|

市场调查报告书

商品编码

1693815

环境咨询:市场占有率分析、行业趋势和统计数据、成长预测(2025-2030 年)Environmental Consulting - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

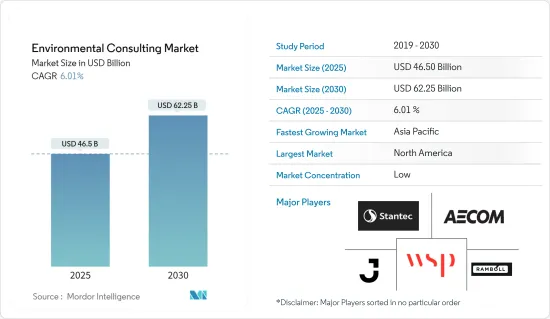

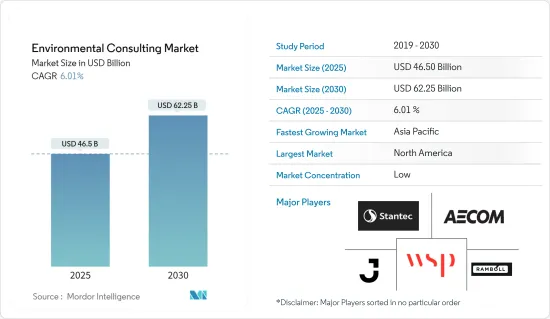

预计 2025 年环境咨询市场规模为 465 亿美元,到 2030 年将达到 622.5 亿美元,预测期内(2025-2030 年)的复合年增长率为 6.01%。

关键亮点

- 近年来,全球环境咨询市场由于多种因素而显着增长,包括人们对全球环境问题的兴趣日益浓厚以及遵守严格的环境标准的需要。环境咨询公司提供一系列服务,包括环境影响评估、永续性报告、环境管理系统和合规审核。这些服务可帮助公司减少对环境的影响并确保遵守法规。

- 人们越来越意识到人类活动对环境的影响,导致各领域对永续实践的需求增加。这为环境顾问公司提供了为企业采取永续做法提供建议的机会。

- 由于全球污染水准不断上升,需要环境咨询服务。这些服务支持政府和企业解决环境问题、遵守法规和减少环境影响的努力。控制污染和环境破坏的迫切需求推动全球环境咨询市场的快速成长。

- 全球环境咨询市场受到不断变化的监管环境和企业对环境敏感性日益重视的推动。在全球范围内,各国政府正在製定更严格的环境标准,对企业施加更大的压力,要求其遵守标准并展示对永续性的承诺。环境顾问公司对于帮助企业遵守这些法规并实现永续性目标至关重要。

- 快速成长的经济体在采用永续性进展缓慢,这对全球环境咨询市场构成了挑战。与中国和印度一样,这些经济体正在快速工业化并劣化。然而,这些国家采用永续性技术的速度滞后,对于寻求提高永续性的环境咨询公司来说是一个问题。

- 新冠疫情的出现,迫使工业界重新思考传统的製造方法,首先推动的是整个生产线的数位转型和智慧製造技术。製造商也被迫开发和实施各种创新、灵活的产品和品管方法。

- 后疫情时代的激烈竞争是环境顾问业面临的最严峻挑战之一。透过线上研究环境顾问,客户可以从广泛的专业知识中进行选择。最后,为了保持市场领先地位,公司必须采取新的竞争思维并突显其独特的品质。

环境咨询市场的趋势

公共部门最终用户产业预计将占据相当大的市场占有率

- 公共部门是经济部门,包括政府拥有和经营的所有营业单位。这包括从学校和医院到高速公路和桥樑的一切。公共部门的主要目标是提供社会福利所必需的服务。这些服务通常免费或以折扣价提供。

- 公共部门环境咨询是一种与地方政府、州和联邦政府及政府机构合作的管理咨询。一些大型管理顾问公司(BCG、麦肯锡、Monitor、Booz & Company、PA Consulting Group)都将公共部门作为整体业务的一部分。

- 公共部门对于社会高效运作至关重要。他们为当地社区的福祉提供基本服务。此外,公共部门对于促进经济成长和稳定至关重要。

- 政府通常会聘请顾问临时提供专业服务,例如工程、资讯科技或策略。政府相关人员表示,咨询公司通常提供公共部门无法提供的专业知识和技能,而透过基于计划的合约可以更有效地提供这些知识和技能。

- 此外,世界各地的各个公共部门政府越来越多地寻求顾问来实现其整体发展目标。由于所有这些因素,预计未来几年咨询业务将大幅扩张。例如,2022年5月,汉莎航空与BCG合作,寻求策略咨询服务,以协助其製定业务復苏计画。德国政府已收购该公司 20% 的股份,并获得 90 亿欧元(约 97.9 亿美元)的资金,以暂时维持这家陷入困境的航空公司的营运。

- 环境顾问解决的问题包括土地和水污染、废弃物管理政策、环境管理系统、空气品质评估、环境影响评估、环境审核、为客户管理法律问题、开发概念模型(识别和检查潜在污染源)、与客户、检查员、法规和政策的持续沟通,以及在评估财产时识别过去的活动或污染。人口成长和全球化导致全球产生的垃圾量不断增加。根据世界银行集团的报告,近年来全球产生了20.1亿吨城市固态废弃物(MSW),其中至少33%以生态学不可持续的保守方式进行管理。

- 全球整体,每人每天产生的垃圾量平均为0.74公斤,但差异很大,从0.11公斤到4.54公斤不等。高所得国家虽然只占世界人口的16%,但却排放了全球约34%的垃圾,即6.83亿吨,预计到2050年将增加至34亿吨。美国和丹麦是世界上人均城市排放产生量最高的国家之一。这些国家的居民平均每年排放800多公斤垃圾。

预计北美将占据较大的市场占有率

- 对环保企业实践的日益重视、对气候变迁的日益关注以及对环境合规的监管要求是推动美国环境咨询市场发展的关键原因。有效、有效率地管理废弃物、污染和自然资源的需求也推动了对环境咨询服务的需求。此外,工业领域的扩张为咨询公司提供环境评估和补救服务提供了机会。由于该行业的併购,美国的环境咨询市场正在扩大。

- 公司管理环境危害的需要、监管审查的加强以及永续性的重要性是推动美国环境咨询市场发展的一些因素。加强监管监督是美国环境咨询业成长的关键因素。联邦和州政府实施了多项环境法规来保护环境和公众健康。

- 这些法规涵盖废弃物管理、危险物质、空气和水质等许多领域。忽视这些标准的组织将面临严厉的处罚,包括罚款和法律诉讼。为了帮助应对复杂的监管环境并确保遵守环境标准,许多公司求助于环境咨询公司。

- 在加拿大,有许多联邦和省级法律规范永续性和环境保护。这些法律对企业提出了严格的环保要求,例如管理危险废弃物和减少温室气体排放。环境顾问公司经常需要具备遵守这些法规的技能。加拿大政府近期发布了2050年实现净零排放的策略,迫使企业对业务营运做出重大调整,增加了对环境咨询服务的需求。

- 加拿大政府的目标是到2030年90%的电力来自可再生能源。这导致使用风能和太阳能发电厂等可再生能源的计划增加。对于此类计划,通常会聘请环境顾问公司进行环境影响分析并确保遵守法规。

环境咨询业概况

环境咨询市场高度分散,主要参与者包括 Jacobs Solutions Inc.、AECOM、WSP Global Inc.、Stantec Inc. 和 Ramboll Group AS。市场参与企业正在采取联盟和收购等策略来增强其产品供应并获得可持续的竞争优势。

- 2022 年 9 月-Tetra Tech 收购 RPS Group PLC。此次收购旨在协助扩大 Tetra Tech 的全球影响力。 RPS 集团将大幅扩展 Tetra Tech 在英国的水源产业,并加强 Tetra Tech 在可再生能源和环境管理方面的领导地位。此次合併将扩大在英国、欧盟和澳洲的地理覆盖范围。

- 2022 年 8 月-奥雅纳签署各种合约和协议,以扩大现有业务并加强市场地位。该公司与 Matidor.com 合作,使土木工程师能够模拟多种城市规划场景,即时计算和优化能源效率,并开发最佳模型以最大限度地发挥环境影响。同月,该公司获得英国韦林德雷大学 NHS 信託基金的合同,用于开发韦林德雷癌症中心。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 竞争对手之间的竞争

- 替代品的威胁

- COVID-19 市场影响评估

第五章市场动态

- 市场驱动因素

- 全球污染水平令人担忧

- 监管环境的变化以及组织环境问题压力的增加

- 市场限制

- 快速成长的经济体永续性势头低迷

- 各类服务主要趋势分析

- 永续发展策略

- 替代能源开发和能源效率

- 环境实质审查

- EHS 管理与合规

- 地下水咨询、防洪咨询、水力学和水文地质学

- 空气品质和有害物质管理

- 废弃物管理

第六章市场区隔

- 按最终用户产业

- 能源动力

- 矿业

- 公共部门

- 製造业

- 其他的

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 西班牙

- 义大利

- 法国

- 比荷卢经济联盟

- 波兰

- 其他欧洲国家

- 亚太地区

- 中国

- 澳洲

- 其他亚太地区

- 拉丁美洲

- 巴西

- 其他拉丁美洲

- 中东和非洲

- 北美洲

第七章竞争格局

- 公司简介

- Jacobs Solutions Inc.

- AECOM

- WSP Global Inc.

- Stantec Inc.

- Ramboll Group AS

- Tetra Tech Inc.

- The Erm International Group Limited

- Arup

- GHD

- Sweco AB

第八章投资分析

第九章:未来市场展望

The Environmental Consulting Market size is estimated at USD 46.50 billion in 2025, and is expected to reach USD 62.25 billion by 2030, at a CAGR of 6.01% during the forecast period (2025-2030).

Key Highlights

- The global environmental consulting market has grown significantly in recent years due to various factors, including increased global environmental concern and the need to comply with severe environmental standards. Environmental consulting companies offer various services, including environmental impact assessments, sustainability reporting, environmental management systems, and compliance auditing. These services assist firms in reducing their environmental effect and ensuring compliance with legislation.

- Growing awareness of the environmental impact of human activities has increased the demand for sustainable practices in various sectors. This has generated opportunities for environmental consulting firms to advise businesses on implementing sustainable practices.

- Environmental consulting services are required due to the rising pollution levels in the world. These services support government and commercial efforts to resolve environmental issues, adhere to rules, and lessen environmental effects. The pressing need to manage pollution and environmental harm drives the global environmental consulting market's rapid growth.

- The global environmental consulting market is driven by the shifting regulatory landscape and increased emphasis on firms' environmental friendliness. Globally, governments are enacting stricter environmental standards, and businesses are under more pressure to follow them and show their commitment to sustainability. Environmental consulting companies are essential in assisting businesses in navigating these rules and achieving their sustainability objectives.

- The sluggish adoption of sustainability across fast-growing economies presents a challenge for the global market for environmental consultancy. Like China and India, these economies are rapidly industrializing and degrading. However, the slow adoption rate of sustainability techniques in these nations presents a problem for environmental consulting companies looking to advance sustainability.

- The emergence of COVID-19 prompted the industrial sector to reconsider its old manufacturing methods, primarily driving digital transformation and smart manufacturing techniques throughout production lines. Manufacturers were also driven to develop and execute various novel and agile product and quality control approaches.

- Intense competition in the post-pandemic world is one of the most challenging problems in environmental consulting. Customers can choose an environmental consultant from a wide range of expertise by looking them up online. Lastly, to maintain their lead in the market, businesses must adopt a new competitive mindset and show off their unique qualities.

Environmental Consulting Market Trends

Public Sector End-user Industry is Expected to Hold Significant Market Share

- The public sector is a segment of the economy that includes all government-owned and operated entities. This encompasses everything from schools and hospitals to highways and bridges. The primary goal of the public sector is to provide services deemed necessary for societal well-being. These services are often given for free or at a reduced fee.

- Public sector environmental consulting is a type of management consulting that works with municipal, state, and federal governments and government agencies. Some large management consulting companies (BCG, McKinsey, Monitor, Booz&Co., and PA Consulting Group) do public sector engagements as part of their overall business.

- The public sector is critical to the efficient running of society. It delivers essential services that are required for the communities' well-being. Furthermore, the public sector is essential to promoting economic growth and stability.

- Governments typically employ consultants to provide temporary expert services in engineering, information technology, or strategy. Government officials state that consulting businesses provide specialized expertise and skills often unavailable to the public sector and are more effectively supplied through project-based contracts.

- Furthermore, governments in various public sectors worldwide are increasingly turning to consultants to help them meet their overall development goals. As a result of all these causes, the consulting business is expected to expand significantly in the coming years. For instance, in May 2022, Lufthansa partnered with BCG for strategy consulting services to assist their business recovery plan. The German government acquired a 20% interest in the firm, freeing up EUR 9 billion (USD 9.79 billion) to safeguard the troubled airline's immediate survival.

- An environmental consultant addresses issues, such as contamination of the land and water, waste management policies, environmental management systems, air assessment, environmental impact assessment, environmental audit, the management of legislative issues for clients, the development of conceptual models (identifying and considering potential contaminant sources), ongoing communication with clients, inspectors, and regulators identifying previous activities and any contamination when assessing property. The population and globalization have increased global waste volume. In recent years, according to a World Bank Group Report, the world has created 2.01 billion tonnes of municipal solid waste (MSW), with at least 33% of that-to put it mildly-not being managed ecologically sustainably.

- Worldwide, trash created per person per day averages 0.74 kilograms but varies greatly, ranging from 0.11 to 4.54 kilos. Despite having just 16% of the world's population, high-income nations create around 34% of the world's garbage or 683 million tonnes, and it is expected to grow to 3.40 billion tonnes by 2050. The United States and Denmark are two of the global highest per capita producers of municipal solid garbage. These nations' residents generate more than 800 kilograms of garbage annually on average.

North America is Expected to Hold the Significant Market Share

- Growing emphasis on environmentally friendly company practices, rising concerns about climate change, and regulatory requirements for environmental compliance are the key reasons propelling the environmental consulting market in the United States. The need for effective and efficient management of waste, pollution, and natural resources is also driving demand for environmental consulting services. In addition, expanding industrial sectors has given consulting companies a chance to offer environmental assessments and remedial services. The market for environmental consulting in the United States is increasing as a result of mergers and acquisitions within the sector.

- The necessity for enterprises to manage environmental hazards, as well as greater regulatory scrutiny and the importance of sustainability, are some of the factors driving the environmental consulting market in the United States. Increased regulatory scrutiny is a significant factor in the growth of the environmental consulting industry in the United States. The federal and state governments have implemented several environmental rules to safeguard the environment and public health.

- These regulations cover many areas, such as waste management, hazardous materials, and air and water quality. Organizations disregarding these standards risk severe penalties, such as fines and legal action. For assistance navigating the complicated regulatory landscape and ensuring compliance with environmental standards, many enterprises turn to environmental consulting firms.

- Numerous federal and provincial laws and regulations in Canada regulate sustainability and environmental preservation. These laws impose strict ecological requirements on businesses, such as controlling hazardous waste and reducing greenhouse gas emissions. Environmental consulting companies frequently need their skills to comply with these rules. The Canadian government recently unveiled its strategy for achieving net zero emissions by 2050. It will necessitate significant adjustments in how firms run their operations and boost demand for environmental consulting services.

- By 2030, the Canadian government wants to generate 90% of its electricity from renewable resources. Projects using renewable energy, such as wind and solar farms, have grown due to this. For these projects, environmental consulting companies are frequently hired to conduct environmental impact analyses and guarantee regulatory compliance.

Environmental Consulting Industry Overview

The environmental consulting market is highly fragmented, with the presence of major players like Jacobs Solutions Inc., AECOM, WSP Global Inc., Stantec Inc., and Ramboll Group AS. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- September 2022 - Tetra Tech acquired RPS Group PLC. This acquisition aims to help the company to expand its global presence. The RPS Group significantly extends Tetra Tech's water practice in the United Kingdom and strengthens Tetra Tech's leadership position in renewable energy and environmental management. The merger expands the geographic footprint in the United Kingdom, the European Union, and Australia.

- August 2022 - Arup entered various contracts and agreements, expanding its existing operations and strengthening its market position. The company partnered with Matidor.com to enable civil engineers to model multiple urban planning scenarios and calculate and optimize energy efficiency in real-time to develop the best-performing model to achieve maximum environmental impact. In the same month, the company secured a contract from Velindre University NHS Trust to develop Velindre Cancer Centre in the United Kingdom.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitutes

- 4.3 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Alarming Levels of Pollution Globally

- 5.1.2 Changing Regulatory Landscape With Enhanced Stress on Environmental Friendliness of Organizations

- 5.2 Market Restraints

- 5.2.1 Low Movement Toward Sustainability Across Aggressively Growing Economies

- 5.3 Key Trend Analysis Within Various Services

- 5.3.1 Sustainability Strategy

- 5.3.2 Alternative Energy Development and Energy Efficiency

- 5.3.3 Environmental Due Diligence

- 5.3.4 EHS Management and Compliance

- 5.3.5 Groundwater Consultancy, Flood Protection Consultancy, Hydraulic and Hydrogeology

- 5.3.6 Air Quality and Hazardous Materials Management

- 5.3.7 Waste Management

6 MARKET SEGMENTATION

- 6.1 By End-user Industry

- 6.1.1 Energy and Power

- 6.1.2 Mining

- 6.1.3 Public Sector

- 6.1.4 Manufacturing

- 6.1.5 Other End-user Industries

- 6.2 By Geography

- 6.2.1 North America

- 6.2.1.1 United States

- 6.2.1.2 Canada

- 6.2.2 Europe

- 6.2.2.1 United Kingdom

- 6.2.2.2 Germany

- 6.2.2.3 Spain

- 6.2.2.4 Italy

- 6.2.2.5 France

- 6.2.2.6 Benelux

- 6.2.2.7 Poland

- 6.2.2.8 Rest of Europe

- 6.2.3 Asia-Pacific

- 6.2.3.1 China

- 6.2.3.2 Australia

- 6.2.3.3 Rest of Asia-Pacific

- 6.2.4 Latin America

- 6.2.4.1 Brazil

- 6.2.4.2 Rest of Latin America

- 6.2.5 Middle East & Africa

- 6.2.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Jacobs Solutions Inc.

- 7.1.2 AECOM

- 7.1.3 WSP Global Inc.

- 7.1.4 Stantec Inc.

- 7.1.5 Ramboll Group AS

- 7.1.6 Tetra Tech Inc.

- 7.1.7 The Erm International Group Limited

- 7.1.8 Arup

- 7.1.9 GHD

- 7.1.10 Sweco AB