|

市场调查报告书

商品编码

1694005

拉丁美洲电线电缆:市场占有率分析、行业趋势和成长预测(2025-2030 年)Latin America Wire And Cable - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

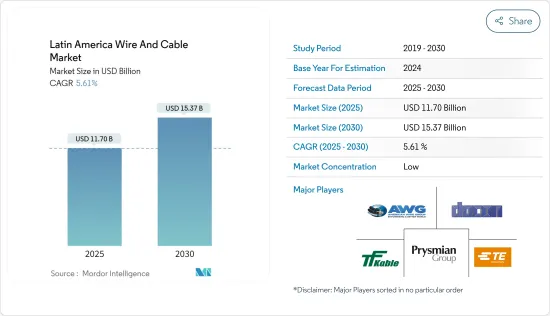

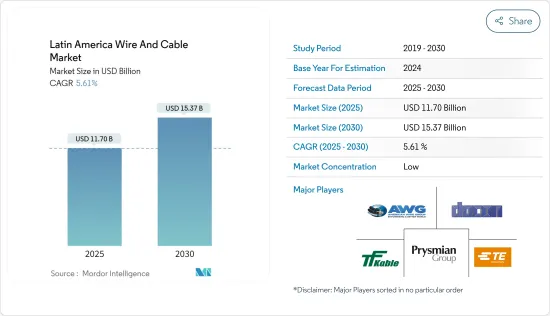

预计 2025 年拉丁美洲电线电缆市场规模将达到 117 亿美元,预计到 2030 年将达到 153.7 亿美元,预测期内(2025-2030 年)的复合年增长率为 5.61%。

人口成长和都市化推动的能源需求快速成长正在推动所研究市场的成长。此外,工业扩张、可再生能源整合和基础设施发展将需要依赖这些电缆的广泛电力分配电网。

建设活动的成长推动电线电缆市场的成长

关键亮点

- 随着该地区人口的成长和经济的发展,电力消耗不断飙升,需要大规模的电力分配网路。都市化和人口的快速增长刺激了新住宅和商业建筑的激增。

- 为了满足日益增长的建筑产品需求,电缆製造商正在提高耐火电缆的生产能力。这些电缆旨在抑制火势蔓延,并配有测量烟雾和有毒气体排放的鞘套。这些电缆主要用于商业建筑、大型住宅和製造设备的布线。

资料中心设施的增加以及 IT 和电讯公司的投资将进一步推动市场

关键亮点

- 该地区资料中心数量的增加可能会进一步推动所研究市场的成长。例如,2023年1月,桑托斯港务局(SPA)与巴西Zeittec公司合作建造了一个新的资料中心。 Zeittec 和监督圣保罗桑托斯港的国有公司 SPA 签署了建设合约。 SPA 安全室的建设工程预计将于 1 月开工,并于 2023 年中期完工。 SPA 安全室拥有经过 NBR 10.636 认证的墙壁,确保耐火时间长达 120 分钟(CF 120),并配备 OM4 雷射多模光纤和 CAT 6A 结构化布线。

- 2023 年 10 月,巴西资料中心供应商 Elea Digital 将其 RJO1 资料中心扩建至 2.5MW。该公司已投资 1 亿巴西币(BRL)(2,015 万美元),在里约热内卢增加 500平方公尺(5,382 平方英尺)的空间和 2.5 兆瓦的 IT 容量。

原物料价格波动可能阻碍市场成长

关键亮点

- 四种主要材料——黄金、铜/黄铜、钢和热塑性塑胶——的价格波动占连接器製造成本的 75%。虽然这些是主要材料,但连接器中也使用其他材料,例如镍和银。由于中国经济放缓(中国购买了约 50% 的新开采铜),预计 2024 年剩余时间内铜价将保持平稳,然后小幅上涨。

随着对速度和效率的需求不断增加,光纤技术也在不断发展。光耦合器、光开关等技术创新正在为全光纤网路(AON)通讯铺平道路。这项进步使得无需电气处理即可传输数据,更容易延长传输距离。预计光纤技术的进步将在预测期内推动该地区的市场成长。

拉丁美洲电线电缆市场趋势

电力电缆占据主要市场占有率

- 电力电缆用于电力传输和配电网络,将电力从发电站输送到变电站、工业设施、商业建筑和住宅远距。这些电缆设计用于承载超过 1,000 伏特的高压电流。

- 电力电缆用于各种应用,从海底和陆上设施到建筑领域。它们在大型输电计划、为施工机械提供动力以及透过发电机和临时变电站进行临时配电中发挥着至关重要的作用。除了建筑之外,这些电缆还可满足汽车、工业和住宅需求。

- 此外,对电网现代化的投资增加预计将推动市场成长。许多国家正在升级和现代化其电网,以使其更加高效、可靠和有弹性。这涉及用更先进的技术(例如高压直流电缆和超导电缆)取代现有的电力电缆,以满足更高的电力需求并提高电网稳定性。

- 墨西哥和巴西在拉丁美洲的智慧电錶采用方面处于领先地位。巴西公用事业公司,包括 AES Eletropaulo、Celpa、Eletrobras 和 Light,正在从先导计画转向大规模、数百万电錶部署。在墨西哥,国营电力公司 CFE 的目标是到 2025 年让 3,020 万客户使用智慧电錶。秘鲁、哥伦比亚和智利等新兴市场对智慧电錶的需求也预计将增加,从而进一步推动预测期内的市场成长。

- 据5G Americas称,截至2023年6月,拉丁美洲和加勒比海地区已部署28张5G网路。巴西和智利各自拥有四个采用该新一代技术的网路。墨西哥、秘鲁和波多黎各也纷纷效仿,各自拥有三张 5G 网路。

巴西占很大份额

- 受发电和输电行业需求激增(尤其是随着巴西电网升级)的推动,巴西正在大力投资电线电缆市场。

- 预计电力消耗量的增加将推动市场的成长。巴西电力商业协会(CCEE)预测,2023年巴西的电力消耗量将达到519.4 TWh,与前一年同期比较成长约25%。巴西的电力消耗量预计将持续成长,到2027年将超过590兆瓦时。

- 巴西在可再生能源领域取得了长足进步,目前其电网的 80% 以上来自可再生能源,而美国这一比例仅为 20%。不过,石油业仍具有影响力,占巴西GDP的3%,并显示出成长迹象。 2024年8月,卢拉总统宣布了新的成长加速计画(New PAC),强调增加对环境永续性和向绿色经济转型的资金投入。值得注意的是,该计画还设想增加对石化燃料的投资。

- 巴西正在大力投资电讯领域,这可能会刺激研究市场的需求。巴西软体协会(ABES)强调巴西是拉丁美洲最大的技术生态系统。根据 Equinix 的数据,拉丁美洲的资讯科技 (IT) 支出近年来增加了 1.3%,预计不久的将来将成长 4-5%。预计对巴西IT和电讯领域的投资将分别达到约400亿至500亿美元。这些投资将显着加强云端运算和资料中心市场。

- 根据 GSMA 的报告,到 2025 年,巴西的智慧型手机连线数量预计将超过 2.18 亿。智慧型手机的快速普及预计将推动对 5G 网路部署的巨大需求。巴西以 5G 连接总数的 77% 领先该地区。

拉丁美洲电线电缆产业概况

由于意识的增强、互联网服务的广泛采用以及数位基础设施的投资而导致的需求不断增长,从而加剧了市场竞争。

拉丁美洲电线电缆市场由在产品和製造方面投入大量资金的参与企业主导。儘管对新参与企业的投资要求不高,但他们的生存取决于强大的竞争策略。产品创新可以透过瞄准新兴和较少探索的应用领域来提高市场占有率。

Tele-Fonika Kable SA、Prysmian Group、TE Connectivity、American Wire Group、Dacon Systems Inc.、Fujikura Ltd.、Encore Wire、Coherent Corporation、Belden Incorporated 和 Southwire Company LLC 等供应商在策略上专注于大规模电线电缆生产。产品发布、合作和收购正在加剧竞争格局。工业公司专注于产品开发、创新突破和业务扩展,以释放高成长和新使用案例。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要和主要发现

第四章 市场洞察

- 市场概览

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 产业价值链分析

第五章市场动态

- 市场驱动因素

- 基础建设和智慧城市计划持续快速发展

- 通讯产业的持续扩张

- 市场限制

- 实施成本高且相关复杂性高

第六章市场区隔

- 按电缆类型

- 光纤电缆

- 讯号/控制电缆

- 电源线

- 其他的

- 按行业

- 建筑(住宅和商业)

- 通讯(IT/通讯)

- 电力基础设施(能源电力、汽车)

- 其他行业

- 按国家

- 墨西哥

- 巴西

- 阿根廷

第七章巴西市场展望

- 巴西领先的供应商

- Acome

- Grupo Alubar

- Brascopper

- Cabelauto

- Cablena

- Cabletech Cabos

- Cobrecom

- Cobreflex

- Cofibam

- Condex.

- Condumax Industria e Comercio Ltda

- Condumig Wire & Cables

- Dipro do Brasil (Conduspar)

- Copperfio SA

- Induscabos Industria e Comercio de Condutores Eletricos Ltda.

- Italcabos

- Lamesa Cabos Eletricos.

- Nexans

- Pan Electric

- Prysmian SpA

- Tramar Condutores Especiais

- Yangtze Optical Fiber & Cable Joint Stock Limited Company

- ZTT Group

- AF Datalink Cabos, Conexoes E Sistemas Ltda.

- Dacota Cabos Eletricos

第八章竞争格局

- 公司简介

- TELE-FONIKA KABLE SA(TFKABLE)

- Prysmian SpA

- TE Connectivity Corporation

- American Wire Group

- Dacon Systems Inc.

- Fujikura Ltd.

- Encore Wire

- Coherent Corporation

- Belden Inc.

- Southwire Company LLC

第九章 市场展望

The Latin America Wire And Cable Market size is estimated at USD 11.70 billion in 2025, and is expected to reach USD 15.37 billion by 2030, at a CAGR of 5.61% during the forecast period (2025-2030).

Surging energy demand, fueled by population growth and urbanization, drives the growth of the market studied. Additionally, industrial expansion, the integration of renewable energy, and infrastructure development necessitate extensive power distribution networks that depend on these cables.

Growing Construction Activities Driving the Growth of the Wire & Cable Market

Key Highlights

- As the region's population grows and its economy develops, electricity consumption is surging, leading to the need for extensive power distribution networks. This urbanization and population boom have catalyzed the rise of new residential and commercial buildings.

- In response to the escalating demand for construction products, cable manufacturers are ramping up their production capacities for fire-resistant cables. These cables are engineered to curb flame spread and come equipped with sheaths that gauge smoke and toxic gas emissions. They're predominantly utilized in commercial buildings, as well as in wiring for expansive residential and manufacturing units.

The Rising Number of Data Center Facilities and Investment from IT and Telecom Providers are Further Driving the Studied Market

Key Highlights

- An increase in data centers in the regions may further propel the growth of the studied market. For instance, In January 2023, the Santos Port Authority (SPA) partnered with Brazilian firm Zeittec to construct a new data center. Zeittec and SPA, the state-owned entity overseeing the Port of Santos in Sao Paulo, finalized a building agreement. Work on the SPA Safe Room is set to commence in January and conclude by mid-2023. The SPA Safe Room boasts NBR 10.636-certified walls, ensuring fire resistance for up to 120 minutes (CF 120), and is equipped with OM4 laser multimode optical fibers and CAT 6A structured cabling.

- In October 2023, Elea Digital, a Brazilian data center provider, expanded its RJO1 data center to 2.5MW. The company invested Brazilian Real (BRL) 100 million (USD 20.15 million) to add 500 sqm (5,382 sq ft) of space and 2.5MW of IT capacity in Rio de Janeiro.

Fluctuating Raw Material Prices Could Hinder the Market Growth

Key Highlights

- The price fluctuations in four key materials-gold, copper/brass, steel, and thermoplastics-account for 75% of the costs in connector production. While these are the primary materials, others like nickel and silver are also utilized in connectors. Due to a slowdown in the Chinese economy, which usually buys about 50% of newly mined copper, copper prices are expected to remain flat with a slight increase for the rest of 2024.

As the demand for speed and efficiency surges, fiber-optic technology is evolving. Innovations like optical couplers and optical switches are paving the way for AON (all-optical networks) communication. This advancement enables data transmission without electrical processing, facilitating longer transmission distances. Such technological strides in fiber optics are poised to propel market growth in the region during the forecast period.

Latin America Wire And Cable Market Trends

Power Cable Holds Major Market Share

- Power cables are used in power transmission and distribution networks to transport electricity over long distances from power plants to substations and industrial facilities, commercial buildings, and residential areas. These cables are designed to carry high-voltage electrical currents of more than 1,000 volts.

- Power cables find diverse applications, from subsea installations and onshore facilities to the construction sector. They play a crucial role in large-scale power transmission projects, powering construction machinery and providing temporary power distribution through generators or temporary substations. Beyond construction, these cables serve automotive, industrial, and residential needs.

- Also, increasing investment in grid modernization is expected to drive market growth. Many countries are upgrading and modernizing their electrical grids to enhance efficiency, reliability, and resilience. This involves replacing existing power cables with more advanced technologies, such as high-voltage direct current cables or superconducting cables, to accommodate higher power demands and improve grid stability.

- Leading the charge in Latin America's smart meter adoption are Mexico and Brazil. Brazilian utilities, including AES Eletropaulo, Celpa, Eletrobras, and Light, have progressed from pilot projects to extensive multimillion-meter deployments. Highlighting the momentum, state-run utility CFE aims to transition 30.2 million consumers to smart meters in Mexico by 2025. Emerging markets like Peru, Colombia, and Chile are also projected to show heightened demand for smart meters, further fueling market growth during the forecast period.

- According to 5G Americas, as of June 2023, 28 5G networks were deployed in Latin America and the Caribbean. Brazil and Chile accounted for four networks of this next-generation technology each. Mexico, Peru, and Puerto Rico followed with 3 5G network deployments each.

Brazil to Hold Major Share

- Brazil is making substantial investments in its Wire & Cable market, driven by a surge in demand from the power generation and transmission sectors, particularly as power transmission networks undergo renewal.

- Rising electricity consumption is poised to drive the growth of the market under study. Camara de Comercializacao de Energia Eletrica (CCEE) (Brazil) forecasts that Brazil's electricity consumption will hit 519.4 TWh in 2023, marking a roughly 25% increase from the previous year. Looking ahead, Brazil's electricity consumption is set to keep climbing, with projections exceeding 590 terawatt-hours by 2027.

- Brazil has made significant advancements in renewable energy, with these sources now powering over 80% of the nation's electrical grid, a stark contrast to the 20% in the United States. Yet, the oil sector remains influential, contributing 3% to Brazil's GDP and showing signs of growth. In August 2024, President Lula unveiled the New Growth Acceleration Program (New PAC), emphasizing increased funding for environmental sustainability and a transition to a greener economy. Notably, the program also anticipates heightened investments in fossil fuels.

- Brazil is making substantial investments in its telecom sector, potentially driving up demand in the studied market. The Brazilian Software Association (ABES) highlights Brazil as the largest technology ecosystem in Latin America. Data from Equinix indicates that Information Technology (IT) investments in Latin America grew by 1.3% in recent years, with a projected upswing of 4-5% in the near future. Brazilian investments in the IT and telecom sectors are set to reach approximately USD 40-50 billion each. Such investments are poised to significantly bolster both the cloud computing and data center markets.

- As reported by GSMA, Brazil is on track to surpass 218 million smartphone connections by 2025. This surge in smartphone adoption is expected to drive a substantial demand for 5G network deployments. Leading the region, Brazil boasts 77% of the total 5G connections.

Latin America Wire And Cable Industry Overview

Rising demand, fueled by heightened awareness, internet service penetration, and investments in digital infrastructure, intensifies competition among market players.

The Latin America wire and cable market features established players with significant investments in products and manufacturing. While new entrants face moderate investment requirements, their survival hinges on robust competitive strategies. Product innovations can bolster their market presence by targeting emerging, less-explored application areas.

Vendors such as Tele-Fonika Kable SA, Prysmian Group, TE Connectivity, American Wire Group, Dacon Systems Inc., Fujikura Ltd, Encore Wire, Coherent Corporation, Belden Incorporated, and Southwire Company LLC have strategically aligned themselves to large-scale cable and wire production. Product launches, partnerships, and acquisitions are intensifying the competitive landscape. Industry players focus on product development, innovative breakthroughs, and expansions to tap into high-growth and emerging use cases.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY AND KEY FINDINGS

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rapid Infrastructure Development and Continuing Smart City Projects

- 5.1.2 Continuous Expansion in the Telecommunications Industry

- 5.2 Market Restraints

- 5.2.1 High Cost of Installation and Associated Complexities

6 MARKET SEGMENTATION

- 6.1 By Cable Type

- 6.1.1 Fiber Optic Cable

- 6.1.2 Signal and Control Cable

- 6.1.3 Power Cable

- 6.1.4 Others

- 6.2 By End-user Vertical

- 6.2.1 Construction (Residential and Commercial)

- 6.2.2 Telecommunications (IT & Telecom)

- 6.2.3 Power Infrastructure (Energy and Power, Automotive)

- 6.2.4 Others End-user Verticals

- 6.3 By Country

- 6.3.1 Mexico

- 6.3.2 Brazil

- 6.3.3 Argentina

7 BRAZIL MARKET OUTLOOK

- 7.1 Key Vendors in Brazil

- 7.1.1 Acome

- 7.1.2 Grupo Alubar

- 7.1.3 Brascopper

- 7.1.4 Cabelauto

- 7.1.5 Cablena

- 7.1.6 Cabletech Cabos

- 7.1.7 Cobrecom

- 7.1.8 Cobreflex

- 7.1.9 Cofibam

- 7.1.10 Condex.

- 7.1.11 Condumax Industria e Comercio Ltda

- 7.1.12 Condumig Wire & Cables

- 7.1.13 Dipro do Brasil (Conduspar)

- 7.1.14 Copperfio S.A.

- 7.1.15 Induscabos Industria e Comercio de Condutores Eletricos Ltda.

- 7.1.16 Italcabos

- 7.1.17 Lamesa Cabos Eletricos.

- 7.1.18 Nexans

- 7.1.19 Pan Electric

- 7.1.20 Prysmian S.p.A

- 7.1.21 Tramar Condutores Especiais

- 7.1.22 Yangtze Optical Fiber & Cable Joint Stock Limited Company

- 7.1.23 ZTT Group

- 7.1.24 AF Datalink Cabos, Conexoes E Sistemas Ltda.

- 7.1.25 Dacota Cabos Eletricos

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 TELE-FONIKA KABLE SA (TFKABLE)

- 8.1.2 Prysmian S.p.A

- 8.1.3 TE Connectivity Corporation

- 8.1.4 American Wire Group

- 8.1.5 Dacon Systems Inc.

- 8.1.6 Fujikura Ltd.

- 8.1.7 Encore Wire

- 8.1.8 Coherent Corporation

- 8.1.9 Belden Inc.

- 8.1.10 Southwire Company LLC