|

市场调查报告书

商品编码

1836449

製药膜过滤:市场份额分析、行业趋势、统计数据和成长预测(2025-2030)Pharmaceutical Membrane Filtration - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

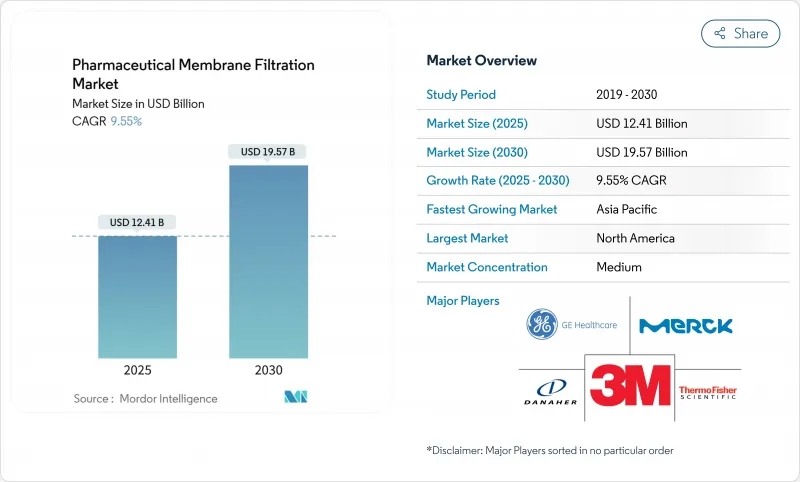

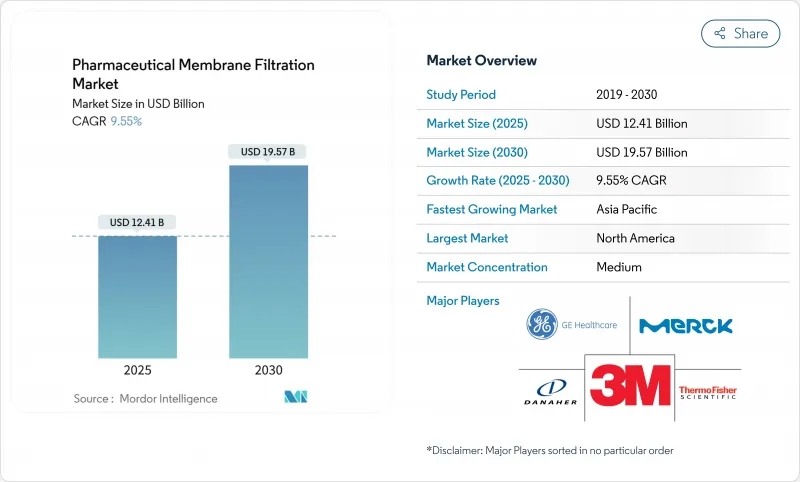

预计 2025 年医药膜过滤市场规模为 124.1 亿美元,到 2030 年将达到 195.7 亿美元,预测期内(2025-2030 年)的复合年增长率为 9.55%。

生技药品、基因疗法和疫苗计画激增,推动了对高性能无菌过滤器的需求。该行业也受益于监管压力,要求其展示能够提高生产灵活性并限制交叉污染的病毒清除和一次性系统。奈米过滤、连续处理和即时分析方面的投资正在推动这些技术的进一步应用,尤其是在病毒去除、蛋白质浓缩和注射用水操作方面。北美凭藉着成熟的生物加工基础设施和美国食品药物管理局(FDA)的明确指导,保持了主导地位;而亚太地区则在大规模产能扩张和生物技术奖励的推动下,发展势头强劲。

全球製药膜过滤市场趋势与见解

一次性技术的采用日益增多

一次性过滤组件已成为现代生技药品设施的核心支柱,可将转换时间缩短高达50%,并无需进行清洁验证。与中空纤维切向流设计的兼容性使生产商能够快速改装现有生产线。灵活的袋式系统可实现个人化治疗的并行宣传活动,整合感测器可传输关键品质数据,满足FDA持续监测的要求。降低公用事业和人事费用,以及减轻建筑材料重量,可减少浪费,进一步提高成本效益。随着基因治疗规模的扩大,内毒素去除率>99.999%的一次性滤芯可实现快速批次週转,且无跨产品交叉污染的风险。此模型符合需要快速现场部署和突波能力的疫情防治策略。

扩大生技药品和基因治疗产品线

全球生技药品研发管线超过10,000种,每个专案都需要强大的病毒过滤,以达到6 log10或更高的病毒截留率。旭化成的Planova FG1可提供7倍的通量,在不影响病毒截留率的情况下缩短处理时间。更新后的Q5A(R2)指南提倡基于风险的验证,并鼓励针对特定应用的过滤器开发,以支援快速商业化。这一趋势也延伸到了mRNA疫苗,该疫苗需要在低结合条件下进行澄清和灭菌,以保护脆弱的脂质奈米颗粒。

高资本投入

商业规模的过滤设备成本可能超过1000万美元,包括滑轨、分析和验证。整合PAT感测器会增加额外费用,需要资料历史记录和经过认证的网路安全层。新兴市场的製造商通常依靠拨款和合作伙伴关係来获得资金,而外汇波动可能会侵蚀预算。赛默飞世尔科技以41亿美元收购Solventum,显示了在净化技术领域保持竞争力所需的投入。跨国公司必须跨地区复製测试通讯协定,导致资本膨胀,并被重复的设施所束缚。

报告中分析的其他驱动因素和限制因素

- 严格的监管要求

- 奈米过滤技术的进展

- 膜污染问题与生命週期缩短

細項分析

聚醚砜 (PES) 凭藉其高耐化学性和低蛋白结合率,将在 2024 年占据医药膜过滤市场的 32.84%。其亲水性使其能够支持 211 mL/min 的流速,且蛋白质吸附率低于 1%,从而在单抗纯化过程中实现稳定的产量。表面磺酸盐和 PEG 接枝增强了其亲水性,延长了使用寿命并减少了结垢。

儘管受到PFAS(全氟辛烷磺酸)的严格审查,PVDF预计仍将以10.01%的复合年增长率增长,这得益于其低萃取物和适用于最终灌装线的特性。监管的不确定性促使供应商开发不含PFAS的产品,而使用者则正在评估PVDF在线上蒸汽循环中的热稳定性。混合纤维素酯、尼龙和聚丙烯膜可满足利基实验室和成本敏感型应用的需求,这些应用对极高的坚固性并非必要。对比研究表明,即使在高固态含量下,PES也能保持渗透性,而PVDF在低结合无菌过滤方面表现出色。製造商的目标是开发超洁净等级的产品,以满足日益严格的萃取物限值,并在储存期间保持产品纯度。

微过滤将在2024年占据44.32%的收入份额,这得益于其在细胞收穫和微生物附着量去除方面的成熟应用。阻力级数模型可实现精确的放大,确保中试资料转换为实际生产。连续微过滤与交替切向流结合,可提高强化补料分批培养的收穫产量。由于疫苗和基因治疗产品线需要高通量病毒去除,奈米过滤的复合年增长率将达到12.95%。

二维材料涂层可在不牺牲20奈米孔隙率的情况下提高水渗透性,从而实现高于6 log10的病毒去除率。小型化钻机有助于确定最佳pH值和电导率窗口,调整参数可实现900%的通量提升。超过滤对于缓衝液交换和蛋白质浓缩仍然至关重要,而逆渗透则用于注射系统的水处理。

本报告按材料(例如聚醚砜、聚二氟亚乙烯)、技术(例如微过滤)、製程阶段(例如最终产品无菌过滤)、规模(例如实验室)和地区(例如北美、欧洲、亚太地区、中东和非洲以及南美)对医药膜过滤市场进行了细分。市场预测以美元计算。

区域分析

2024年,北美将在製药膜过滤市场保持36.55%的份额,这得益于密集的生技药品工厂网路以及FDA以清晰的指导方针支持先进製造。联邦政府为对抗疫情提供的奖励正在支持对高容量一次性系统和连续生产线的支出。欧洲紧随其后,受附件1修正案的推动,该修正案强制生产商采用PUPSIT和自动化完整性检查。企业正在投资病毒过滤器和数据丰富的设备,以满足严格的审核要求。

随着各国政府向物流投入大量资金,到 2030 年,亚太地区的复合年增长率将达到 11.67%。 Cytiva 投资 1.5 亿美元在韩国的工厂和 MilliporeSigma 投资 3 亿欧元在韩国大田的工厂标誌着该地区的崛起,使当地能够供应无菌过滤器和一次性套件并缩短物流链。中国和印度正在加强 GMP 合规性,近 90% 的中国和印度生物技术营运商都计划进入全球市场。随着 CDMO 寻求经济多元化,拉丁美洲和中东地区正在以巴西和沙乌地阿拉伯为首取得进展。 ICH 指南的协调促进了技术转让,使跨国公司能够在多个大洲部署相同的过滤系统。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 一次性技术的采用日益增多

- 扩大生技药品和基因治疗产品线

- 严格的监管要求

- 奈米过滤技术的进展

- 增加研发投入

- 在新兴市场扩大製药生产

- 市场限制

- 高资本投入

- 膜污染问题与生命週期缩短

- 整合复杂性

- 开发中地区认知度较低

- 波特五力分析

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章市场规模及成长预测(单位:美元)

- 按材质

- 聚醚砜(PES)

- 聚二氟亚乙烯(PVDF)

- 混合纤维素酯和醋酸纤维素(MCE和CA)

- 尼龙

- 聚丙烯及其他

- 依技术

- 微过滤

- 超过滤

- 奈米过滤

- 逆渗透及更多

- 按流程阶段

- 最终产品无菌过滤

- 原料药说明

- 细胞分离/收集

- 水和公用设施过滤

- 空气/气体过滤

- 按规模

- 实验室

- 飞行员

- 商业化生产

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 其他亚太地区

- 中东和非洲

- GCC

- 南非

- 其他中东和非洲地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美

- 北美洲

第六章 竞争态势

- 市场集中度

- 市占率分析

- 公司简介

- 3M Company

- Danaher

- Merck KGaA

- Sartorius Stedim Biotech

- Thermo Fisher Scientific

- Parker Hannifin

- Repligen Corporation

- GEA Group

- Graver Technologies

- GE Healthcare

- Meissner Filtration

- Alfa Laval

- Cobetter Filtration

- Amazon Filters

- Porvair Filtration Group

- Novasep

- Donaldson Company

- Asahi Kasei

- Tami Industries

- Cole-Parmer

第七章 市场机会与未来展望

The Pharmaceutical Membrane Filtration Market size is estimated at USD 12.41 billion in 2025, and is expected to reach USD 19.57 billion by 2030, at a CAGR of 9.55% during the forecast period (2025-2030).

Demand stems from the surge in biologics, gene therapies, and vaccine programs that require sterile, high-performance filters. The sector also benefits from regulatory pressure to prove viral clearance and from single-use systems that heighten production agility while curbing cross-contamination. Investments in nanofiltration, continuous processing, and real-time analytics further lift adoption, especially for virus removal, protein concentration, and water-for-injection operations. North America retains a leading position thanks to an entrenched bioprocessing base and clear guidance from the FDA, while Asia-Pacific gains momentum on the back of large-scale capacity additions and biotech incentives.

Global Pharmaceutical Membrane Filtration Market Trends and Insights

Increasing Adoption of Single-Use Technologies

Single-use filtration assemblies shorten change-over times by up to 50% and remove cleaning validation, making them a central pillar of modern biologics facilities. Compatibility with hollow-fiber tangential-flow designs lets producers retrofit legacy lines quickly. Flexible bag-based systems permit parallel campaigns for personalized therapies, while built-in sensors transmit critical quality data that satisfy FDA expectations for continuous monitoring. Cost advantages rise as utilities and labor shrink, and waste volumes decline thanks to lighter construction materials. As gene therapy volumes scale, single-use cartridges rated to >99.999% endotoxin removal enable rapid batch turnaround without risking cross-product carryover. The model aligns with pandemic-preparedness strategies that require fast site deployment and surge capacity.

Expansion of Biologics & Gene Therapy Pipelines

The global biologics pipeline surpasses 10,000 active programs, each requiring robust virus filtration that meets >6 log10 reduction mandates. Plasmid DNA and viral vectors impose high-viscosity loads that spur demand for membranes with optimized pore geometry to avoid shear-induced degradation.Asahi Kasei's Planova FG1 delivers seven-fold higher flux, cutting process time without compromising retention. Updated Q5A(R2) guidance promotes risk-based validation, encouraging application-specific filter development that supports rapid commercialization. The trend extends to mRNA vaccines, where clarification and sterilization must proceed under low binding conditions to protect fragile lipid nanoparticles.

High Capital Investment

Commercial-scale filtration suites cost upward of USD 10 million once skids, analytics, and validation are included, a hurdle for small firms and CDMOs. Integration of PAT sensors raises spending further because data historians and cybersecurity layers must be certified. Emerging-market manufacturers often rely on subsidies or partnerships to secure funding, and currency fluctuations can erode budgets. Thermo Fisher's USD 4.1 billion Solventum purchase shows the size of bets required to stay competitive in purification technology. Multinational companies must duplicate test protocols across regions, swelling capital tied up in duplicate equipment.

Other drivers and restraints analyzed in the detailed report include:

- Stringent Regulatory Requirements

- Advancements in Nanofiltration Technology

- Membrane Fouling Issues & Reduced Lifecycle

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

PES accounted for 32.84% of the pharmaceutical membrane filtration market in 2024, favored for high chemical resistance and low protein binding. Its hydrophilic nature supports 211 mL/min flow rates with protein adsorption below 1%, enabling consistent yields in mAb purification. Surface sulfonation and PEG grafting deepen hydrophilicity, stretch lifespan, and limit fouling.

PVDF is projected to grow at 10.01% CAGR despite PFAS scrutiny, owing to its low extractables and suitability for final fill lines. Regulatory uncertainty encourages suppliers to devise PFAS-free variants, but users value PVDF's thermal stability for steam-in-place cycles. Mixed cellulose ester, nylon, and polypropylene membranes satisfy niche lab or cost-sensitive tasks where extreme robustness is not essential. Comparative studies find PES retains permeability under high solids loads while PVDF excels in low-binding sterile filtration. Manufacturers target ultraclean grades that meet ever tighter leachables limits, preserving product purity throughout storage.

Microfiltration held 44.32% revenue share in 2024 due to entrenched use for cell harvesting and bioburden reduction. Resistance-in-series models allow accurate scale-up, ensuring pilot data translate to manufacturing. Continuous microfiltration combined with alternating tangential flow lifts harvest titers for intensified fed-batch cultures. Nanofiltration is set to rise at 12.95% CAGR on the back of vaccine and gene therapy pipelines demanding virus removal under high flux.

Two-dimensional material coatings raise water permeability without sacrificing 20 nm pore exclusion, facilitating >6 log10 virus clearance. Scale-down rigs help define optimal pH and conductivity windows, driving 900% throughput gains when parameters are tuned. Ultrafiltration remains vital for buffer exchange and protein concentration, whereas reverse osmosis handles water treatment for injection systems.

The Report Covers Pharmaceutical Membrane Filtration Market is Segmented by Material (Polyethersulfone, Polyvinylidene Difluoride, and More), Technique (Microfiltration, and More), Process Stage (Final Product Sterile-Filtration, and More), Scale (Laboratory, and More), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, South America). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retained 36.55% share of the pharmaceutical membrane filtration market in 2024, powered by a dense network of biologics plants and an FDA that endorses advanced manufacturing with clear guidance. Federal incentives for pandemic preparedness sustain spending on high-capacity single-use systems and continuous lines. Europe follows closely, driven by Annex 1 revisions that compel producers to adopt PUPSIT and automated integrity checks. Firms invest in virus filters and data-rich skids to navigate stringent audit expectations.

Asia-Pacific is set to grow at 11.67% CAGR through 2030 as governments pour funds into biotech hubs. Cytiva's USD 150 million Korean site and MilliporeSigma's EUR 300 million plant in Daejeon signal the region's ascent, offering local supply of sterile filters and single-use kits that shorten logistics chains. China and India increase GMP adherence, with close to 90% of Chinese and 100% of Indian biomanagers targeting global market entry. Latin America and the Middle East make incremental progress, led by Brazil and Saudi Arabia, which court CDMOs to diversify their economies. Harmonization of ICH guidelines eases technology transfer, enabling global firms to deploy identical filtration trains across multiple continents.

- 3M

- Danaher

- Merck

- Sartorius

- Thermo Fisher Scientific

- Parker Hannifin

- Repligen

- GEA Group

- Graver Technologies

- GE Healthcare

- Meissner Filtration

- Alfa Laval

- Cobetter Filtration

- Amazon Filters

- Porvair Filtration Group

- Novasep

- Donaldson Company

- Asahi Kasei

- Tami Industries

- Cole-Parmer

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Adoption of Single-Use Technologies

- 4.2.2 Expansion of Biologics & Gene Therapy Pipelines

- 4.2.3 Stringent Regulatory Requirements

- 4.2.4 Advancements in Nanofiltration Technology

- 4.2.5 Rising R&D Investments

- 4.2.6 Expanding Pharmaceutical Manufacturing in Emerging Markets

- 4.3 Market Restraints

- 4.3.1 High Capital Investment

- 4.3.2 Membrane Fouling Issues & Reduced Lifecycle

- 4.3.3 Complexity in Integration

- 4.3.4 Limited Awareness in Developing Regions

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitutes

- 4.4.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value in USD)

- 5.1 By Material

- 5.1.1 Polyethersulfone (PES)

- 5.1.2 Polyvinylidene Difluoride (PVDF)

- 5.1.3 Mixed Cellulose Ester & Cellulose Acetate (MCE & CA)

- 5.1.4 Nylon

- 5.1.5 Polypropylene & Others

- 5.2 By Technique

- 5.2.1 Microfiltration

- 5.2.2 Ultrafiltration

- 5.2.3 Nanofiltration

- 5.2.4 Reverse-Osmosis & Others

- 5.3 By Process Stage

- 5.3.1 Final Product Sterile-filtration

- 5.3.2 Bulk Drug Substance Clarification

- 5.3.3 Cell Separation & Harvesting

- 5.3.4 Water & Utility Filtration

- 5.3.5 Air/Gas Filtration

- 5.4 By Scale

- 5.4.1 Laboratory

- 5.4.2 Pilot

- 5.4.3 Commercial Production

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East & Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East & Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 3M Company

- 6.3.2 Danaher

- 6.3.3 Merck KGaA

- 6.3.4 Sartorius Stedim Biotech

- 6.3.5 Thermo Fisher Scientific

- 6.3.6 Parker Hannifin

- 6.3.7 Repligen Corporation

- 6.3.8 GEA Group

- 6.3.9 Graver Technologies

- 6.3.10 GE Healthcare

- 6.3.11 Meissner Filtration

- 6.3.12 Alfa Laval

- 6.3.13 Cobetter Filtration

- 6.3.14 Amazon Filters

- 6.3.15 Porvair Filtration Group

- 6.3.16 Novasep

- 6.3.17 Donaldson Company

- 6.3.18 Asahi Kasei

- 6.3.19 Tami Industries

- 6.3.20 Cole-Parmer

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment