|

市场调查报告书

商品编码

1836502

智慧聚合物:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030)Smart Polymers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

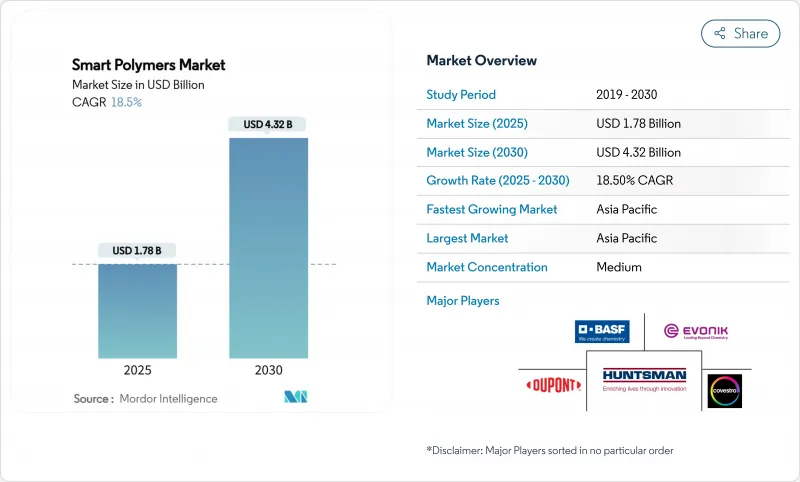

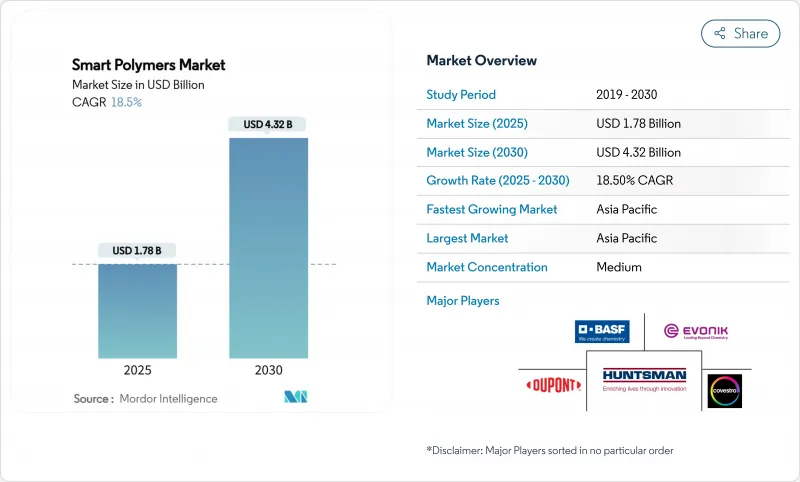

智慧聚合物市场规模预计在 2025 年达到 17.8 亿美元,预计到 2030 年将达到 43.2 亿美元,预测期内(2025-2030 年)的复合年增长率为 18.5%。

这一发展势头的推动因素包括材料化学领域的快速突破、微创医疗解决方案需求的激增,以及消费性电子、纺织品和移动领域中响应性聚合物加速取代被动塑料。由于中国、日本和韩国强大的製造业基础和政府支持的研发支出,亚太地区已成为重要的生产和消费中心。供应商正在将产品系列从单触发系统扩展至多触发系统,以满足业界对可调刚度、自主修復和内建导电性的需求。同时,资本高效的规模化技术(连续流反应器、精密挤出和人工智慧引导的复合)正在缩小与传统工程塑胶的成本差距,从而扩大其在包装和服装等价值驱动型应用中的应用。

全球智慧聚合物市场趋势与洞察

形状记忆聚合物在纺织业的应用不断扩大

纺织品製造商正在将形状记忆聚合物 (SMP) 嵌入织物中,透过随温度变化而收缩和舒张来主动调节舒适度。休閒品牌现在指定使用 SMP 混纺面料,这种面料在高温条件下吸湿排汗,并在环境温度下降时增加编织密度,从而稳定穿着者周围的微气候。 SRTX 实验室展示了一种重新设计的用于针织品的弹道级 SMP,其强度是钢的 10 倍,重量比水轻,并集成了抗菌功能,无需局部涂层。不列颠哥伦比亚大学的一个团队正在印製低成本的压敏电阻阵列,用于捕捉步态动态和生命体征,将连帽衫和压缩袖改造成医疗设备。

自修復涂层的需求

电子、汽车和工业原始设备製造商 (OEM) 正在从手动重新喷漆和过度工程转向能够自主修復刮痕、微裂纹和针孔的涂层。在 Cicoira 的突破性研究中,掺杂乙二醇和单宁酸的 PEDOT:PSS 薄膜在 90% 拉伸应变下恢復电气完整性,即使经过反覆切割也能保持接近 17 S cm-1 的电导率。此配方可黏附在金属、聚烯和热塑性聚氨酯上,为共形感测器、软性电池和耐腐蚀建筑面板的研发铺平了道路。

製造成本高且规模扩大复杂

实验室批量製程依赖精密催化剂、低温进料和多级净化。由于黏度变化和副反应,吨级反应器的放大会降低重现性,导致单位成本高于工程聚合物。连续流合成和反应挤出生产线有望节省成本,但对于中小型公司来说仍然是资本密集的,这减缓了它们进入低利润包装和鞋类市场的速度。

报告中分析的其他驱动因素和限制因素

- 亚洲穿戴式电子产品热潮

- 欧盟强制汽车使用轻质复合材料

- 临床核准的监管不确定性

細項分析

儘管目前销售额较小,但生物刺激响应类产品正以22.7%的复合年增长率加速成长,因为药物传输专家利用酵素、葡萄糖和抗原触发剂进行标靶释放。物理刺激响应类产品仍占智慧聚合物市场份额的41%,其中以用于航太整流罩和智慧窗户的形状记忆合金和感温变色涂层为主导。

透过将pH值和氧化还原敏感性整合到单一聚合物骨架中,调查团队旨在实现化疗药物仅在肿瘤微环境中局部释放,从而降低全身毒性。此混合平台采用印迹识别基团,可模拟抗体,同时经受灭菌循环。这种可客製化吸引了诊断公司将这些聚合物整合到即时诊断生物感测器中。

区域分析

亚太地区占智慧聚合物市场的35%,成长最快,复合年增长率达19.6%。中国的「中国製造2025」计画已将反应性材料列为战略支柱,并为国内生产线提供税收优惠。一家日本企业集团正在开发基于离聚物的SEBS共混物,用于游戏服中的触觉回馈致动器,而一家领先的韩国电子公司正在联合开发用于折迭式显示器的可拉伸电路油墨。

北美津贴了美国国立卫生研究院 (NIH) 和美国国防高级研究计划局 (DARPA) 的资助,用于生物可吸收支架和智能缝合线,波士顿和旧金山湾区则是医疗设备新兴企业和专门从事 GMP 级智能聚合物挤压的受託製造厂商的丛集。

欧洲严格的永续性指令正在推动对可回收和可生物降解等级的需求,而「地平线欧洲」计划支持生物基热可塑性橡胶实现闭合迴路回收,符合汽车製造商的脱碳目标。

虽然南美洲和中东和非洲市场仍在发展中,但巴西的整形外科植入製造商和阿联酋的智慧城市计划已率先采用湿度响应密封剂和温度调节建筑幕墙面板。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 形状记忆聚合物在纺织业的应用不断扩大

- 自修復涂层的需求

- 穿戴式电子产品的繁荣推动了导电智慧聚合物的发展(亚洲)

- 欧盟汽车轻量化指令

- NASA 和 ESA 在航太采用 4D 列印

- 市场限制

- 製造成本高且规模扩大复杂

- 临床核准的监管不确定性

- 多组分智慧聚合物缺乏回收途径

- 价值链分析

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章 市场规模及成长预测(金额)

- 按类型

- 身体刺激反应类型

- 化学刺激反应类型

- 对生物刺激有反应

- 自修復聚合物

- 其他智慧聚合物类型

- 按最终用户产业

- 生物医学保健

- 电气和电子

- 纺织品

- 车

- 其他产业(能源与电力、包装、石油与天然气、建筑)

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 其他南美

- 中东和非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 南非

- 埃及

- 其他中东和非洲地区

- 亚太地区

第六章 竞争态势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- BASF

- Covestro AG

- Dow

- DuPont

- Evonik Industries, AG

- Huntsman International LLC

- Mitsubishi Chemical Group Corporation

- SABIC

- SMP Technologies Inc

- Spintech Holdings Inc.

- The Lubrizol Corporation

第七章 市场机会与未来展望

The Smart Polymers Market size is estimated at USD 1.78 billion in 2025, and is expected to reach USD 4.32 billion by 2030, at a CAGR of 18.5% during the forecast period (2025-2030).

Momentum comes from rapid breakthroughs in materials chemistry, surging demand for minimally invasive healthcare solutions, and the accelerating replacement of passive plastics with responsive polymers in consumer electronics, textiles, and mobility. Asia-Pacific's strong manufacturing base and government-backed research and development spending in China, Japan, and South Korea position the region as the primary production and consumption hub. Suppliers are diversifying product portfolios from single-trigger to multi-trigger systems to meet industry calls for tunable stiffness, autonomous healing, and embedded conductivity. Concurrently, capital-efficient scale-up technologies-continuous flow reactors, precision extrusion, and AI-guided formulation are narrowing the cost gap with conventional engineering plastics, widening adoption prospects in value-conscious sectors such as packaging and apparel.

Global Smart Polymers Market Trends and Insights

Increasing Application of Shape-Memory Polymers in the Textile Industry

Textile producers are embedding shape-memory polymers (SMPs) into fibers that actively regulate comfort by contracting or relaxing with temperature changes. Athleisure brands now specify SMP-blended yarns that wick moisture in high-heat conditions and tighten weave density when ambient temperatures fall, maintaining a stable microclimate around the wearer. SRTX Labs demonstrated ballistic-grade SMPs re-engineered for knits that are 10 times stronger than steel and lighter than water, integrating antimicrobial functionality without topical coatings. Universities are coupling SMP substrates with flexible sensor threads; a University of British Columbia team printed low-cost piezoresistive arrays that capture gait dynamics and vital signs, turning hoodies and compression sleeves into medical devices.

Self-Healing Coatings Demand

Electronics, automotive, and industrial OEMs are shifting from manual repainting and over-engineering toward coatings that autonomously repair scratches, micro-cracks, and pinholes. A landmark study by Cicoira produced PEDOT: PSS films doped with ethylene glycol and tannic acid that recover electrical integrity after 90% tensile strain, sustaining conductivity near 17 S cm-1 even after repeated cuts. The formulation adheres to metals, polyolefins, and thermoplastic polyurethanes, opening pathways in conformal sensors, flexible batteries, and corrosion-resistant architectural panels.

High Production Cost and Scale-up Complexity

Laboratory batches rely on precision catalysts, cryogenic feeds, and multi-step purification. When scaled to tonne-level reactors, viscosity changes and side reactions hamper reproducibility, inflating unit costs beyond engineering polymers. Continuous-flow synthesis and reactive-extrusion lines promise cost compression, yet capital intensity remains high for SMEs, slowing entry into low-margin packaging and footwear markets.

Other drivers and restraints analyzed in the detailed report include:

- Wearable-Electronics Boom in Asia

- EU Lightweight-Composites Mandates in Automotive

- Regulatory Uncertainty for Clinical Approvals

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Though smaller in revenue today, the biological stimuli-responsive category is accelerating with a 22.7% CAGR as drug-delivery specialists exploit enzyme, glucose, and antigen triggers for targeted release. Physical stimuli-responsive grades still dominate 41% of the Smart Polymers market share, anchored by shape-memory alloys and thermochromic coatings specified in aerospace fairings and smart windows.

Researchers are merging pH and redox sensitivity into a single polymer backbone, enabling localized chemotherapeutic release only in the tumor micro-environment, reducing systemic toxicity. Hybrid platforms employ imprinted recognition sites that emulate antibodies yet withstand sterilization cycles. Such customizability is attracting diagnostics firms that embed these polymers into point-of-care biosensors.

The Smart Polymers Market Report Segments the Industry by Type (Physical Stimuli-Responsive, Chemical Stimuli-Responsive, Biological Stimuli-Responsive, Self-Healing Polymers, and Others), End-User Industry (Biomedical and Healthcare, Electrical and Electronics, Textile, Automotive, and Others), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa).

Geography Analysis

Asia-Pacific leads with 35% of Smart Polymers market revenue and exhibits the fastest regional growth at 19.6% CAGR. China's "Made in China 2025" program earmarks responsive materials as a strategic pillar, granting tax rebates for domestic production lines. Japanese conglomerates scale ionomer-based SEBS blends for haptic feedback actuators in gaming suits, while South Korean electronics giants co-develop stretchable circuit inks for foldable displays.

North America is backed by NIH and DARPA grants, funding bioresorbable stents and smart sutures. Collaborative clusters around Boston and the San Francisco Bay Area pair medical-device start-ups with contract manufacturing organizations that specialize in GMP-grade smart polymer extrusion.

Europe enforces stringent sustainability directives, catalyzing demand for recyclable and biodegradable grades. Horizon Europe projects sponsor bio-based thermoplastic elastomers designed for closed-loop recovery, aligning with automotive OEM decarbonization targets.

South America and MEA markets remain nascent, yet Brazil's orthopedic-implant makers and the UAE's smart-city initiatives are early adopters of moisture-responsive sealants and temperature-modulating facade panels.

- BASF

- Covestro AG

- Dow

- DuPont

- Evonik Industries, AG

- Huntsman International LLC

- Mitsubishi Chemical Group Corporation

- SABIC

- SMP Technologies Inc

- Spintech Holdings Inc.

- The Lubrizol Corporation

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Application of Shape Memory Polymer in Textile Industry

- 4.2.2 Self-Healing Coatings Demand

- 4.2.3 Wearable-Electronics Boom Accelerating Conductive Smart Polymers (Asia)

- 4.2.4 EU Lightweight-Composites Mandates in Automotive

- 4.2.5 4-D Printing Adoption in Aerospace by NASA and ESA

- 4.3 Market Restraints

- 4.3.1 High Production Cost and Scale-up Complexity

- 4.3.2 Regulatory Uncertainty for Clinical Approvals

- 4.3.3 Lack of Recycling Pathways for Multi-Component Smart Polymers

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Type

- 5.1.1 Physical Stimuli-Responsive

- 5.1.2 Chemical Stimuli-Responsive

- 5.1.3 Biological Stimuli-Responsive

- 5.1.4 Self-Healing Polymers

- 5.1.5 Other Smart Polymer Types

- 5.2 By End-User Industry

- 5.2.1 Biomedical and Healthcare

- 5.2.2 Electrical and Electronics

- 5.2.3 Textile

- 5.2.4 Automotive

- 5.2.5 Other Industries (Energy and Power, Packaging, Oil and Gas, Construction)

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Spain

- 5.3.3.6 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 United Arab Emirates

- 5.3.5.3 South Africa

- 5.3.5.4 Egypt

- 5.3.5.5 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 BASF

- 6.4.2 Covestro AG

- 6.4.3 Dow

- 6.4.4 DuPont

- 6.4.5 Evonik Industries, AG

- 6.4.6 Huntsman International LLC

- 6.4.7 Mitsubishi Chemical Group Corporation

- 6.4.8 SABIC

- 6.4.9 SMP Technologies Inc

- 6.4.10 Spintech Holdings Inc.

- 6.4.11 The Lubrizol Corporation

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment