|

市场调查报告书

商品编码

1836529

复合材料修復:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Composite Repair - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

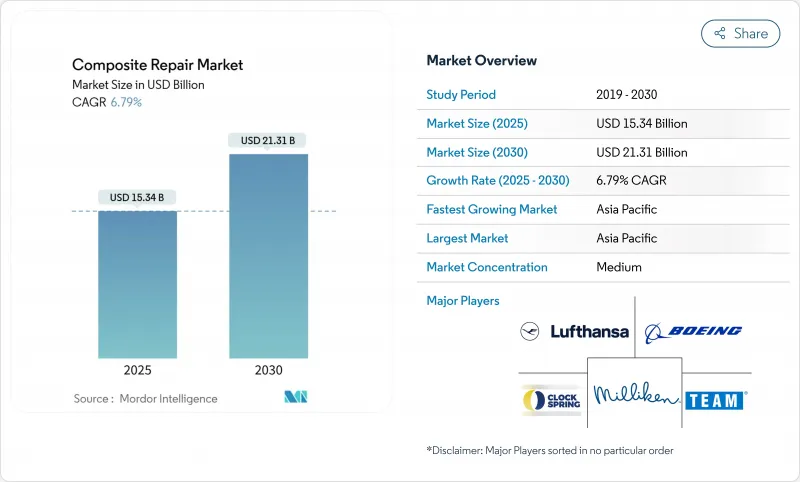

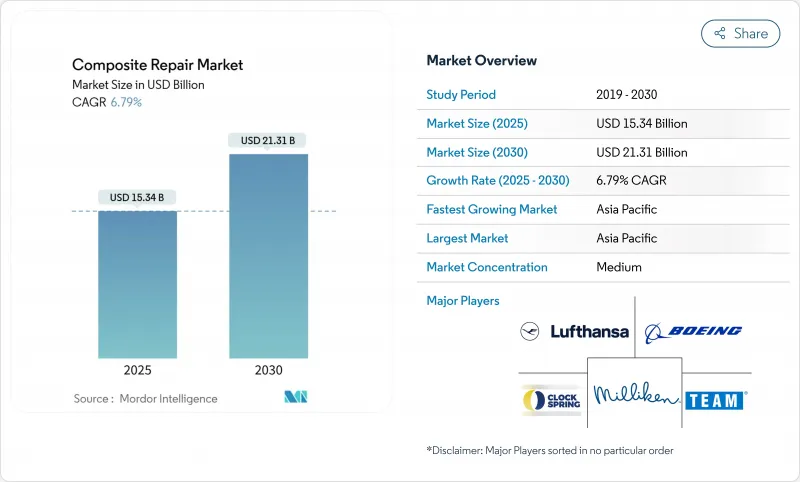

复合材料修復市场预计在 2025 年达到 153.4 亿美元,到 2030 年将成长至 213.1 亿美元,复合年增长率为 6.79%。

随着资产所有者从昂贵的更换转向高效的复合材料修復,以恢復结构性能并减少停机时间,成长持续进行。虽然结构修復仍然是由深厚的认证专业知识支撑的支柱领域,但随着预防性保养,外观修復正以最快的速度发展。虽然航太仍占据最大的终端用户份额,但离岸风电对无法在陆地上移动的叶片的现场维修需求日益增长。数位双胞胎整合、自动化以及 ASME PCC-2 和 ISO 24817 等标准可确保品质、降低风险并支援其在关键基础架构中的广泛应用。

全球复合材料修復市场趋势与洞察

老化资产寿命延长计画投资激增

营运商正在扩展而不是更换管道、飞机和工业厂房,而复合材料缠绕材料正帮助他们在不关闭资产的情况下实施这项策略。 TD Williamson 于 2024 年 12 月收购了 Petro-Line,将 PETROSLEEVE 技术添加到其产品组合中,使现场管道加固能够符合北美完整性义务。 HJ3 使用碳纤维缠绕材料修復公路桥柱,成本仅为更换成本的一半,证明了其对公共基础设施的经济效益。离岸风力发电叶片更换成本约为每片 20 万美元,而复合材料修復平均成本为 3 万美元,因此延长叶片寿命对业主来说是一个极具吸引力的考虑因素。

与金属替换相比,原位复合材料修復的成本效益

与基于焊接的金属修復相比,复合材料覆盖层无需申请热加工许可证,降低保险费,并减少工时。 ASME PCC-2 指南指出,复合材料可以减少 70-80% 的热加工,显着提高安全性和生产效率。澳洲皇家海军报告称,护卫舰甲板碳纤维覆盖层的耐久性可达 15 年,证明了其在海上的长期耐用性。西卡 2024 年销售额达 117.6 亿瑞士法郎,部分原因是其基础设施修復树脂可最大限度地减少停机时间并延长资产寿命。由于预算有限的业主选择复合材料,这些经济效益为成长贡献了 1.5 个百分点。

自修復复合材料层压板的出现

学术突破表明,复合材料自主密封微裂纹,从而有可能降低未来的维修需求。 2025年4月,早稻田大学推出了硅氧烷薄膜,可在加热后自行修復,同时保持1.50 GPa的硬度。德克萨斯农工大学的Diels-Alder聚合物兼具防弹性与自修復能力,引起了日本防卫省的兴趣。虽然这些概念仍处于商业化前阶段,但它们预示着未来可能会减少售后市场的销售量,从2029年起,复合年增长率将下降0.7个百分点。

报告中分析的其他驱动因素和限制因素

- 复合复合材料在航太和国防工业的应用日益广泛

- 增加风力叶片的长度需要现场维修能力

- 认证复合材料修復技术人员短缺

細項分析

2024年,结构修復占了复合材料修復市场份额的44.56%,因为业主优先修復飞机、管道和风电叶片。该领域受益于严格的认证通讯协定,这些协议有利于成熟的供应商,尤其是在航太领域,复合材料主结构需要精确的斜接几何形状和可控的固化曲线。营运商正在采用这些修復方案来延长安全服务间隔并推迟资本密集的更换,从而巩固了该领域在复合材料修復市场的领先地位。

到2030年,外观修復的复合年增长率将达到7.66%,反映出人们正转向及早干预,以便在表面侵蚀变得更加严重之前进行处理。贝尔佐纳(Belzona)涂层等尖端风力发电机处理技术,证明了外观修復能够减少气动损耗,并避免更严重的结构宣传活动。随着预测性维护工具能够更早发现细微的外观缺陷,外观修復领域复合材料修復的市场规模将不断扩大,这将鼓励服务供应商开发快速固化、现场友好的系统,以满足停机需求。

手工积层方法因其便携性和极低的设备要求,在2024年占据了复合材料修復市场份额的38.55%。当天气、地形或通道等因素导致自动化施工无法进行时,现场施工团队通常会选择手工积层。 CompositePatch的5分钟紧急套件在海上事故中展现了其优势,快速的船体密封可避免代价高昂的停机。

由于营运商对高应力零件的航太级品质要求,预计高压釜维修的复合年增长率将达到 8.03%。航空公司正转向高压釜维修厂,将引擎整流罩和飞行控制面修復至与原厂製造相当的品质水准。随着航空业的发展,透过高压釜服务进行复合材料维修的市场规模预计将持续扩大。在英格索尔机床等设备製造商(它们为 MRO 中心提供机器人)的推动下,真空灌注和自动纤维铺放技术持续发展。

区域分析

亚太地区凭藉其庞大的製造业基础、不断扩张的离岸风电项目以及雄心勃勃的基础设施更新计划,占据着全球最大的复合材料修復市场。中国风电原始设备製造商正在部署15兆瓦级风力涡轮机,这推动了对叶片现场修復技术的需求。随着公路、铁路和港口计划整合复合材料增强材料以满足加速的工期,印度和东南亚地区正实现高个位数成长。

北美能源供应主要来自老化的电网和强大的民航机。管线营运商正在采用符合 ASME 标准的碳纤维外包装来缓解腐蚀,同时保持输送量;美国MRO 公司正在投资建造用于宽体高压釜釜设施。该地区也在大平原地区的风电场试行数位双胞胎配置,用于预测性叶片维修。

欧洲仍然以技术为中心,受国家奖励的推动,这些措施促进了研发。德国航太丛集正在研发热塑性无环缝修补技术,丹麦则在叶片机器人技术领域处于领先地位。汉莎科技公司斥资12亿欧元进行的扩张,凸显了该地区致力于成为复合材料MRO领域的领导者的承诺。随着现有设备基础的成熟,但对更先进的维护技术的需求不断增加,欧洲复合材料维修市场的成长将稳定在中等个位数水准。拉丁美洲以及中东和非洲地区总体规模虽小,但发展迅速,它们在采用成熟地区成熟的技术的同时,也在培养国内技术人员队伍。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 老化资产寿命延长计划投资快速增加

- 现场复合材料修復和金属零件更换的成本优势

- 复合复合材料在航太和国防工业的应用日益广泛

- 离岸风电叶片长度增加需要现场维修能力

- 数位双胞胎引导的预测性维护降低了检查成本

- 市场限制

- 自修復复合复合材料层压板的出现

- 认证复合材料修復技术人员短缺

- 缺乏统一的海底复合材料管道修復规范。

- 价值链分析

- 五力分析

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

- 专利分析

第五章 市场规模及成长预测(金额)

- 依产品类型

- 结构

- 半结构化

- 化妆品

- 按修復流程

- 手工积层

- 真空灌注

- 高压釜

- 其他流程

- 依材料类型

- 碳纤维增强聚合物(CFRP)

- 玻璃纤维增强聚合物(GFRP)

- 酰胺纤维复合材料

- 混合纤维和其他纤维

- 按最终用户产业

- 航太/国防

- 风力发电

- 车

- 海洋

- 建造

- 其他行业

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 澳洲

- 其他亚太地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 北美洲

第六章 竞争态势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- 3M

- Belzona International Ltd.

- Boeing

- ClockSpring

- Composite Technology Inc.

- Crawford Composites LLC

- DIAB Group

- Gurit Holding AG

- HAECO Group

- Henkel AG & Co. KGaA

- Hexcel Corporation

- Lufthansa Technik AG

- Milliken Infrastructure Solutions

- ResinTech Inc.

- Sika AG

- TD Williamson Inc.

- TEAM, Inc.

- Toray Advanced Composites

- WR Composites

第七章 市场机会与未来展望

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 老化资产寿命延长计划投资快速增加

- 现场复合材料修復和金属零件更换的成本优势

- 复合复合材料在航太和国防工业的应用日益广泛

- 离岸风电叶片长度增加需要现场维修能力

- 数位双胞胎引导的预测性维护降低了检查成本

- 市场限制

- 自修復复合复合材料层压板的出现

- 认证复合材料修復技术人员短缺

- 缺乏统一的海底复合材料管道修復规范。

- 价值链分析

- 五力分析

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

- 专利分析

第五章 市场规模及成长预测(金额)

- 依产品类型

- 结构

- 半结构化

- 化妆品

- 按修復流程

- 手工积层

- 真空灌注

- 高压釜

- 其他流程

- 依材料类型

- 碳纤维增强聚合物(CFRP)

- 玻璃纤维增强聚合物(GFRP)

- 酰胺纤维复合材料

- 混合纤维和其他纤维

- 按最终用户产业

- 航太/国防

- 风力发电

- 车

- 海洋

- 建造

- 其他行业

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 澳洲

- 其他亚太地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 北美洲

第六章 竞争态势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- 3M

- Belzona International Ltd.

- Boeing

- ClockSpring

- Composite Technology Inc.

- Crawford Composites LLC

- DIAB Group

- Gurit Holding AG

- HAECO Group

- Henkel AG & Co. KGaA

- Hexcel Corporation

- Lufthansa Technik AG

- Milliken Infrastructure Solutions

- ResinTech Inc.

- Sika AG

- TD Williamson Inc.

- TEAM, Inc.

- Toray Advanced Composites

- WR Composites

第七章 市场机会与未来展望

The composite repair market stood at USD 15.34 billion in 2025 and is forecast to rise to USD 21.31 billion by 2030, delivering a 6.79% CAGR.

Growth continues as asset owners pivot from costly replacements to efficient composite repairs that restore structural performance while curbing downtime. Structural repairs remain the anchor segment, supported by deep certification expertise, yet cosmetic repairs are advancing fastest as preventive maintenance gains favor across wind, marine, and transportation assets. Aerospace keeps the largest end-user share, while offshore wind drives incremental demand for in-situ blade work that cannot be moved onshore. Digital twin integration, automation, and standards such as ASME PCC-2 and ISO 24817 ensure quality, contain risk, and underpin expanding adoption across critical infrastructure.

Global Composite Repair Market Trends and Insights

Surging Investment in Ageing-Asset Life-Extension Programs

Operators extend pipelines, aircraft, and industrial plants instead of replacing them, and composite wraps help execute this strategy without shutting down assets. T.D. Williamson's purchase of Petro-Line in December 2024 brought PETROSLEEVE technology into its portfolio, enabling live pipeline reinforcement that meets North American integrity mandates . HJ3 restored a highway bridge column at half the replacement cost using carbon-fiber wraps, illustrating the economic benefit for public infrastructure. Offshore wind blade replacements cost about USD 200,000 each, yet composite repairs average USD 30,000, making life-extension compelling for owners.

Cost Advantages of On-Site Composite Repair Versus Metallic Part Replacement

Composite overwraps avoid hot-work permits, lower insurance premiums, and reduce man-hours versus weld-based metallic repairs. ASME PCC-2 guidance notes that composites can eliminate 70-80% of hot work, materially improving safety and productivity. The Royal Australian Navy reports 15-year durability on carbon-fiber overlays for frigate decks, providing a long proof record at sea. Sika logged CHF 11.76 billion in 2024 sales, partly driven by infrastructure repair resins that extend asset life with minimal downtime. These economics contribute +1.5 points to growth as budget-constrained owners choose composite solutions.

Emergence of Self-Healing Composite Laminates

Academic breakthroughs show composites that autonomously close micro-cracks, potentially lowering future repair demand. Waseda University released a siloxane film in April 2025 that heals after heating while retaining 1.50 GPa hardness. Texas A&M's Diels-Alder polymer combines ballistic resistance and self-repair functions, attracting defense interest. These concepts remain pre-commercial yet illustrate a future scenario that could reduce aftermarket volumes, trimming 0.7 points from the CAGR beyond 2029.

Other drivers and restraints analyzed in the detailed report include:

- Increasing Use of Composites in the Aerospace and Defense Industry

- Offshore Wind Blade Length Growth Demanding In-Situ Repair Capability

- Scarcity of Certified Composite Repair Technicians

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Structural repairs accounted for 44.56% of the composite repair market share in 2024 as owners prioritize restoring load-bearing capacity on aircraft, pipelines, and wind blades. The segment benefits from rigorous certification protocols that favor established providers, especially in aerospace where composite primary structures demand precise scarf geometry and controlled cure profiles. Operators adopt these repairs to extend safe service intervals and defer capital-intensive replacements, reinforcing segment leadership inside the composite repair market.

Cosmetic repairs are rising at a 7.66% CAGR to 2030, reflecting the shift to early-stage interventions that address surface erosion before it propagates. Wind turbine leading-edge treatments, such as Belzona coatings, exemplify how cosmetic activities cut aerodynamic losses and avoid larger structural campaigns. As predictive maintenance tools flag minor surface defects earlier, the composite repair market size attached to the cosmetic category will expand, encouraging service providers to develop fast-cure, field-friendly systems that align with tight outage windows.

The hand lay-up method held 38.55% of composite repair market share in 2024 because of its portability and minimal equipment requirement. Field teams often rely on hand lay-up when weather, geometry, or access challenges rule out automated approaches. CompositePatch's five-minute emergency kits illustrate the advantage in maritime incidents where rapid hull sealing prevents costly downtime.

Autoclave repairs exhibit an 8.03% forecast CAGR as operators insist on aerospace-grade quality for highly loaded components. Airlines route engine cowls and flight-control surfaces to autoclave shops to regain qualification levels equal to original builds. As fleets grow, the composite repair market size for autoclave services will climb because airlines favor centralized, repeatable quality over field expediency. Vacuum infusion and automated fiber placement continue to advance, spurred by equipment manufacturers such as Ingersoll Machine Tools that supply robotics to MRO centers.

The Composite Repair Market Report Segments the Industry by Product Type (Structural, Semi-Structural, and More), Repair Process (Hand Lay-Up, Vacuum Infusion, and More), Material Type (Carbon-Fibre Reinforced Polymer (CFRP), Aramid-Fibre Composites, and More), End-User Industry (Automotive, Wind Energy, and More), and Geography (Asia-Pacific, North America, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific commands the largest composite repair market because of its immense manufacturing base, expanding offshore wind pipelines, and ambitious infrastructure renewal plans. China's wind OEMs deploy fleets of 15-MW class turbines, fueling demand for in-situ blade servicing technologies. India and Southeast Asia register high single-digit growth as road, rail, and port projects integrate composite strengthening to meet accelerated timelines.

North America follows, underpinned by an aging energy network and a robust commercial aviation fleet. Pipeline operators apply ASME-qualified carbon overwraps to mitigate corrosion while maintaining throughput, and MRO houses in the United States invest in autoclave capacity for wide-body nacelles. The region also pilots digital twin deployments for predictive blade repairs on Great Plains wind farms.

Europe remains technology-centric with state incentives that drive R&D. Germany's aerospace cluster works on thermoplastic scarf-less patching, and Denmark pioneers blade robotics. Lufthansa Technik's EUR 1.2 billion expansion underscores local commitment to composite MRO leadership. Composite repair market size growth in Europe stabilizes at mid-single digits as the installed base matures but demands more sophisticated upkeep. Latin America, the Middle East, and Africa collectively form a smaller yet rapidly advancing bloc, adopting proven techniques from mature regions while cultivating domestic technician pipelines.

- 3M

- Belzona International Ltd.

- Boeing

- ClockSpring

- Composite Technology Inc.

- Crawford Composites LLC

- DIAB Group

- Gurit Holding AG

- HAECO Group

- Henkel AG & Co. KGaA

- Hexcel Corporation

- Lufthansa Technik AG

- Milliken Infrastructure Solutions

- ResinTech Inc.

- Sika AG

- TD Williamson Inc.

- TEAM, Inc.

- Toray Advanced Composites

- WR Composites

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surging investment in ageing-asset life-extension programs

- 4.2.2 Cost advantages of on-site composite repair versus metallic part replacement

- 4.2.3 Increasing Use of Composites in the Aerospace and Defense Industry

- 4.2.4 Offshore wind blade length growth demanding in-situ repair capability

- 4.2.5 Digital twin-guided predictive maintenance lowers inspection cost

- 4.3 Market Restraints

- 4.3.1 Emergence of self-healing composite laminates

- 4.3.2 Scarcity of certified composite repair technicians

- 4.3.3 Lack of harmonised repair codes for subsea composite pipelines

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Patent Analysis

5 Market Size & Growth Forecasts (Value)

- 5.1 By Product Type

- 5.1.1 Structural

- 5.1.2 Semi-structural

- 5.1.3 Cosmetic

- 5.2 By Repair Process

- 5.2.1 Hand Lay-up

- 5.2.2 Vacuum Infusion

- 5.2.3 Autoclave

- 5.2.4 Other Processes

- 5.3 By Material Type

- 5.3.1 Carbon-fibre Reinforced Polymer (CFRP)

- 5.3.2 Glass-fibre Reinforced Polymer (GFRP)

- 5.3.3 Aramid-fibre Composites

- 5.3.4 Hybrid & Other Fibres

- 5.4 By End-User Industry

- 5.4.1 Aerospace and Defense

- 5.4.2 Wind Energy

- 5.4.3 Automotive

- 5.4.4 Marine

- 5.4.5 Construction

- 5.4.6 Other Industries

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Australia

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 South Africa

- 5.5.5.3 Rest of Middle East and Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.4.1 3M

- 6.4.2 Belzona International Ltd.

- 6.4.3 Boeing

- 6.4.4 ClockSpring

- 6.4.5 Composite Technology Inc.

- 6.4.6 Crawford Composites LLC

- 6.4.7 DIAB Group

- 6.4.8 Gurit Holding AG

- 6.4.9 HAECO Group

- 6.4.10 Henkel AG & Co. KGaA

- 6.4.11 Hexcel Corporation

- 6.4.12 Lufthansa Technik AG

- 6.4.13 Milliken Infrastructure Solutions

- 6.4.14 ResinTech Inc.

- 6.4.15 Sika AG

- 6.4.16 TD Williamson Inc.

- 6.4.17 TEAM, Inc.

- 6.4.18 Toray Advanced Composites

- 6.4.19 WR Composites

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment

- 7.2 Automation of Composite Repair