|

市场调查报告书

商品编码

1693786

欧洲阻隔膜:市场占有率分析、产业趋势与统计、成长预测(2025-2030)Europe Barrier Films - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

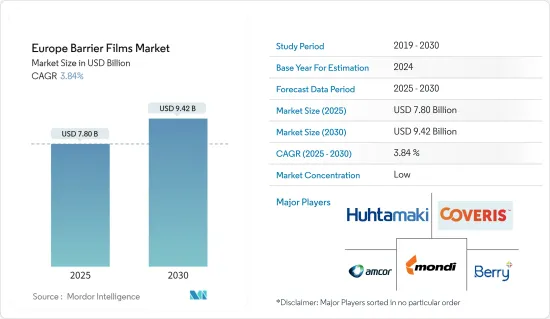

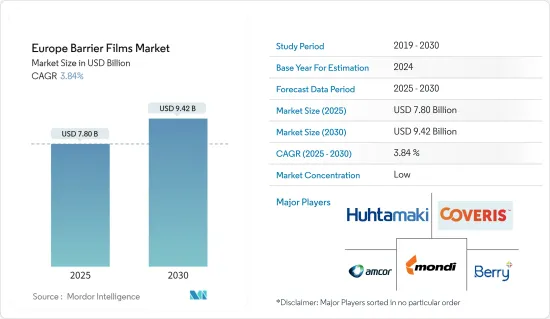

预计 2025 年欧洲阻隔膜市场规模为 78 亿美元,到 2030 年将达到 94.2 亿美元,预测期内(2025-2030 年)的复合年增长率为 3.84%。

市场规模反映了各种包装产品的销售额,例如由各种材料製成的袋子和小袋、拉伸膜和收缩膜、托盘盖膜、包装膜和成型网以及泡壳基膜。这些产品销往欧洲各地的各种终端用户行业,包括宠物食品、食品和饮料、製药和医疗、居家医疗和个人护理。

关键亮点

- 薄膜是食品包装最受欢迎的选择之一。由于其安全性,薄膜比传统食品包装材料更受青睐。这种材料不易受到污染和盗窃。在胶片上列印讯息很容易。该薄膜具有优异的阻隔性、重量轻、可回收。预计製药业对阻隔膜的需求以及食品和饮料包装中阻隔膜的日益广泛的应用将在预测期内推动阻隔膜市场的成长。由于各终端用户产业的阻隔需求不断增加,欧洲阻隔膜市场因对高性能薄膜的需求庞大而大幅扩张。阻隔膜很可能在合适的应用中得到更频繁的使用,并且成本更低,尤其是随着加工技术的进步。

- 收缩膜主要用于电子商务领域包装各种商品。该薄膜具有多种优点,包括广泛的氧气透过率、适合各种食品包装(肉类、奶酪、家禽、零售包装)的最佳保质期、优质的产品外观、高抗衝击性和抗穿刺性、包装刚性产品或具有锋利边缘的产品时的低洩漏、冷冻温度下的强度保持以及包装完整性的维护。然而,预计预测期内,回收基础设施差和阻隔膜原料价格波动将阻碍阻隔膜市场的成长。此外,对阻隔膜核准和销售的严格规定和标准也是阻碍市场需求的挑战。

- 除此之外,阻隔膜的进步已显示出足够的测量能力以满足有机光伏和 OLED 所需的低渗透性水平。阻隔膜的目的是保护产品免于因湿气和氧气而劣化。欧洲是世界上最大的化妆品和个人护理市场之一。英国、德国、法国、义大利、西班牙和波兰等主要国家主导欧洲个人护理市场。

- 阻隔膜广泛用于包装个人保健产品,以延长保质期、防止破损并保留活性成分,而无需使用防腐剂。欧洲製造商正在开发具有阻氧、阻湿和保香功能的高阻隔薄膜。

- 未来五到十年,欧洲的塑胶回收再利用预计将大幅增加,尤其是在当局和消费者日益增长的压力下。减少废弃物和提高塑胶价值链循环性的目标正在被各国政府和知名品牌不断讨论和完善。预计这将对所研究市场的成长构成挑战。

- 自新冠疫情爆发以来,欧洲食品和饮料行业的线上销售额随着时间的推移显着增长。封锁和就地避难的建议迫使人们寻找新的方式来完成日常业务。受疫情影响最严重的国家增幅最大。

- 根据研究公司Voyado的数据显示,疫情期间首次网购食品杂货的消费者比例在西班牙为30%,法国为22%,英国和义大利为20%,瑞典和丹麦为14%,芬兰为11%,波兰、荷兰、比利时和德国为10%,挪威为9%。此外,68% 在网路上购买食品杂货的新购物者表示,他们计划将来再次这样做。人们习惯的这些变化对阻隔膜市场产生了正面的影响。

欧洲阻隔膜市场趋势

食品和宠物食品市场录得显着增长

- 在食品业,每种产品都有自己的品质和包装规格。因此,食品包装必须从食品包装到食用提供适当的环境条件。在食品领域,每种产品都有独特的属性和包装需求。因此,食品包装必须从食品包装到食用提供适当的环境条件。阻隔膜是一种柔韧、无溶剂、不透水的共挤结构(单层或多层),不会与包装食品产生反应。它还可以限制矿物油和紫外线的迁移,并防止与氧气、二氧化碳和水分的相互作用。这种坚硬的屏障由特殊材质製成,还能保留食物的颜色、味道、质地、香气和风味等特性。

- 欧洲食品工业经常使用阻隔膜来延长保质期,并作为防潮和防氧的屏障保护食品免受外界影响。食品包装的新应用正在导致食品包装规范的严格化。需要关注的关键环节是采用更好的阻隔膜来打造真正的包装。为了延长食品保质期,降低食品腐败变质的风险,必须提高包装薄膜的阻隔性能。包装片材可涂有 PVDC 或铝涂层,以达到优异的阻隔性能。

- 据德国冷冻食品研究所称,冷冻食品销售收益从一年前的 159.2 亿欧元(173.1 亿美元)增长到前年的约 195.4 亿欧元(212.5 亿美元)。数据显示,过去十年冷冻食品销售收入一直在逐渐增加。预计这一成长趋势将在预测期内持续下去,全部区域的阻隔膜销售创造巨大的机会。

- 越来越多的宠物主人开始注重健康,并希望他们的宠物和他们吃同样的食物。无麸质和无谷物替代品、可持续采购的产品以及可与任何高级餐厅菜单相媲美的优质美食原料是当前宠物食品的一些趋势。这给宠物食品製造商提出了一个有趣的难题。

- 在欧洲国家,阻隔膜常用于烘焙点心、冷冻食品、水产品、洋芋片、零嘴零食、肉类和乳製品、干果和宠物食品。由于对健康、卫生、轻量和环保包装的需求不断增加,食品和宠物食品产业不断发展,预计欧洲阻隔膜市场将会成长。

德国占有较大的市场占有率

- 德国凭藉其尖端的技术创新、悠久的全球製药传统以及不断增长的医疗产品需求,被认为是药品研究、开发、销售和生产的理想地点之一。由于人口结构的变化、慢性病的增加以及人们对预防和自我治疗的兴趣日益浓厚,欧洲最大的医药市场扩张速度超过了德国经济。

- 袋子等软包装具有成本效益、重量轻、方便(密封、可重新密封、易于携带)的特点,同时确保新鲜度,尤其是对于烘焙食品、糖果零食和乳製品等食品而言。对易于抓握、握持、食用和携带的食品的需求不断增长,推动了对包装袋的需求。为了满足这一需求,製造商正专注于使食品包装便携化,这有望推动德国对阻隔包装领域的需求。

- 新冠疫情导致营养饮料和健康食品的需求急剧增加。大多数此类产品都装在塑胶袋或塑胶袋中。塑胶由于其强度高、重量轻,越来越多地被用于包装。由于消费者更喜欢易于携带和处理的包装,因此包装行业对包装袋的需求正在上升。阻隔包装由于其成本效益和延长的保质期而在许多行业中越来越受欢迎。

- 德国领先的婴儿食品製造商 Jufico 在德国市场推出了其有机品牌 FruchtBar,该品牌采用无铝、完全可回收的单一材料包装袋(Pouch5)。包装袋由预製吸嘴袋领域的全球领导者 Guarapac 开发,是第一款采用阻隔性、可回收单一材料製成的预製吸嘴袋。

- 德国人对新的饮食潮流和文化影响持开放态度。随着我们逐渐成熟,我们的健康和福祉变得越来越重要,我们也越来越重视食物品质。这也为袋装包装市场创造了新的机会。

- 根据德国联邦统计局的数据,德国包装产业的收益预计在 2022 年超过 350 亿欧元(383.5 亿美元),高于前一年的 296 亿欧元(324.3 亿美元)。研究报告显示,德国包装产业去年呈现成长。

- 德国是欧盟最大的食品和饮料市场。食品加工工业是德国第三大产业。根据德国联邦统计局的数据,2008 年德国食品和动物饲料生产商的收益约为 1,358 亿欧元(1,498.7 亿美元),到 2021 年这一数字已增至 1,650.1 亿欧元(1,818 亿美元)。预计所有这些因素都将推动该地区对阻隔膜的需求。

欧洲阻隔膜产业概况

欧洲阻隔膜市场高度分散,主要参与者包括 Amcor、Mondi Group PLC、Berry Global 和 Huhtamaki Oyj,以及一些区域包装参与者。市场参与企业正在采取联盟、创新、併购等策略来加强其产品供应并获得可持续的竞争优势。

- 2023 年 3 月:Amcor 和 Nfinite Nanotechnology Inc. 启动一项合作研究倡议,测试 Nfinite 奈米涂层技术的应用,以改善可回收和生物分解性的包装。

- 2022 年 12 月:作为持续致力于实现塑胶回收再利用闭环的一部分,Coveris推出了一个名为「ReCover」的新业务部门。 ReCover 将作为一家独立企业运营,以自筹资金的方式向 Coveris 工厂提供材料,并向寻求市场上尚未提供的再生材料的第三方客户提供材料。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- COVID-19 工业影响评估

第五章市场动态

- 市场驱动因素

- 硬包装的替代品

- 生物分解性阻隔膜的兴起

- 市场限制

- 有关回收的环境法规

第六章市场区隔

- 按包装产品

- 袋子和小袋

- 拉伸收缩包装膜

- 托盘盖膜

- 包装膜和成网

- 泡壳基膜

- 按材质

- 聚乙烯

- BOPET

- 聚丙烯(CPP和BOPP)

- 聚氯乙烯

- 其他材料(EVOH、聚苯乙烯(PS)、尼龙)

- 按最终用户产业

- 食品 宠物食品

- 饮料

- 製药和医疗

- 个人及居家医疗

- 其他的

- 按国家

- 英国

- 法国

- 德国

- 义大利

- 西班牙

- 其他欧洲国家

第七章竞争格局

- 公司简介

- Amcor PLC

- Coveris Holdings

- Mondi Group PLC

- Berry Global Group Inc.

- Huhtamaki Oyj

- Sealed Air Corporation

- Bak Ambalaj

- Constantia Flexibles

- Cellografica Gerosa SpA

- Wipak Oy(Wihuri Oy)

- Danaflex Group

- UFLEX Limited

- CDM Sp.zoo

- adapa Holding GsembH

- Di Mauro Officine Grafiche SpA

- Sudpack Verpackungen

- Gualapack

- Toppan Inc.

第八章投资分析

第九章:市场的未来

The Europe Barrier Films Market size is estimated at USD 7.80 billion in 2025, and is expected to reach USD 9.42 billion by 2030, at a CAGR of 3.84% during the forecast period (2025-2030).

The market size reflects the sale value of various packaging products, such as bags and pouches, stretch and shrink wrap films, tray lidding films, wrapping films and forming webs, and blister base films made from various material types. These products are consumed by different end-user industries across Europe, including pet food and food, beverage, pharmaceutical and medical, and home and personal care.

Key Highlights

- Films are one of the most popular choices for food packaging. Films are preferred to conventional materials for food packaging in terms of safety. This material is less susceptible to contamination and pilferage. It is easy to print information on films. Films have superior barrier properties, are lightweight, and can be recycled. The demand for barrier films in the pharmaceutical industry and expanding applications of barrier films in food and beverage packaging are expected to drive the growth of the barrier films market during the forecast period. Owing to the increasing barrier demands across various end-user industries, the market for barrier films in Europe is largely expanding due to the enormous demand for high-performance films. Barrier films are likely to be used more frequently in suitable applications and at lower costs due to advancements, notably in processing technology.

- Shrink films are predominantly used in the e-commerce sector for wrapping various products. The films offer various benefits, such as a wide range of oxygen transmission rates, optimal shelf-life for a variety of food packaging (meat, cheese, poultry, and case-ready packaging), premium product presentation, high impact, and puncture resistance, fewer leakers when packing rigid and sharp-edged products, retained strength at freezing temperatures and preserved package integrity.However, poor infrastructure facilities for recycling and fluctuations in barrier film raw material prices are expected to hinder the growth of the barrier films market during the forecast period. Also, stringent regulations and standards for the approval and marketing of barrier films are challenges inhibiting demand in the market.

- Aside from that, advances in barrier films provide adequate measurements at the low permeability levels needed for organic photovoltaics and OLEDs. Barrier films are intended to protect the product against moisture and oxygen deterioration. Europa has one of the largest cosmetics and personal care markets globally. Major countries, including the United Kingdom, Germany, France, Italy, Spain, and Poland, dominate the European personal care market.

- Barrier films are widely used in the packaging of personal care products to extend their shelf life, prevent breakage, and retain the active components without using additional preservatives. European manufacturers are creating high-barrier films, providing an oxygen barrier, a moisture barrier, and scent preservation to confined items.

- In the next five to ten years, European plastic recycling is anticipated to increase dramatically, especially in response to rising pressure from authorities and consumers. Targets to minimize waste and increase the circularity of the plastics value chain are being discussed and improved by governments and large brands constantly. This is expected to pose a challenge to the growth of the market studied.

- Europe's food and beverage industry has experienced significant growth and increased due to online sales over time since the start of the COVID-19 pandemic. People have been compelled to develop new ways to complete their daily tasks due to lockdowns and advisories to stay inside. The nations impacted most by the pandemic have witnessed the most significant increase.

- According to the research Voyado, the proportion of consumers who made their first-ever online grocery purchases during the pandemic was 30% in Spain, 22% in France, 20% in the United Kingdom and Italy, 14% in Sweden and Denmark, 11% in Finland, 10% in Poland, the Netherlands, Belgium, and Germany, and 9% in Norway. Also, 68% of new customers who bought groceries online confirmed that they would keep doing so in the future. This shift in people's habits has positively impacted the barrier films market.

Europe Barrier Films Market Trends

Food and Pet Food Markets to Register Significant Growth

- In the food industry, every product has unique qualities and packaging specifications. Therefore, food packaging should offer the proper environmental conditions from when food is packed until consumed. Every product has unique attributes and packaging needs in the food sector. Therefore, food packaging should offer the proper environmental conditions from when food is packaged until it is consumed. Barrier films have a flexible, solvent-free, impermeable co-extruded structure (single or several layers) that does not react with the packaged food. It also limits the migration of mineral oil and UV radiation and aids in preventing interaction with oxygen, carbon dioxide, or moisture. This rigid barrier, created using specialized materials, also maintains food characteristics, including color, taste, texture, aroma, and flavor.

- Barrier films are frequently used in Europe's food industries to increase shelf life and protect food goods from external effects by acting as moisture and oxygen barriers. New applications for food packaging have led to stricter specifications for food product packaging. A significant area that requires attention is better barrier films to build real packaging. In order to extend food's shelf life and lower the risk of food spoilage and damage, the packaging film's barrier characteristics must be improved. The packaging sheet can be coated with either a PVDC or aluminum coating to obtain superior barrier characteristics.

- According to Deutsches Tiefkuhlinstitut, revenues from frozen food sales were approximately EUR 19.54 billion (USD 21.25 billion) in the previous year, up from EUR 15.92 billion (USD 17.31 billion) in the year before. As per the data, the revenue from the sales of frozen food has been gradually increasing during the past decade. This increasing trend is expected to remain in the forecast period, creating a huge opportunity to sell barrier films across the region.

- An increasing number of health-conscious pet owners want their pets to eat at par with them. Gluten-free and grain-free alternatives, sustainable sourcing, and premium gourmet ingredients that wouldn't look out of place on a fine-dining menu are some of the current trends in pet food. This poses an intriguing conundrum for pet food producers.

- In European countries, a barrier film is often used for items such as baked goods, biscuits, frozen foods, seafood, chips and snacks, meat and dairy products, dry fruits, and pet food. The Europe barrier films market is expected to witness growth due to the growing food and pet food industries owing to the increasing demand for healthy, hygienic, lightweight, and eco-friendly packaging.

Germany to Hold Significant Market Share

- Germany is considered one of the immaculate locations for pharmaceutical R&D, sales, and production of medicines due to its cutting-edge innovation, long tradition as the world's pharmacy, and constantly increasing demand for healthcare products. Europe's largest pharmaceutical market is expanding faster than the German economy due to demographic change, increased chronic diseases, and a greater focus on prevention and self-medication.

- Flexible packaging, such as a pouch, is cost-effective and lightweight, providing convenience (zip-locks, re-sealable seals, and easy to carry) while ensuring freshness, especially in food products like bakery, confectionery, and dairy food. The growing demand for easy food options to grab, hold, eat, or carry is driving the demand for packaging pouches. To meet this demand, manufacturers are putting extra effort into making food packaging portable, which is expected to boost the demand in the barrier packaging sector in Germany.

- The demand for nutritious drinks and healthy food surged dramatically due to the COVID-19 pandemic. Most of these items come in plastic bags and pouches. Plastics are sturdy and lightweight, which increases their use in packing. Consumers like packaging that is portable and easy to handle; therefore, the demand for pouches in the packaging business has increased. Barrier packaging is becoming more popular in numerous industries due to its cost-effectiveness and increased shelf life.

- Jufico, a leading German baby-food producer, launched its organic brand FruchtBar in fully recyclable Monomaterial pouches without Aluminum (Pouch5) into the German market. The pouch was developed by Gualapack, the world leader of premade spouted pouches, and is the first premade spouted pouch available in high-barrier recyclable mono-material.

- The German population is open to new food trends and cultural influences. It is increasingly placing value on food quality, with health and well-being gaining importance as the population matures. This also creates new opportunities for pouch packaging, especially in the market.

- According to Statistisches Bundesamt, the German packaging sector earned over EUR 35 billion (USD 38.35 billion) in revenue in 2022, an increase from EUR 29.6 billion (USD 32.43 billion) over the previous year. As per the research report, the packaging industry in Germany witnessed growth in the past year.

- Germany is the biggest food and beverage market in the European Union. The food processing industry represents the third-largest industry in Germany. According to Statistisches Bundesamt, in 2008, German producers of food and animal feed generated revenues of roughly EUR 135.80 billion (USD 149.87 billion), and by 2021 this figure had increased to EUR 165.01 billion (USD 181.8 billion). All such factors are expected to boost the demand for barrier films in the region.

Europe Barrier Films Industry Overview

The European barrier films market is highly fragmented, with the presence of major players like Amcor, Mondi Group PLC, Berry Global, and Huhtamaki Oyj, among others, accompanied by several regional packaging firms. Players in the market adopt strategies such as partnerships, innovations, mergers, and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- March 2023: Amcor and Nfinite Nanotechnology Inc. launched a collaborative research initiative to test the application of Nfinite's nanocoating technology to improve both recyclable and biodegradable packaging.

- December 2022: As part of its ongoing commitment to closing the loop on circular plastic recycling, Coveris launched a new business division called "ReCover," fully in line with its no-waste mission. ReCover will operate as a distinct business, providing Coveris locations with materials at an arms-length basis and supplying third-party customers looking for recycled materials of a caliber not already offered in the market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Replacement of Rigid Packaging Formats

- 5.1.2 Increasing Biodegradable Barrier Films

- 5.2 Market Restraints

- 5.2.1 Environmental Legislation for Recycling

6 MARKET SEGMENTATION

- 6.1 By Packaging Product

- 6.1.1 Bags and Pouches

- 6.1.2 Stretch and Shrink Wrap Films

- 6.1.3 Tray Lidding Films

- 6.1.4 Wrapping Films and Forming Webs

- 6.1.5 Blister Base Films

- 6.2 By Material

- 6.2.1 Polyethylene

- 6.2.2 BOPET

- 6.2.3 Polypropylene (CPP and BOPP)

- 6.2.4 Polyvinyl Chloride

- 6.2.5 Other Material (EVOH, Polystyrene (PS), and Nylon)

- 6.3 By End user Industry

- 6.3.1 Food and Pet Food

- 6.3.2 Beverages

- 6.3.3 Pharmaceutical and Medical

- 6.3.4 Personal and Home Care

- 6.3.5 Other End-user Industries

- 6.4 By Country

- 6.4.1 United Kingdom

- 6.4.2 France

- 6.4.3 Germany

- 6.4.4 Italy

- 6.4.5 Spain

- 6.4.6 Rest of Europe

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Amcor PLC

- 7.1.2 Coveris Holdings

- 7.1.3 Mondi Group PLC

- 7.1.4 Berry Global Group Inc.

- 7.1.5 Huhtamaki Oyj

- 7.1.6 Sealed Air Corporation

- 7.1.7 Bak Ambalaj

- 7.1.8 Constantia Flexibles

- 7.1.9 Cellografica Gerosa SpA

- 7.1.10 Wipak Oy (Wihuri Oy)

- 7.1.11 Danaflex Group

- 7.1.12 UFLEX Limited

- 7.1.13 CDM Sp.z.o.o.

- 7.1.14 adapa Holding GsembH

- 7.1.15 Di Mauro Officine Grafiche SpA

- 7.1.16 Sudpack Verpackungen

- 7.1.17 Gualapack

- 7.1.18 Toppan Inc.