|

市场调查报告书

商品编码

1694012

北美三片金属罐:市场占有率分析、行业趋势和成长预测(2025-2030 年)North America 3 Piece Metal Cans - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

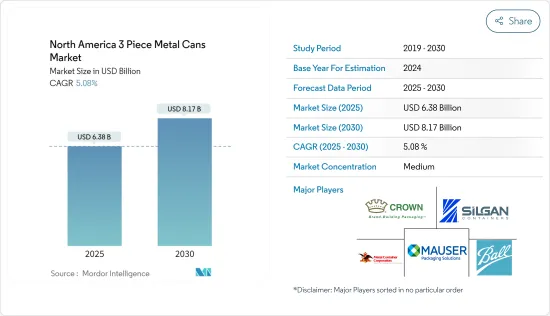

北美三片金属罐市场规模预计在 2025 年为 63.8 亿美元,预计到 2030 年将达到 81.7 亿美元,预测期内(2025-2030 年)的复合年增长率为 5.08%。

关键亮点

- 三片罐是一种用于食品、饮料的金属包装,由圆柱形罐身、顶盖、底盖组成。机身通常由钢或铝製成,呈圆柱形;盖子也由钢或铝製成,并透过接缝密封在机身上。

- 这些罐头通常用于包装蔬菜、水果、汤、肉类、气雾剂、油漆等。它们以其耐用性、抗衝击性、耐高压性、密封性(以保持产品新鲜度)和可回收性而闻名。但与易开罐或袋装罐相比,它们的开启不太方便,并且需要特殊的製罐工艺,这会导致更高的生产成本。

- 美国拥有成熟的饮料市场,涵盖酒精饮料和非酒精饮料。 2021年,美国啤酒市场总价值为1,002亿美元,其中精酿啤酒占268亿美元(21.0%)。美国酿酒商协会指出,精酿啤酒销量成长了 7.9%,相当于约 2,450 万桶。因此,美国市场对金属罐的需求明显增加。

- 此外,策略联盟和新市场的出现预计将推动市场成长。然而,新冠疫情限制了回收活动、矾土开采和原材料运输,导致该行业的供应链和製造业中断。结果,油漆业的三片罐供应量下降。同时,由于消费者购买模式的改变,疫情期间对饮料产品的需求增加,以及封锁期间食品和饮料产品消费的增加,有助于三片罐市场復苏。

北美三片罐市场趋势

消费者对已烹调产品和已调理食品的需求不断增加

- 消费者对即食和即食食品的需求不断增长,促进了已开发经济体和新兴经济体罐头食品市场的成长。劳动人口增加和烹饪时间有限等因素对市场成长产生了正面影响。

- 此外,随着千禧世代人口的增长和人们对预製家常小菜的接受度的提高,罐头产品因其易于准备和节省时间的优点而受到人们的青睐。

- 领先的製造商正在透过采取新策略来应对这一需求,包括推出新产品和扩大生产能力,以更好地服务消费者。市场的主要驱动力是不断增长的城市人口对方便食品的偏好以及对富含蛋白质、功能性纤维、维生素和Omega-3脂肪酸的健康食品的需求。

- 消费者愿意多花一点钱购买具有这些属性的产品,加上对小巧、易于准备的肉类、鱼贝类、有机蔬菜和水果罐头的需求,正在推动市场销售。

加拿大不断成长的市场

- 罐头食品因其在市场上的便利性而变得越来越受欢迎,并已成为许多人饮食中必不可少的一部分。在加拿大地区,这些食品的消费量不断增加,推动了需求的成长,并在促进罐头食品市场发展方面发挥了关键作用。此外,预计主要企业的投资和新产品推出将在未来几年进一步推动市场成长。

- 受战后婴儿潮世代老化、一般民众(尤其是千禧世代)购买力不断增强以及种族多样性日益增强等因素的影响,该国的人口结构变化正在导致人们的饮食偏好发生变化。这些因素推动了营养食品、道德食品选择、环境永续饮食以及创新口味和风味组合的趋势。

- 据加拿大农业和农业食品部 (AAFC) 称,消费者对可快速准备和食用的食品的偏好预计将推动加拿大罐头食品市场的发展。

- 这种变化也反映出人们对食品资讯日益增长的需求,包括生产实践和食品的营养成分。除了营养成分之外,消费者也希望了解食品如何提高他们的体能或改善他们的健康。消费者日益增强的健康意识预计将进一步推动市场发展。

北美三片金属罐产业概况

本报告介绍了北美三片金属罐市场的主要企业。从市场占有率来看,市场以中小型参与企业为主,各公司竞争激烈,但均未占较大的份额。因此,市场竞争激烈且分散。

主要区域参与企业正在向新区域扩张,从而扩大其地理覆盖范围。北美三片金属罐市场正在迎来新的竞争对手,他们提供客製化、行业特定的服务。主要参与企业包括 Crown、Ball Corporation、Silgan Containers、Metal Container Corporation 和 Mauser Packaging Solutions。

北美三片金属罐市场的参与企业表现出与其他参与企业合作的意愿,以节省成本并实现相互的竞争优势。此外,技术的采用也有助于降低营运成本并提高效率。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 调查结果

- 调查前提

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场概览

- 市场驱动因素

- 包装食品需求不断成长

- 涂料产业需求不断成长

- 市场限制

- 原料成本上涨

- 市场机会

- 价值链/供应链分析

- 波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

- 技术简介

- 政府法规和重大倡议

- COVID-19 市场影响

第五章市场区隔

- 按材质

- 铝

- 钢

- 其他的

- 透过内部压力

- 加压罐

- 真空罐

- 按应用

- 饮料

- 食品罐

- 画

- 其他的

- 按国家

- 美国

- 加拿大

- 墨西哥

第六章 竞争格局

- 市场竞争概况

- 公司简介

- Crown

- Ball Corporation

- Silgan Containers

- Metal Container Corporation

- Mauser Packaging Solutions

- Elemental Container Inc.

- Hudson Technologies

- ZERO Manufacturing

- Envases Universales

- Ardagh Metal Packaging*

- 其他公司

第七章 市场机会与未来趋势

第 8 章 附录

The North America 3 Piece Metal Cans Market size is estimated at USD 6.38 billion in 2025, and is expected to reach USD 8.17 billion by 2030, at a CAGR of 5.08% during the forecast period (2025-2030).

Key Highlights

- Three-piece cans are a form of metal packaging utilized for food and beverage items, consisting of a cylindrical body, a top lid, and a bottom lid. The body is typically made of steel or aluminum and shaped into a cylinder, while the lids are also made of steel or aluminum and sealed to the body through a seaming process.

- These cans are commonly used for packaging vegetables, fruits, soups, meats, aerosol sprays, and paint. They are known for their durability, resistance to impact, ability to withstand high pressure, airtight sealing for preserving product freshness, and recyclability. However, they are less convenient to open compared to easy-open cans or pouches and require a specialized canning process, which can increase production costs.

- The United States has a well-established beverage market, encompassing both alcoholic and non-alcoholic drinks. In 2021, the total beer market in the United States was valued at USD 100.2 billion, with craft beer accounting for USD 26.8 billion (21.0%). The Brewers Association noted a 7.9% increase in craft beer sales, equivalent to approximately 24.5 million barrels. Consequently, there is a notable surge in demand for metal cans in the United States market.

- Additionally, strategic collaborations and the emergence of new markets will drive market growth. However, the COVID-19 pandemic led to disruptions in the industry's supply chain and manufacturing units due to restrictions on recycling activities, bauxite mining, and transportation of raw materials. This resulted in a slowdown in the supply of three-piece cans for the paint industry. On the other hand, the demand for beverage products increased during the pandemic as consumer buying patterns shifted, and increased consumption of food and beverage products during the lockdown helped in the recovery of the three-piece cans market.

North America 3 Piece Metal Cans Market Trends

Increasing Demand From Consumers For Ready-To-Cook And Ready-To-Eat Products

- The rise in consumer demand for ready-to-cook and ready-to-eat food products has contributed to the growth of the canned food market in both developed and emerging economies. Factors such as the increasing working population and the limited time available for cooking have positively influenced market growth.

- Additionally, the rise in the millennial population, with their widespread acceptance of ready meals, has led to a preference for canned products due to their ease of preparation and time-saving benefits.

- Major manufacturers are responding to this demand by adopting new strategies, including launching new products and expanding production capacity to better serve consumers. The market is primarily driven by the growing urban population's preference for convenient food and the demand for healthy options rich in protein, functional fibers, vitamins, and omega-3 fatty acids.

- Consumers willing to invest a little more in products with these properties, along with the demand for small, easy-to-cook meat and seafood, as well as organic canned fruits and vegetables, are driving market sales.

Growing Market In Canada

- Canned foods are increasingly preferred due to their convenient availability in the market, making them an integral part of many people's diets. In the Canadian region, the rising consumption of such foods is driving a growing demand, thereby playing a crucial role in boosting the market for canned foods. Moreover, investments and new product launches by key players are anticipated to further propel market growth in the coming years.

- Shifting demographics in the country, influenced by factors such as aging baby boomers, the increasing purchasing power of the general population-especially millennials-and heightened ethnic diversity, contribute to changing food preferences. These factors drive trends toward food products with enhanced nutrition, ethical food choices, environmentally sustainable diets, and novel taste profiles and flavor combinations.

- According to Agriculture and Agri-Food Canada (AAFC), consumers are increasingly favoring foods that are quick to cook or ready for immediate consumption, thereby expected to boost the canned foods market in the country.

- The changing landscape also reflects a growing desire for information about food, encompassing production practices and the nutritious contents of the food. Beyond nutritional composition, consumers seek to understand how foods can enhance their performance or improve their health. This escalating health awareness among consumers is anticipated to further drive the market.

North America 3 Piece Metal Cans Industry Overview

The report covers the major players operating in the North America 3 piece metal can market. In terms of market share, the companies compete heavily with no major share as small and medium-sized players majorly occupy the market. Hence, the market is highly competitive and fragmented.

Major regional players have been observed to venture into new regions, allowing the companies to improve their geographic reach. New competitors are entering the North American three-piece metal can market with customized and industry-specific services. Some major players include Crown, Ball Corporation, Silgan Containers, Metal Container Corporation, and Mauser Packaging Solutions.

The North American three-piece metal can market players have been showing a willingness to partner with other players to reduce cost and leverage on mutual competitive advantage. Additionally, technology adoption has also helped reduce operational costs and improve efficiency.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS & DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Demand of Packed Food

- 4.2.2 Rising Demand in Paint Industry

- 4.3 Market Restraints

- 4.3.1 Increasing Cost of Raw Materials

- 4.4 Market Opportunities

- 4.5 Value Chain / Supply Chain Analysis

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Technological Snapshot

- 4.8 Government Regulations & Key Initiatives

- 4.9 Impact of Covid-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Material

- 5.1.1 Aluminum

- 5.1.2 Steel

- 5.1.3 Other Materials

- 5.2 By Degree of Internal Pressure

- 5.2.1 Pressurized Cans

- 5.2.2 Vacuum Cans

- 5.3 By Application

- 5.3.1 Beverage

- 5.3.2 Canned Food

- 5.3.3 Paints

- 5.3.4 Other Applications

- 5.4 By Country

- 5.4.1 United States

- 5.4.2 Canada

- 5.4.3 Mexico

6 COMPETITIVE LANDSCAPE

- 6.1 Market Competition Overview

- 6.2 Company Profiles

- 6.2.1 Crown

- 6.2.2 Ball Corporation

- 6.2.3 Silgan Containers

- 6.2.4 Metal Container Corporation

- 6.2.5 Mauser Packaging Solutions

- 6.2.6 Elemental Container Inc.

- 6.2.7 Hudson Technologies

- 6.2.8 ZERO Manufacturing

- 6.2.9 Envases Universales

- 6.2.10 Ardagh Metal Packaging*

- 6.3 Other Companies