|

市场调查报告书

商品编码

1842432

可摄取感测器:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Ingestible Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

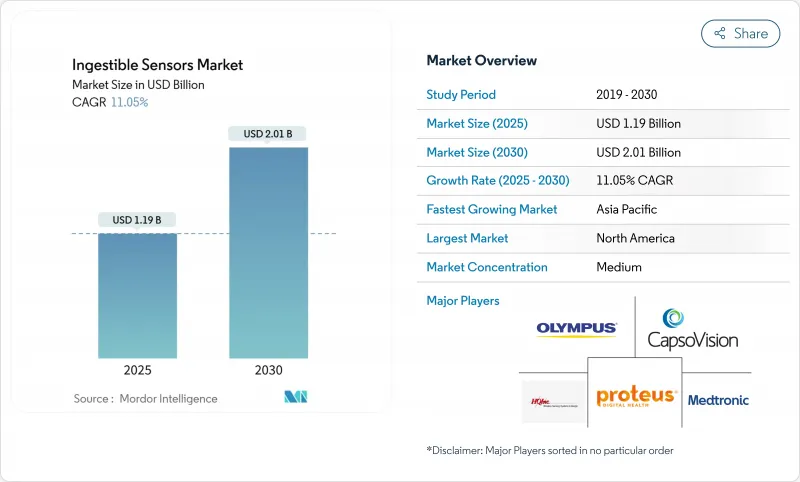

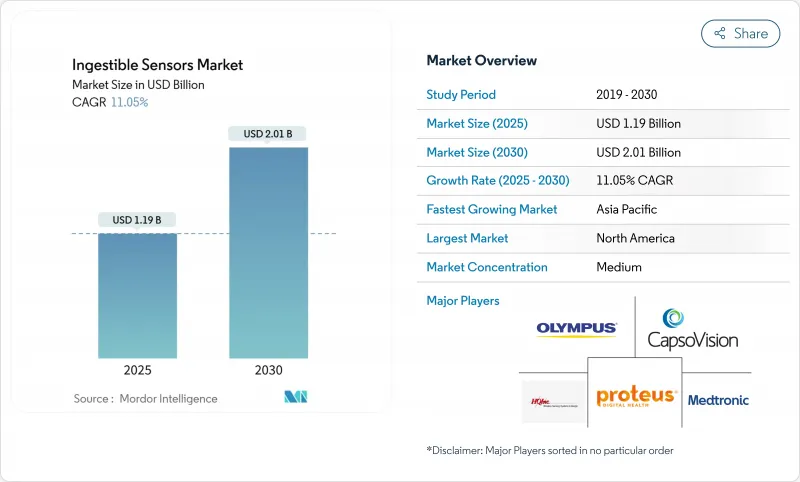

可摄取感测器市场规模预计在 2025 年达到 11.9 亿美元,到 2030 年将增加至 20.1 亿美元,复合年增长率为 11.05%。

这一强劲势头得益于微型电子技术的进步、感测模式的扩展以及医疗保健行业向预防性、数据主导护理的转变。人工智慧与胶囊生成数据的整合,正在拓展即时监测胃肠道疾病(这些疾病曾经需要侵入性诊断)的选择。数位药丸的监管审批正在降低市场准入门槛,而基于价值的报销模式的广泛采用则推动了北美和欧洲的需求。预计到2024年,生物感测新兴企业的创业投资资金将达到创纪录水平,这将鼓励瞄准功率效率和多参数感测的新参与企业。然而,电池容量限制和网路安全的加强正在减缓产品推出的步伐。

全球可摄入感测器市场趋势与洞察

扩大经合组织国家对数位平板电脑的报销范围

经合组织 (OECD) 国家主要医疗保健系统的报销范围不断扩大,增强了可摄取监测解决方案的可预测收益来源。付款方将保险范围与慢性疾病患者持续治疗后将实现的长期成本节省挂钩,鼓励将数位药丸纳入处方笺的标准选项 [ema.europa.eu]。欧洲的临床试验已验证依从性感测器是有效的生物标记物,这进一步加速了其应用。医院目前正在将基于胶囊的服药依从性指标纳入基于结果的合同,从而支持早期技术采用者以外的需求。因此,可摄取感测器市场预计将保持两位数成长。

在北美推广製药公司主导的药物依从性平台

製药公司正在将可摄取标籤嵌入传统药物中,以收集真实世界证据、保护定价并延长专利期限。 Abilify MySite 为 FDA 铺平了道路,使药物-器械组合合法化,并鼓励其他公司大力投资类似计画。数位Abilify摄取数据支持差异化标籤,获得保费报销,并抵消每年 1000 亿至 3000 亿美元的不依从性负担。此类产业措施巩固了商业性终端市场,为早期感测器供应商提供支持,并在资金筹措週期性波动的情况下维持可摄取感测器市场。

FDA网路安全指南设定资料安全障碍

2024年,更严格的网路安全法规将要求可摄取感测器在整个生态系统中纳入多层加密和即时威胁监控[irp.nih.gov]。满足这些标准将带来更严格的功耗和更长的检验週期。规模较小的创新企业将面临更长的设计冻结期和更高的认证成本,使现有企业获得竞争优势。虽然这些措施可以提高患者资料的完整性,但可能会暂时减缓市场进入速度,从而抑制近期可摄取感测器市场的成长预期。

报告中分析的其他驱动因素和限制因素

- 小型化 ASIC 的进步降低了胶囊的电力需求

- 内部远端检测模组 CE 标誌在欧盟范围内激增

- 胶囊电池寿命有限,限制了多参数感测

細項分析

到2024年,温度感测器将占据可吞嚥感测器市场的42%,凭藉其高效的精度和低功耗优势占据主导地位[sciencedirect.com]。运动医学、军事战备和手术全期护理都依赖这些胶囊来避免热压力并监测体温趋势。预计可吞嚥体温感测器的市场规模将稳步扩大,这得益于体育联盟在训练期间强制要求持续监测体温的通讯协定。儘管成像胶囊的基数较小,但其将受益于微型光学元件和胶囊内视镜报销范围的扩大,到2030年将以13.8%的复合年增长率快速增长。

影像驱动的装置正吸引胃肠病学家,他们希望透过非侵入性检测出血、息肉和克隆氏症来避免镇静和内视镜併发症。Medtronic的PillCam Genius SB已证明,基于人工智慧的影像选择可以减少医生的阅片时间,同时捕捉数万张黏膜影像[news.medtronic.com]。最近的原型产品,例如PressureCap,整合了多个应变计,而无需增加胶囊的直径[cell.com]。如果电池创新能够缓解功耗限制,那么融合所有三种感测器的跨模态设计或许能够获得更高的价格。

到2024年,医疗机构将占据可摄取感测器市场收益的86%,其胶囊感测器将用于遵守用药审核、出血定位和发炎性肠道疾病评估。随着临床指引将内视镜检查范围转向侵入性较小的胶囊途径,与医院部署相关的可摄入感测器市场规模预计将持续扩大。 FDA批准的抗精神病药物和抗病毒药物的服药依从性模组显示,遵从率接近99%,这将推动支付方采用基于价值的基本契约。

精英运动队伍和军事组织虽然数量不多,但却构成了成长最快的基本客群,复合年增长率高达14.2%。耐力运动员在奥运等赛事中穿戴的保温胶囊可以保护参与者免于运动性中暑,并优化补水方案。与可穿戴心率带和云分析的集成,可以创建全面的训练仪錶盘,吸引高绩效教练团队。随着时间的推移,随着消费者健身计画采用简化版本,可摄取感测器市场可能会扩展到专业人群以外的领域。

区域分析

到2024年,北美将占据可摄取感测器市场收益的40%,这得益于数位药丸的付费报销、强劲的创业投资资金以及FDA支持性的从头审批途径[accessdata.fda.gov]。医院系统正在引入依从性胶囊,以降低昂贵的再入院率,製药公司则利用真实世界的摄取数据来处方笺处方。区域学术中心也正在进行早期可行性试验,检验下一代感测模式。

预计亚太地区在2025年至2030年间的复合年增长率将达到14.5%,是全球最快的地区。日本的人口老化和中国沉重的胃肠道疾病负担构成了庞大的市场基数。国内製造商正在推出成本优化的胶囊产品,以适应当地的购买力,国家数位健康策略也在推动远端监控的普及。在韩国等市场,政府保险开始考虑将胶囊内视镜检查纳入报销范围,这进一步刺激了市场需求。

欧洲在可吞嚥感测器市场占有显着份额,得益于CE标誌体系,创新远端检测胶囊的早期应用成为可能。公共部门计画强调预防性护理,并与非侵入性诊断相结合。德国和斯堪的纳维亚半岛的风险投资正在增加,支持新兴企业研发自供电感测器和可生物降解外壳。波湾合作理事会和巴西的私人医院是胶囊内视镜的早期采用者,尤其是在高端护理套餐方面。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 扩大经合组织国家对数位药丸的报销范围

- 在北美推广製药公司主导的药物依从性平台

- 随着 ASIC 变得越来越小,胶囊的功率需求也随之降低。

- 欧盟内部远端检测模组CE标誌获取量激增

- 亚太地区胃肠疾病患者数量庞大,推动需求成长

- 生物感测新兴企业的创投(2023-24 年将创历史新高)

- 市场限制

- FDA网路安全指南提高资料安全门槛

- 胶囊电池寿命有限,限制了多参数感测

- 关于付款人结果益处的混合临床证据

- 新兴国家的一次性手术费用高昂

- 价值/供应链分析

- 监理展望

- 技术展望

- 专利情势分析

- 波特五力分析

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

第五章市场规模及成长预测(金额)

- 按组件

- 感应器

- 穿戴式贴片/资料记录器

- 软体和分析平台

- 依感测器类型

- 温度感测器

- 压力感测器

- pH感测器

- 影像感测器

- 按功能

- 影像学

- 监测/遵守

- 药物输送触发器

- 按行业

- 医疗保健/医疗

- 运动/健身

- 按行业

- 按最终用户

- 医院和 ASC

- 家庭医疗保健

- 研究所

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 其他亚太地区

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 其他非洲国家

- 北美洲

第六章 竞争态势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Medtronic PLC(Given Imaging)

- Proteus Digital Health, Inc.

- CapsoVision, Inc.

- IntroMedic Co., Ltd.

- Jinshan Science and Technology

- Olympus Corporation

- HQ, Inc.

- MC10, Inc.

- etectRx, Inc.

- Otsuka Holdings Co., Ltd.

- Atmo Biosciences

- STMicroelectronics

- Philips Healthcare

- Check-Cap Ltd.

- PENTAX Medical

- RF Wireless Systems

- Karl Storz SE and Co. KG

- Boston Scientific Corporation

- CapsuleTech(a Lantronix company)

- Dassiet BioTelemetry

第七章 市场机会与未来展望

The ingestible sensors market size reached USD 1.19 billion in 2025 and is forecast to climb to USD 2.01 billion by 2030, reflecting an 11.05% CAGR.

Strong momentum stems from advances in miniaturized electronics, expanded sensing modalities, and the healthcare sector's pivot toward preventive, data-driven care. Integration of artificial intelligence with capsule-generated data is broadening real-time monitoring options for gastrointestinal disorders that once required invasive diagnostics. Regulatory clearances for digital pills are reducing market-entry barriers, while the spread of value-based reimbursement is pulling demand forward in North America and Europe. Venture funding for biosensing start-ups hit record levels in 2024, encouraging new entrants that target power efficiency and multi-parameter sensing. Nonetheless, battery capacity limits and heightened cybersecurity mandates are moderating the pace of product launches.

Global Ingestible Sensors Market Trends and Insights

Reimbursement Expansion for Digital Pills across OECD

Broader reimbursement in major OECD health systems is reinforcing predictable revenue streams for ingestible monitoring solutions. Payers link coverage to the long-term cost savings that accrue when chronic-disease patients adhere to therapy, prompting formularies to incorporate digital pills as standard options [ema.europa.eu]. Qualification of adherence sensors as valid biomarkers in European clinical trials further accelerates uptake. Hospitals now embed capsule-based adherence metrics in outcome-based contracts, anchoring demand that goes beyond early technology adopters. The resulting pull-through is expected to keep the ingestible sensors market on its double-digit growth path.

Pharma-led Push for Dose Adherence Platforms in North America

Pharmaceutical firms are embedding ingestible tags into legacy drugs to collect real-world evidence, defend pricing, and extend patent life. The FDA pathway opened by Abilify MyCite legitimized drug-device combinations, prompting others to invest heavily in similar programs. Digital ingestion data support differentiated labelling, which commands premium reimbursements and offsets the USD 100-300 billion annual burden of non-adherence. These industry moves solidify a commercial end-market that anchors early-stage sensor suppliers, sustaining the ingestible sensors market despite cyclical funding swings.

FDA Cyber-device Guidance Creating Data-Security Hurdles

Stricter 2024 cybersecurity rules obligate ingestible sensors to embed multi-layer encryption and real-time threat monitoring across their entire ecosystem [irp.nih.gov]. Meeting these standards strains power budgets and prolongs verification cycles. Smaller innovators face longer design-freeze periods and higher certification costs, tilting competitive advantage toward established firms. While the measures improve patient data integrity, they can momentarily decelerate market arrivals, dampening near-term ingestible sensors market growth projections.

Other drivers and restraints analyzed in the detailed report include:

- Miniaturized ASIC Advances Lowering Capsule Power Demand

- CE-mark Surge for In-body Telemetry Modules in EU

- Limited Capsule Battery Life Restricts Multi-Parameter Sensing.

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Temperature sensors contributed 42% of the ingestible sensors market in 2024, a position earned through validated accuracy and low power demand [sciencedirect.com]. Sports medicine, military readiness, and perioperative care rely on these capsules to avert heat stress and monitor core temperature trends. The ingestible sensors market size for temperature devices is projected to expand steadily on the back of sports league protocols that mandate continuous thermal monitoring during training blocks. Imaging capsules, despite a smaller base, are set to grow fastest at 13.8% CAGR through 2030, benefitting from miniaturized optics and expanding reimbursement for capsule endoscopy.

Image-enabled devices elevate non-invasive detection of bleeding, polyps, and Crohn's lesions, thus attracting gastroenterologists who seek to avoid sedation and endoscopic complications. Medtronic's PillCam Genius SB demonstrates how AI-assisted image sorting can reduce physician reading time while capturing tens of thousands of mucosal pictures [news.medtronic.com]. Pressure and pH modules address motility disorders and acid reflux; recent prototypes such as PressureCap integrate multiple strain gauges without inflating capsule diameter [cell.com]. Cross-modality designs that embed all three sensor types may unlock premium pricing once battery innovations alleviate power constraints.

Healthcare facilities accounted for 86% of the ingestible sensors market revenue in 2024, using capsules for medication adherence audits, bleeding localization, and inflammatory bowel disease assessment. The ingestible sensors market size tied to hospital deployment is forecast to keep growing as clinical guidelines shift endoscopy volumes toward less invasive capsule pathways. Adherence modules, cleared by the FDA for antipsychotics and antivirals, show compliance rates approaching 99%, supporting payer adoption in value-based contracts.

Elite sports teams and military organizations, though a smaller slice, form the fastest-growing customer base at a 14.2% CAGR. Thermal capsules worn by endurance athletes during events like the Olympics safeguard participants from exertional heat stroke and optimize hydration regimens. Integration with wearable heart-rate straps and cloud analytics produces a holistic training dashboard, enticing high-performance coaching staffs. Over time, consumer fitness programs may adopt simplified versions, extending the ingestible sensors market beyond professional cohorts.

Ingestible Sensors Market Segmented by Component (Sensors, Wearable Patch / Data Recorder and More), Sensor Type (Temperature Sensor, Pressure Sensor and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America commanded 40% of ingestible sensors market revenue in 2024, underpinned by payer reimbursement for digital pills, strong venture funding, and a supportive FDA De Novo pathway [accessdata.fda.gov]. Hospital systems deploy adherence capsules to curb costly readmissions, while pharmaceutical companies leverage real-world ingestion data to negotiate formulary placements. Regional academic centers also run early-feasibility trials that validate next-generation sensing modalities.

Asia-Pacific is forecast to chart a 14.5% CAGR from 2025 to 2030, the fastest worldwide. Japan's aging population and China's large burden of gastrointestinal disorders create a sizable addressable base. Domestic manufacturers introduce cost-optimized capsules that align with regional purchasing power, while national digital-health strategies encourage remote monitoring adoption. Government insurance in markets such as South Korea has begun considering capsule endoscopy reimbursement, further stimulating demand.

Europe retains a notable share of the ingestible sensors market, leveraging its CE-mark system, which grants earlier access to innovative telemetry capsules. Public-sector programs emphasize preventive care, aligning with non-invasive diagnostics. Increased venture funding in Germany and the Nordics supports start-ups pursuing self-powered sensors and biodegradable housings. Meanwhile, Middle East and Africa and South America together represent a small but rising opportunity; private hospitals in the Gulf Cooperation Council and Brazil are early adopters, especially for capsule endoscopy in premium care packages.

- Medtronic PLC (Given Imaging)

- Proteus Digital Health, Inc.

- CapsoVision, Inc.

- IntroMedic Co., Ltd.

- Jinshan Science and Technology

- Olympus Corporation

- HQ, Inc.

- MC10, Inc.

- etectRx, Inc.

- Otsuka Holdings Co., Ltd.

- Atmo Biosciences

- STMicroelectronics

- Philips Healthcare

- Check-Cap Ltd.

- PENTAX Medical

- RF Wireless Systems

- Karl Storz SE and Co. KG

- Boston Scientific Corporation

- CapsuleTech (a Lantronix company)

- Dassiet BioTelemetry

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Reimbursement Expansion for Digital Pills across OECD

- 4.2.2 Pharma-led Push for Dose Adherence Platforms in North America

- 4.2.3 Miniaturised ASIC Advances Lowering Capsule Power Demand

- 4.2.4 CE-mark Surge for In-body Telemetry Modules in EU

- 4.2.5 Large GI Disorder Patient Pools in APAC Driving Demand

- 4.2.6 Venture Investments in Biosensing Start-ups (2023-24 record high)

- 4.3 Market Restraints

- 4.3.1 FDA Cyber-device Guidance Creating Data-Security Hurdles

- 4.3.2 Limited Capsule Battery Life Restricts Multi-parameter Sensing

- 4.3.3 Mixed Clinical Evidence on Outcome Benefits for Payors

- 4.3.4 High One-time Procedure Costs in Emerging Countries

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Patent Landscape Analysis

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Threat of New Entrants

- 4.8.2 Bargaining Power of Buyers

- 4.8.3 Bargaining Power of Suppliers

- 4.8.4 Threat of Substitutes

- 4.8.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Component

- 5.1.1 Sensors

- 5.1.2 Wearable Patch / Data Recorder

- 5.1.3 Software and Analytics Platform

- 5.2 By Sensor Type

- 5.2.1 Temperature Sensor

- 5.2.2 Pressure Sensor

- 5.2.3 pH Sensor

- 5.2.4 Image Sensor

- 5.3 By Function

- 5.3.1 Imaging

- 5.3.2 Monitoring / Adherence

- 5.3.3 Drug Delivery Trigger

- 5.4 By Industry Vertical

- 5.4.1 Healthcare / Medical

- 5.4.2 Sport and Fitness

- 5.4.3 Other Verticals

- 5.5 By End-user

- 5.5.1 Hospitals and ASCs

- 5.5.2 Home Healthcare

- 5.5.3 Research Institutes

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 India

- 5.6.4.4 South Korea

- 5.6.4.5 Rest of Asia-Pacific

- 5.6.5 Middle East

- 5.6.5.1 Saudi Arabia

- 5.6.5.2 United Arab Emirates

- 5.6.5.3 Turkey

- 5.6.5.4 Rest of Middle East

- 5.6.6 Africa

- 5.6.6.1 South Africa

- 5.6.6.2 Nigeria

- 5.6.6.3 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Medtronic PLC (Given Imaging)

- 6.4.2 Proteus Digital Health, Inc.

- 6.4.3 CapsoVision, Inc.

- 6.4.4 IntroMedic Co., Ltd.

- 6.4.5 Jinshan Science and Technology

- 6.4.6 Olympus Corporation

- 6.4.7 HQ, Inc.

- 6.4.8 MC10, Inc.

- 6.4.9 etectRx, Inc.

- 6.4.10 Otsuka Holdings Co., Ltd.

- 6.4.11 Atmo Biosciences

- 6.4.12 STMicroelectronics

- 6.4.13 Philips Healthcare

- 6.4.14 Check-Cap Ltd.

- 6.4.15 PENTAX Medical

- 6.4.16 RF Wireless Systems

- 6.4.17 Karl Storz SE and Co. KG

- 6.4.18 Boston Scientific Corporation

- 6.4.19 CapsuleTech (a Lantronix company)

- 6.4.20 Dassiet BioTelemetry

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment