|

市场调查报告书

商品编码

1693966

印度 IT 硬体:市场占有率分析、行业趋势和统计数据、成长预测(2025-2030 年)India IT Hardware - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

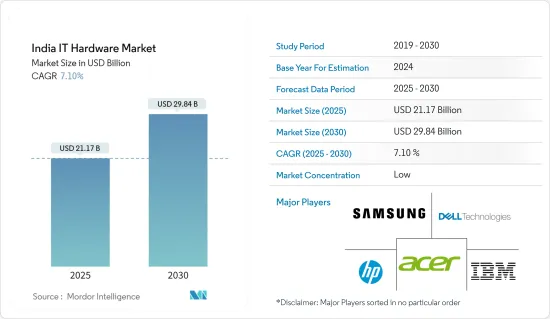

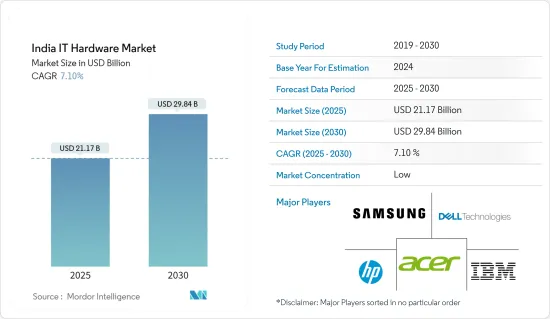

印度 IT 硬体市场规模预计在 2025 年为 211.7 亿美元,预计到 2030 年将达到 298.4 亿美元,预测期内(2025-2030 年)的复合年增长率为 7.1%。

笔记型电脑需求激增推动混合工作方式的采用印度 IT 硬体市场对笔记型电脑的需求大幅激增,这主要是由于混合工作政策的广泛采用。印度各地的组织正在迅速采用远端工作,需要在电脑硬体上进行大量投资。印孚瑟斯 (Infosys) 和威普罗 (Wipro) 等科技巨头报告称,远距工作者数量显着增加,刺激了各个笔记型电脑领域的销售。预计这种向混合工作模式的转变将会持续下去,从而保持对可靠可携式运算设备的需求稳定。

关键亮点

- 数位印度和印度製造计画:数位印度和印度製造计画正在帮助推动 IT 硬体产业(尤其是笔记型电脑)的成长。

- 教育转变:教育机构采用了线上学习系统,导致教育工作者和学生对笔记型电脑的需求增加。

- 电子商务激增:由于具有竞争力的价格和便捷的访问,亚马逊、Flipkart 和 Reliance Digital 等平台大幅提升了笔记型电脑的销售。

- 配件市场:笔记型电脑的销售量不断成长,同时对周边设备和配件的需求也不断增长,支持了高效能家庭办公室设置的发展。

- 技术整合推动高效运算系统:对技术整合和高效运算系统的高需求正在重塑印度 IT 硬体市场。各个领域的公司都在采用物联网、自动化和数据分析等工业 4.0 技术,这些技术需要强大的运算基础设施。这一趋势在製造业、医疗保健、零售业和新兴企业等领域尤为明显。

- 智慧城市计划:印度政府的智慧城市计划正在推动对综合技术解决方案和高效电脑系统的需求。

- 远端医疗的成长:远端医疗和数位健康服务正在蓬勃发展,需要强大的 IT 硬体基础设施来满足日益增长的需求。

- 资料中心扩张:Microsoft Azure、Google Cloud 和 Amazon Web Services 等供应商正在扩大其在印度的业务,并在 IT 硬体方面投入大量资金。

- 人工智慧和机器学习的公告各行各业采用人工智慧和机器学习技术正在推动对 GPU 和加速器等高效能运算硬体的需求。

- 公共部门的数位化加速了 IT 硬体的采用:印度公共部门数位化是 IT 硬体市场的主要驱动力。印度政府雄心勃勃的「数位印度」计画正在扩大对IT基础设施的需求,该计画包括 Aadhaar 数位身分系统、电子治理计画和数位素养宣传活动。

- 电子政府的影响:国家电子政府计画和州特定的政府计划正在增加对伺服器、网路硬体和安全 IT 硬体的需求。

- 数位付款:UPI 等数位付款系统的日益普及导致了对安全付款闸道和 POS 设备的需求。

- 公共分配系统:公共分配系统的数位化正在推动对后端伺服器、生物辨识设备和 POS 终端的需求。

- 改变司法系统:印度司法系统的数位化正在创造对强大的IT基础设施的需求,包括伺服器和视讯会议工具。

- 市场挑战与未来展望:市场面临挑战,尤其是在电子废弃物管理方面。随着科技的快速发展,IT硬体设备的使用寿命不断缩短,导致电子废弃物数量不断增加,这已成为业界和政策制定者日益关注的问题。

展望未来,印度 IT 硬体市场预计将因多种因素而持续成长。

关键亮点

- 5G 和边缘运算:5G 网路和边缘运算的扩展预计将推动对专用硬体的需求。

- 关注永续性:对永续性的更多关注促进了节能硬体和环保认证的发展。

- 新兴技术:VR、AR 和元宇宙的兴起将需要先进的硬体解决方案来支援新的体验。

- 政府投资:政府对数位基础设施的持续关注将维持市场成长。

印度IT硬体市场趋势

个人电脑和工作站占据了很大的市场占有率

- PC 和工作站领域:市场占有率最大:在印度 IT 硬体市场中,PC 和工作站领域占有最大份额,2022 年占 71.40% 的市场份额。 2022 年市场规模价值 124.3 亿美元,预计到 2028 年将达到 171.1 亿美元,预测期内(2023-2028 年)的复合年增长率为 5.62%。

- 政府主导的成长:政府主导的教育计划和升级版 PC 的采购正在推动需求,而政府企业 PC 采购将在 2022 年显着推动需求。

- 技术进步:惠普等公司正在推出支援人工智慧的个人电脑,其创新机型预计将于 2024 年上市,实现人工智慧资料分析等先进功能。

- 产品多样化:2023年4月,戴尔推出了针对不同细分市场和价格分布的全新产品系列,包括Latitude笔记型电脑和Precision行动工作站。

- 企业网路硬体:成长最快的细分市场:企业网路硬体细分市场在 2022 年的价值为 14.3 亿美元,预计到 2028 年将达到 24.9 亿美元,复合年增长率为 10.12%。

- 科技驱动:混合云端环境日益复杂,推动了对安全、无缝网路解决方案的需求

- 产品创新:NETGEAR 将于 2023 年推出 10G/多Gigabit双 WAN 专业路由器,满足企业的高效能需求,并提供满足高阶网路需求的解决方案。

- 致力于本地製造:Ciena 和 Flex 等公司已合作在印度生产路由和交换产品,符合「印度製造」计划。

北印度经济强劲成长

- 北印度:成长最快的区域市场北印度已成为成长最快的区域市场,2022 年价值 53 亿美元,预计到 2028 年将达到 83 亿美元,复合年增长率为 7.92%。

- 哈里亚纳邦的工业中心包括古尔冈和马内萨尔等中心,是IT设备製造和组装中心,拥有先进的基础设施和战略位置优势。

- 企业影响力大型 IT 公司如 HCL 和 HP 在该地区拥有强大的企业发展,推动当地 IT 硬体的需求和供应。

- 教育生态系统:北印度教育机构和学院提供了优秀的 IT 劳动力,为该地区的发展做出了贡献。

印度IT硬体市场概况

全球和本地参与者主导细分市场:印度 IT 硬体市场是细分的,惠普、戴尔科技和思科等全球参与企业与本地製造商竞争。这种参与企业组合促进了竞争和创新,有助于市场成长。

市场领导利用创新:惠普和戴尔等全球参与企业透过持续创新和产品多样化保持竞争力,尤其是在个人电脑和工作站领域。

策略伙伴关係伙伴关係:英特尔和 VVDN Technologies 在设备製造方面的合作对于维持 IT 硬体市场的领先地位至关重要。

新兴技术:思科等网路硬体领导企业专注于支援 5G 的解决方案,并处于对先进IT基础设施日益增长的需求的前沿。

未来成功因素:要取得成功,公司需要专注于开发与人工智慧、物联网和 5G 等新兴技术一致的创新、节能产品。增加本地产量、实践永续性和建立策略伙伴关係关係将是获得市场占有率和满足 BFSI 和电子商务等关键行业不断变化的需求的关键。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场洞察

- 生态系分析

- 评估宏观经济趋势的影响

- 大都会与非大都会产品分析

- 中小型企业对大都会与非大都会的分析

第五章市场动态

- 市场驱动因素

- 混合工作政策导致笔记型电脑需求快速成长

- 对技术整合和高效计算系统的需求很高

- 推动公共部门数位化

- 市场问题

- 对电子废弃物日益增长的担忧

- ICT市场数位化趋势对IT硬体有全面影响

- 市场上的重大创新

第六章市场区隔

- 个人电脑和工作站

- 最终用户

- 消费者

- 企业

- 中小企业

- 大型企业

- 产业

- BFSI

- 零售

- 资讯科技/通讯

- 其他行业

- 地理细分

- 主要供应商名单

- 最终用户

- 企业网路硬体

- 企业

- 中小企业

- 大型企业

- 产业

- BFSI

- 零售

- 资讯科技/通讯

- 其他行业

- 地理细分

- 主要供应商名单

- 企业

- 企业储存设备

- 企业

- 中小企业

- 大型企业

- 产业

- BFSI

- 零售

- 资讯科技/通讯

- 其他行业

- 地理细分

- 主要供应商名单

- 企业

- 伺服器

- 企业

- 中小企业

- 大型企业

- 产业

- BFSI

- 零售

- 资讯科技/通讯

- 其他行业

- 地理细分

- 主要供应商名单

- 企业

- 其他的

- 主要供应商名单

- 按地区

- 北印度

- 东印度

- 印度西部和中部

- 南印度

第七章竞争格局

- 公司简介

- HP Inc.

- Samsung Electronics Co. Ltd

- IBM

- Dell Technologies Inc.

- Acer Inc.

- Lenovo Group Ltd

- NetApp

- Hitachi Corporation

- Panasonic Corporation

- Cisco Systems Inc.

- Juniper

- Arista

第八章市场占有率分析

- 个人电脑和工作站

- 网路硬体

- 储存装置

- 伺服器

第九章:市场的未来

The India IT Hardware Market size is estimated at USD 21.17 billion in 2025, and is expected to reach USD 29.84 billion by 2030, at a CAGR of 7.1% during the forecast period (2025-2030).

Rapid growth in laptop demand drives hybrid work adoption: The India IT Hardware Market is experiencing a significant surge in laptop demand, primarily driven by the widespread adoption of hybrid work policies. Organizations across India have rapidly implemented remote work practices, necessitating substantial investments in computer hardware. Major tech companies like Infosys and Wipro have reported a notable increase in remote workers, fueling sales across various laptop segments. This shift toward hybrid work arrangements is expected to persist, maintaining steady demand for reliable and portable computing devices.

Key Highlights

- Digital India & Make in India Initiatives: The 'Digital India' and 'Make in India' initiatives have been instrumental in propelling the IT hardware sector's growth, especially laptops.

- Educational Shift: Educational institutions have embraced online learning systems, resulting in increased laptop demand among both educators and students.

- E-commerce Surge: Platforms like Amazon, Flipkart, and Reliance Digital have significantly boosted laptop sales through competitive pricing and easy accessibility.

- Accessory Market: The rise in laptop sales has coincided with higher demand for peripherals and accessories, supporting the development of efficient home office setups.

- Technology integration drives efficient computing systems: High demand for technology integration and efficient computing systems is reshaping the Indian IT hardware landscape. Businesses across various sectors are adopting Industry 4.0 technologies, such as IoT, automation, and data analytics, which require powerful computing infrastructure. This trend is particularly evident in sectors like manufacturing, healthcare, retail, and startups.

- Smart City Project: The Indian government's Smart City project is driving demand for integrated technology solutions and efficient computer systems.

- Telemedicine Growth: Telemedicine and digital health services have surged, requiring robust IT hardware infrastructure to handle the increased demand.

- Data Center Expansion: Providers like Microsoft Azure, Google Cloud, and Amazon Web Services are expanding their presence in India, investing heavily in IT hardware.

- AI & ML Adoption: The adoption of AI and machine learning technologies across industries is creating demand for high-performance computing hardware, including GPUs and accelerators.

- Public sector digitization accelerates IT hardware adoption: The increasing digitization of India's public sector is a significant driver of the IT hardware market. The government's ambitious "Digital India" program, including the Aadhaar digital identity system, e-governance initiatives, and digital literacy campaigns, has amplified demand for IT infrastructure.

- E-Governance Impact: National e-governance plans and state-specific government projects have led to increased demand for servers, networking hardware, and secure IT hardware.

- Digital Payments: Digital payment systems like UPI have grown in popularity, driving the need for secure payment gateways and POS devices.

- Public Distribution System: The digitization of the public distribution system has created demand for back-end servers, biometric devices, and point-of-sale terminals.

- Judicial System Transformation: The Indian judiciary's shift toward digital courts has increased demand for robust IT infrastructure, including servers and video conferencing tools.

- Market challenges and future outlook: The market faces challenges, particularly concerning e-waste management. As technology evolves rapidly, the lifespan of IT hardware devices shortens, resulting in higher e-waste volumes, which is becoming a growing concern for the industry and policymakers.

Looking ahead, several factors will drive continued growth in the Indian IT hardware market:

Key Highlights

- 5G & Edge Computing: The expansion of 5G networks and edge computing is expected to fuel demand for specialized hardware.

- Sustainability Focus: Increased focus on sustainability is leading to the development of energy-efficient hardware and eco-friendly certifications.

- Emerging Technologies: The rise of VR, AR, and the metaverse will require advanced hardware solutions to support new experiences.

- Government Investments: Continued government initiatives in digital infrastructure will sustain market growth.

India IT Hardware Market Trends

PC and Workstations to Hold Significant Market Share

- PC and Workstations Segment: Largest Market Share: The PC and Workstations segment commands the largest share of the India IT Hardware Market, accounting for 71.40% of the market in 2022. Valued at USD 12.43 billion in 2022, this segment is projected to reach USD 17.11 billion by 2028, with a CAGR of 5.62% during the forecast period (2023-2028).

- Government-Driven Growth: Government-driven education projects and procurement of upgraded PCs have fueled demand, with government enterprise PC purchases significantly boosting demand in 2022.

- Technological Advancements: Companies like HP are introducing AI-enabled PCs, with innovative models set to enter the market by 2024, allowing advanced functionalities such as AI-powered data analysis.

- Product Diversification: Dell launched a new product portfolio in April 2023, including Latitude Notebooks and Precision Mobile Workstations, targeting various market segments and price points.

- Enterprise Networking Hardware: Fastest Growing Segment: Valued at USD 1.43 billion in 2022, the Enterprise Networking Hardware segment is projected to reach USD 2.49 billion by 2028, registering a CAGR of 10.12%.

- Technological Drivers: The increasing complexity of hybrid cloud environments is driving demand for secure and seamless networking solutions.

- Product Innovation: NETGEAR launched a 10G/Multi-Gigabit Dual WAN Pro Router in 2023 to meet the high-performance needs of businesses, offering solutions for advanced networking requirements.

- Local Manufacturing Initiatives: Companies like Ciena and Flex are partnering to manufacture routing and switching products in India, aligning with the 'Make in India' initiative.

North India to Witness Major Growth

- North India: Fastest Growing Regional Segment: North India is emerging as the fastest-growing regional market, with a valuation of USD 5.30 billion in 2022, projected to reach USD 8.30 billion by 2028, at a CAGR of 7.92%.

- Industrial Hub: Haryana, with hubs like Gurugram and Manesar, has become a center for IT equipment production and assembly, offering advanced infrastructure and strategic location advantages.

- Corporate Presence: Major IT companies like HCL and HP have strong operations in the region, driving local demand and supply of IT hardware.

- Educational Ecosystem: North India's educational institutions and vocational schools provide a qualified IT workforce, contributing to regional growth.

India IT Hardware Market Overview

Global and Local Players Dominate Fragmented Market: The India IT Hardware Market is fragmented, with global players like HP Inc., Dell Technologies, and Cisco competing alongside local manufacturers. This mix of players fosters competition and innovation, contributing to market growth.

Market Leaders Leverage Innovation: Global players like HP and Dell maintain their competitive edge through continuous innovation and product diversification, particularly in the PC and workstation segments.

Strategic Partnerships: Partnerships, such as Intel's collaboration with VVDN Technologies for device manufacturing, are key to maintaining leadership in the IT hardware market.

Emerging Technologies: Leaders in networking hardware like Cisco are focusing on 5G-ready solutions, positioning themselves at the forefront of the growing demand for advanced IT infrastructure.

Factors for Future Success: To succeed, companies must focus on developing energy-efficient, innovative products aligned with emerging technologies like AI, IoT, and 5G. Expanding local manufacturing, adhering to sustainability practices, and forming strategic partnerships will be key to capturing market share and responding to the evolving needs of key sectors like BFSI and e-commerce.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Insights

- 4.2 Industry Ecosystem Analysis

- 4.3 Assessment of the Impact of Macroeconomic Trends

- 4.4 Analysis of Metros and Non-metros for Products

- 4.5 Analysis of Metros and Non-metros by SMEs

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rapid Growth in Demand for Laptops to Accommodate Hybrid Work Policies

- 5.1.2 High Demand for Technology Integration and Efficient Computing Systems

- 5.1.3 Increasing Digitization of the Public Sector

- 5.2 Market Challenges

- 5.2.1 Rising Concern Regarding E-waste

- 5.3 Digital Trends in the ICT Market Having an Overarching Impact on IT Hardware

- 5.4 Key Innovations in the Market

6 MARKET SEGMENTATION

- 6.1 PCs and Workstations

- 6.1.1 End-user

- 6.1.1.1 Consumer

- 6.1.1.2 Enterprise

- 6.1.1.2.1 SMEs

- 6.1.1.2.2 Large Enterprises

- 6.1.1.3 Industry

- 6.1.1.3.1 BFSI

- 6.1.1.3.2 Retail

- 6.1.1.3.3 IT and Telecom

- 6.1.1.3.4 Other Industries

- 6.1.2 Segmentation by Region

- 6.1.3 List of Major Vendors in the Segment

- 6.1.1 End-user

- 6.2 Enterprise Networking Hardware

- 6.2.1 Enterprise

- 6.2.1.1 SMEs

- 6.2.1.2 Large Enterprises

- 6.2.2 Industry

- 6.2.2.1 BFSI

- 6.2.2.2 Retail

- 6.2.2.3 IT and Telecom

- 6.2.2.4 Other Industries

- 6.2.3 Segmentation by Region

- 6.2.4 List of Major Vendors in the Segment

- 6.2.1 Enterprise

- 6.3 Enterprise Storage Devices

- 6.3.1 Enterprise

- 6.3.1.1 SMEs

- 6.3.1.2 Large Enterprises

- 6.3.2 Industry

- 6.3.2.1 BFSI

- 6.3.2.2 Retail

- 6.3.2.3 IT and Telecom

- 6.3.2.4 Other Industries

- 6.3.3 Segmentation by Region

- 6.3.4 List of Major Vendors in the Segment

- 6.3.1 Enterprise

- 6.4 Servers

- 6.4.1 Enterprise

- 6.4.1.1 SMEs

- 6.4.1.2 Large Enterprises

- 6.4.2 Industry

- 6.4.2.1 BFSI

- 6.4.2.2 Retail

- 6.4.2.3 IT and Telecom

- 6.4.2.4 Other Industries

- 6.4.3 Segmentation by Region

- 6.4.4 List of Major Vendors in the Segment

- 6.4.1 Enterprise

- 6.5 Other Hardware (Includes Hard Copy Peripherals such as Printers and Copiers)

- 6.5.1 List of Major Vendors in the Segment

- 6.6 Region

- 6.6.1 North India

- 6.6.2 East India

- 6.6.3 West and Central India

- 6.6.4 South India

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 HP Inc.

- 7.1.2 Samsung Electronics Co. Ltd

- 7.1.3 IBM

- 7.1.4 Dell Technologies Inc.

- 7.1.5 Acer Inc.

- 7.1.6 Lenovo Group Ltd

- 7.1.7 NetApp

- 7.1.8 Hitachi Corporation

- 7.1.9 Panasonic Corporation

- 7.1.10 Cisco Systems Inc.

- 7.1.11 Juniper

- 7.1.12 Arista

8 MARKET SHARE ANALYSIS

- 8.1 PC and Workstation

- 8.2 Networking Hardware (includes Routers, Hubs, Switches)

- 8.3 Storage Devices

- 8.4 Servers