|

市场调查报告书

商品编码

1693965

双组分纤维-市场占有率分析、产业趋势与统计、成长预测(2025-2030)Bicomponent Fiber - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

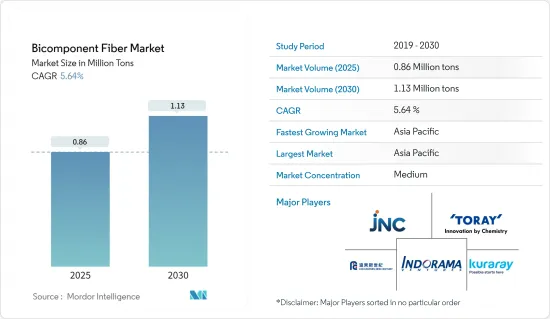

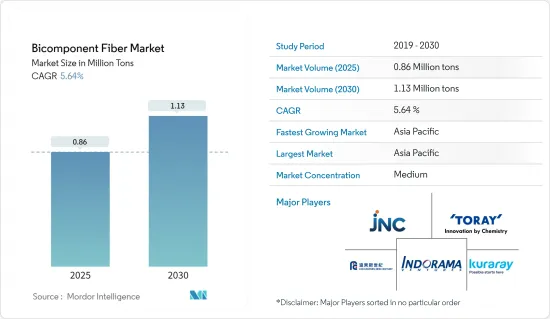

预计 2025 年双组分纤维市场规模为 86 万吨,2030 年将达到 113 万吨,预测期内(2025-2030 年)的复合年增长率为 5.64%。

新冠疫情迫使全球汽车製造商、卫生、医疗和不织布纺织品产品製造商停工,降低了 2022 年对双组分纤维的需求。疫情几乎影响了这些产业的各个方面,从产品需求到劳动力发展,再到疫情爆发时已经出现的趋势的加速或减缓。需求的减少对生产过程产生了重大影响,由于客户及其暂时停产,生产水准下降。不过,预计在预测期的后半段,情况将会改善,所研究的市场将恢復成长轨迹。

关键亮点

- 从长远来看,卫生行业对双组分纤维的采用日益增多以及不织布行业的需求不断增长预计将推动市场需求。

- 预计消费者意识的缺乏和高昂的生产成本将阻碍市场的成长。

- 预计再生双组分纤维的未来应用将为市场提供丰厚的机会。

- 亚太地区占据了最高的市场占有率,并可能在预测期内占据市场主导地位。

双组分纤维市场趋势

卫生产业占市场主导地位

- 双组分纤维用于生产具有柔软手感和其他独特物理和美学特性的不织布,这些特性对于尿布和卫生产品至关重要。

- 这些纤维还具有多种用途:它们清洁、可回收,并提供均匀的黏合剂分布。这些纤维不织布是婴儿训练裤、婴儿尿布、女性护理用品、成人失禁产品、医用垫片、创伤护理和吸收敷料等产品的首选材料。

- 此外,随着人们对婴儿卫生意识的增强,强烈鼓励父母使用婴儿尿布和婴儿擦拭巾。尿布是婴幼儿日常护理中不可或缺的一部分,婴儿擦拭巾有助于防止细菌感染并提供舒适感。

- 根据Parenting Mode预测,到2022年,全球一次性尿布市场规模将达到每年约710亿美元。婴儿在出生后的头两年内将使用约6000片一次性尿布。此外,金佰利的个人护理品牌(包括婴儿卫生产品)在 2022 年创造了 10,620 美元的收益,而 2021 年为 10,270 美元。

- 2023年4月,Millie Moon婴儿纸尿裤宣布在加拿大上市。 Millie Moon 自称是一个清洁、优质的尿布品牌,以实惠的价格提供功能强大、製作精美的尿布和敏感肌肤擦拭巾。该公司还声称,其奢华尿布材料对婴儿的皮肤极其柔软,并采用云触柔软技术,以达到最佳舒适度。

- 2022年3月,作为尼日利亚扩张计画的一部分,金佰利将在拉各斯伊科罗杜开设一家新的製造工厂,生产好奇婴儿纸尿裤和Cortex女性护理用品。我们投资 1 亿美元的先进製造工厂配备了最新技术,以便更好地服务我们的客户。

- 根据欧洲卫生和个人护理协会 (EDANA) 预测,到 2022 年,卫生和个人护理擦拭巾将占欧洲不织布总使用量的 45% 以上。

- 因此,考虑到全球卫生产品的成长趋势和各种计划,卫生产业可能会主导市场,从而导致预测期内对双组分纤维的需求增加。

亚太地区占市场主导地位

- 2022 年,亚太地区以相当大的产量和收益占有率占据了双组分纤维市场的主导地位,预计在预测期内仍将保持主导地位。

- 在全球纺织品服饰市场领域,中国在过去二十年一直是主要参与企业。自加入世界贸易组织(WTO)以来,中国纺织品和服饰的生产和销售大幅成长,主要得益于来自欧洲和美国的业务增加。

- 根据中国不织布工业纤维协会预测,2022年中国不织布产量将比与前一年同期比较增加814万吨。此外,中国仍然是销售运动服装、配件和鞋类的一个有吸引力的市场。

- 中国汽车产量的成长可能会刺激汽车纺织品的消费,预计将进一步支撑研究市场的需求。根据中国工业协会预测,2022年中国汽车产量将达2,702.1万辆,与前一年同期比较去年同期成长3.4%。 2022年汽车产量中,乘用车2,383.6万辆,商用车318.5万辆。

- 双组分纤维用于建筑业的隔热材料和地板铺设。建筑业是中国经济持续发展的重要驱动力。中国正在经历建筑业的蓬勃发展。根据中国国家统计局的数据,预计2022年建筑业产出将达到31.2兆元人民币(4.5兆美元),高于2021年的29.3兆元人民币(4.2兆美元),预计2030年中国的建筑支出将接近13兆美元,为受访市场带来了光明的前景。

- 几家印度尿布製造公司正专注于产品创新和扩张,这可能会进一步刺激对双组分纤维的需求。例如,2023 年 1 月,金佰利宣布重新推出其标誌性尿布品牌好奇,并在印度推出全新「好奇舒适全效」系列。

- 2023 年,Reliance Retail 旗下的 Performax Activewear 成为印度足球队的官方套件赞助商。这个本土运动服饰品牌拥有为所有足球比赛生产套件的独家权利。它还将成为全印度足球联合会 (AIFF) 所有比赛、巡迴赛和训练服装的唯一供应商,包括男子、女子和青年队。此外,作为产品赞助商,Performax也将持有这些产品的製造和零售权。

- 因此,上述原因可能在预测期内推动亚太地区双组分纤维市场的成长。

双组分纤维产业概况

双组分纤维市场部分细分,有几家公司在全球和区域层面开展业务。市场的主要企业(不分先后顺序)包括 Indorama Ventures Public Company Limited、Far Eastern New Century Corporation、JNC Corporation、KURARAY 和 TORAY INDUSTRIES, INC.

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 双组分纤维在卫生产业的应用不断扩大

- 不织布产业需求不断成长

- 限制因素

- 消费者意识不足,生产成本高

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔

- 材料

- 聚乙烯(PE)/聚丙烯(PP)

- 聚丙烯(PP)/聚对苯二甲酸乙二醇酯(PET)

- 高密度聚苯乙烯/低密度聚乙烯

- 聚乙烯/聚对苯二甲酸乙二醇酯(PET)

- 聚酯/PBT

- 其他的

- 结构类型

- 海分

- 并排

- 海中岛

- 其他建筑类型

- 最终用户产业

- 不织布

- 车

- 环卫业

- 建筑学

- 医疗保健

- 其他的

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章竞争格局

- 併购、合资、合作与协议

- 市场排名分析

- 主要企业策略

- 公司简介

- CHA Technologies Group

- EMS-chemie Holding AG

- Far Eastern New Century Corporation

- Freudenberg Performance Materials

- Huvis Corp.

- Indorama Ventures Public Company Limited

- JNC Corporation

- Kolon Glotech

- Kuraray Co. Ltd.

- OC Oerlikon Management AG

- PTT Global Chemical Public Company Limited

- Shaoxing Yaolong Spunbonded Nonwoven Technology Co. Ltd

- TEIJIN Limited

- TORAY Industries Inc.

- WPT Nonwovens Corp.

第七章 市场机会与未来趋势

- 再生双组分纤维的未来应用。

The Bicomponent Fiber Market size is estimated at 0.86 million tons in 2025, and is expected to reach 1.13 million tons by 2030, at a CAGR of 5.64% during the forecast period (2025-2030).

The COVID-19 pandemic, on a global scale, forced automakers, hygiene, medical, and non-woven textile products manufacturers to shut down their operations, lowering the demand for bicomponent fiber in 2022. The pandemic impacted almost every aspect of these industries, from product demand to workforce development to accelerating or decelerating trends already underway when it struck. Customers and their temporary production stops reduced production levels, and demand reductions significantly impacted production processes. However, the condition is expected to recover, restoring the growth trajectory of the market studied during the latter half of the forecast period.

Key Highlights

- In the long term, the growing adoption of bicomponent fiber in the hygiene industry and rising demand from the non-woven textile industry are expected to drive market demand.

- Lack of consumer awareness and high production cost is expected to hinder the market's growth.

- Nevertheless, future applications of recycled bicomponent fibers is expected to offer lucrative opportunities to the market.

- Asia-Pacific accounted for the highest market share, and the region is likely to dominate the market during the forecast period.

Bicomponent Fiber Market Trends

Hygiene Industry to Dominate the Market

- Bicomponent fibers are utilized to produce nonwoven fabrics with a soft touch, along with other unique physical and aesthetic properties, which are deemed essential for diapers and hygiene products.

- These fibers are also used due to their versatile properties of being clean, recyclable, and have a uniform distribution of adhesive. These fiber nonwovens are the material of choice for products such as toddler training pants, infant diapers, feminine care products, adult incontinence products, medical underpads, wound care, and absorbent bandages, among others.

- Furthermore, owing to the increasing awareness about infant hygiene, parents are strongly adopting the usage of baby diapers and baby wipes. Diapers are among the essential infant daily care products, and baby wipes help prevent bacterial infection and provide comfort.

- According to the Parenting Mode company, the global disposable diaper market accounted for approximately USD 71 billion/year by 2022. Babies use about 6,000 diapers during their first two years of life. In addition, the personal care brands of Kimberly Clark, which include baby hygiene products, generated a revenue of USD 10.62 thousand in 2022 as compared to USD 10.27 Thousand in 2021.

- In April 2023, Millie Moon baby diapers announced their launch in Canada. Millie Moon claims to be a clean, luxury diaper brand offering high-performance and beautifully crafted diapers and sensitive wipes at affordable prices. The company also claims that the materials in its Luxury Diapers are extremely soft on babies' skin and engineered with CloudTouch Softness for optimum comfort.

- In March 2022, as part of its expansion plans in Nigeria, Kimberly-Clark opened a new manufacturing facility in Ikorodu, Lagos, which will manufacture Huggies baby diapers as well as Kotex feminine care products. With the investment of USD 100 million in its new state-of-the-art manufacturing facility, the company is equipped with the latest technology to serve its customers better.

- According to EDANA, in 2022, hygiene and personal care wipes accounted for more than 45% of all nonwoven use across Europe.

- Therefore, considering the growth trends and various projects of hygiene products in different regions worldwide, the hygiene industry is likely to dominate the market, which, in turn, is expected to enhance the demand for bicomponent fiber during the forecast period.

Asia-Pacific to Dominate the Market

- The Asia-Pacific region dominated the bicomponent fiber market in 2022, with a considerable volume and revenue share, and is expected to maintain its dominance during the forecast period.

- In the global textile and clothing market segment, China has always been a major player for the last two decades. Since becoming a member of the World Trade Organization, China's textile and clothing manufacturing and sales have increased dramatically, largely due to increased business from the West.

- According to the China Nonwovens and Industrial Textiles Association, the output of nonwovens in China was 8.14 million tons Y-o-Y in 2022. In addition, China continues to be an attractive market for selling athletic apparel, accessories, and footwear.

- The rising production of automobiles in China is likely to enhance the consumption of automotive textiles, which is expected to further support the demand for the studied market. According to the China Association of Automobile Manufacturers (CAAM), China produced 27,021 thousand units of automobiles in 2022, registering a growth rate of 3.4% compared to the previous year. Out of the automobile production in 2022, passenger cars accounted for 23,836 thousand units, whereas commercial car production accounted for 3,185 thousand units.

- Bicomponent fiber is used for insulation and flooring underlayment in the construction industry. The construction sector is key to China's continued economic development. China is amid a construction mega-boom. According to the National Bureau of Statistics of China, The value of construction output accounted for 31.2 trillion yuan (USD 4.5 trillion) in 2022, up from 29.3 trillion yuan (USD 4.2 trillion) in 2021, China is expected to spend nearly USD 13 trillion on buildings by 2030, creating a positive outlook for the studied market.

- Several diaper manufacturing companies in India are focusing on product innovation and expansion, which is further likely to drive the demand for bicomponent fibers. For instance, in January 2023, Kimberly-Clark announced the relaunch of its iconic diaper brand, Huggies, with the new 'Huggies Complete Comfort' range in India.

- In 2023, Reliance Retail's Performax activewear became the official kit sponsor for the Indian football team. The homegrown sportswear brand will have the exclusive rights to manufacture kits across all formats of the game. The firm will also be the sole supplier for all matches, travel, and training wear for the AIFF (All India Football Federation), including men's, women's, and youth teams. In addition to this, as the merchandise sponsor, Performax is also expected to hold the rights to manufacture and retail these products.

- Hence, the reasons mentioned above are likely to fuel the growth of the bicomponent fiber market in Asia-Pacific over the forecast period.

Bicomponent Fiber Industry Overview

The bicomponent fiber market is partially fragmented, with several companies operating on both global and regional levels. Some of the major players in the market (Not in any particular order) include Indorama Ventures Public Company Limited, Far Eastern New Century Corporation, JNC Corporation, KURARAY CO., LTD., and TORAY INDUSTRIES, INC., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Adoption of Bicomponent Fiber In the Hygiene Industry

- 4.1.2 Rising Demand From the Non-woven Textile Industry

- 4.2 Restraints

- 4.2.1 Lack of Consumer Awareness and High Production Cost

- 4.3 Industry Value-Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume and Revenue)

- 5.1 Material

- 5.1.1 Polyethylene (PE)/Polypropylene (PP)

- 5.1.2 Polypropylene (PP)/polyethylene Terephthalate (PET)

- 5.1.3 High-density Polyethylene/Low-density Polyethylene

- 5.1.4 Polyethylene/polyethylene Terephthalate (pet)

- 5.1.5 Polyester/PBT

- 5.1.6 Other Materials

- 5.2 Structure Types

- 5.2.1 Sheath-core

- 5.2.2 Side-by-Side

- 5.2.3 Islands in the Sea

- 5.2.4 Other Structure Types

- 5.3 End-user Industry

- 5.3.1 Non-Woven Textiles

- 5.3.2 Automotive

- 5.3.3 Hygiene

- 5.3.4 Construction

- 5.3.5 Medical

- 5.3.6 Other End-user Industries

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 Italy

- 5.4.3.4 France

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 CHA Technologies Group

- 6.4.2 EMS-chemie Holding AG

- 6.4.3 Far Eastern New Century Corporation

- 6.4.4 Freudenberg Performance Materials

- 6.4.5 Huvis Corp.

- 6.4.6 Indorama Ventures Public Company Limited

- 6.4.7 JNC Corporation

- 6.4.8 Kolon Glotech

- 6.4.9 Kuraray Co. Ltd.

- 6.4.10 OC Oerlikon Management AG

- 6.4.11 PTT Global Chemical Public Company Limited

- 6.4.12 Shaoxing Yaolong Spunbonded Nonwoven Technology Co. Ltd

- 6.4.13 TEIJIN Limited

- 6.4.14 TORAY Industries Inc.

- 6.4.15 WPT Nonwovens Corp.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Future Applications of Recycled Bicomponent Fibers