|

市场调查报告书

商品编码

1693787

新加坡资料中心 -市场占有率分析、产业趋势与成长预测(2025-2030 年)Singapore Data Center - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

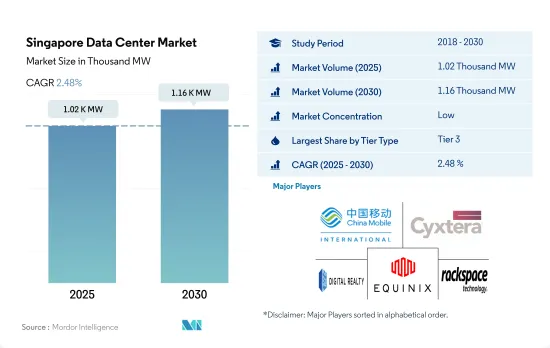

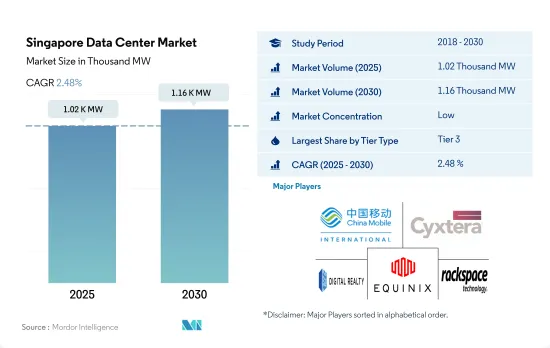

新加坡资料中心市场规模预计在 2025 年达到 1,020MW,预计 2030 年达到 1,160MW,复合年增长率为 2.48%。

预计 2025 年主机託管收益将达到 10.688 亿美元,2030 年将达到 15.993 亿美元,预测期内(2025-2030 年)的复合年增长率为 8.40%。

2023 年,Tier 3 将占据市场占有率的主导地位,而 Tier 4 将成为成长最快的资料中心

- 预计预测期内,三级和四级细分市场将占据最高的市场占有率。预计 2023 年 Tier 3 部分将占据最高的市场占有率,达到 71.5%。然而,随着 2029 年 Tier 4 资料中心的出现,该份额可能会略微下降至 61.4%。

- 预计 Tier 3 部门在预测期内的复合年增长率为 0.43%,主要原因是吉宝资料中心和 STT GDC 私人有限公司计划推出三个设施,累计 IT 负载容量为 90 兆瓦。

- 预计一级和二级市场在预测期内的复合年增长率为 1.88%,到 2029 年将占据 12.1% 的市场占有率。这一成长趋势主要归功于 NTT 有限公司即将建成的资料中心,该公司计划推出一个 IT 负载容量为 5MW 的设施。

- 预测期内,其复合年增长率将达到 12.69%,IT 负载容量将达到 269.65 MW。

- 在新加坡,资料中心占总电力消耗量的 7%,到 2030 年这一比例可能会上升到 12% 以上。因此,该国正致力于透过引入最新的基础设施和冷却技术来更有效地利用资料中心。营运商正在考虑投资更高效的冷却解决方案,例如区域冷却,以及为其资料中心供电的更环保的选择,例如购电协议(PPA)。 Tier 4 认证设施将帮助营运商达到这些标准,从而有助于推动该领域的成长。

新加坡资料中心市场趋势

连网型设备和智慧家庭的兴起将推动市场需求

- 新加坡的人口相对于其他东南亚国家较少,因此智慧型手机用户数量相对较低。

- 预计到 2029 年,该国智慧型手机用户数将从 2022 年的 540 万增加到 621 万。

- 根据 Hootsuite 的数据,该国都市化达 100%,行动电话连线数达 870 万,覆盖 147% 的人口。数据显示,每个公民至少拥有一台行动装置。连网型设备和智慧家庭的普及也推动了对数位数据和网路流量的需求的成长。由于这些因素,该国的智慧型手机用户数量预计会增加。

新加坡电信和爱立信的 5G 网路扩展将推动资料中心需求

- 新加坡是 2020 年最早采用 5G 网路的国家之一,而其 2G 网路早在 2016 年就已逐步淘汰。截至 2022 年,4G 以 49.7Mbps 的速度占据市场主导地位,预计到 2029 年速度将达到 54.75Mbps。

- 该国的 5G 网路正在蓬勃发展,预计到 2029 年将达到 946.04 Mbps。随着服务供应商寻找新的方式来在已经饱和的市场中吸引客户,5G 网路和服务预计将成为未来几年通讯产业成长的支柱。

- 新加坡电信与爱立信合作,透过扩展其网路和开发新的 5G 用例,加强其在新加坡的 5G 独立 (SA) 部署。这家瑞典供应商在新闻稿中表示,计划利用其 5G 无线接入产品和云端原生双模 5G 核心网路解决方案为新加坡电信的 5G SA 网路提供支援。 2021年9月,新加坡电信确认其5G网路覆盖新加坡三分之二以上的地区。在蔡厝港、榜鹅、三巴旺和淡滨尼等人口密集的地区增加了新的5G站点。

新加坡资料中心产业概况

新加坡资料中心市场较为分散,前五大厂商的市占率为28.33%。该市场的主要企业包括中国移动国际有限公司、Cyxtera Technologies、Digital Realty Trust Inc.、Equinix Inc. 和 Rackspace Technology Inc.。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章执行摘要和主要发现

第二章 报告要约

第三章 引言

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 市场展望

- 负载能力

- 占地面积

- 主机代管收入

- 安装机架数量

- 机架空间利用率

- 海底电缆

第五章 产业主要趋势

- 智慧型手机用户数量

- 每部智慧型手机的数据流量

- 行动数据速度

- 宽频数据速度

- 光纤连接网路

- 法律规范

- 新加坡

- 价值炼和通路分析

第六章市场区隔

- 热点

- 新加坡东部

- 新加坡西部

- 其他中东和非洲地区

- 资料中心规模

- 大规模

- 超大规模

- 中等规模

- 超大规模

- 小规模

- 等级类型

- 1级和2级

- 第 3 层

- 第 4 层

- 吸收量

- 未使用

- 使用

- 按主机託管类型

- 超大规模

- 零售

- 批发的

- 按最终用户

- BFSI

- 云

- 电子商务

- 政府

- 製造业

- 媒体与娱乐

- 电信

- 其他的

第七章竞争格局

- 市场占有率分析

- 商业状况

- 公司简介

- 1-Net Singapore Pte Ltd(Mediacorp)

- Air Trunk Operating Pty Ltd

- China Mobile International Ltd

- Cyxtera Technologies

- Digital Realty Trust Inc.

- Empyrion DC

- Equinix Inc.

- Global Switch Holdings Limited

- PhoenixNAP

- Princeton Digital Group

- Rackspace Technology Inc.

- STT GDC Pte Ltd

第八章:CEO面临的关键策略问题

第九章 附录

- 世界概况

- 概述

- 五力分析框架

- 全球价值链分析

- 全球市场规模和DRO

- 资讯来源及延伸阅读

- 图表清单

- 关键见解

- 数据包

- 词彙表

The Singapore Data Center Market size is estimated at 1.02 thousand MW in 2025, and is expected to reach 1.16 thousand MW by 2030, growing at a CAGR of 2.48%. Further, the market is expected to generate colocation revenue of USD 1,068.8 Million in 2025 and is projected to reach USD 1,599.3 Million by 2030, growing at a CAGR of 8.40% during the forecast period (2025-2030).

Tier 3 holds the majority market share in 2023, Tier 4 is the fastest growing data center

- The tier 3 and 4 segments are expected to hold the highest market share during the forecast period. The tier 3 segment is expected to hold the highest market share of 71.5% in 2023. However, its share may decrease marginally to 61.4% in 2029 due to the upcoming tier 4 data centers.

- The tier 3 segment is expected to record a CAGR of 0.43% during the forecast period, majorly due to the upcoming data centers from Keppel Data Center and STT GDC Pte Ltd, which plan to launch three facilities with a cumulative IT load capacity of 90 MW.

- The tier 1 & 2 segment is expected to record a CAGR of 1.88% during the forecast period, with a market share of 12.1% by 2029. The growth trend is majorly due to the upcoming data centers from NTT Ltd, which plans to launch one facility with an IT load capacity of 5 MW.

- Both the tier 1 & 2 and tier 3 segments may witness a dip in their market share due to the growth of the tier 4 segment, with a CAGR of 12.69% and an IT load capacity of 269.65 MW during the forecast period.

- In Singapore, 7% of total electricity consumption goes to data centers, which may grow to more than 12% by 2030. As a result, the country aims to efficiently use data centers by equipping them with modern infrastructure and cooling techniques. Operators are considering investing in more efficient cooling solutions, such as district cooling, and greener options for powering data centers, such as engaging in Power Purchase Agreements (PPAs). Tier 4-certified facilities may help operators achieve these standards, thus boosting the segment's growth.

Singapore Data Center Market Trends

Growing application of connected devices and smart homes to boost the market demand

- The country has a smaller population compared to other Southeast Asian countries, owing to which the number of smartphone users is comparatively lesser than the rest.

- The country is expected to grow significantly and reach 6.21 million users by 2029, from 5.4 million users in 2022.

- According to Hootsuite, the country has a 100% urbanized population with 8.7 million cellular mobile connections, accounting for 147% of the population. This data suggests that each citizen in the country owns more than one cellular device. The growing application of connected devices and smart homes also boosted the demand for digital data and increased network traffic. Such factors are anticipated to increase the number of smartphone users in the country.

Singtel's expanding 5G network in partnership with Ericsson boost the data center demand

- Singapore was one of the early adopters of the 5G network in 2020, while the presence of 2G was decommissioned as early as 2016. As of 2022, 4G dominated the market with 49.7 Mbps, while its speed is expected to reach 54.75 Mbps by 2029.

- The country's 5G network is booming and is expected to reach 946.04 Mbps by 2029. 5G networks and services are expected to form the backbone of growth in the telecom sector over the coming years as service providers seek new ways to engage customers in a market that is otherwise already saturated.

- Singtel is ramping up its 5G standalone (SA) deployment in Singapore by expanding the network and developing new 5G use cases in partnership with Ericsson. In a press release, the Swedish vendor stated its plans to power Singtel's 5G SA network with 5G radio access products and cloud-native dual-mode 5G Core network solutions. In September 2021, Singtel confirmed that its 5G network covers over two-thirds of Singapore. New 5G sites were added in densely populated areas like Choa Chu Kang, Punggol, Sembawang, and Tampines.

Singapore Data Center Industry Overview

The Singapore Data Center Market is fragmented, with the top five companies occupying 28.33%. The major players in this market are China Mobile International Ltd, Cyxtera Technologies, Digital Realty Trust Inc., Equinix Inc. and Rackspace Technology Inc. (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 MARKET OUTLOOK

- 4.1 It Load Capacity

- 4.2 Raised Floor Space

- 4.3 Colocation Revenue

- 4.4 Installed Racks

- 4.5 Rack Space Utilization

- 4.6 Submarine Cable

5 Key Industry Trends

- 5.1 Smartphone Users

- 5.2 Data Traffic Per Smartphone

- 5.3 Mobile Data Speed

- 5.4 Broadband Data Speed

- 5.5 Fiber Connectivity Network

- 5.6 Regulatory Framework

- 5.6.1 Singapore

- 5.7 Value Chain & Distribution Channel Analysis

6 MARKET SEGMENTATION (INCLUDES MARKET SIZE IN VOLUME, FORECASTS UP TO 2030 AND ANALYSIS OF GROWTH PROSPECTS)

- 6.1 Hotspot

- 6.1.1 East Singapore

- 6.1.2 West Singapore

- 6.1.3 Rest of Singapore

- 6.2 Data Center Size

- 6.2.1 Large

- 6.2.2 Massive

- 6.2.3 Medium

- 6.2.4 Mega

- 6.2.5 Small

- 6.3 Tier Type

- 6.3.1 Tier 1 and 2

- 6.3.2 Tier 3

- 6.3.3 Tier 4

- 6.4 Absorption

- 6.4.1 Non-Utilized

- 6.4.2 Utilized

- 6.4.2.1 By Colocation Type

- 6.4.2.1.1 Hyperscale

- 6.4.2.1.2 Retail

- 6.4.2.1.3 Wholesale

- 6.4.2.2 By End User

- 6.4.2.2.1 BFSI

- 6.4.2.2.2 Cloud

- 6.4.2.2.3 E-Commerce

- 6.4.2.2.4 Government

- 6.4.2.2.5 Manufacturing

- 6.4.2.2.6 Media & Entertainment

- 6.4.2.2.7 Telecom

- 6.4.2.2.8 Other End User

7 COMPETITIVE LANDSCAPE

- 7.1 Market Share Analysis

- 7.2 Company Landscape

- 7.3 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 7.3.1 1-Net Singapore Pte Ltd (Mediacorp)

- 7.3.2 Air Trunk Operating Pty Ltd

- 7.3.3 China Mobile International Ltd

- 7.3.4 Cyxtera Technologies

- 7.3.5 Digital Realty Trust Inc.

- 7.3.6 Empyrion DC

- 7.3.7 Equinix Inc.

- 7.3.8 Global Switch Holdings Limited

- 7.3.9 PhoenixNAP

- 7.3.10 Princeton Digital Group

- 7.3.11 Rackspace Technology Inc.

- 7.3.12 STT GDC Pte Ltd

- 7.4 LIST OF COMPANIES STUDIED

8 KEY STRATEGIC QUESTIONS FOR DATA CENTER CEOS

9 APPENDIX

- 9.1 Global Overview

- 9.1.1 Overview

- 9.1.2 Porter's Five Forces Framework

- 9.1.3 Global Value Chain Analysis

- 9.1.4 Global Market Size and DROs

- 9.2 Sources & References

- 9.3 List of Tables & Figures

- 9.4 Primary Insights

- 9.5 Data Pack

- 9.6 Glossary of Terms