|

市场调查报告书

商品编码

1693668

泰国金属包装:市场占有率分析、行业趋势和成长预测(2025-2030 年)Thailand Metal Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

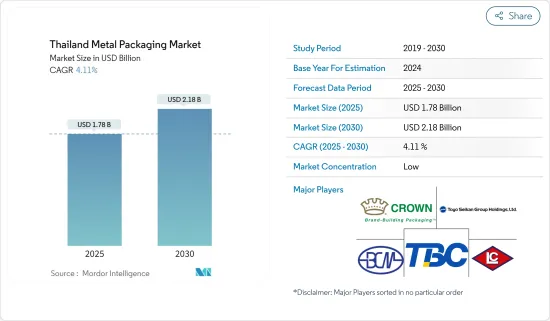

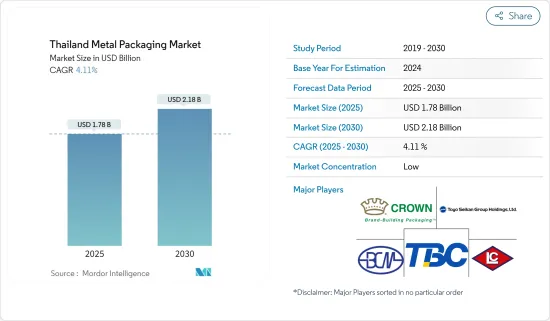

泰国金属包装市场规模预计在 2025 年为 17.8 亿美元,预计到 2030 年将达到 21.8 亿美元,预测期内(2025-2030 年)的复合年增长率为 4.11%。

关键亮点

- 金属包装市场对泰国的包装产业至关重要,为各个领域提供强大且可靠的解决方案。该研究深入研究了金属包装市场的复杂动态,并将其分为两个主要部分:工业市场和金属罐市场。

- 受工业活动增加、食品和饮料消费成长以及环保意识增强等多种因素的影响,泰国金属包装市场表现出韧性和成长。工业金属包装,包括中型散装容器、散装容器、桶和封盖,由于其耐用性和保护性,在化学品、润滑剂、农产品等领域受到稳定的需求。

- 该地区的金属罐市场正在经历强劲增长,这得益于化妆品、汽车和工业、油漆和清漆以及药品等各种终端用户对包装食品和饮料储存罐以及气雾罐的需求不断增长。永续包装解决方案的采用正在推动可回收和环保金属包装的需求。消费者偏好正在发生变化,监管措施也有利于环保包装。

- 泰国金属包装市场持续成长,为世界各地的产业参与企业提供了新的创新和合作机会。例如,特种化学品公司东洋油墨集团的日本母公司东洋SC控股于2023年3月宣布,已与其合併子公司东洋油墨泰国公司签署了一项股份购买协议,以收购泰国罐头市场无印刷罐外墙涂料製造商泰国Eurocoat的100%股权。

- 铝是一种可回收材料。废物被控制在最低限度,几乎 100% 可回收。铝製汽水罐可以回收成大小大致相同的新罐。据泰国饮料罐有限公司称,多年来生产的铝中有近75%仍在使用。在泰国,90%以上的铝罐都是可回收的。

- 金属包装面临其他包装解决方案的竞争。塑胶包装解决方案等材料是该行业的替代包装选择之一。塑胶包装已成为许多行业大规模仓储和运输中金属包装的主要竞争对手。食品和饮料行业是金属罐的主要用户,现在开始采用可回收塑胶包装解决方案。塑胶罐是透明的,这有助于品牌表明食品的品质。此外,政府推广环保储存材料的措施也限制了市场的成长。

泰式金属包装市场趋势

罐装食品占据很大市场占有率

- 罐装饮料非常适合盛装啤酒等酒精饮料,尤其是那些略带气泡的饮料。罐子是密封的,非常适合盛装酸性强且可在压力下储存的软性饮料。二氧化碳不像穿过其他材料那样容易穿过金属,因此气体浓度会随着时间的推移而增加,从而给消费者带来更「发泡」的体验。

- 各公司逐渐意识到罐装优质饮料包装的巨大潜力,这一趋势有望推动市场成长。例如,饮料业主要企业卡拉宝集团凭藉其首款产品拉格啤酒(酒精浓度为4.9%)进入啤酒市场。 2023年11月,该公司在泰国推出了两个金属罐装的新啤酒品牌:Carabao Beer和Tawan Daeng Beer。

- 此外,根据泰国工业经济办公室的数据,泰国的啤酒总销售额从2023年7月的2.867亿美元逐渐增加到2023年12月的4.356亿美元。随着消费量的增加,啤酒销售也呈现出巨大的需求,这直接影响了对用于包装啤酒的金属罐的需求,因为金属罐具有其特性。总体而言,这些趋势正在促进市场充满活力和不断扩大,为该地区的老牌参与企业和新兴品牌提供机会。

- 随着泰国个人护理和化妆品行业的发展,对环保包装的需求也显着增长。这是因为个人护理和化妆品含有可与阳光和空气反应的化学物质,并且采用气雾金属罐包装。因此,各大公司开始推出铝製气雾罐,特别是用于髮胶和除臭剂等产品。此外,具有环保意识的消费者选择可自然分解的可回收包装,促进了气雾罐的销售。

饮料业预计将占据主要市场占有率

- 饮料业包括苏打水、果汁、咖啡、茶等多种饮料。它回应了消费者对清爽、偏好饮料不断变化的偏好。对健康和保健的关注促使消费者寻求更健康的饮料。功能性饮料、运动饮料、维生素和矿物质强化饮料、益生菌等机能饮料正在兴起。

- 此外,消费者越来越关注糖的消费量以及它对他们的健康和福祉的影响。在此背景下,人们对不含添加糖的天然有机饮料的需求日益增加。饮料产业的变化是罐装饮料包装市场扩大的驱动力之一。

- 即饮饮料(RTD)是成熟品牌和新兴品牌机能饮料的最新趋势之一。随着越来越多的人寻求新颖、创新的方式来享受他们最喜欢的饮料,RTD 已成为一种流行的选择。对于经常出门的人来说,罐装饮料是理想的选择,因为它们易于携带,可以让饮料更长时间地保持冷鲜,而且不易破碎。

- 饮料罐的目的是为了保持果汁成分的新鲜度。它也很方便,因为您可以在旅途中饮用。罐头保存期限长,可保留风味,方便消费者储存、堆迭和维护。 2024 年 2 月,泰国的果汁销售额大幅增长,从 2023 年 10 月的 44,200 美元增长至 57,700 美元,表明该地区的果汁需求增加,从而塑造了一系列金属罐的市场。

- 罐子光滑、纤薄的风格易于抓握,而且外观也很漂亮。它还可以作为光线和空气的屏障,帮助能量饮料保持更长的新鲜并更快冷却。这些环保罐与其他饮料罐一样,光滑、纤薄、可堆迭、重量轻且可 100% 无限回收。因此,罐装能量饮料的需求很高,尤其是年轻一代,这为製造商创造了良好的机会。例如,2023年6月,TCP集团新成立的「Refreshment Booster」部门将在该地区推出罐装「红牛能量汽水」。

泰国金属包装产业概况

泰国金属包装市场的竞争格局分为东洋制管集团控股公司、昭和电工株式会社等参与企业。 (SDK)、Crown Holdings, Inc.、Lohakij Rung Charoen Sub 和 Thai Beverage Can Ltd. 随着市场参与企业对研发的投资,他们的产品变得更加差异化,并在竞争中占据上风。

- 2023 年 9 月 - 泰国饮料罐有限公司在 WHA工业区的泰国饮料罐 2 号工厂开设第五条铝罐生产线。新的生产设施将能够根据客户需求生产铝罐和铝瓶。最初,该公司计划生产常规的 500 毫升罐和 DWI(拉深和壁厚)铝瓶。 DWI 铝瓶纤薄而坚固且轻便,采用现代设计,有 310 毫升和 510 毫升两种尺寸。

- 2023 年 7 月 - 皇冠控股已将其铝业管理倡议(ASI) 认证扩展到亚太地区,强调其 Twentyby30 永续发展倡议,以促进道德供应链。泰国的 Nong Khae 工厂和 Crown TCP 饮料包装工厂最近获得了 ASI 性能标准认证。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 产业价值链分析

- 产业吸引力-波特五力模型

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章市场动态

- 市场驱动因素

- 都市化加速,经济持续成长

- 罐头需求推动市场成长

- 市场问题

- 替代产品成本下降可能抑制市场成长

- 全球金属包装市场概览

第六章市场区隔

- 依材料类型

- 铝

- 钢

- 依产品类型

- 能

- 食品罐

- 饮料罐

- 气雾罐

- 散装容器

- 运输桶和鼓

- 瓶盖和瓶塞

- 能

- 按行业

- 饮料

- 食物

- 油漆和化学品

- 工业的

第七章竞争格局

- 公司简介

- Toyo Seikan Group Holdings, Ltd.

- ALUCON Public Company Limited(TAKEUCHI PRESS INDUSTRIES CO., LTD.)

- Crown Holdings, Inc.

- Lohakij Rung Charoen Sub Co., Ltd.

- SWAN实业(泰国)有限公司

- Thai Beverage Can Ltd.

- Bangkok Can Manufacturing Co., Ltd.

- Next Can Innovation Co., Ltd.

- Asian-Pacific Can Co., Ltd(Thai Union Group PCL)

- 标准罐头有限公司(泰国)

- Royal Can Industries Company Limited

第八章投资分析

第九章:市场的未来

The Thailand Metal Packaging Market size is estimated at USD 1.78 billion in 2025, and is expected to reach USD 2.18 billion by 2030, at a CAGR of 4.11% during the forecast period (2025-2030).

Key Highlights

- The metal packaging market is vital to the Thailand packaging industry, offering robust and reliable solutions across various sectors. The study delves into the intricate dynamics of the metal packaging market, categorizing it into two primary segments: the industrial and metal cans markets.

- The Thai metal packaging market demonstrates resilience and growth, driven by diverse factors such as increasing industrial activities, expanding food and beverage consumption, and growing environmental awareness. Industrial metal packaging, including IBCs, bulk containers, drums, and closures, witnesses steady demand from sectors like chemicals, lubricants, and agricultural products due to their durability and protective qualities.

- The metal cans segment is experiencing strong growth in the region, driven by the growing demand for storage cans for packaged food and beverages and aerosol cans for various end-users, including cosmetics, automotive and industrial, paints and varnishes, pharmaceuticals, etc. Adopting sustainable packaging solutions increases the demand for metal packaging, which is recyclable and eco-friendly. Consumer preferences are changing, and regulatory measures favor eco-friendly packaging.

- The Thai metal packaging market will continue to grow, providing new opportunities for innovation and cooperation between industry players worldwide. For instance, Toyo SC Holdings, the Japanese parent company of the specialty chemicals company Toyo Ink Group, announced that, on March 2023, it and its consolidated subsidiary, Toyo Ink Thailand, entered into a share purchase agreement to acquire 100% of Thai Eurocoat, a manufacturer of external paints for nonprinted cans in the Thai canned food market.

- Aluminium is a highly recyclable material. It is almost 100% recyclable with minimal loss. Ann aluminum soda can can can be recycled into a new can of nearly the exact same size. According to Thai Beverage Can Ltd.,nearly 75% of all aluminium produced over the years is still in use. In Thailand, aluminium cans can be recycled more than 90%.

- Metal packaging is facing a lot of competition from other packaging solutions. Materials like plastic packaging solutions are among the alternative packaging options in the industry. Plastic packaging is the main competitor of metal packaging in many industries for large-scale storage and transportation. The food and beverage industry, the primary user of metal cans, has started adopting recyclable plastic packaging solutions. Plastic cans are transparent, which helps brands to show their food's quality. Further, the government's efforts to promote environmentally friendly storage materials limit market growth.

Thailand Metal Packaging Market Trends

Can segment to Hold Significant Market Share

- Cans are perfect for alcoholic beverages like beer, especially those with a hint of foam. The airtight nature of the can makes it ideal for soft drinks, which have a higher acidity level and are pressurized. Carbon dioxide cannot pass through metal than other materials, so the gas concentration can increase over time, providing consumers with a much more "fizzy" experience.

- Companies recognize the immense potential of premium beverage packaging in cans, a trend poised to drive market growth. For instance, the Carabao Group, a significant player in the beverage industry, has entered the beer market with its first product, "Lager," with 4.9 percent alcohol content. In November 2023, it launched Carabao Beer and Tawan Daeng Beer, two new beer brands in Thailand, in metal cans.

- Further, per the Office of Industrial Economics (Thailand) data, total beer sales in Thailand increased gradually in December 2023 to USD 435.6 million, up from USD 286.7 million in July 2023. With the growing consumption, beer sales also show significant demand, directly impacting the demand for metal cans for packing beer due to its characteristics. These trends collectively contribute to a dynamic and expanding market, offering opportunities for established players and emerging brands in the region.

- As Thailand's personal care and cosmetics sector grows, the need for environmentally friendly packaging has significantly increased. This is because personal care and cosmetic items contain chemicals that can react to sunlight and air, leading to the use of aerosol metal cans for their packaging. As a result, major companies are now launching aerosol cans made from aluminum, particularly for items like hair sprays and deodorants. Moreover, consumers who care about the environment are choosing recyclable packaging that can break down naturally, which is helping to boost the sales of aerosol cans.

Beverage Segment is Expected to Hold a Significant Market Share

- The beverage industry encompasses many drinks, including carbonated soft drinks and juices, coffee and tea, and more. It caters to consumers with changing preferences for refreshing and indulgent beverages. Health and wellness concerns have prompted consumers to look for healthier beverages. Functional drinks such as functional water, sports drinks, vitamins and minerals-fortified drinks, probiotics, and more are rising.

- Further, consumers are becoming more conscious of their sugar consumption and how it affects their health and well-being. With this in mind, there is an increasing demand for sugar-free, natural, organic drinks. The changing landscape of the beverage industry has been one of the driving forces behind the expansion of the can market in beverage packaging.

- Ready-to-drink beverages (RTDs) are one of the latest trends in functional drinks for both established and up-and-coming brands. As more people seek new and innovative ways to enjoy their favorite beverages, RTDs have become the go-to choice for many. Cans are easy to transport, keep drinks cold and fresh longer, and are unbreakable, making them ideal for constantly moving people.

- The purpose of the beverage can is to maintain the freshness of the juice's ingredients. It is also convenient and easy to consume on the go. Cans provide a long shelf life, keep the flavor, and allow consumers to store, stack, and maintain their supply. The fruit juices' sales value increased significantly in Thailand in February 2024. It was USD 57.7 thousand, which increased from USD 44.2 thousand in October 2023, showing the increasing demand for Juice in the region, creating a market for different metal cans.

- Sleek and slim-style cans are more accessible to grip and look good. They also act as a barrier to light and air, which helps keep your energy drinks fresh longer and allows them to cool down faster. These eco-friendly cans are sleek, slim, stackable, lightweight, and 100% infinitely recyclable like all beverage cans. Thus, there is a high demand for energy de=rink cans in the young generation, creating an opportunity for the manufacturers. For instance, in June 2023, TCP Group's new "refreshment booster" segment launches "Red Bull Energy soda" in can packaging in the region.

Thailand Metal Packaging Industry Overview

The competitive landscape of the Thailand Metal Packaging Market is fragmented, with several players, such as Toyo Seikan Group Holdings, Ltd., Showa Denko K.K. (SDK), Crown Holdings, Inc., Lohakij Rung Charoen Sub Co., Ltd., Thai Beverage Can Ltd., and more. As the market participants spend on R&D, their products become more distinct, and the idea of product differentiation is to gain a competitive edge.

- September 2023-Thai Beverage Can Ltd. opened the fifth aluminum can production line at the Thai Beverage Can two plant in the WHA Industrial Area. This new production facility can produce aluminum cans and bottles to meet customer demand. Initially, the production will include 500 ml regular cans and DWI (Drawn and wall-ironed) aluminum bottles, which are thinner yet solid and lightweight, available in modern designs of 310 ml and 510 ml sizes.

- July 2023-With its Twentyby30 sustainability initiative to promote ethical supply chains, Crown Holdings, Inc. has broadened its Aluminium Stewardship Initiative (ASI) certifications across the Asia Pacific. The Thailand Nong Khae and Crown TCP beverage packaging facilities recently received the ASI Performance Standard certification.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter Five Forces

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Urbanization and Consistent Economic Growth in the Country

- 5.1.2 Demand for Canned Food Drive the Market Growth

- 5.2 Market Challenges

- 5.2.1 Lower Cost of Substitute Products may Restrain the Market Growth

- 5.3 Overview of Global Metal Packaging Market

6 MARKET SEGMENTATION

- 6.1 By Material Type

- 6.1.1 Aluminum

- 6.1.2 Steel

- 6.2 By Product Type

- 6.2.1 Cans

- 6.2.1.1 Food Cans

- 6.2.1.2 Beverage Cans

- 6.2.1.3 Aerosol Cans

- 6.2.2 Bulk Containers

- 6.2.3 Shipping Barrels and Drums

- 6.2.4 Caps and Closures

- 6.2.1 Cans

- 6.3 By End-User Vertical

- 6.3.1 Beverage

- 6.3.2 Food

- 6.3.3 Paints and Chemicals

- 6.3.4 Industrial

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Toyo Seikan Group Holdings, Ltd.

- 7.1.2 ALUCON Public Company Limited (TAKEUCHI PRESS INDUSTRIES CO., LTD.)

- 7.1.3 Crown Holdings, Inc.

- 7.1.4 Lohakij Rung Charoen Sub Co., Ltd.

- 7.1.5 SWAN Industries (Thailand) Company Limited

- 7.1.6 Thai Beverage Can Ltd.

- 7.1.7 Bangkok Can Manufacturing Co., Ltd.

- 7.1.8 Next Can Innovation Co., Ltd.

- 7.1.9 Asian-Pacific Can Co., Ltd (Thai Union Group PCL)

- 7.1.10 Standard Can Co,. Ltd. (Thailand)

- 7.1.11 Royal Can Industries Company Limited