|

市场调查报告书

商品编码

1693771

中国生物防治剂市场:份额分析、产业趋势与统计、成长预测(2025-2030)China Biocontrol Agents - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

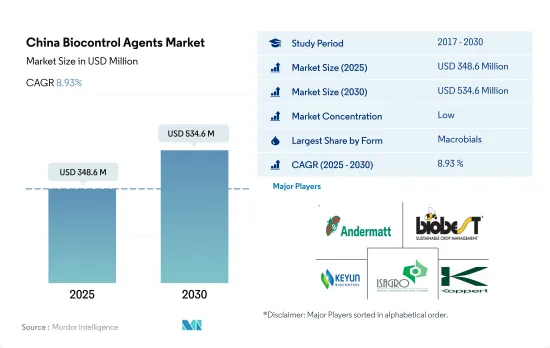

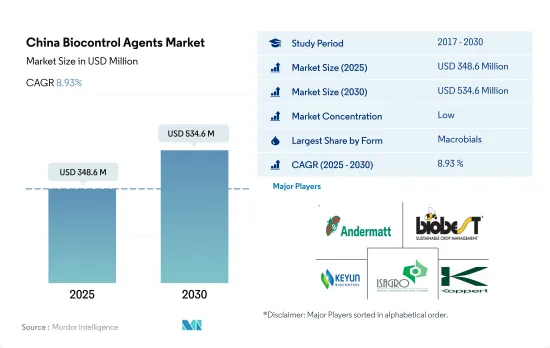

预计 2025 年中国生物防治剂市场规模为 3.486 亿美元,到 2030 年将达到 5.346 亿美元,预测期内(2025-2030 年)的复合年增长率为 8.93%。

- 大型生物防治剂占据中国生物防治剂市场的主导地位。 2022年市场规模约为2.792亿美元。大型生物防治剂的优点主要在于它们能够控制多种害虫。

- 掠食者主宰着宏观生物控制市场。捕食者部分在整个生物防治剂市场中占据主导地位,主要是因为它能够攻击害虫的不同生命阶段,甚至不同害虫种类。与其他生物防治剂相比,掠食者是贪婪的食客,到 2022 年将占生物防治剂总市场的约 47.4%。

- 到2022年,微生物生物防治剂将占中国生物防治剂市场的不到1%。微生物生物防治剂市场占有率有限的主要原因是其作用方式复杂,国内农民认知度较低。微生物製剂具有控制多种病虫害的能力,因此市场占有率有扩大的空间。

- 说到微生物生物防治剂,细菌生物防治剂占据市场主导地位。细菌生物防治剂的优越性主要在于其广泛的策略。它们直接或间接地与病原体相互作用,并结合一种或多种机制来预防或减少植物疾病。

- 中国政府已设计各级地方政府倡议,减少化学农药的整体使用量,发展本地有机农业。奖励也推出了激励措施,鼓励生产者转向有机农业。预计这些因素将在 2023 年至 2029 年期间进一步推动该国的生物防治剂市场的发展。

中国生物防治剂市场趋势

农药使用量零成长和有机产品出口增加促进了有机农业的发展。

- 根据FiBL和IFOAM的最新报告,中国有机食品市场正以每年25.0%的速度成长。鑑于中国每年出口29.1亿美元的农产品,从传统农业向有机农业的转变意味着中国转向更永续的食品体系的转变。

- 随着收入的增加和食品安全日益重要,越来越多的人开始购买有机产品,中国的有机农场面积迅速成长。过去三年,中国有机种植面积增加了10%,2020年达到240万公顷。此外,国家推出了推动有机生产的政策,并提出了「绿水青山就是金山银山」和「绿色发展」的口号。

- 中国的有机农业主要以出口为导向。出口和进口商品包括谷物、大豆、水果和蔬菜。中国东北三省(辽宁、吉林、黑龙江)是全国有机农产品产量、产值、面积最大的省区。中国北方(如山东省和辽宁省)的大多数有机农场都向周边城市供应有机蔬菜和水果。另外部分产品也出口到日本、韩国、欧美等美国。

- 由于过度使用合成肥料和杀虫剂导致土壤污染,人们越来越担心土壤毒性,中国对永续农业实践和有机食品生产的需求正在增长。农业实践的这种变化是一个缓慢但不断增长的趋势,并且它正在增加对作物营养和保护产品的需求。

由于对有机产品的需求不断增长,约73%的中国消费者希望购买有机食品。

- 中国有机食品市场发展迅速,中国消费者对有机食品的潜在需求庞大。更富裕的中阶的崛起和对健康影响的认识不断提高是这一现象背后的驱动力。 2021年,中国有机食品销售额约达775.4亿美元。

- 由于政府的各项法律都倾向于有机食品而非食品安全,且消费者偏好有机食品而非传统食品,因此对有机食品的需求大幅增加。中国的有机蔬菜价格是传统蔬菜的3至15倍,而有机蔬菜的价格一般是传统蔬菜的5至10倍。然而,儘管价格因素是一个障碍,富裕家庭和有健康问题的个人仍愿意扩大预算,约 73% 的中国消费者愿意为有机食品支付额外费用。

- 中国政府正逐步实现有机食品领域的自给自足。例如,透过鼓励农民减少使用化学肥料,转而使用生物替代品,经济正逐步走向绿色农业。中国连锁专利权协会2020年的调查显示,中国发达城市民众中了解永续食品生产概念的有机意识已达83%。儘管中国的有机食品产业仍规模较小,远未满足国内外消费者的需求,但考虑到2021年国内销售额预计将成长4.01%,可以说中国有机食品在国内外市场都具有巨大的潜力。

中国生物防治剂产业概况

中国生物防治剂市场细分化,前五大企业市占率合计为13.22%。市场的主要企业包括安德马特集团 (Andermatt Group AG)、Biobest Group NV、河南济源白云实业、Isagro SPA、Koppert Biological Systems Inc. 等。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章执行摘要和主要发现

第二章 报告要约

第三章 引言

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 产业主要趋势

- 有机种植区

- 有机产品人均支出

- 法律规范

- 中国

- 价值炼和通路分析

第五章市场区隔

- 形式

- 大型微生物

- 按生物体

- 昆虫病原线虫

- 寄生虫

- 铁血战士

- 微生物

- 按生物体

- 细菌生物防治剂

- 真菌生物防治剂

- 其他微生物

- 大型微生物

- 作物类型

- 经济作物

- 园艺作物

- 耕地作物

第六章竞争格局

- 重大策略倡议

- 市场占有率分析

- 商业状况

- 公司简介

- Andermatt Group AG

- Biobest Group NV

- Henan Jiyuan Baiyun Industry Co. Ltd

- Isagro SPA

- Koppert Biological Systems Inc.

第七章:CEO面临的关键策略问题

第 8 章 附录

- 世界概况

- 概述

- 五力分析框架

- 全球价值链分析

- 市场动态(DRO)

- 资讯来源及延伸阅读

- 图片列表

- 关键见解

- 数据包

- 词彙表

简介目录

Product Code: 500031

The China Biocontrol Agents Market size is estimated at 348.6 million USD in 2025, and is expected to reach 534.6 million USD by 2030, growing at a CAGR of 8.93% during the forecast period (2025-2030).

- Macrobial biocontrol agents dominated the Chinese biocontrol agents market. They were valued at about USD 279.2 million in 2022. The domination of macrobial biocontrol agents is mainly due to their ability to control a wide range of pests.

- Predators dominate the macrobial biocontrol agents market. The dominance of the predators segment in the overall biocontrol agents market is mainly due to their ability to attack different life stages of pests and even different pest species. Predators are voracious feeders compared to other biocontrol agents, accounting for about 47.4% of the overall biocontrol agents market in 2022.

- Microbial biocontrol agents accounted for less than 1% of the Chinese biocontrol agents market value in 2022. The limited market share of microbial biocontrol agents is mainly due to their complex mode of action and less awareness among the farmers in the country. Microbial agents have the scope to increase their market share due to their ability to control a wide range of pests and diseases.

- Bacterial biocontrol agents dominate the microbial biocontrol agents market. The dominance of bacterial biocontrol agents is mainly due to their wide range of strategies. They may interact directly or indirectly with the pathogen to prevent or minimize plant disease via one or a combination of mechanisms.

- The Chinese government's initiatives to decrease the overall use of chemical pesticides and the development of local organic agriculture were planned by municipal governments at all levels. They also introduced incentives to encourage producers to switch to organic farming. These factors are expected to further drive the biocontrol agents market in the country between 2023 and 2029.

China Biocontrol Agents Market Trends

Country's zero growth in pesticides use and increasing exports under organic products driving the organic cultivation.

- According to the latest reports by FiBL and the IFOAM, the market for organic food in China is growing at an annual rate of 25.0%. The shift from conventional to organic is a transformation toward a more sustainable food system within China, given the USD 2.91 billion of agri-food commodities exported from China each year.

- The size of organic farmland increased rapidly in China because more people started buying organic products due to increased incomes and the increasing importance of food safety. In the last three years, China's organic planting area increased by 10%, reaching 2.4 million ha in 2020. In addition, national policies have been adopted to promote organic production, advocating the slogans that state, "lucid waters and lush mountains are invaluable assets" and "green development".

- Organic farming in China is majorly export-oriented. The products that are both exported and imported include cereals, soybeans, fruits, and vegetables. China's three northeastern provinces (Liaoning, Jilin, and Heilongjiang) support the largest organic production nationally in terms of output, volume, and area. Most organic farms located in the northern part of China (e.g., Shandong and Liaoning) supply organic vegetables and fruits to nearby cities. In addition, they export some products to Japan, South Korea, Europe, and the United States.

- With the increasing concerns of soil toxicity due to the overuse of synthetic fertilizers and pesticides that lead to soil contamination, the demand for sustainable agriculture practices and organic food production is on the rise in China. This moderately slow yet increasing shift in cultivation practices has also subsequently increased the demand for crop nutrition and protection products.

The growing demand for organic products, approximately 73% of Chinese consumers are willing to have organic food

- China's organic food market is developing rapidly, and the potential demand for organic food among Chinese consumers is enormous. This is due to the growth of the wealthier middle classes and a greater awareness of the health implications. In 2021, organic food sales in China amounted to about USD 77.54 billion.

- Due to various government laws that favor organic food over food safety and customer preferences for organic food over conventional food, the demand for organic food items has considerably expanded. While prices of organic vegetables in China range from 3 to 15 times the cost of conventional produce, prices for organic vegetables are generally between 5 and 10 times that of their conventional counterparts. However, despite the price factor being a barrier, wealthy families and individuals with health problems are eager to increase their budget, with approximately 73% of Chinese consumers willing to pay extra for organic foods.

- The Chinese government is slowly aiming to become self-reliant in the organic food sector. For instance, the economy is slowly moving toward a green agriculture practice by encouraging farmers to scale back the use of chemical fertilizers and switch to bio-based alternatives. The China Chain Store and Franchise Association (CCFA) research in 2020 declared that organic awareness among the Chinese population in developed cities was at 83% when it came to an understanding of the concept of sustainable food production. Although China's organic food sector is still quite small and falls far short of satisfying domestic and international consumer demand, it can be stated that organic food in China has enormous potential in both the domestic and foreign markets, considering the rise in domestic sales by 4.01% in 2021.

China Biocontrol Agents Industry Overview

The China Biocontrol Agents Market is fragmented, with the top five companies occupying 13.22%. The major players in this market are Andermatt Group AG, Biobest Group NV, Henan Jiyuan Baiyun Industry Co. Ltd, Isagro SPA and Koppert Biological Systems Inc. (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Area Under Organic Cultivation

- 4.2 Per Capita Spending On Organic Products

- 4.3 Regulatory Framework

- 4.3.1 China

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Form

- 5.1.1 Macrobials

- 5.1.1.1 By Organism

- 5.1.1.1.1 Entamopathogenic Nematodes

- 5.1.1.1.2 Parasitoids

- 5.1.1.1.3 Predators

- 5.1.2 Microbials

- 5.1.2.1 By Organism

- 5.1.2.1.1 Bacterial Biocontrol Agents

- 5.1.2.1.2 Fungal Biocontrol Agents

- 5.1.2.1.3 Other Microbials

- 5.1.1 Macrobials

- 5.2 Crop Type

- 5.2.1 Cash Crops

- 5.2.2 Horticultural Crops

- 5.2.3 Row Crops

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 Andermatt Group AG

- 6.4.2 Biobest Group NV

- 6.4.3 Henan Jiyuan Baiyun Industry Co. Ltd

- 6.4.4 Isagro SPA

- 6.4.5 Koppert Biological Systems Inc.

7 KEY STRATEGIC QUESTIONS FOR AGRICULTURAL BIOLOGICALS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219