturing. A digital textile printer is the best option for commercial and industrial textile printing since it can print on various fabrics and garments, including cotton, silk, wool, and mixes.

- The inkjet printing business has experienced a significant shift because of digitization. It now encompasses product personalization, innovation, and communication that closely match the expanding possibilities of digital printing. Customers want interactive features and comprehensive information about the products. Gadgets have technological elements such as virtual reality and QR codes with links to social media.

- Industrial inkjet printing systems, along with their printheads, fall into two main categories, namely, continuous inkjet (CIJ) and drop-on-demand (DOD), each with its own subtypes. In continuous inkjet systems, drops are ejected continuously from the printhead, with the option to direct them either onto the printing surface or back to a collector for recycling. On the other hand, drop-on-demand systems release drops only when needed.

- Inkjet printing is particularly intriguing for applications in the printed electronics industry because it enables quick prototyping and is compatible with a range of substrates as well as conductive, semiconductive, and dielectric inks that can be cured at low temperatures, low production costs, eco-friendly technologies, and a variety of substrate options. The rise in the demand for flexible electronics applications is expected to propel the market forward. For example, the number of individuals using digital health and fitness trackers is expected to rise exponentially over the forecast period.

Asia-Pacific to Register Major Growth

- The inkjet printhead market in Asia-Pacific is anticipated to grow significantly during the forecast period. The market's growth is attributed to low labor and manufacturing costs, making Asia-Pacific a popular location for companies seeking to establish production facilities for inkjet printheads.

- Asia-Pacific is rising as one of the largest markets for printing ink, driven by economies such as China, India, and several other rapidly developing nations. The region is home to various international ink makers, such as DIC, Sakata INX, and Toyo Ink, which have a significant market presence.

- China is a major supplier of innovative chemicals, such as ink and solvent components, which are crucial input materials for the printing processes and a supply source for many European printing enterprises. Smartphone manufacturers are increasingly investing in the production of these printers, which is further driving the market.

- In March 2024, Japan-based Kyocera Corporation introduced its new inkjet printhead with ink recirculation technology at the nozzle. The company's KJ4B-EX600-RC printhead helps gain productivity over a wide range of printing applications, such as textiles, building materials, and corrugated boards. The product is compatible with a wide range of inks. It also features ink recirculation at the nozzle, which helps with the compatibility of fast-drying inks, among others, over a broader range of applications. The solution also ensures higher productivity, high driving frequency, and greater maximum drop volume. It offers customers high print quality through the company's monolithic piezo actuator, and the simple and robust flow channel structure achieves durability. Kyocera's printhead technology also enables continuous printing to improve productivity in industrial printing operations.

- Overall, the growing advantages of digital printing, which include immediate, customizable printing in any quantity while reducing environmental impact by eliminating liquid waste, have increased the demand for digital printing, including inkjet printing.

- The rapid expansion from traditional paper media into textiles, food-grade packaging, and building materials, as well as the diversification of ink formulations to increase productivity and accommodate a broader range of applications, is propelling the market's growth. Consequently, the demand for printheads that can handle a variety of inks at high speeds is rising for better print resolutions and enhanced durability requirements.

Inkjet Printhead Market Overview

The inkjet printhead market is highly fragmented due to the presence of both global players and small and medium-sized enterprises. Some of the major players in the market are Ricoh Company Ltd, FUJIFILM Holdings Corporation, Canon Inc., Konica Minolta Inc., and XAAR PLC. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- In December 2023, the construction of a new factory at Seiko Epson Corporation's group company, Akita Epson Corporation, was completed with a total investment of JPY 3.5 billion (USD 23 million). The new factory is designed to approximately triple Akita Epson's future printhead production capacity. With the increasing demand for commercial and industrial inkjet printers and a technology shift from analog to digital in industries, such as digital textile printing, there is a rising demand for commercial and industrial inkjet printers with PrecisionCore MicroTFP printheads for increased flexibility. The new Akita Epson factory will speed up the production and assembly of printheads to keep pace with the increased production of MicroTFP print chips.

- In June 2024, Tohoku Epson Corporation, a subsidiary of Seiko Epson Corporation, was set to invest around JPY 5.1 billion (USD 31.60 Million) into erecting an advanced factory dedicated to inkjet printheads. The company recently marked the occasion with a ground-breaking ceremony on its existing grounds. Construction was slated to commence on June 15, 2024, with a target completion date of September 2025. This strategic move is anticipated to bolster Tohoku Epson's printhead production capacity, potentially quadrupling its current output.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Ecosystem Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4 Key Technological Innovations in Inkjet Printing Market

- 4.5 Impact of COVID-19 and Recent Trends on the Growth of the Inkjet Printhead Market

- 4.6 Pricing Analysis of Inkjet Printheads in Key Categories

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Piezo-Based Printheads Witnessing Higher Adoption in Industrial and Commercial Segments

- 5.1.2 Ongoing Technological Advancements

- 5.2 Market Restraints

- 5.2.1 Cost Remains a Key Prohibitive Factor Compared to Other Technologies

6 MARKET SEGMENTATION

- 6.1 By Technology Type

- 6.1.1 Drop-on-demand

- 6.1.1.1 Thermal

- 6.1.1.2 Piezo-based

- 6.1.2 Continuous

- 6.1.1 Drop-on-demand

- 6.2 By Type

- 6.2.1 MEMS-based

- 6.2.2 Conventional

- 6.3 By End-user Type

- 6.3.1 Office and Consumer-Based

- 6.3.2 Industrial Printing

- 6.3.3 Graphic Printing

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Ricoh Company Ltd

- 7.1.2 FUJIFILM Holdings Corporation

- 7.1.3 Canon Inc.

- 7.1.4 Konica Minolta Inc.

- 7.1.5 XAAR PLC

- 7.1.6 Memjet Holdings Limited

- 7.1.7 Funai Electric Co. Ltd

- 7.1.8 Kyocera Corporation

- 7.1.9 Toshiba Corporation

- 7.1.10 Hewlett-Packard Development Company LP

- 7.1.11 Seiko Epson Corporation