|

市场调查报告书

商品编码

1693840

非洲聚对苯二甲酸乙二醇酯(PET)-市场占有率分析、产业趋势与统计、成长预测(2024-2029)Africa Polyethylene Terephthalate (PET) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

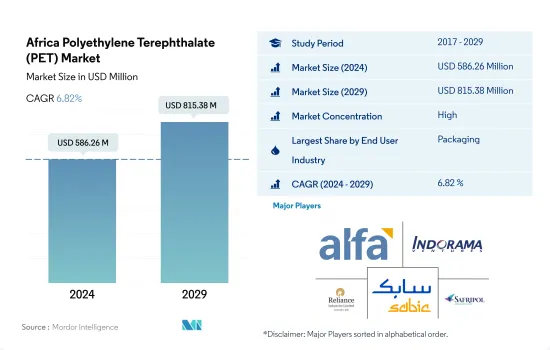

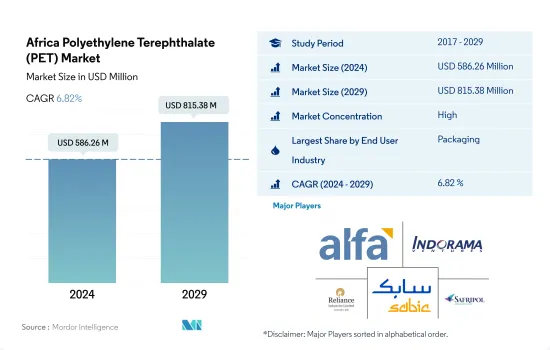

2024 年非洲聚对苯二甲酸乙二醇酯 (PET) 市场规模估计为 5.8626 亿美元,预计到 2029 年将达到 8.1538 亿美元,预测期内(2024-2029 年)的复合年增长率为 6.82%。

汽车领域PET需求成长最快

- 聚对苯二甲酸乙二醇酯是透明且半结晶质的,这使其适用于包装和电气电子行业的广泛应用,包括食品和饮料,特别是方便装的软饮料、果汁和水瓶装,电气封装的线圈形式,电气设备,螺线管和智能电錶。 2022年,非洲PET树脂市场价值与2021年相比成长了7.69%。

- 包装产业是该地区市场最大的终端用户产业,其主要原因是家庭规模变小、单人家庭数量大幅增加,对功能性、预包装和方便食品的需求不断增长。预计2022年非洲塑胶包装产量将达313万吨,预测期内(2023-2029年)的复合年增长率为4.69%。由于这些因素,预计预测期内对聚对苯二甲酸乙二醇酯的需求将会增加。

- 汽车是该地区收入成长最快的终端用户产业,预计在预测期内(2023-2029 年)的复合年增长率为 10.59%。技术创新的快速步伐正在推动对更新、更快的汽车产品的需求。随着非洲各国政府采取措施推广电动车,预计不久的将来对 PET 的需求将会上升。该地区的汽车产量预计将从 2022 年的 119 万辆增加到 2029 年的 174 万辆。因此,该地区汽车产量的成长预计将在未来推动对 PET 树脂的需求。

南非仍是非洲最大的PET消费国

- PET 在包装和电气电子行业中有着广泛的应用,包括食品和饮料的包装,特别是方便装软性饮料、水、线圈包装、电气封装、电气设备和智慧电錶。 2022年,非洲将占全球PET树脂消费量的约2.15%。 PET树脂具有多种特性,也用于其他各种行业。

- 由于南非包装产量不断增加,南非成为该地区最大的 PET 树脂消费国。 2022 年,南非包装产业在非洲 PET 市场的收益占有率为 25.79%。预计2022年该国塑胶包装产量将以年均2.20%的速度成长,达到约94万吨。此外,南非是该地区成长最快的国家,以金额为准年增长率为 6.24%,这可能会在未来几年推动市场需求的增加。

- 尼日利亚是非洲 PET 树脂市场第二大国家,预计预测期内(2023-2029 年)的以金额为准年增长率为 5.86%。由于塑胶包装产量的增加,该国对 PET 树脂的需求正在大幅增加。该国塑胶包装产量将从2021年的约28万吨增加到2022年的约30万吨。

- 汽车业是非洲地区成长最快的终端用户产业,预计预测期内收益复合年增长率约为 10.59%。一些非洲国家正在投资当地汽车製造业,以满足日益增长的汽车需求并减少对进口的依赖。

非洲聚对苯二甲酸乙二酯(PET)市场趋势

製造业扩张以满足激增的需求

- 南非是非洲领先的製造地。其製造能力、高效的物流网络和优惠的区域市场进入使南非成为寻求供应非洲的电子公司的理想之地。南非电子产业多元化,涵盖电子机械、家用电子电器产品、通讯设备、消费性电子产品等。 2022年,非洲地区进口满足其本土电气和电子设备需求的约70%。

- 家用电子电器产业仍高度依赖进口。据估计,2018年南非进口了非洲60%的消费性电子产品。 2020年,由于政府采取大规模封锁措施以及封锁导致的供应链中断,该国电气和电子设备产量销售年增率下降与前一年同期比较3.2%。在功能手机领域,由于厂商持续从功能手机转型为入门级智慧型手机,出货量较去年与前一年同期比较下降 26.6% 至 2,190 万台。所有这些因素导致该地区电气和电子元件产量下降,2020-2022 年期间的复合年增长率为 -9.41%。

- 政府致力于促进和支持国内製造、研发以及製定电气和电子製造的安全标准。预计预测期内(2023-2029 年),电气和电子元件产量的复合年增长率将达到 6.28%,以满足非洲新兴中产阶级的需求。

非洲聚对苯二甲酸乙二醇酯(PET)产业概况

非洲聚对苯二甲酸乙二醇酯(PET)市场相当集中,前五大企业占100%的市占率。该市场的主要企业包括 Alfa SAB de CV、Indorama Ventures Public Company Limited、Reliance Industries Limited、SABIC、KAP Diversified Industrial (Pty) Ltd 的 Safripol 部门等。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章执行摘要和主要发现

第二章 报告要约

第三章 引言

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 产业主要趋势

- 最终用户趋势

- 航太

- 车

- 建筑与施工

- 电气和电子

- 包装

- 进出口趋势

- 聚对苯二甲酸乙二酯(PET)贸易

- 价格趋势

- 形态趋势

- 回收概述

- 聚对苯二甲酸乙二醇酯(PET)的回收趋势

- 法律规范

- 奈及利亚

- 南非

- 价值炼和通路分析

第五章市场区隔

- 最终用户产业

- 车

- 建筑与施工

- 电气和电子

- 工业/机械

- 包装

- 其他的

- 国家

- 奈及利亚

- 南非

- 其他非洲国家

第六章竞争格局

- 关键策略趋势

- 市场占有率分析

- 商业状况

- 公司简介

- Alfa SAB de CV

- Far Eastern New Century Corporation

- Indorama Ventures Public Company Limited

- JBF Industries Ltd

- Reliance Industries Limited

- SABIC

- Safripol division of KAP Diversified Industrial(Pty)Ltd

第七章 CEO 的关键策略问题

第 8 章 附录

- 世界概况

- 概述

- 五力分析框架(产业吸引力分析)

- 全球价值链分析

- 市场动态(DRO)

- 资讯来源及延伸阅读

- 图片列表

- 关键见解

- 数据包

- 词彙表

The Africa Polyethylene Terephthalate (PET) Market size is estimated at 586.26 million USD in 2024, and is expected to reach 815.38 million USD by 2029, growing at a CAGR of 6.82% during the forecast period (2024-2029).

Automotive segment to record the fastest-growing demand for PET

- Polyethylene terephthalate has a transparent and semi-crystalline nature, which makes it suitable for a wide range of applications in the packaging and electrical and electronics industries, such as packaging foods and beverages, especially in the bottling of convenience-sized soft drinks, juices, and water, and coil forms for electrical encapsulation, electrical devices, solenoids, and smart meters. In 2022, the African PET resin market grew by 7.69% in value over 2021.

- The packaging segment is the largest end-user industry in the regional market due to significant factors such as the sizes of families becoming smaller and a substantial increase in single-person homes, which is resulting in higher demand for functional, prepackaged, and convenient food products. African plastic packaging production reached a volume of 3.13 million tons in 2022 and is likely to record a CAGR of 4.69% during the forecast period (2023-2029). Such factors are expected to increase the demand for polyethylene terephthalate in the region during the forecast period.

- Automotive is the fastest-growing end-user industry in the region by revenue, expected to record a CAGR of 10.59% during the forecast period (2023-2029). The rapid pace of technological innovation is driving demand for newer and faster automotive products. The initiatives taken by governments in the African region to promote electric vehicles in their respective countries are expected to boost the demand for PET in the near future. The region's vehicle production is projected to reach 1.74 million units by 2029, growing from 1.19 million units in 2022. As a result, the increase in automotive production in the region is projected to drive the demand for PET resin in the future.

South Africa to remain the major PET consumer in Africa

- PET has a wide range of applications in the packaging and electrical and electronics industries, including in packaging foods and beverages, specifically convenience-sized soft drinks, water, coil forms, electrical encapsulation, electrical devices, and smart meters. Africa accounted for nearly 2.15% of the global consumption of PET resin in 2022. The resins exhibit versatile properties, which find applications in various other industries as well.

- South Africa is the region's largest consumer country of PET resin due to the rising packaging production in the country. South Africa's packaging industry held a revenue share of 25.79% in 2022 in the African PET market. Plastic packaging production in the country increased at an annual rate of 2.20% in 2022 and reached around 0.94 million tons. South Africa is also the fastest-growing country in the region, with a CAGR of 6.24% by value, and it is likely to create more demand for the market in the future.

- Nigeria is the second-largest country in the African PET resin market, which is expected to register a CAGR of 5.86% in terms of value during the forecast period (2023-2029). The country's demand for PET resin is increasing significantly due to rising plastic packaging production. The plastic packaging production in the country reached around 0.30 million tons in 2022 from around 0.28 million tons in 2021.

- Automotive is the fastest-growing end-user industry in the African region, which is expected to register a revenue CAGR of around 10.59% over the forecast period. Several African countries are investing in local automotive manufacturing to meet the growing demand for vehicles and reduce reliance on imports.

Africa Polyethylene Terephthalate (PET) Market Trends

Manufacturing on the rise to tackle the rapidly growing demand

- South Africa is the leading manufacturing hub in Africa. Its manufacturing capabilities, efficient logistics network, and preferential regional market access position the country as an ideal location for electronics companies seeking to supply their products to Africa. South Africa has a diverse electronics industry that ranges from electrical machinery, household appliances, and telecommunication equipment to consumer electronics. In 2022, the African region imported around 70% of its local electrical and electronics demand.

- The consumer electronics industry still relies heavily on imports. According to estimates, South Africa brought 60% of all consumer electronics into Africa in 2018. In 2020, the electrical and electronic production in the country decreased at a growth rate of around 3.2%, by revenue, compared to the previous year, owing to the widespread lockdown adopted by the government and the supply chain disruption faced due to the lockdown. In the feature phone space, shipments were down by 26.6% to 21.9 million units as vendors were transitioning away from these devices toward entry-level smartphones. All such factors led to a decrease in the production of electrical and electronic components in the region at a CAGR of -9.41% from 2020 to 2022.

- The government is focused on promoting and supporting domestic manufacturing, R&D, and developing safety standards for the electrical and electronics manufacturing industry. The output of electrical and electronic industrial components is anticipated to record a CAGR of 6.28% during the forecast period (2023-2029) to supply the emerging African middle-class population.

Africa Polyethylene Terephthalate (PET) Industry Overview

The Africa Polyethylene Terephthalate (PET) Market is fairly consolidated, with the top five companies occupying 100%. The major players in this market are Alfa S.A.B. de C.V., Indorama Ventures Public Company Limited, Reliance Industries Limited, SABIC and Safripol division of KAP Diversified Industrial (Pty) Ltd (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 End User Trends

- 4.1.1 Aerospace

- 4.1.2 Automotive

- 4.1.3 Building and Construction

- 4.1.4 Electrical and Electronics

- 4.1.5 Packaging

- 4.2 Import And Export Trends

- 4.2.1 Polyethylene Terephthalate (PET) Trade

- 4.3 Price Trends

- 4.4 Form Trends

- 4.5 Recycling Overview

- 4.5.1 Polyethylene Terephthalate (PET) Recycling Trends

- 4.6 Regulatory Framework

- 4.6.1 Nigeria

- 4.6.2 South Africa

- 4.7 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 End User Industry

- 5.1.1 Automotive

- 5.1.2 Building and Construction

- 5.1.3 Electrical and Electronics

- 5.1.4 Industrial and Machinery

- 5.1.5 Packaging

- 5.1.6 Other End-user Industries

- 5.2 Country

- 5.2.1 Nigeria

- 5.2.2 South Africa

- 5.2.3 Rest of Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 Alfa S.A.B. de C.V.

- 6.4.2 Far Eastern New Century Corporation

- 6.4.3 Indorama Ventures Public Company Limited

- 6.4.4 JBF Industries Ltd

- 6.4.5 Reliance Industries Limited

- 6.4.6 SABIC

- 6.4.7 Safripol division of KAP Diversified Industrial (Pty) Ltd

7 KEY STRATEGIC QUESTIONS FOR ENGINEERING PLASTICS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework (Industry Attractiveness Analysis)

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms