|

市场调查报告书

商品编码

1836678

网路取证:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Network Forensics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

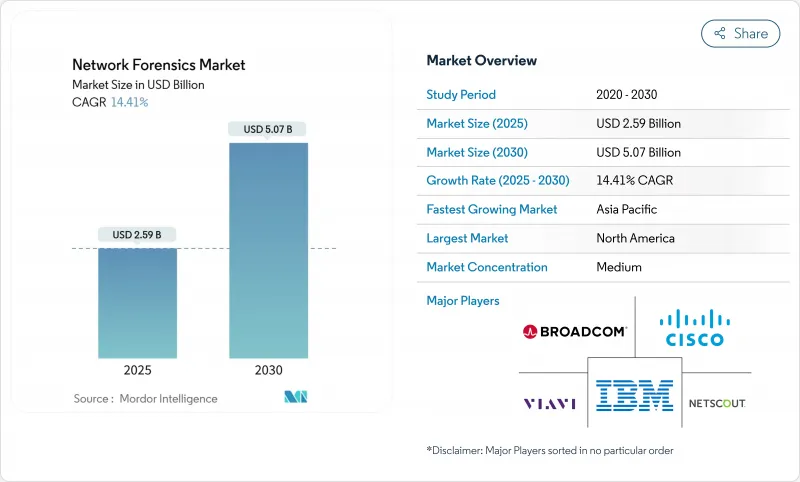

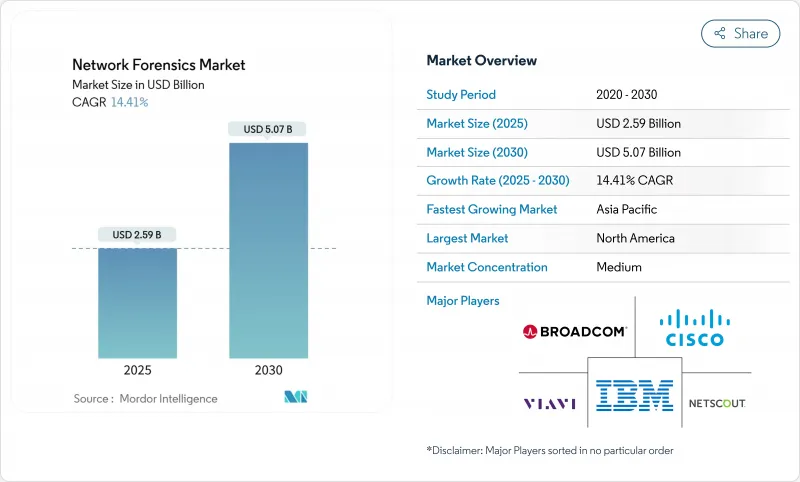

预计到 2025 年网路取证市场规模将达到 25.9 亿美元,到 2030 年将达到 50.7 亿美元,复合年增长率为 14.41%。

由于资料包级视觉性对于快速漏洞诊断、监管报告和网路保险合规至关重要,因此采用曲线非常陡峭。在混合云流量、5G 部署和加密的东西向流量暴露出传统边界工具无法发现的盲点的领域,支出势头尤为强劲。因此,供应商正在将取证功能整合到其网路侦测和回应 (NDR) 平台中,以减少工具的蔓延并缩短平均回应时间。由于保险公司要求提供资料包证据以检验索赔,并且美国证券交易委员会 (SEC) 和欧盟《数位营运弹性法案》等监管机构要求及时记录事件揭露,因此需求也在增长。

全球网路取证市场趋势与洞察

云端和混合式 IT 流量可见度的需求快速成长

随着云端迁移速度超越传统监控,73% 的企业已无法从现有工具集中获取实际的洞察。临时工作负载之间的东西向流量通常在传统收集器捕获之前就消失了,这推动了对云端原生捕获引擎的需求,这些引擎可跨多个 IaaS 和 PaaS 域自动收集证据。新产品将资料包撷取、工件保存和时间轴重建整合到单一工作流程中,从而提高了调查效率,并支援在本地、公共云端和混合环境中实施一致的策略。提供者开始整合智慧储存分层,实现长期保留而无需线性成本上升,并使监管机构能够按需审核取证证据。

网路攻击的频率和复杂度不断增加

2024年,全球资料外洩成本将达到488万美元,凭证窃盗事件将激增84%,这促使人们采用网路分析技术来发现异常身分验证峰值和横向行动信标。医疗保健机构仍面临重重挑战,93%的机构在三年内遭遇过资料洩露,这促使人们采用持续资料包撷取技术来精确定位攻击驻留时间和攻击来源。企业目前正在将丰富的网路遥测技术整合到威胁搜寻例程中,这些例程可以交叉引用端点、身分和云端日誌,从而提高对抗对手的门槛,并加快法律、监管和保险相关人员的事件后取证工作。

缺乏熟练的资料包级调查员

预计2022年至2032年间,资讯安全分析师的需求将成长32%,但大学和培训管道却落后,导致54%的雇主无法填补资料包分析职缺。为此,各组织正在将常规分析任务迁移至AI辅助策略,将一级监控外包给託管服务合作伙伴,并优先考虑工具的易用性,以便非专业人士也能以最小的推出完成资料包时间线。

报告中分析的其他驱动因素和限制因素

- 透过 5G 独立部署扩大东西向流量捕获

- 需要资料包级证据的网路保险政策

- 超过 40Gbps 的捕获设备资本支出较高

細項分析

受高速资料包撷取、行为分析和加密流量可视性需求的推动,到2024年,解决方案将贡献网路取证市场62%的收益。供应商整合机器学习演算法,可在数秒内建立基准流量设定檔并发现偏差。由于企业需要整合、调优和持续的调查支持,而人才短缺,目前规模较小的服务领域正以18%的复合年增长率扩张。供应商正在捆绑评估、事件回应预付费和託管侦测服务,将一次性许可证转化为经常性收益来源。在预测期内,硬体供应商和全球系统整合商的联合上市计划将推动其进一步应用,尤其是在需要全天候证据搜寻的受监管行业。

投资模式表明,自动化解决方案将主导资本预算,而咨询服务将作为策略覆盖,以最大化工具价值。支援从部署到事件事后分析的生命週期管理的混合模式,将确保网路取证市场对不同的买家群体保持强大的吸引力。

由于许多金融、政府和国防组织需要现场证据存储,本地部署将在2024年占据网路取证市场规模的53%。然而,随着流量转向SaaS、IaaS和容器化堆迭,云端原生部署将以22.5%的复合年增长率激增。云端收集器可以跨区域编配证据收集,在高容量事件期间自动扩展,并透过将储存与运算分开来降低前期成本。混合架构将出现,将敏感资料保存在现场,同时利用云端收集器来处理突发性工作负载和监管较少的领域。

平台供应商目前正在推出可部署在 Kubernetes 丛集中或作为 Sidecar 的轻量级感测器,以确保虚拟网路和实体交换器跨度之间的遥测一致性。合规团队重视云端对象储存所带来的不可变审核线索,而财务团队则重视基于营运支出的消费,以便根据季节性流量波动调整支出。这些动态共同推动了更广泛的网路取证市场持续转向分散式收集拓扑。

区域分析

受美国证券交易委员会(SEC)揭露规则(要求在四天内报告违规行为)以及将保险范围与证据品质挂钩的渐进式网路保险生态系统的推动,北美将在2024年占据40%的市场份额。美国公司正在采用人工智慧分析技术来克服技能短缺,并为潜在的诉讼和监管调查维护全面的日誌。受强制性隐私外洩通知和关键基础设施营运商集中部署的推动,加拿大也处于类似的发展轨迹。

受惠于《一般资料保护规范》(GDPR)的实施以及2025年1月推出的资料处理与分析(DORA)标准,欧洲将在2024年占据网路取证市场28%的收益。英国、德国和法国的银行中心已将其资料包捕获预算翻倍,以实现24小时事件通知。专注于5G走廊的公共部门计划正在投入8.65亿欧元(9.31亿美元)用于网路建设,推动新安全监控层的建置。欧盟的跨国资料共用架构也刺激了符合跨司法管辖区证据可采性标准的标准化取证工作流程的需求。

亚太地区是成长最快的地区,2025年至2030年的复合年增长率为17.9%。中国的数位金融扩张、印度的5G竞标以及澳洲的关键基础设施改革正在创造持续的机会。预计到2025年,光是韩国的数位鑑识产业规模就将达到35.2亿美元,这反映了公共和私营部门对该国网路韧性的大力投资。儘管技能短缺仍然严重,但託管安全服务正在抵消地区差异,并加速中型企业采用该技术。该地区对民族国家主导的宣传活动的接触进一步提升了能够重建高级多阶段入侵的网路取证市场工具的重要性。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 调查结果

- 调查范围

- 调查前提

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 云端和混合式 IT 流量可见度的需求快速成长

- 网路攻击的频率和复杂程度迅速增加

- 严格的违规通报义务(GDPR、SEC、DORA)

- 结合 NDR 和取证技术可减少工具蔓延

- 透过 5G 独立部署扩展东西向流量捕获

- 需要资料包级证据的网路保险政策

- 市场限制

- 缺乏熟练的资料包级调查员

- 40 Gbps 以上捕获设备的资本支出较高

- 多重云端内嵌监控的效能开销

- 跨境资料包储存的资料主权限制

- 价值/供应链分析

- 监管状况

- 技术展望(基于AI的资料包分析、TLS1.3解密)

- 五力分析

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

- 投资与资金筹措分析

第五章市场规模及成长预测(金额)

- 按组件

- 解决方案

- 按服务

- 依实施类型

- 本地部署

- 云端基础

- 按组织规模

- 中小企业

- 大公司

- 按用途

- 端点安全

- 资料中心安全

- 网路安全

- 应用程式安全

- 按最终用户产业

- 资讯科技/通讯

- BFSI

- 零售与电子商务

- 政府和国防

- 医疗保健和生命科学

- 製造业

- 其他(能源、教育)

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 其他南美

- 欧洲

- 英国

- 德国

- 法国

- 其他欧洲国家

- APAC

- 中国

- 印度

- 日本

- 澳洲

- 亚太地区其他国家

- 中东和非洲

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 其他非洲国家

- 北美洲

第六章 竞争态势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Broadcom(Symantec)

- Cisco Systems

- IBM Corporation

- Netscout Systems

- Trellix(FireEye)

- RSA Security

- AccessData(OpenText)

- LogRhythm

- LiveAction

- NIKSUN

- Rapid7

- Palo Alto Networks

- Darktrace PLC

- ExtraHop Networks

- Vectra AI

- CrowdStrike Holdings

- Fortinet Inc.

- Check Point Software Tech.

- Sophos Group

- Gigamon

第七章 市场机会与未来展望

The network forensics market size is valued at USD 2.59 billion in 2025 and is forecast to reach USD 5.07 billion by 2030, advancing at a 14.41% CAGR.

The adoption curve is steep because packet-level visibility has become indispensable for rapid breach diagnosis, regulatory reporting and cyber-insurance compliance. Spending momentum is especially strong where hybrid-cloud traffic, 5G roll-outs and encrypted east-west flows expose blind spots that traditional perimeter tools overlook. Vendors are therefore embedding forensic functionality into Network Detection and Response (NDR) platforms, shrinking tool sprawl and lowering mean-time-to-respond. Demand is also lifted by insurers that now require packet evidence for claims validation and by regulators such as the SEC and the EU's Digital Operational Resilience Act, which mandate timely, well-documented incident disclosure.

Global Network Forensics Market Trends and Insights

Proliferation of Cloud & Hybrid IT Traffic Visibility Needs

Cloud migration has outpaced traditional monitoring, leaving 73% of enterprises unable to derive actionable insight from existing toolsets. East-west traffic among ephemeral workloads often vanishes before legacy collectors capture it, prompting demand for cloud-native capture engines that automate evidence gathering across multiple IaaS and PaaS domains. Emerging offerings integrate packet capture, artifact preservation and timeline reconstruction in a single workflow, improving investigative efficiency and supporting consistent policy enforcement across on-premises, public cloud and hybrid environments. Providers have begun to embed smart storage tiering, enabling long-term retention without linear cost escalation and ensuring regulators can audit forensic evidence on demand.

Escalating Frequency & Sophistication of Cyber-Attacks

Global breach costs climbed to USD 4.88 million in 2024, while credential-theft incidents surged 84%, fueling adoption of network analytics that surface anomalous authentication spikes and lateral-movement beacons. Healthcare institutions remain under siege as 93% encountered a breach within three years, pushing them to deploy continuous packet capture that pinpoints dwell time and attack provenance. Enterprises now integrate enriched network telemetry into threat-hunting routines that cross-reference endpoint, identity and cloud logs, raising the bar for adversaries and accelerating post-incident forensics for legal, regulatory and insurance stakeholders.

Shortage of Skilled Packet-Level Investigators

Demand for information-security analysts is projected to expand 32% between 2022-2032, yet universities and training pipelines lag, leaving 54% of employers unable to fill packet-analysis roles.The deficit inflates salary baselines beyond USD 119,000 and amplifies operational risk when alerts outstrip triage capacity. Organizations respond by shifting routine parsing to AI-assisted playbooks, outsourcing level-1 monitoring to managed service partners and prioritizing tool usability so non-specialists can navigate packet timelines with minimal ramp-up.

Other drivers and restraints analyzed in the detailed report include:

- 5G Standalone Roll-outs Expanding East-West Traffic Capture

- Cyber-Insurance Policies Mandating Packet-Level Evidence

- High CAPEX of >40 Gbps Capture Appliances

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Solutions generated 62% of network forensics market revenue in 2024, a position powered by demand for high-speed packet capture, behavioural analytics and encrypted-traffic visibility. Feature velocity is brisk, with vendors embedding machine-learning algorithms that establish baseline traffic profiles and surface deviations in seconds. The services segment is smaller today yet expands at an 18% CAGR because organizations need integration, tuning and continuous investigation support while talent remains scarce. Providers bundle assessment, incident-response retainers and managed detection to convert one-time licences into recurring revenue streams. Over the forecast horizon, joint go-to-market programs between hardware vendors and global system integrators will further amplify adoption, especially in regulated industries that require 24-hour evidence retrieval.

Investment patterns suggest that automation-ready solutions will dominate capital budgets, while advisory services grow as strategic overlays that maximize tooling value. The blended model supports life-cycle management from deployment to incident post-mortems, ensuring the network forensics market retains strong pull across diverse buyer personas.

On-premise deployments maintained 53% share of network forensics market size in 2024 because many financial, government and defense entities require local custody of evidence. Nevertheless, cloud-native deployments soar at a 22.5% CAGR as traffic migrates to SaaS, IaaS and containerised stacks. Cloud collectors orchestrate evidence gathering across regions, auto-scale during volumetric events and decouple storage from compute, slashing upfront expense. Hybrid architectures emerge where sensitive data stays on site, yet burst workloads and less regulated segments leverage cloud collectors.

Platform providers now ship lightweight sensors deployable in Kubernetes clusters or as side-cars, ensuring parity of telemetry between virtual networks and physical switch spans. Compliance teams value the immutable audit trails that cloud object stores enable, while finance teams appreciate opex-based consumption that aligns spend with seasonal traffic variance. Together these dynamics reinforce an enduring pivot toward distributed collection topologies within the broader network forensics market.

Network Forensic Market is Segmented by Component (Solution and Services), by Deployment Model (On-Premise, Cloud), by Organization Size (Small and Medium Enterprises (SMEs) and Large Enterprises), by Application (Endpoint Security, Data Center Security, Network Security, and More), by End-User Industry (IT and Telecom, BFSI, and More), and by Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America held 40% share in 2024, driven by SEC disclosure rules that enforce four-day breach reporting and by an advanced cyber-insurance ecosystem that ties coverage to evidence quality. U.S. enterprises deploy AI-enabled analysis to overcome skills shortages and maintain comprehensive logs for potential litigation or regulatory inquiry. Canada follows a comparable trajectory, underpinned by mandatory privacy breach notifications and concentrated presence of critical infrastructure operators.

Europe captured 28% of network forensics market revenue in 2024, benefiting from GDPR enforcement and the January 2025 start of DORA. Banking hubs in the United Kingdom, Germany and France doubled packet-capture budgets to achieve 24-hour incident notification. Public-sector projects focused on 5G corridors channel EUR 865 million (USD 931 million) into network build-outs, prompting new security monitoring layers. Cross-border data-sharing frameworks inside the EU also stimulate demand for standardized forensic workflows that meet multi-jurisdictional evidence admissibility criteria.

Asia-Pacific is the fastest-growing theatre with a 17.9% 2025-2030 CAGR. China's digital-finance expansion, India's 5G auctions and Australia's critical-infrastructure reforms create sustained opportunities. South Korea's digital forensics sector alone is projected at USD 3.52 billion by 2025, reflecting public-private investment in national cyber-resilience. While skills shortages remain acute, managed security services offset local gaps and accelerate uptake among medium-sized enterprises. The region's exposure to state-sponsored campaigns further elevates the relevance of network forensics market tools that can reconstruct sophisticated, multi-stage intrusions.

- Broadcom (Symantec)

- Cisco Systems

- IBM Corporation

- Netscout Systems

- Trellix (FireEye)

- RSA Security

- AccessData (OpenText)

- LogRhythm

- LiveAction

- NIKSUN

- Rapid7

- Palo Alto Networks

- Darktrace PLC

- ExtraHop Networks

- Vectra AI

- CrowdStrike Holdings

- Fortinet Inc.

- Check Point Software Tech.

- Sophos Group

- Gigamon

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Scope of the Study

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Proliferation of cloud and hybrid IT traffic visibility needs

- 4.2.2 Escalating frequency and sophistication of cyber-attacks

- 4.2.3 Stringent breach-reporting mandates (GDPR, SEC, DORA)

- 4.2.4 Convergence of NDR and forensics reducing tool sprawl

- 4.2.5 5G standalone roll-outs expanding east-west traffic capture

- 4.2.6 Cyber-insurance policies mandating packet-level evidence

- 4.3 Market Restraints

- 4.3.1 Shortage of skilled packet-level investigators

- 4.3.2 High CAPEX of >40 Gbps capture appliances

- 4.3.3 Performance overhead in multi-cloud inline monitoring

- 4.3.4 Data-sovereignty limits on cross-border packet storage

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook (AI-driven packet analytics, TLS1.3 decryption)

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment and Funding Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Component

- 5.1.1 Solutions

- 5.1.2 Services

- 5.2 By Deployment Mode

- 5.2.1 On-premise

- 5.2.2 Cloud-based

- 5.3 By Organization Size

- 5.3.1 Small and Medium Enterprises (SMEs)

- 5.3.2 Large Enterprises

- 5.4 By Application

- 5.4.1 Endpoint Security

- 5.4.2 Data-Center Security

- 5.4.3 Network Security

- 5.4.4 Application Security

- 5.5 By End-user Industry

- 5.5.1 IT and Telecom

- 5.5.2 BFSI

- 5.5.3 Retail and E-commerce

- 5.5.4 Government and Defense

- 5.5.5 Healthcare and Life Sciences

- 5.5.6 Manufacturing

- 5.5.7 Others (Energy, Education)

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 United Kingdom

- 5.6.3.2 Germany

- 5.6.3.3 France

- 5.6.3.4 Rest of Europe

- 5.6.4 APAC

- 5.6.4.1 China

- 5.6.4.2 India

- 5.6.4.3 Japan

- 5.6.4.4 Australia

- 5.6.4.5 Rest of APAC

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 Saudi Arabia

- 5.6.5.1.2 United Arab Emirates

- 5.6.5.1.3 Turkey

- 5.6.5.1.4 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles

- 6.4.1 Broadcom (Symantec)

- 6.4.2 Cisco Systems

- 6.4.3 IBM Corporation

- 6.4.4 Netscout Systems

- 6.4.5 Trellix (FireEye)

- 6.4.6 RSA Security

- 6.4.7 AccessData (OpenText)

- 6.4.8 LogRhythm

- 6.4.9 LiveAction

- 6.4.10 NIKSUN

- 6.4.11 Rapid7

- 6.4.12 Palo Alto Networks

- 6.4.13 Darktrace PLC

- 6.4.14 ExtraHop Networks

- 6.4.15 Vectra AI

- 6.4.16 CrowdStrike Holdings

- 6.4.17 Fortinet Inc.

- 6.4.18 Check Point Software Tech.

- 6.4.19 Sophos Group

- 6.4.20 Gigamon

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment