|

市场调查报告书

商品编码

1694031

不织布包装:市场占有率分析、产业趋势与成长预测(2025-2030)Non-woven Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

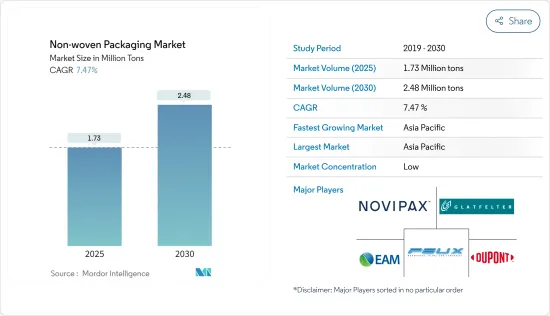

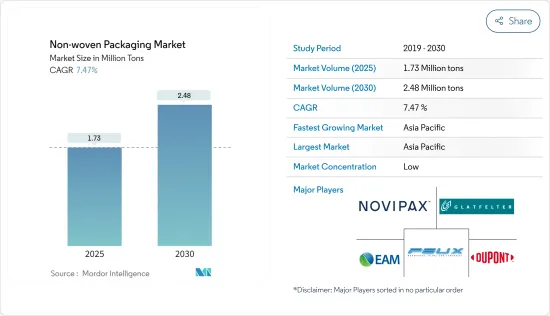

预计2025年不织布包装市场规模为173万吨,2030年将达248万吨,预测期(2025-2030年)复合年增长率为7.47%。

不织布製造流程的创新和改进也促进了市场的成长。材料和製造技术的创新为不不织布提供了机会,使其能够提供更高的强度、柔韧性和阻隔性性,为现有的包装产品提供替代品。随着这些先进技术的出现,不织布包装的应用范围正在向各个行业扩展,进一步推动市场成长。

纺织业日益全球化,生产和消费遍布不同地区。因此,在纺织品生产方面拥有竞争优势的国家,如人事费用低、原料取得便利,就能够扩大纱线生产以供出口。因此,国际纺织纱线贸易量激增。

不织布为农业、建筑和零售等各行各业提供轻盈、耐用且经济高效的包装解决方案。不织布的多功能性使其适用于多种不同类型的小袋和袋子,从而推动了其在包装应用中的采用。

包括环保时尚在内的环境意识正在全球范围内不断发展。可持续来源的不织布袋处于这一趋势的前沿,为传统塑胶袋提供了一种时尚且负责任的替代品。

地缘政治局势经常影响全球能源市场,影响原油和天然气价格。这些商品是不织布製造中使用的聚丙烯和聚酯等石化原料的主要来源,因此能源价格的波动会直接影响原料成本。能源价格的大幅上涨将推不织布生产商的生产成本,并可能导致不织布包装材料的价格上涨。

不织布包装市场的趋势

食品包装占据主要市场占有率

- 食品包装领域的生产商和加工商正在积极创新以创造可持续的解决方案,通常采用天然纤维并优化原材料的使用。含有大量天然纤维的气流成网不织布在食品垫片中扮演核心角色。

- 此外,纺粘/SAP/纺粘层压板在市场上越来越受欢迎。这些食品级不织布垫片可有效吸收肉类和水果等易腐烂物品中的液体,保持新鲜,延长保质期,最终减少食物浪费。根据经合组织预测,到 2032 年全球禽肉消费量将达到 156.24 吨。

- 据代表不织布行业的贸易协会 INDA 称,气流成网特别适合食品垫片,因为它类似于卫生吸收芯。它能快速吸收液体,最大限度地减少再润湿,并提供高吸收性。然而,其他类型的不织布,如纺粘、熔喷和针刺,在食品包装行业也发挥独特的作用。

- 不织布材料在食品包装中的主要优势之一是与塑胶和纸等传统包装材料相比具有成本效益。这种实惠的价格使其成为从生鲜食品到加工食品等各种食品包装应用的理想选择。

- 不织布材料在製作用于运输生鲜食品(如杂货、家常小菜和冷冻食品)的保温袋和托特包具有不可估量的价值。这些袋子可确保运输过程中内容物的新鲜度和质量,并隔热材料以保持所需的温度。此外,不织布也广泛用于製作可重复使用的杂货、水果蔬菜和食品购物袋。这些袋子因其耐用性、强度和多功能性而备受推崇,是一次性塑胶袋的环保替代品。

亚太地区:预计大幅成长

- 该地区各国一直注重支持纺织业的各个方面。人们特别关注不织布在各种包装应用中的众多应用。不织布袋因其耐用、抗撕裂和柔韧的特性,在该地区被广泛用于广告、运输、包装和促销用途。

- 不织布和技术纺织品被认为是纺织业最有前景和最具活力的部分,因此,印度对不织布和技术纺织品的需求和消费量在整个预测期内可能会稳步增长。印度工业已开始追随国际趋势,邀请外国参与企业与印度企业家合作,并鼓励製造商创新和扩大不织布包装生产线。

- 包装是中国不织布最传统的应用之一。由于禁止使用塑胶袋,对不织布可重复使用购物袋的需求很大。未来,中国不织布产业预计将更加重视工业包装、医疗包装、食品包装应用。

- 在中国,医疗外科产业对不织布的需求预计随时都会改变。预计「健康中国」计划以及产品和应用的发展将继续推动不织布医疗外科包装的消费。

- 根据代表中国不织布、工业纤维及相关产业的中国不织布布和工业纤维协会 2023 年 5 月发布的数据,2022 年新增约 50 条纺粘和熔喷不织布生产线、20 条水针线和 150 条针织生产线。

不织布包装产业概况

不织布包装市场由全球参与企业和中小型企业细分。市场的主要参与企业包括 Novipax Buyer, LLC、EAM Corporation(Domtar Corporation)、Glatfelter Corporation、Felix Non-wovens 和 Dupont de Nemours, Inc. 该市场的参与企业正在采用合作和收购等策略来加强其产品供应并获得可持续的竞争优势。

- 2024 年 2 月 - Berry Global Group, Inc. 和 Glatfelter Corporation 宣布,双方已达成协议,将 Berry Global Group 的大部分卫生、健康和特种部门及其全球不织布和薄膜业务合併到 Glatfelter。此次合併标誌着该公司向成为不织布和特殊材料全球市场领导者迈出了第一步。

- 2023 年 11 月 - Novipax 增强了其吸收垫片(名为 Prep 垫片 )在餐饮服务业的优势,可用于各种用途,例如保存食物以便储存和运输,以及包装食物以吸收多余的油和水分。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 产业价值链分析

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章市场动态

- 市场驱动因素

- 对环境永续包装解决方案的需求不断增长

- 在其他领域的使用日益增多,例如用于运输和保护目的的麻袋和袋子、灭菌包装、吸尘器袋和金属包装

- 市场问题

- 地缘政治不确定性及其对原物料和价格波动的影响

- 全球不织布消费量(分主要地区)

- 技术趋势:梳理成网不织布工艺与压延不织布工艺

第六章市场区隔

- 依技术

- 干式突袭

- 纺丝成网

- 其他的

- 按最终用户包装应用

- 食品包装

- 工业的

- 医疗的

- 其他最终用户包装应用

- 按地区

- 北美洲

- 欧洲

- 亚洲

- 澳洲和纽西兰

- 拉丁美洲

- 中东和非洲

第七章竞争格局

- 公司简介

- Novipax Buyer LLC

- EAM Corporation(Domtar Corporation)

- Glatfelter Corporation

- Felix Nonwovens

- Dupont de Nemours Inc.

- Freudenberg Performance Materials(Freudenberg Group)

- Mundo Products Co. Ltd

- Eximius Innovative Pvt. Ltd

第八章投资分析

第九章:未来展望与市场机会

The Non-woven Packaging Market size is estimated at 1.73 million tons in 2025, and is expected to reach 2.48 million tons by 2030, at a CAGR of 7.47% during the forecast period (2025-2030).

Innovation and improvements in the non-woven fabric manufacturing processes have also contributed to market growth. Innovations in materials and production techniques have led to the development of non-woven fabrics with enhanced properties such as strength, flexibility, and barrier capabilities, creating opportunities for the products to substitute existing packaging products. The advancements mentioned have expanded the application scope of non-woven fabric packaging across various industries, further driving market growth.

The textile industry has become increasingly globalized, spreading production and consumption across various regions. As a result, countries with competitive advantages in textile production, such as low labor costs or access to raw materials, have been able to ramp up their yarn production for export purposes. This has led to a surge in the volume of textile yarn traded internationally.

Non-woven materials offer lightweight, durable, and cost-effective solutions for packaging in various industries such as agriculture, construction, and retail. The versatility of non-woven fabrics makes them suitable for different types of sacks and bags, driving their adoption in packaging applications.

Environmental awareness, such as eco-friendly fashion has evolved worldwide. Non-woven bags, created from sustainable resources, are at the forefront of this trend, providing a chic and responsible substitute to conventional plastic bags.

The geopolitical situation often influences global energy markets, impacting the prices of crude oil and natural gas. Since these commodities are key feedstocks for petrochemical-based raw materials used in non-woven fabric production, such as polypropylene and polyester, fluctuations in energy prices can directly affect the cost of raw materials. Sharp increases in energy prices can drive up production costs for non-woven fabric manufacturers, leading to higher prices for non-woven packaging materials.

Non-woven Packaging Market Trends

Food Packaging to Hold Major Market Share

- Producers and converters in the food packaging sector are actively innovating to create sustainable solutions, often incorporating natural fibers and optimizing raw material usage. In food pads, air-laid non-wovens take center stage, boasting a high proportion of natural fibers.

- Additionally, spun bond/SAP/spun bond laminates are gaining traction in the market. These non-woven food pads effectively absorb liquids from perishable goods like meat and fruit, preserving freshness and extending shelf life, ultimately reducing food wastage. According to the OECD, the projected global consumption of poultry meat will amount to 156.24 metric kilotons by 2032.

- According to INDA, the association representing the non-woven fabrics industry, air-laid is particularly well-suited for food pads due to its resemblance to hygiene absorbent cores. It exhibits rapid liquid acquisition, minimal rewetting, and high absorbency capacities. However, other types of non-woven fabrics, including spun bond, melt blown, and needle-punched varieties, also serve distinct roles in the food packaging industry.

- One of the key advantages of non-woven materials in food packaging is their cost-effectiveness compared to traditional packaging materials such as plastics and paper. This affordability makes them an appealing choice for various food packaging applications, from fresh produce to processed foods.

- Non-woven materials are crucial in crafting insulated bags and totes designed for transporting perishable food items like groceries, prepared meals, and frozen foods. These bags are equipped with thermal insulation to maintain the desired temperature, ensuring the freshness and quality of the contents during transit. Additionally, non-woven fabrics are extensively utilized to create reusable shopping bags tailored for groceries, produce, and food items. These bags are prized for their durability, strength, and versatility, serving as an eco-friendly substitute for disposable plastic bags.

Asia Pacific Expected to Witness Significant Growth

- The countries across the region have focused on supporting all aspects of the textile industry. In particular, attention was given to the numerous uses of non-wovens in different packaging applications. Non-woven bags are widely acceptable in the region due to their durability and tear-resistant, flexible features for advertisements, shipping, packing, and promotion.

- As non-wovens and technical textiles are considered the most promising and dynamic segment of the textiles industry, the demand and consumption of Non-wovens and Technical Textiles will grow steadily throughout the forecasted period in India. Indian industry is beginning to follow international trends by calling on foreign players to collaborate with the entrepreneurs in India and pushing manufacturers to innovate non-woven packaging and increase the production line.

- Packaging is one of the most traditional non-woven applications in China. Due to the ban on plastic bags, there is a considerable demand for non-woven reusable shopping bags. The Chinese non-woven industry will continue to focus more on industrial packaging, medical packaging, and food packaging applications in the future.

- In China, the demand for non-wovens in the medical and surgical industry will change occasionally. The Healthy China Initiative and the development of products and applications will continue to boost non-woven medical and surgical packaging consumption.

- China Non-wovens and Industrial Textiles Association, which represents the non-wovens, industrial textiles, and related industries in China, released data in May 2023 stating that in 2022, approximately 50 spun-bonded and melt-blown non-wovens production lines, 20 spun laced lines, 150 needle-punched line production lines have been added.

Non-woven Packaging Industry Overview

The Non-woven Packaging market is fragmented owing to global players and small and medium-sized enterprises. Some of the major players in the market are Novipax Buyer, LLC, EAM Corporation (Domtar Corporation), Glatfelter Corporation, Felix Non-wovens, and Dupont de Nemours, Inc. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- February 2024 - Berry Global Group, Inc. and Glatfelter Corporation declared their agreements to merge the majority of Berry Global Group's hygiene, health, and specialties segment to incorporate its global non-wovens and films business with Glatfelter. This merger is the first step for the company to become the market leader in non-woven and specialty materials in the global markets.

- November 2023 - Novipax enhanced the benefits of its absorbents pad named Prep Pads in the food service industry for various purposes, including storage of food for storage and transportation, food packaging to absorb excess oil and moisture, and others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products and Services

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growth in Demand for Environmentally Sustainable Packaging Solutions

- 5.1.2 Increasing Use in Sacks & Bags, Sterilization Wrapping, and Other Fields, such as Vacuum Cleaner Bags & Metal Wraps, for Transportation & Protection Purposes

- 5.2 Market Challenges

- 5.2.1 Uncertainty in Geopolitical Situation and its Impact on Raw Materials and Price Fluctuations

- 5.3 Consumption Volume of Non-Woven Fabric Worldwide (With a Breakdown for Major Regions)

- 5.4 Technology Trends: Carded and Calendering Nonwoven Process

6 MARKET SEGMENTATION

- 6.1 By Technology

- 6.1.1 Dry-Laid

- 6.1.2 Spun-Laid

- 6.1.3 Other Technologies

- 6.2 By End-user Packaging Applications

- 6.2.1 Food Packaging

- 6.2.2 Industrial

- 6.2.3 Medical

- 6.2.4 Other End User Packaging Applications

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Novipax Buyer LLC

- 7.1.2 EAM Corporation (Domtar Corporation)

- 7.1.3 Glatfelter Corporation

- 7.1.4 Felix Nonwovens

- 7.1.5 Dupont de Nemours Inc.

- 7.1.6 Freudenberg Performance Materials (Freudenberg Group)

- 7.1.7 Mundo Products Co. Ltd

- 7.1.8 Eximius Innovative Pvt. Ltd