|

市场调查报告书

商品编码

1693971

北美立式袋包装:市场占有率分析、产业趋势与成长预测(2025-2030)North America Stand-Up Pouch Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

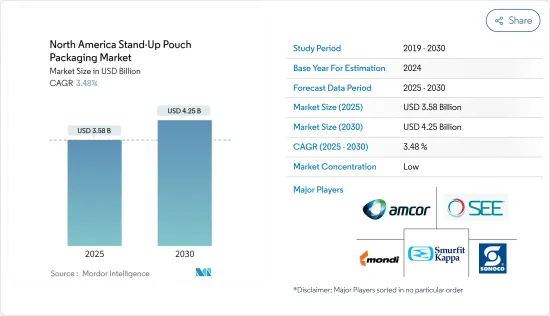

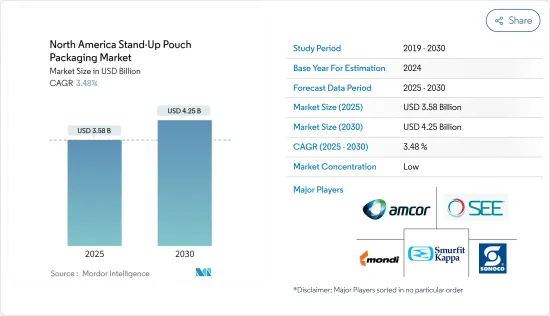

北美立式袋包装市场规模预计在 2025 年为 35.8 亿美元,预计到 2030 年将达到 42.5 亿美元,预测期内(2025-2030 年)的复合年增长率为 3.48%。

预计市场规模将从 2025 年的 269.9 亿台成长到 2030 年的 314.9 亿台,预测期间(2025-2030 年)的复合年增长率为 3.13%。

市场研究涵盖了标准、无菌和蒸馏等立式袋包装产品。立式袋包装在运输过程中提供了理想的保护屏障,防止湿气和污垢等外部因素与物品接触。

关键亮点

- 预计全部区域冷冻包装行业的成长将对市场产生积极影响。包装食品和食品饮料的需求不断增加、即食食品(RTE)的需求不断增加、使用方便性以及包装袋的成本效益是推动市场成长的关键因素。

- 此外,人们对随时随地吃零食的需求不断增长,导致对可重复密封的立式袋的需求增加,这为消费者提供了便利。此外,消费者生活方式、饮食偏好的改变以及食品技术的变化正在进一步推动市场需求。

- 消费者对环境问题的意识不断提高、监管规范不断变化、持续推动永续性(包括用生物分解性材料取代塑胶包装产品)以及缺乏最先进的回收设施而导致的回收率不足,这些都对市场成长构成了挑战。

- 包装器材正在进行技术创新,以跟上快速变化的市场需求,但这对使用传统机械的包装製造商提出了挑战,因为他们无法满足当前市场需求日益增加的工作量。参与企业必须投资新工具、备件和软体或转换新机器以满足不断变化的市场需求。

- 后新冠疫情导致包装需求激增,这得益于食品饮料和製药业需求的增加。

北美立式袋包装市场趋势

标准袋型市场预计将占据主要市场占有率

- 标准包装袋,包括婴儿食品和液体包装(茶、咖啡、果汁),广泛应用于食品和饮料行业。消费者期望包装的生鲜食品能够保留其所有天然特性和风味,这推动了标准包装袋的采用。

- 标准立式袋正经历来自终端用户产业的需求激增,促使製造商努力寻求创新解决方案。该领域的特点是动态策略,公司采用合作、扩张、收购和产品发布来保持竞争力。

- 根据美国对外农业服务局的数据,2022/2023财政年度美国咖啡消费量超过2,630万袋(每袋60公斤)。这比美国2020/2021 财年的咖啡总消费量(2,594 万袋,每袋 60 公斤)略有增加。

- 随着咖啡消费量的增加,对容纳和分发咖啡的包装解决方案的需求也将增加。标准立式袋是一种流行且用途广泛的包装选择,具有便利性、保护性和可视性和可视性。随着咖啡消费量的增加,对这些小袋子的需求也可能增加。

- 咖啡市场竞争激烈,品牌经常利用包装脱颖而出。立式袋为品牌、标籤和行销讯息提供了充足的空间。随着咖啡消费量的增加,公司可能会投资包装,以帮助他们的产品在货架上脱颖而出,从而增加对立式袋的需求。

加拿大:预期成长显着

- 加拿大立式袋需求不断增长的关键驱动因素是该国对包装和加工食品的高度依赖。根据多伦多大学的报告显示,加拿大约75%的食品供应来自加工食品。消费模式的改变凸显了对便利、永续包装解决方案的需求,使得立式袋成为加拿大市场的首选。

- 食品业正在快速扩张和变化,不断扩大包装选择并寻求更有效率的运输方式。此外,随着更多环保和永续的包装解决方案的出现,例如 Logos Pack、Omniplast、Canada Brown、Rootree 和 Grauman Packaging,越来越多的公司正在重新考虑他们的包装决策。

- 加拿大的宠物食品产业正在蓬勃发展,根据加拿大农业和农业食品部 (AAFC) 的数据,加拿大宠物食品零售额预计将以 4.9% 的复合年增长率进一步增长,到 2025 年达到 53 亿加元(2.2 亿美元)。在宠物食品行业,立式袋通常用于包装干粮和湿粮。这些袋子具有撕裂槽口和易打开功能,为饲主餵养宠物提供了便利。

- 该地区消费者对包装选择的需求不断增长,导致食品、食品和饮料以及製药业的包装采用率不断提高。此外,日益增长的医疗问题和环境法规正在推动轻质、阻隔性包装产品的使用。可重复密封包装的优势正在推动个人护理和化妆品应用的成长。

- 外国人口的不断增长以及尝试新产品的渴望也推动了对调理食品的需求。该地区社会和经济模式的变化导致对快餐和方便食品(包括预製家常小菜)的需求增加。随着健康意识的增强,消费者也将注意力转向植物性家常小菜。据加拿大农业食品部称,加拿大植物性预製家常小菜(不含肉类)的零售额将在 2021 年达到 1,910 万美元,2022 年达到 2,210 万美元。

- 加拿大各类终端用户需求的增加也促使企业扩张併购,以增加公司在加拿大市场的占有率。

北美立式袋包装产业概况

北美立式袋包装市场主要由 Amcor PLC、Mondi Group、Sealed Air Corporation、Sonoco Products Company 和 Smurfit Kappa Group 等主要参与者组成。市场参与企业正在采取联盟和收购等策略来增强其产品供应并获得可持续的竞争优势。

- 2023 年 7 月 - Furutamaiki OYJ 宣布对其位于美国德克萨斯州巴黎的工厂进行重大投资。投资将包括扩大製造能力和整合外部仓库。生产资产投资约为 3000 万美元,将租赁仓库和製造设施。这为我们提高北美业务的产能和支援食品服务业务的成长提供了重要的机会。

- 2023 年 1 月 - Glenroy 宣布,经过两年的开发过程,其可回收 STANDCAP 已获得塑胶回收再利用协会 (APR) 颁发的关键指导认证。作为硬质塑胶和玻璃瓶的完美环保替代品,100% 聚乙烯、可回收的 STANDCAP 对环境、消费者、品牌、零售商和食品安全来说是一个巨大的胜利。透过强调其可持续的软包装选择,Glenroy 正在为其生态目标做出贡献,同时利用市场对永续解决方案日益增长的偏好来推动长期业务成长。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家/消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 产业生态系统分析

- 行业标准和法规

- 立式袋市场的最新创新

- 比较分析:平袋包装与立式袋包装

第五章市场动态

- 市场驱动因素

- 北美食品和饮料需求预计将扩大,推动市场成长

- 标准包装袋使用方便(有拉炼、滑动和吸嘴包装可供选择),并且比其他包装袋所需材料更少

- 市场问题

- 改造灌装机以生产立式袋使转型变得困难

第六章市场区隔

- 按包装类型

- 标准

- 无菌

- 蒸馏

- 其他包装类型

- 依材料类型

- 塑胶(PE、PP、PVC、EVOH、生质塑胶)

- 金属/箔

- 纸

- 按最终用户

- 食物

- 饮料

- 医疗药品

- 宠物食品

- 家庭和个人护理

- 其他的

- 按国家

- 美国

- 加拿大

第七章竞争格局

- 公司简介

- Amcor PLC

- Mondi Group

- Sealed Air Corporation

- Sonoco Products Company

- Smurfit Kappa Group

- ProAmpac LLC

- Clondalkin Group

- Huhtamaki Oyj

- Dazpak Flexible Packaging

- Glenroy Inc.

- PPC Flexible Packaging LLC

第八章:市场的未来

The North America Stand-Up Pouch Packaging Market size is estimated at USD 3.58 billion in 2025, and is expected to reach USD 4.25 billion by 2030, at a CAGR of 3.48% during the forecast period (2025-2030). In terms of market size, the market is expected to grow from 26.99 billion units in 2025 to 31.49 billion units by 2030, at a CAGR of 3.13% during the forecast period (2025-2030).

Stand-up pouch packaging products such as Standard, Aseptic, and Retort are considered under the scope of the market study. Stand-up pouch packaging offers an ideal protective barrier during shipment and transit and prevents any external element, such as moisture and dirt, from coming into contact with the item.

Key Highlights

- The growth of the frozen packaged industry across the region is expected to impact the market positively. Rising demand for packaged food and beverages, increasing demand for Ready-to-Eat (RTE) food, convenience of use, and cost-effectiveness of pouches are primary factors supporting the market growth.

- In addition, the rise in the need for on-the-go snacks has led to the demand for re-closable stand-up pouches as they offer convenience to customers. In addition, the changing lifestyle and food preferences among consumers and changing food technology further boost the market's demand.

- The growing consumer attention to environmental concerns, dynamic regulatory standards, the ongoing drive for sustainability, which comprises replacing plastic-based packaging products with biodegradable materials, and inadequate recycling rates due to the lack of cutting-edge recycling facilities are challenging the market's growth.

- The ongoing technological changes in packaging machinery to cope with the rapidly changing market requirements will pose a challenge as packaging manufacturers using traditional machinery are not well equipped to take the increasing workload of current market requirements. Players must either invest in new tools, spare parts, and software to meet the changing market needs or switch to new machinery.

- The post-COVID-19 pandemic resulted in a surge in demand for packaging aided by the growing demand from the food and beverage and pharmaceutical industries, which will likely continue for the next few years.

North America Stand-Up Pouch Packaging Market Trends

Standard Pack Type Segment is Expected to Hold Significant Market Share

- Standard pouches, including baby food and liquid packaging (tea, coffee, and juices), are widely used in the food and beverage industry. Consumers' expectations for packaged fresh food to store all the natural properties and aromas drive the usage of standard pouches.

- The Standard Stand-up pouches are experiencing a surge in end-user industry demand, prompting manufacturers to strive for innovative solutions. The landscape is characterized by dynamic strategies, with companies adopting approaches such as collaboration, expansion, acquisition, and product launches to stay competitive.

- According to the USDA Foreign Agricultural Service, Coffee consumption in the United States amounted to over 26.3 million 60-kilogram bags in the 2022/2023 fiscal year. This is a slight increase from the total United States coffee consumption in the 2020/2021 fiscal year, which amounted to 25.94 million 60-kilogram bags.

- With increased coffee consumption, there is likely to be a higher demand for packaging solutions to contain and distribute the coffee. Standard Stand-up Pouches are a popular, versatile packaging option offering convenience, protection, and visibility. As coffee consumption rises, the demand for these pouches may also increase.

- The coffee market is highly competitive; brands often use packaging to differentiate themselves. Stand-up pouches provide ample space for branding, labeling, and marketing messages. As coffee consumption increases, companies will invest more in packaging that helps their products stand out on the shelves, which could boost the demand for stand-up pouches.

Canada Expected to Witness Significant Growth

- A key driving factor for the increased demand for stand-up pouches in Canada is the prevalent reliance on packaged and processed foods. University of Toronto's report indicated that approximately 75% of the nation's food supply comes from processed foods. The shift in consumption patterns underscores the need for convenient and sustainable packaging solutions, making stand-up pouches a preferred choice in the Canadian market.

- The food industry is expanding and changing swiftly, extending its packaging alternatives and looking for methods to be more productive. Additionally, more businesses, such as Logos Pack, Omniplast, Canada Brown, Rootree, and Grauman Packaging, are reconsidering their packaging decisions as more eco-friendly and sustainable packaging solutions become available.

- The pet food industry in Canada is booming, and as per Agriculture and Agri-Food Canada (AAFC) data, retail sales of pet food in Canada are expected to increase in CAGR by a further 4.9%, attaining CAD 5.3 billion (USD 0.22 billion) by 2025. In the pet food industry, stand-up pouches are a popular choice for packaging dry and wet pet food. Pouches with tear notches and easy-open features cater to the convenience of pet owners when serving their pets meals.

- The region is witnessing increased consumer demand for packaging options and rising adoption in the food, beverage, and pharmaceutical industries. Also, growing healthcare concerns and environmental regulations have increased the use of lightweight, high-barrier packaging products. The resealable benefit bolsters the growth of personal care and cosmetic applications.

- The existence of an expanding ex-pat population and the urge to try new products also drive the demand for ready meals. The region's need for quick and easy food, including prepared meals, is increasing due to shifting social and economic patterns. With rising health concerns, consumers are also focused on plant-based ready meals. According to Agriculture and Agri-Food Canada, the retail sales of plant-based ready meals (free from meat) in Canada were 19.1 million USD in 2021, reaching 22.1 million USD in 2022.

- The market also witnessed corporate expansions, mergers, and acquisitions to expand corporate presence in the Canadian market due to increased demand across various end-users in the country.

North America Stand-Up Pouch Packaging Industry Overview

The North America stand-up pouch packaging market is fragmented, with the precence of major players like Amcor PLC, Mondi Group, Sealed Air Corporation, Sonoco Products Company, and Smurfit Kappa Group. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- July 2023 - Huhtamaki OYJ announced a significant investment in its Paris, Texas, facility in the United States. The investment consists of an expansion of its manufacturing capacity as well as a consolidation of an external warehouse. The investment into production assets is approximately USD 30 million, and the warehouse and manufacturing facility will be leased. This brings significant opportunities to increase the North America business segment's capacity to support the growth of the food service business.

- January 2023- Glenroy Inc. announced that after a two-year development process, they received Critical Guidance Recognition from the Association of Plastic Recyclers (APR) for the recyclable STANDCAP. As a complete eco-friendly alternative to rigid plastic and glass bottles, the 100% Polyethylene recyclable STANDCAP is a major win for the environment, consumers, brands, retailers, and food safety. By emphasizing the company's sustainable, flexible packaging options, Glenroy contributes to ecological goals while also capitalizing on the growing market preference for sustainable solutions, driving business growth in the long term.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Ecosystem Analysis

- 4.4 Industry Standards and Regulations

- 4.5 Recent Innovations in the Stand-Up Pouch Market

- 4.6 Comparative Analysis: Flat Packaging vs Stand-Up Pouch Packaging

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Demand for Food and Beverage Expected to Grow in North America, thereby Contributing to the Market Growth

- 5.1.2 Standard Pouches Offer a High Level of Convenience (Available in Zipper, Slider, Spout Packs, Etc.) and Require Less Material Volumes as Compared to Alternative

- 5.2 Market Challenges

- 5.2.1 Filling Machinery Changes for Producing Stand-Up Pouches Make Transitions Difficult to Implement

6 MARKET SEGMENTATION

- 6.1 By Pack Type

- 6.1.1 Standard

- 6.1.2 Aseptic

- 6.1.3 Retort

- 6.1.4 Other Pack Types

- 6.2 By Material Type

- 6.2.1 Plastic (PE, PP, PVC, EVOH, Bio-Plastics)

- 6.2.2 Metal/Foil

- 6.2.3 Paper

- 6.3 By End User

- 6.3.1 Food

- 6.3.2 Beverages

- 6.3.3 Medical and Pharmaceutical

- 6.3.4 Pet Food

- 6.3.5 Home and Personal Care

- 6.3.6 Other End Users

- 6.4 By Country

- 6.4.1 United States

- 6.4.2 Canada

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Amcor PLC

- 7.1.2 Mondi Group

- 7.1.3 Sealed Air Corporation

- 7.1.4 Sonoco Products Company

- 7.1.5 Smurfit Kappa Group

- 7.1.6 ProAmpac LLC

- 7.1.7 Clondalkin Group

- 7.1.8 Huhtamaki Oyj

- 7.1.9 Dazpak Flexible Packaging

- 7.1.10 Glenroy Inc.

- 7.1.11 PPC Flexible Packaging LLC