|

市场调查报告书

商品编码

1693788

越南资料中心 -市场占有率分析、产业趋势与统计、成长预测(2025-2030)Vietnam Data Center - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

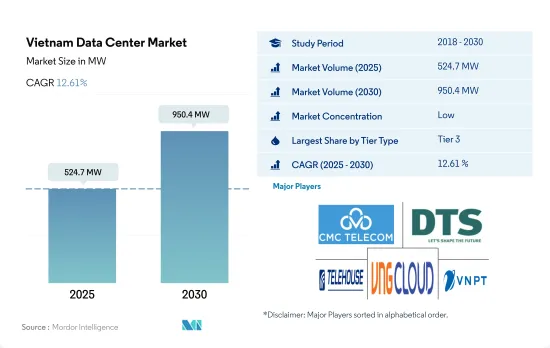

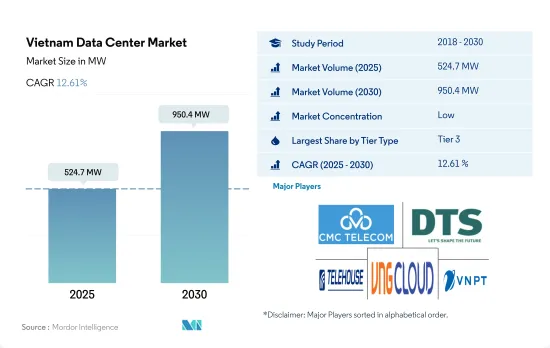

预计越南资料中心市场规模将在2025年达到524.7MW,2030年达到950.4MW,复合年增长率为12.61%。

预计主机託管收益将在 2025 年达到 5.889 亿美元,到 2030 年达到 14.034 亿美元,预测期内(2025-2030 年)的复合年增长率为 18.97%。

2023 年,Tier 3 资料中心将占据大部分市场占有率,但 Tier 4 资料中心将成为预测期内成长最快的细分市场

- 不间断商业服务的成长导致一级和二级设施的需求减少。越来越多的全球企业正在建立业务永续营运服务并将优先事项转移到 Tier 3 资料中心。

- 2022年越南资料中心市场Tier 3级IT负载容量达119.56MW,预计2029年将达到139.56MW,复合年增长率为2.23%。对资料中心基础设施和技术进步的投资正在增加。预计 2029 年市场将迎来丰厚的成长机会。

- 线上娱乐,包括影片和音乐串流媒体以及游戏,也是越南网路用户日益增长的活动。近年来,串流影片和电影已成为农村地区主要的日常上网活动之一。 YouTube 是最受欢迎的电影串流平台。这些服务需要停机时间短且提供全天候支援的资料中心设施,而 Tier 3 设施可以提供这些服务。

- 到2021年,预计22%的人每天将使用网路超过9个小时,用于学习、娱乐和购物,其中大多数人将使用智慧型手机。 2023年1月越南网路用户数将达7793万人。 2022年至2023年间,乘客人数增加了530万人次(增幅7.3%)。

- 越南市场也受到许多基础设施效率低下和瓶颈的困扰,Tier 4 设施仍处于发展初期阶段。因此,分析显示最高级别的设施市场尚未开发。

越南资料中心市场趋势

5G 等数位化措施的优先化以及消费支出的扩大将推动市场成长

- 预计到 2023 年,该国智慧型手机用户数将达到 7,790 万,到 2029 年将达到 9,350 万,预测期内复合年增长率为 3.09%。

- 数位科技的使用在越南正在迅速扩大。网路和智慧型手机技术正被各种企业迅速采用,并对消费行为重大影响。 2022年,越南的消费支出从2021年的1,930.8亿美元增加至2,146.8亿美元。因此,更多人能够购买智慧型手机,智慧型手机的使用率也随之增加。此外,超过 73% 的越南成年人使用智慧型手机。政府的目标是透过「2025年国家数位基础设施战略」到2025年将这一比例提高到80%以上。

- 未来几年,预计将引入5G技术,4G网路将在全国扩展。政府有四家业者。四家业者拥有 4G 客户:MobiFone、Vietnammobile、Viettal Mobile 和 Vinaphone。 2022年,越南将发放5G服务牌照,并从胡志明市和河内开始扩展5G,随后扩展到其他都市区和工业区。越南三大行动电话营运商MobiFone、Viettel Mobile和Vinaphone已在16个城市和省份试运行5G。 MobiFone提案在需求较低的偏远地区与通讯业者共用5G 网络,以降低成本。虽然通讯业者的目标是在未来几年内实现 5G 商业化,但 4G 和 3G 仍然很重要,因为消费者花费最多的时间与这些成熟的技术连接。 3G 和 4G 网路连接的改善以及 5G 在智慧型手机上的推出将满足该国日益增长的智慧型手机用户的需求。

通讯业者加大对 5G 网路扩展的投资以及政府支持的区域数位化成长愿景将推动市场成长。

- 2022年,5G网路和Viettel的推出彻底改变了该国的数位市场。根据OpenGov Asia通报,内务部肩负着加速数位经济发展的主要责任。该部的任务是指导和支持其他部会和地方政府实施该策略。此外,该部还将向总理提交其成就报告。此外,由于越南国内生产毛额的成长,预计2023年至2030年间越南的无线和宽频用户率将持续上升,从而增加通讯业者的收益。

- Vientel、Vinaphone 和 Mobifone 的市场占有率从 90% 左右到 90% 以上不等。同时,Gmobile、西贡胡志明电信、西贡邮政电信和 SCTV 等不太知名的参与企业的合併也可能会在未来宣布。政府还可能出售其在 VNPT 和 Mobifone 中高达 50% 的股份,以吸引私人投资并提高市场透明度。此外,根据越共中央政治局关于参与第四次工业革命指引的决议,越南计画在2025年将数位经济占国内生产总值)的比重提高到20%。越南全国4G网路覆盖率已达99.8%,越南三大业者Viettel、VNPT和MobiFone已在16个省市成功试行5G技术。随着 4G 和 5G 的不断推出,越南预计将关闭 2G 和 3G 服务。

越南资料中心产业概况

越南资料中心市场较为分散,前五大公司占37.86%的市占率。该市场的主要企业包括 CMC Telecom、DTS Communication、Telehouse(KDDI Corporation)、VNG Cloud、VNPT Online 等。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章执行摘要和主要发现

第二章 报告要约

第三章 引言

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 市场展望

- 负载能力

- 占地面积

- 主机代管收入

- 安装机架数量

- 机架空间利用率

- 海底电缆

第五章 产业主要趋势

- 智慧型手机用户数量

- 每部智慧型手机的数据流量

- 行动数据速度

- 宽频数据速度

- 光纤连接网路

- 法律规范

- 越南

- 价值炼和通路分析

第六章市场区隔

- 热点

- 河内

- 胡志明市

- 其他的

- 其他中东和非洲地区

- 资料中心规模

- 大规模

- 超大规模

- 中等规模

- 超大规模

- 小规模

- 等级类型

- 1级和2级

- 第 3 层

- 第 4 层

- 吸收量

- 未使用

- 使用

- 按主机託管类型

- 超大规模

- 零售

- 批发的

- 按最终用户

- BFSI

- 云

- 电子商务

- 政府

- 製造业

- 媒体与娱乐

- 电信

- 其他的

- 其他的

第七章竞争格局

- 市场占有率分析

- 商业状况

- 公司简介

- CMC Telecom

- DTS Communication

- FPT Telecom Joint Stock Company

- GDS(JV of NTT and VNPT)

- HTC-ITC(Hanoi Telecommunications Corporation)

- QTSC Telecom Center

- Telehouse(KDDI Corporation)

- USDC Technology

- Viettel-CHT Company Limited(Viettel IDC)

- Viettel IDC

- VNG Cloud

- VNPT Online

- VNTT

第八章:CEO面临的关键策略问题

第九章 附录

- 世界概况

- 概述

- 五力分析框架

- 全球价值链分析

- 全球市场规模与DRO

- 资讯来源及延伸阅读

- 图表清单

- 关键见解

- 数据包

- 词彙表

The Vietnam Data Center Market size is estimated at 524.7 MW in 2025, and is expected to reach 950.4 MW by 2030, growing at a CAGR of 12.61%. Further, the market is expected to generate colocation revenue of USD 588.9 Million in 2025 and is projected to reach USD 1,403.4 Million by 2030, growing at a CAGR of 18.97% during the forecast period (2025-2030).

Tier 3 data centers accounts for majority market share in 2023, Tier-4 is the fastest growing in forecasted period

- The growth in uninterrupted business services is causing Tier 1 & 2 facilities to lose demand. A growing number of global companies are creating business continuity services and shifting priority to tier 3 data centers.

- The tier 3 sector in the Vietnamese data center market reached an IT load capacity of 119.56 MW in 2022. It is expected to register a CAGR of 2.23% to reach 139.56 MW by 2029. There is an increased investment in data center infrastructure and technological advancements. It is expected to create lucrative opportunities for market growth in 2029.

- Online entertainment, such as video and music streaming and games, was another activity gaining momentum among internet users across Vietnam. In rural areas, video and movie streaming has been one of the major daily online activities in recent years. YouTube was the most popular movie streaming platform. These services need data center facilities with minimum downtime and 24/7 support, which tier 3 facilities can offer.

- In 2021, 22% of people were estimated to use the internet for more than 9 hours a day for studying, entertainment, and shopping, with the majority on their smartphones. Vietnam had 77.93 million internet users in January 2023. The number of users increased by 5.3 million (+7.3%) between 2022 and 2023.

- The Vietnamese market is nascent for tier 4 facilities since it has many infrastructural inefficiencies and hiccups. Hence, as per analysis, the market has not witnessed any developments for the highest tier-based facilities.

Vietnam Data Center Market Trends

Prioritizing digital initiatives, such as 5G, growing consumer spending to drives the market growth

- The total number of smartphone users in the country was 77.9 million in 2023, which is expected to register a CAGR of 3.09% during the forecast period to reach a value of 93.5 million by 2029.

- The usage of digital technology is rapidly expanding in Vietnam. The quick adoption of Internet and smartphone technology in various businesses has significantly impacted consumer behaviour. In 2022, consumer spending in Vietnam increased to USD 214.68 Billion from USD 193.08 Billion in 2021. As a result, more people can now purchase smartphones, leading to an increase in smartphone usage. Additionally, Vietnam has more than 73% of adults using smartphones. The government aims to increase this proportion to more than 80% by 2025 through the National Digital Infrastructure Strategy by 2025.

- Over the next several years, it is anticipated that 5G technology will be deployed, and the 4G network will extend across the country. The government has four operators: MobiFone, Vietnamobile, Viettal Mobile, and Vinaphone, with 4G customers. In 2022, Vietnam will issue licenses for 5G services, starting to expand 5G from Ho Chi Minh City and Hanoi and extending to other urban and industrial zones. Vietnam's three mobile operators, MobiFone, Viettel Mobile, and Vinaphone, have piloted 5G in 16 cities and provinces. MobiFone proposed sharing a 5G network among carriers in remote areas with low demand to uptake cost-saving. The operators are looking to commercialize 5G over the coming years, while 4G and 3G are highly significant because consumers spend most time connected to these mature technologies. The increased network connectivity of 3G and 4G networks and the deployment of 5G in smartphones will cater to an increase in smartphone users in the country.

The increasing investments for the expansion of 5G network by Operators and region vision to grow digital with the government support drives the growth of the market

- In 2022, the launch of the 5G network and Viettel revolutionized the digital market of the country. MIC has been assigned primary responsibility for accelerating the development of the digital economy, as reported by OpenGov Asia. The Ministry is tasked with directing and assisting other ministries, agencies, and local governments in implementing the strategy. In addition, it provides the Prime Minister with reports on its achievements. Further, owing to an increase in the country's GDP, it is expected that from 2023 to 2030, wireless and broadband subscription rates will continue to rise across Vietnam, resulting in increased revenues for operators.

- The market share of Vientel, Vinaphone, and Mobifone ranges from about 90% to more than 90%. At the same time, mergers involving less prominent players such as Gmobile, Saigon Ho Chi Minh Telecommunications, Post Saigon Tel, or SCTV could be announced in the future. Also, to attract private investment and improve market transparency, the government could sell down its stakes in VNPT and Mobifone by up to 50%. Moreover, according to a resolution passed by the Politburo on Guidelines for Participation in the Fourth Industrial Revolution, Vietnam has plans to increase its share of the digital economy's gross domestic product (GDP) to 20% by 2025. Vietnam enjoys 99.8% 4G coverage nationwide, with three major carriers, Viettel, VNPT, and MobiFone, successfully piloting 5G technology in 16 cities and provinces. Due to the increasing launch of 4G and 5G, the country is expected to shut down its 2G and 3G services.

Vietnam Data Center Industry Overview

The Vietnam Data Center Market is fragmented, with the top five companies occupying 37.86%. The major players in this market are CMC Telecom, DTS Communication, Telehouse (KDDI Corporation), VNG Cloud and VNPT Online (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 MARKET OUTLOOK

- 4.1 It Load Capacity

- 4.2 Raised Floor Space

- 4.3 Colocation Revenue

- 4.4 Installed Racks

- 4.5 Rack Space Utilization

- 4.6 Submarine Cable

5 Key Industry Trends

- 5.1 Smartphone Users

- 5.2 Data Traffic Per Smartphone

- 5.3 Mobile Data Speed

- 5.4 Broadband Data Speed

- 5.5 Fiber Connectivity Network

- 5.6 Regulatory Framework

- 5.6.1 Vietnam

- 5.7 Value Chain & Distribution Channel Analysis

6 MARKET SEGMENTATION (INCLUDES MARKET SIZE IN VOLUME, FORECASTS UP TO 2030 AND ANALYSIS OF GROWTH PROSPECTS)

- 6.1 Hotspot

- 6.1.1 Hanoi

- 6.1.2 Ho Chi Minh City

- 6.1.3 Others

- 6.1.4 Rest of Vietnam

- 6.2 Data Center Size

- 6.2.1 Large

- 6.2.2 Massive

- 6.2.3 Medium

- 6.2.4 Mega

- 6.2.5 Small

- 6.3 Tier Type

- 6.3.1 Tier 1 and 2

- 6.3.2 Tier 3

- 6.3.3 Tier 4

- 6.4 Absorption

- 6.4.1 Non-Utilized

- 6.4.2 Utilized

- 6.4.2.1 By Colocation Type

- 6.4.2.1.1 Hyperscale

- 6.4.2.1.2 Retail

- 6.4.2.1.3 Wholesale

- 6.4.2.2 By End User

- 6.4.2.2.1 BFSI

- 6.4.2.2.2 Cloud

- 6.4.2.2.3 E-Commerce

- 6.4.2.2.4 Government

- 6.4.2.2.5 Manufacturing

- 6.4.2.2.6 Media & Entertainment

- 6.4.2.2.7 Telecom

- 6.4.2.2.8 Other End User

- 6.4.2.2.9 Others

7 COMPETITIVE LANDSCAPE

- 7.1 Market Share Analysis

- 7.2 Company Landscape

- 7.3 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 7.3.1 CMC Telecom

- 7.3.2 DTS Communication

- 7.3.3 FPT Telecom Joint Stock Company

- 7.3.4 GDS (JV of NTT and VNPT)

- 7.3.5 HTC-ITC (Hanoi Telecommunications Corporation)

- 7.3.6 QTSC Telecom Center

- 7.3.7 Telehouse (KDDI Corporation)

- 7.3.8 USDC Technology

- 7.3.9 Viettel - CHT Company Limited (Viettel IDC)

- 7.3.10 Viettel IDC

- 7.3.11 VNG Cloud

- 7.3.12 VNPT Online

- 7.3.13 VNTT

- 7.4 LIST OF COMPANIES STUDIED

8 KEY STRATEGIC QUESTIONS FOR DATA CENTER CEOS

9 APPENDIX

- 9.1 Global Overview

- 9.1.1 Overview

- 9.1.2 Porter's Five Forces Framework

- 9.1.3 Global Value Chain Analysis

- 9.1.4 Global Market Size and DROs

- 9.2 Sources & References

- 9.3 List of Tables & Figures

- 9.4 Primary Insights

- 9.5 Data Pack

- 9.6 Glossary of Terms