|

市场调查报告书

商品编码

1693690

食品卡车:市场占有率分析、行业趋势和成长预测(2025-2030 年)Food Truck - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

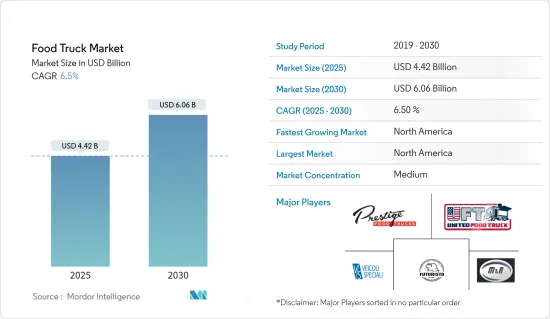

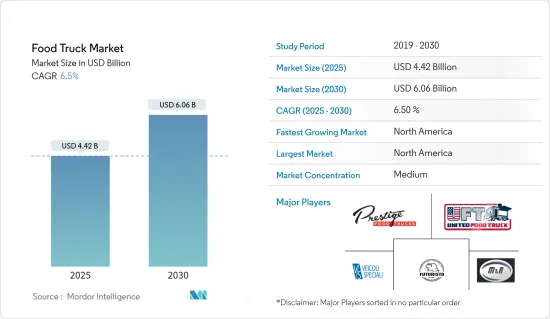

预计 2025 年食品卡车市场规模为 44.2 亿美元,到 2030 年将达到 60.6 亿美元,预测期内(2025-2030 年)的复合年增长率为 6.5%。

过去十年来,餐车市场经历了显着成长,成为更广泛的餐饮服务业中充满活力且不可或缺的一部分。该行业具有流动性、灵活性和独特的烹饪产品的特点,已从边缘新兴事物发展成为主流食品服务现象。科技在餐车市场的发展和成功中发挥关键作用。如今的餐车配备了先进的厨房设备,并提高了其高效准备各种菜餚的能力。此外,POS(销售点)系统和行动付款解决方案的整合简化了交易流程,使顾客更容易订购和付款食品。

社群媒体和数位行销对于推广和发展您的餐车也至关重要。 Instagram、Facebook 和 Twitter 等平台被餐车经营者广泛用于与顾客互动、宣传其位置、推广其菜单并吸引忠实的追随者。这种数位化呈现方式可以提高知名度、培养社区意识以及与客户的直接互动。

虽然餐车市场提供了许多机会,但它也面临着因地区而异的监管挑战。地方政府对食品安全、卫生标准、停车许可证、营业时间和分区法律制定法规。遵守这些规定对于食品卡车经营者来说至关重要,但在复杂且不一致的监管环境中生存可能会很困难。

餐车市场竞争激烈,许多经营者都在争取顾客的注意力。成功的餐车营运商通常透过独特的品牌、高品质的食品、卓越的客户服务和策略性的位置选择来脱颖而出。与当地企业合作并参加美食车节和社区活动也可以提高知名度和客户参与。

新冠疫情以多种方式影响了餐车市场。虽然一些企业因封锁、人流减少和活动取消而面临重大挑战,但其他企业则利用其移动性和户外服务模式进行调整,继续运作。疫情加速了非接触式付款系统和线上订购的采用,这些现在已成为整个行业的标准做法。

在疫情期间,当传统餐厅关闭或容量受限时,餐车透过提供方便快速的餐饮选择,在支持当地社区方面也发挥了至关重要的作用。这种弹性和适应性帮助食品卡车市场巩固了其作为餐饮服务业重要组成部分的地位。

餐车市场已发展成为餐饮服务业中一个充满活力且不可或缺的领域,其特点是灵活性、创新性和适应性。消费者偏好的变化、技术进步和经济优势的结合继续推动市场成长和多样化。

餐车市场趋势

速食推动市场成长

过去十年,餐车市场经历了令人瞩目的成长,其中速食业是这一扩张的主要推动力。快餐的固有属性——方便、实惠和快速——与餐车经营模式完美匹配,产生了推动两个行业向前发展的协同效应。

便利性或许是餐车在速食业最大的优势。现今的消费者生活忙碌,对方便、易得的餐点的需求从未如此高涨。食品卡车本质上是移动的,可以去客户所在的地方,例如办公大楼外、公园或热门活动场所。这种移动性是快餐店的关键卖点,快餐店依靠提供快速、方便的餐食而蓬勃发展。与传统的实体速食店不同,餐车可以根据需求改变位置,确保稳定的顾客流量。

与传统餐厅相比,启动和运营餐车的成本相对较低,因此对企业家来说是一项有吸引力的投资。快餐模式非常适合餐车模式,因为它通常需要更便宜的原料并且週转速度更快。企业家可以以较少的投资进入市场,并最大限度地降低财务风险。这种经济优势导致食品卡车数量激增,提供各种速食选择,从汉堡和塔可饼到三明治和披萨。

此外,消费者的偏好也不断变化,越来越重视独特、优质的用餐体验。餐车利用这一趋势,提供有别于传统快餐连锁店的美味快餐选择。这些餐车经常尝试融合菜餚、手工食材和创新食谱,吸引寻求不同风味的美食家。品质与便利的结合使得餐车在速食领域占有一席之地。

消费者偏好的变化、技术进步和经济优势共同推动着快餐车的持续扩张。

北美和欧洲成长显着

全球餐车市场正在经历显着成长,其中北美和欧洲成为推动这一扩张的关键地区。在北美和欧洲,消费者的偏好正转向独特、高品质和便利的用餐体验。在这两个地区,对传统餐厅无法提供的各种美食的需求日益增长。餐车透过提供创新和不拘一格的菜单来满足这种需求,这些菜单通常以美食、民族料理和融合菜餚为主。

经济因素在餐车市场的成长中也扮演关键角色。与传统的实体餐厅相比,餐车的推出和营运成本相对较低,因此对创业家来说,餐车是一项相当吸引人的投资。餐车业务的初始投资相当低,通常在 50,000 美元到 200,000 美元之间。这种经济实惠的价格使得更多的企业家能够进入市场,从而推动了食品卡车在北美和欧洲城市的流行。

北美和欧洲的法规环境对餐车产业的支持越来越大。许多城市的地方政府都认识到了美食车的经济和文化效益,并正在努力建立更有利的法律规范。其中包括简化许可流程、指定食品卡车运营的特定区域以及提供有关健康和安全标准的明确指导。

在北美,洛杉矶、纽约、奥斯汀等城市都推出了完善的法规来支持餐车市场的发展。同样,在欧洲,伦敦、柏林和巴黎等城市也出现了越来越多的餐车项目,这有助于市场的成长。

随着市场的不断发展,北美和欧洲的餐车营运商可能会受益于永续性、技术整合和健康饮食等持续趋势。竞争格局推动着不断创新,为消费者提供多样化和令人兴奋的食品选择。餐车的弹性和适应性使其在充满活力和不断变化的餐饮服务业中占据有利地位,从而使得北美和欧洲成为全球餐车市场的关键地区。

餐车产业的细分

食品卡车市场由几家主要企业主导,包括 Prestige Food Trucks、United Food Trucks United LLC 和 M&R Specialty Trailers and Trucks。该行业的主要企业专注于技术进步。这些公司专注于创新和技术进步,以使他们的食物卡车更具功能性和吸引力。例如,我们投资最先进的厨房设备、先进的 POS 系统和环保技术,以满足不断变化的消费者需求和监管要求。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场驱动因素

- 快餐消费的成长预计将推动市场

- 市场限制

- 线上食品配送的增加可能会阻碍市场成长

- 波特五力分析

- 供应商的议价能力

- 买家/消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章市场区隔

- 类型

- 范

- 拖车

- 追踪

- 其他的

- 尺寸

- 14 英尺或更短

- 超过14英尺

- 按应用

- 速食

- 素食主义者和肉类工厂

- 麵包店

- 其他的

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 北美其他地区

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 其他欧洲国家

- 亚太地区

- 印度

- 中国

- 日本

- 韩国

- 其他亚太地区

- 其他的

- 巴西

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 南非

- 北美洲

第六章竞争格局

- 供应商市场占有率

- 公司简介

- Prestige Food Trucks

- United Food Trucks United LLC

- VS VEICOLI SPECIALI

- Futuristo Trailers

- M& R Specialty Trailers and Trucks

- MSM Catering Manufacturing Inc.

- The Fud Trailer Company

- Food Truck Company BV

- Foodtrucker Engineering LLP

第七章 市场机会与未来趋势

The Food Truck Market size is estimated at USD 4.42 billion in 2025, and is expected to reach USD 6.06 billion by 2030, at a CAGR of 6.5% during the forecast period (2025-2030).

The food truck market has experienced substantial growth over the past decade, emerging as a dynamic and integral part of the broader foodservice industry. This industry, characterized by its mobility, flexibility, and unique culinary offerings, has evolved from a fringe novelty into a mainstream foodservice phenomenon. Technology plays a crucial role in the evolution and success of the food truck market. Modern food trucks are equipped with advanced kitchen equipment that enhances their ability to efficiently prepare a wide range of dishes. Moreover, the integration of point-of-sale (POS) systems and mobile payment solutions has streamlined the transaction process, making it easier for customers to order and pay for their meals.

Social media and digital marketing are also pivotal in promoting and growing food trucks. Platforms like Instagram, Facebook, and Twitter are extensively used by food truck operators to engage with customers, announce locations, promote menu items, and build a loyal following. This digital presence increases visibility and fosters a sense of community and direct interaction with customers.

While the food truck market offers numerous opportunities, it also faces regulatory challenges that vary significantly by region. Local governments impose regulations on food safety, health standards, parking permits, operating hours, and zoning laws. Compliance with these regulations is essential for food truck operators, but navigating the complex and often inconsistent regulatory landscape can be challenging.

The food truck market is highly competitive, with numerous operators vying for customer attention. Successful food truck businesses often differentiate themselves through unique branding, high-quality food, exceptional customer service, and strategic location choices. Collaboration with local businesses and participation in food truck festivals and community events can also enhance visibility and customer engagement.

The COVID-19 pandemic had a mixed impact on the food truck market. While some operators faced significant challenges due to lockdowns, reduced foot traffic, and event cancellations, others adapted by leveraging their mobility and outdoor service model to continue operating. The pandemic accelerated the adoption of contactless payment systems and online ordering, which have now become standard practices in the industry.

Food trucks also played a crucial role in supporting communities during the pandemic by providing accessible and convenient dining options when traditional restaurants were closed or limited in capacity. This resilience and adaptability reinforced the food truck market's position as a vital component of the foodservice industry.

The food truck market has evolved into a dynamic and integral segment of the foodservice industry, characterized by its flexibility, innovation, and adaptability. The combination of changing consumer preferences, technological advancements, and economic advantages continues to drive growth and diversification in the market.

Food Truck Market Trends

Fast Food is Driving Market Growth

The food truck market has grown impressively over the past decade, and a significant driver of this expansion has been the fast food segment. Fast food's inherent qualities, such as convenience, affordability, and speed, align perfectly with the food truck business model, creating a synergy that propels both industries forward.

The convenience factor is perhaps the most significant advantage of food trucks in the fast food industry. Consumers today lead busy lives, and the demand for quick, accessible meals is at an all-time high. By their very nature, food trucks offer mobility, allowing them to reach customers where they are, outside office buildings, at parks, or at popular events. This mobility is a key selling point for fast food offerings, which thrive on providing quick, on-the-go meals. Unlike traditional brick-and-mortar fast food restaurants, food trucks can relocate based on demand, ensuring a steady stream of customers.

The relatively low start-up and operational costs of food trucks compared to traditional restaurants make them an attractive venture for entrepreneurs. The fast food model, which typically requires less expensive ingredients and faster turnover, fits well within the food truck framework. Entrepreneurs can enter the market with a smaller investment, minimizing financial risk. This economic advantage has led to a proliferation of food trucks offering various fast food options, from burgers and tacos to sandwiches and pizza.

Moreover, consumer preferences are evolving, with a growing emphasis on unique and high-quality dining experiences. Food trucks have capitalized on this trend by offering gourmet fast food options that stand out from traditional fast food chains. These trucks often experiment with fusion cuisines, artisanal ingredients, and innovative recipes, attracting food enthusiasts looking for something different. This blend of quality and convenience has helped food trucks carve out a niche in the fast food segment.

The combination of changing consumer preferences, technological advancements, and economic advantages continues to drive the expansion of fast food trucks.

North America and Europe Witnessing Major Growth

The food truck market has been experiencing substantial growth globally, with North America and Europe emerging as significant regions driving this expansion. In North America and Europe, consumer preferences are shifting toward unique, high-quality, and convenient dining experiences. There is a growing demand for diverse culinary offerings in both regions that traditional restaurants may not provide. Food trucks cater to this demand by offering innovative and eclectic menus, often featuring gourmet, ethnic, and fusion cuisines.

Economic considerations also play a crucial role in the growth of the food truck market. The relatively low start-up and operational costs of food trucks compared to traditional brick-and-mortar restaurants make them an attractive venture for entrepreneurs. Initial investments for a food truck business are significantly lower, often ranging between USD 50,000 and USD 200,000. This affordability allows more entrepreneurs to enter the market, contributing to the proliferation of food trucks across cities in North America and Europe.

The regulatory environment in North America and Europe has become increasingly supportive of the food truck industry. Local governments in many cities have recognized the economic and cultural benefits of food trucks and are working to create more favorable regulatory frameworks. This includes streamlining the permit process, designating specific areas for food truck operations, and providing clear guidelines on health and safety standards.

In North America, cities like Los Angeles, New York, and Austin have established comprehensive regulations that support the growth of the food truck market. Similarly, in Europe, cities like London, Berlin, and Paris have seen an increase in food truck-friendly policies, which has contributed to the market's growth.

As the market continues to evolve, food truck operators in North America and Europe are likely to benefit from ongoing trends such as sustainability, technology integration, and health-conscious dining. The competitive landscape will drive continuous innovation, ensuring that consumers have access to a diverse and exciting array of food options. With their resilience and adaptability, food trucks are well-positioned to thrive in the dynamic and ever-changing foodservice industry, making North America and Europe key regions in the global food truck market.

Food Truck Industry Segmentation

The food truck market is dominated by several key players, such as Prestige Food Trucks, United Food Trucks United LLC, and M&R Specialty Trailers and Trucks. Major players in this industry are focusing on technological advancements. These companies focus on innovation and technological advancements to enhance the functionality and appeal of their food trucks. For example, they invest in state-of-the-art kitchen equipment, advanced POS systems, and eco-friendly technologies to meet evolving consumer demands and regulatory requirements.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Increasing Consumption of Fast Food Expected to Drive the Market

- 4.2 Market Restraints

- 4.2.1 Increase in Online Food Deliveries May Hamper Market Growth

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD)

- 5.1 Type

- 5.1.1 Vans

- 5.1.2 Trailers

- 5.1.3 Trucks

- 5.1.4 Other Types

- 5.2 Size

- 5.2.1 Up to 14 Feet

- 5.2.2 Above 14 Feet

- 5.3 By Application Type

- 5.3.1 Fast Food

- 5.3.2 Vegan and Meat Plant

- 5.3.3 Bakery

- 5.3.4 Other Applications

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States Of America

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 India

- 5.4.3.2 China

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 Rest of the World

- 5.4.4.1 Brazil

- 5.4.4.2 Saudi Arabia

- 5.4.4.3 United Arab Emirates

- 5.4.4.4 South Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Prestige Food Trucks

- 6.2.2 United Food Trucks United LLC

- 6.2.3 VS VEICOLI SPECIALI

- 6.2.4 Futuristo Trailers

- 6.2.5 M&R Specialty Trailers and Trucks

- 6.2.6 MSM Catering Manufacturing Inc.

- 6.2.7 The Fud Trailer Company

- 6.2.8 Food Truck Company BV

- 6.2.9 Foodtrucker Engineering LLP