|

市场调查报告书

商品编码

1693901

Wi-Fi 路由器:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Wi-Fi Router - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

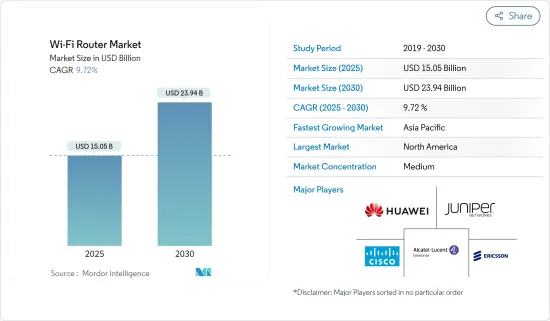

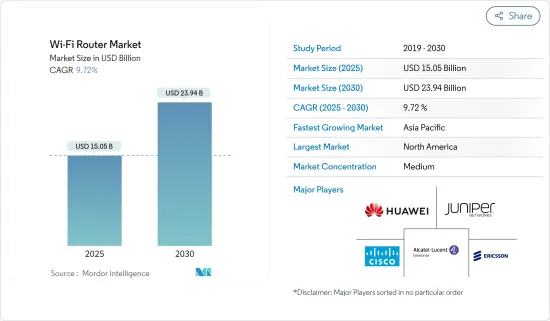

预计 2025 年 Wi-Fi 路由器市场规模为 150.5 亿美元,到 2030 年将达到 239.4 亿美元,预测期内(2025-2030 年)的复合年增长率为 9.72%。

还有更多。

随着越来越多的客户参与网页浏览、行动学习和其他线上相关活动,对更快网路存取的需求也日益增长。因此,在笔记型电脑、个人电脑和平板电脑中大量使用的无线路由器已成为人类生存的必需品。无线路由器在满足消费者对可靠网路存取日益增长的需求以及加强许多国家的网路连线方面发挥了关键作用。还有更多。

主要亮点

- 越来越多的客户参与电子商务交易、网页浏览、行动学习和其他线上相关活动,对更快的网路存取产生了需求。因此,在笔记型电脑、个人电脑和平板电脑中大量使用的无线路由器已成为人类生存的必需品。 Wi-Fi 路由器在加速消费者对可靠网路存取的需求以及加强许多国家的 Wi-Fi 连线方面发挥了关键作用。

- 医疗保健、教育、商业、金融服务和其他应用中连网装置的使用日益增多是全球无线路由器市场的主要驱动力之一。此外,中小企业采用自备设备政策也对市场成长产生了正面影响。此外,预计预测期内政府加大对智慧城市计划的投入将为市场扩张创造有利机会。

- 此外,通讯(ITU)预测,到2022年,全球将有53亿人(占全球人口的66%)使用网路。这比 2019 年成长了 24%,预计 2019 年将有 11 亿人加入网路。网路普及率的提高将为国内外无线路由器厂商推出新产品、提高频宽、抢占更大市场占有率创造机会。

- 此外,思科年度网际网路报告预测,到 2023 年,连网装置和连线的数量将达到近 300 亿,高于 2018 年的 184 亿。到 2023 年,物联网设备将占所有连网装置的 50%(147 亿),高于 2018 年的 33%(61 亿)。此外,据思科称,固定网路 IP 流量将从 2016 年的 65,942 台装置成长到 2021 年的 187,386 台装置。互联网流量的这种增长可能会推动所研究的市场。

- 此外,统计计数器显示,在加拿大,2022 年 1 月行动流量占所有网站流量的 38.04% 以上,低于 2020 年的 40.95%。桌上型电脑和笔记型电脑继续主导加拿大的网路使用。互联网连接设备的增加可能会促进市场的成长。

- 随着数位化化技术的不断普及,这一数字可能还会增加。城市地区的交通量比以前高很多。近年来,第四代长期演进(4G/LTE)行动宽频网路大大促进了跨辖区和跨部门的通讯互通性。

Wi-Fi路由器市场趋势

零售和电子商务预计将占据很大市场份额

- 电子商务(electronic commerce)是透过网路购买和销售商品和服务。它包括一系列针对线上买家和卖家的数据、系统和工具,包括用于行动购物和线上付款的加密。大多数拥有线上业务的企业都使用线上商店或平台来进行电子商务行销和销售活动,以及监督物流和履约。这种电子商务趋势可能会刺激对 Wi-Fi 路由器的需求,以便消费者可以访问任何网路购物网站。

- 越来越多的客户参与电子商务交易、网页浏览、行动学习和其他线上相关活动,对更快的网路存取产生了需求。因此,笔记型电脑、个人电脑和平板电脑中普遍使用的无线路由器已成为人类生存的必需品。 Wi-Fi 路由器在加速消费者对可靠网路存取的需求以及加强许多国家的 Wi-Fi 连线方面发挥了关键作用。

- 根据GSMA(全球行动通讯系统协会)的情报数据,截至2022年初,新加坡拥有870万个活跃的行动连线。此外,到 2022 年 1 月,新加坡的行动连线将占其总人口的 147%。该地区的互联网普及率可能会推动电子商务市场的发展。此外,根据新加坡统计局的数据,到 2022 年,电脑和通讯设备的线上销售额将占总销售额的 47.4%。相较之下,30%的家具和家电都是在网路上购买的。该地区线上购物的成长可能为新参与者进入市场创造重大机会,同时也为国际参与者机会在新加坡的业务创造重大机会。

- 根据通讯(MoTC) 的数据,卡达以平均 264 美元的交易额位居中东地区首位。此外,去年该国有 350 家电子商务企业投入运营,预计未来六个月内还将有 66 家电子商务企业开业,截至去年 12 月底,电子商务企业总数将达到 416 家。

- 此外,卡达的电子商务渗透率为62.1%。此外,以属性看网路购物,最大的群体是卡达人(22%),其次是西方人(17%)、阿拉伯人(19%)、亚洲人(20%)和其他人群(22%)。卡达是中东和北非 (MENA) 地区 (与海湾合作委员会相比) 每位用户年度平均电子商务支出最高的国家,其每笔线上交易的平均价值也超过了海湾合作委员会的平均水平。

- 根据 Kibo Commerce 的数据,在美国,2022 年第二季 2.3% 的电商网站流量促成了购买。在英国,线上购物者的转换率上升至 4% 以上。儘管行动商务在页面浏览量和收益方面正在迎头赶上,但传统的透过个人电脑进行的网路购物仍然占据主导地位。线上用户转换率的提高对学生市场产生了积极影响。

预计北美将占据很大市场份额

- 美国是技术发展、商业数位化和互联网使用的领先国家之一。为了满足国家数位转型进程的要求,高速网路的需求已变得至关重要。根据Cisco预测,北美地区的平均Wi-Fi网路连线速度将从2020年的70.7 Mbps提升至2023年的109.5 Mbps。如此巨大的网速可能会鼓励玩家开发能够支援这种网速的新型Wi-Fi路由器。

- 美国政府与美国私营部门合作,致力于支持泰国4.0。 2022 年,美国和泰国政府及企业主管启动了研讨会,共用有关 6 GHz 频谱分配和下一代 Wi-Fi 技术意义的知识。除了提高家庭 Wi-Fi 速度外,研讨会还有望进一步巩固泰国作为先进製造业和工业创新中心的地位。两国之间的此次伙伴关係预计将推动美国Wi-Fi製造商市场的发展。

- 为了增加市场占有率,该地区的公司正在以经济的价格推出最新产品。例如,美国路由器製造商 Linksys 计划于 2022 年 5 月推出双频 Wi-Fi 6 路由器,如 Hydra 6 和 Atlas 6。这些路由器以实惠的价格提供速度和效能,为混合工作、线上游戏、4K UHD 串流媒体等提供可靠的连接。

- 加拿大是一个经济发达的国家,人们有能力购买有用的智慧设备。此外,据思科称,到2023年,加拿大的网路用户数量预计将达到3530万,这表明该国的Wi-Fi路由器具有巨大的成长潜力,因为网路用户的增加将对Wi-Fi路由器产生积极影响。

- 该国对低延迟、高速网路服务的需求日益增长,许多全球参与者正在该国发布先进的 Wi-Fi 路由器和网状 Wi-Fi 路由器。例如,2022 年 10 月,Google在加拿大推出了支援 Wi-Fi 6E 的 Nest Wi-Fi Pro,这是其首款能够在三频网状网路中运作的路由器。在相容设备上,Wi-Fi 6E(E 代表扩展)使用新的、不太拥挤的 6 GHz 无线电频宽,提供高达 Wi-Fi 6 两倍的速度。

Wi-Fi路由器产业概况

Wi-Fi 路由器市场相当集中,有多家参与者,包括Cisco、爱立信、华为技术、Juniper Networks和阿尔卡特朗讯企业。每家公司都继续投资于策略伙伴关係和产品开发,以大幅增加市场占有率。还有更多。

2023 年 3 月,NETGEAR 发布了首款支援 Wi-Fi 7 的路由器 Nighthawk RS700。 NETGEAR 表示,三频设备专为低延迟 AR(扩增实境)/VR(虚拟实境)游戏、UHD Zoom 通话、同步 8K 串流等而设计。 RS700 具有新的塔式外形,让人联想到以前的 Nighthawk 路由器,并采用内建天线设计,可实现 360 度覆盖,覆盖面积达 3,500 平方英尺。还有更多。

2022 年 11 月,全球消费和商业网路产品供应商 TP-Link 宣布推出整个面向家庭和企业的 Wi-Fi 7 产品线。 TP-Link 为 ISP 市场推出全新 Wi-Fi 7 路由器、Omada EAP、Deco 产品、Aginet 产品,涵盖所有用例。 TP-Link 的新款 HomeShield 3.0 也提供了更可靠、更智慧的网路解决方案。作为性能最佳的 Archer 系列之一,Wi-Fi 7 路由器为您的家庭带来前所未有的体验。此次活动发表了三款新型Wi-Fi 7路由器。其中,Archer BE900 拥有四频 24Gbps Wi-Fi 7 速度,以及有别于传统路由器的全新设计。还有更多。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 生态系分析

- 产业吸引力-波特五力分析

- 买家的议价能力

- 供应商的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- COVID-19 市场影响评估

- 使用案例

第五章市场动态

- 市场驱动因素

- 网路流量增加以及消费者对网路设备的需求

- 数位化正在推动整个企业频宽需求呈指数级增长

- 市场限制

- 网路安全和网路管理的复杂性

- 行动宽频使用情况

第六章市场区隔

- 按类型

- 边缘路由器

- 核心路由器

- 按组织规模

- 中小企业

- 大型企业

- 按最终用户产业

- 卫生保健

- 运输和物流

- 零售与电子商务

- 製造业

- 政府

- BFSI

- 其他的

- 按地区

- 北美洲

- 欧洲

- 亚洲

- 澳洲和纽西兰

- 中东和非洲

- 拉丁美洲

第七章竞争格局

- 公司简介

- Cisco Systems Inc

- Ericsson Inc.

- Huawei Technologies Co.ltd

- Juniper Networks Inc.

- Alcatel Lucent Enterprise SAS

- ARUBA SPA

- Fortinet Inc.

- Panasonic Corporation

- Broadcom Inc

- Extreme Networks Inc.

第八章投资分析

第九章:未来趋势

The Wi-Fi Router Market size is estimated at USD 15.05 billion in 2025, and is expected to reach USD 23.94 billion by 2030, at a CAGR of 9.72% during the forecast period (2025-2030).

A growing number of customers are engaging in web browsing, mobile learning, and other online-related activities, driving the demand for faster Internet access. As a result, the wireless router, frequently utilized in laptops, PCs, and tablets, has become essential for human existence. Wireless routers are primarily responsible for the rising need among consumers to stay linked to dependable Internet and for enhancing internet connections in numerous nations.

Key Highlights

- A growing number of customers are engaging in e-commerce transactions, web browsing, mobile learning, and other online-related activities, driving the demand for faster Internet access. As a result, the wireless router, frequently utilized in laptops, PCs, and tablets, has become essential for human existence. Wi-Fi routers are mostly responsible for the rising need among consumers to stay linked to dependable Internet and for enhancing Wi-Fi connections in numerous nations.

- The increasing use of connected devices in healthcare, education, business, financial services, and other applications is one of the critical drivers of the worldwide wireless router market. Additionally, the market growth is positively impacted by small and medium businesses adopting a bring your device policy. Further, during the projected period, a rise in government initiatives for smart city projects is anticipated to create lucrative opportunities for market expansion.

- Further, in 2022, the International Telecommunication Union (ITU) estimates that 5,300 Million people, or 66% of the world's population, will use the Internet. This marks a 24% growth from 2019, with an expected 1.1 billion individuals joining the Internet throughout that time. The advancement in Internet penetration will create opportunities for international and local Wireless router vendors to introduce new products and improve the bandwidth to capture a significant market share.

- Moreover, By 2023, there will be close to 30 billion network-connected devices and connections, up from 18.4 billion in 2018, predicts Cisco's Annual Internet Report. By 2023, IoT devices will drive up 50% (14.7 billion) of all networked devices, up from 33% (6.1 billion) in 2018. Further, according to Cisco, the fixed internet IP traffic has increased from 65,942 units in 2016 to 1,87,386 units in 2021. Such a rise in internet traffic will drive the studied market.

- Further, according to the stats counter, in Canada, mobile traffic accounted for more than 38.04 % of all website traffic in January 2022, down from 40.95% in 2020. In Canada, desktops and laptops continue to dominate web usage. Such a rise in Internet-connected devices would allow the studied market to grow.

- As digitization adaptation increases, this amount will increase even more. Traffic in metro areas has significantly increased as compared to prior years. In recent years, inter-jurisdictional and inter-disciplinary communications interoperability was greatly aided by the fourth generation Long Term Evolution (4G/LTE) mobile broadband networks.

Wi-Fi Router Market Trends

Retail and E-commerce are Expected to Hold Significant Share of the Market

- E-commerce (or electronic commerce) is the buying and selling of goods or services on the Internet. It encompasses various data, systems, and tools for online buyers and sellers, including mobile shopping and online payment encryption. Most businesses with an online presence use an online store and/or platform to conduct ecommerce marketing and sales activities and to oversee logistics and fulfillment. Such trends in E-commerce would drive the demand for Wi-Fi routers so that consumers can have access to any online shopping site.

- A growing number of customers are engaging in e-commerce transactions, web browsing, mobile learning, and other online-related activities, driving the demand for faster internet access. As a result, the wireless router, frequently utilized in laptops, PCs, and tablets, has become essential for human existence. Wi-Fi routers are mostly responsible for the rising need among consumers to stay linked to dependable Internet and for enhancing Wi-Fi connections in numerous nations.

- At the beginning of 2022, Singapore had 8.70 million active mobile connections, according to data from Groupe Speciale Mobile Association (GSMA) Intelligence. Furthermore, mobile connections in Singapore were equivalent to 147% of the total population in January 2022. Such internet penetration in the region will drive the e-commerce market. Furthermore, According to the Singapore Department of Statistics, in 2022, online computer and telecommunications equipment sales accounted for 47.4% of total sales. In comparison, 30% of furniture and household equipment were acquired online. Such a rise in online purchases in the region will significantly create an opportunity for new players to enter the market and for international players to expand their presence in Singapore.

- According to the Ministry of Transport and Communications (MoTC), Qatar leads the Middle Eastern countries in terms of the average value of a single transaction at USD 264 per transaction. Moreover, 350 e-commerce companies were operating in the country last year, and 66 more e-commerce companies opened in the next six months, bringing the total to 416 by the end of December last year.

- Further, in Qatar, e-commerce penetration is 62.1%. Also, online shoppers by demographics, Qataris (22%), are the most likely to shop online, followed by Westerners (17%), Arabs (19%), Asians (20%), and others (22%). Qatar has the most significant average yearly e-commerce spend per user in the Middle East and Northern Africa (MENA) area (relative to the GCC), and the average value per online transaction is greater than the GCC average.

- According to Kibo Commerce, During the second quarter of 2022, 2.3% of visits to e-commerce websites in the United States converted to purchases. In Great Britain, online shopper conversion rates rose to over four percent. Although mobile commerce is catching up regarding page views and revenue, traditional online shopping via PC still holds the top. Such a rise number of online users' conversion rates positively impact the student market.

North America is Expected to Hold Significant Share of the Market

- The United States is one of the leading countries in terms of technological development, digitalization of businesses, and internet usage. The requirement of high-speed internet is becoming essential to match the requirement for the country's digital transformation journey. According to Cisco Systems, the average Wi-Fi network connection speed in North America was 109.5 Mbps in 2023, an increase from 70.7 Mbps in 2020. Such huge speed internet would push the players to develop new Wi-Fi routers to support such internet speeds.

- The United States government is engaged in assisting Thailand 4.0., as they were collaborating with America's private sectors. In 2022, the United States, the Royal Thai government, and business executives started a workshop to share knowledge on the significance of 6 GHz spectrum allocation and next-generation Wi-Fi technology, which will not only make home Wi-Fi faster but also further solidify Thailand's position as a hub of advanced manufacturing and industry innovation. These partnerships between the country will drive the market for Wi-Fi manufacturers in the USA.

- Companies in the region are launching updated products with economical prices to increase their market shares. For example, in May 2022, American router maker Linksys intends to introduce dual-band Wi-Fi 6 routers, including the Hydra 6 and Atlas 6. These routers would offer reliable connectivity for hybrid work, online gaming, 4K UHD streaming, and more because they are designed for speed and performance at a reasonable price.

- Canada is an economically developed country for which people can afford smart devices for their convenience, and the number of connected devices has been increasing in the country, fueled by internet penetration. According to Cisco,In addition, by 2023, there will be 35.3 million Internet users in Canada, which shows huge growth potential for the Wi-Fi routers in the country because the growth of Internet users will positively impact the Wi-Fi routers.

- The country's need for Internet services with low latency and increasing speed is increasing, and many global players are launching advanced Wi-Fi routers or meshed Wi-Fi routers in the country. For example, in October 2022, Google launched its Nest Wi-Fi Pro with Wi-Fi 6E support in Canada, the company's first router capable of operating in a triband mesh network. On compatible devices, Wi-Fi 6E (E for Extended), which uses the new, less-congested 6 GHz radio band, provides speeds up to two times quicker than Wi-Fi 6.

Wi-Fi Router Industry Overview

The Wi-Fi router market is moderately consolidated with the presence of several players like Cisco Systems Inc, Ericsson Inc., Huawei Technologies Co. Ltd., Juniper Networks Inc., Alcatel Lucent Enterprise, etc. The companies continuously invest in strategic partnerships and product developments to gain substantial market share.

In March 2023, NETGEAR introduced its first Wi-Fi 7-capable router, the Nighthawk RS700 - possibly one of the fastest consumer-grade networking devices capable of a 19 Gbps peak data rate. NETGEAR stated the tri-band unit is designed for low-latency AR(Augmented Reality)/VR (Virtual reality) gaming, UHD Zoom calls, 8k simultaneous streaming, and many more. The RS700 has a new tower-like shape not reminiscent of the last Nighthawk routers, which is designed to house antennas for 360-degree coverage of up to 3,500 square feet.

In November 2022, TP-Link, a global consumer and business networking product provider, released an entire home and business Wi-Fi 7 product line. TP-Link launched new Wi-Fi 7 routers, Omada EAPs, Deco products, and Aginet products for ISP markets to cover all usage scenarios. TP-Link's new HomeShield 3.0 also provides more reliable and smarter network solutions. Continuing as one of the top performances of the Archer series, Wi-Fi 7 routers bring unprecedented experiences to homes. Three Wi-Fi 7 routers were unveiled at the event. Among them, Archer BE900 has quad-band 24 Gbps Wi-Fi 7 speeds and has a brand new design reimagined from previous routers.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Ecosystem Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Buyers

- 4.3.2 Bargaining Power of Suppliers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the Impact of COVID-19 on the Market

- 4.5 Use Cases

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growth in Internet Traffic and Increasing Consumer Demand for Internet-enabled Devices

- 5.1.2 Exponential Increase in the Bandwidth Requirements across Enterprises owing to Digitization

- 5.2 Market Restraints

- 5.2.1 Network Security and Complexities Related to Network Management

- 5.2.2 Usage of Mobile Broadband

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Edge Router

- 6.1.2 Core Router

- 6.2 By Organization Size

- 6.2.1 SMEs

- 6.2.2 Large Enterprises

- 6.3 By End-User Industry

- 6.3.1 Healthcare

- 6.3.2 Transportation & Logistics

- 6.3.3 Retail & eCommerce

- 6.3.4 Manufacturing

- 6.3.5 Government

- 6.3.6 BFSI

- 6.3.7 Others

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia

- 6.4.4 Australia and New Zealand

- 6.4.5 Middle East and Africa

- 6.4.6 Latin America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Cisco Systems Inc

- 7.1.2 Ericsson Inc.

- 7.1.3 Huawei Technologies Co.ltd

- 7.1.4 Juniper Networks Inc.

- 7.1.5 Alcatel Lucent Enterprise SAS

- 7.1.6 ARUBA S.P.A

- 7.1.7 Fortinet Inc.

- 7.1.8 Panasonic Corporation

- 7.1.9 Broadcom Inc

- 7.1.10 Extreme Networks Inc.