|

市场调查报告书

商品编码

1694034

全球电池製造混合设备市场:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Global Mixing Equipment For Battery Manufacturing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

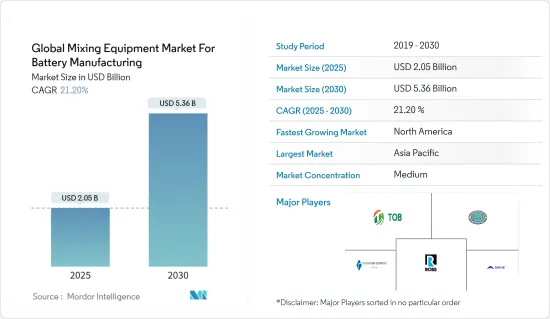

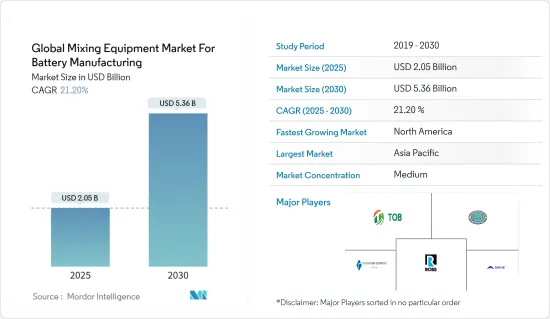

预计全球电池製造混合设备市场规模将从 2025 年的 20.5 亿美元成长到 2030 年的 53.6 亿美元,预测期间(2025-2030 年)的复合年增长率为 21.2%。

关键亮点

- 从中期来看,预计在预测期内,扩大电池生产能力的投资增加和电动车的普及将推动市场发展。

- 然而,预计高昂的物流成本将在预测期内阻碍市场成长。

- 先进电池解决方案的日益普及正在推动电池製造业的扩张。预计这一趋势与电池製造设备的技术发展一起将在预测期内为市场带来巨大的成长机会。

- 在北美,由于众多终端产业对电池的使用日益增多,预计市场将显着成长。

混合设备市场的全球趋势

扩大电池产能的投资预计将推动市场成长

- 随着汽车、电子、可再生能源等各行业对电池的使用日益增多,电池製造能力已成为世界各国关注的重点。为了满足这项需求,许多国家正在投资扩建电池製造厂。公司正专注于采购混合设备。

- 例如,根据永续能源商业委员会的数据,美国锂离子电池製造能力到 2022 年将达到 108 吉瓦时,而 2021 年为 59 吉瓦时。由于电动车和电池能源储存等各类终端用户的需求不断增长,预计製造能力将会增加。

- 混合设备需求的增加是新电池製造厂投资增加的直接结果。这些工厂需要专门的设备来有效率、大规模地生产电池。混合设备对于确保电池品质、性能和安全起着至关重要的作用。

- 例如,2023年10月,宁德时代新能源科技有限公司宣布启用新的电池生产基地,该基地拥有一条高度自动化的生产线,每秒可生产一个电芯。该工厂将分两期建设,预计年总合生产能力为 60GWh。

- 因此,预计在预测期内增加投资以提高电池生产能力将推动市场发展。

预计北美市场将大幅成长

- 受政府支持发展锂离子电池工厂、电动车使用增加以及美国电池机械製造商的成立等因素影响,北美预计将出现强劲成长。

- 鼓励企业在美国建立电池製造厂可能会对电池製造设备,尤其是混合设备的需求产生重大影响。电池製造设备,包括混合设备,在生产过程中起着至关重要的作用。随着对电池的需求不断增长,对高效、可靠的混合设备的需求也在不断增长,以确保高品质的电池生产。

- 例如,库柏州长于 2023 年 12 月宣布将在莫里斯维尔建造一座新的锂离子电池工厂,代表着对北卡罗来纳州清洁能源技术和创造就业机会的重大投资。 Forge Nano 及其投资者计划投资超过 1.65 亿美元在莫里斯维尔建立一个锂离子电池製造工厂。 Forge 电池厂预计将于 2026 年开始运营,为该州的经济成长和永续发展做出贡献。

- 在美国,电动车的普及度和销量不断增加,因此,电动车(EV)电池的产量也在增加。电动车电池产量的激增推动了对高效生产这些电池的混合设备的需求。

- 例如,丰田汽车公司于2023年10月宣布,将在北卡罗来纳州的电动车电池製造厂额外投资80亿美元。此举是这家日本汽车製造商加速推进其汽车产品线电气化的努力的一部分。丰田的目标是到2025年为其所有车型提供电动选项,此次投资使其在北卡罗来纳工厂的总投资达到约139亿美元。

- 因此,随着电池製造业的兴起,对混合设备的需求预计会增加。因此,预计预测期内北美市场将显着成长。

全球电池製造混合设备产业概况

全球电池製造混合设备市场规模减少了一半。市场的主要企业包括世赫集团、Charles Ross & Son Company、厦门天马电池设备有限公司、SCM GROUP LIMITED.HK、厦门托博新能源科技等。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究范围

- 市场定义

- 调查前提

第二章执行摘要

第三章调查方法

第四章 市场概述

- 介绍

- 2029 年市场规模与需求预测

- 近期趋势和发展

- 政府法规和政策

- 市场动态

- 驱动程式

- 加大投资,扩大电池产能

- 电动车日益普及

- 限制因素

- 物流成本高

- 驱动程式

- 供应链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁产品/服务

- 竞争对手之间的竞争

第五章市场区隔

- 类型

- 湿搅拌机

- 干搅拌机

- 地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 法国

- 英国

- 义大利

- 西班牙

- 北欧的

- 土耳其

- 俄罗斯

- 其他欧洲国家

- 亚太地区

- 中国

- 印度

- 澳洲

- 日本

- 马来西亚

- 泰国

- 印尼

- 越南

- 其他亚太地区

- 中东和非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 卡达

- 埃及

- 奈及利亚

- 南非

- 其他中东和非洲地区

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 南美洲其他地区

- 北美洲

第六章竞争格局

- 併购、合资、合作与协议

- 主要企业策略

- 公司简介

- SIEHE GROUP

- Charles Ross & Son Company

- Xiamen Tmax Battery Equipments Limited

- SCM GROUP LIMITED. HK

- XIAMEN TOB NEW ENERGY TECHNOLOGY Co. LTD

- Processall

- ONGOAL

- Jongia Mixing Technology

- IKA India Private Limited

- MIXACO

- 市场排名分析

第七章 市场机会与未来趋势

- 扩大先进电池解决方案的引入

简介目录

Product Code: 50002203

The Global Mixing Equipment Market For Battery Manufacturing Industry is expected to grow from USD 2.05 billion in 2025 to USD 5.36 billion by 2030, at a CAGR of 21.2% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, the increase in investments to enhance the battery production capacity and rising adoption of electric vehicles are expected to drive the market over the forecast period.

- On the other hand, the high logistic costs are expected to hamper the market growth over the forecast period.

- The increasing deployment of advanced battery solutions is leading to the expansion of battery manufacturing. This, along with technology development in battery manufacturing equipment, is expected to create a significant growth opportunity for the market during the forecast period.

- The market is expected to witness significant growth in North America due to the increasing battery applications across numerous end-use industries in the region.

Global Mixing Equipment Market Trends

Investments To Enhance the Battery Production Capacity is expected to Drive the Market Growth

- Battery manufacturing capacity has become a crucial focus for countries worldwide due to the increasing usage of batteries in various industries such as automotive, electronics, and renewable energy. To meet this demand, many countries are investing in expanding their battery manufacturing plant. Companies are focused on procuring mixing equipment.

- For instance, according to the Business Council for Sustainable Energy, in 2022, the US lithium-ion battery manufacturing capacity reached 108 GWh, compared to 59 GWh in 2021. The manufacturing capacity is expected to increase with rising demand from various end users, such as electric vehicles, battery energy storage, etc.

- The increasing demand for mixing equipment is a direct result of the increasing investments in deploying new battery manufacturing plants. These plants require specialized equipment to produce batteries efficiently and at scale. Mixing equipment plays a crucial role in ensuring the quality, performance, and safety of batteries.

- For instance, in October 2023, CATL, Contemporary Amperex Technology Co. Limited, a leading Chinese manufacturer of lithium-ion batteries, announced the opening of a new battery production base that boasts highly automated production lines capable of producing one cell every second. The facility is being constructed in two phases and is expected to have a combined annual capacity of 60 GWh.

- Thus, the increase in investments to enhance the battery production capacity is expected to drive the market over the forecast period.

The Market is Expected to Witness Significant Growth in North America

- North America is expected to witness significant growth due to factors such as support from the government for lithium-ion battery plant development, rising electric vehicle usage, and the formation of US battery machine builders.

- Encouraging companies to establish battery manufacturing plants in the United States can have a significant impact on the demand for battery manufacturing equipment, particularly mixing equipment. Battery manufacturing equipment, including mixing equipment, plays a crucial role in the production process. As the demand for batteries grows, so does the need for efficient and reliable mixing equipment to ensure high-quality battery production.

- For instance, in December 2023, Governor Cooper's announcement of a new lithium-ion battery plant for Morrisville signified a significant investment in clean energy technology and job creation in North Carolina. Forge Nano Inc. and its investors are set to invest over USD 165 million to establish a lithium-ion battery manufacturing facility in Morrisville. The Forge Battery plant is projected to commence operations in 2026, contributing to the state's economic growth and sustainability efforts.

- The increase in the usage and sales of electric vehicles in the United States has led to a corresponding rise in the production of electric vehicle (EV) batteries. This surge in EV battery production has increased the demand for mixing equipment to manufacture these batteries efficiently.

- For instance, in October 2023, Toyota Motor Corporation announced a significant boost in investment, allocating an additional USD 8 billion to its electric vehicle battery manufacturing plant in North Carolina. This move was part of the Japanese automaker's accelerated efforts to electrify its vehicle lineup. Toyota aims to offer electrified options for all its models by 2025, and this investment would bring the total investment in the North Carolina plant to about USD 13.9 billion.

- Thus, owing to the increase in battery manufacturing, the demand for mixing equipment is expected to increase. Thus, the market is expected to witness significant growth in North America during the forecast period.

Global Mixing Equipment Industry Overview

The global mixing equipment market for battery manufacturing is semi-fragmented. The key players in the market include SIEHE GROUP, Charles Ross & Son Company, Xiamen Tmax Battery Equipments Limited, SCM GROUP LIMITED. HK, and XIAMEN TOB NEW ENERGY TECHNOLOGY Co. LTD.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 The Increase in Investments to Enhance the Battery Production Capacity

- 4.5.1.2 Rising Adoption of Electric Vehicles

- 4.5.2 Restraints

- 4.5.2.1 The High Logistic Cost

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Wet Mixers

- 5.1.2 Dry Mixers

- 5.2 Geography

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.1.3 Rest of North America

- 5.2.2 Europe

- 5.2.2.1 Germany

- 5.2.2.2 France

- 5.2.2.3 United Kingdom

- 5.2.2.4 Italy

- 5.2.2.5 Spain

- 5.2.2.6 NORDIC

- 5.2.2.7 Turkey

- 5.2.2.8 Russia

- 5.2.2.9 Rest of Europe

- 5.2.3 Asia-Pacific

- 5.2.3.1 China

- 5.2.3.2 India

- 5.2.3.3 Australia

- 5.2.3.4 Japan

- 5.2.3.5 Malaysia

- 5.2.3.6 Thailand

- 5.2.3.7 Indonesia

- 5.2.3.8 Vietnam

- 5.2.3.9 Rest of Asia-Pacific

- 5.2.4 Middle East and Africa

- 5.2.4.1 Saudi Arabia

- 5.2.4.2 United Arab Emirates

- 5.2.4.3 Qatar

- 5.2.4.4 Egypt

- 5.2.4.5 Nigeria

- 5.2.4.6 South Africa

- 5.2.4.7 Rest of Middle East and Africa

- 5.2.5 South America

- 5.2.5.1 Brazil

- 5.2.5.2 Argentina

- 5.2.5.3 Columbia

- 5.2.5.4 Rest of South America

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 SIEHE GROUP

- 6.3.2 Charles Ross & Son Company

- 6.3.3 Xiamen Tmax Battery Equipments Limited

- 6.3.4 SCM GROUP LIMITED. HK

- 6.3.5 XIAMEN TOB NEW ENERGY TECHNOLOGY Co. LTD

- 6.3.6 Processall

- 6.3.7 ONGOAL

- 6.3.8 Jongia Mixing Technology

- 6.3.9 IKA India Private Limited

- 6.3.10 MIXACO

- 6.5 Market Ranking Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Deployment of Advanced Battery Solutions

02-2729-4219

+886-2-2729-4219