|

市场调查报告书

商品编码

1693846

中东聚醚醚酮(PEEK):市场占有率分析、产业趋势与成长预测(2024-2029年)Middle East Polyether Ether Ketone (PEEK) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

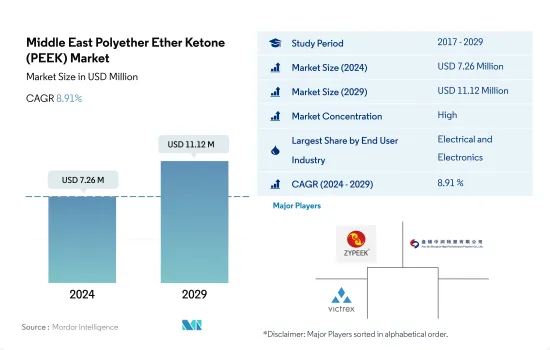

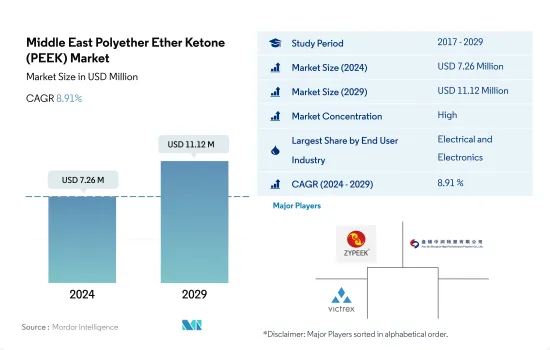

中东聚醚醚酮 (PEEK) 市场规模预计在 2024 年为 726 万美元,预计到 2029 年将达到 1,112 万美元,在预测期内(2024-2029 年)的复合年增长率为 8.91%。

电子产业可能主导 PEEK 需求

- 聚醚醚酮 (PEEK) 材料因其重量轻、强度高、低疲劳和低可燃性等优良特性而受到许多行业的欢迎。它的可燃性较低,可承受高达近 600°C 的温度。中东在全球PEEK市场的销售份额为1.03%。

- 受新冠疫情的影响,2020年中东PEEK市场出现下滑。与 2019 年相比,该市场的以收益为准下降了 4.33%。供应链中断、原材料短缺以及该地区多个国家的全国封锁影响了市场。但由于原料供应稳定,PEEK树脂收益将季增,2022年的成长率将达到15.32%。

- PEEK 树脂广泛用于中东市场的其他终端用户工业领域。该地区生产由 PEEK 树脂製成的消费品,包括厨房和家居用品、家具和体育用品。预计未来几年消费品和医疗设备需求的成长将推动对 PEEK 树脂的需求。

- 在中东,电气和电子是 PEEK 树脂成长最快的终端用户产业,预计 2023-2029 年的收益预测期复合年增长率为 10.71%。预计到 2029 年,该产业对 PEEK 树脂的消费量将达到约 22.59 吨。中东地区半导体产量的成长预计将推动对 PEEK 树脂的需求。例如,沙乌地阿拉伯先进电子公司(AEC)签署了一份谅解备忘录,旨在加速该国数位生态系统的发展,包括实现半导体晶片製造的在地化。

阿联酋各行业对 PEEK 的需求超过沙乌地阿拉伯

- 2022年中东将占全球PEEK消费量的1.03%。在中东,PEEK是汽车、航太、电气和电子等各行业的重要聚合物。

- 由于航太、汽车、电气和电子工业的不断发展,阿联酋是该地区最大的 PEEK 消费国。航太零件生产占中东市场总收益占有率的 17.2%。预计2023年将达5.33亿美元,2029年将达8.02亿美元。

- 由于汽车产量增加和电子产业不断发展,沙乌地阿拉伯对 PEEK 树脂的需求正在大幅增长。沙乌地阿拉伯是该地区第二大汽车生产国。 2022年产量为12,780辆。该国的电子产品市场也不断扩大,电子产品生产收入预计将从 2022 年的 126.8 亿美元增加到 2029 年的 233.3 亿美元。

- 中东其他地区包括伊朗、伊拉克、土耳其、叶门、阿曼和其他国家。中东其他地区的汽车产量预计将从 2023 年的 119 万辆增至 2029 年的 136 万辆,这可能会推动该地区对树脂的需求。

- 阿拉伯联合大公国是 PEEK 树脂成长最快的消费国,预测期内以金额为准复合年增长率为 10.27%。预计到 2027 年,航太和电气电子产业将分别占收益的 12% 和 51%,从而推动对 PEEK 树脂的需求。阿联酋航太业的收益和预测期内复合年增长率将达到 8.51%,从而推动对 PEEK 树脂的需求。

中东聚醚醚酮(PEEK)市场趋势

政府和私人企业增加投资

- 在中东,沙乌地阿拉伯已迅速崛起为电气电子产业主要市场之一。除石油和天然气工业外,沙乌地阿拉伯还拥有庞大的消费基础和广泛的工业,这有助于其电气和电子工业年产量的快速成长。因此,2017年至2019年期间,该地区电气和电子设备生产以收益为准的复合年增长率为18%。

- 2020年,新冠疫情增加了远距办公和家庭娱乐家用电子电器产品的需求。 2020年,沙乌地阿拉伯的智慧型手机普及率达到全球最高,约97%,约60%的沙乌地阿拉伯消费者能够透过社群网路发现新的卖家。沙乌地阿拉伯电子商务成长近60%(2019-2020年),主要原因是受到疫情的影响。电气和电子产品生产收益比上年度增长1.8%。

- 预计预测期内(2023-2029 年),电气和电子製造业的复合年增长率为 8.51%。成长的主要动力可能是政府和三星等製造商的投资增加。三星也在中东推广其 5G 无线技术。沙乌地阿拉伯已根据其「2030愿景」计画推出了5G网路。预计所有这些因素都将在预测期内促进该地区的电子产品生产。

中东聚醚醚酮(PEEK)产业概览

中东聚醚醚酮(PEEK)市场相当集中,前三大公司占了81.76%的市占率。该市场的主要企业有吉林联合聚合物、盘锦中润高性能聚合物、威格斯等。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章执行摘要和主要发现

第二章 报告要约

第三章 引言

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 产业主要趋势

- 最终用户趋势

- 航太

- 车

- 建筑与施工

- 电气和电子

- 包装

- 法律规范

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 价值炼和通路分析

第五章市场区隔

- 最终用户产业

- 航太

- 车

- 电气和电子

- 工业/机械

- 其他的

- 国家

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 其他中东地区

第六章竞争格局

- 重大策略倡议

- 市场占有率分析

- 商业状况

- 公司简介

- Jilin Joinature Polymer Co., Ltd.

- Pan Jin Zhongrun High Performance Polymer Co.,Ltd

- Victrex

第七章:CEO面临的关键策略问题

第 8 章 附录

- 世界概况

- 概述

- 五力分析框架(产业吸引力分析)

- 全球价值链分析

- 市场动态(DRO)

- 资讯来源及延伸阅读

- 图片列表

- 关键见解

- 数据包

- 词彙表

简介目录

Product Code: 5000184

The Middle East Polyether Ether Ketone (PEEK) Market size is estimated at 7.26 million USD in 2024, and is expected to reach 11.12 million USD by 2029, growing at a CAGR of 8.91% during the forecast period (2024-2029).

Electronics industry may dominate the demand for PEEK

- Polyetheretherketone (PEEK) material is prevalent in many industries due to its lightweight and high quality in terms of strength, low fatigue, and low flammability. Due to its low flammability, it can withstand combustion up to nearly 600°C. The Middle East has a 1.03% share of the revenue in the global PEEK market.

- The PEEK market in the Middle East recorded a dip in 2020 due to the impact of COVID-19. The market declined by 4.33% in terms of revenue compared to 2019. The supply chain disruptions, raw material shortage, and nationwide lockdown in several countries in the region have impacted the market. However, due to a consistent supply of raw materials, revenue for PEEK resin increased in successive years, with a growth rate of 15.32% in 2022.

- PEEK resin is commonly used in other-end user industries segment of the Middle East market. The region produces consumer goods, such as kitchen and household utensils, furniture, and sports equipment, using PEEK resin. The rising demand for consumer goods and medical equipment is expected to drive the demand for PEEK resin in the coming years.

- Electrical and electronics is expected to be the fastest-growing end-user industry for PEEK resin in the Middle East, with an expected CAGR of 10.71% in terms of revenue during the forecast period of 2023-2029. The consumption of PEEK resin in the industry is expected to reach around 22.59 tons by 2029. The rising semiconductor production in the Middle East is expected to drive the demand for PEEK resin. For instance, Saudi Arabia's Advanced Electronics Company (AEC) signed an MoU aimed at accelerating the Kingdom's digital ecosystem development, including the localization of semiconductor chip manufacturing.

United Arab Emirates to overtake Saudi Arabia due to demand for PEEK in various industries

- The Middle East accounted for 1.03% of the global PEEK consumption in 2022. PEEK is a key polymer in the Middle East for various industries, including automotive, aerospace, and electrical and electronics.

- The United Arab Emirates (UAE) is the largest consumer of PEEK in the region due to its growing aerospace, automotive, and electrical and electronics industries. Aerospace component production held a revenue share of 17.2% of the overall Middle Eastern market. It is expected to reach USD 802 million by 2029 from USD 533 million in 2023.

- Saudi Arabia's demand for PEEK resin is increasing significantly due to rising vehicle production and the growing electronics industry. Saudi Arabia is the region's second-largest vehicle producer. In 2022, the country produced 12,780 units. Its electronics market is also expanding, and the electronics production revenue is expected to reach USD 23.33 billion in 2029 from USD 12.68 billion in 2022.

- The Rest of Middle East regional segment comprises Iran, Iraq, Turkey, Yemen, Oman, and other countries. Automotive production in the Rest of Middle East is expected to reach 1.36 million units by 2029 from 1.19 million units in 2023, which may drive the resin demand in the region.

- The United Arab Emirates is the fastest-growing consumer of PEEK resin, with a CAGR of 10.27% in terms of value during the forecast period. The revenue of the aerospace and electrical and electronics industries are expected to account for shares of 12% and 51%, respectively, in 2027, thus boosting the demand for PEEK resin. The UAE aerospace industry is expected to record a CAGR of 8.51% by revenue during the forecast period, thus driving the demand for PEEK resin.

Middle East Polyether Ether Ketone (PEEK) Market Trends

Growing investments from the government and private players

- In the Middle East, Saudi Arabia is quickly emerging as one of the key markets for the electrical and electronics industry. Aside from the oil and gas industry, the country has a sizable consumer base and a broad range of industrial pursuits, contributing to the rapid annual increase in production for the electrical and electronics industry. Thus, electrical and electronics production in the region registered a CAGR of 18% from 2017 to 2019 in revenue terms.

- In 2020, the demand for consumer electronics for remote working and home entertainment increased due to the COVID-19 pandemic. In 2020, Saudi Arabia registered the highest smartphone penetration rate, around 97%, in the world, which enabled approximately 60% of Saudi customers to discover new sellers through social networks. Saudi Arabia faced a higher rate of e-commerce growth, nearly 60% (between 2019 and 2020), mainly due to the pandemic. The revenue from electrical and electronics production increased by 1.8% compared to the previous year.

- Electrical and electronic production is expected to witness a CAGR of 8.51% in value during the forecast period (2023-2029). The major driving component behind the growth is likely to be the growing investments from the government and the manufacturers like Samsung. Samsung has also been pitching its 5G wireless technology to the Middle East. Saudi Arabia implemented a 5G network in line with the Vision 2030 initiative. All such factors are expected to boost electronics production over the forecast period in the region.

Middle East Polyether Ether Ketone (PEEK) Industry Overview

The Middle East Polyether Ether Ketone (PEEK) Market is fairly consolidated, with the top three companies occupying 81.76%. The major players in this market are Jilin Joinature Polymer Co., Ltd., Pan Jin Zhongrun High Performance Polymer Co.,Ltd, Victrex (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 End User Trends

- 4.1.1 Aerospace

- 4.1.2 Automotive

- 4.1.3 Building and Construction

- 4.1.4 Electrical and Electronics

- 4.1.5 Packaging

- 4.2 Regulatory Framework

- 4.2.1 Saudi Arabia

- 4.2.2 United Arab Emirates

- 4.3 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 End User Industry

- 5.1.1 Aerospace

- 5.1.2 Automotive

- 5.1.3 Electrical and Electronics

- 5.1.4 Industrial and Machinery

- 5.1.5 Other End-user Industries

- 5.2 Country

- 5.2.1 Saudi Arabia

- 5.2.2 United Arab Emirates

- 5.2.3 Rest of Middle East

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 Jilin Joinature Polymer Co., Ltd.

- 6.4.2 Pan Jin Zhongrun High Performance Polymer Co.,Ltd

- 6.4.3 Victrex

7 KEY STRATEGIC QUESTIONS FOR ENGINEERING PLASTICS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework (Industry Attractiveness Analysis)

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219