|

市场调查报告书

商品编码

1836695

堆高机:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Forklift Trucks - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

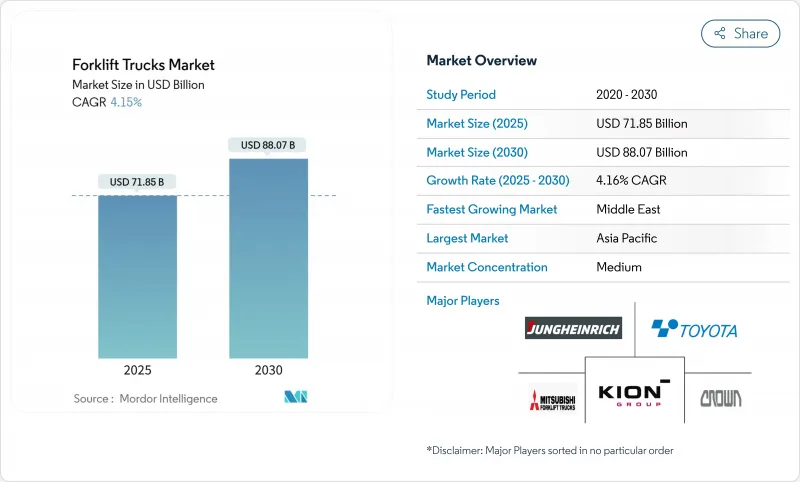

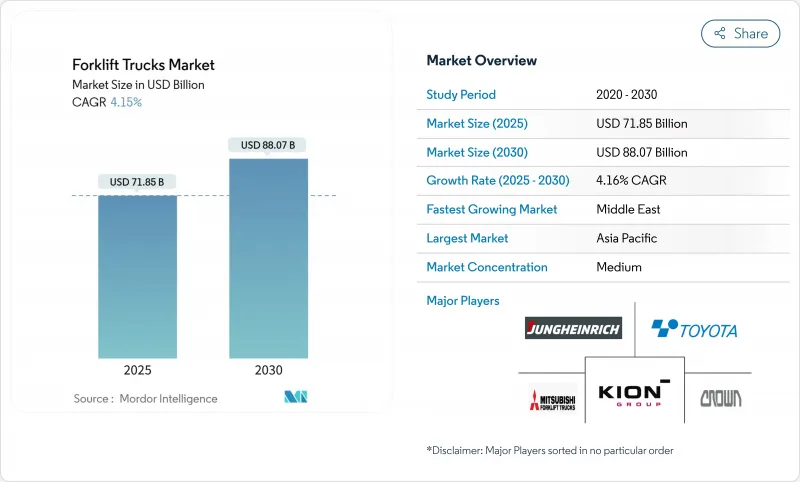

预计2025年堆高机市场规模将达718.5亿美元,2030年将达880.7亿美元,复合年增长率为4.16%。

儘管宏观经济情绪依然喜忧参半,但仓库自动化方面的稳健资本支出、更严格的排放法规以及老旧车队的稳定更换週期,正在支撑这一进程。从内燃机转向电动和氢燃料电池车型是堆高机市场最大的结构性变化,因为它再形成了动力传动系统供应链、充电基础设施和售后服务收益来源。锂离子电池透过实现无需更换电池的多班次作业,正在加速这一转变,而氢能技术在快速加氢至关重要的领域也越来越受欢迎。同时,中东和东南亚等高成长地区正在待开发区物流中心采用先进设备,确保堆高机市场在成熟地区经济成长放缓的情况下仍能保持成长动能。

全球堆高机市场趋势与洞察

北美自动化电商仓库的扩张

线上零售的快速成长正刺激美国和加拿大各地仓库建设创下纪录。预计2024年,美国电子商务销售额将达到1.19兆美元,年增8.2%。自动驾驶和半自动卡车的需求成长最快,因为这些设备与仓库管理软体集成,提高了处理能力,并缓解了持续的劳动力短缺问题。由此形成的技术主导升级週期,即使在GDP成长放缓的情况下,也能维持出货量的成长。

欧洲低温运输设施中锂离子堆高机的采用率不断提高

德国、法国和北欧地区的冷库营运商正从铅酸堆高机转向锂离子堆高机,因为锂电池在-30°C下仍能维持95%以上的容量,充电时间缩短至1-2小时,电池寿命也因此增加三倍。低温运输食品和饮料产业的复合年增长率已超过4.9%,而限製冷库内酸性气体暴露的排放法规也正在强化这项转变。到2025年,锂离子堆高机将占欧洲冷库新增电动堆高机销售量的40%。将电池租赁与远端资讯处理支援捆绑在一起的原始设备製造商将透过展示相对于传统解决方案的总成本优势来获得更高的利润。

电动式堆高机高机的高初始成本限制了其普及

电动车款的购买价格比同类型内燃机车高出 20-40%。一级电动卡车的平均价格为 36,000 美元,而内燃机卡车的平均价格为 28,000 美元,这限制了其在小型企业中的普及。对于自动驾驶卡车来说,这种价格差异更加明显,其感测器套件的安装成本可能超过 10 万美元。电池租赁、按次付费协议和车队即服务套餐等替代融资方式正日益普及,但在信贷管道紧张的地区仍处于起步阶段。

报告中分析的其他驱动因素和限制因素

- 亚太地区严格的排放法规加速电动堆高机的普及

- 疫情后製造业回流将提振美国堆高机需求

- 欧洲和北欧熟练堆驾驶人短缺

細項分析

氢燃料电池车型的扩张速度超过其他动力传动系统,到2030年,其复合年增长率将达到10.60%。堆高机市场受惠于三分钟即可完成的加氢,其运作时间与内燃机汽车相当,排放。 局部 Power已在300个地点部署了超过6万个燃料电池,证明了其商业性可行性。到2024年,电动车将占据堆高机市场的69.20%,但加州、中国和欧盟的监管期限正在加速电动车队的转型。

内燃机製造商正在透过混合动力配置和替代燃料来应对这一挑战,但事实证明,引擎效率的迭代改进成本过高。电池成本趋势正在下降,燃料供应商和物流设施营运商之间的氢能发行伙伴关係关係预计将在2027年前降低发行成本。因此,动力传动系统的多样化将提升竞争力,使那些与电芯、电堆、充电器和软体供应商建立合作关係的品牌受益。

三级托盘搬运车在最后一哩交叉转运网中占据44.70%的市场份额,但这些卡车相对商品化,导致利润压力增加。多样化的需求迫使原始设备製造商管理各种各样的SKU组合,从用于微型仓配中心的紧凑型三轮电动车到用于货柜存放场的18吨重型卡车。因此,跨类别电子设备的标准化已成为降低成本的关键策略。

受锂离子技术推动,I类电动雷射雷达的复合年增长率为4.53%,该技术支援无需更换电池的多班次室内作业。随着电商设施采用12公尺以上的货架系统,对堆高机的提升高度和稳定性提出了更高的要求,窄通道II类雷射雷达的堆高机市场规模也不断扩大。

区域分析

受中国、日本和印度在自动化仓库和智慧工厂方面大量投资的推动,到2024年,亚太地区堆高机市场收益将占全球堆高机市场的45.10%。本土品牌正利用成本优势和政府奖励,在国内和东南亚地区扩张,加剧了来自美国现有企业的竞争。日本和韩国的成熟堆高机车队正进入强制更换週期,严格的排放法规促使新购车辆转向锂离子和氢动力装置。与区域全面经济伙伴关係(RCEP)相关的货运走廊将促进跨境标准化,进一步扩大潜在需求。

中东是成长最快的地区,预计到2030年复合年增长率将达到6.12%。沙乌地阿拉伯、阿联酋和卡达正根据国家长远愿景,建造港口、铁路货场和沙漠物流枢纽。中国和韩国的汽车製造商正利用该地区的自由贸易区在当地组装汽车,而欧洲品牌则透过售后服务和自动驾驶选项来打造差异化竞争优势。

北美依然是技术领导者。製造业回流、电商履约以及加州的零排放堆高机法规,正在支撑对电动I类和氢动力V类车辆的需求。美国在远端资讯处理应用方面也处于领先地位,使车队管理人员能够追踪电池健康状况、驾驶员行为和维护间隔,从而提高运转率。加拿大也采取了类似的模式,并得益于不列颠哥伦比亚省和安大略省新建的内陆港口。

在劳动力供应紧张的情况下,欧洲堆高机市场持续转型为零排放动力传动系统。超过40万名持证操作员的技能短缺推动了自动化试点项目,尤其是在北欧地区。德国在锂离子电池回收和二次利用应用的研发方面处于领先地位,并支持循环设备经济的发展。随着汽车和电子产品供应链向欧洲大陆核心消费市场转移,东欧国家的产量成长高于平均值。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 北美自动化仓库和电商仓库的扩张

- 欧洲低温运输设施中锂离子堆高机的采用率不断提高

- 亚太地区严格的排放法规将加速电动堆高机的普及

- 疫情后製造业的重新整合将提振美国堆高机的需求。

- 海湾合作委员会的基础建设投资打造待开发区物流中心

- 日韩堆高机老化更换週期

- 市场限制

- 电动堆高机的高初始成本限制了其普及

- 欧洲和北欧熟练堆高机司机短缺

- 激烈的租赁车队竞争对原始设备製造商的利润带来压力

- 供应链中断影响零件可得性

- 价值/供应链分析

- 监管和技术展望

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章市场规模与成长预测(价值,美元)

- 依动力传动系统类型

- 内燃机(ICE)

- 电动车

- 铅酸电池

- 锂离子

- 氢燃料电池汽车(HFCV)

- 按车辆类别

- I 类(电动驾驶卡车)

- Ⅱ类(电动窄通道)

- III类(电动托盘车)

- IV 类(ICE 缓衝轮胎)

- V 类(ICE 充气轮胎)

- 负载容量

- 少于5吨

- 5-15吨

- 超过15吨

- 按最终用户产业

- 製造业

- 物流/仓储

- 建筑和基础设施

- 零售和批发

- 食品饮料低温运输

- 按地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 其他欧洲国家

- 中东

- GCC

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 其他海湾合作委员会

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 其他非洲国家

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

第六章 竞争态势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Toyota Industries Corp.

- KION Group AG

- Jungheinrich AG

- Hyster-Yale Materials Handling Inc.

- Mitsubishi Logisnext Co. Ltd.

- Crown Equipment Corp.

- Hangcha Group Co.

- Doosan Industrial Vehicles Co. Ltd.

- Komatsu Ltd.

- Anhui Heli Co. Ltd.

- Clark Material Handling Co.

- Caterpillar Inc.(CAT Lift Trucks)

- Hyundai Material Handling

- Lonking Holdings Ltd.

- Manitou Group

- Godrej & Boyce Mfg. Co.

- EP Equipment Co.

- Liugong Machinery Co.

- UniCarriers Corp.

- SANY Group Co.

第七章 市场机会与未来展望

The forklift trucks market size stands at USD 71.85 billion in 2025 and is forecast to reach USD 88.07 billion by 2030 at a 4.16% CAGR.

Healthy capital spending on warehouse automation, stricter emission rules, and a steady replacement cycle for aging fleets underpin this advance even as macro-economic sentiment remains mixed. Within the forklift trucks market, the pivot from internal-combustion to electric and hydrogen fuel-cell models is the single biggest structural change because it reshapes power-train supply chains, charging infrastructure, and after-sales revenue streams. Lithium-ion batteries are accelerating that shift by delivering multi-shift performance without battery swaps, while hydrogen technology is gaining traction where rapid refueling is critical. In parallel, high-growth geographies such as the Middle East and Southeast Asia are adopting advanced equipment at greenfield logistics hubs, ensuring that the forklift trucks market retains momentum despite slowing economic growth in mature regions.

Global Forklift Trucks Market Trends and Insights

Expansion of Automated & E-commerce Warehouses in North America

Rapid on-line retail growth is fueling record warehouse construction across the United States and Canada. US eCommerce sales stood at $1.19 trillion in 2024, an increase of 8.2% from the previous year Autonomous and semi-autonomous truck demand is rising fastest because these units integrate with warehouse-management software, boost throughput, and mitigate a persistent labor shortage. The result is a technology-led upgrade cycle that keeps unit shipments rising even when headline GDP growth softens.

Rising Adoption of Lithium-ion Forklifts in European Cold-Chain Facilities

Cold-store operators across Germany, France, and the Nordics are switching from lead-acid to lithium-ion powered trucks because lithium cells retain more than 95% capacity at -30 °C, cut charging hours to 1-2, and triple battery life. The cold-chain food & beverage segment already tops 4.9% CAGR, and emissions rules limiting acid-gas exposure inside chilled warehouses are reinforcing the shift. By 2025 lithium-ion units represent 40% of new electric forklift sales in European cold rooms as operators prioritize uptime and reduced battery maintenance . OEMs that bundle battery leasing and telematics support capture higher margins by proving total-cost advantages over legacy solutions.

High Upfront Cost of Electric Forklifts Is Restraining Adoption

Electric models carry a 20-40% purchase premium over comparable ICE units. A Class I electric truck averages USD 36,000 versus USD 28,000 for ICE, limiting take-up among small enterprises . The price gap is steeper in autonomous variants, whose sensor suites can lift installed cost above USD 100,000. Alternative financing, such as battery leasing, pay-per-use contracts, and fleet-as-a-service packages, is gaining traction but remains nascent in regions where credit access is tight.

Other drivers and restraints analyzed in the detailed report include:

- Stringent APAC Emission Mandates Accelerating Electric Forklift Uptake

- Post-pandemic Reshoring of Manufacturing Boosting United States Forklift Demand

- Shortage of Skilled Forklift Operators in Europe & Nordics

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Hydrogen fuel-cell models are scaling more rapidly than any other power-train, expanding at 10.60% CAGR through 2030. The forklift trucks market benefits because hydrogen refueling takes 3 minutes, matching ICE uptime while offering zero localized emissions. Plug Power has deployed over 60,000 fuel cells across 300 sites, proving commercial viability. Although the 69.20% electric share still dominates the forklift trucks market in 2024, regulatory deadlines in California, China, and the EU accelerate the pivot to electrified fleets.

ICE manufacturers respond with hybrid configurations and alternative fuels, but achieving repeated engine efficiency gains is proving to be cost-prohibitive. Battery cost curves are trending downward, and hydrogen distribution partnerships between fuel suppliers and logistics park operators promise lower dispensing costs by 2027. Consequently, power-train diversification enhances competitive intensity, rewarding brands that secure supplier alliances for cells, stacks, chargers, and software.

Class III pallet movers dominate with 44.70% market share due to last-mile cross-dock networks, but margin pressure is intensifying because these trucks are relatively commoditized. Demand diversification forces OEMs to manage a broad SKU mix ranging from compact three-wheel electrics for micro-fulfilment centers to heavy 18-ton rigs for container yards. Electronics standardization across classes is therefore a key cost-reduction strategy.

Class I electric riders book 4.53% CAGR, propelled by lithium-ion technology that supports multi-shift indoor operations without battery swaps. The forklift trucks market size for narrow-aisle Class II units is also expanding as e-commerce facilities adopt racking systems above 12 m high, demanding trucks with enhanced lift height and stability.

The Forklift Trucks Market Report is Segmented by Power-Train Type (Internal Combustion Engine, Electric and More), Vehicle Class (Class I, Class II and More), Load Capacity (Less Than 5 Tons, 5-15 Tons and More), End-User Industry (Manufacturing, Logistics and Warehousing and More), and Geography. The Market Sizes and Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia Pacific held 45.10% of the forklift trucks market revenue in 2024 as China, Japan, and India invested heavily in automated warehousing and smart factories. Domestic brands leverage cost advantages and government incentives to expand at home and Southeast Asia, heightening competition for European and U.S. incumbents. Mature fleets in Japan and South Korea are entering mandatory replacement cycles, and strict emission caps tilt new purchases toward lithium-ion or hydrogen units. Freight corridors linked to the Regional Comprehensive Economic Partnership foster cross-border standardization that further enlarges addressable demand.

The Middle East is the fastest-growing region, projected at 6.12% CAGR to 2030, as Saudi Arabia, UAE, and Qatar build ports, rail yards, and desert distribution hubs under long-range national visions. Chinese and Korean OEMs use regional free-trade zones to assemble units locally, while European brands differentiate on after-sales service and autonomous options.

North America remains a technology bellwether. Manufacturing reshoring, e-commerce fulfillment, and California's zero-emission forklift regulation combine to sustain demand for electric Class I and hydrogen Class V machines. The United States also leads telematics adoption, with fleet managers tracking battery health, operator behavior, and maintenance intervals to boost utilization. Canada follows similar patterns, helped by new inland ports in British Columbia and Ontario.

Europe's forklift trucks market continues to transition to zero-emission power-trains amid tight labor availability. Skill shortages exceeding 400,000 certified operators drive automation pilots, especially in the Nordics. Germany leads R&D on lithium-ion battery recycling and second-life applications, supporting a circular equipment economy. Eastern European member states exhibit above-average unit growth as automotive and electronics supply chains migrate closer to the continent's core consumer markets.

- Toyota Industries Corp.

- KION Group AG

- Jungheinrich AG

- Hyster-Yale Materials Handling Inc.

- Mitsubishi Logisnext Co. Ltd.

- Crown Equipment Corp.

- Hangcha Group Co.

- Doosan Industrial Vehicles Co. Ltd.

- Komatsu Ltd.

- Anhui Heli Co. Ltd.

- Clark Material Handling Co.

- Caterpillar Inc. (CAT Lift Trucks)

- Hyundai Material Handling

- Lonking Holdings Ltd.

- Manitou Group

- Godrej & Boyce Mfg. Co.

- EP Equipment Co.

- Liugong Machinery Co.

- UniCarriers Corp.

- SANY Group Co.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Expansion of Automated & E-commerce Warehouses in North America

- 4.2.2 Rising Adoption of Lithium-ion Forklifts in European Cold-Chain Facilities

- 4.2.3 Stringent APAC Emission Mandates Accelerating Electric Forklift Uptake

- 4.2.4 Post-pandemic Reshoring of Manufacturing Boosting U.S. Forklift Demand

- 4.2.5 Infrastructure Investments Across GCC Creating Greenfield Logistics Hubs

- 4.2.6 Aging Forklift Fleet Replacement Cycle in Japan & South Korea

- 4.3 Market Restraints

- 4.3.1 High Upfront Cost of Electric Forklift Is Restraining Adoption

- 4.3.2 Shortage of Skilled Forklift Operators in Europe & Nordics

- 4.3.3 Intense Rental-Fleet Competition Compressing OEM Margins

- 4.3.4 Supply Chain Disruptions Affecting Component Availability

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory & Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Power-train Type

- 5.1.1 Internal Combustion Engine (ICE)

- 5.1.2 Electric

- 5.1.2.1 Lead-acid

- 5.1.2.2 Li-ion

- 5.1.3 Hydrogen Fuel-cell Vehicle (HFCV)

- 5.2 By Vehicle Class

- 5.2.1 Class I (Electric Rider Trucks)

- 5.2.2 Class II (Electric Narrow-Aisle)

- 5.2.3 Class III (Electric Pallet)

- 5.2.4 Class IV (ICE Cushion-Tire)

- 5.2.5 Class V (ICE Pneumatic-Tire)

- 5.3 By Load Capacity

- 5.3.1 Less than 5 Tons

- 5.3.2 5-15 Tons

- 5.3.3 Above 15 Tons

- 5.4 By End-user Industry

- 5.4.1 Manufacturing

- 5.4.2 Logistics & Warehousing

- 5.4.3 Construction & Infrastructure

- 5.4.4 Retail & Wholesale

- 5.4.5 Food & Beverage Cold-Chain

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Rest of North America

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Rest of Europe

- 5.5.4 Middle East

- 5.5.4.1 GCC

- 5.5.4.1.1 Saudi Arabia

- 5.5.4.1.2 United Arab Emirates

- 5.5.4.1.3 Rest of GCC

- 5.5.4.2 Turkey

- 5.5.4.3 Rest of Middle East

- 5.5.5 Africa

- 5.5.5.1 South Africa

- 5.5.5.2 Rest of Africa

- 5.5.6 Asia Pacific

- 5.5.6.1 China

- 5.5.6.2 India

- 5.5.6.3 Japan

- 5.5.6.4 South Korea

- 5.5.6.5 Rest of Asia Pacific

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves (M&A, JVs, Product Launches)

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Toyota Industries Corp.

- 6.4.2 KION Group AG

- 6.4.3 Jungheinrich AG

- 6.4.4 Hyster-Yale Materials Handling Inc.

- 6.4.5 Mitsubishi Logisnext Co. Ltd.

- 6.4.6 Crown Equipment Corp.

- 6.4.7 Hangcha Group Co.

- 6.4.8 Doosan Industrial Vehicles Co. Ltd.

- 6.4.9 Komatsu Ltd.

- 6.4.10 Anhui Heli Co. Ltd.

- 6.4.11 Clark Material Handling Co.

- 6.4.12 Caterpillar Inc. (CAT Lift Trucks)

- 6.4.13 Hyundai Material Handling

- 6.4.14 Lonking Holdings Ltd.

- 6.4.15 Manitou Group

- 6.4.16 Godrej & Boyce Mfg. Co.

- 6.4.17 EP Equipment Co.

- 6.4.18 Liugong Machinery Co.

- 6.4.19 UniCarriers Corp.

- 6.4.20 SANY Group Co.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment