|

市场调查报告书

商品编码

1836568

汽车燃料供应系统:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Automotive Fuel Delivery System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

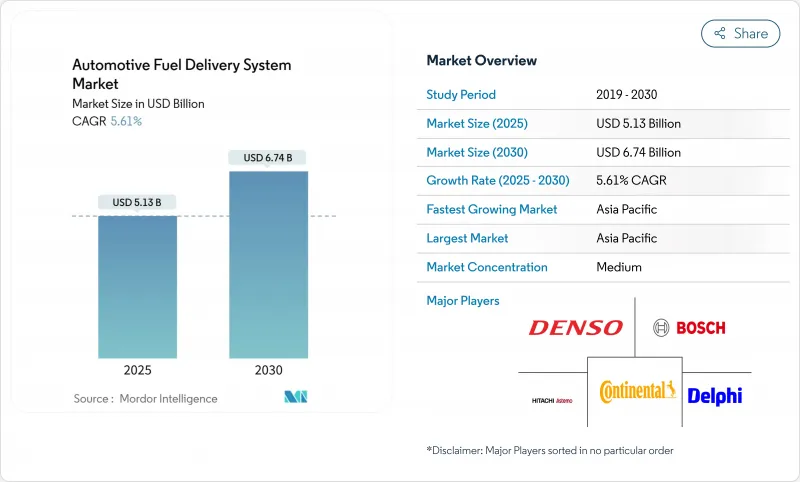

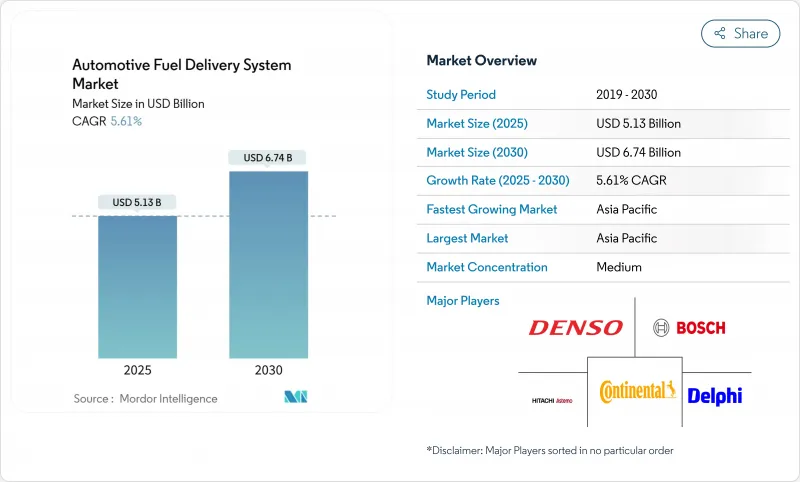

预计2025年汽车燃料供应系统市场规模将达51.3亿美元,2030年将达67.4亿美元,复合年增长率为5.61%。

这一成长轨迹反映了该行业适应日益严格的排放法规的能力,同时在电气化日益发展的时代保持了其重要性。将于2025年7月生效的欧7法规和将于2027年生效的美国环保署第三阶段标准,正推动汽车製造商向高精度喷射模组和耐腐蚀生产线迈进,从而维持对现代内燃机 (ICE) 架构的资本投资。供应商正在采用「技术中立」的产品组合,以维持内燃机的价值流,同时为需求转向插电式混合动力汽车和燃料电池做好准备,从而限制汽车燃料输送系统市场的下行风险。

全球汽车燃料供应系统市场趋势与洞察

严格的排放法规推动先进的燃料输送模组

欧盟7标准自2026年11月起对所有轻型引擎的颗粒物和氮氧化物排放基准值进行了加强,而美国环保署第三阶段计划则要求在2027年将重型卡车的氮氧化物排放标准降至35毫克/马力/小时。这将迫使汽车製造商在全球平台上统一高压泵和汽油颗粒过滤器的排放标准。耐久性要求将提高到16万公里,这将促使供应商开发长寿命喷油器和耐腐蚀导轨。

增加全球汽车产量并振兴帕尔克

轻型汽车产量将在2025年復苏,随着欧洲汽车平均车龄超过12年,汽车更换週期也将缩短,这将增强汽车燃油供应系统市场的零件需求。汽车製造商将在印度、印尼和墨西哥设立本地工厂,从而为一级供应商带来区域采购吸引力。车队营运商将更新硬体以满足燃油经济性基准,儘管电动车的普及,但内燃机汽车的市场地位仍将持续提升。

电动车的快速成长导致内燃机汽车占比下降。

中国和加州正加速推进到2035年实现完全零排放的目标。电动车的蓬勃发展预计将使内燃机汽车的利润池在未来十年内减少50%。燃油泵和喷油器并未整合到电池平台中,这将带来长期的阻力,但地区差异使汽车燃油输送系统市场在重型车辆、农村地区和新兴市场领域中保持着重要的地位。

报告中分析的其他驱动因素和限制因素

- 乘用车对缸内喷油引擎的需求不断增加

- 轻型商用车销售增加

- 燃料系统部件原料价格波动;

細項分析

到2024年,燃油泵将占汽车燃油输送系统市场收入的37.81%,并将继续成为所有尺寸引擎的重要组成部分,支撑汽车燃油输送系统市场。燃油泵的普及将确保即使在电气化发展的情况下也能实现稳定的供应。到2030年,受2,200 psi汽油直喷(GDI)需求的推动,喷油器将以7.14%的复合年增长率快速增长,这将推动「智慧」先进设计和用于乙醇混合燃料的不銹钢导轨的发展。

目前,组件升级主要集中在机载诊断、远端压力感测和无线韧体,这些技术可以减少意外停机。生质燃料的兴起推动了对耐腐蚀管路和过滤器的需求,而蒸气回收阀和油箱安装感测器则提升了电子产品的价值。儘管未来电动车市场面临淘汰的威胁,但这些转变正共同推动汽车燃油输送系统组件市场呈现上升趋势。

2024年,乘用车将占汽车燃油输送系统市场收益的64.33%。掀背车和轿车需要经济高效的无回流泵,而SUV由于扭矩负载增加而整合高压油轨。轻型商用车的复合年增长率预计为6.23%,更重视耐用性而非效率,因此保留钢丝编织软管和可更换过滤器。

随着每日行驶里程的增加和车辆远端资讯处理开闢了改装业务,中型和重型卡车维持高流量柴油喷射轨道以稳定车队数量(儘管数量较少),直到电池密度允许远距替代方案,从而保持汽车燃料供应系统市场的工作週期多样性。

区域分析

预计到2024年,亚太地区将占据汽车燃油供应系统市场收入的38.55%,超过其他地区,到2030年的复合年增长率将达到6.92%。中国汽车製造商正在泰国和印尼建造燃油系统子系统,以规避关税并缩短物流链,从而增强整个东南亚汽车燃油供应系统市场。日本的半导体合资企业也确保了高压帮浦微控制器的供应,从而降低了该地区的供应风险。

北美仍然技术雄厚,这得益于美国环保署 (EPA) 法规,该法规要求在 2027 年实现每桶马力小时氮氧化物排放量达到 0.035 克。美国2,600 万美元的 E15 基础设施计画等投资正在推动生质燃料的普及,从而创造了对乙醇相容导轨和密封件的利基市场需求,从而扩大了汽车燃料输送系统市场。墨西哥具有吸引力的经济劳动力价格以及 USMCA 贸易优惠,正在鼓励一级供应商在拉莫斯阿里斯佩和阿瓜斯卡连特斯增加产能。

欧洲面临欧7和加速碳中和的双重压力。原始设备製造商正在2026年之前维修颗粒过滤器和蒸气抑制硬件,这增加了每辆车的零件成本,但供应商订单却保持不变。东欧工厂正在降低生产线组装成本,以确保在西欧工厂转向电动模组之际保持竞争力。从西班牙到德国的氢能走廊试验,为汽车燃料供应系统市场在燃料电池应用方面提供了早期立足点。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 严格的排放法规推动先进燃料输送模组的采用

- 增加全球汽车产量并振兴帕尔克

- 乘用车对缸内喷油引擎的需求不断增加

- 新兴市场轻型商用车销售成长

- 将智慧诊断功能整合到电动燃油泵中

- 合成/生质燃料混合物对耐腐蚀管线的需求迅速增加

- 市场限制

- 电动车快速成长降低内燃机汽车份额

- 燃油系统部件原料价格波动;

- 由于蒸发排放法规更加严格,系统成本增加

- 半导体短缺扰乱电子泵浦控制器

- 价值/供应链分析

- 监管状况

- 技术展望

- 波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章市场规模与成长预测(价值,美元)

- 按组件

- 燃油帮浦

- 燃油喷射器

- 燃油导轨

- 燃油压力调节器

- 燃油滤清器

- 燃油管路和软管

- 其他的

- 按车辆类型

- 搭乘用车

- 掀背车

- 轿车

- 跑车轿小轿车

- SUV与跨界车

- 商用车

- 轻型商用车(LCV)

- 中型和重型商用车(MCV 和 HCV)

- 搭乘用车

- 按燃料类型

- 汽油

- 柴油引擎

- 灵活燃料(E10-E85)

- CNG和LPG

- 生质燃料和合成燃料

- 氢

- 按供应方式

- 进气道燃油喷射

- 缸内喷油

- 无回流燃油系统

- 共轨柴油喷射

- 按分销管道

- OEM(工厂安装)

- 售后市场(更换)

- 按地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 南美洲

- 巴西

- 阿根廷

- 智利

- 其他南美

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 澳洲和纽西兰

- 亚太地区其他国家

- 中东和非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 南非

- 奈及利亚

- 埃及

- 其他中东和非洲地区

- 北美洲

第六章 竞争态势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Robert Bosch GmbH

- Continental AG

- DENSO Corporation

- Delphi Technologies(BorgWarner)

- Magna International Inc.

- TI Fluid Systems plc(TI Automotive)

- Toyoda Gosei Co., Ltd.

- Ucal Fuel Systems Ltd.

- Marelli Holdings Co., Ltd.

- Hitachi Astemo Ltd.

- Stanadyne LLC

- Carter Fuel Systems LLC

- Aisin Corporation

- Valeo SA

- MS Motorservice International GmbH(Pierburg)

- Walbro LLC

- Johnson Electric Holdings Ltd.

- Woodward, Inc.

第七章 市场机会与未来展望

- 閒置频段和未满足需求评估

The automotive fuel delivery system market size stood at USD 5.13 billion in 2025 and is forecast to reach USD 6.74 billion by 2030, advancing at a 5.61% CAGR.

The growth trajectory reflects the sector's ability to meet tougher emission limits while staying relevant in an era of rising electrification. Euro 7 rules that apply from July 2025 and the EPA Phase 3 standards, effective 2027, are pushing automakers toward high-precision injection modules and corrosion-resistant lines, sustaining capital expenditure on modern internal-combustion (ICE) architectures. Suppliers adopt "technology-neutral" portfolios that keep ICE value streams alive yet prepare for plug-in and fuel-cell demand shifts, limiting downside risk for the automotive fuel delivery system market.

Global Automotive Fuel Delivery System Market Trends and Insights

Stringent Emission Norms Driving Advanced Fuel-Delivery Modules

Euro 7 tightens particulate and NOx thresholds for all light-duty engines from November 2026, while EPA Phase 3 slashes NOx to 35 mg/hp-hr for heavy trucks in 2027 . Automakers are therefore standardizing high-pressure pumps and gasoline particulate filters across global platforms. Durability requirements rise to 160,000 km, pushing suppliers to develop long-life injectors and corrosion-proof rails, factors that underpin the automotive fuel delivery system market through 2030.

Rising Global Vehicle Production and Parc Rejuvenation

Light-vehicle output rebounded in 2025, and replacement cycles shortened as average fleet age passed 12 years in Europe, reinforcing component demand for the automotive fuel delivery system market. Vehicle-makers localize plants in India, Indonesia, and Mexico, creating regional sourcing pull for tier-1 suppliers. Fleet operators refresh hardware to meet fuel-economy benchmarks, prolonging ICE relevance despite EV penetration.

Rapid Growth of Electric Vehicles Reducing ICE Share

China and California are accelerating toward full zero-emission mandates by 2035. EV momentum is cutting ICE-linked profit pools by an anticipated 50% this decade. Fuel pumps and injectors are absent from battery platforms, creating long-run headwinds, yet regional differences keep the automotive fuel delivery system market relevant in heavy-duty, rural, and developing-country segments.

Other drivers and restraints analyzed in the detailed report include:

- Growing Demand for Gasoline Direct-Injection Engines in Passenger Cars

- Increasing Sales of Light Commercial Vehicles

- Volatility in Raw-Material Prices for Fuel-System Components

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Fuel pumps generated 37.81% revenue of the automotive fuel delivery system market in 2024 and remain indispensable across all engine sizes, anchoring the automotive fuel delivery system market. Their ubiquity provides steady volumes even as electrification advances. Accelerating fastest, injectors will rise at 7.14% CAGR to 2030 on the back of 2,200 psi GDI requirements, pushing "smart" tip designs and stainless-steel rails for ethanol blends.

Component upgrades now emphasize on-board diagnostics, remote pressure sensing, and over-the-air firmware that cuts unplanned downtime. Biofuel growth lifts demand for corrosion-resistant lines and filters, while vapor-recovery valves and tank-mounted sensors add incremental electronics value. Together, these shifts keep the automotive fuel delivery system market size for components on an upward curve despite future EV displacement threats.

Passenger cars delivered 64.33% of the automotive fuel delivery system market revenue in 2024. Hatchbacks and sedans require cost-efficient returnless pumps, whereas SUVs integrate higher-pressure rails because of increased torque loads. Light commercial vehicles, forecast at 6.23% CAGR, prefer robustness over efficiency, sustaining steel-braid hoses and replaceable filters, a pattern that enlarges the automotive fuel delivery system market share commanded by commercial platforms.

Longer daily mileage and fleet telematics open retrofitting business, while medium and heavy trucks, though smaller in volume, retain high-flow diesel injection rails that stabilize volumes until battery densities permit long-haul substitution. As such, the automotive fuel delivery system market remains diversified across duty cycles.

The Automotive Fuel Delivery System Market Report is Segmented by Component (Fuel Pump, Fuel Injector, and More), Vehicle Type (Passenger Cars, and Commercial Vehicles), Fuel Type (Gasoline, Diesel, and More), Delivery Method (Port Fuel Injection, Gasoline Direct Injection, and More), Distribution Channel (OEM (Factory-Fitted) and Aftermarket (Replacement)), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia Pacific captured 38.55% of the automotive fuel delivery system market's 2024 turnover and will outpace all other regions with a 6.92% CAGR to 2030, owing to China's outsized production, India's highway expansion, and ASEAN's localized assembly clusters. Chinese OEMs are building fuel-system subsystems in Thailand and Indonesia to bypass tariffs and shorten logistics chains, strengthening the automotive fuel delivery system market across Southeast Asia. Semiconductor joint ventures in Japan also secure microcontroller flow for high-pressure pumps, buffering regional supply risk.

North America remains technology-rich, driven by EPA regulations that mandate 0.035 g/b-hp-hr NOx by 2027. Investments such as the USDA's USD 26 million E15 infrastructure program expand biofuel uptake, creating niche demand for ethanol-ready rails and seals that enlarge the automotive fuel delivery system market. Mexico's attractively priced labor and USMCA trade benefits encourage tier-1s to add capacity in Ramos Arizpe and Aguascalientes.

Europe faces the twin pressures of Euro 7 and accelerated carbon-neutrality pledges. OEMs are retrofitting particulate filters and vapor-containment hardware ahead of 2026, raising per-vehicle bill-of-materials but sustaining supplier order books. Eastern European plants offer lower costs for line assemblies, ensuring competitiveness even as Western European factories pivot to electric modules. Hydrogen corridor pilots from Spain to Germany are also giving the automotive fuel delivery system market an early foothold in fuel-cell applications.

- Robert Bosch GmbH

- Continental AG

- DENSO Corporation

- Delphi Technologies (BorgWarner)

- Magna International Inc.

- TI Fluid Systems plc (TI Automotive)

- Toyoda Gosei Co., Ltd.

- Ucal Fuel Systems Ltd.

- Marelli Holdings Co., Ltd.

- Hitachi Astemo Ltd.

- Stanadyne LLC

- Carter Fuel Systems LLC

- Aisin Corporation

- Valeo SA

- MS Motorservice International GmbH (Pierburg)

- Walbro LLC

- Johnson Electric Holdings Ltd.

- Woodward, Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Stringent emission norms driving adoption of advanced fuel-delivery modules

- 4.2.2 Rising global vehicle production and parc rejuvenation

- 4.2.3 Growing demand for gasoline direct-injection engines in passenger cars

- 4.2.4 Increasing sales of light commercial vehicles in emerging markets

- 4.2.5 Integration of smart diagnostics within electric fuel pumps

- 4.2.6 Surge in synthetic/bio-fuel blends requiring corrosion-resistant lines

- 4.3 Market Restraints

- 4.3.1 Rapid growth of electric vehicles reducing ICE share

- 4.3.2 Volatility in raw-material prices for fuel-system components

- 4.3.3 Tightening evaporative-emission norms raising system cost

- 4.3.4 Semiconductor shortages disrupting electronic pump controllers

- 4.4 Value/Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Component

- 5.1.1 Fuel Pump

- 5.1.2 Fuel Injector

- 5.1.3 Fuel Rail

- 5.1.4 Fuel Pressure Regulator

- 5.1.5 Fuel Filter

- 5.1.6 Fuel Line and Hoses

- 5.1.7 Others

- 5.2 By Vehicle Type

- 5.2.1 Passenger Cars

- 5.2.1.1 Hatchback

- 5.2.1.2 Sedan

- 5.2.1.3 Sports Car and Coupe

- 5.2.1.4 SUV and Crossover

- 5.2.2 Commercial Vehicles

- 5.2.2.1 Light Commercial Vehicles (LCV)

- 5.2.2.2 Medium and Heavy Commercial Vehicles (MCV and HCV)

- 5.2.1 Passenger Cars

- 5.3 By Fuel Type

- 5.3.1 Gasoline

- 5.3.2 Diesel

- 5.3.3 Flex Fuel (E10-E85)

- 5.3.4 CNG and LPG

- 5.3.5 Biofuel and Synthetic Fuel

- 5.3.6 Hydrogen

- 5.4 By Delivery Method

- 5.4.1 Port Fuel Injection

- 5.4.2 Gasoline Direct Injection

- 5.4.3 Returnless Fuel Systems

- 5.4.4 Common-Rail Diesel Injection

- 5.5 By Distribution Channel

- 5.5.1 OEM (Factory-fitted)

- 5.5.2 Aftermarket (Replacement)

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Rest of North America

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Chile

- 5.6.2.4 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Russia

- 5.6.3.7 Rest of Europe

- 5.6.4 Asia Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 India

- 5.6.4.4 South Korea

- 5.6.4.5 Australia and New Zealand

- 5.6.4.6 Rest of APAC

- 5.6.5 Middle East and Africa

- 5.6.5.1 Saudi Arabia

- 5.6.5.2 UAE

- 5.6.5.3 Turkey

- 5.6.5.4 South Africa

- 5.6.5.5 Nigeria

- 5.6.5.6 Egypt

- 5.6.5.7 Rest of Middle East and Africa

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, SWOT Analysis, and Recent Developments)

- 6.4.1 Robert Bosch GmbH

- 6.4.2 Continental AG

- 6.4.3 DENSO Corporation

- 6.4.4 Delphi Technologies (BorgWarner)

- 6.4.5 Magna International Inc.

- 6.4.6 TI Fluid Systems plc (TI Automotive)

- 6.4.7 Toyoda Gosei Co., Ltd.

- 6.4.8 Ucal Fuel Systems Ltd.

- 6.4.9 Marelli Holdings Co., Ltd.

- 6.4.10 Hitachi Astemo Ltd.

- 6.4.11 Stanadyne LLC

- 6.4.12 Carter Fuel Systems LLC

- 6.4.13 Aisin Corporation

- 6.4.14 Valeo SA

- 6.4.15 MS Motorservice International GmbH (Pierburg)

- 6.4.16 Walbro LLC

- 6.4.17 Johnson Electric Holdings Ltd.

- 6.4.18 Woodward, Inc.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment