|

市场调查报告书

商品编码

1836694

印度豪华车:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)India Luxury Car - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

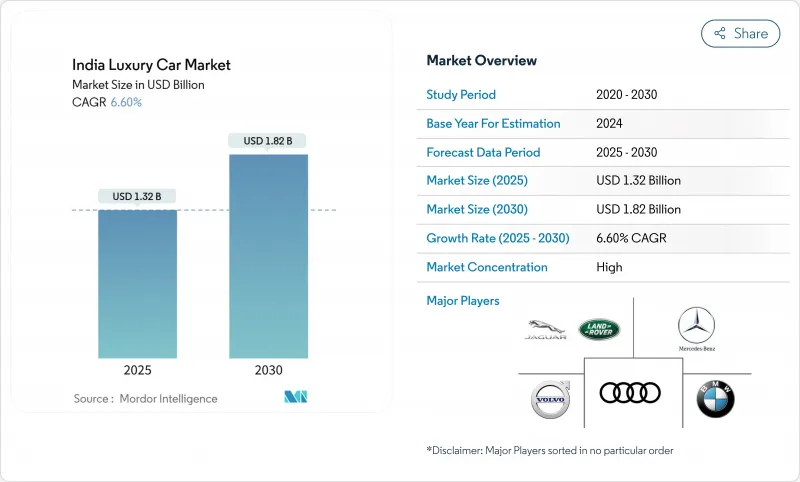

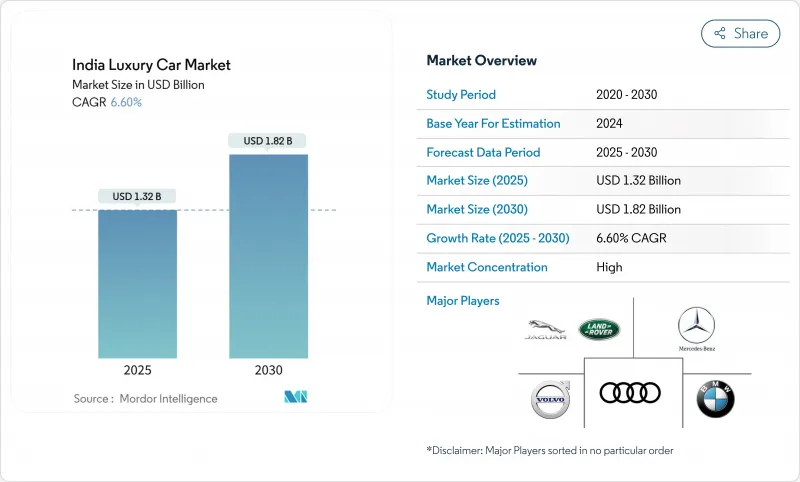

印度豪华车市场预计到 2025 年将达到 13.2 亿美元,到 2030 年将达到 18.2 亿美元,复合年增长率为 6.60%。

强劲成长的动力源于中上层家庭可支配收入的提高、信贷供应的扩大以及各州差异化的电动车奖励,这些激励措施降低了豪华车的总拥有成本。竞争日益激烈,尤其是来自德国本土企业的竞争,带来了更广泛的产品选择和更短的车型週期。在需求方面,进口关税的降低以及价格维持在5万至8万印度卢比范围内的本地组装正在推动成长,而来自二线城市的购车者也越来越青睐高端品牌。儘管税收的复杂性和ADAS服务领域的技能短缺正在抑製成长轨迹,但随着客户群的扩大以及原始设备製造商将数位零售之旅融入购买流程中,长期趋势仍然强劲。

印度豪华车市场趋势与洞察

中上阶层家庭的优质化

预计到 2025 年,年收入 2,000 万印度卢比或以上的富裕家庭数量将从 1,000 万人增长到 2,600 万,这将为印度豪华车市场创造广阔的基础。年轻的专业人士和第一代企业家越来越多地将豪华车视为身份的象征,并在每次购车时分配更多的预算。梅赛德斯-奔驰报告称,到 2024 年,80% 的交付将采用融资方式,Star Agility 计划的渗透率将达到 63%。该品牌在苏拉特和哥印拜陀等二线枢纽的展示室的访客数量翻了一番,标誌着其正在向大都会圈以外的地区扩张。这些人口结构的变化显着扩大了现有基础,在宏观经济波动中推动了持续成长。

入门车型(CKD)供应增加

本地组装使原始设备製造商能够避免对全量生产的车辆征收进口关税,并在不影响其豪华价值的情况下使其入门车型具有竞争力。 BMW已实现 50% 的本地化,梅赛德斯 - 奔驰已实现 60%,从而能够在 20,000-50,000 印度卢比的入门级细分市场中实现战略定价。长轴距衍生、增强的后座冷却系统和印度特定的悬吊配置展示了 CKD 营运如何使全球车型适应当地偏好。然而,2024 年预算中的新规定要求在本地组装关键的动力传动系统总成部件,从而提高了盈亏平衡点并迫使一些小批量车型提价。儘管如此,原始设备製造商仍将 CKD 视为扩大产量、建立供应商生态系统和加快车型更新周期的关键,从而增强了 CKD 对市场成长的净正贡献。

高消费税和附加税结构(最高 50%)

商品及服务税 (GST) 和附加税 (Cess)总合可能导致展示室上涨 50%,从而推高购置成本,并抑制整体可寻址需求,儘管人们的生活水平不断提高。 2024 年预算将价格超过 4 万美元的高端进口商品关税减半至 70%,同时引入 40% 的农业基础设施和发展附加税,实际上将课税恢復到 110%。这种波动使 OEM 定价策略变得复杂,通常会鼓励品牌提供高达 15,000 印度卢比的折扣来清理库存。虽然对于超高阶整车厂 (CBU) 来说,这种惩罚更为严厉,但对本地组装车型的相对保护正在推动 CKD 生产线的持续扩张,即使是小众车型也是如此。

报告中分析的其他驱动因素和限制因素

- 州政府电动车激励措施

- 城际走廊快速部署150kW以上公共直流充电桩

- 认证二手车网路建置延迟

細項分析

2024年,SUV占据了印度豪华车市场48.10%的份额,这得益于其感知安全性、卓越的道路表现力以及适合混合公路路况的出色离地间隙。宽敞的座舱空间也支援企业CEO们常见的专车接送需求。梅赛德斯-奔驰GLE和宝马X5继续领先销量,而本地组装的奥迪Q3则拓展了其在高端市场的影响力。原始设备製造商透过「越野」体验活动进一步刺激了需求,让首次购买豪华车的消费者对其产品的可靠性更加放心。

轿车正经历復苏,预计复合年增长率为9.80%,这得益于热爱驾驶的千禧世代和X世代消费者对其动感的操控和精緻的美学设计所吸引。 2024年,BMWM系销量飙升250%,梅赛德斯-迈巴赫销量几乎翻了一番,显示人们对高功率动力传动系统和后座豪华配置的需求强劲。 BMWi7和梅赛德斯EQS等电动豪华轿车也正在重塑细分市场的认知,它们将性能与永续性性相结合,创造出与无处不在的SUV截然不同的价值提案。以销售量计算,轿车预计将从2024年的27%成长到2030年的32%,提升所有主要原始设备製造商(OEM)的产品组合多样性。

这主要归功于汽油混合动力和动力传动系统,它们拥有久经考验的可靠性、快速加油功能以及来自超过275家授权维修厂的全面服务支援。高端纯电动车预计将以21.35%的复合年增长率成长。 BMW的iX、i4和i7车型正在为首次购买电动车的消费者带来超越许多内燃机汽车的先进驾驶辅助功能。

直流快速充电的日益普及,帮助富裕消费者克服了续航里程焦虑的最后障碍,而运行成本的下降和绿色牌照的优惠则提升了便利性的价值。混合动力汽车占据着一个短暂的市场,吸引着那些热衷于燃油效率但对其所在城市充电基础设施不满意的客户。特斯拉将于2025年在孟买开设展示室,这可能会加剧竞争,并提高客户对无线更新、动态软体功能和直销透明度的期望。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 中上阶层家庭的优质化

- 入门车型增加(CKD)

- 州政府电动车激励措施

- 城际走廊快速部署150kW以上公共直流充电桩

- OEM订购和租赁计划

- 中国超豪华电动车品牌将印度视为下一个扩张目的地

- 市场限制

- 高消费税和附加税结构(最高 50%)

- 整车进口关税的不确定性

- 认证二手车网路建置延迟

- ADAS 和高压系统训练有素的技术人员短缺

- 价值/供应链分析

- 监管状况

- 技术展望

- 波特五力分析

- 买家/消费者的议价能力

- 供应商的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章市场规模与成长预测:价值(美元)

- 按车辆类型

- SUV

- 轿车

- 掀背车

- 按驱动类型

- 内燃机

- 杂交种

- 电池电动

- 价格分布

- INR 20 L~50 L

- INR 50 L~80 L

- 80印度卢比或以上

- 按销售管道

- 直营展示室

- 授权经销商/专利权

- 线上(直接面向消费者)

- 按地区(印度)

- 北印度

- 西印度群岛

- 南印度

- 印度东部和东北部

第六章 竞争态势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Mercedes-Benz AG

- BMW Group

- Audi AG

- Jaguar Land Rover Automotive PLC

- Volvo Car AB

- Lexus

- Porsche AG

- Rolls-Royce Motor Cars India

- Bentley Motors Limited

- Automobili Lamborghini SpA

- Ferrari India

- Maserati SpA

- Aston Martin Lagonda Global Holdings PLC

- Jeep(Stellantis)

第七章 市场机会与未来展望

The India luxury car market size stands at USD 1.32 billion in 2025 and is forecast to reach USD 1.82 billion by 2030, expanding at a 6.60% CAGR.

Robust growth stems from rising disposable income among upper-middle-class households, expanded credit availability, and differentiated state-level EV incentives that compress the total cost of ownership for premium automobiles. Intensifying competitive activity, particularly among German incumbents, continues to widen product choice and shorten model cycles, while accelerating infrastructure roll-outs ease range anxiety for high-performance battery electric vehicles. On the demand side, aspirational buyers from Tier-II cities increasingly favour premium brands, helped by localized assembly that trims import duties and keeps prices within the INR 50-80 lakh bracket. Although taxation complexity and skill shortages in ADAS servicing temper the growth curve, the long-term trajectory remains firmly positive as customer cohorts expand and OEMs embed digital retail journeys into the purchase process.

India Luxury Car Market Trends and Insights

Premiumization of Upper-middle-class Households

Affluent households earning over INR 20 lakh annually are forecast to increase from 10 million to 26 million by 2025, laying a broad foundation for the Indian luxury car market. Younger professionals and first-generation entrepreneurs increasingly view premium vehicles as status symbols, driving higher budget allocations per purchase. OEM finance programmes reinforce the trend; Mercedes-Benz notes that 80% of deliveries were financed in 2024 and that its Star Agility scheme grew 63% in penetration. Brand showrooms in Tier-II hubs such as Surat and Coimbatore are now seeing double the footfall, signaling diffusion beyond metropolitan areas. This demographic shift materially enlarges the addressable base, propelling consistent growth even amid macro volatility.

Rising Availability of Entry-level Models (CKD)

Localized assembly enables OEMs to bypass steep import duties on completely built units, positioning entry variants competitively without eroding luxury cachet. BMW has achieved 50% localization, while Mercedes-Benz has reached 60%, allowing strategic pricing in the INR 20-50 lakh gateway segment. Tailored long-wheelbase derivatives, enhanced rear-seat cooling, and India-specific suspension setups showcase how CKD operations adapt global models to local preferences. New 2024 Budget rules, however, require domestic assembly of critical powertrain components, raising breakeven thresholds and pushing some low-volume nameplates toward price hikes. Even so, OEMs regard CKD as indispensable for volume scale, supplier ecosystem development, and faster model refresh cycles, reinforcing its net positive contribution to market growth.

High GST & Cess Structure (up to 50%)

Combined GST and cess charges can lift ex-showroom prices by 50%, inflating acquisition costs and constricting total addressable demand despite rising affluence. While the 2024 Budget halved customs duty on premium imports above USD 40,000 to 70%, it introduced a 40% Agriculture Infrastructure and Development Cess, returning the effective levy to 110% . This volatility complicates OEM pricing strategies and nudges brands toward discounting, often up to INR 15 lakh, to clear inventory. The penalty is more acute for ultra-luxury CBUs, whereas locally assembled variants remain relatively sheltered, driving continuous expansion of CKD lines even for niche models.

Other drivers and restraints analyzed in the detailed report include:

- EV Incentives by State Governments

- Rapid Rollout of 150 kW+ Public DC Chargers on Inter-city Corridors

- Slow Build-out of Certified Pre-owned Luxury Networks

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

SUVs captured 48.10% of India's luxury car market share in 2024 on the back of perceived safety, commanding road presence, and superior ground clearance suited to mixed highway conditions. Larger cabin volume also supports chauffeur-driven use cases common among corporate principals. Mercedes-Benz GLE and BMW X5 remained volume anchors, while locally assembled Audi Q3 extended reach into aspirational cohorts. OEMs further amplified demand through 'off-road' experiential events that reassured first-time luxury buyers about product robustness.

Sedans are resurging with a forecast 9.80% CAGR as driving-enthusiast millennials and Gen-X consumers gravitate toward dynamic handling and sleek aesthetics. BMW M series deliveries soared 250% in 2024, and Mercedes-Maybach nearly doubled volumes, indicating a robust appetite for high-output powertrains and rear-seat luxury. Electrified limousines such as the BMW i7 and Mercedes EQS also reset segment perception by combining performance with sustainability, creating a differentiated value proposition against omnipresent SUVs. In volume terms, sedans are expected to lift their contribution from 27% in 2024 to 32% by 2030, boosting portfolio diversity for all major OEMs.

Internal combustion platforms still underpin 75.20% of deliveries, largely because petrol hybrids and diesel powertrains offer proven reliability, quick refuelling, and extensive service support across 275+ authorized workshops. However, electrification momentum is unmistakable: luxury BEVs are expected to register a 21.35% CAGR. BMW's iX, i4, and i7 models are introducing first-time EV buyers to advanced driver-assist features that surpass many ICE counterparts.

Widening DC-fast-charge availability pushes affluent consumers over the last range-anxiety hurdle, while lower running costs and green-number-plate privileges add material convenience value. Hybrids occupy a transitory segment, absorbing customers keen on fuel efficiency but unconvinced about charging infrastructure in their city. Tesla's Mumbai showroom opening in 2025 is likely to intensify competition and elevate customer expectations for over-the-air updates, dynamic software features, and direct sales transparency.

The India Luxury Car Market Report is Segmented by Vehicle Type (SUV, Sedan and More), Drive Type (IC Engine, Hybrid and More), Price Range (INR 20 L- 50 L, INR 50 L - 80 L and More), Sales Channel (Company-Owned Showrooms, Authorized Dealerships/Franchise and More) and Region. The Market Sizes and Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Mercedes-Benz AG

- BMW Group

- Audi AG

- Jaguar Land Rover Automotive PLC

- Volvo Car AB

- Lexus

- Porsche AG

- Rolls-Royce Motor Cars India

- Bentley Motors Limited

- Automobili Lamborghini S.p.A.

- Ferrari India

- Maserati S.p.A

- Aston Martin Lagonda Global Holdings PLC

- Jeep (Stellantis)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Premiumization of Upper-middle-class households

- 4.2.2 Rising availability of entry-level models (CKD)

- 4.2.3 EV incentives by state governments

- 4.2.4 Rapid rollout of 150 kW+ public DC chargers on inter-city corridors

- 4.2.5 OEM-financed subscription & leasing schemes

- 4.2.6 Chinese ultra-luxury EV brands eyeing India as next launch pad

- 4.3 Market Restraints

- 4.3.1 High GST & Cess structure (up to 50 %)

- 4.3.2 Import duty uncertainty on CBUs

- 4.3.3 Slow build-out of certified pre-owned luxury networks

- 4.3.4 Scarcity of trained technicians for ADAS & high-voltage systems

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Buyers/Consumers

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value (USD))

- 5.1 By Vehicle Type

- 5.1.1 SUV

- 5.1.2 Sedan

- 5.1.3 Hatchback

- 5.2 By Drive Type

- 5.2.1 IC Engine

- 5.2.2 Hybrid

- 5.2.3 Battery Electric

- 5.3 By Price Range

- 5.3.1 INR 20 L to 50 L

- 5.3.2 INR 50 L to 80 L

- 5.3.3 Above INR 80 L

- 5.4 By Sales Channel

- 5.4.1 Company-owned Showrooms

- 5.4.2 Authorized Dealerships / Franchise

- 5.4.3 Online (Direct-to-Consumer)

- 5.5 By Region (India)

- 5.5.1 North India

- 5.5.2 West India

- 5.5.3 South India

- 5.5.4 East & North-East India

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Mercedes-Benz AG

- 6.4.2 BMW Group

- 6.4.3 Audi AG

- 6.4.4 Jaguar Land Rover Automotive PLC

- 6.4.5 Volvo Car AB

- 6.4.6 Lexus

- 6.4.7 Porsche AG

- 6.4.8 Rolls-Royce Motor Cars India

- 6.4.9 Bentley Motors Limited

- 6.4.10 Automobili Lamborghini S.p.A.

- 6.4.11 Ferrari India

- 6.4.12 Maserati S.p.A

- 6.4.13 Aston Martin Lagonda Global Holdings PLC

- 6.4.14 Jeep (Stellantis)

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment