|

市场调查报告书

商品编码

1693798

义大利资料中心:市场占有率分析、产业趋势与成长预测(2025-2030 年)Italy Data Center - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

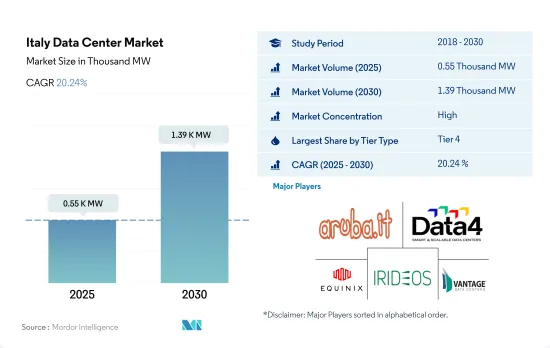

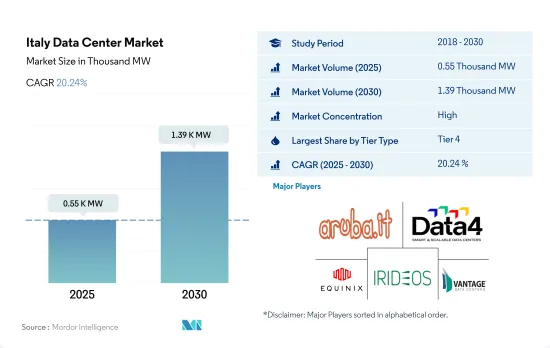

义大利资料中心市场规模预计在 2025 年达到 550MW,预计 2030 年达到 1,390MW,复合年增长率为 20.24%。

预计主机託管收益将在 2025 年达到 9.98 亿美元,在 2030 年达到 26.525 亿美元,预测期内(2025-2030 年)的复合年增长率为 21.59%。

预计到 2023 年,Tier 4 资料中心将占据最大份额,并在整个预测期内保持主导地位。

- 早期的资料中心是为了满足最低限度的需求而建造的。因此,所建构的资料结构设施规模很小。这些设施主要通过了 Tier 1 和 Tier 2 认证,因为它们只安装了最低限度的机架。预计这些资料中心将占据3%的市场占有率,到2029年将下降到1%,该部分的IT负载能力为14.1MW。

- 在容量方面,Tier 4 资料中心引领市场。预计 Tier 4 资料中心容量将从 2023 年的 227.6MW 成长到 2029 年的 918.2MW,复合年增长率为 26.2%。义大利用户对观看串流内容、玩线上游戏和网路购物的智慧型手机应用程式的需求不断增长,促使资料中心公司增加其设施中的机架数量。

- 预计 Tier 3 设施在预测期内的成长率将位居第二,为 15.8%,该领域的 IT 负载容量预计将从 2023 年的 163.06 MW 扩大到 2029 年的 394.08 MW。此外,由于设施和基础设施的持续发展以获得 Uptime Institute Tier 4 认证,市场占有率预计在 2023 年将达到 40.5%,到 2029 年将下降到 29.7%。

- 随着越来越多的城市实施智慧系统并发展成为智慧城市,对处理数据的大型设施的需求预计将相应增加。义大利的 VOD用户数量增加了五倍,从 2017 年的 330 万增加到 2021 年的 1500 万。因此,由于海量数据的产生,BFSI、媒体娱乐和製造业是预计将推动四级和三级企业成长的最终用户群。

义大利资料中心市场趋势

用户渗透率的提高将刺激市场需求

- 义大利的智慧型手机使用率正在上升,预计智慧型手机普及率将从 2021 年的 77% 增长到 2025 年的 81%。儘管人口减少,但预计用户普及率将从 2021 年的 89% 增长到 2025 年的 90%,反映出普及前景光明。

- 然而,负成长率、人口减少和平均年龄增加在决定该国的设备使用率方面发挥关键作用。根据义大利统计局的数据,2021 年人口平均年龄为 45.9 岁,而 2017 年为 44.9 岁。

- 义大利在数位化和采用现代通讯技术方面具有独特的人口结构。中国是全球率先推出3G网路的国家之一,领先国际水准。政府关于「维修权」和「计画报废」的立法可能意味着用户可以修理更多行动电话,避免花钱购买新智慧型手机。这可能会进一步阻碍市场上新智慧型手机数量的成长。义大利的数据生成点较少,这可能会进一步减少数据生成并影响该地区的数据中心需求。

国内对 FTTH 宽频服务的投资将刺激市场需求

- 义大利是宽频服务的重要消费者,有许多公司提供宽频和超宽频服务。该国整体宽频连线率从2011年的约62.4%提升至2021年底的约93.5%。疫情影响了服务结构的重组,并对义大利宽频服务基础设施接入产生了巨大的需求。这也反映在2017年至2021年间数据流量的成长约为150%,从17,700PB成长到超过44,200PB,进一步凸显了未来的成长前景。

- 该地区的光纤连接率从2011年的1.3%增加到2018年的64.4%,其中包括FTTH和FTTC服务。 AGCOM 数据强调,每条宽频线路的每月数据消费量将从 2017 年的 96.6GB 增长到 2019 年的 210GB 左右。到 2021 年底,透过超宽频服务连接住宅和商业宽频的用户将达到 1,870 万,相当于每 100 人拥有约 31.7 条线路。

- 预计该国对 FTTH 宽频服务的投资将在预测期内影响市场。基础设施因过去的大规模投资而受益匪浅。 2022年4月,义大利电信的FiberCop与TLC Telecomunicazioni等知名公司签署协议,共同发展FTTH接入。宽频服务在义大利人口中的广泛普及将有助于资料中心设施更快地传输数据,并利用其网路根据需要与网路交换器和通讯业者进行互动。

义大利资料中心产业概况

义大利资料中心市场高度整合,前五大公司占89.41%的市占率。该市场的主要企业包括 Aruba SpA、Data4、Equinix, Inc.、Irideos SpA、Vantage Data Centers LLC 等。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章执行摘要和主要发现

第二章 报告要约

第三章 引言

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 市场展望

- 负载能力

- 占地面积

- 主机代管收入

- 安装机架数量

- 机架空间利用率

- 海底电缆

第五章 产业主要趋势

- 智慧型手机用户数量

- 每部智慧型手机的数据流量

- 行动数据速度

- 宽频数据速度

- 光纤连接网路

- 法律规范

- 义大利

- 价值炼和通路分析

第六章市场区隔

- 热点

- 米兰

- 其他中东和非洲地区

- 资料中心规模

- 大规模

- 超大规模

- 中等规模

- 超大规模

- 小规模

- 等级类型

- 1级和2级

- 第 3 层

- 第 4 层

- 吸收量

- 未使用

- 使用

- 按主机託管类型

- 超大规模

- 零售

- 批发的

- 按最终用户

- BFSI

- 云

- 电子商务

- 政府

- 製造业

- 媒体与娱乐

- 电信

- 其他的

第七章竞争格局

- 市场占有率分析

- 商业状况

- 公司简介

- Aruba SpA

- AtlasEdge Data Centres

- CDLAN SpA

- Data4

- Equinix, Inc.

- Irideos SpA

- IT.Gate SpA

- ITnet Srl

- MIX SRL

- Seeweb Srl

- Stack Infrastructure, Inc.

- Vantage Data Centers LLC

第八章:CEO面临的关键策略问题

第九章 附录

- 世界概况

- 概述

- 五力分析框架

- 全球价值链分析

- 全球市场规模与DRO

- 资讯来源及延伸阅读

- 图表清单

- 关键见解

- 数据包

- 词彙表

The Italy Data Center Market size is estimated at 0.55 thousand MW in 2025, and is expected to reach 1.39 thousand MW by 2030, growing at a CAGR of 20.24%. Further, the market is expected to generate colocation revenue of USD 998 Million in 2025 and is projected to reach USD 2,652.5 Million by 2030, growing at a CAGR of 21.59% during the forecast period (2025-2030).

Tier 4 data center accounted for majority share in terms of volume in 2023, and is expected to dominate through out the forecasted period

- The initial data centers were built in accordance with the minimal demand. Hence the data structure facilities created were small. These facilities were mainly Tier 1 & 2 certified due to their minimal requirements, and they had minimum racks installed. These data centers are expected to hold 3% of the market share, which is expected to decrease to 1% by 2029, with the segment accounting for an IT load capacity of 14.1 MW.

- Tier 4 data centers lead the market in terms of capacity. Tier 4 data center capacity is expected to increase from 227.6 MW in 2023 to 918.2 MW in 2029 at a CAGR of 26.2%. The increasing demand for smartphone applications to view streaming content, play online games, and shop online by Italian users has led data center companies to increase the number of racks in their facilities.

- Tier 3 facilities are expected to witness the second-highest growth of 15.8% during the forecast period, while the segment's IT load capacity is expected to grow from 163.06 MW in 2023 to 394.08 MW by 2029. It is also expected to hold a market share of 40.5% in 2023, which is expected to decrease to 29.7% by 2029, owing to the increasing development and infrastructural advancements of facilities to procure Tier 4 certification from the Uptime Institute.

- As more cities adopt smart systems and evolve into smart cities, the demand for huge facilities to process data is expected to grow proportionally. The number of subscribers to VOD in Italy increased by five times, from 3.3 million in 2017 to 15 million in 2021. Thus, BFSI, media and entertainment, and manufacturing are end-user segments expected to boost the growth of Tier 4 and Tier 3 facilities in line with huge data generation.

Italy Data Center Market Trends

Increment in the subscriber penetration rate is boosting the market demand

- Italy has increasing smartphone usage in the country, with a smartphone adoption rate expected to increase from 77% in 2021 to 81% in 2025. Despite a decreasing population, the expected increment in the subscriber penetration rate from 89% in 2021 to 90% by 2025 reflects a promising scenario for adoption.

- However, the decreasing population with a negative growth rate and higher average age play a crucial role in determining device usage in the country. The data from ISTAT highlighted the average age of the population in 2021 to be 45.9 years, compared to 44.9 years in 2017.

- Italy has a unique demographical scenario regarding digitalization and adopting the latest telecommunications technology. The country was among the initial ones to deploy a 3G network and has been ahead of the international timeline. The government legislation on the 'Right To Repair' and 'Planned Obsolescence Law' would allow users to repair their phones more, which may help them avoid expenditure on new smartphones. This may further hamper the growth of the number of new smartphones in the market. This may further lead to a decrease in data generation due to lesser data-generating points in Italy, affecting the demand for data centers in the region.

Investments in the country's FTTH broadband service is boosting the market demand

- Italy has been a significant consumer of broadband services, with companies offering broadband and ultra-broadband services. The overall broadband connections in the country increased from about 62.4% in 2011 to about 93.5% by the end of 2021. The pandemic influenced the restructuring of the services, creating significant demand to utilize the infrastructure for broadband services in Italy. This was also evident in the increase in data traffic by about 150%, from 17,700 to more than 44,200 PB from 2017 to 2021, which further highlights the future growth prospects.

- Fiber connectivity in the region increased from 1.3% in 2011 to 64.4% in 2018, including FTTH and FTTC services. The data from AGCOM highlighted the monthly data consumption per broadband line from 96.6 GB in 2017 to about 210 GB in 2019. Broadband access through residential and business ultra-broadband services by the end of 2021 reached 18.7 million units, accounting for about 31.7 lines for every 100 inhabitants.

- The investments in the country's FTTH broadband services would shape the market during the forecast period. With the significant investments in the past, the infrastructure was greatly benefitted, which would be carried forward by the operators accordingly. In April 2022, prominent players like Telecom Italia's FiberCop and TLC Telecomunicazioni signed an agreement to develop FTTH access jointly. The deep penetration of broadband services availed by the Italian population may help data center facilities to deliver data faster and leverage the network to interact with internet exchanges and telecommunication operators, as required.

Italy Data Center Industry Overview

The Italy Data Center Market is fairly consolidated, with the top five companies occupying 89.41%. The major players in this market are Aruba SpA, Data4, Equinix, Inc., Irideos SpA and Vantage Data Centers LLC (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 MARKET OUTLOOK

- 4.1 It Load Capacity

- 4.2 Raised Floor Space

- 4.3 Colocation Revenue

- 4.4 Installed Racks

- 4.5 Rack Space Utilization

- 4.6 Submarine Cable

5 Key Industry Trends

- 5.1 Smartphone Users

- 5.2 Data Traffic Per Smartphone

- 5.3 Mobile Data Speed

- 5.4 Broadband Data Speed

- 5.5 Fiber Connectivity Network

- 5.6 Regulatory Framework

- 5.6.1 Italy

- 5.7 Value Chain & Distribution Channel Analysis

6 MARKET SEGMENTATION (INCLUDES MARKET SIZE IN VOLUME, FORECASTS UP TO 2030 AND ANALYSIS OF GROWTH PROSPECTS)

- 6.1 Hotspot

- 6.1.1 Greater Milan

- 6.1.2 Rest of Italy

- 6.2 Data Center Size

- 6.2.1 Large

- 6.2.2 Massive

- 6.2.3 Medium

- 6.2.4 Mega

- 6.2.5 Small

- 6.3 Tier Type

- 6.3.1 Tier 1 and 2

- 6.3.2 Tier 3

- 6.3.3 Tier 4

- 6.4 Absorption

- 6.4.1 Non-Utilized

- 6.4.2 Utilized

- 6.4.2.1 By Colocation Type

- 6.4.2.1.1 Hyperscale

- 6.4.2.1.2 Retail

- 6.4.2.1.3 Wholesale

- 6.4.2.2 By End User

- 6.4.2.2.1 BFSI

- 6.4.2.2.2 Cloud

- 6.4.2.2.3 E-Commerce

- 6.4.2.2.4 Government

- 6.4.2.2.5 Manufacturing

- 6.4.2.2.6 Media & Entertainment

- 6.4.2.2.7 Telecom

- 6.4.2.2.8 Other End User

7 COMPETITIVE LANDSCAPE

- 7.1 Market Share Analysis

- 7.2 Company Landscape

- 7.3 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 7.3.1 Aruba SpA

- 7.3.2 AtlasEdge Data Centres

- 7.3.3 CDLAN SpA

- 7.3.4 Data4

- 7.3.5 Equinix, Inc.

- 7.3.6 Irideos SpA

- 7.3.7 IT.Gate S.p.A.

- 7.3.8 ITnet S.r.l

- 7.3.9 MIX SRL

- 7.3.10 Seeweb Srl

- 7.3.11 Stack Infrastructure, Inc.

- 7.3.12 Vantage Data Centers LLC

- 7.4 LIST OF COMPANIES STUDIED

8 KEY STRATEGIC QUESTIONS FOR DATA CENTER CEOS

9 APPENDIX

- 9.1 Global Overview

- 9.1.1 Overview

- 9.1.2 Porter's Five Forces Framework

- 9.1.3 Global Value Chain Analysis

- 9.1.4 Global Market Size and DROs

- 9.2 Sources & References

- 9.3 List of Tables & Figures

- 9.4 Primary Insights

- 9.5 Data Pack

- 9.6 Glossary of Terms