|

市场调查报告书

商品编码

1836558

管道涂料:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Pipe Coatings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

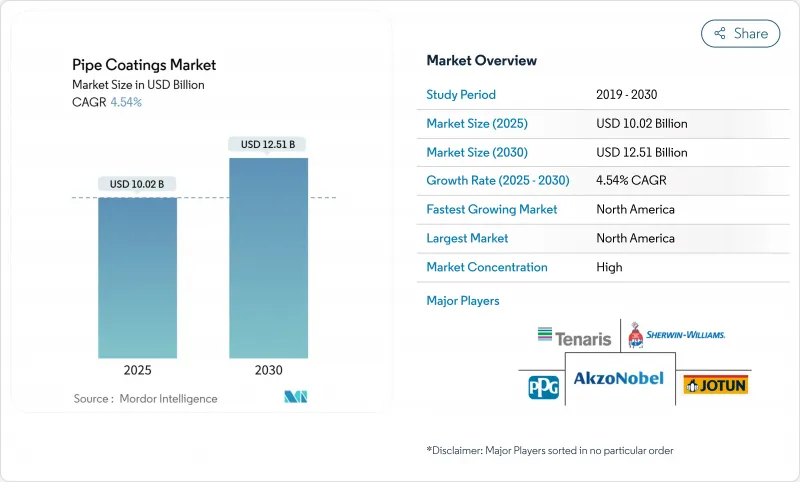

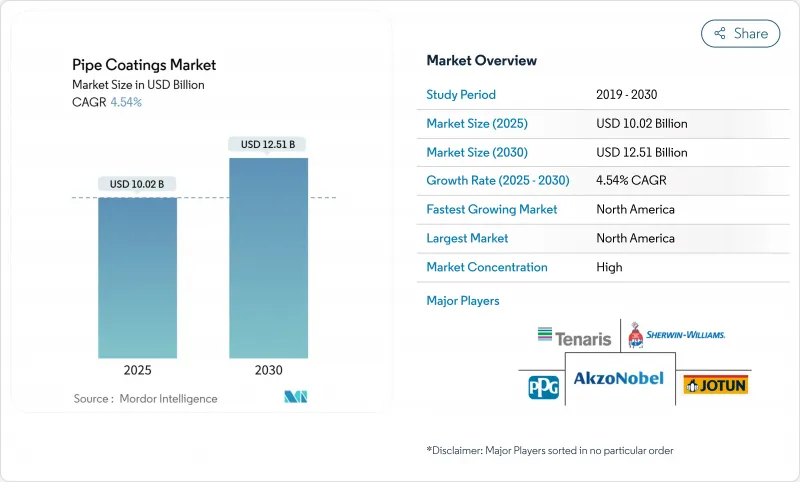

管道涂料市场规模预计在 2025 年达到 100.2 亿美元,预计到 2030 年将达到 125.1 亿美元,预测期内(2025-2030 年)的复合年增长率为 4.54%。

新管道投资的不断增加、稳定的资产维护计划以及更严格的安全法规,正在维持石油天然气、水利和工业领域对防护整理加工剂的需求。北美页岩油开发以及欧洲液化天然气和氢气计画正在推动产能的强劲成长,而亚太地区的城市扩张将推动长期结构性成长。双组分聚氨酯喷涂系统、石墨烯增强水性涂料和低温固化粉末等技术进步正在扩大应用范围并降低生命週期成本。永续性的压力正促使采购团队转向水性和粉末解决方案,但溶剂型解决方案在严苛环境中仍站稳脚跟,因为可靠的性能至关重要。高性能化学品是日益激烈的竞争的核心,全球供应商正在扩展特种产品线,以确保获得海上、高压和氢气服务的订单。

全球管道涂料市场趋势与洞察

页岩气产能增加加速维修週期

北美营运商正在快速建造新的和现有的管道,这推动了对能够抵御硫化氢、二氧化碳和微生物侵蚀的坚固涂料的需求。由于Oleoductos del Valle油田的扩建,预计到2025年,阿根廷瓦卡穆埃尔塔油田的产能将翻一番,达到54万桶/天,从而相应地缩短了维护窗口和重涂间隔。配方师为此设计了一层厚厚的环氧涂层和一层耐磨的胺甲酸乙酯外涂层,可在现场一次完成施工,从而减少操作员的停机时间。

高性能涂料越来越多地用于保护管道免受腐蚀

腐蚀成本迫使资产所有者采用具有自修復功能、耐膜下腐蚀并延长检查週期的内衬。双组分聚氨酯系统与环氧密封涂层相结合,可提供强大的附着力和不透水的表面,从而能够在狭窄空间内快速进行现场修復。在海上管线中,单一故障就可能危及安全和生产执行时间,因此,越来越多地采用由热熔粘合环氧树脂、耐磨外涂层和聚乙烯外包装组成的多层结构。

新发现能源蕴藏量的营运挑战

在3000公尺深的海底施工,涂层必须承受超出常规规范的静水压力和温差。美国管道和危险材料安全管理局(Pipeline and Hazardous Materials Safety Administration,简称PASS)支持的研究正在考虑将厚聚合物包裹层与牺牲复合材料层结合,以减轻海底安装过程中的衝击损伤。进入限制也使检查变得复杂,增加了首次验证涂层完整性的困难。

报告中分析的其他驱动因素和限制因素

- 亚太地区基础建设发展与工业化

- 东南亚灌溉和农业活动的增加

- 非开挖PE管在市政供水的应用日益广泛

細項分析

预计到2024年,环氧树脂和聚氨酯产品将占管道涂料市场规模的40.76%,到2030年,复合年增长率将达到4.91%,超过整体市场。环氧树脂对喷砂钢材具有可靠的附着力,而聚氨酯面漆则具有耐磨性和紫外线稳定性。现场施工人员青睐双组分喷涂钻机,这种设备可以一次喷涂750微米的涂层,缩短了带电作业的周转时间。

聚乙烯和聚丙烯因其低水分扩散性和机械柔韧性,在输水和区域供热应用中仍然很受欢迎。在管道外围,水泥基包裹层和沥青瓷漆可提供强大的机械保护,但环境限制限制了它们的广泛应用。交联多层解决方案结合了熔结环氧树脂和耐磨覆盖层,目前正在保护定向钻井段等高衝击区域,展现了混合系统如何持续提升性能基准。

到2024年,外部涂层将占据管道涂层市场份额的78.19%,因为营运商优先保护埋地钢管免受土壤中氯化物侵蚀和杂散电流的影响。由于北美和欧洲管道网格的老化,预计到2030年,该类别的复合年增长率将达到5.18%。采用环氧树脂底漆和黏合剂的三层聚乙烯缠绕材料由于其在湿回填条件下的附着力和机械韧性,仍将占据主导地位。

内衬虽然收益不高,但当流动效率和减少硫化氢点蚀的效果能够证明资本支出合理时,其预算正在增加。低剪切环氧内衬可以透过提高有效吞吐量和节省泵浦的能源消耗,在几年内抵消安装成本。未来的成长将取决于炼油厂的瓶颈消除和量化摩擦损失的智慧清管数据,从而说服业主将内衬专案扩展到酸性服务集输管线之外。

区域分析

预计到 2024 年,北美将占总营收的 31.54%,到 2030 年将以 5.31% 的最快复合年增长率成长。该地区受益于页岩气产量的上升、远距天然气走廊的扩张以及《2025 年洩漏检测规则》等加强的安全法规。管道所有者正在为高硬度胺甲酸乙酯面漆和自修復环氧树脂分配更大的预算,以最大限度地减少未来在偏远地区的挖掘。

亚太地区的成长主要由中国、印度和印尼推动,这些地区的水、能源和化学管道数量正在增加。涂料供应商必须设计出能够在季风潮湿环境下可靠固化并能抵抗热带真菌的系统。当地粉末製造商正在提高产能,以满足预先的仓储订单,以支持中国五年规划中的大型基础设施项目。

欧洲仍在推进新的液化天然气和天然气进口管道建设,而氢气试点通道则需要新的防渗透层。涂层配方製造商正在与测试实验室合作,检验聚合物-金属复合阻隔层,使其能够在100巴的压力下持续数十年捕获氢分子。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 页岩气产能增加加速维修週期

- 越来越多地采用高性能涂料来保护管道防腐

- 亚太地区基础建设发展与工业化

- 东南亚灌溉和农业活动的增加

- 欧洲对能源基础设施的需求不断增长

- 市场限制

- 新发现能源蕴藏量的营运挑战

- 非开挖PE管在市政供水的应用日益广泛

- 来自可再生能源替代品的竞争

- 价值链分析

- 五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章 市场规模及成长预测(金额)

- 依材料类型

- 聚乙烯和聚丙烯

- 环氧树脂/聚氨酯

- 水泥和混凝土

- 煤焦油瓷漆

- 沥青瓷漆

- 依表面积

- 管道外涂层

- 管道内涂层

- 按成分

- 粉末

- 溶剂型液体

- 水性液体

- 按最终用户产业

- 石油和天然气

- 用水和污水处理

- 矿业

- 农业

- 化学加工和运输

- 基础设施

- 其他最终用户产业

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 其他南美

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争态势

- 市场集中度

- 策略趋势

- 市占率(%)/排名分析

- 公司简介

- 3M

- AW Chesterton Company

- Abdel Hadi A. Al-Qahtani & Sons Group of Companies

- Aegion Corporation(Bayou)

- Akzo Nobel NV

- Allan Edwards, Inc.

- Axalta Coating Systems, LLC

- BASF

- Bauhuis BV

- Blocher Oberflachentechnik GmbH

- Borusan Mannesmann

- Celanese Corporation

- CENERGY HOLDINGS

- Dura-Bond Industries

- GBA Products Co Ltd

- Hempel A/S

- Jotun

- LyondellBasell Industries Holdings BV

- Mutares SE & Co. KGaA

- Nippon Paint Holdings Co., Ltd.

- PERMAA-PIPE International Holdings, Inc.

- PPG Industries, Inc.

- Tenaris

- The Sherwin-Williams Company

- Wasco Berhad

第七章 市场机会与未来展望

The Pipe Coatings Market size is estimated at USD 10.02 billion in 2025, and is expected to reach USD 12.51 billion by 2030, at a CAGR of 4.54% during the forecast period (2025-2030).

Mounting investment in new pipelines, a steady asset maintenance schedule, and stricter safety rules sustain demand for protective finishes across oil and gas, water, and industrial segments. North America's shale build-out and Europe's LNG and hydrogen plans keep capacity additions steady, while Asia-Pacific's urban expansion drives long-term structural growth. Technology advances, such as dual-component polyurethane spray systems, graphene-enhanced water-based options, and low-temperature cure powders, are widening application windows and lowering life-cycle costs. Sustainability pressures steer procurement teams toward waterborne and powder solutions, yet solvent systems retain a foothold in harsher environments where proven performance records matter most. Competitive intensity centers on high-performance chemistries, with global suppliers scaling specialized lines to secure offshore, high-pressure, and hydrogen service orders.

Global Pipe Coatings Market Trends and Insights

Increasing Shale Gas Capacity Additions Accelerating Maintenance Cycles

North American operators are fast-tracking new and legacy pipelines, lifting demand for robust coatings that tolerate hydrogen sulfide, carbon dioxide, and microbial attack. With capacity in Argentina's Vaca Muerta field set to double to 540,000 bpd in 2025 because of Oleoductos del Valle's expansion, comparable maintenance windows are shortening, and re-coating intervals are tightening. Formulators respond with thicker epoxy layers and abrasion-resistant urethane overcoats that can be field-applied in a single pass, reducing downtime for operators.

Rising Adoption of High-Performance Coatings for Corrosion Protection in Pipelines

Corrosion costs have put pressure on asset owners to adopt linings that self-heal, resist under-film corrosion, and extend inspection cycles. Dual-component polyurethane systems paired with epoxy seal coats show strong adhesion and an impermeable surface, enabling quick spot repairs in confined spaces. Offshore lines, where a single failure jeopardizes safety and production uptime, are now specified with multi-layer builds that combine fusion-bonded epoxy, abrasion-resistant overcoats, and outer polyethylene wraps.

Operational Challenges in Newly Discovered Energy Reserves

Coatings applied at 3,000 m water depth endure hydrostatic pressures and temperature differentials that stretch legacy specifications. Research backed by the Pipeline and Hazardous Materials Safety Administration is examining thick polymer wraps combined with sacrificial composite layers to mitigate impact damage during seabed installation. Access constraints also complicate inspection, raising the stakes for first-time coating integrity.

Other drivers and restraints analyzed in the detailed report include:

- Growing Infrastructure and Industrialization in the Asia-Pacific Region

- Rise in Irrigation and Agricultural Activities in Southeast Asia

- Rising Adoption of Trenchless PE Pipe in Municipal Water Supply

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Epoxy and polyurethane products accounted for 40.76% of the pipe coatings market size in 2024 and are forecast to outpace the aggregate market at a 4.91% CAGR through 2030. Epoxies deliver proven adhesion over grit-blasted steel, while polyurethane top coats bring abrasion resistance and UV stability. Field crews favor dual-component spray rigs that can lay down a 750-micron build in one pass, shrinking turnaround time on live lines.

Polyethylene and polypropylene maintain traction in water transmission and district heating because of their low moisture diffusion and mechanical flexibility. At the fringes, cementitious wraps and asphalt enamel serve heavy-duty mechanical protection, yet environmental constraints are curbing further uptake. Cross-linked multilayer solutions that combine fusion-bonded epoxy with abrasion-resistant overlays now protect high-impact areas such as directional drill sections, demonstrating how hybrid systems continue to elevate performance baselines.

External finishes represented 78.19% of the pipe coatings market share in 2024 as operators prioritized safeguarding buried steel from soil-borne chloride attack and stray current. The category is predicted to post a 5.18% CAGR until 2030 as pipeline grids age in North America and Europe. Three-layer polyethylene wraps incorporating epoxy primers and adhesive ties remain a mainstay because they couple adhesion with mechanical toughness under wet backfill conditions.

Internal linings, although accounting for a smaller revenue pool, are winning budgets where flow efficiency and mitigation of H2S-induced pitting justify capital outlays. Low-shear epoxy linings can raise effective throughput or enable pump energy savings that offset installation expense within a few years. Future growth hinges on refinery debottlenecking and smart pigging data that quantify friction losses, convincing owners to extend internal coating programs beyond sour-service gathering lines.

The Pipe Coatings Market Report Segments the Industry by Material Type (Polyethylene and Polypropylene, Epoxy and Polyurethane, and More), Surface Location (External Pipe Coatings and Internal Pipe Coatings), Formulation (Powder, and More), End-User Industry (Oil and Gas, Water and Wastewater Treatment, Mining, Agriculture, and More), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa).

Geography Analysis

North America contributed 31.54% of 2024 revenue and is expected to post the fastest 5.31% CAGR through 2030. The region benefits from shale output growth, long-haul gas corridor expansions, and reinforced safety regulations such as the 2025 leak detection rule. Pipeline owners are allocating larger budgets to high-build urethane topcoats and self-healing epoxies that minimize future dig-ups in remote terrain.

Asia-Pacific's growth is driven by China, India, and Indonesia, adding pipelines for water, energy, and chemicals. Coating suppliers must engineer systems that cure reliably in monsoon humidity and resist tropical fungi. Local powder producers are installing extra capacity to satisfy build-ahead warehousing orders for mega-infrastructure plans under China's Five-Year Program.

Europe presents a two-speed pattern: new LNG and gas import pipes still move forward, while hydrogen pilot corridors demand novel permeation-resistant layers. Coating formulators are partnering with test labs to validate polymer-metal composite barriers capable of confining hydrogen molecules at 100 bar pressure for decades.

- 3M

- A.W. Chesterton Company

- Abdel Hadi A. Al-Qahtani & Sons Group of Companies

- Aegion Corporation (Bayou)

- Akzo Nobel N.V.

- Allan Edwards, Inc.

- Axalta Coating Systems, LLC

- BASF

- Bauhuis B.V.

- Blocher Oberflachentechnik GmbH

- Borusan Mannesmann

- Celanese Corporation

- CENERGY HOLDINGS

- Dura-Bond Industries

- GBA Products Co Ltd

- Hempel A/S

- Jotun

- LyondellBasell Industries Holdings B.V.

- Mutares SE & Co. KGaA

- Nippon Paint Holdings Co., Ltd.

- PERMAA-PIPE International Holdings, Inc.

- PPG Industries, Inc.

- Tenaris

- The Sherwin-Williams Company

- Wasco Berhad

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Shale Gas Capacity Additions Accelerating Maintenance Cycles

- 4.2.2 Rising Adoption of of High Performance Coatings for Corrosion Protection in Pipelines

- 4.2.3 Growing Infrastructure and Industrialization in the Asia-Pacific Region

- 4.2.4 Rise in Irrigation and Agricultural Activities in Southeast Asia

- 4.2.5 Accelerating Demand for Energy Infrastructure in Europe

- 4.3 Market Restraints

- 4.3.1 Operational Challenges in Newly Discovered Energy Reserves

- 4.3.2 Rising Adoption of Trenchless PE Pipe in Municipal Water Supply

- 4.3.3 Competition from Renewable Energy Substitutes

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Material Type

- 5.1.1 Polyethylene and Polypropylene

- 5.1.2 Epoxy and Polyurethane

- 5.1.3 Cement and Concrete

- 5.1.4 Coal Tar Enamel

- 5.1.5 Asphalt Enamel

- 5.2 By Surface Location

- 5.2.1 External Pipe Coatings

- 5.2.2 Internal Pipe Coatings

- 5.3 By Formulation

- 5.3.1 Powder

- 5.3.2 Solvent-Borne Liquid

- 5.3.3 Water-Borne Liquid

- 5.4 By End-User Industry

- 5.4.1 Oil and Gas

- 5.4.2 Water and Wastewater Treatment

- 5.4.3 Mining

- 5.4.4 Agriculture

- 5.4.5 Chemical Processing and Transport

- 5.4.6 Infrastrure

- 5.4.7 Other End-User Industry

- 5.5 Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 Japan

- 5.5.1.4 South Korea

- 5.5.1.5 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle-East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 South Africa

- 5.5.5.3 Rest of Middle-East and Africa

- 5.5.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 3M

- 6.4.2 A.W. Chesterton Company

- 6.4.3 Abdel Hadi A. Al-Qahtani & Sons Group of Companies

- 6.4.4 Aegion Corporation (Bayou)

- 6.4.5 Akzo Nobel N.V.

- 6.4.6 Allan Edwards, Inc.

- 6.4.7 Axalta Coating Systems, LLC

- 6.4.8 BASF

- 6.4.9 Bauhuis B.V.

- 6.4.10 Blocher Oberflachentechnik GmbH

- 6.4.11 Borusan Mannesmann

- 6.4.12 Celanese Corporation

- 6.4.13 CENERGY HOLDINGS

- 6.4.14 Dura-Bond Industries

- 6.4.15 GBA Products Co Ltd

- 6.4.16 Hempel A/S

- 6.4.17 Jotun

- 6.4.18 LyondellBasell Industries Holdings B.V.

- 6.4.19 Mutares SE & Co. KGaA

- 6.4.20 Nippon Paint Holdings Co., Ltd.

- 6.4.21 PERMAA-PIPE International Holdings, Inc.

- 6.4.22 PPG Industries, Inc.

- 6.4.23 Tenaris

- 6.4.24 The Sherwin-Williams Company

- 6.4.25 Wasco Berhad

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment

- 7.2 Growth in Deep-Water Exploration and Production

- 7.3 Industrial Expansion in Middle-East and Africa