|

市场调查报告书

商品编码

1693801

南美资料中心市场占有率分析、产业趋势和成长预测(2025-2030 年)South America Data Center - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

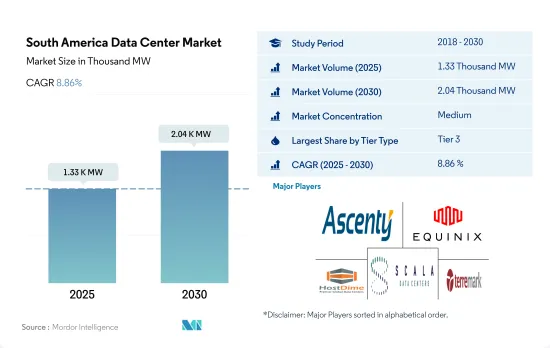

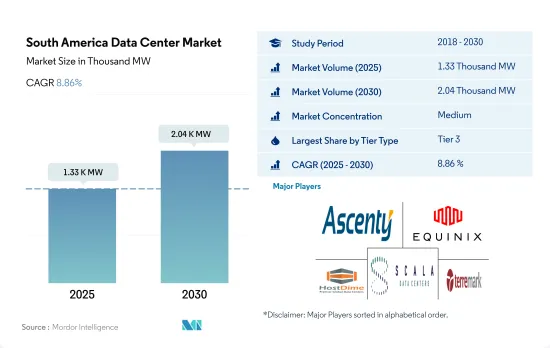

南美资料中心市场规模预计在 2025 年达到 1,330 兆瓦,预计到 2030 年将达到 2,040 兆瓦,复合年增长率为 8.86%。

预计 2025 年主机託管收益将达到 50.091 亿美元,2030 年将达到 85.247 亿美元,预测期内(2025-2030 年)的复合年增长率为 11.22%。

2023 年,Tier 3 资料中心将占据大部分市场占有率,但 Tier 4 资料中心在预测期内将快速成长

- 在南美市场,Tier 3 细分市场目前凭藉其显着的功能优势占据了大部分份额。此层类型高度冗余,具有多个电源和冷却路径。这些资料中心的运转率约为 99.982%,每年的停机时间为 1.6 小时。随着边缘和云端连接的日益普及,Tier 3 细分市场的成长预计将进一步加速。

- 巴西拥有该地区最多的 Tier 3 资料中心。 2022年,巴西的58个资料中心将获得Tier 3认证。 2022 年,圣保罗将拥有全国最多的 Tier 3 资料中心,占 77.9%,里约热内卢将拥有 27.2%。其他热点地区(塞阿拉、卡斯卡维尔、库里蒂巴和里贝朗普雷图等)的份额为 14.8%。预计 Tier 3 部分将从 2023 年的 649 兆瓦成长到 2029 年的 987.67 兆瓦,复合年增长率为 7.25%。

- 预计在预测期内,Tier 4 部分的最高复合年增长率将达到 20.94%。巴西等多个已开发国家正致力于采用 Tier 4 认证,该认证具有所有组件的完全容错和冗余功能。这也是发展中地区也采用 Tier 4 类型的主要原因。预计市场的主要企业将在预测期内扩大其设施,包括拥有 17 个设施的 Scala 资料中心(366 MW)和拥有 1 个设施的 ODATA(24 MW)。

- 预计一线和二线市场将在 GDP 成长较低且成本较高的低度开发国家开发中国家和发展中国家实现显着成长。这些国家包括玻利维亚、巴拉圭、苏利南和厄瓜多尔,其中大多数是由无法负担三级和四级设施的中小型企业组成。

巴西占据主要份额,预计在调查期间将继续占据主导地位

- 巴西和智利占据南美洲资料中心市场的最大份额。巴西政府透过国家宽频计画(REPNBL)提供奖励,其中包括购买基础设施的奖励。巴西的绝对投资金额较 2021 年增长了 40%,这得益于 Ascenty、Scala Data Centers 和 ODATA 等主机託管服务提供商以及 GlobeNet Telecom、Ava Telecom 和 Embratel 等通讯业者的投资。圣保罗是巴西主要的金融城市,也是资料中心的主要枢纽。里约热内卢和福塔莱萨等其他城市也是巴西的主要投资中心。

- 智利的能源价格具有竞争力,这在很大程度上归功于可再生能源发电潜力的计划。能源成本已降至五年前的三分之一,这主要归功于可再生能源目前占总发电量的 46%。智利传统上拥有该地区最好的通讯基础设施之一,目前有两个主要的光纤计划正在进行中,以确保完全冗余的光纤主干网路。其中包括国营的 Fibra Optica Austral (FOA) 海底电缆,该电缆将澳洲南部与 Gtd(一条 3,500 公里的南北海底电缆)连接起来。 2022年,Scala Data Centers、ODATA、Ascenty(Digital Realty)和EdgeConneX等主机代管业者成为智利资料中心市场的主要投资者。

- 在阿根廷,布宜诺斯艾利斯是一个重要的投资地点,该市已确定的第三方设施贡献了现有电力容量的 90% 以上。现有的资料中心大多是在有限空间内建造的小型设施。根据国际可再生能源机构(IRENA)的数据,2020年可再生能源占阿根廷总电力供应的约33%,阿根廷的目标是到2025年可再生能源发电量占比达到20%,并计划在未来成为全球最大的资料中心枢纽之一。

南美洲资料中心市场的趋势

各行各业对互联网和智慧型手机技术的广泛采用以及全部区域数位化使用率的不断增长正在推动市场需求

- 2020年,行动科技和服务占拉丁美洲地区GDP的7.1%,经济增加值贡献超过3,400亿美元。行动生态系统也支持超过 160 万个就业机会(直接和间接)。到 2025 年,随着拉丁美洲各国越来越多地受益于行动服务日益普及所带来的生产力和效率的提高,拉丁美洲行动生态系统的经济贡献预计将增长到 300 亿美元以上。

- 巴西的数位应用正在迅速成长。各公司对网路和智慧型手机的广泛使用影响了消费者的行为。日本越来越多的人能够购买智慧型手机,导致智慧型手机用户数量增加。 2020年5月,拉丁美洲下载的购物应用程式大部分来自巴西,巴西以约4,400万次下载量位居榜首。

- 智利的电子商务正在稳步扩张。 2020年智利每位付费用户平均年收入达913美元,智利消费者的跨国电商购买量达69%。这导致了大量数据的产生,增加了全国对数据中心的需求。受新网路持续推出、设备生态系统不断扩大以及针对消费者和企业的新应用开发的推动,南美洲正在快速向 5G 转型。

由于银行、商业和通讯服务对互联网的依赖性不断增强,该地区的 FTTH用户正在增加,从而推动了市场成长。

- 在拉丁美洲和加勒比地区,只有不到 50% 的人口可以使用固定宽频互联网,只有 9.9% 的人口可以使用光纤互联网。许多农村地区由于网路设备价格昂贵,网路覆盖不完善。智利在固定宽频领域为其他国家树立了标准。智利拥有拉丁美洲最快的数据下载速度。智利的平均网路下载速度为 219Mbps,远远领先该地区最大的经济体巴西,巴西的平均网路下载速度为 95.95Mbps。

- 在新冠疫情期间,巴西人越来越依赖网路进行银行业务、商业、通讯和休閒。然而,截至2021年4月,巴西固定通讯速度全球排名第49位,通讯速度排名第74位。这意味着网路存取和宽频速度正在快速成长,这意味着资料中心将受益于更快的资料传输、更高的储存率和更低的延迟。

- 预计到 2022 年拉丁美洲光纤到府 (FTTH) 市场将拥有约 1.05 亿个光纤连接家庭,比 2021 年底成长 36%,即新增 2,800 万个光纤连接家庭。目前拉丁美洲的光纤普及率已接近61%。在投资方面,智利行动电话营运商 WOM 已与数位支援和收益管理软体公司 Aleppo 合作,计划于 2021 年进军固定宽频 (FTTH) 市场。

南美洲资料中心产业概况

南美洲资料中心市场适度整合,前五大公司占50.76%的市场。该市场的主要企业包括 Ascenty(Digital Realty Trust Inc.)、Equinix Inc.、HostDime Global Corp.、Scala Data Centers 和 Terremark(Verizon)。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章执行摘要和主要发现

第二章 报告要约

第三章 引言

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 市场展望

- 负载能力

- 占地面积

- 主机代管收入

- 安装机架数量

- 机架空间利用率

- 海底电缆

第五章 产业主要趋势

- 智慧型手机用户数量

- 每部智慧型手机的数据流量

- 行动数据速度

- 宽频数据速度

- 光纤连接网路

- 法律规范

- 巴西

- 智利

- 价值炼和通路分析

第六章市场区隔

- 资料中心规模

- 大规模

- 超大规模

- 中等规模

- 超大规模

- 小规模

- 等级类型

- 1级和2级

- 第 3 层

- 第 4 层

- 吸收量

- 未使用

- 使用

- 按主机託管类型

- 超大规模

- 零售

- 批发的

- 按最终用户

- BFSI

- 云

- 电子商务

- 政府

- 製造业

- 媒体与娱乐

- 电信

- 其他的

- 国家

- 巴西

- 智利

- 南美洲其他地区

第七章竞争格局

- 市场占有率分析

- 商业状况

- 公司简介

- Ascenty(Digital Realty Trust Inc.)

- EdgeUno Inc.

- Equinix Inc.

- GTD Grupo Teleductos SA

- HostDime Global Corp.

- Lumen Technologies Inc.

- NABIAX

- ODATA(Patria Investments Ltd)

- Quantico Data Center

- Scala Data Centers

- SONDA SA

- Terremark(Verizon)

第八章:CEO面临的关键策略问题

第九章 附录

- 世界概况

- 概述

- 五力分析框架

- 全球价值链分析

- 全球市场规模和DRO

- 资讯来源及延伸阅读

- 图表清单

- 关键见解

- 数据包

- 词彙表

The South America Data Center Market size is estimated at 1.33 thousand MW in 2025, and is expected to reach 2.04 thousand MW by 2030, growing at a CAGR of 8.86%. Further, the market is expected to generate colocation revenue of USD 5,009.1 Million in 2025 and is projected to reach USD 8,524.7 Million by 2030, growing at a CAGR of 11.22% during the forecast period (2025-2030).

Tier 3 data centers accounts for majority market share in 2023, Tier-4 is the fastest growing in forecasted period

- The Tier 3 segment currently has a majority share in the South American market due to the major advantage of its features. This tier type has a high redundancy level and multiple paths for power and cooling. These data centers have an uptime of around 99.982%, translating into a downtime of 1.6 hours per year. With the increasing adoption of edge and cloud connectivity, the growth in the Tier 3 segment is expected to increase further.

- Brazil hosts the maximum number of Tier 3 data centers in the region. In 2022, 58 data centers in Brazil had Tier 3 certification. In 2022, Sao Paulo hosted the maximum number of Tier 3 data centers in the country, with a market share of 77.9% and Rio de Janeiro with 27.2%. Among other hotspots (Ceara, Cascavel, Curitiba, Ribeirao Preto, and others), the share was 14.8%. The Tier 3 segment is expected to grow from 649 MW in 2023 to 987.67 MW in 2029, at a projected CAGR of 7.25%.

- The Tier 4 segment is expected to record the highest CAGR of 20.94% during the forecast period. Various developed countries, such as Brazil, are focusing on adopting the Tier 4 certification to be completely fault-tolerant and redundant for every component. This is the major reason why even the developing regions are adopting the Tier 4 type. Major players in the market are expected to expand their facilities, which include Scala Data Centers (366 MW) with 17 facilities and ODATA (24 MW) with one facility during the forecast period.

- The Tier 1 & 2 segment is expected to showcase significant growth in developing countries, with a low GDP rate index in under-developed countries with a high expense burden. These countries include Bolivia, Paraguay, Suriname, and Ecuador, which have the majority of SMEs that cannot afford Tier 3 and 4 facilities.

Brazil holds the major share and expected to continue the dominance during the study period

- Brazil and Chile hold the largest shares in the South American data center market. The Brazilian government provides incentives through the Regime Especial de Tributacao do Programa Nacional de Banda Larga (REPNBL) program, which includes incentives for purchasing infrastructure that help improve colocation services in the country. Brazil has witnessed an absolute growth of 40% in investments from the 2021 values due to investments from colocation providers such as Ascenty, Scala Data Centers, and ODATA and telecom operators such as GlobeNet Telecom, Ava Telecom, and Embratel. Sao Paulo, Brazil's significant financial capital, serves as the primary data center hub. Other cities, such as Rio de Janeiro and Fortaleza, are major investment locations in Brazil.

- Chile has competitive energy prices, primarily fueled by plans to take advantage of its natural renewable energy generation potential over the coming years. Energy costs have dropped to one-third of what they were five years ago, mainly based on renewable energy that now makes up 46% of the total produced. Chile traditionally has some of the region's best telecommunications infrastructure, and two major fiber projects are underway to ensure it will have a fully redundant fiber backbone. These include the state-funded Fibra Optica Austral (FOA) submarine cable connecting the deep south and Gtd's 3,500 km north-south submarine cable. In 2022, colocation operators, such as Scala Data Centers, ODATA, Ascenty (Digital Realty), and EdgeConneX, were the major investors in the Chilean data center market.

- In Argentina, Buenos Aires is the major investment destination, with the identified third-party facilities in the city contributing to over 90% of the existing power capacity. Most existing data centers are smaller facilities built over a limited area. The International Renewable Energy Agency (IRENA) stated that renewable energy contributed to around 33% of the overall electricity capacity in 2020 in Argentina, and the country aims to generate 20% of the electricity via renewable sources by 2025. The country aims to be one of the largest data center hubs in the coming time period.

South America Data Center Market Trends

The high internet and smartphone technology adoption by various businesses and growing digital usage across the region drives the market demand

- In 2020, mobile technologies and services accounted for 7.1% of GDP in Latin America - a contribution that amounted to more than USD 340 billion of economic value added. The mobile ecosystem also supported more than 1.6 million jobs (directly and indirectly). By 2025, the economic contribution of the Latin American mobile ecosystem will grow by more than USD 30 billion as countries in the region increasingly benefit from the improvements in productivity and efficiency brought about by the increased take-up of mobile services.

- Digital usage is expanding rapidly in Brazil. The high internet and smartphone technology adoption by various businesses has impacted consumer behavior. More people in the country can now purchase smartphones, leading to a growing number of smartphone users. In May 2020, most shopping apps downloaded in South America were developed in Brazil, which stood out with approximately 44 million app downloads in this category.

- In Chile, e-commerce is expanding steadily. Chile's average annual revenue per paying user amounted to USD 913 in 2020. Most cross-border e-commerce purchases by Chilean shoppers stand at 69%. As a result, vast amounts of data have been created, increasing the demand for data centers nationwide. In South America, the transition to 5G is progressing rapidly, driven by the continued rollout of new networks, the expansion of the device ecosystem, and the development of new applications for consumers and enterprises.

People across the region increasingly reliant on the internet for banking, business, & telecommunication services and increasing FTTH subscribers across the region drives the market growth

- In South America and the Caribbean, less than 50% of the population has access to fixed broadband internet, and only 9.9% has fiber internet access. Many rural areas have patchy network coverage due to expensive network equipment. Chile has set the standard for other countries to follow in fixed broadband. Chile has the fastest data download speeds in Latin America. With an average rate of 219 Mbps, Chile is well ahead of the region's largest economy, Brazil, where internet download speeds average 95.95 Mbps.

- The Brazilian population became increasingly reliant on the internet for banking, business, telecommunication, and leisure during the COVID-19 pandemic. However, the country ranked 49th globally for fixed broadband speed and 74th for mobile speed as of April 2021. This shows that access to the internet and broadband speed are growing rapidly, meaning data centers will benefit from faster data transfer, higher storage rates, and lower latency.

- Latin America's fiber-to-the-home (FTTH) market was set to register approximately 105 million homes with fiber in 2022, an increase of 36%, or 28 million new premises, compared with the end of 2021. Latin America now has a fiber penetration rate of nearly 61%. In terms of investment, in 2021, to penetrate the fixed broadband (FTTH) market, Chilean mobile operator WOM teamed with digital enablement and revenue management software company Aleppo.

South America Data Center Industry Overview

The South America Data Center Market is moderately consolidated, with the top five companies occupying 50.76%. The major players in this market are Ascenty (Digital Realty Trust Inc.), Equinix Inc., HostDime Global Corp., Scala Data Centers and Terremark (Verizon) (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 MARKET OUTLOOK

- 4.1 It Load Capacity

- 4.2 Raised Floor Space

- 4.3 Colocation Revenue

- 4.4 Installed Racks

- 4.5 Rack Space Utilization

- 4.6 Submarine Cable

5 Key Industry Trends

- 5.1 Smartphone Users

- 5.2 Data Traffic Per Smartphone

- 5.3 Mobile Data Speed

- 5.4 Broadband Data Speed

- 5.5 Fiber Connectivity Network

- 5.6 Regulatory Framework

- 5.6.1 Brazil

- 5.6.2 Chile

- 5.7 Value Chain & Distribution Channel Analysis

6 MARKET SEGMENTATION (INCLUDES MARKET SIZE IN VOLUME, FORECASTS UP TO 2030 AND ANALYSIS OF GROWTH PROSPECTS)

- 6.1 Data Center Size

- 6.1.1 Large

- 6.1.2 Massive

- 6.1.3 Medium

- 6.1.4 Mega

- 6.1.5 Small

- 6.2 Tier Type

- 6.2.1 Tier 1 and 2

- 6.2.2 Tier 3

- 6.2.3 Tier 4

- 6.3 Absorption

- 6.3.1 Non-Utilized

- 6.3.2 Utilized

- 6.3.2.1 By Colocation Type

- 6.3.2.1.1 Hyperscale

- 6.3.2.1.2 Retail

- 6.3.2.1.3 Wholesale

- 6.3.2.2 By End User

- 6.3.2.2.1 BFSI

- 6.3.2.2.2 Cloud

- 6.3.2.2.3 E-Commerce

- 6.3.2.2.4 Government

- 6.3.2.2.5 Manufacturing

- 6.3.2.2.6 Media & Entertainment

- 6.3.2.2.7 Telecom

- 6.3.2.2.8 Other End User

- 6.4 Country

- 6.4.1 Brazil

- 6.4.2 Chile

- 6.4.3 Rest of South America

7 COMPETITIVE LANDSCAPE

- 7.1 Market Share Analysis

- 7.2 Company Landscape

- 7.3 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 7.3.1 Ascenty (Digital Realty Trust Inc.)

- 7.3.2 EdgeUno Inc.

- 7.3.3 Equinix Inc.

- 7.3.4 GTD Grupo Teleductos SA

- 7.3.5 HostDime Global Corp.

- 7.3.6 Lumen Technologies Inc.

- 7.3.7 NABIAX

- 7.3.8 ODATA (Patria Investments Ltd)

- 7.3.9 Quantico Data Center

- 7.3.10 Scala Data Centers

- 7.3.11 SONDA SA

- 7.3.12 Terremark (Verizon)

- 7.4 LIST OF COMPANIES STUDIED

8 KEY STRATEGIC QUESTIONS FOR DATA CENTER CEOS

9 APPENDIX

- 9.1 Global Overview

- 9.1.1 Overview

- 9.1.2 Porter's Five Forces Framework

- 9.1.3 Global Value Chain Analysis

- 9.1.4 Global Market Size and DROs

- 9.2 Sources & References

- 9.3 List of Tables & Figures

- 9.4 Primary Insights

- 9.5 Data Pack

- 9.6 Glossary of Terms