|

市场调查报告书

商品编码

1693634

印度混合动力汽车市场:市场占有率分析、行业趋势和统计数据、成长预测(2025-2030 年)India Hybrid Vehicles - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

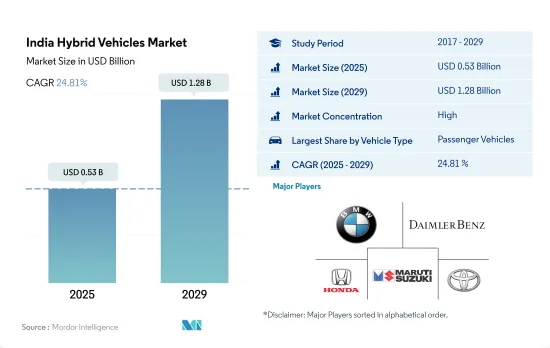

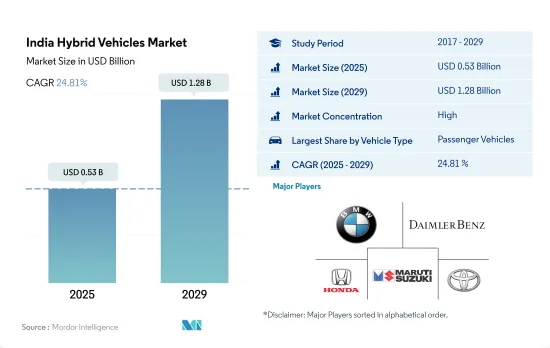

印度混合动力汽车市场规模预计在 2025 年为 5.3 亿美元,预计到 2029 年将达到 12.8 亿美元,预测期内(2025-2029 年)的复合年增长率为 24.81%。

混合动力汽车是向全电动汽车过渡的桥樑,标誌着印度向电气化迈出了坚实的一步。

- 印度混合动力汽车市场虽然不如纯电动车市场规模大,但却是实现提高燃油效率、减少汽车、商用车和两轮车等多种车型排放这一更广泛目标的重要基石。全混合动力汽车无需插电即可使用内燃机和马达,在传统汽车和全电动汽车之间提供了一种可行的折衷方案,与传统汽车相比,它具有更高的燃油经济性和更低的排放气体。

- 在乘用车领域,全混合动力汽车逐渐受到印度消费者的欢迎,主要在中高端市场。混合动力汽车在印度的吸引力在于,它能够显着提高燃油效率、降低营运成本,而且不存在纯电动车的续航里程焦虑和基础设施需求。然而,由于初始购买价格高和车型选择有限,混合动力车在乘用车领域的成长受到了一定程度的限制。然而,随着越来越多的製造商进入市场以及技术成本的下降,这种情况开始改变。

- 印度商用车领域对混合动力技术的兴趣虽然有限但日益增长,尤其是在环境问题和燃油效率日益重要的领域。混合动力公车就是一个显着的例子,一些城市已经开始试行或小规模部署混合动力技术,以减少公共交通的排放气体和燃料消耗。

印度混合动力汽车市场趋势

受印度储备银行措施和贷款实务变化的推动,印度的汽车利率一直呈下降趋势。

- 印度近期汽车利率约 8.567%,低于 2021 年的 8.698%。这一约 1.5% 的小幅下降延续了前几年的趋势,当时利率从 2019 年的 9.15% 降至 2021 年的 8.698%。支持这项措施的因素可能包括印度储备银行 (RBI) 的货币政策决定、国内信贷需求和更广泛的宏观经济经济状况。

- 2017年至2023年,印度汽车利率为9.508%。在接下来的几年里,利率经历了小幅波动,2018 年小幅下降至 9.454%,2019 年小幅上升至 9.466%。然而,自 2019 年以来出现了更显着的下降,2022 年达到 8.567%。根据印度储备银行的报告,这些变化可以归因于宽鬆的货币政策、不断变化的贷款实践以及在全球疫情等挑战面前刺激经济成长的努力。

- 对印度汽车利率近期趋势的分析表明,预计未来几年相对较低的利率趋势仍将持续下去。当前利率将在 2022 年降至 8.567%,这一降幅高于 2019 年的 9.15%,反映了印度储备银行 (RBI) 为刺激经济成长而做出的刻意努力。随着印度储备银行继续采取宽鬆的货币政策,并不断改进贷款实践以支持信贷需求,这种利率下行压力可能会持续存在。

政府措施和严格规范推动印度电动车市场快速成长

- 印度的电动车 (EV) 市场正处于成长阶段,政府正在积极制定应对污染的策略。 2015年启动的Fame India计画在推动汽车电气化方面发挥了关键作用。基于其成功经验,Fame 第二阶段计划将持续到 2022 年 4 月,预计将进一步推动电动车的销量,尤其是在 2021 年,政府将为电池容量高达 15kWh 的电动车提供 10,000 印度卢比(约 1,000 万美元)的补贴。

- 印度各邦政府正大力引进电动公车,以摆脱内燃机(ICE)公车的束缚。此举不仅可以降低营运成本,还可以抑制碳排放并改善空气品质。引人注目的是,德里政府已于 2021 年 3 月批准采购 300 辆新型低地板电动(AC)公车,其中 100 辆将于 2022 年 1 月上路。这些倡议导致印度对电动商用车的需求大幅成长,2022 年与 2021 年相比成长了 62.58%。

- 受政府严格标准的推动,近年来电动车的需求激增。 2021年8月,印度政府宣布了汽车报废政策,旨在逐步淘汰污染严重且不合规的汽车,无论其使用年限为何。该政策将于 2024 年实施,旨在推动消费者购买电动车。此外,政府还设定了一个雄心勃勃的目标,即到 2030 年使印度 30% 的汽车实现电动化。这些努力预计将在 2024 年至 2030 年期间促进印度的电动车销售。

印度混合动力汽车产业概况

印度混合动力汽车市场相当巩固,前五名厂商占据 100% 的市场。市场的主要企业有:宝马印度私人有限公司、戴姆勒股份公司(梅赛德斯-奔驰股份公司)、本田汽车印度有限公司、玛鲁蒂铃木印度有限公司和丰田 Kirloskar Motor Pvt。有限公司(按字母顺序)

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章执行摘要和主要发现

第二章 报告要约

第三章 引言

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 产业主要趋势

- 人口

- 人均GDP

- 消费者汽车支出(cvp)

- 通货膨胀率

- 汽车贷款利率

- 共乘

- 电气化的影响

- 电动车充电站

- 电池组价格

- 新款 Xev 车型发布

- 物流绩效指数

- 二手车销售

- 燃油价格

- OEM生产统计

- 法规结构

- 价值炼和通路分析

第五章市场区隔

- 车辆类型

- 商用车

- 公车

- 大型商用卡车

- 轻型商用皮卡车

- 轻型商用厢型车

- 中型商用卡车

- 商用车

第六章竞争格局

- 关键策略趋势

- 市场占有率分析

- 商业状况

- 公司简介

- Audi Auto India Pvt. Ltd.

- BMW India Private Limited

- Daimler AG(Mercedes-Benz AG)

- Honda Cars India Limited

- Hyundai Motor India Limited

- Maruti Suzuki India Limited

- Toyota Kirloskar Motor Pvt. Ltd.

- Volvo Auto India Private Limited

第七章:CEO面临的关键策略问题

第 8 章 附录

- 世界概况

- 概述

- 五力分析框架

- 全球价值链分析

- 市场动态(DRO)

- 资讯来源及延伸阅读

- 图片列表

- 关键见解

- 数据包

- 词彙表

The India Hybrid Vehicles Market size is estimated at 0.53 billion USD in 2025, and is expected to reach 1.28 billion USD by 2029, growing at a CAGR of 24.81% during the forecast period (2025-2029).

Hybrid vehicles serve as a bridge in the country's shift to full electric mobility, marking India's incremental steps toward electrification

- The Indian hybrid vehicles market, though not as vast as that for purely electric vehicles, presents a critical stepping stone toward achieving broader goals of fuel efficiency and reduced emissions across different vehicle types, such as passenger cars, commercial vehicles, and two-wheelers. Full hybrids, which can operate on both an internal combustion engine and an electric motor without the need to be plugged in, offer a practical compromise between traditional and fully electric vehicles, providing enhanced fuel efficiency and lower emissions compared to conventional vehicles.

- In the passenger car segment, full hybrid vehicles are gradually gaining traction among Indian consumers, primarily in the mid to high-end market segments. The appeal of hybrid cars in India lies in their ability to offer significant improvements in fuel efficiency and reduced operational costs without the range anxiety or infrastructure demands associated with pure electric vehicles. However, the growth of HEVs in the passenger car segment has been somewhat constrained by higher initial purchase prices and a limited selection of models, although this is beginning to change as more manufacturers enter the market and technology costs decrease.

- The commercial vehicle segment in India has seen limited but growing interest in hybrid technology, particularly in sectors where environmental concerns and fuel efficiency are becoming increasingly important. Hybrid buses are a notable example, with several cities initiating trials or small-scale deployments of hybrid technology to reduce emissions and fuel consumption in public transportation.

India Hybrid Vehicles Market Trends

India's auto interest rates have shown a consistent downward trend, driven by RBI's measures and evolving lending practices

- In recent times, India's auto interest rate stood at approximately 8.567%, marking a decline from the 8.698% observed in 2021. This slight decrement of about 1.5% continues the trend from the prior year, wherein rates reduced from 9.15% in 2019 to 8.698% in 2021. Factors underpinning these dynamics may encompass monetary policy decisions by the Reserve Bank of India (RBI), domestic credit demand, and broader macroeconomic conditions.

- During 2017-2023, India's auto interest rate was observed at 9.508%. Over the subsequent years, the rate experienced minor fluctuations, descending slightly to 9.454% in 2018 and then marginally ascending to 9.466% in 2019. However, a more significant decline was observed from 2019 onwards, culminating at 8.567% in 2022. Reports from the RBI suggest that these shifts could be attributed to a combination of monetary easing measures, evolving lending practices, and attempts to bolster economic growth in the face of challenges such as the global pandemic.

- The recent trend analysis of India's auto interest rates anticipates a continued trend of relatively lower interest rates in the coming years. The current decrease to 8.567% in 2022, building on the decline from 9.15% in 2019, reflects a deliberate effort by the Reserve Bank of India (RBI) to stimulate economic growth. This downward pressure on rates is likely to persist as the RBI continues to employ monetary easing measures and lending practices evolve to support credit demand.

Government initiatives and stringent norms drive rapid growth in the electric vehicle market in India

- India's electric vehicle (EV) market is in a growth phase, with the government actively formulating strategies to combat pollution. The Fame India scheme, launched in 2015, has played a pivotal role in driving vehicle electrification. Building on its success, Fame Phase 2, active till April 2022, further bolstered EV sales, especially in 2021, with the government offering subsidies like INR 10,000 grants for electric cars with battery capacities up to 15 kWh.

- State governments across India are increasingly incorporating electric buses into their fleets, aiming to transition from internal combustion engine (ICE) buses. This move not only cuts operational costs but also curbs carbon emissions and improves air quality. In a notable move, the Delhi government greenlit the procurement of 300 new low-floor electric (AC) buses in March 2021, with 100 of them hitting the roads in January 2022. These initiatives contributed to a significant 62.58% surge in demand for electric commercial vehicles in India in 2022 over 2021.

- The demand for electric cars has surged in recent times, driven by the government's introduction of stringent norms. In August 2021, the Indian government unveiled the Vehicle Scrappage Policy, targeting the phasing out of polluting and unfit vehicles, irrespective of their age. This policy, set to be implemented by 2024, is steering consumers toward electric cars. Additionally, the government has set an ambitious target of having 30% of all cars in India electrified by 2030. These initiatives are poised to propel electric car sales during the 2024-2030 period in India.

India Hybrid Vehicles Industry Overview

The India Hybrid Vehicles Market is fairly consolidated, with the top five companies occupying 100%. The major players in this market are BMW India Private Limited, Daimler AG (Mercedes-Benz AG), Honda Cars India Limited, Maruti Suzuki India Limited and Toyota Kirloskar Motor Pvt. Ltd. (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Population

- 4.2 GDP Per Capita

- 4.3 Consumer Spending For Vehicle Purchase (cvp)

- 4.4 Inflation

- 4.5 Interest Rate For Auto Loans

- 4.6 Shared Rides

- 4.7 Impact Of Electrification

- 4.8 EV Charging Station

- 4.9 Battery Pack Price

- 4.10 New Xev Models Announced

- 4.11 Logistics Performance Index

- 4.12 Used Car Sales

- 4.13 Fuel Price

- 4.14 Oem-wise Production Statistics

- 4.15 Regulatory Framework

- 4.16 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 Vehicle Type

- 5.1.1 Commercial Vehicles

- 5.1.1.1 Buses

- 5.1.1.2 Heavy-duty Commercial Trucks

- 5.1.1.3 Light Commercial Pick-up Trucks

- 5.1.1.4 Light Commercial Vans

- 5.1.1.5 Medium-duty Commercial Trucks

- 5.1.1 Commercial Vehicles

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Audi Auto India Pvt. Ltd.

- 6.4.2 BMW India Private Limited

- 6.4.3 Daimler AG (Mercedes-Benz AG)

- 6.4.4 Honda Cars India Limited

- 6.4.5 Hyundai Motor India Limited

- 6.4.6 Maruti Suzuki India Limited

- 6.4.7 Toyota Kirloskar Motor Pvt. Ltd.

- 6.4.8 Volvo Auto India Private Limited

7 KEY STRATEGIC QUESTIONS FOR VEHICLES CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms