|

市场调查报告书

商品编码

1693725

欧洲半导体材料:市场占有率分析、行业趋势和统计数据、成长预测(2025-2030 年)Europe Semiconductor Materials - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

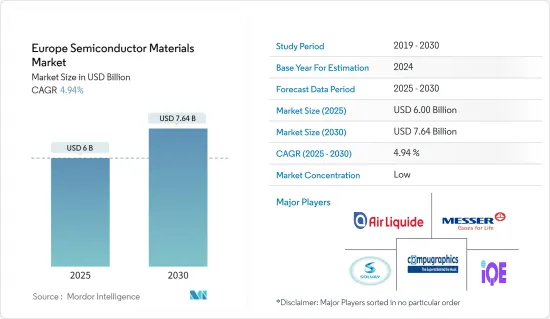

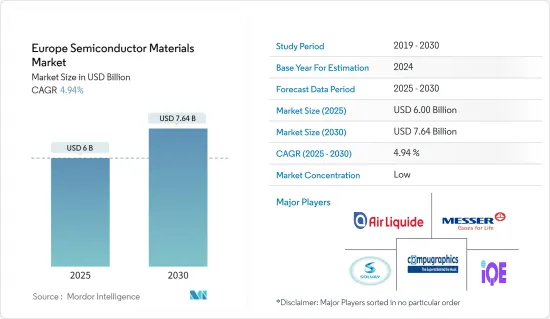

预计 2025 年欧洲半导体材料市场规模为 60 亿美元,到 2030 年将达到 76.4 亿美元,预测期内(2025-2030 年)的复合年增长率为 4.94%。

半导体材料是电子产业的关键技术创新之一。硅(Si)、锗(Ge)和砷化镓(GaAs)等材料的采用使电子製造商能够取代传统的热敏设备,这些设备会使电子产品变得笨重且不便携。

关键亮点

- 硅是目前市面上最常见的半导体设备。但对更小、更快的积体电路日益增长的需求正在将硅的效率推向极限,导致许多业内专家担心硅可能很快就会达到摩尔定律的极限。同时,各种研究倡议正在进行,以开发新材料,推动研究市场的创新。

- 此外,由于生产先进节点积体电路、异质整合和 3D 记忆体架构需要更多的处理步骤,半导体产业正在加速发展,预计这将增加晶圆製造和封装材料的消费量,从而增加对半导体材料的需求。

- 提高能源效率并因此减少任何电子设备运作中的损耗是普遍的行业趋势。因此,预计节能组件的需求将强劲增长,特别是在从电动车驱动装置到充电站和电源等能源密集型应用领域。

- 半导体产业被认为是最复杂的产业之一。这是因为他们的製造涉及多个流程和各种产品,并且面临着充满挑战的环境,包括动盪的电子市场和不可预测的需求。

- 包括欧洲在内的全球范围内爆发的新冠肺炎疫情严重扰乱了受访市场的供应链和生产。市场上的许多终端用户产业也受到了疫情的影响,进而对市场产生了负面影响。

欧洲半导体材料市场趋势

半导体材料的技术进步与产品创新

- 随着新材料和新製造方法的发现,半导体正在从切割或形成薄盘或晶片的刚性基板转向更柔软的塑胶材料甚至纸张。基板越来越软的趋势使得一系列装置成为可能,从发光二极体到太阳能电池到电晶体。

- 此外,2022 年 12 月,开发新晶片製造方法的英国新兴企业Pragmatic Semiconductor 从投资者那里筹集了 3,500 万美元。该公司营运晶片製造工厂,生产可弯曲而不会断裂的柔性处理器。最值得注意的是,此处理器不含硅。 2022 年,Pragmatic 和 Arm 展示了 PlasticArm,这是一种由安装在塑胶基板上的金属氧化物晶体管组成的软体处理器。

- 摩尔定律推动了计算设备的进步,使其变得更小、更快、更便宜。因此,半导体产业必须解决如何将最初为几微米开发的製程转移到几奈米量级的连接点形成的挑战。

- 在欧盟资助的FACIT(复合半导体快速退火用于新技术整合)计划中,科学家成功地将III-V族材料铟镓砷(InGaAs)与硅锗(SiGe)技术结合,并製造出了CMOS晶片。新开发的製程适合晶片的大规模生产,这使其成为晶片製造商的可行选择。企划团队开发了一种工艺,可以使用相同的 350-400 毫米大型 Si 晶圆整合 InGaAs、SiGe 和 Si CMOS 层。科学家设想这种方法可以在奈米层级上进一步缩小和微型化 CMOS 技术。

消费性电子产品成长

- 半导体材料的开发是电子产业最重大的技术进步之一。这种材料因其高电子迁移率、宽动作温度范围和低能量要求而受到青睐。大多数家用电子电器产品都使用半导体。行动电话、电脑、游戏机、微波炉、冰箱等都采用积体电路、二极体、电晶体等半导体元件。

- 电力电子技术所使用的半导体材料直接影响系统效率。电力电子系统用于行动电话和家用电子电器产品,将电能从一种形式转换为另一种形式并调节其能量水平。其中之一就是碳化硅(SiC)。特别是,SiC 具有使其能够在高温和高电位下运作的特性,从而可以製造出更小的组件并提高功率转换效率。因此,该领域的进步推动了对 SiC 等材料的迫切需求。

- 电子製造商延长电池寿命的需求正在推动对 SiC 半导体材料的需求。消费性电子产品製造商正在升级其产品中的电池。该领域的市场扩张是由消费者对低充电设备的需求所推动的。该市场SiC半导体的主要消费者是智慧型手机、穿戴式装置和其他主要家用电子电器产品的製造商。

- 製造商和政府正在开发能够在相对较短的时间内为设备充电的智慧型手机充电器。因此,它们的额定电流从 0.5 毫安培增加到 5 毫安培。 USB-C 和板载转接器中的 SiC 半导体对于维持所需的电流和电压等级至关重要。穿戴式装置市场和个人电脑市场都遵循着类似的轨迹。未来几代车载充电器和 USB-C 转接器中的 GaN 和 SiC 设备将具有超高功率密度。 OPPO、One Plus、摩托罗拉、三星和苹果等製造商分销这些快速充电适配器已成为其行销策略的主要内容。

欧洲半导体材料产业概况

欧洲半导体材料市场竞争适中,由几家大公司组成。市场似乎相当集中。新玩家的进入门槛很高。新进入者必须适应高资本要求,而市场技术密集的性质使得市场先驱者必须密切追踪技术发展。

- 2022 年 10 月-IQE(国际量子外延)PLC 与 SK Silicon 签署策略合作协议,共同开发和商业化复合半导体产品。 IQE 和 SK Ultron 将专注于开发和交付基于 SiC(碳化硅)上 GaN(氮化镓)的创新外延片,用于无线通讯市场的射频应用,以及基于 Si(硅)上 GaN 的创新外延片,用于各种市场的电力电子应用。

- 2022 年 7 月-BASF和工业株式会社(TODA)宣布进一步扩大其位于日本小野田工厂的BASF户田电池材料有限责任公司(BTBM)的生产能力。此次扩建将增加高镍正极活性材料的供应,使电池产能达到每年45GWh。此次扩张将为工业和消费产业的二次电池和合金生产中的半导体製造商带来更多利益。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- 产业价值链/供应链分析

- COVID-19 市场影响

第五章市场动态

- 市场驱动因素

- 半导体材料的技术进步与产品创新

- 家用电子电器产品需求不断成长

- OSAT/封装公司的需求增加

- 市场限制

- 製造过程的复杂性

第六章市场区隔

- 按应用

- 製造

- 製程化学

- 光掩模

- 电子气体

- 光阻剂

- 溅镀靶材

- 硅

- 其他製造应用

- 包装

- 基板

- 导线架

- 陶瓷封装

- 键合线

- 封装树脂(液体)

- 晶片黏接材料

- 其他包装应用

- 製造

- 按最终用户产业

- 消费性电子产品

- 通讯业

- 製造业

- 车

- 能源公共产业

- 其他的

第七章竞争格局

- 公司简介

- Solvay SA

- Messer SE & Co. KGaA

- Air Liquide SA

- Compugraphics(MacDermid Alpha Electronics Solutions)

- International Quantum Epitaxy PLC(IQE PLC)

- BASF SE

- Henkel AG & Co. KGaA

- Caplinq Europe BV

第八章 市场展望

The Europe Semiconductor Materials Market size is estimated at USD 6.00 billion in 2025, and is expected to reach USD 7.64 billion by 2030, at a CAGR of 4.94% during the forecast period (2025-2030).

Semiconductor materials represent one of the significant innovations in the electronics industry. By employing materials such as silicon (Si), germanium (Ge), and gallium arsenide (GaAs), electronics manufacturers have been able to replace traditional thermal devices that made electronic items heavy and non-portable.

Key Highlights

- Silicon is the most popular semiconductor element available in the current market scenario. However, the increasing demand for ever-smaller, faster-integrated circuits has pushed the efficiency of the material to its limits, with many industry experts fearing silicon will soon reach the limits of Moore's Law. In the meantime, various research initiatives are being undertaken to develop new materials, driving innovation in the studied market.

- Moreover, with the miniaturization trend gaining momentum in the semiconductor industry, the demand for semiconductor materials is also expected to grow as manufacturing advanced node ICs, heterogeneous integration, and 3D memory architectures require more processing steps, driving higher wafer fabrication and packaging materials consumption as a result.

- Higher energy efficiency and resulting lower losses in all electronic operations is a general trend in the industry. As such, the demand for energy-efficient components is expected to grow strongly, especially in energy-intensive applications, from electric vehicle drives to charging stations and power supplies.

- The semiconductor industry is considered one of the most complex industries. This is because more than several processing steps and various products are involved in their manufacturing and the harsh environment it faces, e.g., the volatile electronic market and the unpredictable demand.

- The outbreak of the COVID-19 pandemic worldwide, including in Europe, significantly disrupted the supply chain and production of the market studied. Many end-user industries of the market were also affected by the pandemic, which, in turn, had a negative impact on the market.

Europe Semiconductor Materials Market Trends

Technical Advancement and Product Innovation of the Semiconductor Materials

- Semiconductors are moving away from rigid substrates, cut or formed into thin discs or wafers, to more flexible plastic material and paper, all due to new material and fabrication discoveries. The trend toward more flexible substrates has led to numerous devices, from light-emitting diodes to solar cells and transistors.

- Moreover, in December 2022, Pragmatic Semiconductor Ltd, a UK-based startup developing a new approach to chip production, raised USD 35 million from investors. The company operates a chip fabrication facility, or fab, that manufactures flexible processors that bend without breaking. Most notably, the processors do not contain silicon. In 2022, Pragmatic and Arm Ltd demonstrated a flexible processor, PlasticArm, which consists of metal-oxide transistors implemented on a plastic substrate.

- Moore's law has been driving advances in computing devices as they keep getting smaller, faster, and cheaper. Thus, the semiconductor industry needs to address the challenge of how to migrate processes that were once developed for a few microns to be able to form junctions that are a few nanometers in scale.

- Within the project FACIT (fast annealing of compound semiconductors for integration of new technologies), which is funded by the European Union, scientists have successfully combined III-V materials, indium, gallium, and arsenide (InGaAs), with silicon germanium (SiGe) technology to create CMOS chips. The newly developed process is compatible with high-volume chip fabrication, which makes it a viable option for chip manufacturers. Using the same large-sized Si wafer of 350-400 mm, the project team has developed a process that allows the integration of InGaAs, SiGeand Si CMOS layers. Scientists have considered this method as a way of further shrinking and scaling CMOS technology at a nanometer level.

Consumer Electronics to Witness the Growth

- The creation of semiconductor materials is one of the most significant technological advances in the electronics industry. Because of its high electron mobility, wide operating temperature range, and low energy need, the material is well-liked. Semiconductors are used in the majority of consumer electronics. Mobile phones, computers, game consoles, microwaves, and refrigerators all employ semiconductor components, including integrated circuits, diodes, and transistors.

- Power electronics use semiconductor materials, which directly impact system efficiency. Power electronics systems are used by mobile phones and home appliances to convert electrical power from one form to another and regulate its energy level. One of these is silicon carbide (SiC), which has characteristics that, among other things, enable operation at higher temperatures and higher electrical potential, resulting in smaller components and greater power conversion efficiency. Thus, advancements in this area immediately raise the need for materials like SiC.

- The requirement for electronic makers to extend battery life is fuelling the demand for SiCmaterial semiconductors. Manufacturers of consumer gadgets are upgrading the batteries in their products. The market expansion of this sector is driven by consumer desire for low-charging gadgets. The primary consumers of SiC semiconductors in this market are the manufacturers of smartphones, wearable devices, and other major consumer electronics.

- Manufacturers and governments are creating smartphone chargers that can charge the device in a relatively short period. Therefore, the current rating for these has increased from 0.5 milliamps to 5 milliamps. The USB-C and On Board adapters' SiC semiconductors are essential for sustaining the necessary current and voltage levels. The wearable device and PC markets have both followed a similar trajectory. GaNand SiC Devices in the future generation of onboard chargers and USB-C adapters provide ultra-high power density. The distribution of these fast-charging adapters by producers like OPPO, One Plus, Motorola, Samsung, and Apple is the cornerstone of their marketing tactics.

Europe Semiconductor Materials Industry Overview

The European semiconductor materials market is reasonably competitive and consists of several major players. The market appears to be moderately concentrated. The market poses high barriers to entry for new firms. New entrants must be content with high capital requirements, while the technology-intensive nature of the market makes it imperative for market players to closely track technological developments.

- October 2022 - IQE (International Quantum Epitaxy) PLC entered into a strategic collaboration agreement with SK silicon to develop and commercialize compound semiconductor products. IQE and SK Ultron will focus on developing and delivering innovative epi wafers based upon GaN (Gallium Nitride) on SiC (Silicon Carbide) for radio frequency applications in the wireless communications market and GaN on Silicon (Si) for power electronics applications across various markets.

- July 2022 - BASF and Toda Kogyo Corp. (TODA) announced that they would further expand the production capacity of BASF TODA Battery Materials LLC (BTBM) at the Onoda site in Japan. This expansion increases the supply of high nickel cathode active materials for up to 45 GWh cell capacity per year. This expansion would increase benefits for the semiconductor manufacturers in manufacturing rechargeable batteries and alloys across industrial and consumer industries.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain/Supply Chain Analysis

- 4.4 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Technical Advancement and Product Innovation of the Semiconductor Materials

- 5.1.2 Rising Demand for Consumer Electronics Goods

- 5.1.3 Increased Demand from OSAT/Packaging Companies

- 5.2 Market Restraints

- 5.2.1 Complexity in the Manufacturing Process

6 MARKET SEGMENTATION

- 6.1 By Application

- 6.1.1 Fabrication

- 6.1.1.1 Process Chemicals

- 6.1.1.2 Photomasks

- 6.1.1.3 Electronic Gases

- 6.1.1.4 Photoresists Ancillaries

- 6.1.1.5 Sputtering Targets

- 6.1.1.6 Silicon

- 6.1.1.7 Other Fabrication Applications

- 6.1.2 Packaging

- 6.1.2.1 Substrates

- 6.1.2.2 Lead Frames

- 6.1.2.3 Ceramic Packages

- 6.1.2.4 Bonding Wire

- 6.1.2.5 Encapsulation Resins (Liquid)

- 6.1.2.6 Die Attach Materials

- 6.1.2.7 Other Packaging Applications

- 6.1.1 Fabrication

- 6.2 By End-user Industry

- 6.2.1 Consumer Electronics

- 6.2.2 Telecommunication

- 6.2.3 Manufacturing

- 6.2.4 Automotive

- 6.2.5 Energy and Utility

- 6.2.6 Other End-User Industries

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Solvay SA

- 7.1.2 Messer SE & Co. KGaA

- 7.1.3 Air Liquide SA

- 7.1.4 Compugraphics (MacDermid Alpha Electronics Solutions)

- 7.1.5 International Quantum Epitaxy PLC (IQE PLC)

- 7.1.6 BASF SE

- 7.1.7 Henkel AG & Co. KGaA

- 7.1.8 Caplinq Europe BV