|

市场调查报告书

商品编码

1836585

聚合物乳剂:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030)Polymer Emulsions - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

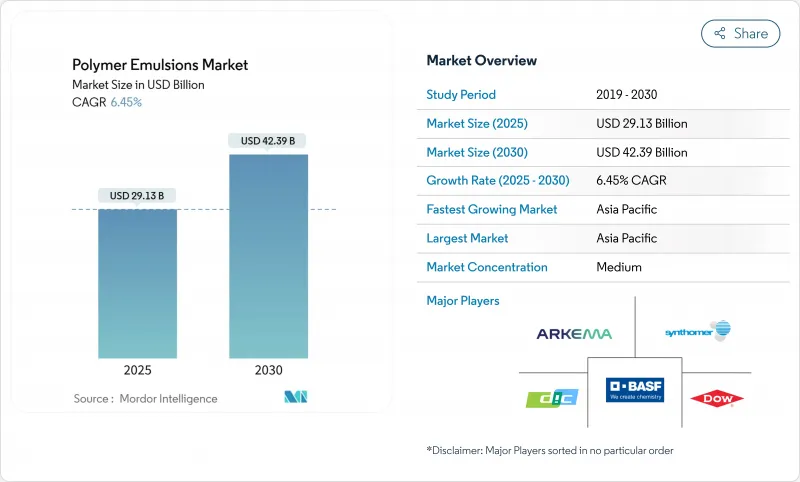

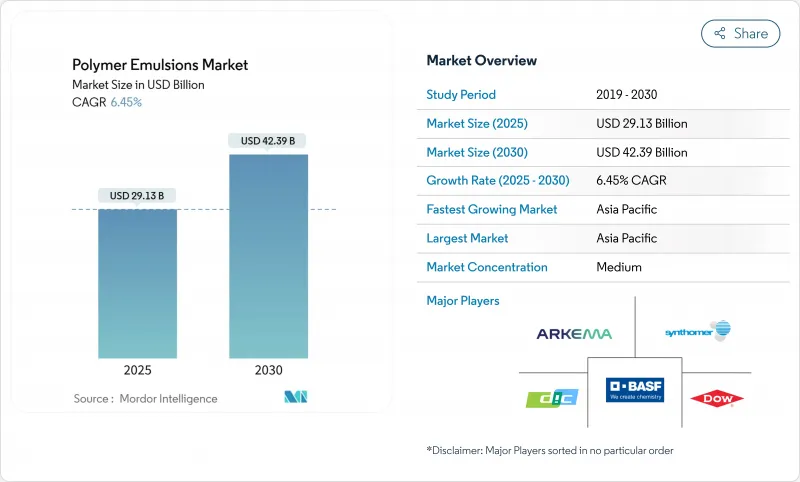

预计 2025 年聚合物乳剂市场价值将达到 291.3 亿美元,预计到 2030 年将达到 423.9 亿美元,预测期内(2025-2030 年)的复合年增长率为 6.45%。

全球空气品质法规日益严格,加速了水性系统取代溶剂型技术,尤其是在建筑涂料和工业整理加工剂,推动了该领域的成长。无界面活性剂光引发乳液聚合技术的最新突破也促进了该领域的应用,该技术可降低加工能耗并提高胶体稳定性。 pubs.rsc.org。欧洲对溶剂型胶黏剂的监管禁令,以及北美和亚洲对低挥发性有机化合物(VOC)的要求,正在推动包装、汽车和建筑价值链朝向永续化学方向发展。供应商正积极应对,推出生物基单体、可再生能源驱动的工厂以及数位化指导的配方平台,以加快新产品的上市时间。

全球聚合物乳剂市场趋势与洞察

亚洲建筑业繁荣推动低VOC水性涂料的转变

随着亚洲特大城市以创纪录的速度不断增加住房和基础设施,对符合严格排放标准的水性内外墙涂料的需求也日益增长。中国最新的空气品质规划和印度国家建筑规范的更新,均提倡使用挥发性有机化合物(VOC)含量不超过50克/公升的涂料,这正迅速推动溶剂型醇酸树脂的替代品。製造商纷纷推出耐腐蚀、低气味的丙烯酸乳胶漆,例如Lamberty的ESACOTE AC 509。健康和安全优势、易于清洁以及降低工人暴露限值,推动了人们对这些系统的青睐,并产生了超越单纯合规性的积极反馈,巩固了聚合物乳剂市场的长期需求。

汽车原始设备製造商需要环保的防刮涂层

北美和欧洲的汽车组装现在指定使用水性底漆-中涂-透明涂层组合,以满足耐溶剂性要求,同时减少碳排放。配方师正在采用带有自交联嵌段的混合聚氨酯-丙烯酸基质,以提供硬度和耐刮擦性。太阳化学的WATERSOL AC系列产品就反映了这一进步,其被覆剂具有高光泽度和低微刮擦性,同时可将挥发性有机化合物(VOC)减少高达90%。随着主流性能障碍的消除,品牌所有者正在将永续性认证推向市场,并加速全球汽车工厂的销售量成长。

挥发性丁二烯和丙烯酸酯单体定价

原料价格的快速波动正在挤压乳胶生产商的利润,尤其是与石脑油成本波动相关的苯乙烯-丁二烯等级。合约配方很少会超过季度调整一次,这使得供应商面临价格飙升的风险。然而,短期波动可能会继续给盈利带来压力,并推迟产能升级。

报告中分析的其他驱动因素和限制因素

- 欧盟禁止使用溶剂型黏合剂,推动乳液在包装领域的应用

- 在纺织和造纸工业的应用日益增多

- 与重防腐应用中的溶剂型涂料相比的性能差异

細項分析

2024年,丙烯酸树脂占销售量的45%,2025年销售额达131.1亿美元。由于广泛的兼容性、可靠的耐候性和快速的监管核准,该细分市场巩固了其作为装饰涂料、密封胶和感压标籤预设平台的地位。塞拉尼斯EcoVAE牌号兼具低气味和A级耐擦洗性,可满足绿色建筑专案的要求。苯乙烯丁二烯乳胶仍然是纸张涂料和地毯背衬的经济高效的选择,儘管随着再生纤维品质的提高,其增长仍然温和。醋酸乙烯酯聚合物在石膏和腻子化合物中保持稳定的需求,因为柔韧性是这些化合物的必需品。 「其他」丛集,包括有机硅改质和生物基乳液,正在医用薄膜等高利润的利基领域选择性扩张。同时,聚氨酯分散体是成长最快的细分市场,复合年增长率为6.9%。这是由高端汽车、软包装和特殊地板涂料应用推动的,这些应用要求产品韧性、透明度和耐水解性,因此价格更高。总体而言,产品多样化支撑了聚合物乳剂市场的韧性。

低碳排放的推动正在刺激对无界面活性剂光引发製程的投资,这些製程可减少泡沫和挥发性有机化合物 (VOC)。实验室研究表明,无需传统皂基体系即可获得55%固态的稳定晶格,从而简化合规性和废水处理流程。整合这些方法的供应商将获得先发优势。扩大生物丙烯酸和糖根丁二烯的生产规模,应能进一步降低生命週期影响评分,与主要下游品牌的范围3目标保持一致,并强化推动聚合物乳剂产业永续性的概念。

到2024年,油漆和涂料将占总需求的46%,价值134亿美元。严格的挥发性有机化合物(VOC)法规正在推动装饰、防护和汽车系统转向水性平台。 Lamberti的直接金属丙烯酸涂料干膜厚度为120微米,具有相当的耐溶剂腐蚀性,展现了性能均等性如何使其在重载应用中得到应用。随着软包装和建筑胶带逐步淘汰溶剂型丙烯酸涂料,黏合剂和地毯背衬的复合年增长率最高,达到7.1%。水性压敏胶由于能够耐受冷冻储存和紫外线照射,其性能正在不断提升。

纸张和纸板市场保持稳定,但正在发生质的变化。含有叔碳酸乙烯基酯的水性阻隔材料提高了防潮防油性能,使得用单一材料结构取代聚乙烯挤出杯和托盘成为可能。纺织品、皮革和新兴的3D列印黏合剂则填补了「其他」领域的空白。在每个细分市场中,数位配色和线上黏度控制系统降低了批次差异,进一步规范了水性应用,并提升了聚合物乳剂市场的发展轨迹。

区域分析

预计亚太地区将占2025年销售额的41.2%,达到120亿美元,到2030年复合年增长率将达到7.3%。中国、印度、印尼和越南的建筑业蓬勃发展,推动了建筑乳胶漆的大量消费,而当地汽车製造商则正在应用耐刮擦水性面漆。跨国供应商在中国和越南等新兴中心扩大产能,缩短了前置作业时间,并保护了买家免受运费波动的影响。日本和韩国专注于高性能利基市场,例如光学薄膜、导电涂料和环保皮革涂饰,其雄厚的国内研发实力确保了产品的高价格。

北美是第二大地区。美国正在推动水性涂料在家居装修、基础设施和电动车製造领域的应用。对低气味、快干配方的需求正促使供应商部署新一代丙烯酸-聚氨酯混合涂料。加拿大木材涂饰和包装涂料的消费保持健康。墨西哥的家电和汽车组装厂正在快速扩张,这提振了当地需求,而近岸外包趋势正在推动涂料供应链向南转移。

欧洲是一个至关重要的市场,其发展受到欧盟严格的溶剂减量指令的影响。德国、法国、英国和义大利正在实施绿色建筑标准,加速了装饰涂料和工业维护产品的转型。德国、法国、英国和义大利已禁止使用溶剂型贴合黏剂,推动了水性胶合剂在软包装生产线中的快速应用。同时,由于VAM(醋酸乙烯酯/丙烯酰胺)供应週期性中断导致的原料限制凸显了供应安全隐患,促使加工商在东欧和中东地区寻找双源。

虽然南美洲、中东和非洲的份额较小,但其发展势头引人注目。巴西受益于基础设施建设和住房项目,这些项目正在扩大乳胶砂浆的使用。沙乌地阿拉伯和阿联酋新建的丙烯酸乳液工厂正在向欧洲和亚洲出口产品,从而改变贸易流向。南非正在透过政府支持的道路和住房计划来支持非洲的消费,这些计画需要耐用、低VOC涂料。在这些新兴地区,各国政府越来越多地参考世界卫生组织 (WHO) 的室内空气品质指南,使当地法规与全球规范保持一致,并确保对聚合物乳剂的持续需求。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

第二章研究假设与市场定义

- 调查范围

- 调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 亚洲建筑业繁荣推动低VOC水性涂料的转型

- 北美和欧洲汽车原始设备製造商对环保防刮涂层的需求

- 欧盟禁止使用溶剂型黏合剂,推动乳液在包装领域的应用

- 海湾合作委员会国家丙烯酸乳液工厂产能扩张

- 在纺织和造纸工业的应用日益增多

- 市场限制

- 挥发性丁二烯和丙烯酸酯单体定价

- 与溶剂型重防腐蚀涂料相比的性能差异

- 欧洲VAM供应中断

- 价值链分析

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争的激烈程度

- 供需分析

- 目前和计划的重大计划

- 贸易分析

- 目前供需情况

第五章市场规模及成长预测(金额)

- 依产品类型

- 丙烯酸纤维

- 苯乙烯丁二烯(SB)乳胶

- 醋酸乙烯酯聚合物

- PVA均聚物

- 其他醋酸乙烯酯

- 聚氨酯(PU)分散体

- 其他的

- 按用途

- 油漆和被覆剂

- 黏合剂和地毯背衬

- 纸和纸板

- 其他的

- 按最终用户产业

- 建筑/施工

- 汽车和运输

- 包装

- 木材/家具

- 纺织品和服装

- 其他(化学品和一般製造业)

- 固态分馏

- 高固态(超过 55%)

- 中等固态(45-55)

- 低固态(低于 45%)

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 其他南美

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争态势

- 市场集中度

- 策略性倡议(併购、合资、资金筹措)

- 市占率分析

- 公司简介

- 3M

- Allnex GmbH

- Akzo Nobel NV

- Arkema

- Asahi Kasei Corporation

- BASF

- Celanese Corporation

- Clariant

- Covestro AG

- DIC CORPORATION

- Dow

- Eastman Chemical Company

- Eni SpA

- Georgia-Pacific

- JSR Corporation

- Kamsons Polymer Limited

- Lamberti SpA

- Mallard Creek Polymers

- Polynt SpA

- Synthomer plc

- The Lubrizol Corporation

- Wacker Chemie AG

- ZEON CORPORATION

第七章 市场机会与未来展望

The Polymer Emulsions Market size is estimated at USD 29.13 billion in 2025, and is expected to reach USD 42.39 billion by 2030, at a CAGR of 6.45% during the forecast period (2025-2030).

Growth is led by tightening global air-quality rules that speed the replacement of solvent technologies with water-based systems, especially in architectural paints and industrial finishes. Accelerated adoption is also supported by recent breakthroughs in surfactant-free photoinitiated emulsion polymerization that reduce processing energy and improve colloidal stability pubs.rsc.org. Regulatory bans on solvent adhesives in Europe, together with parallel low-VOC mandates in North America and Asia, are pushing packaging, automotive, and construction value chains toward sustainable chemistries. Suppliers are responding with bio-based monomers, renewable-energy-powered plants, and digitally guided formulation platforms that compress time-to-market for new grades.

Global Polymer Emulsions Market Trends and Insights

Shift Toward Low-VOC Water-Borne Coatings Fueled by Asia's Construction Boom

Asian megacities continue to add housing and infrastructure at record pace, raising demand for water-based exterior and interior paints that comply with strict emission targets. China's latest air-quality plan and India's updated National Building Code promote coatings below 50 g VOC l-1, spurring rapid substitution of solvent alkyds. Manufacturers answer with acrylic latexes such as Lamberti's ESACOTE AC 509 that pair corrosion resistance with low odor. Health-and-safety benefits, easier cleanup, and fewer worker exposure limits reinforce preference for these systems, creating positive feedback that extends beyond pure compliance and cements long-term demand in the polymer emulsions market.

OEM Automotive Demand for Eco-Friendly Scratch-Resistant Finishes

Vehicle assemblers in North America and Europe now specify water-borne primer-surfacer and clear-coat packages that match solvent durability while cutting carbon footprints. Formulators employ hybrid polyurethane-acrylic matrices with self-cross-linking blocks to achieve hardness and mar resistance. Sun Chemical's WATERSOL AC line illustrates this progress with coatings that deliver high gloss and low micro-scratch while eliminating up to 90% VOCs. With mainstream performance hurdles removed, brand-owners market sustainability credentials, accelerating volume growth across global auto plants.

Volatile Butadiene and Acrylate Monomer Pricing

Rapid feedstock swings compress latex producer margins, especially for styrene-butadiene grades tied to fluctuating naphtha costs. Contract formulas rarely adjust faster than quarterly, exposing suppliers during spikes. Firms diversify procurement and explore sugar-based acrylics to stabilize input budgets, but near-term volatility continues to weigh on profitability and may delay capital upgrades.

Other drivers and restraints analyzed in the detailed report include:

- EU Bans on Solvent-Borne Adhesives Boosting Packaging Emulsion Uptake

- Increased Textile and Paper Industry Usage

- Performance Gap versus Solvent-Borne Coatings in Heavy-Duty Uses

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Acrylic resins controlled 45% of 2024 volume and generated USD 13.11 billion in 2025. The segment benefits from broad compatibility, solid weatherability, and rapid regulatory approvals, cementing its role as the default platform across decorative paints, sealants, and pressure-sensitive labels. Celanese's EcoVAE grades combine low odor with Class A scrub resistance, satisfying green-building schemes. Styrene-butadiene latex remains a cost-efficient choice for paper coating and carpet backing, though growth is modest as recycled fiber quality improves. Vinyl acetate polymers sustain steady demand in plaster and putty compounds where flexibility is essential. The "Others" cluster, including silicone-modified and bio-derived emulsions, expands selectively in high-margin niches such as medical films. Polyurethane dispersions, however, advance fastest at 6.9% CAGR, fueled by premium automotive, flexible packaging, and specialty floor-finish applications where toughness, clarity, and hydrolysis resistance justify higher prices. Collectively, product diversification anchors resilience in the polymer emulsions market.

The push for lower embodied carbon spurs investment in surfactant-free photoinitiated processes that tame foaming and cut VOCs. Laboratory work shows stable lattices at 55% solid without traditional soap systems, which can simplify compliance and effluent treatment. Suppliers integrating these methods stand to capture early-mover premiums. As bio-acrylic and sugar-route butadiene scale, life-cycle impact scores should fall further, aligning with scope-3 targets of major downstream brands and reinforcing the sustainability narrative driving the polymer emulsions industry.

Paints and coatings consumed 46% of 2024 demand, equal to USD 13.40 billion in 2025. Stringent VOC caps encourage conversion of decorative, protective, and automotive systems to water-borne platforms. Lamberti's direct-to-metal acrylic, which matches solvent corrosion protection at 120 µm dry film, exemplifies how performance parity unlocks heavy-duty adoption. Adhesives and carpet backing record the fastest 7.1% CAGR as flexible packaging and construction tapes phase out solvent acrylics. Water-borne pressure-sensitives now withstand freezer storage and UV exposure, broadening their function set.

Paper and paperboard remain steady but are undergoing qualitative change. Water-based barriers incorporating vinyl ester of Versatic acid improve moisture and oil resistance, allowing substitution of polyethylene-extruded cups and trays with single-material structures. Textile, leather, and emerging 3-D printing binders fill the diverse "Others" bucket. Across segments, digital color-matching and inline viscosity control systems reduce batch variability, further normalizing water-borne use and lifting the polymer emulsions market trajectory.

The Polymer Emulsions Market Report Segments the Industry by Product Type (Acrylics, Styrene Butadiene (SB) Latex, Vinyl Acetate Polymers, Polyurethane (PU) Dispersions, and Others), Application (Paints and Coatings, Adhesives and Carpet Backing, and More), Solid Content (High Solids, Medium Solids, and Low Solids), and Geography (Asia-Pacific, North America, Europe, South America, and Middle East and Africa).

Geography Analysis

Asia-Pacific commanded 41.2% of revenue in 2025, equivalent to USD 12.00 billion, and is projected to grow at 7.3% CAGR through 2030. Building booms in China, India, Indonesia, and Vietnam consume vast volumes of architectural latex, while regional automakers apply scratch-resistant water-borne topcoats. Capacity additions by multinational suppliers in China and emerging hubs such as Vietnam shorten lead times and shield buyers from freight swings. Japan and South Korea concentrate on high-performance niches-optical films, conductive coatings, and eco-friendly leather finishes-where domestic research and development depth secures premium pricing.

North America sits as the second-largest region. The United States drives water-borne adoption in remodeling, infrastructure, and EV manufacturing. Demand for low odor and rapid-dry formulations pushes suppliers to roll out next-generation acrylic-PU hybrids. Canada maintains healthy consumption in wood finishes and packaging grades. Mexico's fast-expanding appliance and automotive assembly plants lift local demand, aided by near-shoring trends that draw coatings supply chains southward.

Europe remains a pivotal market shaped by the EU's aggressive solvent-reduction mandates. Germany, France, the United Kingdom, and Italy implement national green-building codes that accelerate switch-overs in decorative paints and industrial maintenance products. The bloc's ban on solvent-borne laminating adhesives propels swift uptake of water-borne chemistries in flexible packaging lines. Meanwhile, feedstock constraints from periodic VAM outages underscore supply-security concerns, pushing converters to qualifying dual sourcing in Eastern Europe and the Middle East.

South America and the Middle East and Africa hold smaller shares yet exhibit notable momentum. Brazil benefits from infrastructure and housing programs that expand latex mortar use. The Middle East leverages feedstock advantage; new acrylic emulsion plants in Saudi Arabia and the UAE export to Europe and Asia, altering trade flows. South Africa anchors African consumption with government-backed road and housing projects that call for durable low-VOC coatings. Across these emerging regions, governments increasingly reference the World Health Organization indoor air guidelines, aligning local regulations with global norms and ensuring sustained demand for the polymer emulsions market.

- 3M

- Allnex GmbH

- Akzo Nobel N.V.

- Arkema

- Asahi Kasei Corporation

- BASF

- Celanese Corporation

- Clariant

- Covestro AG

- DIC CORPORATION

- Dow

- Eastman Chemical Company

- Eni S.p.A.

- Georgia-Pacific

- JSR Corporation

- Kamsons Polymer Limited

- Lamberti S.p.A.

- Mallard Creek Polymers

- Polynt S.p.A.

- Synthomer plc

- The Lubrizol Corporation

- Wacker Chemie AG

- ZEON CORPORATION

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

2 Study Assumptions and Market Definition

- 2.1 Scope of the Study

- 2.2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Shift Toward Low-VOC Water-borne Coatings Fueled by Asia's Construction Boom

- 4.2.2 OEM Automotive Demand for Eco-Friendly Scratch-Resistant Finishes in North America and Europe

- 4.2.3 EU Bans on Solvent-Borne Adhesives Boosting Packaging Emulsion Uptake

- 4.2.4 Capacity Expansions of Acrylic Emulsion Plants in GCC Nations

- 4.2.5 Increased Textile and Paper Industry Usage

- 4.3 Market Restraints

- 4.3.1 Volatile Butadiene and Acrylate Monomer Pricing

- 4.3.2 Performance Gap vs. Solvent-borne Coatings in Heavy-Duty Uses

- 4.3.3 VAM Supply Disruptions in Europe

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Rivalry

- 4.6 Supply and Demand Analysis

- 4.6.1 Major Current and Planned Projects

- 4.6.2 Trade Analysis

- 4.6.3 Current Supply and Demand Scenario

5 Market Size and Growth Forecasts (Value)

- 5.1 By Product Type

- 5.1.1 Acrylics

- 5.1.2 Styrene-Butadiene (SB) Latex

- 5.1.3 Vinyl Acetate Polymers

- 5.1.3.1 PVA Homopolymer

- 5.1.3.2 Other Vinyl Acetates

- 5.1.4 Polyurethane (PU) Dispersions

- 5.1.5 Others

- 5.2 By Application

- 5.2.1 Paints and Coatings

- 5.2.2 Adhesives and Carpet Backing

- 5.2.3 Paper and Paperboard

- 5.2.4 Others

- 5.3 By End-User Industry

- 5.3.1 Building and Construction

- 5.3.2 Automotive and Transportation

- 5.3.3 Packaging

- 5.3.4 Wood and Furniture

- 5.3.5 Textile and Apparel

- 5.3.6 Others (Chemicals and General Manufacturing)

- 5.4 By Solid Content

- 5.4.1 High Solids (more than 55 %)

- 5.4.2 Medium Solids (45-55 %)

- 5.4.3 Low Solids (less than 45 %)

- 5.5 Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 Japan

- 5.5.1.4 South Korea

- 5.5.1.5 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 South Africa

- 5.5.5.3 Rest of Middle East and Africa

- 5.5.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves (Mergers and Acquisitions, JVs, Funding)

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 3M

- 6.4.2 Allnex GmbH

- 6.4.3 Akzo Nobel N.V.

- 6.4.4 Arkema

- 6.4.5 Asahi Kasei Corporation

- 6.4.6 BASF

- 6.4.7 Celanese Corporation

- 6.4.8 Clariant

- 6.4.9 Covestro AG

- 6.4.10 DIC CORPORATION

- 6.4.11 Dow

- 6.4.12 Eastman Chemical Company

- 6.4.13 Eni S.p.A.

- 6.4.14 Georgia-Pacific

- 6.4.15 JSR Corporation

- 6.4.16 Kamsons Polymer Limited

- 6.4.17 Lamberti S.p.A.

- 6.4.18 Mallard Creek Polymers

- 6.4.19 Polynt S.p.A.

- 6.4.20 Synthomer plc

- 6.4.21 The Lubrizol Corporation

- 6.4.22 Wacker Chemie AG

- 6.4.23 ZEON CORPORATION

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment

- 7.2 Emerging Market for Bio-based Emulsion Polymer