|

市场调查报告书

商品编码

1693687

铝锻造-市场占有率分析、产业趋势与统计、成长预测(2025-2030)Aluminium Forging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

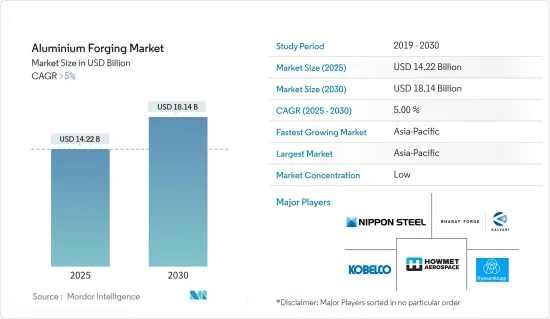

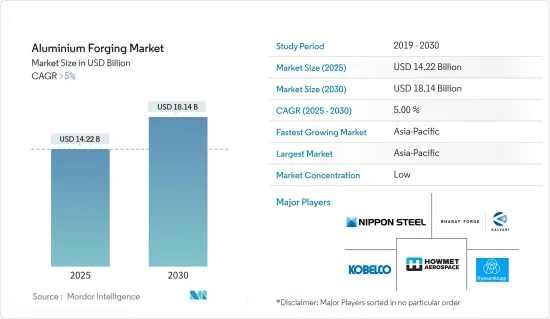

预计 2025 年铝锻造市场规模为 142.2 亿美元,到 2030 年将达到 181.4 亿美元,预测期内(2025-2030 年)的复合年增长率将超过 5%。

受新冠疫情影响,铝锻造市场遭遇挫折。全球封锁和严格的政府监管导致大面积製造工厂关闭。然而,预计市场将在 2021 年復苏,并在未来几年经历显着成长。

关键亮点

- 短期内,工业领域轻量材料的使用日益增长以及汽车和运输行业的需求不断增长是推动研究市场需求的关键因素。

- 然而,铝价波动和严格的品质标准预计会阻碍市场成长。

- 锻造和模拟技术的进步有望为该市场带来新的机会。

- 预计亚太地区将主导全球市场,其中中国和印度的需求将占据大部分市场份额。

铝锻造市场趋势

汽车和运输领域占据市场主导地位

- 铝在汽车领域有着广泛的应用。它们对于引擎散热器、车轮、保险桿、悬吊元件、引擎汽缸体、变速箱体以及包括引擎罩、车门和车架在内的车身部件至关重要。铝因其重量轻、耐用和美观而成为一种受欢迎的选择,尤其是对于外部组件。

- 此外,锻造铝零件在汽车领域至关重要。随着汽车产业越来越注重燃油效率、轻量化和减少二氧化碳排放,铝在现代汽车中的重要性日益凸显。每使用一公斤铝,就会减轻一辆汽车的重量,这导致汽车零件对铝的依赖增加,从而增加了市场需求

- 铝的减震能力是钢的两倍,因此是首选。这种效应促使製造商在保险桿中更广泛地使用铝。此外,铝製车身增强了安全性。即使铝部件变形,与保持整体形状的钢不同,这种变化只局部撞击区域,从而确保了乘员的安全。

- 2023年,在强劲的经济扩张和不断变化的消费者偏好的推动下,汽车产业经历了强劲成长。根据国际汽车製造商组织(OICA)的数据,2019年全球汽车产量(包括乘用车和商用车)约为9,355万辆。这将较2022年的产量约8,483万辆有显着成长,成长率约为10.26%。

- 2023年,亚太地区新商用车销量将较2022年成长10.9%,达796万辆,而2022年为717万辆。

- 然而,在印度,商用车 (CV) 销量在 2024 财年实现 2-5% 的小幅成长后,预计 2024-25 年 (FY25) 将会下降。根据印度投资资讯和信用评等机构(ICRA)的数据,预计2025财年将下降4-7%。

- 预计2023年北美汽车销量将达到1,919万辆,较2022年的1,693万辆成长13.4%。其中,乘用车398万辆,商用车1521万辆,其余为重型货车、客车及长途客车。

- 此外,根据欧洲汽车工业协会的数据,2023年欧洲新车註册量将成长18.7%,乘用车销售量将达到1,500万辆,商用车销售量将达到290万辆,分别高于2022年的1,264万辆和2,44万辆。

- 2024年第一季,英国贸易和工业部记录了104,000辆商用车註册,比去年同期显着增加了59%。

- 根据OICA数据,2023年巴西轻型商用车产量将达42.2万辆,与前一年同期比较成长20%,证实了市场成长。

- 此外,沙乌地阿拉伯的商用车市场正在经历转型。经济多样化和基础设施现代化正在推动对先进商用车的需求,尤其是在 NEOM 和红海计划等大型企划的实施过程中。

- 沙乌地阿拉伯商用车产业正朝着「2030愿景」目标快速发展。美国沙乌地阿拉伯商务委员会预测,受基础设施快速发展和对先进物流解决方案日益增长的需求的推动,到 2025 年,该市场规模将达到 67 亿美元。

- 鑑于这些动态,市场预计在预测期内大幅成长。

亚太地区占市场主导地位

- 预计亚太地区将引领铝锻造市场,并成为预测期内成长最快的地区。这种快速成长主要归因于航太和国防、汽车和运输、工业机械和建筑等领域的需求不断增长,尤其是在中国、印度、韩国、日本和东南亚各国。

- 铝锻件具有强度高、重量轻、耐腐蚀等特点,是高层建筑、办公大楼等高层建筑中不可或缺的材料。这些零件可以承受恶劣的环境条件,最大限度地减少维护和维修的需要。随着该地区建筑业的扩张,未来几年对铝锻件的需求将会上升。

- 中国的都市化进程旨在2030年使都市化达到70%,这凸显了住宅需求和中阶改善生活水准的愿望。这些趋势将推动住宅市场和住宅,从而使铝锻造市场受益。

- 到2024年,印度的经济适用住宅预计将成长70%。据投资印度 (Invest India) 称,到 2025 年,建筑业的估值预计将达到 1.4 兆美元。预计到 2030 年,超过 30% 的人口将成为居住者,因此迫切需要超过 2,500 万套中型和经济适用住宅。近期推出的《房地产法》、《商品及服务税》和《房地产投资信託》等旨在加快审批速度和加强建筑业的改革正在推动市场成长。

- 铝锻件在航太领域发挥至关重要的作用,用于机身、机翼和控制面等结构部件。这些部件透过减轻引擎和结构部件的重量来提高飞机和太空船的性能。随着该地区航太部门的扩张,对铝锻件的需求也预计会成长。

- 中国在全球航太领域脱颖而出,引领飞机製造和国内航空旅行。该国的飞机零件和组装产业正在迅速扩张,拥有超过 200 家小型零件製造商。

- 根据国际贸易管理局(ITA)的数据,中国是世界第二大民用航太市场。根据中国国家统计局和中国民航局报告,截至2024年1月,全国民航机7,351架,比2022年增加550多架。

- 铝锻件对于减轻车辆重量、提高燃油效率和减少排放气体起着至关重要的作用。除了减轻重量之外,这些部件还可以减轻车身重量和加强底盘,从而使汽车更加安全。该地区汽车产量的成长预计将推动对铝锻件的需求。

- 根据印度汽车製造商工业(SIAM)的数据,2024年1月至3月,印度的乘用车、商用车、三轮车、两轮车和四轮车产量为739万辆。其中,乘用车销售114万辆,商用车销售26.8万辆。

- 铝锻件因其强度重量比、耐腐蚀性和耐用性而备受推崇,广泛应用于工业机械。典型应用包括齿轮、变速箱、帮浦、阀门、轴承和衬套。随着工业机械需求的增加,铝锻件的市场需求也预计将增加。

- 印度商务部数据显示,2023财年出口额中,电子机械设备位居首位,紧随其后的是酪农、食品加工和纺织等工业机械,出口额超过80亿美元。展望未来,预计2024年电子机械和设备出口将达到近124亿美元。

- 锻造铝零件透过减轻重量和降低能耗来提高电子和仪器零件的性能。亚太地区的电子产业正在蓬勃发展,这可能会刺激该领域对铝锻造件的需求。

- 根据日本电子情报技术产业协会数据显示,2024年1月至6月,日本电子产业生产产品价值5,452.56亿日圆(约33.86亿美元),较去年同期大幅成长104.7%。

- 鑑于这些动态,预测期内亚太地区对铝锻件的需求将快速成长。

铝锻造业概况

铝锻造市场较为分散。主要企业(不分先后顺序)包括 Howmet Aerospace、Bharat Forge、蒂森克虏伯股份公司、神户製钢所和新日铁株式会社。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 工业领域越来越多地使用轻量材料

- 汽车和运输业的需求增加

- 其他驱动因素

- 限制因素

- 铝价波动

- 严格的品质标准

- 其他限制因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔

- 锻造造型

- 自由锻造

- 密闭式模具模锻

- 环辊锻造

- 最终用户产业

- 航太和国防

- 汽车和运输

- 工业机械

- 建造

- 其他终端用户产业(电子及测量仪器、能源电力、农业农村)

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 马来西亚

- 泰国

- 印尼

- 越南

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 北欧国家

- 土耳其

- 俄罗斯

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 卡达

- 阿拉伯聯合大公国

- 奈及利亚

- 埃及

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章竞争格局

- 併购、合资、合作与协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- Accurate Steel Forgings(INDIA)Limited

- Al Forge Tech Co., Ltd.

- All Metals & Forge Group

- Aluminum Precision Products

- Anchor Harvey

- Anderson Shumaker Company

- Bharat Forge

- Ellwood Group Inc.

- Howmet Aerospace

- ILJIN Co., Ltd.

- Kobe Steel, Ltd.

- Nippon Steel Corporation

- Norsk Hydro ASA

- Ramkrishna Forgings Ltd

- Scot Forge Company

- Thyssenkrupp AG

- Wheel India Limited

第七章 市场机会与未来趋势

- 先进的锻造和模拟技术

- 其他机会

The Aluminium Forging Market size is estimated at USD 14.22 billion in 2025, and is expected to reach USD 18.14 billion by 2030, at a CAGR of greater than 5% during the forecast period (2025-2030).

The aluminum forging market faced setbacks due to COVID-19. Global lockdowns and stringent government regulations led to widespread shutdowns of production hubs. However, the market rebounded in 2021 and is projected to see significant growth in the upcoming years.

Key Highlights

- Over the short term, the growing use of lightweight materials in the industrial sector and increasing demand from the automotive and transportation industries are the major factors driving the demand for the market studied.

- However, fluctuations in aluminum prices and stringent quality standards are expected to hinder the market's growth.

- Nevertheless, advanced forging techniques and simulation technologies is expected to create new opportunities for the market studied.

- Asia-Pacific region is expected to dominate the market across the world, with the majority of demand coming from China and India.

Aluminum Forging Market Trends

Automotive and Transportation Segment to Dominate the Market

- Aluminum is extensively used in the automotive sector. It's integral to components like engine radiators, wheels, bumpers, suspension elements, engine cylinder blocks, gearbox bodies, and body parts, including hoods, doors, and frames. Valued for its lightweight nature, durability, and aesthetic appeal, aluminum is especially favored for exterior components.

- Moreover, forged aluminum components are pivotal in the automotive realm. With the industry's emphasis on fuel efficiency, weight reduction, and curbing CO2 emissions, aluminum's significance in contemporary vehicles has surged. Every kilogram of aluminum reduces the vehicle's weight, prompting a growing reliance on aluminum for car parts and subsequently boosting market demand.

- Aluminum's shock-absorbing capabilities, being twice as effective as steel, make it a preferred choice. This efficacy has led manufacturers to use aluminum in bumpers consistently. Additionally, aluminum bodies offer enhanced safety; when aluminum parts deform, the change is localized to the impact area, unlike steel, which maintains the overall shape, ensuring passenger safety.

- In 2023, the automotive industry experienced significant growth, buoyed by robust economic expansion and evolving consumer preferences. Data from the Organisation Internationale des Constructeurs d'Automobiles (OICA) reveals a production of approximately 93.55 million units of vehicles worldwide, encompassing both passenger cars and commercial vehicles. This marked a notable uptick from the roughly 84.83 million units of vehicles produced in 2022, translating to a growth rate of about 10.26%.

- In 2023, the Asia Pacific region witnessed 10.9% increase in new commercial vehicle sales compared to 2022, with 7.96 million units registered in 2023, compared to 7.17million units in 2022.

- However, in India, commercial vehicle (CV) sales are projected to dip in the financial year 2024-25 (FY 25) after a modest 2-5% growth in FY24. As per the data from ICRA (Investment Information and Credit Rating Agency of India Limited) forecasts a 4-7% decline in FY25.

- North America saw motor vehicle sales reach 19.19 million units in 2023, a 13.4% rise from 2022's 16.93 million units, as reported by OICA. Of the total, passenger cars comprised 3.98 million units, commercial vehicles accounted for 15.21 million units, with the remainder being heavy trucks, buses, and coaches.

- Furthermore, as per the data from the European Automobile Manufacturers Association highlights an 18.7% surge in new motor vehicle registrations in Europe for 2023. Passenger car sales hit 15 million units, while commercial vehicles reached 2.90 million units, both up from 2022's 12.64 million and 2.44 million units, respectively.

- In the first quarter of 2024, the United Kingdom's trade industry recorded 104,000 commercial registrations, a notable 59% increase year-on-year, bolstered by the Ministry of Commerce's issuance of 65,363 permits in the same quarter of 2023.

- OICA data highlights Brazil's light commercial vehicle production at 422 thousand units in 2023, a 20% increase from the previous year, underscoring the market's growth.

- Moreover, Saudi Arabia is witnessing a transformation in its commercial vehicle market. As the nation diversifies its economy and modernizes its infrastructure, there's a growing demand for advanced commercial vehicles, especially with mega projects like NEOM and the Red Sea Project underway.

- Racing towards its Vision 2030 goals, Saudi Arabia's commercial vehicle sector is rapidly evolving. Projections suggest the market will reach USD 6.7 billion by 2025, driven by swift infrastructure developments and a rising demand for advanced logistics solutions, as per the U.S.-Saudi Arabian Business Council.

- Given these dynamics, the market is poised for significant growth during the forecast period.

Asia-Pacific Region to Dominate the Market

- Asia-Pacific is poised to lead the aluminum forging market, emerging as the region with the fastest growth during the forecast period. This surge is primarily fueled by rising demands in sectors like aerospace and defense, automotive and transportation, industrial machinery, and construction, particularly in nations such as China, India, South Korea, Japan, and various Southeast Asian countries.

- Owing to their high strength, lightweight nature, and corrosion resistance, forged aluminum parts are integral to high-rise buildings, including skyscrapers and office towers. These parts can endure harsh environmental conditions, minimizing maintenance and repair needs. With the region's construction sector expanding, the demand for aluminum forging is set to increase in the coming years.

- China's urbanization drive, targeting a 70% urban rate by 2030, underscores the demand for housing and the middle class's aspirations for improved living standards. These trends are poised to invigorate the housing market and residential construction, benefiting the aluminum forging market.

- In 2024, India is set to witness a 70% surge in the availability of affordable housing. According to Invest India, the construction sector is projected to attain a valuation of USD 1.4 trillion by 2025. With forecasts suggesting that over 30% of the population will be urban dwellers by 2030, there's a pressing need for 25 million more mid-end and affordable housing units. Recent reforms, such as the Real Estate Act, GST (Goods and Services Tax) and REITs (Real Estate Investment Trusts), aim to expedite approvals and strengthen the construction industry, driving market growth.

- Forged aluminum parts play a crucial role in aerospace, being used in structural components like fuselages, wings, and control surfaces. These parts enhance aircraft and spacecraft performance by lightening engine and structural components. As the aerospace sector expands in the region, the demand for aluminum forging is projected to grow.

- China stands out in the global aerospace arena, leading in aircraft manufacturing and domestic air travel. The nation's aircraft parts and assembly sector is rapidly expanding, boasting over 200 small parts manufacturers.

- As per the data from the International Trade Administration (ITA), China is the second-largest civil aerospace market globally. As of January 2024, the National Bureau of Statistics of China and the Civil Aviation Administration of China reported 7,351 civil aircraft, an increase of over 550 airplanes from 2022.

- Forged aluminum parts play a pivotal role in reducing vehicle weight, which in turn boosts fuel efficiency and curtails emissions. Beyond weight reduction, these components enhance vehicle safety by lightening the body and reinforcing the chassis. Given the uptick in vehicle production in the region, the demand for aluminum forging is set to rise.

- In India, data from the Society of Indian Automobile Manufacturers (SIAM) indicates that from January to March 2024, the production of passenger vehicles, commercial vehicles, three wheelers, two wheelers and quadricycle reached 7.39 million units. Specifically, sales for passenger and commercial vehicles were 1.14 million and 268 thousand units, respectively.

- Aluminum forging finds extensive application in industrial machinery, prized for its strength-to-weight ratio, corrosion resistance, and durability. Common applications include gears, gearboxes, pumps, valves, bearings, and bushings. As demand for industrial machinery rises, so too will the market's demand for aluminum forging.

- Data from India's Department of Commerce highlights that in the 2023 fiscal year, electric machinery and equipment topped the export value charts, followed closely by industrial machinery for dairy, food processing, and textiles, exceeding USD 8 billion. Looking ahead, exports of electrical machinery and equipment are expected to reach nearly USD 12.4 billion in the 2024 fiscal year.

- Forged aluminum parts enhance the performance of electronic and instrumentation components by reducing weight and energy consumption. With the electronics sector booming in Asia-Pacific, the demand for aluminum forging in this domain is set to escalate.

- Data from the Japan Electronics and Information Technology Industries Association reveals that Japan's electronics industry produced goods worth JPY 5,452,56 million (~USD 3,386 million) from January to June 2024, marking a remarkable 104.7% growth compared to the same period the previous year.

- Given these dynamics, the Asia-Pacific region is poised for a surge in aluminum forging demand during the forecast period.

Aluminum Forging Industry Overview

The aluminum forging market is fragmented in nature. The major players (not in any particular order) include Howmet Aerospace, Bharat Forge, Thyssenkrupp AG, Kobe Steel, Ltd., and Nippon Steel Corporation, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Use of Lightweight Material in Industrial Sector

- 4.1.2 Increasing Demand from the Automotive and Transportation Industry

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Fluctuations in Aluminum Prices

- 4.2.2 Stringent Quality Standards

- 4.2.3 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Forging Type

- 5.1.1 Open Die Forging

- 5.1.2 Close Die Forging

- 5.1.3 Ring Rolled Forging

- 5.2 End-User Industry

- 5.2.1 Aerospace and Defense

- 5.2.2 Automotive and Transportation

- 5.2.3 Industrial Machinery

- 5.2.4 Construction

- 5.2.5 Other End-user Industries (Electronics and Instrumentation, Energy Power, Agriculture and Farming)

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Malaysia

- 5.3.1.6 Thailand

- 5.3.1.7 Indonesia

- 5.3.1.8 Vietnam

- 5.3.1.9 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Spain

- 5.3.3.6 Nordic Countries

- 5.3.3.7 Turkey

- 5.3.3.8 Russia

- 5.3.3.9 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 Qatar

- 5.3.5.3 United Arab Emirates

- 5.3.5.4 Nigeria

- 5.3.5.5 Egypt

- 5.3.5.6 South Africa

- 5.3.5.7 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) **/ Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Accurate Steel Forgings (INDIA) Limited

- 6.4.2 Al Forge Tech Co., Ltd.

- 6.4.3 All Metals & Forge Group

- 6.4.4 Aluminum Precision Products

- 6.4.5 Anchor Harvey

- 6.4.6 Anderson Shumaker Company

- 6.4.7 Bharat Forge

- 6.4.8 Ellwood Group Inc.

- 6.4.9 Howmet Aerospace

- 6.4.10 ILJIN Co., Ltd.

- 6.4.11 Kobe Steel, Ltd.

- 6.4.12 Nippon Steel Corporation

- 6.4.13 Norsk Hydro ASA

- 6.4.14 Ramkrishna Forgings Ltd

- 6.4.15 Scot Forge Company

- 6.4.16 Thyssenkrupp AG

- 6.4.17 Wheel India Limited

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Advanced Forging Techniques and Simulation Technologies

- 7.2 Other Opportunities