|

市场调查报告书

商品编码

1836651

银行云端安全:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Cloud Security In Banking - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

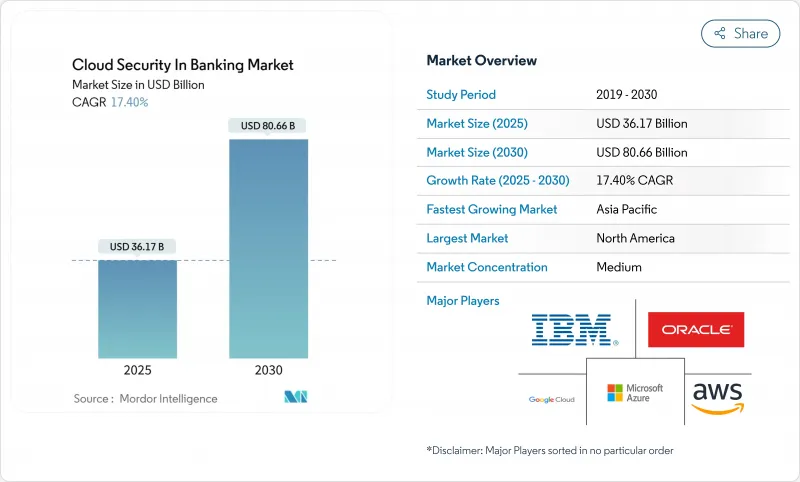

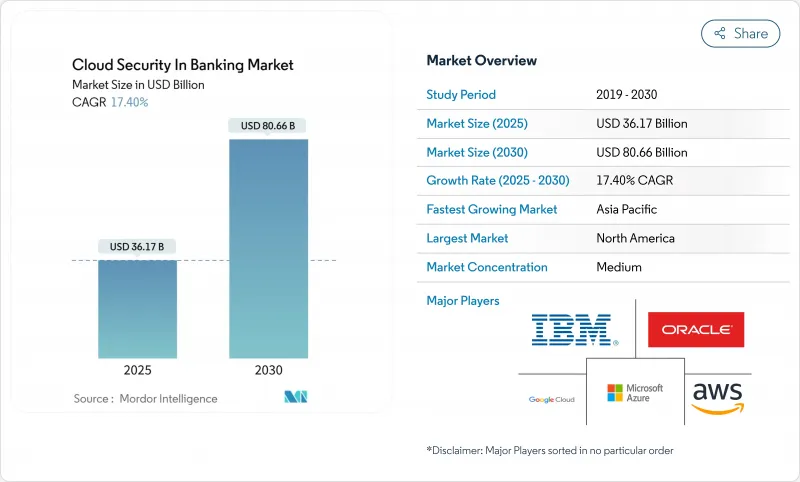

预计到 2025 年银行云端安全市场规模将达到 361.7 亿美元,到 2030 年将达到 806.6 亿美元。

这项扩张反映了银行转向云端原生架构以降低营运成本、提高敏捷性并满足监管机构对成熟营运弹性的要求。到 2024 年,针对金融机构工作负载的勒索软体事件将增长到 78%,因此对云端原生架构的需求也在增长,这促使资讯安全领导者加快采用零信任并加强第三方风险监控。安全供应商之间的整合使银行能够存取结合了 API 保护、身分管治和人工智慧驱动的诈欺分析的广泛平台。同时,公有云供应商正在整合预先建置的合规工具,以简化根据欧盟数位营运弹性法案 (DORA) 等措施进行的审核,该法案于 2025 年 1 月生效。到 2024 年,北美将保持 37.2% 的市场份额,而亚太公共云端将出现最快的成长,到 2030 年,区域复合年增长率将达到 17.8%,这主要得益于各国数据本地化法规和行动优先的消费者银行业务趋势。

全球银行云端安全市场趋势与洞察

针对银行的网路攻击增加且更加复杂

2024年,金融机构将面临78%的勒索软体受害率。攻击者目前正在利用API滥用、容器配置错误和第三方软体漏洞,其中包括一次云端配置错误,该漏洞使约50万摩根大通客户面临风险。由于每次违规的平均成本高达1000万美元,迫切需要过渡到行为分析主导的零信任管理,以检验每个会话和资产。大型银行正在将持续的合规性扫描和威胁搜寻纳入其DevSecOps管道,将暴露窗口从几天缩短到几小时。全球支付管道SWIFT正在与Google云端试行一种联邦学习模型,该模型可以在不移动敏感资料的情况下标记异常交易,展示了人工智慧如何在保护隐私的同时检测诈欺行为。随着组织犯罪者透过在暗网市场上取得被盗银行凭证收益,主动云端隔离和最低权限IAM已成为董事会层面的优先事项。

即时合规自动化要求(巴塞尔协议 III、DORA 等)

欧盟的数据和行动韧性计划 (DORA) 要求 22,000 家金融机构在 24 小时内报告严重网路事件,并测试关键云供应商的退出计划,敦促银行实施自动证据收集引擎,向监管机构提供近乎即时的资讯。美国监管机构也朝着同一方向发展。美国财政部的《2025 年云端韧性报告》敦促对系统性金融机构进行持续控制监控。云端供应商现在将巴塞尔协定 III、PCI DSS 和 GDPR 映射范本捆绑到仪表板中,从而将人工审核工作减少了 40%。对于全球营运的银行来说,在统一的合规结构上进行标准化使它们能够使用一套政策来满足重迭的司法管辖区的要求,这在客户资料跨越欧盟、美国和亚洲流动时尤其有价值。早期采用者报告产品推出更快,因为嵌入式管治消除了冗长的安全审查週期,将合规性从收益抑制因素转变为推动因素。

与多租户公有云的资料居住竞争

GDPR、中国的《网路安全法》和印度的《资料保护条例》(DPDP) 都要求银行资料在地化,这与全球多租户架构相反。超大规模云端服务供应商提供的主权云端承诺元资料隔离和本地金钥存储,但未能达到某些监管机构要求的精细化部署控制。在规模较小的亚太地区市场,通常适用「一国资料中心」规则,这削弱了规模经济,并迫使银行转向混合拓扑结构,将敏感资料集置于本地或本地私有区域中。由此产生的架构复杂性推高了成本,增加了配置错误的风险,并延缓了云端采用计画。政策制定者正在与业界讨论,以完善居住规定,确保网路弹性优势大于司法管辖权方面的担忧,但2020年之前不太可能达成解决方案。

报告中分析的其他驱动因素和限制因素

- 透过无伺服器和容器原生安全控制避免成本

- 扩展开放银行 API 推动零信任采用

- 银行SOC团队缺乏云端安全技能

細項分析

这反映了银行从边界控制转向以身分为中心的防护措施,能够在几毫秒内对使用者、服务和 API 进行身分验证。随着分散式营运模式的持续发展,IAM 整合了单一登入、特权存取管理和设备状态检查,构成了零信任计画的支柱。供应商现在正在整合持续的风险评分和无密码流程,以减少登入阻力。

云端加密是成长最快的领域,到2030年,复合年增长率将达到18.2%。量子威胁意识和日益严格的资料保护法规正在推动银行采用硬体安全模组和集中式金钥编配。随着量子安全演算法在支付管道上的试点,以加密为重点的云端安全产品市场规模预计将持续成长,这使得加密技术既成为合规的必要条件,也成为竞争优势。多方运算和格式保留加密的兴起,使金融机构能够在无需解密的情况下分析数据,从而推动跨境诈欺分析和人工智慧模型训练方面的突破。

到2024年,公共云端部署将占银行云端安全市场规模的62.4%,进一步印证了人们对超大规模防御、专用金融服务区域和共享责任蓝图的信心。 AWS和微软等供应商报告称,银行工作负载实现了两位数成长,这得益于PCI DSS按需审核包等缩短评估时间的工具。然而,主权云和区域云的变体表明,单一模式并不适合所有司法管辖区,而英国监管机构要求的退出策略测试凸显了仍然存在的集中风险。

混合云的采用率正以 20.1% 的复合年增长率成长,因为银行可以利用公共架构来扩展分析能力,同时满足资料驻留要求。容器和服务网格提供了工作负载的可移植性,并支援压力退出演练,可在数小时内将流量从高风险提供者转移出去。随着监管机构对单一供应商依赖关係的审查,多重云端工具链正成为衡量营运韧性的更广泛指标,从而加速了用于跨提供者保护和编配的抽象层的采购。

区域分析

2024年,北美以37.2%的份额占据银行云端安全市场的主导地位。多年的监管和供应商对话、成熟的公私威胁共用以及摩根大通每年170亿美元的技术支出,凸显了当地市场需求的深度。美国财政部发布的《2025年云端弹性研究》正式鼓励关键机构在部署即时监控管道的同时采用多重云端,从而加速跨提供者整合安全堆迭的订购。加拿大监管机构目前在其开放银行指南中明确提及零信任和安全API规范,预示着进一步的投资动能。

随着监管机构在数据在地化和创新之间取得平衡,到2030年,亚太地区的复合年增长率将达到17.8%,位居榜首。日本的一个地区性银行联盟采用了运作IBM和Kyndryl基础设施的共用混合平台,展示了一种协作式的、经济高效且合规的安全方案。新加坡在全国推广的数位身分认证和马来西亚的RMiT标准也分别推动了身分存取管理(IAM)和即时监控的采用。中国的等级保护制度(MLPS 2.0)要求加密、持续监控和在岸金钥存储,这促使提供者推出具有硬体身份验证的本地区域。

在欧洲,DORA 和 PSD2/PSD3 正在加速发展。义大利银行 Credem Banca 已迁移至以安全为中心的云端平台,该平台整合了加密和即时事件通知功能,将监管报告速度提高了 20%。泰雷兹 2024 年的一项调查发现,65% 的欧洲公司将云端安全列为其第二大网路安全优先事项,凸显了董事会层面对云端安全的重视。多重云端弹性演练和主权云端试点现已成为合约要求,这刺激了对编配层的需求,该编排层可在亚马逊、微软和谷歌环境中强制执行策略,而无需手动复製规则。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 针对银行工作负载的网路攻击日益增加且愈发复杂

- 即时合规自动化要求(巴塞尔协议 III、DORA 等)

- 透过无伺服器和容器原生安全管理避免成本

- 扩展开放银行 API 推动零信任采用

- 人工智慧诈欺侦测与云端安全套件捆绑在一起

- 市场限制

- 与多租户公有云的资料居住竞争

- 银行 SOC 团队缺乏精通云端安全的人才

- 第三方金融科技整合中隐藏的依赖风险

- 产业价值链分析

- 监管状况

- 技术展望

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

- 宏观经济因素如何影响市场

第五章市场规模及成长预测(金额)

- 依软体类型

- 云端身分和存取管理 (IAM)

- 云端电子邮件安全

- 云入侵侦测与预防(IDPS)

- 云端加密

- 云端网路安全

- 按部署模型

- 公共云端

- 私有云端

- 混合云端

- 保全服务

- 资料安全

- 应用程式安全

- 网路安全

- 安全监控与编配(SIEM/SOAR)

- 身份、身份验证和诈欺分析

- 按银行类型

- 零售/消费者银行业务

- 企业及投资银行业务

- 卡和支付服务供应商

- 纯数位银行/新银行

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 智利

- 其他南美

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 其他欧洲国家

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 马来西亚

- 新加坡

- 澳洲

- 其他亚太地区

- 中东和非洲

- 中东

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 埃及

- 其他非洲国家

- 北美洲

第六章 竞争态势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- AWS(Amazon.com, Inc.)

- Google Cloud Platform(Alphabet Inc.)

- Microsoft Azure(Microsoft Corporation)

- IBM Cloud Security(IBM Corporation)

- Oracle Cloud(Oracle Corporation)

- Salesforce, Inc.

- Palo Alto Networks, Inc.

- Fortinet Inc.

- Check Point Software Technologies Ltd.

- Trend Micro Inc.

- CrowdStrike Holdings, Inc.

- Zscaler, Inc.

- Proofpoint Inc.

- Okta, Inc.

- Ping Identity Corporation

- SailPoint Technologies Holdings Inc.

- Netskope, Inc.

- Imperva, Inc.

- Qualys, Inc.

- Rapid7, Inc.

- Sophos Ltd.

- Illumio Inc.

- Akamai Technologies Inc.

- Thales Group(Vormetric)

- Temenos AG

- nCino, Inc.

第七章 市场机会与未来趋势

The cloud security in banking market stood at USD 36.17 billion in 2025 and is forecast to reach USD 80.66 billion by 2030, reflecting a 17.4% CAGR.

This expansion mirrors banks' pivot toward cloud-native architectures that cut operating costs, improve agility, and satisfy regulators demanding proven operational resilience. Demand is also rising because ransomware incidents targeting financial workloads climbed to 78% in 2024, pushing chief information security officers to accelerate zero-trust adoption and deeper third-party risk oversight. Consolidation among security vendors is giving banks access to broad platforms that combine API protection, identity governance, and AI-powered fraud analytics. In parallel, public cloud providers are embedding pre-configured compliance tooling that simplifies audits under measures such as the EU's Digital Operational Resilience Act (DORA), which came into force in January 2025. Although North America retained a 37.2% share in 2024, Asia-Pacific is advancing the fastest on the back of national data-localization rules and mobile-first consumer banking, contributing a 17.8% regional CAGR to 2030.

Global Cloud Security In Banking Market Trends and Insights

Growing Volume and Sophistication of Cyber-Attacks on Banking Workloads

Financial institutions faced 78% ransomware hit rates in 2024, double the prior year. Attackers are now exploiting API abuse, container misconfigurations, and third-party software flaws-in 1 incident, a cloud misconfiguration exposed nearly 500,000 JPMorgan Chase customers, underlining the new perimeter-free threat surface. Average breach costs reach USD 10 million per incident, prompting urgent migration to behavior analytics-driven zero-trust controls that verify every session and asset. Major banks are embedding continuous compliance scanning and threat-hunting into DevSecOps pipelines to shrink exposure windows from days to hours. Global payments rail SWIFT is piloting federated-learning models with Google Cloud that flag anomalous transactions without moving sensitive data, showing how AI can detect fraud while protecting privacy. As organized crime monetizes access to stolen banking credentials on dark-net markets, proactive cloud segmentation and least-privilege IAM have become board-level priorities.

Real-Time Compliance Automation Requirements (Basel III, DORA, etc.)

The EU's DORA obliges 22,000 financial entities to report severe cyber incidents within 24 hours and test exit plans for critical cloud suppliers, pushing banks to deploy automated evidence-collection engines that feed regulators in near real time. U.S. regulators are moving in the same direction: the Treasury's 2025 cloud resilience report urges continuous control monitoring for systemic institutions. Cloud vendors now bundle mapping templates for Basel III, PCI DSS, and GDPR into dashboards, cutting manual audit workloads by 40%. Banks with global footprints are standardizing on unified compliance fabrics so a single policy set satisfies overlapping jurisdictions-particularly valuable when customer data flows span EU, U.S. and Asia. Early adopters report faster product launches because embedded governance eliminates lengthy security-review cycles, turning compliance from a blocker into a revenue enabler.

Data Residency Conflicts with Multi-Tenant Public Clouds

GDPR, China's CSL, and India's DPDP Act oblige banks to localize data, conflicting with global multi-tenant setups. Sovereign-cloud variants from hyperscalers promise metadata isolation and local key custody, yet still lack the granular placement controls some regulators demand. Smaller APAC markets often enforce data-center-in-country rules that erode economies of scale, nudging banks toward hybrid topologies where sensitive datasets stay on-prem or in local private regions. Resulting architectural complexity inflates cost and elevates configuration-error risk, adding drag to widespread cloud adoption plans. Policymakers are consulting with industry to refine residency stipulations so cyber resilience benefits outweigh jurisdictional concerns, but resolution is unlikely before the end of the decade.

Other drivers and restraints analyzed in the detailed report include:

- Cost Avoidance Through Serverless and Container-Native Security Controls

- Expansion of Open-Banking APIs Driving Zero-Trust Adoption

- Shortage of Cloud-Security-Skilled Talent in Banks' SOC Teams

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Cloud Identity and Access Management accounted for 29.2% of the cloud security in the banking market share in 2024, reflecting banks' shift from perimeter controls to identity-centric guardrails that authenticate users, services, and APIs at a millisecond scale. As distributed work models persist, IAM consolidates single sign-on, privileged access management, and device posture checks, forming the backbone of zero-trust programs. Vendors are now embedding continuous risk scoring and passwordless flows that trim login friction-a critical user-experience factor in consumer banking.

Cloud Encryption is the fastest segment, posting an 18.2% CAGR through 2030. Quantum-threat awareness and stricter data-protection statutes are pushing banks to deploy hardware security modules and centralized key orchestration. The cloud security in the banking market size for encryption-focused products is forecast to rise alongside pilots of quantum-safe algorithms across payment rails, positioning cryptography as both a compliance must-have and a competitive differentiator. Multi-party computation and format-preserving encryption are gaining traction, letting institutions analyze data without decrypting it, a breakthrough for cross-border fraud analytics and AI model training.

Public-cloud implementations captured 62.4% of the cloud security in the banking market size in 2024, underscoring confidence in hyperscaler defenses, dedicated financial-services regions, and shared-responsibility blueprints. Providers such as AWS and Microsoft report double-digit growth in bank workloads, aided by artifacts like PCI DSS on-demand audit packs that slice assessment times. However, sovereign-cloud and regional-cloud variants illustrate that one model will not fit every jurisdiction, and exit-strategy testing demanded by U.K. supervisors underscores residual concentration risk.

Hybrid-cloud installations are expanding at a 20.1% CAGR because they let banks meet data residency mandates while still bursting to public fabric for analytics surges. Containers and service meshes deliver workload portability, enabling stress-exit drills that shift traffic off a compromised provider within hours. As regulators scrutinize single-vendor dependencies, multi-cloud toolchains are becoming broad metrics for operational resilience, accelerating procurement of abstraction layers that secure and orchestrate across providers.

Cloud Security in Banking Market is Segmented by Software Type (Cloud Identity and Access Management, Cloud Email Security, and More), Deployment Model (Public Cloud, Private Cloud, and Hybrid Cloud), Security Service (Data Security, Application Security, and More), Banking Type (Retail/Consumer Banking, Corporate and Investment Banking, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America dominated the cloud security in the banking market with a 37.2% share in 2024. Long-standing regulator-vendor dialog, mature private-public threat-sharing, and USD 17 billion in annual tech spending at JPMorgan Chase underline the depth of local demand. The U.S. Treasury's 2025 cloud-resilience study formally encourages critical institutions to adopt multi-cloud while implementing real-time monitoring pipelines, accelerating orders for unified security stacks that can span providers. Canadian regulators now reference zero-trust and secure-API norms explicitly in open-banking guidance, signaling further investment momentum.

Asia-Pacific delivers the fastest CAGR at 17.8% to 2030 as regulators balance data-localization with innovation. Japan's consortium of regional banks adopted a shared hybrid platform running on IBM and Kyndryl infrastructure, illustrating collaborative approaches to cost-effective yet compliant security. Singapore's national digital ID roll-out and Malaysia's RMiT standard also drive the adoption of IAM and real-time monitoring, respectively. China's multi-level protection scheme (MLPS 2.0) compels encryption, continuous monitoring, and onshore key custody, prompting providers to launch local-only regions with hardware attestation.

Europe is accelerating due to DORA and PSD2/PSD3. Italian bank Credem Banca migrated to a specialist security cloud that embeds encryption and real-time incident notification, achieving 20% faster regulatory reporting. The Thales 2024 study notes that 65% of European firms rank cloud security as their second-largest cyber priority, evidencing board-level focus. Multi-cloud resilience drills and sovereign-cloud pilots are now contractual requirements, spurring demand for orchestration layers that enforce policies across Amazon, Microsoft, and Google environments without manual rule duplication.

List of Companies Covered in this Report:

- AWS (Amazon.com, Inc.)

- Google Cloud Platform (Alphabet Inc.)

- Microsoft Azure (Microsoft Corporation)

- IBM Cloud Security (IBM Corporation)

- Oracle Cloud (Oracle Corporation)

- Salesforce, Inc.

- Palo Alto Networks, Inc.

- Fortinet Inc.

- Check Point Software Technologies Ltd.

- Trend Micro Inc.

- CrowdStrike Holdings, Inc.

- Zscaler, Inc.

- Proofpoint Inc.

- Okta, Inc.

- Ping Identity Corporation

- SailPoint Technologies Holdings Inc.

- Netskope, Inc.

- Imperva, Inc.

- Qualys, Inc.

- Rapid7, Inc.

- Sophos Ltd.

- Illumio Inc.

- Akamai Technologies Inc.

- Thales Group (Vormetric)

- Temenos AG

- nCino, Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing volume and sophistication of cyber-attacks on banking workloads

- 4.2.2 Real-time compliance automation requirements (Basel III, DORA, etc.)

- 4.2.3 Cost avoidance through serverless and container-native security controls

- 4.2.4 Expansion of open-banking APIs driving zero-trust adoption

- 4.2.5 AI-powered fraud detection bundled with cloud security suites

- 4.3 Market Restraints

- 4.3.1 Data residency conflicts with multi-tenant public clouds

- 4.3.2 Shortage of cloud-security-skilled talent in banks' SOC teams

- 4.3.3 Hidden dependency risk in third-party fintech integrations

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Impact of Macroeconomic Factors on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Software Type

- 5.1.1 Cloud Identity and Access Management (IAM)

- 5.1.2 Cloud Email Security

- 5.1.3 Cloud Intrusion Detection and Prevention (IDPS)

- 5.1.4 Cloud Encryption

- 5.1.5 Cloud Network Security

- 5.2 By Deployment Model

- 5.2.1 Public Cloud

- 5.2.2 Private Cloud

- 5.2.3 Hybrid Cloud

- 5.3 By Security Service

- 5.3.1 Data Security

- 5.3.2 Application Security

- 5.3.3 Network Security

- 5.3.4 Security Monitoring and Orchestration (SIEM/SOAR)

- 5.3.5 Identity, Authentication and Fraud Analytics

- 5.4 By Banking Type

- 5.4.1 Retail/Consumer Banking

- 5.4.2 Corporate and Investment Banking

- 5.4.3 Card and Payment Service Providers

- 5.4.4 Digital-Only/Neobanks

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Chile

- 5.5.2.4 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 India

- 5.5.4.3 Japan

- 5.5.4.4 South Korea

- 5.5.4.5 Malaysia

- 5.5.4.6 Singapore

- 5.5.4.7 Australia

- 5.5.4.8 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 United Arab Emirates

- 5.5.5.1.2 Saudi Arabia

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Egypt

- 5.5.5.2.4 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 AWS (Amazon.com, Inc.)

- 6.4.2 Google Cloud Platform (Alphabet Inc.)

- 6.4.3 Microsoft Azure (Microsoft Corporation)

- 6.4.4 IBM Cloud Security (IBM Corporation)

- 6.4.5 Oracle Cloud (Oracle Corporation)

- 6.4.6 Salesforce, Inc.

- 6.4.7 Palo Alto Networks, Inc.

- 6.4.8 Fortinet Inc.

- 6.4.9 Check Point Software Technologies Ltd.

- 6.4.10 Trend Micro Inc.

- 6.4.11 CrowdStrike Holdings, Inc.

- 6.4.12 Zscaler, Inc.

- 6.4.13 Proofpoint Inc.

- 6.4.14 Okta, Inc.

- 6.4.15 Ping Identity Corporation

- 6.4.16 SailPoint Technologies Holdings Inc.

- 6.4.17 Netskope, Inc.

- 6.4.18 Imperva, Inc.

- 6.4.19 Qualys, Inc.

- 6.4.20 Rapid7, Inc.

- 6.4.21 Sophos Ltd.

- 6.4.22 Illumio Inc.

- 6.4.23 Akamai Technologies Inc.

- 6.4.24 Thales Group (Vormetric)

- 6.4.25 Temenos AG

- 6.4.26 nCino, Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 White-Space and Unmet-Need Assessment