|

市场调查报告书

商品编码

1693907

5G基地台-市场占有率分析、产业趋势与统计、成长预测(2025-2030)5G Base Station - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

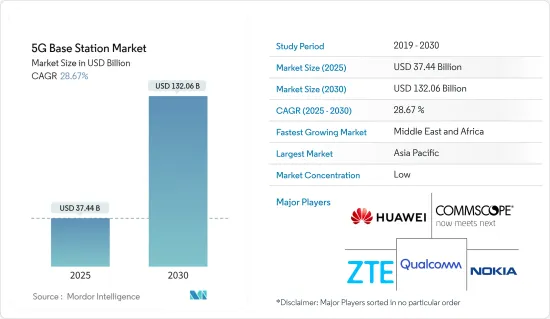

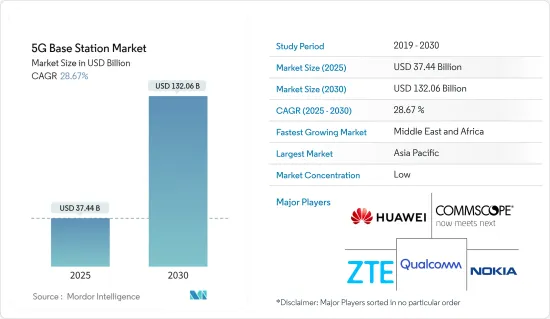

5G基地台市场规模预计在2025年为374.4亿美元,预计到2030年将达到1,320.6亿美元,预测期间(2025-2030年)的复合年增长率为28.67%。

全球范围内智慧型手机的日益普及以及对高速连接日益增长的需求正在推动市场成长率。市场规模和估值反映了北美、欧洲、亚太地区和全球各种最终用户使用的基地台类型所产生的收益。

关键亮点

- 5G技术将大幅减少讯息传输的延迟和滞后。这种减少提高了用户体验并为创新应用铺平了道路。

- 此外,5G 架构的一个面向是超可靠低延迟通讯(URLLC),它将有效地安排资料传输。 URLLC 将支援工厂自动化、工业互联网、智慧电网、自动驾驶和机器人手术等领域的先进服务。因此,这些应用中对降低延迟的日益增长的需求正在推动全球 5G基地台市场的成长。

- 智慧型手机改变了个人存取和消费数据的方式,从网路浏览和影片串流到行动应用程式使用和社交媒体参与。随着智慧型手机的普及,数据消费量也迅速增加。为了满足日益增长的需求,通讯业者正在扩大其网路容量和覆盖范围。这种成长通常需要建造更多的基地台来管理不断增加的资料流量。随着智慧型手机使用量的增长,对可靠行动网路覆盖的需求也在增长,通讯业者建造更多的基地台并加强其基础设施。

- 5G 的主要优势包括速度提升、延迟降低、容量增强、频宽增加、可用性和覆盖范围扩大。与 4G 相比,新兴的 5G 网路具有更低的延迟、更高的容量和更快的速度。这些网路改进的影响可能会非常深远。

- 5G基地台架构旨在为各种设备提供高速、低延迟和大规模连接。这种架构比前几代行动网路更加复杂,适应性更强。 5G网路的引进将需要大量的基础设施投资,包括铺设新的基地台、小型基地台和光纤电缆。对于前几代行动电话网络,5G基础设施部署依赖于减少蜂窝规模和增加网路容量,因此需要更密集的网路架构。这种密集化增加了基础设施需求和整体资本支出,导致网路营运商和服务供应商的前期成本更高。

- 全球智慧型手机用户数量的增加以及对高速连接的需求也推动了对 5G 网路的需求,从而推动了 5G基地台市场的发展。例如,根据爱立信的数据,到2028年全球智慧型手机行动网路用户数量预计将达到7,948.92。

5G基地台市场趋势

智慧城市终端用户领域预计将显着成长

- 5G技术是物联网的基石,由于智慧城市从根本上依赖物联网,因此这些城市环境中5G应用的不断增加正在推动5G基地台的需求。此外,联合国数据预测,到2050年,都市化将达68%。这些全球都市化趋势凸显了自动化、互联城市的需求,并将5G定位为城市发展的关键技术。此外,5G 技术提供的独特高密度和低延迟组合有望彻底改变智慧城市,进一步扩大全球城市应用中对 5G基地台的需求。

- 正如 GSMA《2024 年行动经济》报告中所强调的,到 2030 年,北美将成为 5G 的领跑者,预计订阅率将飙升,达到 4.43 亿用户(占总人口的 93%)。相较之下,大中华区将占据主导地位,拥有超过 16.4 亿个 5G 连接,占总连接数的 88%。欧洲落后,但预计仍将实现令人印象深刻的81%的普及率,5G连线数超过6.54亿。

- 此外,全球智慧城市倡议的加速推进也对5G基地台解决方案产生了强劲的需求。例如,2024年6月,领先的资讯与通讯技术公司中兴通讯与中国电信上海分店合作,设计了利用5G-A技术的智慧园区蓝图。这项倡议将科技、自然和人类情感融为一体,开启了城市发展的新篇章。世纪公园部署的5G-A ISAC基地台将增强低空安防,方便无人机航线规划,确保空中安全监控细緻入微。

- 根据类型,小型基底站在预测期内将在智慧城市领域占据主要份额。小型基地台是低功耗基地台,在智慧城市应用中越来越受到青睐,因为它们对于在街道、建筑物、商场等特定位置提供覆盖和容量至关重要。此外,路灯和交通号誌等街道资产上的小型基地台将有助于提供将企业和消费者连接到超高速 5G 网路所需的室外密集程度。

- 此外,小型基地台5G基地台对于在智慧城市中部署 5G 等技术的角色变得至关重要。市场供应商已经认识到部署小型基地台的必要性,以增加人口密集城市的行动网路容量和覆盖范围。分析认为,这样的发展将有助于市议会制定智慧城市计划,进而促进市场成长。

- 例如,2024年1月,欧洲通讯基础设施供应商Cellnex宣布已与Urban Service Point(USP)签署合同,在人口密度特别高且数据消费需求特别大的地区报摊安装小型基地台。 Cellnex 和 USP 之间的这项协议将报摊定位为小型基地台部署的主要网路。这将有助于该市朝着智慧城市的方向发展,并为其公民提供基本服务。

中东和非洲市场可望大幅成长

- *中东和非洲正在快速部署和采用 5G 技术,从而促进更大的连结性、数位转型和经济扩张。随着对更快、更可靠、更低延迟网路的需求不断增长,这些地区正在大力投资 5G基地台,为不同领域的新途径铺平道路。

- *中东和非洲地区5G基础设施部署正在快速推进。卡达、阿联酋、沙乌地阿拉伯和南非已推出商用5G网路。该地区以其年轻、精通技术的人口、飙升的智慧型手机普及率和对高速连接的需求而脱颖而出。

- 中东和非洲国家正积极拥抱5G,推动医疗、交通、智慧城市、製造业等领域的数位转型。这包括远端医疗、物联网公共产业、智慧交通系统和工业自动化等应用。

- 诺基亚行动宽频指数最近的一项研究显示,中东采用 5G 的速度比非洲更快。研究也显示,儘管许多非洲通讯业者仍在完善其 4G经营模式,波湾合作理事会(GCC) 在 5G 领域处于领先地位。沙乌地阿拉伯尤其有望发挥关键作用,预计到 2027 年该地区 5G用户将激增 75%,这一发展预示着市场将实现良好成长。

- 沙乌地阿拉伯正根据「2030愿景」积极推动数位转型,推动5G网路的广泛采用与推广。 IT和通讯公司正积极投资5G基础设施,5G网路已遍布沙乌地阿拉伯,对5G基地台的需求也日益增加。例如,2024 年 5 月,着名通讯供应商 Zain KSA 宣布计划投资约 4.26 亿美元加强其基础设施。该计划旨在将服务范围从沙乌地王国的 66 个城市和省份扩展到 122 个城市和省份,并优先在麦加和其他圣地提供 5G 连接。

- 由于5G普及率高、主要通讯业者不断扩大5G部署以及主要市场供应商的存在,卡达的5G基地台市场正在快速成长。卡达本土通讯业者,包括 Ooredoo Qatar 和 Vodafone Qatar,正在与爱立信、诺基亚和中兴通讯等全球供应商合作,以促进该国 5G基地台市场的成长。

- 例如,2024年4月,Ooredoo集团为追求5G创新,与全球科技巨头诺基亚签署了一份谅解备忘录(MOU),旨在透过先进的5G解决方案增强业务连接。该协议概述了两家公司在建立和实施 5G 专用网路方面的密切合作,并提供量身定制的解决方案来满足不同领域企业的独特需求。

5G基地台行业概况

竞争企业之间的竞争强度取决于影响市场的各种因素,例如进入障碍、强大的竞争策略以及企业集中。

市场的主要企业包括华为技术有限公司、中兴通讯股份有限公司、诺基亚公司、康普控股公司和高通公司。

所研究的市场包括几家全球性公司,它们在相当竞争的市场空间中争夺关注。由于许多公司都将这个市场视为全球扩张的机会,预计企业集中度在预测期内将实现高成长。

另一方面,投资新技术和市场渗透的能力表明竞争对手之间的竞争将持续加剧。

产品开发早期阶段的这种竞争表明,竞争对手之间的敌意在预测期内可能会加剧。

研究市场中竞争公司之间的竞争态势非常激烈,预计在预测期内将保持不变。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 竞争对手之间的竞争

- 替代品的威胁

第五章市场动态

- 市场驱动因素

- 智慧型手机普及率不断提高

- 5G 相较于领先技术的主要优势

- 市场问题

- 设计和营运挑战

- 市场机会

- 继续努力在新兴国家引入5G

第六章市场区隔

- 按类型

- 小型基地台

- 大型基地台

- 按最终用户

- 商用

- 住宅

- 工业的

- 政府

- 智慧城市

- 其他的

- 按地区

- 北美洲

- 欧洲

- 亚洲

- 澳洲和纽西兰

- 拉丁美洲

- 中东和非洲

第七章竞争格局

- 公司简介

- Huawei Technologies Co. Ltd

- ZTE Corporation

- Nokia Corporation

- CommScope Holding Company Inc.

- QUALCOMM Incorporated

- Qorvo Inc.

- Alpha Networks Inc.

- NEC Corporation

- Telefonaktiebolaget LM Ericsson

- Samsung Electronics Co. Ltd

第八章投资分析

第九章:市场的未来

The 5G Base Station Market size is estimated at USD 37.44 billion in 2025, and is expected to reach USD 132.06 billion by 2030, at a CAGR of 28.67% during the forecast period (2025-2030).

The growing smartphone penetration globally and the growing demand for high-speed connectivity are boosting the market growth rate. The market sizing estimates reflect the revenue generated from the base station types that are being used by various end-users across North America, Europe, Asia Pacific, and worldwide across different end users.

Key Highlights

- 5G technology significantly reduces latency and delays in information transmission. This reduction enhances user experiences and paves the way for innovative applications.

- Moreover, Ultra-Reliable Low Latency Communications (URLLC), a facet of 5G architecture, efficiently schedules data transfers. URLLC supports advanced services in areas like factory automation, the industrial internet, smart grids, autonomous driving, and robotic surgeries. Consequently, the heightened demand for reduced latency in these applications is propelling the global 5G base station market's growth.

- Smartphones have transformed how individuals access and consume data, from internet browsing and video streaming to mobile app usage and social media engagement. As smartphone adoption has surged, so has data consumption. To keep pace with this rising demand, telecom operators are expanding their network capacity and coverage. This growth often necessitates installing additional base stations to manage the heightened data traffic. As smartphone usage expands, so does the demand for reliable mobile network coverage, driving telecom operators to bolster their infrastructure with more base stations.

- The key benefits of the 5G offered over the predecessors include speed upgrades, low latency, enhanced capacity, increased bandwidth, and availability and coverage. Compared to 4G, the emerging 5G networks are characterized by shorter delays, higher capacity, and increased speed. The impact of these network improvements will be far-reaching.

- 5G base station architecture is designed to provide high-speed, low-latency, and massive connectivity to a wide range of devices. The architecture is more complex and adaptable than past generations of mobile networks. Deploying 5G networks requires significant infrastructure investments, including installing new base stations, small cells, and fiber optic cables. Previous generations of cellular networks, 5G infrastructure deployment involved a denser network architecture due to its reliance on smaller cell sizes and increased network capacity. This densification increases the infrastructure requirements and overall capital expenditure, leading to high initial costs for network operators and service providers.

- The growing number of smartphone subscriptions worldwide and the demand for high-speed connectivity are also contributing to the demand for 5G networks, thereby boosting the 5G base station market. For instance, according to the data from Ericsson, the number of smartphone mobile network subscriptions is expected to reach 7948.92 globally by 2028.

5G Base Station Market Trends

Smart Cities End User Segment Expected to Witness Significant Growth

- 5G technology serves as a cornerstone for IoT, and given that smart cities fundamentally depend on IoT, the rising applications of 5G in these urban environments are propelling the demand for 5G base stations. Moreover, United Nations data projects that urbanization will hit 68% by 2050. This global trend towards urbanization underscores the need for automated and interconnected cities, positioning 5G as an essential technology for their development. Additionally, the unique combination of high density and low latency that 5G technology offers promises to revolutionize smart cities, further amplifying the demand for 5G base stations in these urban applications worldwide.

- As highlighted in the GSMA Mobile Economy 2024 report, North America is poised to be a frontrunner in the 5G landscape by 2030, with projections indicating a surge in adoption rates, reaching 443 million subscribers (93% of the population). In contrast, Greater China is set to dominate with over 1.64 billion 5G connections, accounting for a staggering 88% of its total connections. Europe, while trailing, is still projected to achieve an impressive 81% penetration, translating to over 654 million 5G connections.

- Furthermore, the global acceleration of smart city initiatives presents a robust demand for 5G base station solutions. For example, in June 2024, ZTE Corporation, one of the leading players in integrated information and communication technology, collaborated with China Telecom's Shanghai Branch to design a blueprint for smart parks leveraging 5G-A technology. This initiative combines technology, nature, and human sentiment, heralding a new chapter in urban development. Deployed in Century Park, the 5G-A ISAC base stations enhance low-altitude security, facilitate drone route planning, and ensure meticulous aerial security oversight.

- By type, small cells are analyzed to hold a significant share in the smart cities segment over the forecast period. The small cells are low-power base stations that are vital to provide coverage and capacity in specific locations, such as streets, buildings, and malls, thus gaining significant traction in smart city applications. Moreover, Small cells on street assets like lampposts and traffic lights can help the level of outdoor densification needed to connect businesses and consumers to superfast 5G networks.

- Furthermore, the role of a small cell 5G base station is becoming paramount to roll out technologies such as 5G in smart cities. Market vendors are recognizing the need to deploy small cells to increase the capacity and coverage of mobile networks in dense cities. Such developments are analyzed to help city councils in smart city planning and subsequently drive the growth of the market.

- For instance, in January 2024, European telecom infrastructure provider Cellnex announced signing an agreement with Urban Service Point (USP) to install small cells in newspaper stands, notably in areas with high population density and high demand for data consumption. This agreement between Cellnex and USP will position newspaper stands as a principal network for the deployment of small cells. This will help city councils to advance toward smart city capabilities and deliver an essential service for citizens.

Middle East and Africa Expected to Witness Significant Growth in the Market

- *The Middle East & Africa are witnessing a surge in 5G technology deployment and adoption, fueling advancements in connectivity, digital transformation, and economic expansion. With a rising appetite for faster, more reliable, and low-latency networks, these regions are channeling significant investments into 5G base stations, opening up new avenues across diverse sectors.

- *The Middle East & Africa is witnessing a swift pace of 5G infrastructure rollout. Qatar, the UAE, Saudi Arabia, and South Africa, have already launched commercial 5G networks. This region stands out with its youthful and tech-savvy population, escalating smartphone penetration, and a surging appetite for high-speed connectivity.

- MEA nations are actively leveraging 5G to drive digital transformations across healthcare, transportation, smart cities, and manufacturing sectors. This includes applications such as telemedicine, IoT-enabled utilities, smart transportation systems, and industrial automation.

- A recent Nokia Mobile Broadband Index study highlights the Middle East's faster 5G adoption compared to Africa. The study also reveals that while many African operators are still refining their 4G business models, the Gulf Cooperation Council (GCC) is leading the 5G charge. Notably, Saudi Arabia is poised to play a pivotal role, contributing significantly to the projected 75% surge in 5G subscribers in the region by 2027, a trend that bodes well for market growth.

- Under its Vision 2030 initiative, Saudi Arabia is aggressively pushing for a digital transformation, leading to widespread adoption and deployment of 5G networks. Telecommunications companies are heavily investing in 5G infrastructure, broadening its reach across the Kingdom and fueling the demand for 5G base stations. For example, in May 2024, Zain KSA, a prominent telecom provider, unveiled plans to invest around USD 426 million to bolster its infrastructure. This initiative aims to extend its services to 66 to 122 cities and governorates across the Kingdom, with Mecca and other Holy sites being prioritized for 5G connectivity.

- Qatar's 5G base station market is experiencing rapid growth driven by the high penetration of 5G, expanding 5G rollouts by major telcos and the presence of major market vendors. Local telecoms in Qatar, including Oredoo Qatar and Vodafone Qatar, have partnered with global vendors like Ericsson, Nokia, and ZTE Corporation, bolstering the growth of the country's 5G base station market.

- For example, in April 2024, Ooredoo Group, pursuing 5G innovation, inked a Memorandum of Understanding (MOU) with global tech giant Nokia, aiming to enhance business connectivity through advanced 5G solutions. The agreement outlines a close collaboration between the two firms to craft and implement 5G private networks, offering tailored solutions that cater to the unique demands of businesses across various sectors.

5G Base Station Industry Overview

The intensity of competitive rivalry depends on various factors affecting the market, such as barriers to exit, powerful competitive strategy, and firm concentration.

Some of the major players in the market are Huawei Technologies Co. Ltd, ZTE Corporation, Nokia Corporation, CommScope Holding Company Inc., and QUALCOMM Incorporated among others.

The market studied comprises several global players vying for attention in a fairly contested the market space. The firm concentration ratio is anticipated to record higher growth during the forecast period because several firms look at this market as a lucrative opportunity to expand globally.

Whereas, looking at the ability to invest in new technologies and market penetration, the competitive rivalry is anticipated to continue to grow.

Such competition in the initial stages of product commercialization indicates a high probability of increased competitive rivalry over the forecast period.

The intensity of competitive rivalry in the market studied is high, and it is expected to remain the same over the forecast period.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitute Products and Services

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increase in Penetration Rate of Smartphones

- 5.1.2 Key Benefits Offered by 5G over its Predecessors

- 5.2 Market Challenges

- 5.2.1 Design and Operational Challenges

- 5.3 Market Opportunities

- 5.3.1 Ongoing Efforts Toward The Introduction of 5G in Emerging Countries

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Small Cell

- 6.1.2 Macro Cell

- 6.2 By End User

- 6.2.1 Commercial

- 6.2.2 Residential

- 6.2.3 Industrial

- 6.2.4 Government

- 6.2.5 Smart Cities

- 6.2.6 Other End Users

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Huawei Technologies Co. Ltd

- 7.1.2 ZTE Corporation

- 7.1.3 Nokia Corporation

- 7.1.4 CommScope Holding Company Inc.

- 7.1.5 QUALCOMM Incorporated

- 7.1.6 Qorvo Inc.

- 7.1.7 Alpha Networks Inc.

- 7.1.8 NEC Corporation

- 7.1.9 Telefonaktiebolaget LM Ericsson

- 7.1.10 Samsung Electronics Co. Ltd