|

市场调查报告书

商品编码

1693669

亚太海上地震探勘服务-市场占有率分析、产业趋势与统计、成长预测(2025-2030)Asia Pacific Offshore Seismic Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

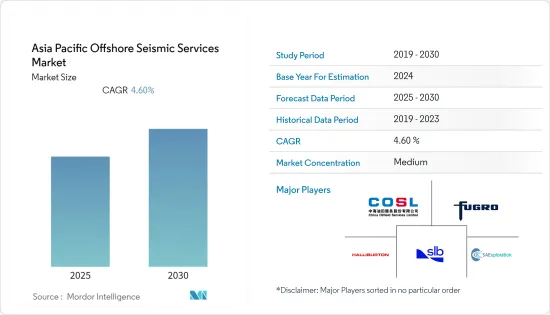

预计预测期内亚太海上地震探勘服务市场复合年增长率将达 4.6%。

2020 年,市场受到新冠疫情的不利影响。目前市场已恢復至疫情前的水准。

关键亮点

- 从长远来看,海上石油和天然气探勘的增加以及原油价格的上涨预计将推动市场发展,因为它们使上游活动具有经济可行性。

- 另一方面,中国、印度、印尼和马来西亚等亚太国家正在向可再生能源转型,这可能会抑制预测期内的市场成长。

- 预计石油和天然气探勘地震探勘技术的进步将为未来地震探勘市场参与企业提供重大机会。

- 由于印度专注于开发国内碳氢化合物资源,预计预测期内印度的地震探勘服务市场将出现最快的成长。

亚太地区海上地震探勘服务市场趋势

数据采集领域占据市场主导地位

- 预计地震探勘服务市场的资料收集部分在预测期内将占据相当大的份额。海上探勘资料的品质通常比陆上地震资料的品质高得多。这是由于几个有利条件,包括可重复和一致的源、源和接收器的良好耦合条件以及水作为介质的均匀特性。

- 印度国营石油天然气公司(ONGC)在海上领域积极进行的探勘活动预计将带来对地震探勘服务的大量需求。 2021年11月,印度石油天然气公司启动了地震探勘竞标,以取得孟买和安达曼盆地多个海上区块的3D宽频资料。新的勘探计划获取五个主要油气区块 8,500 平方公里的 3D 宽频数据。

- 这五个区块中,有三个位于孟买盆地,水深从 40 公尺到 150 公尺不等,印度石油天然气公司希望获得面积约 4,400 平方公里的 3D 宽频数据。其余两个区块位于印度东海岸的安达曼盆地,该公司希望在那里取得超过 4,100 平方公里的 3D 宽频数据。

- 此外,2022 年 7 月,挪威地震探勘公司 PGS 获得了两份在亚太地区进行 4D 采集和 3D探勘的合同,宣传活动为期约五个月。第一份合约授予了一家未公开的能源公司,负责印尼近海的三维探勘。对于印尼近海的 3D探勘合同,PGS 可能会在 10 月中旬调动 Ramform Sovereign 号船,预计工作将于 2022 年 12 月完成。

- 此外,中国国营石油公司中国海洋石油总公司(中海油)计划在未来几年开发深水油田综合体,目标是到2025年将勘探工作量和探明蕴藏量翻一番。 2022年初,中海油计画钻探227口海上探勘井和132口陆上传统型探勘井,并取得约1.7万平方公里的三维探勘资料。中海油2022年总资本支出约156.7亿美元。在总资本支出中,勘探、开发、生产和其他资本支出分别约占20%、57%、21%和2%。

- 考虑到上述情况,预计资料收集部分将在预测期内占据市场主导地位。

印度可望主导市场

- 预计印度将成为未来几年成长最快的探勘服务市场。该国计划勘探其碳氢化合物资源并减少石油进口,并打算投入更多油井生产。此外,政府也推出了开放英亩许可证计画(OALP)等优惠政策,以降低外国石油和燃气公司的进入门槛,并提高国内石油和天然气产量。预计这种环境将增加该国对地震探勘服务的需求。

- 石油部宣布计划加大石油和天然气区块的竞标,不仅是为了增加收入,也是为了提高产量。此外,印度政府于 2016 年 3 月核准的《碳氢化合物探勘和许可政策》(HELP)是政府到 2022-2023 年使印度石油和天然气产量翻一番的策略的一部分。

- 2021年,印度天然气总产量增加,从2020年的286.72亿标准立方公尺增加到约340.24亿标准立方公尺。此外,政府还提供了行销和定价自由,以奖励在高压高温 (HPHT)储存以及深水和超深水等难采地区生产天然气。这种允许的销售自由受到根据替代燃料的到岸成本设定的价格上限的限制。

- 此外,2022 年 3 月,国营石油天然气公司 (ONGC) 宣布将对印度专属经济区 (EEZ) 未发现区域进行二维 (2D) 地震探勘。印度石油天然气公司将在西部、东部和安达曼三个区域,对印度专属经济区的近海区进行二维地震探勘,其中包括采集、处理和解释 (API) 70,000 线公里的二维探勘资料。

- 总体而言,预计印度将在预测期内主导亚太海上地震探勘服务市场。

亚太地区海上地震探勘服务产业概况

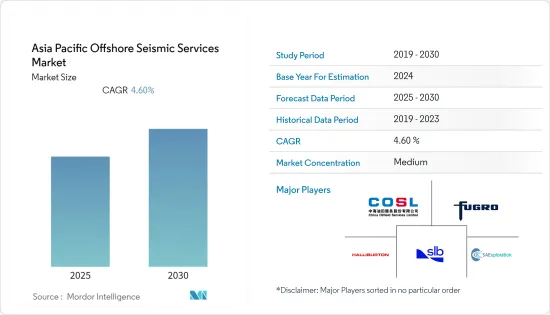

亚太地区海上地震探勘服务市场区隔程度适中。主要企业(排名不分先后)包括斯伦贝谢有限公司、哈里伯顿公司、中海油田服务股份有限公司、辉固公司、南非勘探控股公司。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究范围

- 市场定义

- 调查前提

第二章执行摘要

第三章调查方法

第四章 市场概述

- 介绍

- 2027 年市场规模与需求预测

- 截至2021年亚太地区主要国家活跃陆上及海上钻机数量

- 近期趋势和发展

- 政府法规和政策

- 市场动态

- 驱动程式

- 限制因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章市场区隔

- 服务

- 数据采集

- 数据处理和解释

- 部署位置

- 陆上

- 海上

- 地区

- 中国

- 印度

- 马来西亚

- 印尼

- 其他亚太地区

第六章 竞争格局

- 併购、合资、合作与协议

- 主要企业策略

- 公司简介

- Schlumberger Ltd

- Halliburton Company

- China Oilfield Services Limited

- Fugro NV

- SAExploration Holdings Inc.

- PGS SA

- TGS ASA

- Cgg SA

- Ion Geophysical Corporation

- Saexploration Holdings Inc.

第七章 市场机会与未来趋势

简介目录

Product Code: 93168

The Asia Pacific Offshore Seismic Services Market is expected to register a CAGR of 4.6% during the forecast period.

The market was negatively impacted by COVID-19 in 2020. Currently, the market has reached pre-pandemic levels.

Key Highlights

- Over the long term, increasing oil and gas exploration in offshore areas and strengthening crude oil prices, making upstream activities economically feasible, are likely to drive the market.

- On the other, the countries in the Asia-Pacific region, such as China, India, Indonesia, and Malaysia, are shifting to renewable energy sources, which may restrain the market growth during the forecast period.

- Nevertheless, the technological advancements in seismic surveys for oil and gas exploration are expected to provide a significant opportunity for the seismic market players in the future.

- India is expected to witness the fastest growth in the seismic service market during the forecast period as it focuses on unlocking domestic hydrocarbon resources.

APAC Offshore Seismic Services Market Trends

Data Acquisition Segment to Dominate the Market

- The data acquisition segment of the seismic service market is expected to have a significant share during the forecast period. As offshore seismic data usually has much higher quality than onshore due to several favorable conditions, including repeatable and consistent sources, good conditions for coupling at sources and receivers, and the uniform property of water as the medium.

- India's state-controlled Oil & Natural Gas Corporation's (ONGC) proactive exploration activity in the country's offshore sector is expected to contribute to the significant demand for seismic services. In November 2021, ONGC launched a seismic tender for 3D broadband data acquisition in multiple offshore tracts in the Mumbai and Andaman basins. The new survey aims to acquire 3D broadband data over 8,500 square kilometers spread across five key oil and gas blocks.

- Of the five blocks, three blocks lie in the Mumbai basin, offshore the country's western coast in water depths ranging between 40 and 150 meters, in which ONGC wants to acquire almost 4,400 square kilometers of 3D broadband data. The remaining two blocks are located in the Andaman basin blocks near India's east coast, where the company wants to acquire 3D broadband data over 4,100 square kilometers.

- Moreover, in July 2022, PGS, a Norwegian-based seismic company, secured two contracts for the 4D acquisition and 3D exploration in the Asia-Pacific region, constituting a nearly five-month campaign. The company signed the first contract with an undisclosed energy company for a 3D exploration acquisition offshore Indonesia. For the 3D exploration contract off Indonesia, PGS may mobilize its vessel Ramform Sovereign in mid-October, and the work is expected to end by December 2022.

- In addition, China National Offshore Oil Corporation (CNOOC), a Chinese national oil company, has plans to develop a deepwater oilfield complex in the coming years and aims to double its exploration workload and proven reserves by 2025. In early 2022, CNOOC Ltd planned to drill 227 offshore exploration wells and 132 onshore unconventional exploration wells and acquire about 17,000 sq. km of 3D seismic data. CNOOC's total capital expenditure for 2022 is around USD 15.67 billion. The capital expenditures for exploration, development, production, and others may account for about 20%, 57%, 21%, and 2% of total capital expenditures, respectively.

- Owing to the above points, the data acquisition segment is expected to dominate the market during the forecast period.

India is Expected to Dominate the Market

- India is expected to be the fastest-growing seismic service market in the coming years. The country plans to unlock its hydrocarbon resources and reduce oil imports, intending to bring more wells into production. In addition, the government has eased the barriers to entry for foreign oil and gas companies and rolled out favorable policies, such as the Open Acreage License Policy (OALP), to increase domestic oil and gas production. Such an environment is expected to increase the demand for seismic services in the country.

- The Ministry of Petroleum announced its plans to focus on the oil and gas blocks auction not only to earn more revenue but also to increase production. In addition, the Hydrocarbon Exploration and Licensing Policy (HELP), approved by the government in March 2016, forms a part of the government's strategy to double India's oil and gas output by 2022-2023.

- In 2021, the country witnessed a rise in total gas production, recording about 34024 million Standard Cubic meters (MMSCM) from 28672 MMSCM in 2020. Furthermore, the government has given marketing and pricing freedom to incentivize gas production from difficult areas, such as high-pressure, high-temperature (HPHT) reservoirs and deepwater and ultra-deepwater areas. The marketing freedom so granted would be capped by a ceiling price arrived at based on the landed cost of alternative fuels.

- Moreover, in March 2022, State-run Oil and Natural Gas Corporation Ltd (ONGC) announced to undertake a two-dimensional (2D) seismic survey of the unappraised areas of India's Exclusive Economic Zone (EEZ). The scope of the work includes ONGC carrying out a 2D Seismic Survey in offshore areas up to EEZ of India involving the acquisition, processing, and interpretation (API) of 70,000 line kilometers of 2D Seismic Data in three sectors -- Western, Eastern and Andaman.

- Owing to the above points, India is expected to dominate the Asia-Pacific offshore seismic services market during the forecast period.

APAC Offshore Seismic Services Industry Overview

The Asia-Pacific offshore seismic service market is moderately fragmented. Some of the major companies (not in particular order) include Schlumberger Ltd, Halliburton Company, China Oilfield Services Limited, Fugro NV, and SAExploration Holdings Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2027

- 4.3 Onshore and Offshore Active Rig Count, by Major Countries, Asia-Pacific, till 2021

- 4.4 Recent Trends and Developments

- 4.5 Government Policies and Regulations

- 4.6 Market Dynamics

- 4.6.1 Drivers

- 4.6.2 Restraints

- 4.7 Supply Chain Analysis

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Consumers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitutes Products and Services

- 4.8.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Service

- 5.1.1 Data Acquisition

- 5.1.2 Data Processing and Interpretation

- 5.2 Location of Deployment

- 5.2.1 Onshore

- 5.2.2 Offshore

- 5.3 Geography

- 5.3.1 China

- 5.3.2 India

- 5.3.3 Malaysia

- 5.3.4 Indonesia

- 5.3.5 Rest of Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Schlumberger Ltd

- 6.3.2 Halliburton Company

- 6.3.3 China Oilfield Services Limited

- 6.3.4 Fugro NV

- 6.3.5 SAExploration Holdings Inc.

- 6.3.6 PGS SA

- 6.3.7 TGS ASA

- 6.3.8 Cgg SA

- 6.3.9 Ion Geophysical Corporation

- 6.3.10 Saexploration Holdings Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219