|

市场调查报告书

商品编码

1842427

液位感测器:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Level Sensor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

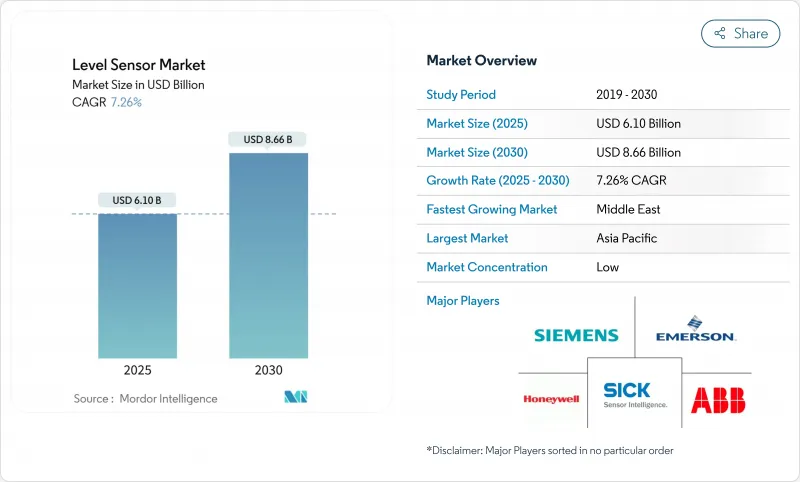

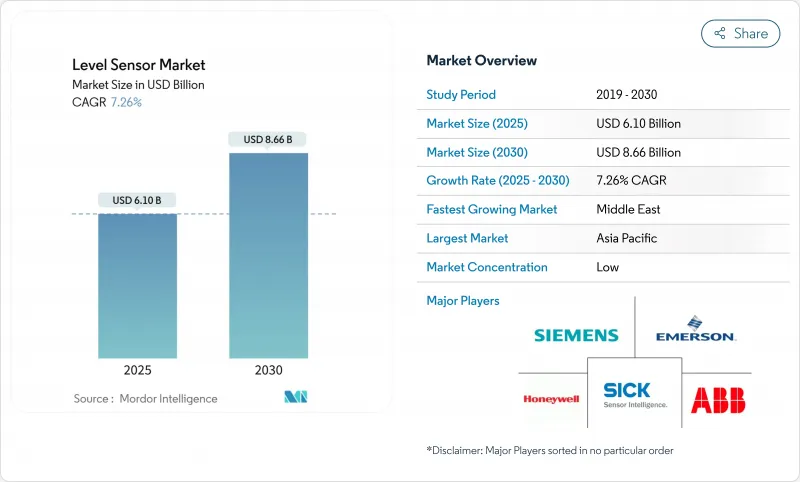

预计 2025 年液位感测器市场规模将达到 61 亿美元,到 2030 年将达到 86.6 亿美元,复合年增长率为 7.26%。

工业数位化专案、严格的全球安全法规以及高要求应用领域向高频 80 GHz 雷达平台的快速转变,正在推动雷达市场的成长。亚太地区公共部门在海水淡化和污水大型企划上的强劲投入,正在加速对雷达的需求,而北美地区贸易交接升级则进一步巩固了超高精度雷达设计的溢价。製造商也不断拓展其产品组合,将支援物联网的变送器和自我诊断功能融入其中,以支援预测性维护策略。随着全球领导者透过收购和合作,将互补的感测、通讯和分析能力结合,以增强其产品组合,竞争也日益激烈。

全球液位感测器市场趋势与洞察

数位化主导海湾合作委员会油库自动化浪潮

沙乌地阿拉伯和阿联酋在数位经济领域的积极投入,推动了对联网液位传送器的需求,这些变送器可为即时库存仪錶板和预测性维护模型提供数据,从而实现码头运营的现代化。 「愿景2030」计画正在将人工智慧和5G预算投入工业IoT,以实现液位数据与ERP和排放监测系统的无缝整合。随着营运商从传统浮式计过渡到SIL认证的雷达平台,拥有区域服务中心的供应商的订单量高于平均水平。

海水淡化和污水大型企划的快速扩张

亚太地区的膜法海水淡化生产线和先进的生物污水处理专案需要精确、耐腐蚀的液位感测技术来管理化学品注入和污泥处理过程。目前,各工厂正在采用人工智慧模组,利用连续液位数据进行能源优化,并越来越多地采用适用于高盐度介质的雷达和超音波仪表。中东地区占全球海水淡化产能的46%,该地区的同步投资将提振长期设备需求。

EMI 引起的钢厂精度漂移

感应炉附近的高电磁场会扭曲电子液位讯号,导致昂贵的重新校准週期,并限制了雷达感测器在印度快速成长的钢铁业的应用。虽然供应商正在测试多层屏蔽和数位滤波技术,但价格敏感的营运商正在推迟升级,直到出现可靠且经济实惠的解决方案。

报告中分析的其他驱动因素和限制因素

- 欧洲化工园区液化天然气强制进行SIL-3安全审核

- FSRU订单燃料点需求

- 导波雷达在卫生应用的接受度较低

細項分析

到2024年,点式设备将占据液位感测器市场份额的58%,尤其适用于溢流控制和空运转保护措施。连续测量产品虽然出货量较低,但随着营运商追求即时库存追踪以降低营运成本和能耗,其年增长率达到8%。随着支援分析的变送器的普及,预计到2030年,连续平台的液位感测器市场规模将超过30亿美元。将开关功能和连续功能整合在一个机壳中的混合设备正在赢得空间受限的滑轨的青睐,并扩大了供应商的差异化。

80GHz雷达的普及正在推动水处理、化学和食品工厂持续采用该技术,以对抗泡沫、蒸汽和灰尘。整合诊断功能现在可以标记积聚物并提供预测性清洁提示,从而延长运作。随着机器製造商逐步采用智慧感测器架构,将IO-Link和无线通讯协定整合到连续仪表中的供应商将获得OEM设计的青睐。

2024年,接触式技术将占液位感测器总收入的64%,其中以静水压和磁致伸缩探头为主导,因其机械结构简单而备受青睐。然而,受食品、药品和腐蚀性液体无污染测量需求的推动,非接触式技术正以每年8.2%的速度成长。雷达和超音波技术可避免因零件接触液体而导致的停机,而支援蓝牙的设备则可透过行动应用程式试运行。非接触式平台目前占液位感测器市场规模的近三分之一,预计到2029年,其在高价值化工和能源计划中的出货量将超过接触式平台。

雷达领域的进步最为显着:FMCW 架构利用高达 80 GHz 的频率,使窄波束能够导航内部结构。供应商也在推动韧体改进,以消除搅拌槽中的虚假回波。超音波仍保持着发展势头,尤其是在成本敏感性高于性能的领域,例如市政水利计划,但随着雷达价格下降,其市场份额正在下降。

区域分析

受中国工业自动化普及以及印度和东南亚资本投资加速的推动,亚太地区将在2024年引领液位感测器市场,占据45%的收益。仅纯电动车价值链就需要数千个用于电解、浆料和溶剂罐的耐化学腐蚀雷达液位计。在日益都市化的地区,污水基础设施对与主导控制迴路相关的连续感测器的订单日益增多。投资本地生产和售后服务网路的供应商将在二线和三线城市获得更大的市场份额。

中东是2025年至2030年复合年增长率最快的地区,将达9%。与「2030愿景」和阿布达比国家石油公司下游计划相关的油库自动化项目,以及创纪录的海水淡化产能成长,将维持对SIL级雷达和智慧点开关的多年需求。由于新的终端和管道需要库存监控,印度-中欧经济走廊等物流走廊的感测器订单将增加。

在北美,储罐和转运罐的现代化升级仍在继续,80GHz雷达技术的应用使其能够进行对收益至关重要的体积计算。同时,页岩相关的水处理作业正在采用能够抵御沉积物和碳氢化合物侵蚀的超音波设备和雷达设备。欧洲化工工业正在优先考虑SIL-3升级和永续性指标,这推动了对认证雷达设备和云端诊断的需求。南美洲的采矿和纸浆业务将逐步扩张,但当地原始设备製造商在满足国际SIL标准方面面临成本障碍,导致目前采用速度缓慢。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 调查结果

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 数位化主导波湾合作理事会(GCC)油库自动化浪潮

- 亚太地区海水淡化和污水大型企划激增

- 欧洲化工工业强制实施SIL-3安全审核,推动雷达安装

- 北美保管和转运系统向 80GHz FMCW 雷达过渡

- 中国纯电动车(BEV)电解产能投资

- LNG浮体式储存和再气化装置 (FSRU)订单加速点级需求

- 市场限制

- 钢铁厂电磁干扰引起的精度漂移限制了印度的采用

- 导波雷达在卫生製药生产线的接受度较低(美国和欧盟 GMP)

- 80GHz 前端应用的 8 吋 GaAs MMIC 代工产能短缺。

- 南美小型原始设备製造商的SIL认证成本复杂

- 价值/供应链分析

- 监理展望

- ATEX 和 IECEx 危险区域更新

- 技术展望

- 支援人工智慧的自校准水平感测器

- 波特五力分析

- 新进入者的威胁

- 替代品的威胁

- 供应商的议价能力

- 买方的议价能力

- 竞争对手之间的竞争

第五章市场规模及成长预测(金额)

- 按监控类型

- 点液位感测器

- 机械/磁性浮子

- 电容

- 震动探头

- 电导率

- 其他点感测器

- 连续液位感测器

- 雷射

- 超音波

- 磁致伸缩

- 雷达

- 其他连续感测器

- 点液位感测器

- 按技术(设备类型)

- 接触式感应器

- 静水压型

- 磁致伸缩

- 导波雷达

- 非接触式感测器

- 超音波

- 24 GHz雷达

- 80 GHz雷达

- 光学/红外线

- 接触式感应器

- 透过感测器技术

- 电容式

- 电导率

- 光学/光电

- 微波/雷达

- 超音波

- 振动叉

- 按组件

- 感测元件和探头

- 发射器/转换器

- 显示和控制器

- 按检测介质

- 液体

- 固体(散装)

- 界面(油水等)

- 按最终用户产业

- 石油和天然气

- 上游

- 中下游

- 发电

- 火力

- 核能

- 采矿和金属加工

- 化学

- 基础化学品

- 特殊/精密化学

- 饮食

- 酪农

- 酿造

- 海水淡化

- 水和污水管理

- 製药和生物过程

- 水泥、纸浆和造纸

- 石油和天然气

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 其他欧洲国家

- 亚太地区

- 中国

- 印度

- 日本

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美

- 中东

- 海湾合作委员会国家

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 其他非洲国家

- 北美洲

第六章 竞争态势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- ABB Ltd

- Emerson Electric Co.

- Honeywell International Inc.

- Siemens AG

- Endress+Hauser AG

- Sick AG

- VEGA Grieshaber KG

- KROHNE Group

- Baumer Group

- TE Connectivity Ltd

- First Sensor AG

- BinMaster Inc.

- AMETEK Inc.

- Pepperl+Fuchs SE

- Anton Paar GmbH

- Omega Engineering Inc.

- ifm electronic GmbH

- Yokogawa Electric Corp.

- Omron Corporation

- Rockwell Automation Inc.

- KOBOLD Messring GmbH

第七章 市场机会与未来展望

The level sensors market size is valued at USD 6.1 billion in 2025 and is forecast to reach USD 8.66 billion by 2030, advancing at a 7.26% CAGR.

Growth is propelled by industrial digitization programs, stringent global safety mandates, and the rapid shift to high-frequency 80 GHz radar platforms in demanding applications. Strong public-sector spending on desalination and wastewater megaprojects across Asia-Pacific is accelerating unit demand, while custody-transfer upgrades in North America reinforce premium pricing for ultra-high-accuracy radar designs. Manufacturers are also widening their product mix with IoT-ready transmitters and embedded self-diagnostics to align with predictive-maintenance strategies. Competitive intensity is rising as global leaders strengthen portfolios through acquisitions and alliances that combine complementary sensing, communications, and analytics capabilities.

Global Level Sensor Market Trends and Insights

Digitization-driven tank-farm automation surge in GCC

Aggressive digital-economy spending in Saudi Arabia and the UAE is modernizing terminal operations, elevating demand for networked level transmitters that feed real-time inventory dashboards and predictive-maintenance models. Vision 2030 programs funnel AI and 5G budgets toward industrial IoT, allowing level data to integrate seamlessly with ERP and emissions-monitoring systems. Suppliers with localized service hubs are seeing above-average order volumes as operators migrate from legacy float gauges to SIL-certified radar platforms.

Rapid build-out of desalination & wastewater megaprojects

Asia-Pacific capital plans for membrane desalination lines and advanced biological wastewater treatment require precise, corrosion-resistant level sensing to manage chemical dosing and sludge processes. Plants now embed AI modules that leverage continuous level data for energy optimization, lifting adoption of radar and ultrasonic instruments rated for high-salinity media. Parallel investments in the Middle East's 46% share of global desalination capacity reinforce long-term unit demand.

EMI-induced accuracy drift in steel mills

High electromagnetic fields near induction furnaces distort electronic level signals, driving costly recalibration cycles and limiting uptake of radar sensors in India's rapidly growing steel sector. Vendors are testing multilayer shielding and digital filtering, yet price-sensitive operators defer upgrades until robust, affordable solutions emerge.

Other drivers and restraints analyzed in the detailed report include:

- Mandatory SIL-3 safety audits in European chemical parks

- LNG FSRU orders accelerating point-level demand

- Low acceptance of guided-wave radar in hygienic applications

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Point devices dominated 2024 with a 58% level sensors market share, favored for binary control in overfill and dry-run safeguards. Continuous measurement products, though smaller in shipment volume, are growing 8% annually as operators pursue real-time inventory tracking to cut working capital and energy use. The level sensors market size for continuous platforms is projected to exceed USD 3 billion by 2030, alongside the adoption of analytics-ready transmitters. Hybrid instruments that fuse switching and continuous functions in a single housing are winning conversions in space-constrained skids, widening supplier differentiation.

The migration to 80 GHz radar is powering continuous segment uptake in water, chemical, and food plants that battle foam, vapor, and dust. Integrated diagnostics now flag buildup, offering predictive-cleaning prompts and elevating uptime. Suppliers that combine IO-Link or wireless protocols into continuous gauges capture OEM design wins as machine builders standardize on smart-sensor architectures.

Contact technologies retained 64% of 2024 revenue, anchored by hydrostatic and magnetostrictive probes valued for mechanical simplicity. Yet non-contact devices are expanding 8.2% each year, riding demand for contamination-free measurement in foods, pharmaceuticals, and corrosive liquids. Radar and ultrasonic models avoid downtime tied to wetted parts, and Bluetooth-enabled units ease commissioning via mobile apps. Non-contact platforms now represent nearly one-third of level sensors market size and are forecast to surpass contact shipments in high-value chemical and energy projects by 2029.

Radar progress is most visible: FMCW architectures leverage 80 GHz frequencies for narrow beams that navigate internal structures. Suppliers also push firmware advances that remove false echoes in agitator-equipped tanks. Ultrasonic retains traction where cost sensitivity tops performance, especially in municipal water projects, but its share edges lower as radar pricing falls.

Level Sensor Market is Segmented by Monitoring Type (Point Level Sensors and Continuous Level Sensors), Technology (Contant Sensors and Non-Contact Sensors), Sensor Technology (Capacitive, Conductive, Optical/Photoelectric and More), Component, Detection Medium, End-User Industry (Oil & Gas, Power Generation and More), Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific led the level sensors market with 45% revenue in 2024, underpinned by extensive industrial automation in China and accelerating capital investment in India and Southeast Asia. Battery-electric vehicle value-chains alone require thousands of chemically resistant radar gauges for electrolyte, slurry, and solvent tanks. Regional wastewater infrastructure, buoyed by urbanization, fuels orders for continuous sensors tied to AI-driven control loops. Suppliers investing in localized manufacturing and aftersales networks deepen share across tier-2 and tier-3 cities.

The Middle East registers the fastest regional CAGR at 9% from 2025-2030. Tank-farm automation programs linked to Vision 2030 and ADNOC downstream projects, plus record desalination capacity additions, sustain multi-year demand for SIL-rated radar and smart point switches. Logistics corridors such as the India-Middle East-Europe Economic Corridor amplify sensor orders as new terminals and pipelines require inventory monitoring.

North America continues to modernize custody-transfer tanks with 80 GHz radar for revenue-critical volume calculations, while shale-related water-handling operations adopt ultrasonic and radar devices resistant to sediment and hydrocarbons. European chemical parks prioritize SIL-3 upgrades and sustainability metrics, boosting demand for certified radar units and cloud-enabled diagnostics. South American mining and pulp operations expand gradually, though local OEMs face cost hurdles meeting international SIL standards, moderating near-term penetration.

- ABB Ltd

- Emerson Electric Co.

- Honeywell International Inc.

- Siemens AG

- Endress + Hauser AG

- Sick AG

- VEGA Grieshaber KG

- KROHNE Group

- Baumer Group

- TE Connectivity Ltd

- First Sensor AG

- BinMaster Inc.

- AMETEK Inc.

- Pepperl + Fuchs SE

- Anton Paar GmbH

- Omega Engineering Inc.

- ifm electronic GmbH

- Yokogawa Electric Corp.

- Omron Corporation

- Rockwell Automation Inc.

- KOBOLD Messring GmbH

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions and Market Definition

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Digitisation-driven Tank-Farm Automation Surge in Gulf Cooperation Council (GCC)

- 4.2.2 Rapid Build-out of Desalination and Waste-water Megaprojects Across Asia-Pacific

- 4.2.3 Mandatory SIL-3 Safety Audits in European Chemical Parks Boosting Radar Installations

- 4.2.4 Transition to 80 GHz FMCW Radar in North-American Custody-Transfer Systems

- 4.2.5 Battery-Electric Vehicle (BEV) Electrolyte Production Capacity Investments in China

- 4.2.6 LNG Floating Storage and Regasification (FSRU) Orders Accelerating Point-Level Demand

- 4.3 Market Restraints

- 4.3.1 EMI-Induced Accuracy Drift in Steel Mills Limiting Adoption in India

- 4.3.2 Low Acceptance of Guided-Wave Radar in Hygienic Pharma Lines (US and EU GMP)

- 4.3.3 Shortage of 8-inch GaAs MMIC Foundry Capacity for 80 GHz Front-ends

- 4.3.4 Complex SIL Certification Cost for Small OEMs in South America

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.5.1 ATEX and IECEx Hazard-Zone Updates

- 4.6 Technological Outlook

- 4.6.1 AI-Enabled Self-Calibrating Level Sensors

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Threat of Substitutes

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Bargaining Power of Buyers

- 4.7.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Monitoring Type

- 5.1.1 Point Level Sensors

- 5.1.1.1 Mechanical and Magnetic Float

- 5.1.1.2 Capacitance

- 5.1.1.3 Vibratory Probe

- 5.1.1.4 Conductivity

- 5.1.1.5 Other Point Sensors

- 5.1.2 Continuous Level Sensors

- 5.1.2.1 Laser

- 5.1.2.2 Ultrasonic

- 5.1.2.3 Magnetostrictive

- 5.1.2.4 Radar

- 5.1.2.5 Other Continuous Sensors

- 5.1.1 Point Level Sensors

- 5.2 By Technology (Device Type)

- 5.2.1 Contact Sensors

- 5.2.1.1 Hydrostatic

- 5.2.1.2 Magnetostrictive

- 5.2.1.3 Guided-Wave Radar

- 5.2.2 Non-Contact Sensors

- 5.2.2.1 Ultrasonic

- 5.2.2.2 24 GHz Radar

- 5.2.2.3 80 GHz Radar

- 5.2.2.4 Optical/IR

- 5.2.1 Contact Sensors

- 5.3 By Sensor Technology

- 5.3.1 Capacitive

- 5.3.2 Conductive

- 5.3.3 Optical/Photoelectric

- 5.3.4 Microwave/Radar

- 5.3.5 Ultrasonic

- 5.3.6 Vibratory Fork

- 5.4 By Component

- 5.4.1 Sensing Element and Probe

- 5.4.2 Transmitter/Converter

- 5.4.3 Display and Controller

- 5.5 By Detection Medium

- 5.5.1 Liquids

- 5.5.2 Solids (Bulk)

- 5.5.3 Interface (Oil-Water, etc.)

- 5.6 By End-user Industry

- 5.6.1 Oil and Gas

- 5.6.1.1 Upstream

- 5.6.1.2 Mid/Downstream

- 5.6.2 Power Generation

- 5.6.2.1 Thermal

- 5.6.2.2 Nuclear

- 5.6.3 Mining and Metal Processing

- 5.6.4 Chemical

- 5.6.4.1 Basic Chemicals

- 5.6.4.2 Specialty and Fine Chemicals

- 5.6.5 Food and Beverage

- 5.6.5.1 Dairy

- 5.6.5.2 Brewery

- 5.6.5.3 Desalination

- 5.6.6 Water and Waste-water Management

- 5.6.7 Pharmaceuticals and Bioprocessing

- 5.6.8 Cement and Pulp and Paper

- 5.6.1 Oil and Gas

- 5.7 By Geography

- 5.7.1 North America

- 5.7.1.1 United States

- 5.7.1.2 Canada

- 5.7.1.3 Mexico

- 5.7.2 Europe

- 5.7.2.1 Germany

- 5.7.2.2 United Kingdom

- 5.7.2.3 France

- 5.7.2.4 Rest of Europe

- 5.7.3 Asia-Pacific

- 5.7.3.1 China

- 5.7.3.2 India

- 5.7.3.3 Japan

- 5.7.3.4 Rest of Asia-Pacific

- 5.7.4 South America

- 5.7.4.1 Brazil

- 5.7.4.2 Argentina

- 5.7.4.3 Rest of South America

- 5.7.5 Middle East

- 5.7.5.1 GCC Countries

- 5.7.5.2 Turkey

- 5.7.5.3 Rest of Middle East

- 5.7.6 Africa

- 5.7.6.1 South Africa

- 5.7.6.2 Nigeria

- 5.7.6.3 Rest of Africa

- 5.7.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, and Recent Developments)

- 6.4.1 ABB Ltd

- 6.4.2 Emerson Electric Co.

- 6.4.3 Honeywell International Inc.

- 6.4.4 Siemens AG

- 6.4.5 Endress + Hauser AG

- 6.4.6 Sick AG

- 6.4.7 VEGA Grieshaber KG

- 6.4.8 KROHNE Group

- 6.4.9 Baumer Group

- 6.4.10 TE Connectivity Ltd

- 6.4.11 First Sensor AG

- 6.4.12 BinMaster Inc.

- 6.4.13 AMETEK Inc.

- 6.4.14 Pepperl + Fuchs SE

- 6.4.15 Anton Paar GmbH

- 6.4.16 Omega Engineering Inc.

- 6.4.17 ifm electronic GmbH

- 6.4.18 Yokogawa Electric Corp.

- 6.4.19 Omron Corporation

- 6.4.20 Rockwell Automation Inc.

- 6.4.21 KOBOLD Messring GmbH

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment