|

市场调查报告书

商品编码

1836720

透明电子产品:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Transparent Electronics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

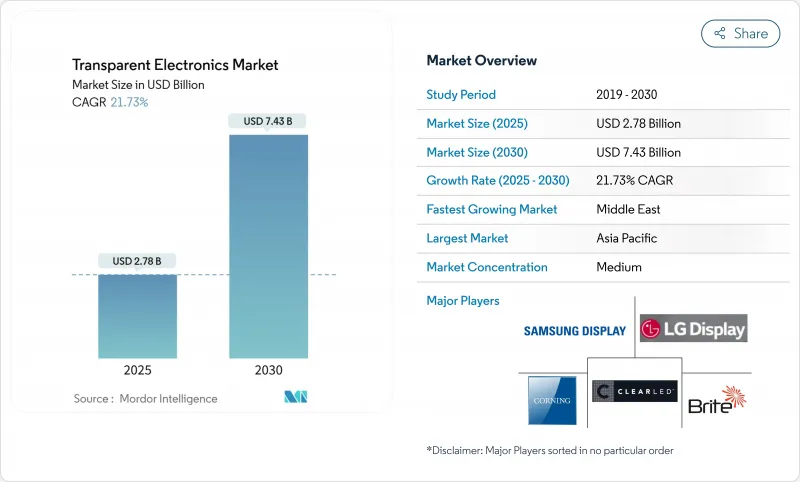

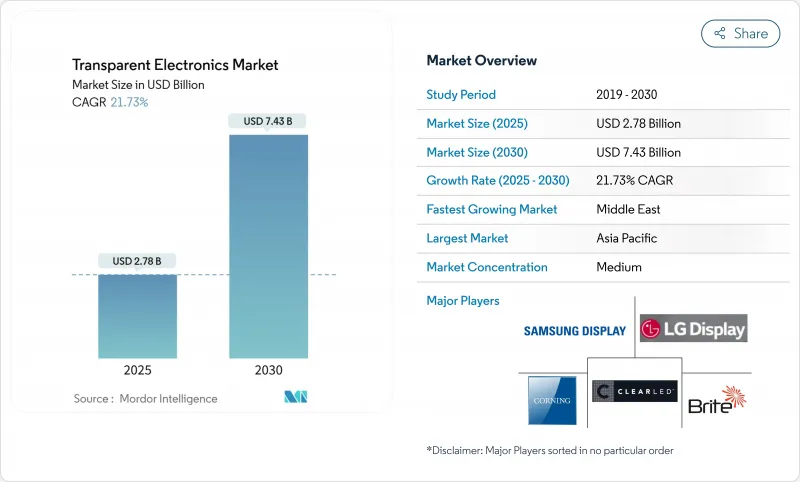

透明电子市场规模预计到2025年将达到27.8亿美元,到2030年将扩大到74.3亿美元,复合年增长率为21.73%。

将光学透明性与电子功能相结合的产品创新,正在将这项技术从小众显示应用推向节能建筑、先进汽车驾驶座、身临其境型零售等领域的主流应用。净零建筑的监管压力、交通电气化以及对互动式商业空间日益增长的需求,正在加速资本流入透明光伏、MicroLED 和电致变色平台。竞争优势日益不仅取决于面板尺寸,还取决于能否获得柔性材料和高产量比率沉积製程。那些将业务拓展到氧化铟锡 (ITO) 以外的领域,并致力于建筑一体化光伏 (BIPV) 和自动驾驶电子产品的製造商,将有望抓住下一波成长浪潮。

全球透明电子产品市场趋势与洞察

净零建筑规范推动智慧窗户集成

欧洲立法规定,到2030年所有新建建筑的能耗性能将接近零,促使建筑师转向能够动态调节太阳辐射增益的电致变色嵌装玻璃。在德国和斯堪地那维亚,试点安装已显示製冷节能超过20%,而新型液流电致变色设计现在增加了根据季节调整室内温度5°C的功能。与楼宇自动化系统的整合正成为标准,为感测器和控制器製造商以及面板製造商开闢了收益管道。国家维修计画的资金筹措,确保为外墙维修(包括智慧窗户)提供专案预算,这为中期成长前景提供了支撑。

透明显示器在自动驾驶汽车中越来越受欢迎

汽车製造商正在转向大型透明抬头显示器(HUD),将导航、驾驶辅助和资讯娱乐数据直接投射到挡风玻璃上。最近的 MicroLED 原型已实现 85% 的透明度,同时保持 1,000 尼特的亮度,克服了先前在日间光线变化条件下产生的眩光限制。这项性能符合美国、日本和欧盟严格的驾驶员分心和安全标准,并有望成为计划于 2026 年发布的中阶电动车的设计标竿。随着自动驾驶功能向 L3 级的过渡,需要更宽的视野来获取系统状态信息,短期内对 MicroLED 的需求将进一步扩大。

铟供应脆弱性威胁生产稳定性

ITO 仍然是主要的透明导体,但由于超过一半的精炼铟来自同一国家,因此面板製造商每年面临超过 30% 的现货价格突然波动。这些价格飙升挤压了显示器製造商的净利率,并推迟了产能扩张决策。材料製造商正在推出奈米银线替代品,这种替代品可以承受 1,000 次弯曲循环,并且在 90% 的透射率下电阻小于 30 Ω/□。然而,这种转变需要新的固化温度和图形化化学工艺,从而延长了量产的认证週期。

报告中分析的其他驱动因素和限制因素

- 利用透明数位电子看板改变零售业

- 利用建筑一体化太阳能发电拓展透明太阳能创新

細項分析

透明显示器在 2024 年占据了最大的收入份额,为 43.1%,而透明太阳能电池板预计到 2030 年将以 25.5% 的复合年增长率增长,这得益于鼓励现场发电的建筑规范。瑞士企业推出了一款 400W 玻璃状 BIPV 模组,可融入标准建筑幕墙,而不会改变外观美感。预计到 2030 年,太阳能板的透明电子市场将达到 19 亿美元,这反映了它们作为发电和采光錶面的双重作用。产品多样化现在扩展到支援触控感测器和加热器的透明导电薄膜,以及用于航太屏蔽的耐用透明陶瓷。具有动态着色功能的智慧窗户单元在商业房地产中继续受到欢迎,部分原因是营运成本降低,在温暖的气候下将投资回收期缩短至五年以内。

透明电子产品市场越来越注重产品类型之间的互通性。新兴的串联太阳能电池与microLED背板共用沉积设备,实现了多用途生产线。嵌入汽车挡风玻璃的透明感测器开始向ADAS(高级驾驶辅助系统)提供居住和环境数据,这表明价值正在从分立元件转变为整合功能。

预计到2024年,氧化铟锡将占据透明电子产品市场52.1%的份额,并在LCD/TFT和触控萤幕供应链中稳固占有一席之地。然而,预计银奈米线复合材料和金属网将蚕食这一领先地位,到2030年,其复合年增长率将达到22.3%。实验室设备已证明,在90%的透射率下,薄片电阻为26 Ω/sq,在120%的应变下,电阻漂移仅为10%。应用优化指南材料选择。 PEDOT:PSS等导电聚合物可用于涂覆注塑成型的塑胶基板,从而实现低成本的柔性显示器,而石墨烯则解决了可穿戴生物感测器中热性能和讯号均匀性的挑战。透明陶瓷在恶劣环境下的光学应用中占据了利基市场,而奈米碳管混合物正在光学透明性至关重要的电磁屏蔽层中崭露头角。

区域分析

受大规模显示器生产工厂和中国全球最大BIPV专案的推动,亚太地区将在2024年占据全球销售额的43.1%。在上海和深圳等特大城市,政府将城市空气品质目标与可再生能源发电量挂钩的奖励正在推动透明太阳能建筑幕墙的普及。日本和韩国公司在OLED研究领域占据主导地位,并定期展示树立透射率和像素密度新标竿的原型产品。

北美在自动驾驶汽车软体领域处于领先主导,这加速了对透明HUD和感测器丰富的挡风玻璃的需求。各州的建筑节能法规各不相同,但电致变色应用正朝着商业维修的方向发展。欧洲严格的2030年气候变迁议程将智慧玻璃和BIPV置于维修资金的核心,从而刺激了建筑幕墙建筑商和材料专家之间的跨国合作激增。

预计2025年至2030年,中东和非洲的智慧城市投资将以22.6%的复合年增长率成长,数位电子看板、自我调整遮阳和太阳能玻璃将融入地标性计划中。沙乌地阿拉伯的「2030愿景」将拨款数十亿美元用于融合透明显示墙和互动内容的身临其境型计画。拉丁美洲代表着一片尚未开发的前沿领域,丰富的太阳照度正推动着透明光伏在城市高层建筑建筑的应用。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 净零建筑标准将加速智慧窗户的采用(欧盟)

- 抬头显示器在自动驾驶汽车和电动车驾驶座中的快速应用(北美)

- 支持 AR 的透明零售指示牌在亚洲一线城市激增

- 随着建筑一体化太阳能发电成为强制性要求,透明太阳能板发展势头强劲(中国)

- 穿戴式医疗感测器需要柔性透明导体

- 市场限制

- 铟价格波动及供应集中度

- 低产量比率大面积透明OLED面板

- 欧洲电子垃圾重金属氧化膜法规

- 磁控溅镀及ALD设备的资本投资高

- 生态系分析

- 技术展望

- 波特五力分析

- 新进入者的威胁

- 购买者和消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章 市场规模及成长预测(金额)

- 按产品

- 透明显示器

- 透明太阳能板

- 智慧窗户/智慧玻璃

- 透明导电膜

- 透明陶瓷和铝

- 透明感测器等

- 依材料类型

- 氧化铟锡(ITO)

- 替代 TCO(AZO、FTO)

- 奈米银线和金属网

- 碳基奈米材料(石墨烯、CNT)

- 导电聚合物(PEDOT:PSS)

- 依技术

- LCD/TFT

- OLED和微型OLED

- 量子点微型LED

- 薄膜太阳能电池(CIGS、钙钛矿)

- 电致变色和SPD

- 按最终用户使用

- 消费性电子产品

- 汽车和运输设备

- 架构和基础设施

- 能源和公共产业(BIPV、农业光伏)

- 航太/国防

- 医疗保健和穿戴式设备

- 零售/数位电子看板

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 北欧国家(丹麦、瑞典、挪威、芬兰)

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 韩国

- 印度

- 东南亚

- 澳洲

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美

- 中东

- 波湾合作理事会成员国

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 其他非洲国家

- 北美洲

第六章 竞争态势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- BOE Technology Group Co., Ltd.

- LG Display Co., Ltd.

- Samsung Display Co., Ltd.

- Corning Incorporated

- AGC Inc.

- NSG Group(Pilkington)

- Saint-Gobain SA

- Ubiquitous Energy Inc.

- Brite Solar Inc.

- ClearLED Ltd.

- Panasonic Holdings Corp.

- Cambrios Technology Corp.

- Surmet Corporation

- 3M Company

- DuPont de Nemours Inc.

- PPG Industries Inc.

- Guardian Industries Holdings

- Shenzhen Nexnovo Technology Co., Ltd.

- Shenzhen AuroLED Technology Co., Ltd.

- Street Communication Inc.

- Apple Inc.(Transparent AR Glass R&D)

- JX Nippon Mining and Metals Corp.

- Heraeus Holding GmbH

- American Elements Corp.

第七章 市场机会与未来展望

The transparent electronics market size reached USD 2.78 billion in 2025 and is forecast to expand to USD 7.43 billion by 2030, registering a 21.73% CAGR.

Product innovation that merges optical clarity with electronic functionality is shifting the technology from niche display uses toward mainstream roles in energy-smart buildings, advanced vehicle cockpits, and immersive retail. Regulatory pressure for net-zero construction, the electrification of transport, and rising demand for interactive commercial spaces are accelerating capital flows into transparent photovoltaic, micro-LED, and electrochromic platforms. Competitive advantage is increasingly determined by access to flexible materials and high-yield deposition processes rather than panel size alone. Manufacturers that diversify beyond indium tin oxide (ITO) and align with building-integrated photovoltaics (BIPV) or autonomous-vehicle electronics are positioned to capture the next wave of growth.

Global Transparent Electronics Market Trends and Insights

Net-zero building codes driving smart-window integration

European legislation that mandates nearly zero-energy performance for all new structures by 2030 is pushing architects toward electrochromic glazing that dynamically modulates solar gain. Pilot installations across Germany and Scandinavia have shown cooling-energy cuts exceeding 20%, and newer liquid-flow electrochromic designs added the ability to shift interior temperatures 5 °C seasonally. Integration with building-automation systems is becoming standard, opening revenue streams for sensor and controls suppliers alongside panel manufacturers. Medium-term growth prospects are reinforced by funding under national renovation programs, which reserve dedicated budgets for envelope upgrades that include smart windows.

Autonomous vehicles accelerating transparent display adoption

Automakers are turning to large-format transparent head-up displays (HUDs) that project navigation, driver-assist, and infotainment data directly onto windshields. Recent micro-LED prototypes have achieved 85% transparency while retaining 1,000-nit brightness, overcoming prior glare limitations in variable daylight. This capability satisfies stringent driver-distraction and safety norms in the United States, Japan, and the EU, triggering design wins in mid-segment electric vehicles slated for 2026 release. Short-term demand is amplified by the transition to autonomous Level 3 functions, which require larger visual fields for system-status information.

Indium supply vulnerabilities threatening production stability

ITO remains the workhorse transparent conductor, yet more than half of refined indium originates from a single country, exposing panel producers to sudden spot-price swings above 30% per annum. These spikes compress display-maker margins and delay capacity-expansion decisions. Materials firms are responding with silver-nanowire alternatives that exhibit sub-30 Ω/sq resistance at 90% transmittance while tolerating 1,000 bending cycles. The transition, however, requires new curing temperatures and patterning chemistries, prolonging qualification cycles for high-volume production.

Other drivers and restraints analyzed in the detailed report include:

- Retail transformation through transparent digital signage

- Building-integrated photovoltaics expanding transparent solar innovation

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Transparent displays generated the largest revenue share in 2024 at 43.1%, yet transparent solar panels are projected to grow at a 25.5% CAGR to 2030, propelled by building codes that reward on-site generation. A Swiss venture introduced a 400 W glass-like BIPV module that blends into standard facades without altering exterior aesthetics. The transparent electronics market size for solar panels is forecast to reach USD 1.9 billion by 2030, reflecting their dual role as power generators and daylighting surfaces. Product diversification now extends to transparent conductive films that underpin touch sensors and heaters, as well as rugged transparent ceramics for aerospace shielding. Smart-window units equipped with dynamic tinting continue to gain traction in commercial real estate, aided by operating-cost reductions that shorten payback periods to under five years in warm climates.

The transparent electronics market increasingly values interoperability between product categories. Emerging tandem solar cells share deposition tools with micro-LED backplanes, enabling multi-purpose manufacturing lines. Transparent sensors embedded in vehicle windshields are beginning to feed occupancy and environment data into advanced driver-assistance systems, illustrating how value migrates from stand-alone components to integrated functions.

Indium tin oxide accounted for 52.1% of transparent electronics market share in 2024, underscoring its entrenched position across LCD/TFT and touch-panel supply chains. Nevertheless, silver-nanowire composites and metal meshes are expected to erode this lead, climbing at 22.3% CAGR through 2030. Lab devices have demonstrated 26 Ω/sq sheet resistance at 90% transmittance, with only 10% resistance drift under 120% strain, making them viable for foldable phones and e-skin patches. Application-specific optimisation guides material choice. Conductive polymers such as PEDOT:PSS now coat injection-moulded plastic substrates for low-cost, flexible displays, while graphene manages heat and signal-uniformity challenges in wearable biosensors. Transparent ceramics secure niche demand in harsh-environment optics, and carbon-nanotube hybrids are emerging in electromagnetic-shielding layers where optical transparency is non-negotiable.

The Transparent Electronics Market Report is Segmented by Product (Transparent Displays, Transparent Solar Panels, Smart, and More), Material Type (Indium Tin Oxide (ITO), Alternative TCOs (AZO, FTO), and More), Technology (LCD/TFT, and More), End-User Application (Consumer Electronics, Automotive and Transportation, Aerospace and Defense, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia Pacific commanded 43.1% of 2024 revenue, anchored by high-volume fabs for displays and the world's largest BIPV programme in China. Government incentives that link urban air-quality targets to renewable-energy capacity fuel adoption of transparent solar facades in megacities such as Shanghai and Shenzhen. Japanese and South Korean firms dominate OLED research, regularly showcasing prototypes that set new benchmarks in transmittance and pixel density.

North America leverages its leadership in autonomous-vehicle software to accelerate demand for transparent HUDs and sensor-rich windshields. Building-energy rules vary by state, yet collectively favour electrochromic adoption in commercial retrofits. Europe's strict 2030 climate agenda places smart glass and BIPV at the centre of renovation funding, driving a surge of cross-border partnerships between facade contractors and materials specialists.

The Middle East and Africa is forecast to grow at 22.6% CAGR from 2025 to 2030 as smart-city investments integrate digital signage, adaptive shading and solar glass in landmark projects. Saudi Arabia's Vision 2030 allocates multi-billion-dollar budgets to immersive heritage sites that blend transparent display walls with interactive content. Latin America represents an untapped frontier where abundant solar irradiance aligns with transparent PV adoption in urban high-rise developments, although supply-chain hurdles and financing costs temper near-term uptake.

- BOE Technology Group Co., Ltd.

- LG Display Co., Ltd.

- Samsung Display Co., Ltd.

- Corning Incorporated

- AGC Inc.

- NSG Group (Pilkington)

- Saint-Gobain SA

- Ubiquitous Energy Inc.

- Brite Solar Inc.

- ClearLED Ltd.

- Panasonic Holdings Corp.

- Cambrios Technology Corp.

- Surmet Corporation

- 3M Company

- DuPont de Nemours Inc.

- PPG Industries Inc.

- Guardian Industries Holdings

- Shenzhen Nexnovo Technology Co., Ltd.

- Shenzhen AuroLED Technology Co., Ltd.

- Street Communication Inc.

- Apple Inc. (Transparent AR Glass R&D)

- JX Nippon Mining and Metals Corp.

- Heraeus Holding GmbH

- American Elements Corp.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Net-Zero Building Codes Accelerating Smart-Window Adoption in EU

- 4.2.2 Rapid Uptake of Head-Up Displays in Autonomous and EV Cockpits (North America)

- 4.2.3 AR-Enabled Transparent Retail Signage Surge in Asia's Tier-1 Cities

- 4.2.4 Building-Integrated PV Mandates Spurring Transparent Solar Panels in China

- 4.2.5 Wearable Medical Sensors Requiring Flexible Transparent Conductors

- 4.3 Market Restraints

- 4.3.1 Indium Price Volatility and Supply Concentration

- 4.3.2 Low Yield Scaling Large-Area Transparent OLED Panels

- 4.3.3 E-waste Rules on Heavy-Metal Oxide Films in Europe

- 4.3.4 High CapEx for Magnetron Sputtering and ALD Equipment

- 4.4 Industry Ecosystem Analysis

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Product

- 5.1.1 Transparent Displays

- 5.1.2 Transparent Solar Panels

- 5.1.3 Smart Windows/Smart Glass

- 5.1.4 Transparent Conductive Films

- 5.1.5 Transparent Ceramics and Aluminum

- 5.1.6 Transparent Sensors and Others

- 5.2 By Material Type

- 5.2.1 Indium Tin Oxide (ITO)

- 5.2.2 Alternative TCOs (AZO, FTO)

- 5.2.3 Silver Nanowire and Metal Mesh

- 5.2.4 Carbon-Based Nanomaterials (Graphene, CNT)

- 5.2.5 Conductive Polymers (PEDOT:PSS)

- 5.3 By Technology

- 5.3.1 LCD/TFT

- 5.3.2 OLED and micro-OLED

- 5.3.3 Quantum-Dot and micro-LED

- 5.3.4 Thin-Film Photovoltaic (CIGS, Perovskite)

- 5.3.5 Electrochromic and SPD

- 5.4 By End-user Application

- 5.4.1 Consumer Electronics

- 5.4.2 Automotive and Transportation

- 5.4.3 Building and Infrastructure

- 5.4.4 Energy and Utilities (BIPV, Agrivoltaics)

- 5.4.5 Aerospace and Defense

- 5.4.6 Healthcare and Wearables

- 5.4.7 Retail and Digital Signage

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Nordics (Denmark, Sweden, Norway, Finland)

- 5.5.2.7 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 South Korea

- 5.5.3.4 India

- 5.5.3.5 Southeast Asia

- 5.5.3.6 Australia

- 5.5.3.7 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East

- 5.5.5.1 Gulf Cooperation Council Countries

- 5.5.5.2 Turkey

- 5.5.5.3 Rest of Middle East

- 5.5.6 Africa

- 5.5.6.1 South Africa

- 5.5.6.2 Nigeria

- 5.5.6.3 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 BOE Technology Group Co., Ltd.

- 6.4.2 LG Display Co., Ltd.

- 6.4.3 Samsung Display Co., Ltd.

- 6.4.4 Corning Incorporated

- 6.4.5 AGC Inc.

- 6.4.6 NSG Group (Pilkington)

- 6.4.7 Saint-Gobain SA

- 6.4.8 Ubiquitous Energy Inc.

- 6.4.9 Brite Solar Inc.

- 6.4.10 ClearLED Ltd.

- 6.4.11 Panasonic Holdings Corp.

- 6.4.12 Cambrios Technology Corp.

- 6.4.13 Surmet Corporation

- 6.4.14 3M Company

- 6.4.15 DuPont de Nemours Inc.

- 6.4.16 PPG Industries Inc.

- 6.4.17 Guardian Industries Holdings

- 6.4.18 Shenzhen Nexnovo Technology Co., Ltd.

- 6.4.19 Shenzhen AuroLED Technology Co., Ltd.

- 6.4.20 Street Communication Inc.

- 6.4.21 Apple Inc. (Transparent AR Glass R&D)

- 6.4.22 JX Nippon Mining and Metals Corp.

- 6.4.23 Heraeus Holding GmbH

- 6.4.24 American Elements Corp.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment