|

市场调查报告书

商品编码

1693958

PyroFuse-市场占有率分析、产业趋势与统计、成长预测(2025-2030)Pyro Fuse - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

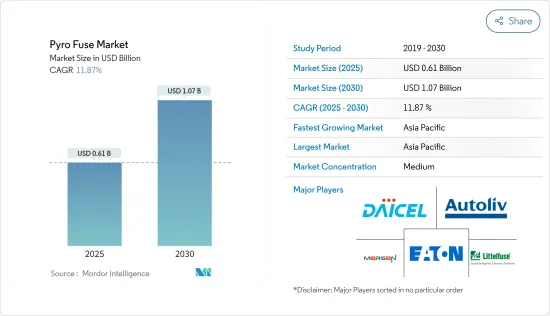

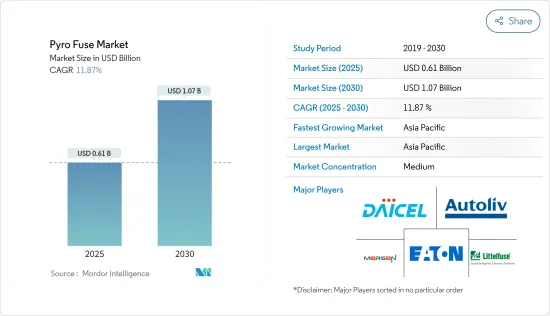

预计 2025 年热熔断器市场规模为 6.1 亿美元,到 2030 年将达到 10.7 亿美元,预测期内(2025-2030 年)的复合年增长率为 11.87%。

关键亮点

- 与传统机械断路器相比,热熔断器有助于快速清除故障电流,并最大限度地降低成本和重量。可根据时间电流曲线客製热熔断器,以适应应用的故障响应特性。

- 对于低电压,可以使用热熔断器代替接触器,但由于热熔断器需要讯号,因此本身并不安全。然而,它独立于保险丝,并且可以配置为触发来自电流感测器的任何电流。超过 3,000A DC 时,接触器可能会发生故障,且保险丝必须能够处理该电流。其中值得注意的是热熔断器,它采用不同的方法,使用安全气囊 ECU 的讯号来启动烟火点火装置,然后击穿汇流排以物理切断连接。

- 联合国工业发展组织称,包括製造业、采矿业、电力、水利、废弃物管理和其他公共产业在内的工业部门成长了 2.3%,标誌着全球经济在疫情后復苏。一些危险产业,包括石油和天然气,在未来可能仍将保持重要地位,因为它们是全球不断增长的人口负担得起的、可靠的和多功能的能源产品。

- 根据国际能源总署 (IEA) 的数据,2019 年石油和天然气合计占全球能源需求的 50% 以上,预计到 2040 年将长期成长 25%。石油和天然气开采活动会对财产和环境造成损害或破坏。它甚至可能导致受伤和生命损失,特别是如果活动没有适当的管理、监控和监管。

- 与石油和天然气开采活动相关的安全隐患包括但不限于车辆碰撞、爆炸和火灾。与密闭空间相关的安全隐患包括易燃蒸气或气体、电力和其他危险能量的点火。

- 结果,该产业的事故和爆炸数量不断增加,迫使世界各国政府实施严格的安全法规。不断增长的能源需求以及海上和陆上油田探勘活动的活性化为市场在该领域建立支柱提供了巨大的机会。

- 在石油和天然气行业,现代电气设备经过专门设计,可以承受石油和天然气行业内各种工艺的恶劣条件,包括马达控制和支援。随着各行各业电气设备的使用不断增加,对用于降低爆炸风险的防火熔断器的需求也日益增长。

火药保险丝市场趋势

汽车领域占据主要市场占有率

- 随着未来几年电动车逐渐成为主流,汽车产业对热熔断器的使用预计会成长。热熔断器、热敏开关或断路器可防止汽车系统过热。各种系统都是为了确保电动车在出现异常状况时的安全。一些经常用于保护电动车免于火灾和短路的机制在电动车中被广泛使用。

- 汽车製造商非常重视确保车辆安全。因此,乘用车和商用车配备了各种各样的传感器、保险丝和开关。这些部件共同作用,为车辆和驾驶员提供最佳保护,同时维护製造商的品牌声誉。其中一项安全措施是热熔引信,即快速反应爆炸引信。此保险丝用于在发生严重事故时将高压电池与电路断开。由安全气囊控制设备或 BMS 启动的高温保险丝可确保在车辆变形导致潜在短路之前断开电路。

- 电动车销量的增加和电动车生产投资的增加预计将带来各种市场机会。高温熔断器经常被用作电动车电气保护系统的组成部分。这些保险丝利用烟火装置在发生故障或过流时快速可靠地断开电路。其目的是快速中断电流,保护车辆的电气元件并降低火灾或电池系统损坏等潜在风险。高温熔断器通常用于电动车的高压系统,包括电池组、马达控制器和其他关键零件。

- 国际能源总署(IEA)强调,全球汽车产业正经历深刻变革时期,对能源产业产生重大影响。预计到 2030 年,电气化应用的不断普及将使石油需求量每天减少 500 万桶。根据国际能源总署的报告,预计 2022 年全球电动车销量将超过 1,000 万辆,2023 年将达到 1,400 万辆,增幅为 35%。

- 同样,在净零情境下,到 2030 年,电动车销量将占汽车销量的 67% 左右。为了实现这一情景,电动车销量需要在 2023 年至 2030 年期间每年增长约 25%。电动车的主要市场是中国、欧洲和美国。

- 例如,根据国际能源总署的预测,2022年中国将占全球电动车新註册量的近60%。在中国,电动车占国内汽车总销量的比例从2021年的16%上升到2022年的29%。预计到2025年,将超过20%销售份额的国家目标。因此,许多热熔断器製造商不断投资关键技术创新,以在市场上获得竞争优势。

亚太地区预计将经历强劲成长

- 由于电动车产业的兴起以及中国、印度和韩国等多个国家的工业应用不断扩大,该地区的热熔断器市场预计将在未来几年获得发展动力。政府为推动电动车的普及而采取的倡议不断增多,对电动车生产的投资不断增加,以及消费者对混合动力电动车的需求不断增长,预计将加强该地区汽车领域热熔断器的应用。

- 汽车产业对该地区的市场扩张产生了重大影响。人们对碳排放担忧正推动世界各地推出提倡广泛采用电动车的政策。因此,电动车越来越受欢迎,加速了该地区智慧马达市场的成长。重要的是,中国和印度等主要国家电动车的采用率正在显着增长,预计这将推动市场成长。

- 亚太地区凭藉其广泛的工业供应链网络,一直是全球经济成长的主要引擎。印度、中国和日本等国家拥有主要的工业基地,使该地区成为世界上最大的工业中心之一。该地区各国政府正积极采取措施,透过整合先进技术来加强工业生产能力。

- 各行各业对电气短路的担忧日益加剧,推动了对先进电气设备的需求。该地区日益严重的能源问题推动了节能电气设备的采用,从而导致了紧凑高效的电气设备和设备的发展,从而支持了热熔断器市场的成长。

- 预计韩国、马来西亚和日本等其他地区也将为市场成长做出贡献。预计航太业、电动车的普及以及电动车销量的增加将成为推动市场成长的关键因素。根据KAMA报道,2022年韩国汽车出口量将达230万辆,其中包括乘用车和商用车。与去年的204万台相比,这一数字大幅增加了15%。

- 据国土交通省称,截至 2023 年 5 月,电动车 (EV) 约占韩国汽车市场的 1.8%。展望未来,韩国政府设定了一个雄心勃勃的目标,到2030年将电动和氢动力汽车在新车销量中的比例提高到33%。

- 根据2023年预算案前的宣言,航太部门被视为一条新的进步途径,可加速马来西亚在2025年之前发展成为高所得国家。马来西亚航太工业协会(MAIA)预测,2023年预算将扩大对本地航太业发展的支持,正如第一个马来西亚计划所阐明的那样。高温熔断器广泛应用于航太工业,因此该领域的成长预计将显着推动市场发展。

PyroFuse市场概览

半固体熔断器市场占据主导地位,主要企业包括 Daicel Corporation、Autoliv Inc.、Littelfuse Inc.、Eaton Corporation 和 Mersen Group。市场参与企业正在采取联盟和收购等策略来加强其产品供应并获得可持续的竞争优势。

- 2023年9月,DAICEL主办了北美电池展,吸引了来自先进电池、电动车和混合动力汽车产业的775多家顶级供应商参展。特别工作组主题包括电池安全、市场预测、下一代技术和热失控预防。

- 2023 年 5 月,伊顿宣布其电动车业务已赢得向一家全球汽车製造商供应电池断开装置 (BDU) 的合约。 BDU 有 400 V 和 800 V 配置,用于电动乘用车。伊顿的 BDU 采用了断路器电路保护技术,有效降低了复杂性和成本。 BDU 的主要功能是根据驾驶模式(例如充电或驾驶)充当车辆电池的开/关开关。目前,大多数电动车在其 BDU 中采用三种传统电路保护配置之一:保险丝和接触器、热熔断器和接触器,或在单一 BDU 中采用保险丝、热熔断器和接触器的组合。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

- 产业价值链分析

- 宏观趋势如何影响市场

第五章市场动态

- 市场驱动因素

- 环保电动车(BEV、HEV)的普及率不断提高

- 各行业对电气短路保护的需求日益增加

- 市场限制

- 固态开关等替代元件的需求激增

第六章市场区隔

- 按电压类型

- 高电压(700V以上)

- 中压(400-700V)

- 低电压(400V以下)

- 按应用

- 汽车领域

- 工业的

- 按地区

- 北美洲

- 欧洲

- 亚洲

- 澳洲和纽西兰

- 拉丁美洲

- 中东和非洲

第七章竞争格局

- 公司简介

- Daicel Corporation

- Autoliv Inc.

- Littelfuse Inc.

- Eaton Corporation

- Mersen Group

- Robert Bosch Gmbh

- Rheinmetall AG

- STMicroelectronics

- Pacific Engineering Corporation(PEC)

- MTA SpA

- Astotec Holding GmbH

第八章投资分析

第九章 市场机会与未来趋势

简介目录

Product Code: 50001338

The Pyro Fuse Market size is estimated at USD 0.61 billion in 2025, and is expected to reach USD 1.07 billion by 2030, at a CAGR of 11.87% during the forecast period (2025-2030).

Key Highlights

- Pyrofuses facilitate rapid clearance of fault currents and minimize cost and weight compared to conventional mechanical breakers. Pyrofuses can tune the time-current curve to fit the application's fault response characteristics.

- For low-level voltages, pyro fuses can be utilized instead of a contactor, but they are not inherently safe as they require a signal. However, they can be independent of the fuse and can be set to trigger with any current from a current sensor. At over 3000 A DC, a contactor can break down, and the fuse must handle the current. Notably, the pyro fuse takes a different approach, utilizing the signal from the airbag's ECU to trigger a pyrotechnic ignitor, which punches through the busbar to sever the connection physically.

- According to the United Nations Industrial Development Organization, there was a 2.3% growth in industrial sectors, encompassing manufacturing, mining, electricity, water supply, waste management, and other utilities, signaling a post-pandemic recovery globally. Some hazardous industries, including oil and gas, will remain important as affordable, reliable, and versatile energy products for a growing global population.

- According to the International Energy Agency, oil and gas combined accounted for more than 50% of global energy demand in 2019, and it is expected in the long term that energy demand will still grow by 25% by 2040. Oil and gas extraction activities have the potential to cause damage to or destruction of property and the environment. They could even lead to injury and loss of life, particularly if the activity is not controlled, monitored, or regulated appropriately.

- Safety hazards associated with oil and gas extraction activities include but are not limited to vehicle collisions, explosions, and fires. Safety hazards related to confined space include ignition of flammable vapors or gases and electrical and other hazardous energy.

- As a result, governments worldwide are compelled to enforce strict safety regulations due to the rising number of accidents and explosions in the industry. The expanding energy requirements and the growing exploration activities in offshore and onshore oil fields present a substantial opportunity for the market to establish a foothold in this sector.

- In the oil and gas industry, modern electrical equipment is specifically engineered to withstand the demanding conditions of various processes within the oil and gas industry, including motor controls and supports. As the utilization of electrical equipment continues to rise across the industry, there is a growing requirement for pyro-fuse to mitigate the risk of explosions.

Pyro Fuse Market Trends

Automotive Segment to Hold Major Market Share

- The applications of pyro fuses in the automotive industry look promising with the dominance of electric vehicles in the coming years. Pyro fuses, or thermal switches or cutoffs, can prevent overheating in automotive systems. Various systems are in place to guarantee the safety of electric vehicles in case of abnormal circumstances. Among the frequently employed mechanisms to safeguard EVs from fire and short circuits is the profuse use in electric cars.

- Vehicle manufacturers place a high priority on ensuring the safety of their vehicles. To achieve this, they install a range of sensors, fuses, and switches in passenger cars and commercial vehicles. These components work together to provide optimal protection for the vehicle and its driver, all while upholding the manufacturer's brand reputation. One such safety feature is the pyro fuse, a fast-acting explosive fuse. This fuse is designed to disconnect high-voltage batteries from the circuit in the event of a significant accident. Activated by the airbag control device or BMS, the pyro fuse reliably breaks the circuit before any potential short-circuiting can occur due to vehicle deformation.

- The increasing sales of EVs and rising investments in the production of electric vehicles are expected to offer various market opportunities. Pyro fuses are frequently employed in electric vehicles as a component of the electrical protection system. These fuses utilize pyrotechnic elements to swiftly and securely disconnect the electrical circuit in case of a fault or overcurrent situation. Their purpose is to promptly interrupt the current flow, safeguarding the vehicle's electrical components and mitigating potential risks like fire or harm to the battery system. Pyro fuses find typical applications in the high-voltage systems of EVs, encompassing the battery pack, motor controller, and other vital components.

- The automotive industry globally is undergoing a significant transformation, as highlighted by the International Energy Agency (IEA), with profound implications for the energy sector. The increasing adoption of electrification is projected to reduce the demand for 5 million barrels of oil per day by 2030. According to the IEA's report, the sales of electric cars globally exceeded 10 million in 2022, and this number is expected to grow by 35% in 2023, reaching a total of 14 million sales.

- Similarly, in the Net Zero Scenario, electric vehicle sales will constitute approximately 67% of total car sales by 2030. To align with this scenario, the annual growth rate of electric car sales needs to be around 25% from 2023 to 2030. The leading markets for electric vehicles are China, Europe, and the United States.

- For instance, China accounted for nearly 60% of all new electric car registrations worldwide in 2022, according to the IEA. In China, the share of electric cars in total domestic car sales increased from 16% in 2021 to 29% in 2022. It is expected to surpass the national target of a 20% sales share by 2025. Consequently, numerous pyro-fuse manufacturers continuously invest in significant innovations, enabling the market to gain a competitive advantage.

Asia-Pacific is Expected to Witness Significant Growth

- The market for pyro fuses in the region is expected to gain traction over the coming years due to the rising EV industry and growing industrial applications across various countries like China, India, Korea, and others. The growing government initiatives in boosting the adoption of EVs, increasing investments in the production of electric vehicles, and growing consumer demand for hybrid electric vehicles are expected to enhance the applications of pyro fuse in the region's automotive segment.

- The automotive industry heavily influences the market expansion in the region. The growing concerns over carbon emissions have prompted the introduction of policies that advocate for the widespread use of electric vehicles globally. This has, in turn, accelerated the smart motors market's growth in the region due to the rising popularity of electric vehicles. It is important to note that major countries such as China, India, and other nations are seeing a significant uptick in electric vehicle adoption, which is forecasted to drive market growth.

- The Asia-Pacific region has historically served as a key driver of global economic growth due to its extensive network of industrial supply chains. With major industrial hubs in countries such as India, China, and Japan, the region stands out as one of the largest industrial centers worldwide. Governments in the area are actively implementing measures to enhance industrial production capabilities by integrating advanced technologies.

- The rise in concerns regarding electrical short circuits across various industries fuels the demand for advanced electrical equipment. The escalating energy issues in the region are prompting the adoption of energy-efficient electrical devices, leading to the development of compact and efficient electrical equipment and devices, thereby boosting the growth of the pyro fuse market.

- Other regions like Korea, Malaysia, Japan, and other countries are expected to contribute to the market's growth. The aerospace industry, increasing adoption of EVs, and rising EV sales are expected to act as major factors driving the market's growth. According to KAMA's report, South Korea's vehicle exports in 2022 reached an impressive 2.3 million units, encompassing passenger cars and commercial vehicles. This marked a substantial 15% growth compared to the previous year's 2.04 million units.

- As of May 2023, electric vehicles (EVs) accounted for approximately 1.8% of the South Korean automobile market, as stated by the Ministry of Land, Infrastructure and Transport. Looking toward the future, the South Korean government has set an ambitious goal of increasing the share of electric and hydrogen vehicles in new vehicle sales to 33% by 2030.

- Per the pre-Budget 2023 declaration, the aerospace sector has been acknowledged as a fresh avenue for progress to hasten Malaysia's evolution into a high-income nation by 2025. The Malaysia Aerospace Industry Association (MAIA) predicts that the 2023 Budget will extend support for the growth of the local aerospace industry, as articulated in the 12th Malaysia Plan. As pyro fuses are extensively finding their applications in the aerospace industry, the growth in the sector is anticipated to drive the market significantly.

Pyro Fuse Market Overview

The pyro fuse market is semi-consolidated with major players like Daicel Corporation, Autoliv Inc., Littelfuse Inc., Eaton Corporation, and Mersen Group. Players in the market adopt strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- September 2023: Daicel organized the battery show in North America, and over 775 top suppliers from the advanced battery and electric and hybrid vehicles industry participated. Special workgroup topics include battery safety, market forecasting, next-generation technology, and prevention of thermal runaway.

- May 2023: Eaton announced that its eMobility business secured a contract to supply its battery disconnect unit (BDU) to a global vehicle manufacturer. The BDU will be available in 400 V and 800 V configurations and used in electrified passenger vehicles. Eaton's BDU incorporates its Breaktor circuit protection technology, effectively reducing complexity and cost. The primary function of the BDU is to act as an on/off switch for the vehicle's battery, depending on the mode of operation, such as charging or driving. Currently, most electric cars utilize one of three traditional circuit protection configurations in the BDU: fuse and contactor, pyro fuse and contactor, or fuse, pyro fuse, and contactor combined in a single BDU.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Degree of Competition

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of Macro Trends in the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Adoption of Eco-friendly Electric Vehicles (BEV, HEV)

- 5.1.2 Rising Demand for Electrical Protection Against Short Circuits In Different Industries

- 5.2 Market Restraints

- 5.2.1 Surging Demand for Alternative Components Like Semiconductor Switches

6 MARKET SEGMENTATION

- 6.1 By Voltage Type

- 6.1.1 High Voltage (More than 700 V)

- 6.1.2 Medium Voltage (Between 400 V to 700 V)

- 6.1.3 Low Voltage (Below 400 V)

- 6.2 By Application

- 6.2.1 Automotive

- 6.2.2 Industrial

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Daicel Corporation

- 7.1.2 Autoliv Inc.

- 7.1.3 Littelfuse Inc.

- 7.1.4 Eaton Corporation

- 7.1.5 Mersen Group

- 7.1.6 Robert Bosch Gmbh

- 7.1.7 Rheinmetall AG

- 7.1.8 STMicroelectronics

- 7.1.9 Pacific Engineering Corporation (PEC)

- 7.1.10 MTA SpA

- 7.1.11 Astotec Holding GmbH

8 INVESTMENT ANALYSIS

9 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219