|

市场调查报告书

商品编码

1836590

玻璃砖:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Glass Tiles - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

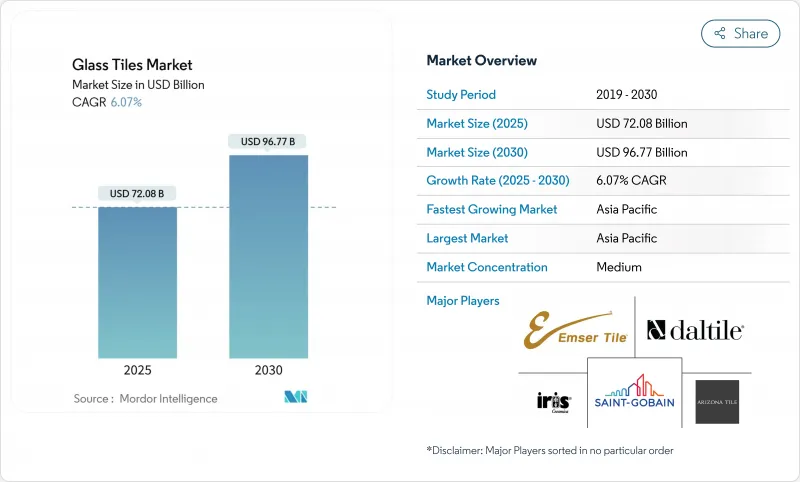

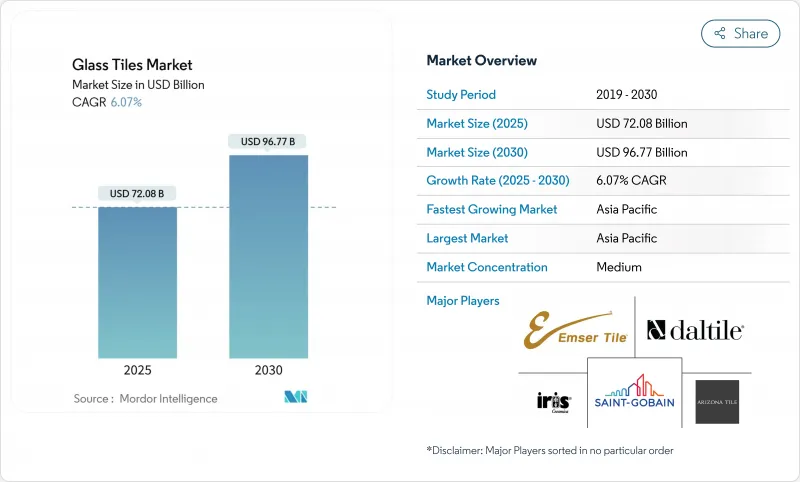

预计到 2025 年全球玻璃砖市场规模将达到 720.8 亿美元,到 2030 年将达到 967.7 亿美元,复合年增长率为 6.07%。

都市化加快、维修成本上升以及严格的绿建筑标准,使得轻质低碳的覆层材料备受青睐,玻璃砖市场也因此成为住宅、商业和基础建设计划的首选解决方案。烧结技术因其能够降低烧成温度以减少能源消耗而发展势头强劲,而雾面饰面的设计趋势则拓展了建筑师的美学选择。由于大型基础设施规划、一体化的供应链以及不断增长的可支配收入,亚太地区在生产和消费方面均处于领先地位。

全球玻璃砖市场趋势与洞察

房屋建设需求不断成长

追求耐用美观的厨房和浴室的房主正在推动房屋改造,并增加优质材料的使用。预计到2025年3月,加拿大的建筑投资将达到222亿加元,年增5.4%,凸显了住宅需求的韧性。住宅瓷砖占据了51.04%的市场份额,反映出人们对高价值饰面的偏好,而非普通的陶瓷替代品。玻璃砖的耐污性和持久性使其在潮湿的房间中拥有长期价值,并符合买家对低生命週期成本的期望。因此,亚太和北美地区成熟住宅存量和豪华公寓计划稳定的更换週期将使玻璃砖市场受益。

环保製造工艺

监管机构和建筑评级系统支持低碳材料,鼓励製造商增加玻璃屑含量并转向再生能源。 AGC Glass Europe 计画在 2024 年回收 70 万吨玻璃屑,到 2030 年达到 50% 的玻璃屑比例,减少 49 万吨二氧化碳排放。 NSG Group 计划在英国的新型绿色氢炉的支持下,到 2024 年实现 50% 的再生能源,到 2050 年实现碳中和。这些努力创造了品牌差异化并满足欧洲和北美的规范标准,建筑师选择有助于 LEED 和 BREEAM 积分的产品。降低窑温的烧结製程放大了这些环境效益,并指导从检验的脱碳蓝图的供应商购买。

原材料和能源成本的波动;

玻璃生产是能源密集型,这使得製造商容易受到燃料价格上涨和电力短缺的影响。 《工程新闻记录》报导,到 2024 年底,材料成本指数将上涨 3%,预计关税和能源税将推动 2025 年玻璃价格上涨 6-11%。预计钢铁价格将上涨 11.2%,从而增加熔炉维护成本并挤压利润率。欧洲天然气现货价格在 2024 年大幅上涨,暂时迫使产能限制和前置作业时间延长。这种波动可能会促使开发商在预算紧缩时转向瓷砖,特别是在绿色建筑奖励较少的新兴市场。对冲策略和现场再生能源对于玻璃砖製造商稳定营运费用至关重要。

报告中分析的其他驱动因素和限制因素

- 扩大在豪华和高端建筑计划中的使用

- 高层建筑维修对轻质玻璃砖的需求不断增长

- 更便宜的陶瓷和瓷器替代品

細項分析

虽然到2024年,光滑/亮面产品将占据56.09%的市场份额,但雾面饰面的成长速度最快,复合年增长率为7.16%。设计师重视低光泽表面,因为它能提供微妙的深度和现代美感。防指纹处理使雾面即使在人流量大的饭店大厅也能保持其纯度,从而将用途扩展到浴室以外的领域。奈米蚀刻技术的进步使製造商能够实现缎面般的外观,同时保持亮面玻璃易于清洁的表面。雾面玻璃的价格通常高出10-15%,促使製造商将产能分配给这些SKU。混合数位印刷系统可在雾面背景上呈现金属质感,满足高端商业室内装潢的需求。受亚太地区豪华公寓需求的推动,预计到2030年,雾面玻璃砖市场规模将超过150亿美元。

光滑瓷砖在临床环境、食品服务区和游泳池中仍然必不可少,因为其不透水的釉药简化了卫生操作。美国公共卫生法要求商用厨房的食品製备线后方必须安装无孔墙体,这确保了对光面玻璃的基本需求。生产商正在将抗菌银离子添加到透明釉药中,以使其与陶瓷竞争对手区分开来。雾面瓷砖越来越受欢迎,但均衡的生产组合有助于缓解风格波动。整合式设施透过使用连续的炉区在不停止生产线的情况下在光面和哑光饰面之间切换来保持产量。总体而言,产品类型的多样化使玻璃瓷砖市场免受时尚週期波动的影响,同时为经销商提供了更广泛的选择。

到 2030 年,烧结产品的复合年增长率最高,为 7.25%,而熔融砖在 2024 年的份额将保持在 38.16%。烧结砖烧成温度较低,减少了瓦斯消费量和二氧化碳排放。製造商正在将回收的碎玻璃屑加入烧结混合物中,以在不影响强度的情况下获得 LEED 评分。虽然熔融砖由于成熟的窑炉基础设施仍在批量生产中占据主导地位,但不断上涨的碳排放税正在推高营运成本。铸造砖和烧结砖用于手工马赛克和文物修復,其手工製作的纹理证明了它们的高价是合理的。工业的一项研究展示了一种可用于玻璃砖熔炉的低温回收路线,有可能进一步降低能源成本。建筑师越来越要求产品具有环境声明,而烧结砖供应商正在获得公共资助计划的优先供应商地位。因此,玻璃砖产业正在将资本投资引导到具有废热回收功能的连续烧结生产线中,从而加强了从传统熔炼方式的转变。

较低的热预算可延长窑炉寿命并节省表面涂层研发的维护成本。自动化压机和压延设备可提高尺寸精度、方便现场应用并降低承包商的人事费用。玻璃砖市场正在采用烧结板来製造通风建筑幕墙系统,其中轻量化结构和严格的公差至关重要。生产商在单一途径中共烧彩虹色釉药,与单独的熔化过程相比,缩短了循环时间。生命週期分析表明,与熔融加工的产品相比,隐含碳减少了 25%,从而支持根据欧洲绿色政府采购法规进行采购。因此,预计到 2030 年,烧结技术将在玻璃砖市场上缩小与熔融型产品的差距。

区域分析

预计到2024年,亚太地区将占据全球玻璃砖市场的52.18%,到2030年的复合年增长率将达到6.94%。中国地铁建设计划、印度智慧城市计划以及日本在全球事件前夕的酒店业繁荣,都将支撑该地区强劲的采购势头。广东和山东的一体化供应链使生产商能够在地采购,从而降低物流成本并实现积极的出口定价。各国政府正在推动回收强制规定,这赋予了烧结砖製造商国内市场优势,并增强了其区域领导地位。都市区家庭的快速成长也支撑了强劲的房屋翻新需求,使亚太地区成为跨国瓷砖品牌的战略重点。

北美市场成熟且富有韧性。美国老旧住宅存量的更新需求推动了强劲的维修支出;而加拿大的建筑投资也呈现出稳健的势头,截至2025年3月,已达到222亿加元。纽约、芝加哥和多伦多的高层建筑建筑维修青睐轻质玻璃板,以最大程度地降低结构加强成本。墨西哥商业房地产的成长支撑了购物中心对背面玻璃壁画的需求。严格的能源法规推动了低辐射镀膜玻璃覆层的采用,这种覆层比陶瓷覆层具有功能优势。因此,儘管面临经济逆风,玻璃砖市场仍保持其高端地位。

欧洲占了很大份额,这得益于严格的脱碳政策以及富含玻璃屑的低碳玻璃。 AGC 的目标是到 2030 年将玻璃屑使用量降至 50%,同时透过混合熔炉试点计画实现 75% 的排放,以满足欧盟的税收要求。德国和法国的公共部门正在竞标需要环境产品声明的交通枢纽维修,从而加快了从认证供应商的采购。英国和义大利正致力于文物建筑的维修,玻璃马赛克在不影响原貌的前提下,与修復后的美感相得益彰。儘管亚太地区的成长滞后,但稳定的公共部门支出和明确的监管政策支撑了欧洲对全球销售的贡献。

南美洲、中东和非洲地区展现出早期潜力。巴西沿海地区的饭店和度假村建设正在刺激对彩虹色泳池马赛克的利基需求。沙乌地阿拉伯的大型计划已指定大尺寸背光玻璃墙用于零售区,但供应链缺口和价格敏感度阻碍了其广泛应用。经销商正在投资区域仓库以缩短前置作业时间,一旦经济状况稳定,玻璃砖市场将迎来更快的普及。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 房屋建设需求不断成长

- 环保製造工艺

- 扩大在豪华和高端建筑计划中的使用

- 高楼维修对轻质玻璃砖的需求不断增加

- 在家居装修和 DIY 市场越来越受欢迎

- 市场限制

- 原材料和能源成本的波动;

- 陶瓷和瓷器的经济实惠替代品

- 地震带微裂缝的风险

- 价值链分析

- 五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章 市场规模及成长预测(金额)

- 依产品类型

- 雾面饰面

- 光滑玻璃砖

- 按製造工艺

- 史玛蒂蒂尔

- 熔融磁砖

- 烧结砖

- 铸砖

- 其他製造方法(塌陷/蚀刻瓷砖)

- 按用途

- 墙壁材料

- 地板材料

- 后挡板和檯面

- 户外与环境

- 按最终用户产业

- 住房

- 商业

- 基础设施(交通、游泳池、建筑幕墙)

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 其他南美

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争态势

- 市场集中度

- 策略趋势

- 市占率(%)/排名分析

- 公司简介

- American Olean

- Arizona Tile

- Artaic, LLC

- Bellavita Tile

- Crossville Inc.

- Daltile

- Emser Tile

- Fireclay Tile

- Hirsch Glass Corp.

- Iris Ceramica Group

- Lunada Bay Tile

- Maniscalco

- Marazzi Group Srl

- Mulia Inc.

- Oceanside Glass & Tile

- Roca Tile USA

- Saint-Gobain

- Sonoma Tilemakers

- Susan Jablon

第七章 市场机会与未来展望

The global glass tiles market size stands at USD 72.08 billion in 2025 and is projected to reach USD 96.77 billion by 2030, growing at a 6.07% CAGR.

Rising urbanization, premium renovation spending, and stricter green-building codes favor lightweight, low-carbon cladding materials, positioning the glass tiles market as a preferred solution in residential, commercial, and infrastructure projects. Sintered technology gains momentum because it trims firing temperatures and cuts energy use, while design trends toward matte finishes widen aesthetic options for architects. Asia-Pacific leads both production and consumption thanks to large-scale infrastructure programs, integrated supply chains, and growing disposable incomes.

Global Glass Tiles Market Trends and Insights

Rising Demand in Residential Construction

Renovation activity fuels premium material uptake as homeowners target kitchens and bathrooms where durability and aesthetics justify higher budgets. Canada's building construction investment reached CAD 22.2 billion in March 2025, and year-over-year growth of 5.4% underscores resilient housing demand . The residential share of 51.04% reflects this preference for higher-value finishes over commodity ceramic alternatives. Glass tiles' stain resistance and color permanence add long-term value in moisture-prone rooms, aligning with buyer expectations for low lifecycle costs. Consequently, the glass tiles market benefits from steady replacement cycles in mature housing stock and upscale condominium projects in Asia-Pacific and North America.

Eco-Friendly Manufacturing Processes

Regulators and building-rating schemes favor low-carbon materials, prompting manufacturers to increase cullet content and switch to renewable power. AGC Glass Europe recycled 700,000 tonnes of cullet in 2024 and targets a 50% cullet ratio by 2030, cutting 490,000 tonnes of CO2 emissions. NSG Group plans to reach 50% renewable electricity in 2024 and achieve carbon neutrality by 2050, supported by new green-hydrogen furnaces in the United Kingdom. These initiatives create brand differentiation and meet specification criteria in Europe and North America, where architects select products that contribute to LEED and BREEAM credits. Sintered processes that lower kiln temperatures amplify these environmental gains, steering procurement toward suppliers with verifiable decarbonization roadmaps.

Raw-Material & Energy Cost Volatility

Glass production is energy-intensive, making manufacturers vulnerable to fuel spikes and electricity shortages. Engineering News-Record reported a 3% increase in its Materials Cost Index by end-2024, with glass prices expected to climb 6-11% in 2025 due to tariffs and energy levies. Steel price inflation of 11.2% compounded furnace maintenance costs, squeezing margins. Spot natural-gas rates in Europe surged during 2024, temporarily forcing capacity curtailments and elongating lead times. Such volatility prompts developers to switch to ceramic tiles when budgets tighten, especially in emerging markets lacking green-building incentives. Hedging strategies and on-site renewable power become critical for glass tile producers to stabilize operating expenses.

Other drivers and restraints analyzed in the detailed report include:

- Growing Usage in Luxury and High-End Architectural Projects

- Increasing Demand for Lightweight Glass Tiles for High-Rise Retrofits

- Cheaper Ceramic & Porcelain Substitutes

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Smooth/glossy products held 56.09% share in 2024, yet matte finishes expand fastest at 7.16% CAGR. Designers appreciate low-glare surfaces that provide subtle depth and modern aesthetics. Anti-fingerprint treatments now preserve matte purity in high-traffic hotel lobbies, widening use cases beyond bathrooms. Advances in nano-etching allow manufacturers to retain the easy-clean surface of glossy glass while delivering a satin appearance. Matte variants often command price premiums of 10-15%, encouraging producers to allocate incremental capacity to these SKUs. Hybrid digital-print systems apply metallic accents onto matte backgrounds, satisfying luxury commercial interiors. The glass tiles market size for matte finishes is projected to exceed USD 15 billion by 2030, underpinned by upscale condominium demand in Asia-Pacific.

Smooth tiles remain essential in clinical settings, foodservice areas, and swimming pools because their impervious glaze simplifies sanitation. Public health codes in the United States mandate non-porous wall surfaces behind commercial kitchen prep lines, securing baseline demand for glossy glass. Producers bundle anti-microbial silver ions into clear glazes, differentiating from ceramic rivals. Although matte popularity rises, balanced production portfolios help mitigate style swings. Integrated facilities dedicate sequential furnace zones to alternate between gloss and matte runs without stopping the line, maintaining throughput. Overall, product-type diversification anchors the glass tiles market against fashion-cycle volatility while giving distributors a broader palette.

Sintered products register the highest 7.25% CAGR through 2030 while fused tiles retain 38.16% share in 2024. The glass tiles market rewards sintering because the process fires at lower temperatures, cutting gas consumption and CO2 emissions. Manufacturers embed recycled cullet into sintered blends without compromising strength, aligning with LEED scoring. Fused formats still dominate large-run production due to mature kiln infrastructure, but rising carbon taxes elevate operating costs. Cast and smalti tiles serve artisanal mosaics and heritage restorations where hand-crafted textures justify premium pricing. Research at the Saitama Institute of Technology shows low-temperature recycling routes that could transfer to glass tile furnaces and further reduce energy bills. As architects demand environmental product declarations, sintered suppliers gain preferred-vendor status in publicly funded projects. The glass tiles industry thus pivots capital expenditure toward continuous sinter lines equipped with waste-heat recovery, reinforcing the shift away from traditional fusion.

Lower thermal budgets extend kiln life, freeing maintenance outlays for surface-coating R&D. Automated pressing and calendaring equipment boosts dimensional accuracy, easing site installation and trimming labor spend for contractors. The glass tiles market sees sintered planks entering ventilated facade systems where lighter weight and tight tolerances are critical. Producers co-fire iridescent glazes in a single pass, reducing cycle time compared with separate fusing stages. Lifecycle analyses demonstrate up to 25% embodied-carbon savings relative to fused equivalents, supporting procurement under green-public-procurement rules in Europe. Consequently, sintered technology is forecast to narrow the glass tiles market share gap with fused formats before 2030.

The Glass Tiles Market Report Segments the Industry by Product Type (Matte-Finished, and Smooth Glass Tile), Manufacturing Process (Smalti Tiles, Fused Tiles, and More), Application (Wall Cladding, Flooring, and More), End-User Industry (Residential, Commercial, and More), and Geography (Asia-Pacific, North America, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific held 52.18% share of the glass tiles market in 2024 and continues to grow at a 6.94% CAGR through 2030. China's metro-station construction pipeline, India's Smart Cities Mission, and Japan's hotel boom ahead of global events sustain robust regional purchasing. Integrated supply chains in Guangdong and Shandong provinces let producers source float glass, colorants, and packaging locally, cutting logistics costs and enabling aggressive export pricing. Governments promote recycled-content mandates, giving sintered producers a domestic advantage and bolstering regional leadership. Rapid urban household formation also supports steady residential renovation demand, making Asia-Pacific the strategic priority for multinational tile brands.

North America represents a mature yet resilient market. United States renovation outlays stay strong as aging housing stock needs updates, while Canada's CAD 22.2 billion construction investment in March 2025 signals healthy activity. High rise retrofits in New York, Chicago, and Toronto prefer lightweight glass panels to minimize structural reinforcement costs. Mexico's commercial real-estate growth underpins demand for back-painted glass murals in shopping centers. Stringent energy-codes catalyze adoption of low-emissivity coated glass cladding, offering a functional edge over ceramic alternatives. Consequently, the glass tiles market maintains premium positioning despite economic headwinds.

Europe commands significant share, anchored by strict decarbonization policies that align with cullet-rich, low-carbon glass. AGC's target of 50% cullet usage by 2030, together with hybrid-furnace pilots cutting emissions 75%, meets EU taxonomy requirements. Public authorities in Germany and France tender transit-hub refurbishments demanding environmental product declarations, accelerating procurement from certified suppliers. United Kingdom and Italy focus on heritage building upgrades, where glass mosaics complement restoration aesthetics without compromising authenticity. Although growth lags Asia-Pacific, stable public-sector spending and regulatory certainty underpin Europe's contribution to global revenue.

South America and Middle East and Africa offer early-stage potential. Brazil's hotel and resort construction along coastal corridors spurs niche demand for iridescent pool mosaics. Saudi Arabia's giga-projects specify large-format back-lit glass walls in retail districts, yet supply-chain gaps and price sensitivity limit widespread adoption. Distributors invest in regional warehouses to shorten lead times, positioning the glass tiles market for faster uptake as economic conditions stabilize.

- American Olean

- Arizona Tile

- Artaic, LLC

- Bellavita Tile

- Crossville Inc.

- Daltile

- Emser Tile

- Fireclay Tile

- Hirsch Glass Corp.

- Iris Ceramica Group

- Lunada Bay Tile

- Maniscalco

- Marazzi Group S.r.l.

- Mulia Inc.

- Oceanside Glass & Tile

- Roca Tile USA

- Saint-Gobain

- Sonoma Tilemakers

- Susan Jablon

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising demand in residential construction

- 4.2.2 Eco-friendly manufacturing processes

- 4.2.3 Growing usage in luxury and high-end architectural projects

- 4.2.4 Increasing demand for lightweight glass tiles for high-rise retrofits

- 4.2.5 Growing popularity in renovation and DIY market

- 4.3 Market Restraints

- 4.3.1 Raw-material & energy cost volatility

- 4.3.2 Cheaper ceramic & porcelain substitutes

- 4.3.3 Micro-cracking risk in seismic zones

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size & Growth Forecasts (Value)

- 5.1 By Product Type

- 5.1.1 Matte-finished

- 5.1.2 Smooth glass tile

- 5.2 By Manufacturing Process

- 5.2.1 Smalti Tiles

- 5.2.2 Fused Tiles

- 5.2.3 Sintered Tiles

- 5.2.4 Cast Tiles

- 5.2.5 Other Manufacturing Processes (Slumped / Etched Tiles)

- 5.3 By Application

- 5.3.1 Wall Cladding

- 5.3.2 Flooring

- 5.3.3 Backsplashes and Countertops

- 5.3.4 Outdoor and Landscape

- 5.4 By End-User Industry

- 5.4.1 Residential

- 5.4.2 Commercial

- 5.4.3 Infrastructure (Transit, Pools, Facades)

- 5.5 By Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 Japan

- 5.5.1.4 South Korea

- 5.5.1.5 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 Italy

- 5.5.3.4 France

- 5.5.3.5 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 South Africa

- 5.5.5.3 Rest of Middle East and Africa

- 5.5.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/Ranking Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.4.1 American Olean

- 6.4.2 Arizona Tile

- 6.4.3 Artaic, LLC

- 6.4.4 Bellavita Tile

- 6.4.5 Crossville Inc.

- 6.4.6 Daltile

- 6.4.7 Emser Tile

- 6.4.8 Fireclay Tile

- 6.4.9 Hirsch Glass Corp.

- 6.4.10 Iris Ceramica Group

- 6.4.11 Lunada Bay Tile

- 6.4.12 Maniscalco

- 6.4.13 Marazzi Group S.r.l.

- 6.4.14 Mulia Inc.

- 6.4.15 Oceanside Glass & Tile

- 6.4.16 Roca Tile USA

- 6.4.17 Saint-Gobain

- 6.4.18 Sonoma Tilemakers

- 6.4.19 Susan Jablon

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment