|

市场调查报告书

商品编码

1694040

欧洲医药塑胶包装:市场占有率分析、产业趋势与统计、成长预测(2025-2030)Europe Pharmaceutical Plastic Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

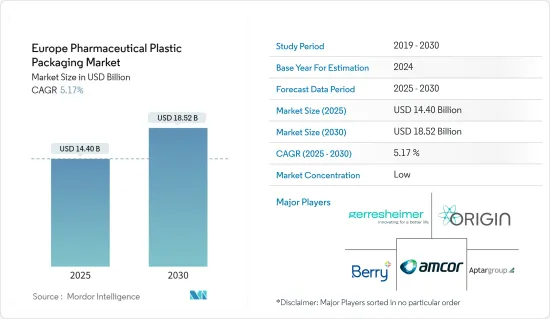

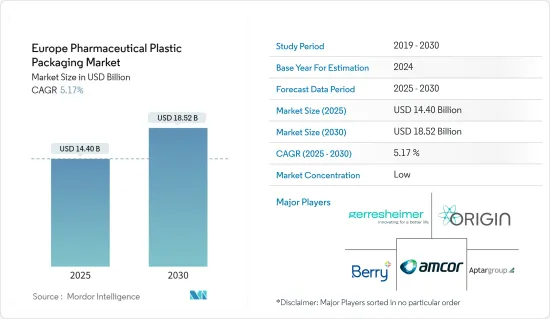

预计2025年欧洲医药塑胶包装市场规模为144亿美元,到2030年将达到185.2亿美元,预测期内(2025-2030年)的复合年增长率为5.17%。

塑胶包装材料和产品具有重量轻、成本低、柔韧性、机械强度和稳定性等优势,适合在欧洲医药包装市场使用。

关键亮点

- 泡壳包装在药品包装中的应用日益广泛,方便储存和运输锭剂和胶囊等固态药物,这推动了对塑胶包装的需求。

- 由于塑胶瓶不易破损且重量较轻,欧洲製药公司越来越倾向于使用塑胶瓶来包装止咳糖浆和其他液体药物,以提高利润率,从而支持塑胶包装在研究市场的成长。

- 硬质塑胶瓶和管瓶具有出色的阻隔性,可保护药物免受潮湿和污染。它重量轻、易于操作且有多种尺寸可供选择,支持了塑胶包装在製药行业的发展。柔性塑胶袋和泡壳包装方便分配单一剂量或随时随地服用。

- 欧洲更先进的医疗保健基础设施的发展正在推动医药塑胶包装市场的发展。先进的医疗机构通常拥有强大的低温运输基础设施来储存和运输疫苗等对温度敏感的药物,因此会考虑到疫苗低温运输要求等物流方面的问题。

- 红海危机源自于以色列与哈马斯的衝突。红海商船和海军舰艇遭受飞弹袭击,扰乱了从中东国家到欧洲的树脂和塑胶原材料供应链路线,导致生态系统原材料价格上涨,阻碍了市场成长。

- 2024年4月,各类软包装製造商的行业协会Flexible Packaging Europe报告称,红海航运中断造成的供应链中断对供应链产生了重大影响,导致2024年第一季欧洲软包装材料(包括塑胶包装材料)价格上涨,对欧洲市场的成长产生了负面影响。

欧洲医药塑胶包装市场趋势

注射器市场预计将占据主要市场占有率

- 欧洲人口不断增长,加上人口老化和慢性病急剧增加,刺激了对注射器和注射药物的需求。同时,主要企业受到有关医用针头使用法规不断发展的驱动,推动医疗技术的进步和创新。

- 注射器已成为肠外给药的重要工具。特别是用于从管瓶中提取和注射药物的预填充注射器越来越受到关注。这些注射器主要用于治疗癌症和糖尿病等慢性疾病,可精确输送药物并最大限度地减少针头暴露,从而提高患者的安全性。

- 考虑到慢性病的增加、对注射药物的偏好日益增长以及注射器领域的持续技术进步,预填充注射器市场预计在未来几年将会成长。 IDF糖尿病地图集第10版预测欧洲糖尿病患者数将大幅增加,预计2030年将达6,700万人,2045年将达6,900万人。

- 塑胶注射器正成为越来越受欢迎的医疗耗材,取代金属和玻璃等传统材料。这一趋势的一个显着例子是采用射出成型聚丙烯树脂製成的一次性注射器。这些注射器包括一个柱塞、一个用于指示容量的刻度体、一个垫圈、一个针头支架和一个保护鞘套。抛弃式注射器在现代医学中应用十分广泛,主要用于注射药物、疫苗以及抽血等。它们比可重复使用的注射器更受欢迎,因为它们可以降低疾病传播的风险。典型的应用包括给糖尿病患者註射胰岛素和给牙医局部麻醉。

- 随着临床测试速度的加快,用于分析的样本量也在增加,因此需要有效地收集、储存和运输这些样本。分散式和虚拟临床实验(远端收集样本)的趋势日益增长,这正在产生对温控塑胶包装的需求。根据再生医学联盟的数据,2023年欧洲进行了329项再生医学临床试验。

- 基于此需求,2024年4月,在今年6月于斯图加特举办的Medtec Europe展会上,德国射出成型机製造商阿博格(Arburg)推出了采用不锈钢材质的电动Allrounder。此机器设计用于使用环状烯烃聚合物(COP)代替玻璃来製造注射器筒。新发布的 Allrounder 370 A 采用符合 GMP 标准的不銹钢製成,专为无尘室工作而设计。其扣夹力600 kN,注射单元尺寸为 70。锁模单元的上部配备了 Ronstatex 洁净空气模组,以确保清洁的生产环境。

德国:预计将出现显着成长

- 由于人口结构的变化以及人们对预防性自我治疗的兴趣日益浓厚,德国製药业正在经历强劲增长。这些因素凸显了该市场的巨大成长潜力。德国是世界领先的临床检测提供国之一,其许多正在进行的研究计画为医学进步做出了贡献。由于大量的研发投入和众多的专利申请,德国在欧洲医药创新领域处于领先地位。根据德国贸易投资署统计,德国是世界第二大医药出口国,其製造业位居世界前列。

- 预计德国政府的倡议将在推动医药塑胶包装市场方面发挥关键作用。特别是,2023年德国政府发布了新的製药策略,概述在战略文件4.0。该策略旨在加强该国的製药业,重点是提高研究和生产能力以及简化市场准入和定价机制。该策略包括大力投资研发、奖励製药公司创新以及简化监管流程的措施。这些改革预计将吸引大量外国投资,刺激国内生产,并确保德国继续处于製药业进步的前沿。

- 主要企业正在加大投资,扩大在德国的业务。投资的激增将直接促进医药领域塑胶包装的生产,成为市场的主要成长动力。

- 例如,2024年2月,全球机构投资者安大略省教师退休金计画委员会和以专注于医疗保健投资而闻名的Nordic Capital宣布与Advanz Pharma建立策略合作伙伴关係。 Advanz Pharma 在欧洲製药业占有重要地位,此次合作将使其能够加强成长和发展倡议。 Advanz Pharma 的业务范围遍布 90 多个国家,专门从事专科、医院和罕见疾病药物。

- 2024 年 9 月,德国医疗包装公司 Sanner 将在本斯海姆开设一个高度自动化的包装製造工厂。欧洲专利局授予德国製药领域申请人的专利对于推动德国製药塑胶包装市场的创新和成长至关重要,凸显了该领域持续适应的必要性。

- 2023年,欧洲专利局向德国申请人授予了172项医药领域专利。德国以其强大的工业基础和严格的品质标准而闻名,在欧洲医药塑胶包装市场占有举足轻重的地位。德国对製造业的精确性和可靠性的重视保证了高品质的包装解决方案。德国对永续性和智慧包装等先进包装技术的承诺预计将推动市场成长并使该国成为该领域的领导者。

欧洲医药塑胶包装产业概况

欧洲医药塑胶包装市场高度细分,主要参与者包括 Gerresheimer AG、Amcor PLC、Berry Global Group Inc.、Aptar Group Inc. 和 Origin Pharma Packaging。市场的主要企业正在采取合作和收购等策略来加强其产品供应并获得可持续的竞争优势。

- 2024年4月,Berry Global Group Inc.对资产和製造能力进行了额外投资,将欧洲三个地点的医疗生产能力提高高达30%。透过这项投资,Berry 将提供包装和药物输送设备,透过改善药物管理和依从性来提升患者体验。

- 2024 年 6 月,Aptar Digital Health 与 SHL Medical 合作,后者是一家先进药物输送系统供应商,包括自动注射器、笔式註射器和创新专业输送系统。透过整合 Aptar Digital Health 的 SaMD 平台,SHL Medical 正在扩展连网型设备技术。此次合作旨在帮助患者管理疾病并提供全面的解决方案,特别是那些接受注射治疗的患者。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

- 产业价值链分析

- 评估宏观经济趋势对市场的影响

第五章市场动态

- 市场驱动因素

- 对硬质和软质药用塑胶产品的需求不断增加

- 建造更好、更先进的医疗基础设施

- 市场问题

- 限製药用塑胶製品销售和供应的规定

- 供应商议价能力导致原物料成本波动

第六章市场区隔

- 按原料

- 聚丙烯(PP)

- 聚对苯二甲酸乙二醇酯(PET)

- 低密度聚乙烯(LDPE)

- 高密度聚苯乙烯(HDPE)

- 其他的

- 依产品类型

- 固态容器

- 滴管瓶

- 滴鼻剂瓶

- 液体瓶

- 口腔护理

- 小袋

- 管瓶/安瓿瓶

- 墨水匣

- 注射器

- 瓶盖和瓶塞

- 其他的

- 按国家

- 英国

- 德国

- 法国

- 西班牙

- 义大利

第七章竞争格局

- 公司简介

- Gerresheimer AG

- Amcor PLC

- Berry Global Group Inc.

- Aptar Group Inc.

- Origin Pharma Packaging

- Pretium Packaging

- Klockner Pentaplast

- Comar

- Gil Plastic Products Ltd

- Drug Plastics Group

- West Pharmaceutical Services Inc.

第八章投资分析

第九章:未来市场展望

The Europe Pharmaceutical Plastic Packaging Market size is estimated at USD 14.40 billion in 2025, and is expected to reach USD 18.52 billion by 2030, at a CAGR of 5.17% during the forecast period (2025-2030).

Advantages associated with plastic packaging materials and products, such as their lightweight, low cost, flexibility, mechanical strength, and stability, make them suitable for use in the European pharmaceutical packaging market.

Key Highlights

- The growing adoption of blister packs in pharmaceutical packaging, which provides convenient methods to store and transport solid medicinal products, such as tablets and capsules, is fueling the demand for plastic packaging.

- Due to the low fragile nature and light weight of plastic bottles, European pharmaceutical companies increasingly prefer plastic bottles for cough syrups and other liquid drug packaging for better profit margins, supporting the growth of plastic packaging in the studied market.

- Rigid plastic bottles and vials offer better barrier properties, protecting medication from moisture and contamination. They are lightweight, easy to handle, and come in various sizes, supporting the growth adoption of plastic packaging in the pharmaceutical industry. Flexible plastic pouches and blister packs are convenient for unit-does dispensing and on-the-go medication use.

- The development of better and advanced healthcare infrastructure in Europe is driving the pharmaceutical plastic packaging market, considering logistical aspects like cold chain requirements for vaccines since advanced healthcare facilities usually have robust cold chain infrastructure for storing and transporting temperature-sensitive medications like vaccines.

- The Red Sea crisis emerged from the Israel and Hamas conflict. It generated missile attacks against merchant and naval vessels in the Red Sea, which disrupted the supply chain route of resins and plastic raw materials to Europe from Middle Eastern countries, raising the price of raw materials in the ecosystem thereby hindering the market's growth.

- In April 2024, Flexible Packaging Europe, the industry association for all types of flexible packaging manufacturers, reported that supply chain disruptions due to the shipping disruptions in the Red Sea had a significant impact on supply chains, leading to increased prices of European flexible packaging materials, including plastic packaging material, in the first quarter of 2024. This negatively impacted the growth of the European market.

Europe Pharmaceutical Plastic Packaging Market Trends

Syringes Segment is Expected to Hold Significant Market Share

- The rise in population in Europe is accompanied by a surge in aging demographics and chronic diseases, fueling the demand for syringes and injectables. Concurrently, key players are driving medical technology advancements and innovations bolstered by evolving regulations on medical needle usage.

- Syringes have become the go-to tools for parenteral medication administration. Specifically, pre-fillable syringes, designed for extracting and administering drug substances from vials, are gaining prominence. These syringes, predominantly used for chronic conditions like cancer and diabetes, offer precise drug delivery and minimize needle exposure, enhancing patient safety.

- Given the uptick in chronic diseases, the rising preference for injectable medications, and ongoing technological strides in the syringe sector, the pre-fillable syringes market is poised for growth in the coming years. The IDF Diabetes Atlas 10th edition projects a significant rise in diabetes cases in Europe, with estimates reaching 67 million by 2030 and 69 million by 2045.

- Plastic syringes are increasingly prevalent in medical disposables, supplanting traditional materials such as metals and glass. A notable instance in this trend is the adoption of disposable syringes made from polypropylene resin through injection molding. These syringes include a plunger, a graduated main body for capacity indication, a gasket, a needle holder, and a protective sheath cover. Disposable syringes find widespread use in modern medicine, primarily for drug and vaccine injections and blood extractions. They are favored over reusable syringes to mitigate disease transmission risks. Typical applications include insulin injections for diabetics and local anesthesia administration by dentists.

- The accelerated pace of clinical trials translates to a higher volume of samples collected for analysis, requiring efficient collection, storage, and transportation of these samples. The growing trend of decentralized and virtual trials, where samples are collected at remote locations, creates demand for temperature-controlled plastic packaging. According to the Alliance for Regenerative Medicine, 329 active clinical trials for regenerative medicine were done in Europe in 2023.

- Considering the demand, in April 2024, at Medtec Europe in Stuttgart this June, Arburg, a German manufacturer of injection molding machines, unveiled its stainless steel electric Allrounder. This machine is designed to produce syringe barrels using cyclic olefin polymer (COP) as a glass alternative. The showcased Allrounder 370 A, crafted from stainless steel to meet GMP standards, is tailored for cleanroom operations. Boasting a clamping force of 600 kN and an injection unit size of 70, it features a Lonstatex clean air module above the clamping unit, ensuring pristine production conditions.

Germany Expected to Witness Significant Growth

- Germany's pharmaceutical industry is experiencing considerable growth, driven by demographic shifts and a heightened focus on prevention and self-medication. These factors highlight the market's substantial growth potential. Germany is a global destination for clinical trials, with numerous ongoing studies contributing to medical advancements. Supported by significant R&D investments and many patent applications, the country leads Europe in pharmaceutical innovation. According to Germany Trade and Invest, Germany is the world's second-largest exporter of medicinal products, with a robust manufacturing sector that ranks among the top pharmaceutical producers globally.

- Government initiatives in Germany are set to play a pivotal role in propelling the pharmaceutical plastic packaging market. Notably, in 2023, the German government unveiled a new pharmaceutical strategy outlined in Strategy Paper 4.0. This strategy, designed to fortify the nation's pharmaceutical sector, focuses on bolstering research and production capabilities and aims to streamline market access and pricing mechanisms. The strategy includes significant investments in R&D, incentives for pharmaceutical companies to innovate, and measures to enhance the efficiency of regulatory processes. These reforms are expected to attract substantial foreign investment, stimulate domestic production, and ensure that Germany remains at the forefront of pharmaceutical advancements.

- Leading pharmaceutical companies are increasing investments in expansion activities in Germany. This investment surge is directly enhancing the production of plastic packaging in the pharmaceutical sector, serving as a key growth driver for the market.

- For instance, in February 2024, the Ontario Teachers' Pension Plan Board, a global institutional investor, and Nordic Capital, known for its focus on healthcare investments, unveiled a strategic collaboration with Advanz Pharma. A key player in the European pharmaceutical landscape, Advanz Pharma is set to benefit from this partnership, which is designed to bolster its growth and development initiatives. With a footprint spanning 90+ nations, Advanz specializes in pharmaceuticals catering to specialty, hospital, and rare diseases.

- In September 2024, Sanner, a German healthcare packaging company, will inaugurate a highly automated packaging production facility in Bensheim. Patents the European Patent Office granted to German applicants in the pharmaceutical sector are crucial in driving innovation and growth within Germany's pharmaceutical plastic packaging market, highlighting the sector's need for continuous adaptation.

- In 2023, the European Patent Office granted 172 patents in the pharmaceutical sector to German applicants. Germany, known for its strong industrial base and rigorous quality standards, is pivotal in the European pharmaceutical plastic packaging market. The country's emphasis on precision and reliability in manufacturing ensures high-quality packaging solutions. Germany's commitment to sustainability and advanced technologies, such as smart packaging, is expected to fuel market growth, making it a leader in this sector.

Europe Pharmaceutical Plastic Packaging Industry Overview

The European pharmaceutical plastic packaging market is highly fragmented, with major players like Gerresheimer AG, Amcor PLC, Berry Global Group Inc., Aptar Group Inc., and Origin Pharma Packaging. Key players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- In April 2024, Berry Global Group Inc. invested in additional assets and manufacturing capabilities to increase its healthcare production capacity by up to 30% across three European sites. With this investment, Berry planned to deliver packaging and drug delivery devices that enhance the patient experience through improved medicine administration and adherence.

- In June 2024, Aptar Digital Health collaborated with SHL Medical, a provider of advanced drug delivery systems such as autoinjectors, pen injectors, and innovative specialty delivery systems. By integrating Aptar Digital Health's SaMD platform, SHL Medical is expanding its connected device technologies. This collaboration aims to offer holistic solutions, aiding patients in managing their diseases, especially those on injectable therapies.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Degree of Competition

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Impact of the Macroeconomic Trends on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for Rigid and Flexible Pharmaceutical Plastic Products

- 5.1.2 Development of Better and More Advanced Healthcare Infrastructure

- 5.2 Market Challenges

- 5.2.1 Regulations Restricting the Sale and Availability of Pharmaceutical Plastic Products

- 5.2.2 Fluctuations in Raw Material Cost Due to Suppliers Bargaining Power

6 MARKET SEGMENTATION

- 6.1 By Raw Material

- 6.1.1 Polypropylene (PP)

- 6.1.2 Polyethylene Terephthalate (PET)

- 6.1.3 Low Density Polyethylene (LDPE)

- 6.1.4 High Density Polyethylene (HDPE)

- 6.1.5 Other Types of Materials

- 6.2 By Product Type

- 6.2.1 Solid Containers

- 6.2.2 Dropper Bottles

- 6.2.3 Nasal Spray Bottles

- 6.2.4 Liquid Bottles

- 6.2.5 Oral Care

- 6.2.6 Pouches

- 6.2.7 Vials and Ampoules

- 6.2.8 Cartridges

- 6.2.9 Syringes

- 6.2.10 Caps and Closures

- 6.2.11 Other Product Types

- 6.3 By Country

- 6.3.1 United Kingdom

- 6.3.2 Germany

- 6.3.3 France

- 6.3.4 Spain

- 6.3.5 Italy

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Gerresheimer AG

- 7.1.2 Amcor PLC

- 7.1.3 Berry Global Group Inc.

- 7.1.4 Aptar Group Inc.

- 7.1.5 Origin Pharma Packaging

- 7.1.6 Pretium Packaging

- 7.1.7 Klockner Pentaplast

- 7.1.8 Comar

- 7.1.9 Gil Plastic Products Ltd

- 7.1.10 Drug Plastics Group

- 7.1.11 West Pharmaceutical Services Inc.