|

市场调查报告书

商品编码

1836528

东南亚建筑化学品:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Southeast Asia Construction Chemicals - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

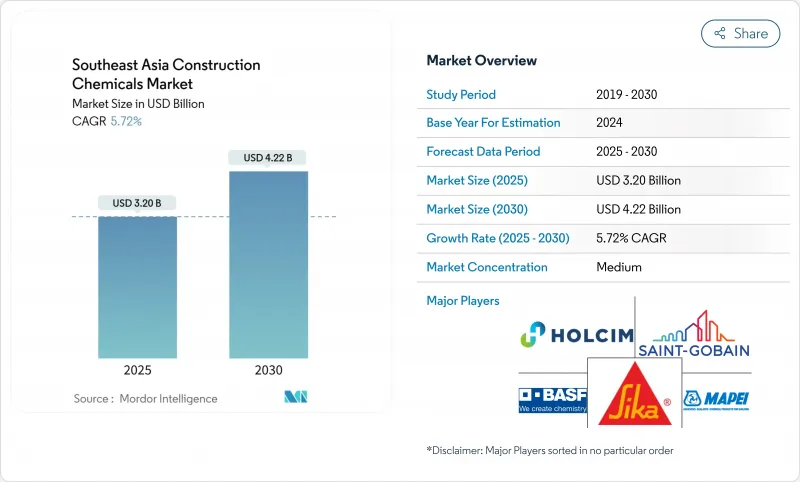

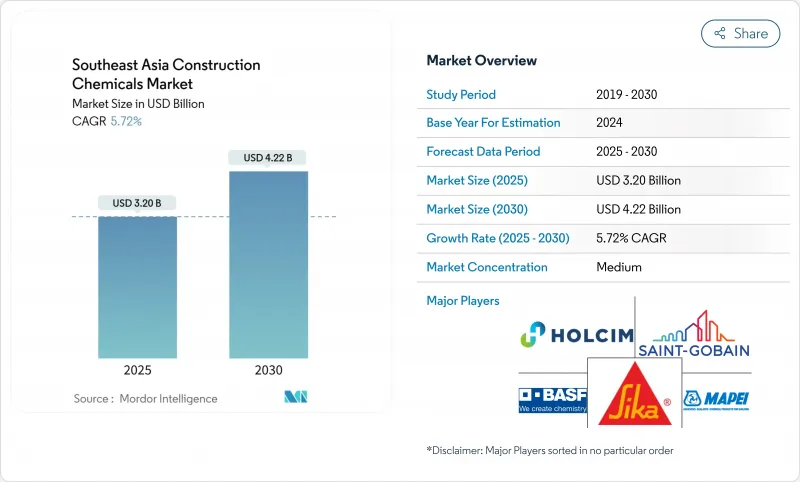

东南亚建筑化学品市场预计到2025年将达到32亿美元,到2030年将达到42.2亿美元,复合年增长率为5.72%。

大型公共基础设施管道、快速的都市化和更严格的性能标准正在推动全部区域对高级外加剂、防水剂和防护涂料的需求。交通走廊、住房和工业园区的公共支出不断增加,导致每年混凝土浇筑量增加,而老化桥樑、港口和建筑的维修需求不断增长,也扩大了高性能修復产品的机会。以新加坡 2025 年持久性化学品法规为首的平行监管压力正在加速向低 VOC 和生物基配方的转变。以圣戈班收购 FOSROC 为例,全球供应商之间的整合日益加强,正在加剧东南亚建筑化学品市场在创新和服务能力上的竞争。

东南亚建筑化学品市场趋势与洞察

公共基础设施投资快速成长

各国政府正在加大建设预算,以解决产能瓶颈并刺激经济成长。印尼已累计423.3 兆印尼币用于 2024 年的基础设施建设,其耗资 350 亿美元的新首都建设预计将消耗 200 万吨水泥,这将刺激对混凝土外加剂和防护被覆剂的需求。越南将于 2024 年启动 13 个交通计划,总价值 12 亿美元,将增加对耐腐蚀涂料和高早强水泥浆的需求。泰国的东部经济走廊大型企划和菲律宾弥补 1000 万套住房供不应求的努力正在加强对防水和密封剂的稳定需求。马来西亚的建筑业在 2024 年上半年成长了 14.6%,这表明财政支出可以转化为外加剂和修补剂消费的增加。

预製和模组化建筑的采用正在蓬勃发展

工业化建筑系统缩短了工期,减少了工时,并重建了化学规范。金务大工业建筑系统(Gamuda IBS)在马来西亚建造了一座50层的塔楼,耗时仅为原先的三分之二,这推动了速水泥浆灌浆料和连接胶的广泛应用。印尼的预製混凝土可节省5-10%的成本,并提高抗震性能,激发了人们对柔性连接材料的兴趣。新加坡建屋发展局已在超过70万套住宅中嵌入了聚合物混凝土,引领了东南亚建筑化学品市场的性能标准。在越南,製造业外商投资的增加正推动模组化建筑的发展,使用专用密封胶进行异地组装。

严格的VOC和甲醛排放法规

新加坡《环境保护和管理法》修正案要求处理持久性有机污染物必须获得许可证,这增加了溶剂型产品的合规成本。越南QCVN 01:2025/BYT法规对工作场所70种物质进行了限制,强制要求对传统黏合剂进行再生产。泰国广泛的环境框架收紧了工厂排放,导致中小型供应商难以筹集资金研发环保配方。印尼涂料製造商预测其建筑业务将继续成长,但他们警告称,消费者对高端环保产品的接受度有限,这可能会限制其应用。

报告中分析的其他驱动因素和限制因素

- 对水性、低VOC建筑解决方案的需求不断增长

- 基础设施老化导致维修需求增加

- 技术纯熟劳工短缺

細項分析

到2024年,混凝土外加剂将占东南亚建设化学品市场的33.48%,这将增强其在大型交通和住房项目中的作用。 2024年,印尼的水泥出货量将达到6,488.7万吨,再加上越南2025年第一季20%的消费量成长,这为减水剂和凝固剂创造了肥沃的土壤,有助于促进现浇结构的周转。防护涂料是成长最快的细分市场,复合年增长率为6.75%,用于修復桥樑、桥墩和管道,需要能够抵抗氯化物侵蚀的高强度环氧树脂。黏合剂和阻燃剂解决了模组化建筑的扩展问题,而防水膜则可以保护暴露于季风循环和高地下水位的计划。

东南亚建筑化学品市场的技术发展轨迹专注于多功能外加剂,旨在缩短週期并减少水泥消费量。西卡对MBCC的整合预计将在2026年产生每年1.8亿至2亿瑞士法郎的协同效应,从而支持广泛的产品组合,同时满足混凝土、地板材料和密封剂的需求。汉高收购了Seal For Life,扩大了其适用于沿海基础设施的长效防腐蚀包装产品组合。区域配方师也在局部化添加剂,以应对热带湿度和地震应力,从而抢占不熟悉当地情况的进口市场份额。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 公共基础设施投资快速成长

- 预製和模组化建筑的采用激增

- 越来越多采用创新施工程序

- 对水性、低VOC建筑解决方案的需求不断增加

- 基础设施老化导致维修需求增加

- 市场限制

- 严格的VOC和甲醛排放法规

- 原物料价格上涨

- 技术纯熟劳工短缺

- 价值链分析

- 五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章 市场规模及成长预测(金额)

- 依产品类型

- 胶水

- 混凝土和水泥外加剂

- 阻燃剂

- 保护漆

- 防水剂

- 其他建筑化学品(水泥浆、密封剂等)

- 按用途

- 商业

- 工业

- 基础设施

- 住房

- 按功能

- 提高强度

- 耐用且耐腐蚀

- 防火/防热

- 美观和表面光洁度

- 按地区

- 印尼

- 越南

- 菲律宾

- 泰国

- 马来西亚

- 新加坡

- 其他东南亚地区

第六章 竞争态势

- 市场集中度

- 策略趋势

- 市占率(%)/排名分析

- 公司简介

- 3M

- Akzo Nobel NV

- Arkema

- Ashland

- BASF SE

- Dow

- HB Fuller

- Henkel AG & Co. KGaA

- Holcim

- MAPEI SpA

- Nippon Paint Holdings Co., Ltd.

- Pidilite Industries Ltd.

- RPM International Inc.

- Saint Gobain

- Sika AG

- The Euclid Chemical Company

- Wacker Chemie AG

第七章 市场机会与未来展望

The Southeast Asia construction chemicals market is valued at USD 3.20 billion in 2025 and is forecast to reach USD 4.22 billion by 2030, registering a 5.72% CAGR.

A sizable public-sector infrastructure pipeline, rapid urbanization, and stricter performance standards are increasing demand for advanced admixtures, waterproofing agents, and protective coatings throughout the region. Elevated public spending on transport corridors, housing, and industrial estates is amplifying the volume of concrete placed each year, while swelling renovation needs for aging bridges, ports, and buildings expand opportunities for high-performance repair products. Parallel regulatory pressure, led by Singapore's 2025 restrictions on persistent chemicals, is accelerating the switch toward low-VOC and bio-based formulations. Intensifying consolidation among global suppliers, exemplified by Saint-Gobain's purchase of FOSROC, is raising the competitive bar on both innovation and service capability across the Southeast Asia construction chemicals market.

Southeast Asia Construction Chemicals Market Trends and Insights

Surging Public-sector Infrastructure Investments

Governments are boosting construction budgets to relieve capacity bottlenecks and spur economic growth. Indonesia has earmarked IDR 423.3 trillion for 2024 infrastructure work, while its USD 35 billion New Capital City is expected to consume 2 million tons of cement, stimulating demand for concrete admixtures and protective coatings. Vietnam began 13 transport projects worth USD 1.2 billion in 2024, raising requirements for corrosion-resistant coatings and high-early-strength grouts. Thailand's Eastern Economic Corridor megaprojects and the Philippines' drive to narrow a 10 million-unit housing backlog reinforce a steady call for waterproofing and sealants. Malaysia's 14.6% construction growth in H1 2024 further illustrates how fiscal outlays translate into higher consumption of admixture and repair compounds.

Booming Prefabricated and Modular Building Adoption

Industrialized Building Systems shorten schedules and cut labor hours, reshaping chemical specifications. Gamuda IBS has erected 50-story towers in two-thirds of the traditional timelines in Malaysia, spurring the uptake of fast-setting grouts and connection adhesives. Indonesian precast concrete delivers 5-10% cost savings and enhanced seismic resilience, driving interest in flexible jointing compounds. Singapore's Housing Development Board has embedded polymer concrete in more than 700,000 units, guiding performance benchmarks across the Southeast Asia construction chemicals market. Vietnam's rising foreign investment inflows into manufacturing fuel modular construction that depends on specialty sealants for off-site assembly.

Stringent VOC and Formaldehyde Emission Caps

The Environmental Protection and Management Act amendments in Singapore require handling licences for persistent organic pollutants, adding compliance costs for solvent-borne products. Vietnam's QCVN 01:2025/BYT regulation sets workplace limits on 70 substances, forcing reformulation of legacy adhesives. Thailand's broad environmental framework tightens factory emissions, with smaller suppliers struggling to finance R&D for greener recipes. Indonesian coatings makers project continued construction growth, yet warn that limited consumer acceptance of premium eco-products could restrain uptake.

Other drivers and restraints analyzed in the detailed report include:

- Rising Demand for Water-based, Low-VOC Construction Solutions

- Growing Renovation Requirements Due to Aging Infrastructure

- Lack of Skilled Labour

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Concrete admixtures held a 33.48% slice of the Southeast Asia construction chemicals market in 2024, cementing their role in large-scale transport and housing programs. Indonesia's cement dispatches of 64.887 million tons in 2024, paired with Vietnam's 20% consumption surge in Q1 2025, created fertile territory for water reducers and set-controllers that accelerate turnaround of cast-in-place structures. Protective coatings, the fastest-growing sub-segment at 6.75% CAGR, ride on rehabilitating bridges, wharves and pipelines that need high-build epoxies to resist chloride ingress. Adhesives and flame retardants cater to the expanding modular-building scene, while waterproofing membranes protect projects exposed to monsoon cycles and high groundwater tables.

Technological trajectories within the Southeast Asia construction chemicals market emphasize multi-functional admixtures that shorten cycle times and shrink cement consumption. Sika's integration of MBCC is slated to deliver CHF 180-200 million in annual synergies by 2026, underpinning broader portfolios that address concrete, flooring and sealant demands simultaneously. Henkel's acquisition of Seal For Life enlarges its offering in long-life anticorrosion wraps tailored to coastal infrastructure. Regional formulators also localize additives to match tropical humidity and seismic stresses, winning share from imports less attuned to local job-site realities.

The Southeast Asia Construction Chemicals Market Report Segments the Industry by Product Type (Adhesives, Concrete and Cement Admixtures, Flame Retardants, and More), Application (Commercial, Industrial, Infrastructure, and Residential), Function (Strength Enhancement, Durability and Corrosion Protection, and More), and Geography (Indonesia, Vietnam, Philippines, Thailand, Malaysia, Singapore, and Rest of Southeast Asia).

List of Companies Covered in this Report:

- 3M

- Akzo Nobel N.V.

- Arkema

- Ashland

- BASF SE

- Dow

- H.B. Fuller

- Henkel AG & Co. KGaA

- Holcim

- MAPEI S.p.A.

- Nippon Paint Holdings Co., Ltd.

- Pidilite Industries Ltd.

- RPM International Inc.

- Saint Gobain

- Sika AG

- The Euclid Chemical Company

- Wacker Chemie AG

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surging Public-sector Infrastructure Investments

- 4.2.2 Booming Prefabricated and Modular Building Adoption

- 4.2.3 Increased Adoption of Innovative Construction Procedures

- 4.2.4 Rising Demand for Water-based, Low-VOC Construction Solutions

- 4.2.5 Growing Renovation Requirements Due to Aging Infrastructure

- 4.3 Market Restraints

- 4.3.1 Stringent VOC and Formaldehyde Emission Caps

- 4.3.2 High Raw-material Price Volatility

- 4.3.3 Lack of Skilled Labour

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Product Type

- 5.1.1 Adhesives

- 5.1.2 Concrete and Cement Admixtures

- 5.1.3 Flame Retardants

- 5.1.4 Protective Coatings

- 5.1.5 Water-proofing Chemicals

- 5.1.6 Other Construction Chemicals (Grouts, Sealants, etc.)

- 5.2 By Application

- 5.2.1 Commercial

- 5.2.2 Industrial

- 5.2.3 Infrastructure

- 5.2.4 Residential

- 5.3 By Function

- 5.3.1 Strength Enhancement

- 5.3.2 Durability and Corrosion Protection

- 5.3.3 Fire and Thermal Protection

- 5.3.4 Aesthetic and Surface Finishing

- 5.4 By Geography

- 5.4.1 Indonesia

- 5.4.2 Vietnam

- 5.4.3 Philippines

- 5.4.4 Thailand

- 5.4.5 Malaysia

- 5.4.6 Singapore

- 5.4.7 Rest of Southeast Asia

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 3M

- 6.4.2 Akzo Nobel N.V.

- 6.4.3 Arkema

- 6.4.4 Ashland

- 6.4.5 BASF SE

- 6.4.6 Dow

- 6.4.7 H.B. Fuller

- 6.4.8 Henkel AG & Co. KGaA

- 6.4.9 Holcim

- 6.4.10 MAPEI S.p.A.

- 6.4.11 Nippon Paint Holdings Co., Ltd.

- 6.4.12 Pidilite Industries Ltd.

- 6.4.13 RPM International Inc.

- 6.4.14 Saint Gobain

- 6.4.15 Sika AG

- 6.4.16 The Euclid Chemical Company

- 6.4.17 Wacker Chemie AG

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment